Bloomberg reported this past week that, based on a court transcript from the Oracle-Google lawsuit, Google paid Apple $1 billion in 2014 to be the default search engine in Safari on iOS. The transcript has since disappeared and neither Google nor Apple have commented on this figure (now or at any previous time). I thought it would be worth dissecting this figure, putting it in context, and discussing what – if anything – it means for the future of the Google-Apple relationship.

Financial context

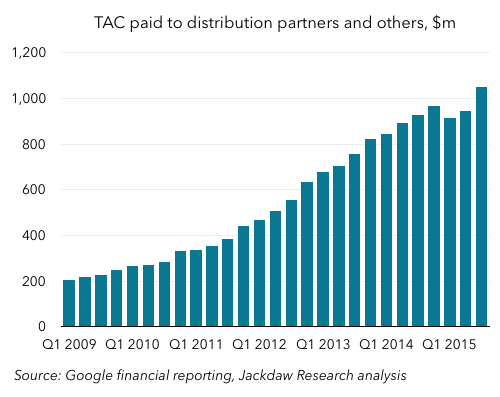

The financial context for the $1 billion figure is that it sits within broader reporting categories at both Google and Apple. For Google, this payment likely sits within the “Traffic acquisition costs (TAC) to distribution partners” category. This category reflects the payments Google makes to various third parties for sending traffic to Google’s search engine and its other websites. The trend for these payments is shown in the chart below:

Of the various parties Google pays for sending traffic its way, Apple is almost certainly the largest. A smaller player in this category is the Mozilla Foundation, maker of the Firefox browser, which received around $300 million from Google in 2014. The Firefox browser obviously has a much lower share of the search market than iOS does, so it makes sense Apple’s cut would have been much higher. Google paid out a total of around $3.6 billion in this category in 2014, so even $1 billion is only a third of the total. To my mind, it’s quite possible the payments to Apple were actually larger, with the $1 billion number representing some sort of floor for payments rather than the total amount.

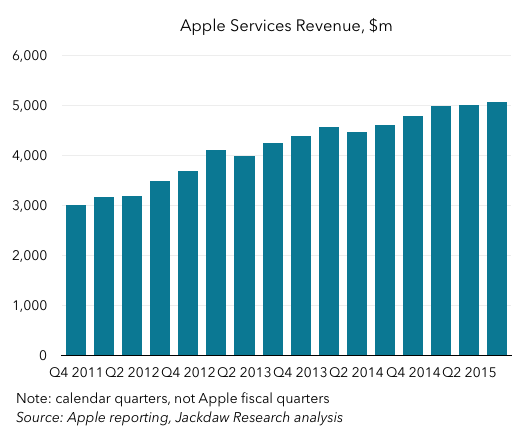

The other way to look at the financial context is by way of Apple’s segment reporting. Unfortunately, these payments from Google are in a fairly opaque and crowded segment at Apple, namely Services. As a reminder, Services includes iTunes and App Store revenues, AppleCare revenues, licensing revenue from the Made For iPhone program, Apple Pay revenue, and revenues from the sale of software, among other items. As such, you have to make a lot of assumptions about the size of those other buckets to even get close to an estimate for Apple’s revenue from Google. For reference, though, here’s revenue for that segment at Apple:

Whereas at Google the reported $1 billion payment is equivalent to about 25% of total annual payments in the category, at Apple it’s well under 10%. I’m inclined to believe the payments are actually a little higher, perhaps as much as $500 million per quarter at this point, but even then it’s just 10% of the total revenue in this category.

Broader significance

The reaction from several quarters has been to ask why, if Google was paying “so little” to be the default search provider, someone else hasn’t come in and trumped it. But even aside from the fact the actual payments may be higher, there are several other reasons why this isn’t so straightforward. To start with, there are only a couple of real alternatives to Google in most major western markets: Microsoft and Yahoo. To further complicate matters, Yahoo still uses Microsoft for a lot of its search results, so we’re really talking about Bing as the underlying search engine for both of these options, at least today (Yahoo is working on building its own search capabilities back up). There are other search engines, but they’re so small they’re unrealistic as potential providers of this default position. DuckDuckGo in particular is very interesting in that its privacy stance is well aligned with Apple’s, but unless Apple acquires it (itself an interesting prospect), it’s very unlikely to become the default search provider in iOS.

At Microsoft, search advertising has grown nicely, but it’s still under $1 billion per quarter in revenue (including its cut from Yahoo), which means making such a significant financial commitment would be a huge jump in its costs. To be sure, it could come with significant rewards, but it would entail significant risk for Microsoft. Search revenue at Yahoo, meanwhile, is less than half a billion a quarter, meaning the $1 billion commitment alone would be half a year’s revenue from search. With all the uncertainty around Yahoo’s core business at the moment, this would be a really tough time to make such a big bet there, too.

But even aside from the financial considerations, I’ve written here previously that Apple is likely to be very cautious about switching the default search provider in Safari, especially after its experience with replacing Google Maps with Apple Maps a few years back. For all Apple’s qualms about Google as a competitor/partner and about Google’s privacy issues, Apple wants to provide the best possible experience out of the box for iPhone and iPad users. And the reality is that, while all the alternatives to Google search are decent, they are not truly competitive. There’s something of a 90/10 problem here, where 90% (or more) of searches are likely handled equally well by Bing, Yahoo, or DuckDuckGo, but for the other 10% or so the results on Google continue to be better. I’m doubtful Apple is willing to sacrifice that part of the user experience at this point. Rather, I suspect it will keep Google as the default option in Safari for now, while continuing to build up its own search operation in the form of Siri/Spotlight, with help from its Topsy acquisition and search results from Bing where necessary.

I tend to think that if Apple could tweak Safari so that tracking would be much harder, that might be a way for them to get the best of both worlds.

Something like a cookie randomiser might be interesting. Apple already has a history of disabling 3rd party cookies on Safari, a feature that I recall Google worked hard to work around, and was subsequently fined.

One way for Apple to allow this would to again add an extension API to Safari, much like what they did for ad blocking, and let 3rd party developers create the actual randomisers.

why would Google accept that?

I don’t think Apple would have any trouble with Google paying less. That’s not how Apple earns money.

Apple is a business with real shareholder that want more money from their investment, not some benevolent protector of some hardcore user privacy despite what Tim cook want you to believe primarily when they will need in the future to milk the IOS platform as much as possible to compensate for lower hardware growth

You have noted very interesting details! ps decent web site.