This is the text from the Insiders Big Picture Newsletter that get’s signed up. If you aren’t getting the Insiders Newsletter, be sure to check your SPAM filter. If you are new to Insiders and have not yet signed up, you can use the Insider Newsletter blue button on the right.

I hope everyone downloaded and enjoyed my tablet report. More to come on the matter as we believe the tablet category will begin to heat up from an innovation standpoint over the next few years.

There is a lot of relevant news in the days leading up to Apple’s fall iPhone event. Our Insiders will be happy to know four of our writers have received their Apple invites and will be at the Apple event — digging into and analyzing all we see and hear. Myself, Tim Bajarin, Bob O’Donnell and Jan Dawson will all be in attendance. We will have a healthy range of Insider content and will also do some video analysis after the event with hopefully all four of us. Doing analyst roundtables in video form with the authors mentioned above is a feature we want to start including for Insiders as well.

Enjoy your Labor Day weekend, and get ready to hold on to your seats for all the interesting developments we expect over the next few months.

— Ben Bajarin

Understanding Mobile Payments

With the latest news from Re/code that Apple is looking to partner with American Express, along with the latest rumors the iPhone 6 will support Near Field Communication (NFC), it seems as though the mobile payment era is upon us. As I pointed out in this insider article on mobile digital identity, Apple is in a unique position to provide the hardware, trusted ecosystem, and other necessary components to take a leadership position in mobile payments.

Regardless of how you feel about Apple, they move the market. Apple typically leads and the market follows. With the significant number of premium customers they own, it is arguable that it is necessary for Apple to lead in mobile payments to truly develop the market, particularly in the US.

In many parts of Europe, mobile payments are becoming more ubiquitous every month. However, in the US, the infrastructure for mobile payments is lacking. We have an interesting example about the willingness for US consumers to spend money via a mobile device if only the right infrastructure existed. Starbucks CEO gives us insight from late in 2013 about the type of volume Starbucks does with their mobile payment solution.

Today with 11% of our U.S. and Canada in-store transitions being paid for with a mobile device, Starbucks is far away the clear leader in mobile payment. We are encouraged by how our customers have fully embraced our mobile apps as the most convenient way to pay, reload and keep track of their loyalty rewards. With the current average of over 4 million mobile transactions per week and more than 8 million customers using our mobile app, Starbucks mobile platforms are fast growing customer touch points. Through them we are communicating with and delivering innovation to our customers in a way that no other retailer can and on the horizon, our enhancement to our mobile apps that include mobile ordering and digital tipping are on its way.

We continually hear from retailers in the US they are ready to embrace mobile payments and are actively looking to invest in the necessary infrastructure over the next few years. Globally, we hear the same in many regions as well. It does appear the market is ready to begin to embark on a paradigm shift to mobile payments.

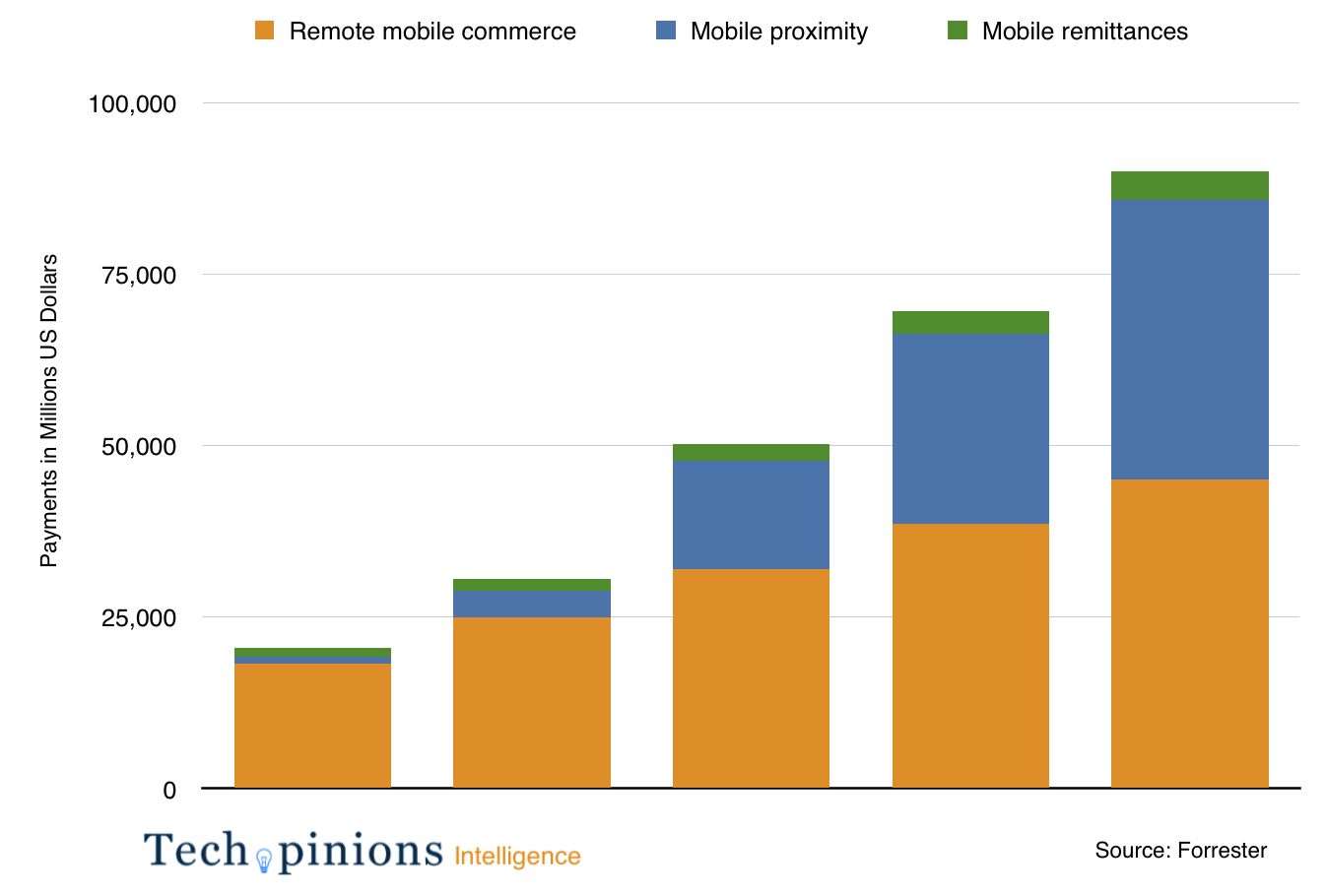

Mobile payments can take many forms, but as you can see in this forecast from Forrester, proximity based mobile payments are poised for rapid growth over the next few years.

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.

Ultimately, this shift will likely lead to a revolution in retail. As highlighted by the Starbucks CEO along with the leadership at Target, Wal-Mart, and many other large retailers, the ability to target and promote to a captive shopper, in their stores, in real time, presents opportunities that have never existed before.

The foundation appears to be in the process and the market appears ready. Apple will undoubtedly take a leadership position, and it will be interesting to see how this plays out in competing ecosystems.

I like the valuable info you provide in your articles.

I’ll bookmark your blog and check again here frequently.

I am quite certain I will learn many new stuff right here!

Best of luck for the next!

It’s awesome in favor of me to have a website, which is

valuable in support of my experience. thanks admin

Hey there! I know this is kind of off topic but I was wondering which blog platform are you using

for this site? I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking

at alternatives for another platform. I would be great if you could point me in the direction of a good platform.