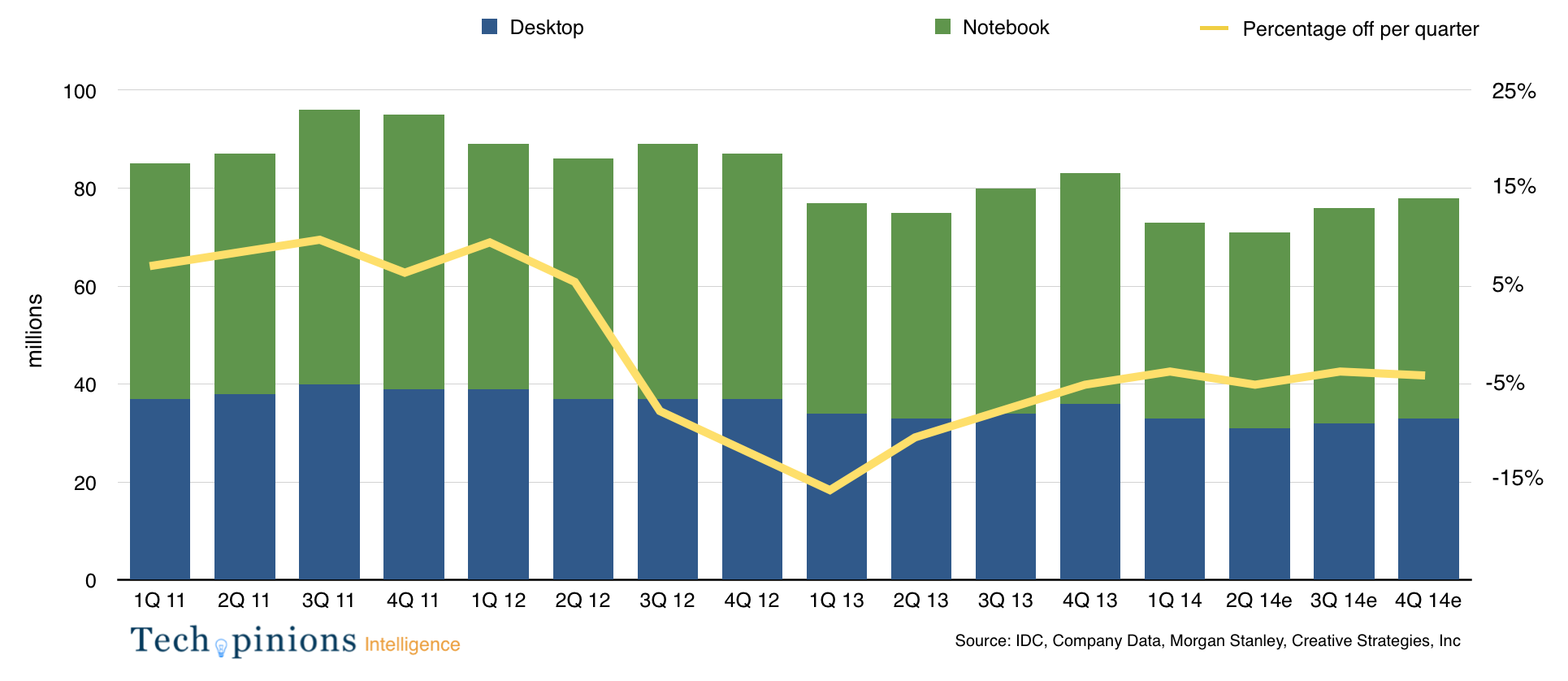

The PC has gone through a rough transition. What we are witnessing is a rebalancing of the PC market. As I reflect on the the turmoil of the PC over the past few years, a single important point stands out. It is highlighted in this chart:

Around 2008-2009, the PC market became heavily weighted towards the consumer market. The implications of this were clear. Consumers operated on different refresh cycles than corporate PC buyers. As we neared 2011, we hit a milestone where roughly half of the PC installed base consisted of consumer PCs. With such a large base of consumer PCs, who operate on different upgrade/refresh cycles, it is no wonder we saw a bit of a collapse in 2012-2013. See the below chart:

Of course the tablet contributed to this as well, as consumers who already don’t upgrade on predictable cycles got their hands on a device that let them hold onto their PCs even longer. What has been interesting is to watch the PC stabilize a bit. While still off, on average about 5% per quarter, we are seeing some stabilization driven mostly by corporate customers starting to engage in a refresh cycle. While the PC industry will likely not return to a growth industry it will remain a stable industry. That is not in question. What is in question is where the rebalancing of the market will stabilize with regard to annual shipments. Understanding where the bottom of the PC rebalance will end up is the key to resetting expectations of this industry. It is safe to assume we will land somewhere in the 200-300m range, probably closer to 200m annually when all is said and done.

While the PC market’s annual sales will remain steady and driven by corporate PC users, there is still a question of what will happen with consumer PCs? As of today, I estimate there are between 400-500m consumer PCs in active use approximately four years old or older. Do consumers still need or want a PC? This data point suggests they do.

This chart shows the type of devices most used to connect to the Internet by the online population. As you can see, the PC remains an important tool by the majority of the online population. Many like to focus on the centrality of the mobile device. However, I am continually surprised by the high usage of PCs even in emerging markets like China and other large “mobile primary” regions. What all the data points I see tell me is the PC’s role remains an important one, even if for many it is more in a companion role than a primary one.

Which leads us back to the question of what will consumers do when it is time to upgrade their PCs? One hypothesis is they will look to desktops over notebooks. In this scenario, consumers are content with a smartphone and/or a tablet for the bulk of their mobile/lean back use cases, and look to get a desktop all-in-one that is used as the shared/family PC. Therefore, we could see spikes in desktop sales for a brief period as consumers upgrade their aging PCs with desktop computers.

Another scenario is more consumers gravitate toward tablets as PC replacements. The tablet will certainly increase in its capabilities through the years which can make this scenario increase its probability.

The commercial and consumer divide is the biggest issue the PC industry must work with. For the stability of the PC industry, vendors must focus on meeting the needs of customers for whom the PC is an essential work tool.

For consumers, PC vendors must embrace the multi-screen reality of the consumer market. Where a corporate customer may spend many hours a day on their PC, a consumer will spread those computing hours over many devices. This is where Apple’s strategy around continuity becomes interesting. Windows vendors should look to apply similar solution-based thinking through software and cloud services to meet the multi-device computing flow of the consumer market.

There is also an opportunity for PC OEMs to look at emerging markets and begin to insert more value for the PC into the ecosystem. Markets like China, which are developing extremely quickly, have young generations growing up middle class who will go to school and the workplace and likely need something other than their phone or tablet for work. Even though this area won’t make up growth volumes, these first time PC customers in emerging markets can at least add to the stability of the market.

Overall, the fact that stability is returning is a good sign for the PC industry. Vendors who can manage the lean years will reap rewards as the stability continues.

I love your charts, Ben.