Understanding what is happening in smartphones is all a matter of perspective. It is easy to get caught up in the OS market share statistics and lose sight of the big picture.

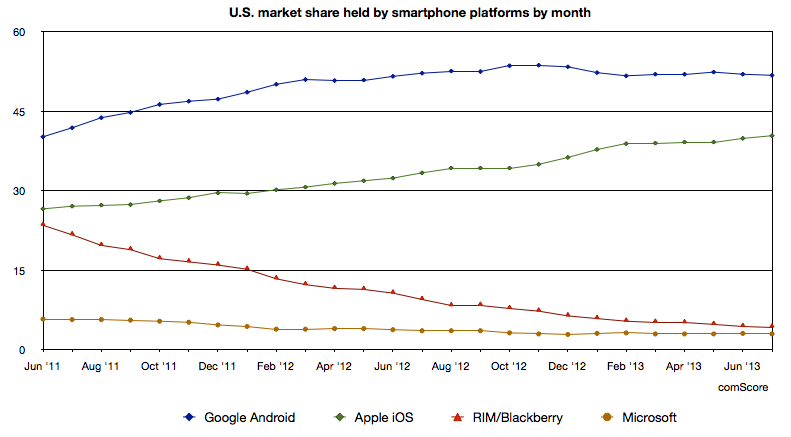

comScore has recently updated their MobiLens and Mobile Metrix, data for US smartphone subscribers in August 2013. Many in the media picked up the point that iOS gained on Android during the month. While this is true, it has actually been going on for almost a year now. In November, 2012, Android peaked in the US at just over 53% share. Since then it has slowly declined. During that same time iOS has been slowly growing.

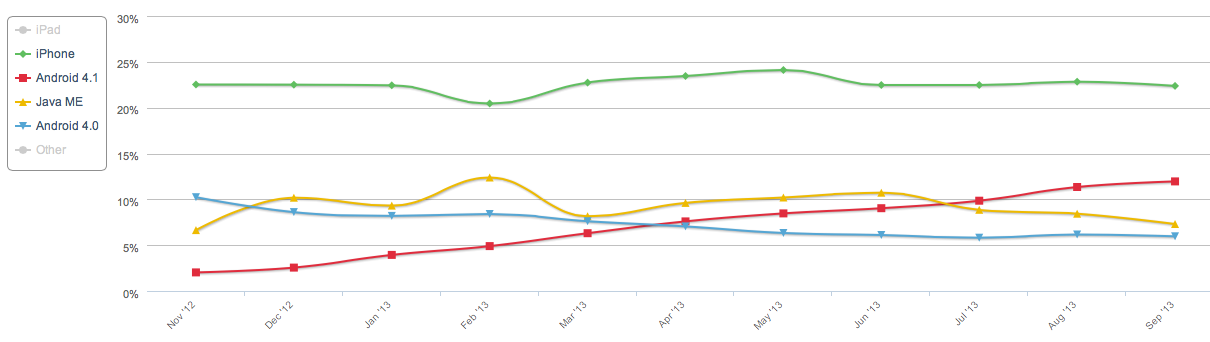

That is, of course, all very interesting and important to know as we try to get a picture of what is happening with smartphones in the US. When we look at browser share between iOS and Android in the US we see a very different picture.

–US Mobile browser share by type from NetMarketShare

In this picture, the iPhone leads all other platforms in web usage. Android is steadily gaining and that is an important takeaway. But as much as we like to generally compare iOS to Android, the uninformed mistakingly compare apples to oranges in doing so. The iPhone, at this point of time, is not competing against the entirety of the Android offerings in the US. The iPhone does not compete with the low-end, extremely low-cost, Android devices offered free by carriers or on pre-pay plans from retailers, which is why comparing the iPhone to the entirety of Android is a mistake. Rather, to get a holistic picture of what is happening, we must compare the iPhone to similarly priced products. More specifically we must compare the iPhone’s market share to that of other vendors’ products at the same price points. When we do that, we get a clearer picture.

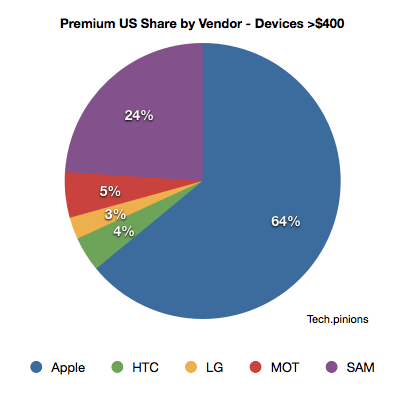

Below is the iPhone’s share against other devices costing greater than $400 wholesale (or offered at $99-$199 subsidized). This chart is based on sell through estimates that I am extremely confident about.

As you can see, the iPhone dominates the premium segment of the market. These estimates are prior to the launch of the iPhone 5c and iPhone 5s. For that reason, I specifically included devices as low as $400, even though the wholesale cost of the iPhone 5c is an estimated $549. I added that price point because I’m convinced that the iPhone 5c will continue to take share from devices — even those devices in the $400 wholesale range — which are generally priced at free by the carriers. I’m also convinced that this will happen in regions beyond the US, as well.

If I were to include only devices which cost more than $500 wholesale or priced at $99 to $199 on contract, the iPhone’s share would jump to well over 70%. As you can see, the iPhone outsells Samsung’s devices at nearly a 3-1 ratio and other devices at a ratio of 5-1 or higher.

Based on all the data I am seeing from demand and sales trends, it is hard not to conclude that iOS will overtake Android in the US in the near future – possibly as soon as the end of the calendar year. But perhaps the most important thing about the iPhone’s share in the premium devices sector is that other competitors have only been able to made weak inroads against it. Samsung, for example, has been spending hundreds of millions of dollars in US-based marketing, yet their share of the premium market has peaked and been trending downward on weaker-than-expected sales in 2013.

All of this is specific to the US. The US market is key for many reasons, not least of which because its one of the most profitable. I am, however, keeping a keen eye on Europe and Asia as well.

The key question in my mind for the US, or other regions for that matter, is whether anyone can legitimately compete with Apple in premium. I think we will observe that Apple can legitimately compete with others in the middle of the market. But whether anyone can challenge Apple’s dominance in the high end is yet to be seen.

I think it’s totally weird to classify products as premium or budget based on wholesale prices that most consumers aren’t very aware of. Couldn’t you simply base your classification on postpaid/prepaid or total cost of ownership per two year span? In super subsidized Japan, iPhones are the cheapest smartphones with a reliable data plan so premium they’re not. The word premium doesn’t represent the actual situation very well.

“Couldn’t you simply base your classification on postpaid/prepaid or total cost of ownership per two year span?”

I suspect he hasn’t done it that way because if one phone costs the carrier $400 and another costs them $280 (both free on contract), they aren’t going to give you a $5 a month discount if you choose the second one. Basing it on the actual cost of the phone to the carrier keeps it a premium-premium comparison.

I don’t know the specifics about the $5 discount you mention so I can’t refer to that directly. What I do know is that nobody in marketing would analyze customer behavior based on wholesale price instead of retail price. Unless wholesale price is a close proxy of retail price (which it isn’t in smartphones, at least in Japan and probably also in many other subsidized markets), it doesn’t make much sense.

What is actually a more important issue is categorizing iPhones as “premium”. “Premium” implies a willingness to satisfy only the high-end of a specific market that is wealthy. That is not the case for the iPhone.

To meaningfully segment the smartphone market, you have to look at usage. There is the segment that uses Twitter, Facebook and the Internet extensively, and the segment that doesn’t. The extensive use segment is likely to be willing to commit to a contract anyway, and for this segment, the iPhone is cheap (through subsidies), not premium. That’s why you see so many young people and even teenagers using iPhones (hardly the premium demographic).

What I’m saying is that looking at wholesale prices lures you to see the iPhone as a premium product, which it actually isn’t.

It may be a premium product for the carriers who pay the subsidies, but not for the consumers. (Actually in B2B, they’re looking at ROI not premium.)

The iPhone is premium compared to a phone you get from a “Get a free Android phone with haircut at Supercuts.”

I’ve seen that sale.

I agree with your basic point, however. It’s like people who say “Apple users are dumb for paying so much for an iPhone.” What? It’s the same $199 that other hero phones charge.

Even that depends… sure I paid $199 for my 4S a couple of years ago, but when I upgraded to my 5S, I turned my 4S into the AT&T store and they gave me $200 credit for it. I paid the activation fee, that’s it.

Try doing that with any android thing.

It is like that with Macs, too. Every few years I sell my Mac for half of what I bought it for and then buy a new Mac. The first Mac was full-price, but since then they have all been half-price. And the Mac I am using is always under AppleCare, totally worry-free.

The interesting thing is that it’s not just Android phones. iPhone 5c is being discounted as well at Best Buy and Wal-Mart (of course with a contract) to sub $50 price-points. In Japan, carriers will actually pay you money for buying an iPhone 5c with contract.

iPhone 5c is no more a “premium” product than the free Android at Supercuts. In fact, if you consider resale value, you can argue that the iPhone 5c is more “budget” than free Android phones.

Reiterating what I said, segmenting based on “premium” wholesale value of phones is close to worthless.

No, “premium” just means you pay more and get more. A deluxe Mini Cooper with giant wheels is a premium Mini Cooper compared to the base model with regular sized wheels. A BMW is a premium car compared to GM.

I think you are mixing up “premium” with “luxury.” However, iPhone is not a luxury item, even if it is the most expensive phone or prettiest phone or most-desirable phone. The reason is, iPhone can save you money, iPhone can replace 3 other devices. iPhone can pay for itself.

For example, I got my first iPhone in June, 2007, when it was $599 cash down, and some people said I was crazy for spending that on a phone. But the first thing I did with my iPhone was got into the habit of browsing job ads while on the train to work, then sending resumes, answering calls, making job interview appointments, navigating to the interviews with Maps, and within 2 weeks I got a new job with a $10,000 raise that paid for my iPhone and its entire 2 year contract 4x over. So I could have bought iPhones for my whole family and still been at net $0 expenditure. You have to keep that kind of thing in mind when considering who is buying iPhones and how premium they are. An iPhone can pay for itself very easily for many, many people.

And my iPhone also went on to replace one of my Macs, which saved me another $1500 every 3 years, yet I work faster and better than I did when I had that Mac and no iPhone. So again, iPhone seems really cheap to me. It keeps saving me money. It is not a luxury item to me.

Teenagers actually can be the high-end demographic for iPhones. A 40 year old business person who continues to make the same voice calls and SMS texts they have made for 15 years now may not see the value in paying extra to get an iPhone instead of a generic phone like a Samsung. However, a teenager who is living their life on Facebook and Twitter and runs 25 games and 50 productivity apps daily could very well see the additional value they can pull out of an iPhone for just a little extra money.

You make a good point about the difference between “premium” and “luxury”. Yes, I am mixing things up a bit, but that is intentional because most consumers do not do a ROI analysis as you have done. Most people buy iPhones because they are a pleasure to use, not because they can earn more money with them. Your point is very valid for B2B though, and explains perfectly why carriers are willing to subsidize iPhones more than Androids (because they can get more post-paid subscribers and hence more stable revenue).

Your explanation of the teenager demographic is exactly as I imagine. As you describe, teenagers are more likely to want to extensively use a smartphone, hence they are more likely to be on an expensive data plan. In their choice of hardware however, given that most carriers heavily subsidize iPhones, choosing an iPhone is not much more expensive than a Galaxy mini for example. I would argue that teenagers are “premium” in their choice of data plan but much less so in their choice of hardware. The additional price for an iPhone is much less than the additional price for an expensive data-plan.

So in summary. Yes I did mix up “premium” and “luxury” a bit because I believe most consumers do. I still think that “premium” does not adequately describe the current iPhone / Android situation. The players that are paying “premium” prices are the consumers who have opted for an expensive data-plan, and the carriers who have decided to subsidize iPhones more heavily than Androids. Customers who chose iPhones over Androids are not paying much “premiums” for the iPhone.

I am puzzled by this information. It seems to contradict everything I see around me. Although informally, I’ve been polling friends, family, co-workers and just strangers near the areas I live and work. What I am seeing is a very strong tendency towards buying Samsung’s products, both the Galaxy S4 phone and their smaller tablets. Not a week goes by without someone in this group getting a new Samsung device. Furthermore, when asking heavy phone users in this group what would their next phone be, the majority of answers are: “Samsung Galaxy”. This is in contrast to 12 to 18 months ago when everybody’s answer was “iPhone 5”. I know this is limited to a very small group of people in South Florida and that it is neither hard data nor statistically relevant, yet it is puzzling to see how it contrasts with the data in this article. It would be great if Mr. Bajarin can comment on this. Thank you.

No offense, but that’s as anecdotal as it gets. What you are asking is the Ben to take reams of national data and explain your super-localized example.

Most of the people I know are Java developers as am I. By your logic, everyone uses Java despite the fact that there are millions of C#, C/C++, ObjectiveC, and Ruby devs.

Have you considered that you are the outlier and the data is correct? The trends for the US both in terms of web usage, dev payouts, profits and sales in the US seem to pretty clearly trend towards iOS.

What’s to explain? You hang around people who buy Samsung products. That’s the explanation. Meanwhile, opening weekend, Apple sold 9 million units. What’s your explanation for that?

The comments are definitively anecdotal. Still this same group of people went from feature phones to Blackberrys to iPhones. Now they seem attracted to Samsungs rather than iPhones. As you can see, these are buyers that have, in the past six or seven years, behaved according to what market data showed. Now they appear to be outliers.

In this same group of people, those with iPhones (the majority up to now) updated to iOS7 in the first 48 hours after it was available to the general public. Again behaving as market data has shown.

I am just curious about this “sudden” change. Can this be a case of “early majority” for Samsung versus “late majority” for Apple? Or, as you say, I just happen to live/work in areas where people are now buying Samsung.

The data in the article shows a marked preference for iPhone with an upward trend that precedes the September launch of new iPhone models. Historically this would have translated into more iPhones, and more intention of buying iPhones, in the small group of people I am in contact with. This has not been the case. It surprises me that, for the first time, I am seeing a purchasing behavior (only in the area where I live/work) that is opposite to the published buying and usage trends.

I wonder how this group behavior correlates with data about intend to purchase or other similar measures.

Interestingly Gazelle, a smartphone trade in website, saw more than a 3x increase in trade in request for the Galaxy S3 just after the iPhone launch. This would suggest massive numbers of customers are trading in the S3 for an iPhone. S4 customers would not be up on contracts so it makes sense it is S3 customers but makes the point that they are unlikely to go to the S4.

Anecdotal data is good for creating a hypothesis, I do it all the time, but anecdotally I can tell you that in many parts of the country I travel to, all I see are iPhones.

Now you point out that all of this is prior to this holiday quarter buying season. So I will have to re-examine early next year and see if Samsung’s share did decline or gained.

From the buying and intent behavior we are seeing I am not optimistic but I will analyze the data fully when I have it early next year.

I’ll add one last point. Anecdotally, I have a hypothesis going that there are groups of consumers who were iPhone customers, switched to Android to see if the grass was greener, and are now going back or intend to go back to the iPhone. Still working on quantifying this one but I have enough initial data to think there is something here.

Anecdotally, this is what I’m seeing amongst my cow-orkers.

How do you ork a cow?

My preference is to do that with a pliffel, but I won’t judge others for doing it differently.

I’m in the iPhone -> Android -> iPhone (maybe) camp you describe. I do like my Android, but the grass is not as green as some would tell you.

I think I might have an explanation to what is going on. 1st. We are talking about Florida. I know that is on average not the most affluent state in the USA. It is less expensive to live there and the salaries are lower there. Plus it is known as a retirement state so I would also suspect that your group of friends are older and like the larger screens on the Samsung products versus the iPhone. So combining all of those factors together it would make sense that you would be seeing something different than the trends that are called out on the article.

I live in the SF Bay Area and if I look around it seems that everyone has some Apple product of some sort. I see tons of iPhones, iPad and Apple computers. If I was just to use my own observations it would seem that Apple has no market to grow here but of course that is not true at all. With over 1 Billion phones sold every year I know that most people do not live like the way we do here.

I also agree with Ben’s reply below. Marketing can do a lot and I am sure that some people are trying out Samsung/Android phones to see what they are all about. Some of them are doing it just because they have become board with the iPhone and are looking for something new to check out. Plus, there are some people that just love to tinker and on iOS you do not nee to do that. Also, for that tech/nerd group that loves to tinker, some of them purchased iPhones at a time when Android phones really sucked. Now that the Android phones have caught up and in some use cases surpassed what the iPhone is offering I can see them switching back. But most people are not nerds and are looking for a smartphone that works and so they will stick with Apple as it is the safe choice.

Thank you all for your comments and answers to my questions. You all have very valid points. I don’t know what the holiday shopping season might bring for this group of people but will be on the lookout.

Demographically, I am talking about 35 to 50 year old individuals that live in a wealthy area of South Florida. Can’t say how susceptible they are to marketing campaigns. A few more data points on this group would be:

– Most of these people have graduate degrees

– The majority are not the type that likes to tinker with their devices

– Their car preference is towards European and Japanese higher end brands (Audi, Porsche, Lexus, Infinity, etc.)

– As Mr. Bajarin mentions, most currently have iPhones (4s and 5)

Based on the few characteristics listed above, I would have thought this group would be perfect and long-time Apple customers. The iPhones are high-end, reliable and the “just work out of the box”. However, those that are just getting new phones are mostly going for Samsungs.

Please note that I have no bias towards a brand or the other. I had an iPhone 4 and just upgraded to a 5s. I also don’t work in technology or telephony. My comments are based on what I see everyday. Based on it I was thinking that, in the area where I live/work the iPhone’s appeal is slowing while that of Samsung is accelerating. This limited conclusion seems to be completely wrong when faced with the data in Mr. Bajarin’s article.

Continuing with the anecdotal information, at lunch I asked a couple carrying Galaxy 4 phones why they chose these and here are their answers:

– They were just recently switching from Blackberrys

– Only considered buying either iPhones or Galaxy 4

– Preferred the bigger screen (although these people were in their late 30s at most)

– Said that Android apps were mostly free while with the iPhone they would have had to pay for the apps (I didn’t know that the same app could be free for Android and not for apple)

– Compatible with t-mobile’s UMA service (allows any phone over wi-fi to operate as if it were connected to the cell-phone network). Apparently the iPhone is not compatible with this service. They mentioned the UMA service for them is very important as they frequently travel overseas.

One more thing. About Mr. Bajarin’s comment about “switching to Android to see if the grass was greener.” Almost all of the Samsung purchases (in this group) have been Galaxy 4s or the small tablets. So, based on the two-year contract/upgrade cycle, I guess I will have to wait and see if there is a return/move to the iPhone.

Thank you all again.

Thanks for your reply. As I suspected, The group you are talking about are in the late 30’s to 50 year olds would be the ones that where looking for a larger screen smartphone. Something that Apple has yet to provide. Even though the rumors are that Apple will make a larger screen size iPhone 6 (4.8″). Rumors are not real products so until this group can get a phone that fits that requirement, it does make sense that they would be choosing the larger screen Samsung offerings.

The whole free app versus paid app thing on Android versus iOS is interesting. It of course depends on the app we are talking about. App’s that are bundled with services like Netflix would always be free as their development is subsidized by the monthly payments. I would be interested in knowing what apps they like to use on Android that their equivalent iOS versions cost money and how much. Many apps are actually not that much money at all especially when you compare them to the cost of traditional desktop software. But of course I have seen the same people complain that computers cost to much at $500 when I have spent over 4K on a computer system years ago. So it is all a matter of perspective.

Compatibility with T-Mobile’s UMA service is interesting. It is just one of the many ways to bridge the gap between the cell phone network and the Internet. The same thing can be done with VoiP services like Skype as you can get a phone number and have it ring the data side of your cell phone. As Skype is on most every platform that is a good way to go too. The only thing I have seen that is a problem with Skype is that the battery life issues but I do wonder if the same battery life issues come up on a UMA call. One of the other nice things about going with VoIP services is that you are not limited to where there is a cell tower from your carrier. Around here I do see some people who have to get MicroCell’s or M-Cell’s from AT&T to get coverage at home for their iPhones as there are just not enough towers in the right areas. But of course those M-Cell’s do not travel with you where as the UMA does. But of course any VoIP service would travel with you too. So it could just be that your group is not aware of the various options for voice services.

I would also be interested in knowing if your group has purchase tablet’s and if so, if they went with the iPad or iPad mini? This would let them keep their iOS purchases while they try out Android.

Regarding the non tinkerer/”just works” thing, It is just as I suspected in that it was the early Android phones that required a lot more tinkering to setup and keep running well where as the current Samsung’s are easier to live with in their default configurations. For the most part, it is only the nerds/tinkerers that really on the whole change the defaults on their devices. This is why defaults matter in many situations. For device security for one.

As you do live in South Florida, I am aware that area is quite affluent and people there do care about style and do have the money to purchase the best. That also normally means service too. I know many of the people I deal with do love the fact that they can go in to an Apple store here. I can see that Apple has a number of stores in the Miami FL area. I assume you are talking about that area. I also do wonder how much they value the Apple Retail Store experience versus going to a random carrier store that really only wants to push the sales of phones & contracts versus the post sale experience.

Thank you so much for your reply and the information you provide.

Of all the people I have talked to here (iPhone and Samsung users), none have mentioned the Apple store as a competitive advantage for buying/owning an iPhone. Personally I believe it is a huge advantage. When my iPhone 4 started malfunctioning, I walked into an Apple store here in Miami and 45 minutes later walked out with my phone working properly. The phone was out of warranty and I did not have Apple Care. I was very surprised that Apple would have a technician (Genius) devote an hour to troubleshooting my phone. Always thought that would have never happened with other phone manufacturer.

Maybe Apple should put emphasis on its stores as part of the hardware-iCloud-apps value equation when it advertises its products.

Another interesting point you mention is the ability to use the same apps purchased on both iPhone and iPad. Most of these people own iPads (don’t know if regular iPads or the minis). The ones recently buying Samsung tablets are getting the small one that also has phone service. What I find interesting is that, again, the advantage of using apps you bought for the iPhone and iPad is not mentioned by anybody in this group. I wonder if they have different Apple IDs in each device.

Thank you again for your comments and answers.

I am glad that we have this great forum on TechPinions to discuss what is going on with others in a respectful way without the typical troll comments that are seen elsewhere.

I am glad to see that you are seeing the same advantages to having an Apple Retail Store that I have seen around here. I know that Tim Cook did make a point recently to try and get more of their sales back in to their own stores. I have seen the same thing here where Apple has gone out of their way to help people with problems even if it means that they are loosing money doing it. I know that Apple tries to make the customer as happy as they can versus just looking at them as a number.

I agree that I would also like to see Apple highlight their retail stores more as they not only open new stores but relaunch bigger stores so that they can have the space to take care of everyone without feeling like you are jammed in to an elevator. There is no question that it is a competitive advantage that even Samsung is trying to copy with their own store within a store inside of Best Buy the same way Apple has done in Best Buy.

I have seen Apple store employee’s give people discounts just by saying that they went to the local university. The front line employees are giving a lot more power than your typical big box/Fry’s kind of store where everything has to go through a manager and take a lot more time to do. At the Apple store they know time=money and they do not want to waste your time if you are going to make a purchase by having you have to run to a different store to get a discount on Apple hardware. Of corse you can get some of the 3rd party accessories for less elsewhere but just like going to the gas station and paying more for a cold drink than a warm one at the supermarket. It is all about connivence.

For the people that do have iPad’s. They should be using the same Apple ID that they used to purchase the app’s on their iPhones so that they can get access to their apps again. What account they use for iCloud may end up being different as it all depends on how they want their data backed up and synced. Also, yes, it is an another advantage Apple has in the fact that you can backup an iPhone and restore it to an iPad without to many issues. Preserving everything, including your camera roll, contacts and calendar.

Sometimes I think that many of these issues get overlooked by people who use Android phones and Windows PC’s as you can roll your own solutions to many of these things but in most cases for the average user if you can afford to go all Apple you will be better off in the end.

I don’t know why, but I took it as much younger. Great call on BMM’s part!

Okay, but here’s the thing that tells me this is a need-specific trend:

If UMA is important, and the iPhone doesn’t work well with UMA, I’d absolutely expect that folks would be getting a phone that fills that need better. In fact, it’d be rather silly of them to buy a phone that doesn’t do what they need it to do.

The people you are describing don’t need iPhones. They are used to buying generic phones at generic carrier stores and doing generic stuff with them. They are almost certainly using their iPhones almost exclusively for voice calls and SMS texts and very basic Web like Google and Facebook. In other words, stuff you could do with a phone 10 years ago. Stuff you can do with a generic phone today. If they see 10,000 Samsung ads they might as well buy a Galaxy since they think it is hip.

But your friends are not typical. Most people don’t just want to replace a generic phone with an iPhone, they want to replace a generic phone, an iPod, and (at least part of the time) a Mac/PC. If you have 5–10 years of iPod habits, it’s hard to use anything other than an iPhone because it is the only mobile with the iTunes ecosystem and iPod features. If you are a heavy Mac/PC user it’s hard to use anything other than an iPhone because it is the only mobile with PC-class native C/C++ apps.

For example, I work in music, and my iPhone replaced one of my Macs. The work I did on that Mac, the apps I ran, the documents I produced — that is all done on an iPhone now. The generic phones and the phone carrier stores — they don’t exist for me. They have nothing I want or can use. That is how it is for a lot of people who come out of a computer background or arts background or audio video background. We bought iPhones because of the unique things iPhone can do. We’re not going to the carrier store every 2 years to get another calls/SMS device, we are going to Apple Store every 2 years to get another computing device. Nobody else is even offering a pocket computer yet. The majority of iPhone users are spoiled rotten and cannot go from their pocket computer back to a generic mobile phone, even one that attempts to impersonate an iPhone.

I don’t see how that question can be reasonably answered. Maybe your group is particularly susceptible Samsung’s marketing. Maybe there’s a “bias” in how you phrase your questions. Maybe they are just attracted to the many BOGO and discounts.

But your statement seems to conflict a bit. You say 12 to 18 months ago every one who is buying a S4 today bought an iPhone 5. So, are they purchasing off-contract? How can the majority have purchased an iPhone 5 as little as 12 months ago being buying S4s today?

Also, strictly speaking, I don’t think they are acting as the market predicted. I could be wrong, but as far as the numbers are concerned two things stand out to me:

1) By the numbers, your friends should have gone to Android. Android passed iPhones in the US sometime ago. That trend now seems to be reversing. It seems that more of your friends should have moved to an Android phone before an iPhone.

2) Most of your iPhone using friends should not have moved to iOS7. Only slightly more than half, going by the overall numbers. I don’t know the US only adoption rate.

I’m also wondering about the “clustering” of Samsung products that you imply. “Samsung’s products, both the Galaxy S4 phone and their smaller tablets.”, you say. All at once? That seems odd that someone would be such a large phone, then such a small tablet so close together. In terms of functionality and experience they would be very similar.

For what its worth, I’ve seen I see S4 phones, but paired with the cheapest 7″ Android tablets money could buy from “normals”.

I wonder if what you see fits in what Ben’s “grass is greener theory”? Jump all in, look around, jump out.

Anecdotally, I see the exact opposite going on in my non-Apple circles, which includes most of my extended family throughout the US. They’ve gone from featurephones to Blackberries (2008-2012) or Android (2011-2012), and then more recently to iPhone.

The number of people who switch from iPhone to Android is vanishingly small. Almost nobody does it. An iPhone user may say they are considering a Galaxy next time, but then they buy the next iPhone. Almost nobody gives up their iPhone. Even first time buyers. iPhone returns are less than 1%, while all the other phones are returned at a 25% rate (1 out of every 4 buyers returns the phone for a refund within 14 days.)

Samsung spends more than everyone else combined on marketing. Everybody has seen 1000 Galaxy phone ads by now. If you talk “next phone” with people they will talk about iPhones and Galaxys. Has very little to do with what they actually buy, what they keep, what they use everyday for 2 years.

You don’t need anecdotal evidence because there are a ton of hard numbers. AT&T is 85% iPhones. Verizon and Sprint are over 60% iPhones. Not just within “smartphones” — that is all phones. When a carrier starts offering iPhone, you can come back within a year or 2 and more than half the phones on the carrier are iPhones. So iPhone is the default choice. It’s not only the best phone and the most innovative phone, it is also simply the most popular. So the onus is not on us to prove iPhone’s popularity to you — iPhone is the biggest electronics product ever, it makes more money by itself than Microsoft and Google combined. The onus is on you to explain why your friends are still buying generic phones.

Maybe you may live right in the middle of a regional carrier that doesn’t offer iPhone, or only just recently started carrying iPhone? Samsung sells on more than 2x the carriers as Apple. So there are places where iPhone lacks availability but that is not because it is unpopular. It is only because Apple is the newest phone maker and has not yet built out to all carriers.

Maybe your friends are basic phone users who only need calls and SMS and value the $0 generic phone? Maybe your friends are accountants who don’t value the Mac-like content-creation platform on iPhone, or the console-like games on iPhone, or the iPod-like audio video platform on iPhone. There are a ton of reasons why your anecdotal evidence doesn’t match the entire country.

You and your friends are all on MetroPCS. Am I right?

While I realise it is a relatively “small” market of only 22 million, but I’m surprised there is not more analysis of the Australian market on this topic.

Three strong 4G networks and a population of early adopters of new technology, surely Samsung/Google would be wanting to advertise that they have over half of the population in Australia using their phones?

Except I’m not sure that they would come close to the iPhone given anecdotal evidence and the amount of marketing that the telcos here do to try and sell the Android and Windows phones.

I think it’s because Australia is a weird market. We’re usually lumped in with Asia because of our geographic location, yet our cultural identity is still mostly aligned with the US, and to some extent the UK (based on what our TV broadcasters show; personal bias can have a huge affect on how one views one’s own culture).

Combine “unusual” with “small” market and you get the situation where analysis of the trends is unlikely to give you data that predicts the rest of the problem space – and unless you have a specific reason to delve deeper, the cost to benefit ratio is unfavourable.

I have done some analysis on factors that determine iPhone vs. Android popularity. What I have found is that (although there is a large variance), countries with a high GDP-per capita ( http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita ) have a strong tendency to prefer the iPhone (I used StatCounter to estimate market share per country). By this metric, it’s not surprising that iPhone is strong in Australia. I don’t think Australia is weird at all.

Germany is the outlier when we look at the high GDP-per capita countries. Germany’s preference for Android might be due to regulatory issues.

For what it’s worth, mid-range GDP-per capita countries prefer Android. Poorer countries still prefer Nokia.

If you have the opportunity to do it, I would recommend a trip on the New York City subway. There is probably no better place to get a peek into the range and penetration of gadgets due to the mix of people that ride the subway.

So what do I see? Three points –

1. Phones: I see a wide range of phones, but the two most common are samsung and iphone. iPhone is most prevalent, but Samsung is very common.

2. Usage: most of the people with headphones on are using an iphone, I rarely see a non-iphone (notice I’m not calling out any other firm specifically) using their headphones. For games I see a more wide range of use, but I see iPhone users engaging with a wider range of games.

3. Tables: I rarely see a non-iPad device, I would say 7 or 8 out of 10 tablet users is carrying/using an iPad

One Additional Note: Does the study compare the use of Android (as a whole, meaning Android on both Tablets and Phones) compared to just iPhone usage (over iOS as a whole)?

Thanks for the comment. I was in NY last fall speaking at a tablet conference and yes the Subway is a good mix of demographics. I also do this frequently at Disneyland where I see similar trends to the one you described.

Keep in mind, I am using sell through estimates for those figures of market share in my chart as is comScore in theirs. The usage stat from NetMarketShare is browser share by version. When you look at that statistic by device the iPad actually has more web usage share than any other device, iPhone included. While this data breaks out iPad and iPhone usage it does not break out Android tablet or phone usage but groups them together.

The subway (even in NYC) is not a good mix of demographics. The subway skews poor. Since Apple only sells high-end devices, Apple devices should under-represented in the subway. The fact that they are dominating there is even worse news for Apple competitors.

The subway doesn’t really skew “poor” in NYC. It skews everyday citizen.

There is no such thing as an Android tablet. Android tablets are just giant Android phones. They are always lumped in together under Android phones. iPad is broken out separately to maintain the illusion of a horse race in the mobile phone and mobile PC markets.

I think this data reflects the fact that these phones are being used to sell data plans. There were two main ways of doing this: the iPhone and cheap/free Android phones with special offers (BOGO, etc). Upgrading people to data plans using Android was important early on, but now smartphone use is higher people are moving to iPhone. It’s likely that once somebody is a smartphone user, operators care less about which smartphone they’re using. Android phones are pushed aggressively to get people to upgrade from feature phones, not get them away from the iPhone. I think Android will continue losing ground in the mature markets going forward.

Once iPhone arrives on a carrier, it quickly outsells all other phones and becomes the most popular phone on the carrier.

iPhone users use their devices much more and pay the highest bills. If you are a carrier and you have an Android user for the past 2 years and they want a new phone, your best bet is to upgrade them to an iPhone.

I totally agree. Looking forward, given that most carriers already sell the iPhone, the basis of competition will be the quality/price of their network, and the amount of subsidy that they offer for iPhones (how cheap they can iPhones). Arguably, subsidy tends to disproportionately influence customer perception. Hence the amount of iPhone subsidy will increase, or hopefully but less likely, the monthly fees will decrease.

In Japan, we now see cases where iPhones are sold with minus downpayment (they pay you to get an iPhone) and cases where iPhone monthly fees are lower than the same plan on Android. The iPhone is the “budget” smartphone in Japan.

Carriers are frantic to get/keep iPhone customers onto their networks, and the lengths they will go to are quite bizarre. Hardly a “premium” situation.

Nobody ever competed with the Mac in the high-end PC market. Apple has had over 90% of high-end PC sales ($999-and-up) for a long, long time. Windows only ever provided a low-end Mac clone for situations like office terminals where only limited functionality is required.

Apple will continue to dominate high-end phones in the same was as high-end PC’s because in both markets, everybody other than Apple is putting their devices together from off-the-shelf kits made by Qualcomm and Intel and others. Apple is making their own bespoke parts, so they can easily stay a generation ahead of everyone else. That is why Apple shipped a 64-bit smartphone before Qualcomm even shipped a 64-bit smartphone part.

The thing is, if you have anything other than basic needs (calls/texts in phones, web/office in PC’s) then an Apple product pays for itself really easily compared to the competition. You’ll pay a slightly higher retail price, but over the lifetime of the product, you’ll pay much less overall and get much more. That used to be the PC industry’s biggest secret, with Microsoft-certified IT guys all using Macs at home. But these days, everybody knows you get the best phones and computers and music players at Apple Store.

Another thing to keep in mind is that Apple offers the only virus-free mobile platform, and the only platform with some hope for privacy and security, and the only mobile platform with PC-class native C/C++ apps. Those are all features of a high-end phone that other manufacturers simply do not have the capability to create. iPhone will be the only choice for high-end users for many years to come yet based on the sorry state of competitor’s software alone.

Ben,

Thanks for the additional enlightening data. But do we really know what underpins iPhone’s share in Comscore/your data? I’m sure it’s a combination of factors, so what are the more important and less important factors? What should a competitor (or group of competitors working together) be doing to get ahead of/outflank/disrupt the iOS kingdom?

I assert that Apple got to this point via 15 years of vision (choosing the right waves to surf) and hard work, including OS X, iMac, Apple Store, iPod, iTunes, iTunes Store, Safari, MB Air (aluminum), etc. And that even now, Apple is building step by step the pieces it needs to achieve its vision (which is mostly hidden to us*) for devices/services that it believes people will want and use 3-5 years from now. For a competitor to succeed, it needs to be building step by step towards some future point as well (skating to where the puck is going), while doing enough to stay profitable today. It’s a complex game of multidimensional tic-tac-toe.

*We can see Apple’s patents, licenses, acquisitions, capital investments, personnel hires, etc, and guess from there.

My answer on what companies need to do will not go over very well. It basically requires nearly every competitor to adopt a strategy that they are simply not built to do.

If you read this which I wrote on Friday (http://techpinions.com/our-services-destiny/23769) then perhaps the best any company can hope is to survive (not thrive) the next 10 years or longer and hope that my scenario #1 levels the playing field.

What many fail to realize is that those who have a computer as well as a phone will strongly prefer to use the computer for web browsing, while many iOS users will use an iPad for web browsing. This shows how dominant the iPad is in the tablet space, or how many Android users have a regular Windows, MacOS X, or even Linux based computer to do their browsing on.

“This shows how dominant the iPad is in the tablet space, or how many Android users have a regular Windows, MacOS X, or even Linux based computer to do their browsing on.”

No, you’re speculating. It’s an interesting theory, but this doesn’t show anything that can confirm what you’re saying.

I have Windows, OS X laptops/desktops, Android and iPads to choose from when I want to surf the net. The iPad is my goto casual device because the overall experience is that much better. Overall portability, performance, rendering, battery life…

I know many other developer and tech types like this.

I do not think there is any logical way to support your hypothesis.

well, Ben, your first chart’s message is pretty clear: Blackberry users are switching mainly to iPhones (as BB dies). which is hardly a surprise, since most were businesspeople and so price – a few hundred dollars difference – is not a big issue for them. either their company pays or it’s a write off.

the other news in that chart is MS Windows Phone has failed to capture those former BB users – which was its main plan in the US. i guess this proves Office ain’t enuff. in Europe MS is doing much better thanks to Nokia’s brand value there.

There’s no such thing as a “premium” Android device. There are expensive Android devices and less expensive (cheap) Android devices but no “premium” ones, any more than there are premium Windows PCs.

Android is a commodity OS that appears on devices that can be purchased for as low as $200 off-contract (and lower I’m sure). That includes top-of-the-line Android (Jelly Bean, if I’m not mistaken). Android is designed to run pretty much on anything you can reasonably put it. It was built by engineers to plug you into Google’s services, its UI/UX designed to be inoffensive but not comprehensively intuitive.

By contrast, iOS only appears on “premium” Apple devices, the least expensive of which is $350 (feel free to correct me if I’m wrong). It was designed with the specific purpose of highly personal, personalized and intuitive computing. iOS is as “custom”-designed for users as a mass market OS can feasibly be.

This is a long way of stating that it’s Apples and oranges. Not only is there no such thing as a “premium” Android device, its commodity nature makes such a thing unlikely. Android will need to make a quantum leap in UI/UX to compete with iOS; with its already massive edge in market share, there is no real incentive for such a thing to happen. Until someone can create a mobile OS that is as comprehensively intuitive as iOS, Apple literally has no competition. Imagine if there was ONLY BMW, and no Porsche, Mercedes, Lexus, etc.

That’s the current landscape. It’s either going to take a new, more finely tailored OS to dislodge Apple at the high-end or a MASSIVE redesign of Android (and Windows, for that matter, in the PC space). Apple literally has the premium space all to itself.

I think you forgot the iPod touch 😉

Sure did. Thanks.

Respectfully, I disagree. Certainly the underlying OS on Android devices is the same on all of them, but the UI is tweaked by each manufacturer hoping to differentiate their product.

I think, rather, the argument should be that there is no premium Android manufacturer – each of them provides a range of devices covering as wide a spectrum of hardware capabilities as possible. My personal opinion is that by taking this approach, their attempts at creating premium devices are hampered by a lack of attention (there is only so much time they can devote to each device, they cannot customise their UI further to cater for the different hardware specs) and thus they cannot reach the heights which Apple has attained. I suspect that should a manufacturer focus solely on premium products they will more closely approach the quality of Apple’s iOS experience; since this is extremely unlikely to happen I guess we’ll never know.

very satisfying in terms of information thank you very much.

Good article with great ideas! Thank you for this important article. Thank you very much for this wonderful information.