Today, I thought I would use some interesting tidbits from Facebook’s earnings to highlight some of the broader themes I have been writing about. Those who read my analysis often know my conviction is the next growth cycle of new internet users will be very tough to monetize. Companies with a “free but advertising supported” business model looking to grow their bottom line in this market — Facebook, Google, etc. — will have to make adjustments to keep their revenue lines up and to the right. One particular slide in Facebook’s results show this clear as day.

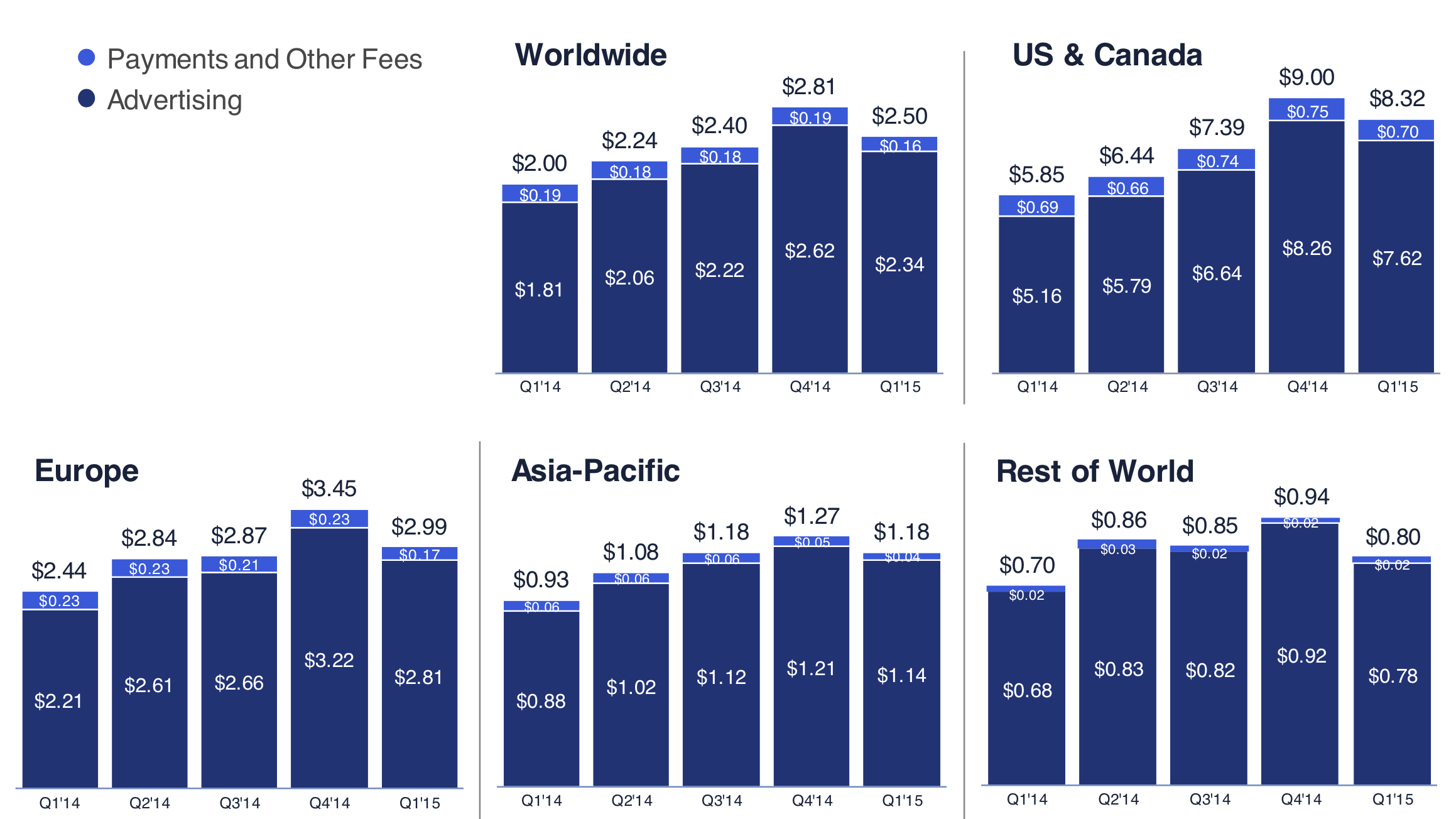

Notice the ARPU difference between some developed areas and Asia Pacific and Rest of World. Now, keeping in mind a theme I have been writing about that all the user growth will come from Asia and Rest of World for Facebook. Meaning, they will be adding to their customer base more rapidly those users with much lower ARPU than they will new users with higher ARPU. Re-visiting this chart is helpful in visualizing where the new user growth potential will come from.

If we are to project out a few years and re-examine this slide, it is extremely likely the ARPU coming from Asia Pacific and Rest of World will be much lower, possibly 50% lower than it is today. This is likely to drive Facebook’s overall ARPU down quite a bit unless they do what I believe all companies in their position must do — monetize their existing base more effectively. This seems to be exactly what Facebook’s management is signaling.

I have no doubt Facebook will add another billion plus users to their network and family of apps. I also have no doubt Facebook is not done acquiring things that will help them add more users. Snapchat still seems like a logical pickup, even though from user data I’ve seen, Snapchat feels extremely over-valued. But Facebook wants whatever apps absorb a large percentage of time. Apps that garner many minutes a day of usage is something Facebook will want to own.

It seems more rich media and visual experiences are the next step for Facebook to deepen engagement and better monetize their base to go along with new customers. To the chart above, I’d be fascinated to see if, in a few years, Facebook’s overall ARPU from transactions increases. A major theory of mine is monetizing the transactions side of the equation has more upside in this next phase of mobile than does advertising.

I’m using this Facebook example to make a broader point since it brings a case study into clarity. We are dealing in hard numbers now. We know how many humans have smartphones today. We know where the most profitable ones are and how many. We know the monetization models that work within the existing user base and we know ARPU differences between operating systems, platform bases, and regions. It is unlikely much changes with what we know in this regard. What we don’t know is much about the next billion plus users. This is why more efficiently monetizing existing users of platforms, software, and services is a mainstream agenda for many today. The opportunities and business model may be something entirely different with the next billion plus so business model flexibility and diversity will be key.

Superb post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.