In my continual analysis of Samsung for many in the industry, I have frequently pointed out the fundamental issues that have led to their current struggles. I had a friend remind me that, over two years ago, I gave a presentation to his VC firm where I pointed out Samsung would face struggles. He reminded me that, at the time, it sounded crazy but in the end I was right. Through our discussion, the topic came up on how to turn Samsung around. I decided I would write up my thoughts.

The Heart of the Matter

Ultimately, Samsung’s fall was fully predictable. In modular ecosystems (ones where you ship a core part of your product or experience which belongs to someone else) will always be susceptible to text book disruption. Samsung wanted to compete with Apple, and they did for a brief time, but ultimately Apple was never really their competition. Other players in the Android ecosystem were, and unfortunately for them, other vendors created good enough hardware that is continuing to eat into their market share.

I highlight this reality in my post on the regionalization of the smartphone market. If you recall that post and the charts that accompany it, you recall in every market but their own in South Korea, Samsung is losing share to the local player who has home field advantage. In China, it is Xiaomi and a host of other Chinese vendors. In India, it is Micromax, XOLO, Lava, and a few others. In the US, they have never led in quarterly sales.

The culprit is the Shenzen ecosystem. This is a radically efficient and rapidly scaling ecosystem of groups of manufacturers who can take a product from nothing to time to market in less than a month. A leading SoC provider from China told me they can get a new customer up and running and in the market with new smartphones and tablets in less than two weeks. Any company can enter this ecosystem, and build “good enough” products to be extremely disruptive.

As an aside, I had a colleague mention, as we spoke about the Shenzen ecosystem, that all this ecosystem needed was a good idea. Now they have Kickstarter for ideas. The key point is product coming out of this region is getting really good.

The Shenzen ecosystem is enabling local manufacturers to build high quality, good enough products and challenge the foreign brands. We are hearing about new smartphone companies coming out of China, Brazil, Vietnam, Europe and more. Local vendors’ home field advantage fueled by a Shenzen ecosystem is starting to rival Samsung with scale and is the thorn in their side.

So what can Samsung do? The obvious answer is chase the low end. However, I think a more interesting alternative may exist.

Procter and Gamble

Why am I bringing up Procter and Gamble in a tech article about Samsung? It is because, as we connect the planet with consumer electronics at extremely affordable prices, I believe we will see similar dynamics to consumer packaged goods come to the consumer electronics industry.

What makes Procter and Gamble successful in global markets is how they regionalize their products and brands. P&G spends a great deal of time researching local markets, understanding consumers needs in those markets, and then creating solutions that meet the unique needs of a region. Often, they use a brand unique to those regions and they market these products differently everywhere. Consumer packaged goods is both commodity but also a continual fight for differentiation. As smartphones reach $10, and as tablets reach $25 it seems inevitable nearly all the dynamics of regionally focused brands, products, and solutions found in consumer packaged goods will come to the tech landscape.

For Samsung, it is essential they get scale. They are oriented in a way many of their core business components depends on the product groups to move significant volume. For the last decade or so, Samsung has achieved their scale by employing a fast follower strategy and executing that strategy at scale. I’m not sure any tech company on the planet is capable of doing this the way Samsung can. This is why they are the most interesting to follow a model like Procter and Gamble’s.

Samsung can ultimately combat the regional brands, who are eating their lunch, by creating regionally focused brands, product, services, and marketing of their own. This would require some significantly different ways of thinking within Samsung to actually do what I suggest. Yet other than just chasing the low end, I’m not sure how else they can recover their former scale. Following Apple is no longer a viable option for growth.

Ultimately, it can be argued the best thing that could happen to Samsung is for Apple to do something truly innovative. The problem is, by being modular, anything they do will be copied and at much more aggressive prices. Apple’s monopoly on iOS allows them to sustain a premium strategy. Samsung doesn’t have such a luxury.

“Apple’s monopoly on iOS allows them to sustain a premium strategy. Samsung doesn’t have such a luxury.”

Then to me the best option for Samsung would be to have a monopoly on Tizen or better yet acquire Blackberry

Having your own OS is necessary but not sufficient. It has to be a pretty good OS too, and it should be ready for primetime on day 1. Not one upgrade cycle from Day 1, but on Day 1.

Doesn’t Samsung already kind of have a monopoly on Tizen by default? No one else uses it. And acquiring BlackBerry would be hard, too…not only that; it’s probably not worth it.

what do you mean by Samsung doesn’t have the mean to sustain a premium strategy.

do you consider the galaxy S and Note brand to be a loosing strategy?

last time i remember they were very competitive to the point of freaking out the Folks at Apple .

the problem with Samsung is that they haven’t created any well built, well conceive good Quality High End premium phones since the Galaxy S3 to protect their premium offering, in fact what they end up doing was destroying their high-end Galaxy strategy line by building a thousand variant of the same design, same specs of the same phone which devalued the Galaxy line. something that happens too often with OEM who does not understand the culture of luxury. which is uniqueness.

i for one do not believe that Android differentiation is the reason why they are down.

the issue is that they never seem to really have a clear cohesive strategy to create a Luxury ecosystem around the Galaxy S and Note brand.

These charts really tell the whole story. Note how in the US Apple was never worried.

http://creativestrategies.com/smartphone-regionalization/

Disruption theory is playing out exactly as predicted in the Android ecosystem. Samsung will never be able to sustain a premium strategy as the Shenzen ecosystem will copy them better and faster than even Samsung can imagine, and customers will get anything Samsung can innovate at much lower prices. Samsung doesn’t have the brand to go up against Apple in premium. And they don’t have the brand to compete with local vendors who are establishing a home field advantage on the basis of culturally pride.

I can assure you, based on the conversations I’ve had with their management. They are very concerned.

i disagree with the assumption that a charts can tell us everything about the future of a company.

Samsung as a company is a giant who does almost everything, from Smartphone, SmartWatch to Appliance, what they lack is a clear vision to make them all work together. so that people can invest in their ecosystem of products instead of just buying a phone or a TV.

No, Ben…charts factor out so many variables that can change the equation.

Charts create a very dangerous bias; that data is totally absolute and data-driven decisions are everything…they aren’t

By the same logic, AT&T should have collapsed into dust after it was gutted in 1984. It didn’t. Instead, it grew its long distance business, jumped into cable broadband, and became moderately successful. And cellular was also part of that story too: acquiring McCaw Cellular helped save AT&T Corp.

Of course, that’s why the chart just looks at the current picture, framed with the trailing. We, of course, to a tremendous amount of trend research, end user research, as well as speak with every major tech company at an executive level, including Samsung, to get their reads on the market as well. We get very candid feedback and it shapes our future outlook as well on markets, products, etc.

As Samsung is learning, it is hard for a single brand to be seen as both premium/exclusive and inexpensive/ubiquitous. That is why Toyota has Lexus.

And that’s why Samsung has Galaxy and Note branding. Pretty ridiculous to not consider Note products as anything other than high end high priced devices and please don’t say Plastics are representative of cheap products. REALITY? Samsung’s Cheil Industries has been in the plastics industry for 60yrs. They supply polycarbonates and composite resins and polymers to everyone from Boeing to Bugatti Veyron. Not to mention Medical Industry, Optometrics, Aviation (Samsung Techwin Research Designs and produces Jet Engines and Robots too), almost the entire automotive industry (including Lexus, BMW and Tesla) and they’ve won so many awards over that 60 history you can’t count them all.

Samsung is a single brand like Colgate Palmolive with their 31 Flavors of Toothpaste, all competing against themselves! …..that’s how massive Samsung is projected to again take #1 smartphone maker in the World this year. They will again more than double Apple’s iPhone sales totals, even thought they are still practically giving away iPhone 4 and 4s with fewer takers of devices that can’t do 4G LTE!!!

Samsung sold 113 Million smartphones (not including feature phones) in Q1 March Quarter and 96 Million smartphones in the Q2 June Quarter despite analysts claims their market is dying. Oh…. Really…. selling 209 Million smartphones vs Apple’s iPhones total of a measly 78 Million total over the same period is somehow indicative of Samsung losing marketshare??? lol….. What planet are Applewellians really living on? haha…. This makes for 3yrs in a row that Samsung has literally blown away all their competition including Apple, with more models for more chose by consumers and fans, the way Colgate Palmolive has done it by competing with themselves!!!

The problem with Samsung’s branding is that all their phones carry the Samsung name, from the very crappy to the very nice. They even do this with the Galaxy brand which includes both the high end Note series and the low end Y. I don’t know if Colgate makes cheap and premium toothpastes, but if they do, I doubt they both carry the same brand and sub-brand names.

Not only do they carry the Samsung name, they also belong to the Galaxy line. There’s a world of difference between a “Samsung Galaxy S5” or “Samsung Galaxy S2” and a “Samsung Galaxy Y”.

It’s supposed to make things clearer (“Galaxy” = Android, “Ativ” = Windows, (nothing) = Tizen or Symbian… But OS is irrelvant since all the action is on the Android side. And what customers need is a clear message as to a product’s values, not its OS.

Samsung has conceded the number one smartphone vendor by sales to Xiaomi in China, they conceded the number one spot in feature phones sales to Micromax in India, and by the end of the year they will concede the number one spot in smartphones as well to Micromax. Apple sells more premium handsets than Samsung by 2-1, Samsung is losing in entry level smartphones as Lenovo has just overtaken them globally as the number one vendor in entry level smartphones. http://www.businesskorea.co.kr/article/6315/entry-tier-leader-lenovo-beats-samsung-global-entry-tier-smartphone-market

My talks with Samsung management back up their deep concerns of shedding market share in so many markets, on top of the fact that deep discounts are not helping their sales globally.

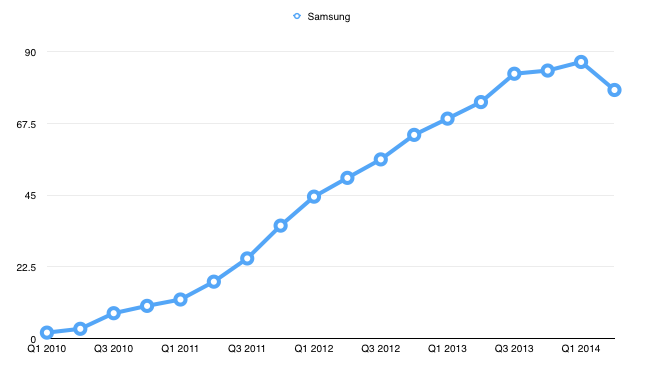

Samsung had a great run, I’ll give them that, they are exceptional at scale and efficiency on executing that scale. But your sales numbers are off, they shipped into the channel 86m smartphones in Q1 2014, and they shipped into the channel 78 m smartphones in Q2 2014. Here is their shipment chart. Also keep in mind shipments don’t always equal sell through.

http://techpinions.com/wp-content/uploads/2014/09/Screen-Shot-2014-08-18-at-3.51.52-PM.png

We will need to see the next few quarter shipment numbers but from the read I am getting from carriers globally, Samsung sales will continue on a downward trend.

He means at some point, Samsung needs to get people to stop buying them for features and capabilities, and simply buy for image and brand, like Apple is achieving.

As consumers, we don’t want that: I’d much rather Samsung keep pumping up specs and capabilites and lowering price, than glue some Swarovski or use metal, make moody/trendy ads, and double prices.

Shareholders sure like that though.

One alternative to the P&G strategy is the BMW strategy. In Japan and I assume in many other emerging nations, foreign brands can succeed hugely against local brands if they are aspirational brands. Apple is obviously one of these brands as is BMW, Mercedes. Even mid-tier brands like Volkswagen or Opel can become aspirational brands in emerging markets if they play their marketing cards right. A history of diluting the Samsung brand with cheap smartphones, might have made this strategy difficult though.

As for P&G, the funny thing is that as I look at the products that they sell in Japan, I actually thought that the vast majority were Japanese products; I didn’t know that they were from P&G. With the exception of beauty products and shavers (which are more aspirational brands), they all look very, very local.

I think Samsung will have to split up their brand in many different ways to survive like P&G or BMW.

Samsung seems to be attempting to be aspirational, but growing evidence in our data is mounting it simply isn’t working out that way. If you read Ben Thompson’s post on the Veblen good, it just doesn’t look as though this is happening for Samsung the way it is for Apple.

They came from the low-end challenger brand / pricing and I think that is lingering in many consumers minds. Not sure they overcome this but I agree with your premise. Just not sure their brand has the cache it needs to pull that off.

Yes. Even if Samsung can pull it off, it will take time.

The P&G route is pretty tough as well.

I’m sure that Samsung has been giving this mountains of thought. It would be interesting to see what strategy they come up with.

I’m also not sure if Samsung’s culture can do what I suggest but it is one way to look at how they can get scale back and maintain that scale.

Yes.

I tend to look at Samsung’s current situation as something that has plagued Japanese companies as well.

East Asian countries have basically followed the Japanese model as they first emerged with low-quality, low-priced offerings. Then, as they improved their production facilities and technical know-how, they moved up the chain to provide great quality at reasonable prices.

The big question is, what should they do next? Japan quickly became a high-quality, high-spec manufacturer at reasonable prices. Unfortunately, that turned out not to be a defendable position. Korea and later China have managed to do the same.

As the Japanese companies as a whole are struggling to find their way to the next level, I feel Samsung is now in a very similar situation.

Some Japanese companies outside of the consumer electronics market have managed to find a defendable position, but within this market, none have succeeded. It would be interesting to see if Samsung can manage the transition better, whichever route they take.

Or, they need to free their premium lines from the stigma of their non-premium ones. Currently, they have the outstanding Samsung Galaxy Sx line, not to be confused with the junk-level Samsung Galaxy Y line. It’s even worse than Sony, who also have… subtle… branding, but not as “subtle” as Samsung.

If they’re serious about going premium, they might want to change the “Samsung” or the “Galaxy” part of the name, not just the one trailing letter.

But they might not want to: it could be argued that the Y line benefits from the S halo effect more than the S is hurt by the Y ?

Ben, the word you are thinking of is “cachet”, not “cache”.

cachet – noun – the state of being respected or admired;

cache – noun – a collection of items of the same type stored in a hidden or inaccessible place

I think it’s easy to explain why Samsung cannot establish itself as an aspirational smart phone brand (in fact I predict that no Android phone can): You cannot have both a low end and a high end segment for computing devices that use the same operating system. It’s like Gresham’s Law (Bad money drives out good money) but in this case the low end drives out the high end. Of course the question is how come? But that’s an article I hope to write someday.

No, there’s nothing wrong with low-end + high-end.

The problem is that Samsung is terrible at brand positioning, and the way they handled their brand in the past is killing them now. It takes time to undo the damage.

Ultimately, the problem is that Samsung is way too disconnected from its customers; the real customers.

Interestingly P&G has announced that they are selling or shutting down about half of their brands. Most of the impacted brands are local/regional brands.

It would be interesting to know why. Sounds very much like a misguided strategy along the lines of the “Capitalist’s Dilemma” that Clayton Christensen recently described in HBR. http://hbr.org/2014/06/the-capitalists-dilemma/ar/1

Cost cutting and savings were the official reasons given. To be fair, P&G manages hundreds of brands so it is quite possible they needed to cull the herd.

I sense this is similar to something that I’ve seen quite often in the few huge companies that I’ve worked for.

The management in the global headquarters imagines that their main brand is so strong that it will work worldwide. They think that “P&G” is such a strong brand.

People working in local branch offices know better. They know that “P&G” doesn’t mean a thing (“P&G” isn’t really strong as a general brand in Japan, for example. Our local “Kao”, “Shiseido” are much stronger.). But the local branch offices often don’t have a strong say in this. They are overruled and their local brands are demolished.

A couple of years later, global headquarters starts wondering why their sales have tanked. Layoffs are initiated….

Do you mean “Turn Around”, or “Take to the next level” ? Samsung is doing quite nicely even with the latest small slump, so turning that around would be… falling sales and losses ?

I know it sounds crazy to say Samsung needs a turn around, but they are really facing some serious headwinds from a trend level. It may not seem like it now, but I’ve known for a while that many fundamental things are plaguing them the root of their serious decline in sales. I also am privy to some tricky things they have been doing to mask how bad it really is.

I don’t think they are in trouble of going the way like HTC or Blackberry but it is going to be a big deal that they shrink so much as a percent of quarterly shipments from a cultural and business mechanism given their components business are heavily based on their OEM channel.

Thinking on it, I don’t think Shenzen (as in anonymous OEMs) is the culprit, but rather the other major OEMs finally getting their act together. This year (or late last year), Sony and HTC released their first Hero smartphones that struck a chord and didn’t have major misses (they used to have one or several of: bad screen, bad camera, no SD, Apple-like <1d battery…). Huawei and Lenovo also got serious about smartphones, and there's the Xiaomi situation in China.

Samsung has had it easy, appealing to nerds because of superior features, to fashion victims because of best brand image, and to regular Joes with their junior lines because of halo effect. I don't think their Entreprise push has had much success though (but that takes time).

I think Samsung are aware that these different markets need at least different products, possibly different lines or brands (see: Galaxy Alpha). Not by region, but by segment. They need to bite the bullet and use fancy materials, not just glue some crystals onto plastic. Try and make their apps AppStore-based, so they don't hold back Android OS updates (basically turning their phones into Google Editions). Maybe stop announcing ludicrous prices and permanent promotions (I'll buy a $200 rather than a $300 -$100 rebate everytime).

Samsung are in the unique position of being able to differentiate w/ features (they have their own SoCs, their own screens, their own cameras, their own apps, industry-leading HW and SW engineers…) and compete on price because they're sourcing most components internally (that goes away if they lose scale though). They even got design and branding right for features-oriented users. But that segment is not, by far, the biggest. They need to better address the other segments. Probably not with local brands/lines, but with global&segmented brands/lines.

I agree with the article, but this strategy would fail because Samsung is not set up to do it.

The way Samsung Electronics is organized and run makes it impossible for Samsung to develop brands and services that are focused on particular regions. I disagree that Samsung needs to have fundamentally different products for each region (i.e. completely different hardware) in mobile phones: that would destroy manufacturing scale, and make everything more expensive. However, I do agree that Samsung needs to develop different branding, software, and services for each region to cater to their needs…and that means also getting some real Samsung stores too!

Samsung needs to rethink its entire approach to the global stage. It goes back to this: http://www.azizfirat.com/blog/2014/7/11/rebranding-samsung

It’s a shame that Samsung doesn’t do unique stuff like Motorola does. Of course, it can’t if it doesn’t have local production facilities in all regions; it lacks one in the US, Europe, and North Africa (though you can arguably get away without having one in Africa if you have one in Europe…I would say the reverse, but Africa is pretty volatile).

Motorola is shaping up to become the Apple of Android. They’re even evolving their product families in a similar manner. Granted, Motorola still has like five models of the Moto X, but it’s a lot less than Samsung. With Motorola shutting down the Texas facility used to power Moto Maker, someone else should take it over…after all, Moto is shutting it down because of Lenovo, and Motorola did go through all that trouble to modernize that old Nokia phone manufacturing facility.

We always follow your beautiful content, I look forward to the continuation.