In 1997, while on one of my trips to Japan, I spent some time with local executives who were in the wireless business. During one of our dinners, we started talking about the culture in Japan and how their elders are revered. I asked one of them about the role technology played in the lives of the elderly, and they told me a fascinating story about how WIFI was used in parental eldercare.

It turns out that for most of the elderly in Japan, they still observe an age-old tradition of having tea around 4:00 PM each day. This tea ceremony is done like clockwork. At the same time, their children, who are now grown and may have their own families or are full-time salarymen and work long hours, wanted a way to check in on their parents daily to see if they are doing ok. Remember, this was in the days before smartphones and cellular was broadly available and accepted technology.

Knowing that these elders would have tea each day at 4:00 PM, they worked with some makers of teapots to add WIFI and motion sensors to them and created an algorithm so that every time the parent initially lifted the teapot, it would send a message to their grown children’s PC to alert them. That way they knew that the parents were having tea, which translated into them being relatively ok.

Today, wireless eldercare is already a big market. From using Find My Friends like apps to determine aging parents location, to giving them technology that can send instant alerts if they have fallen, need to contact a relative, or call 911. Or they could even call them to see how they are doing. So there are now many ways for grown children to keep in touch with parents as needed.

But one of the un-reported technologies being used by elders is the Apple Watch, and more specifically, grown children buying them for their parents to encourage them to use it to monitor their health. This is quietly becoming a significant market for Apple.

Although I cannot find any reports or numbers that tell us how grown children are buying many Apple Watches for their parents, I hear a lot of anecdotal feedback on this. And it makes sense.

Gen Xers and millennial’s are busy with their careers and family and have parents that are in their mid to late 60’s or early 70’s who are beginning to deal with health issues they did not have when younger. This younger generation has become more health conscious and is more in tune with using things like the Apple Watch, Fitbit, etc. to monitor their health and want their parents to do the same.

In my case, I wear the Dexcom continuous glucose monitor and can share my blood sugar readings with key family members 24X7. My biggest fear as a person with diabetes is low blood sugar that saps my energy and can be very dangerous if it gets too low. Sometimes I can’t feel my blood sugar going lower, but my Dexcom monitor knows and sends designated family members and me an alert. More than once my phone was in silent mode, and I could not feel the alarm, but one of my family saw the warning on their Apple Watch and called me to make sure I took something to bring my blood sugar up to safer level.

With the various health apps that monitor a person’s health and the ability to share real-time health data with family members, the Apple Watch is becoming much more valuable to the care of aging parents. I believe the majority of grown adults buying Apple Watches to help aging parents monitor their health and keep moving comes out of real concern. But in talking to some who have bought Apple Watches and health monitoring wearables for aging parents, they have admitted that part of the motivation for this is due to the guilt of not being near their parents so they can check up on them in person. Or are so busy that, even if close to them, are not proactive in connecting with them more often.

However, all those I have spoken with who have bought Apple Watches for their parents say that they have a real concern for their parent’s health and are glad to have a wearable technology that can monitor the health and summon immediate help if needed. They also like that it motivates them to move and exercise too.

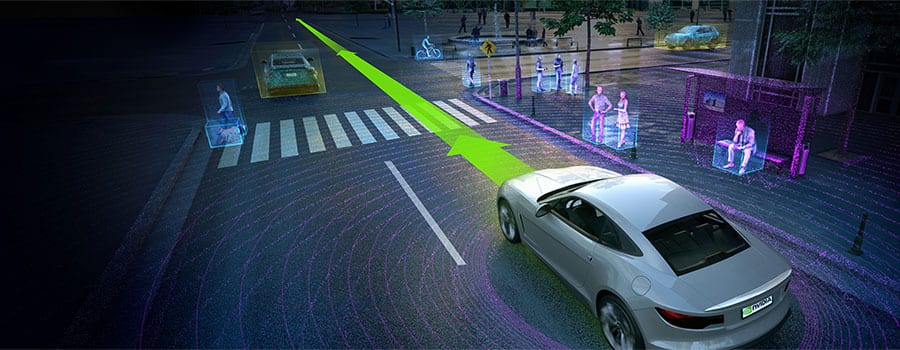

There are a lot of wireless monitoring services for health care that use WIFI or Cellular for location tracking. One of the more interesting ones comes from GTX Corp, which manufactures the GPS SmartSole®. This sole can be slipped in a loved one’s shoes and can monitor their location 24/7.

Another innovative one comes from Trusense. TruSense integrates with technologies like the Echo Dot and includes a motion sensor, contact sensor, smart outlet, and hub that all work together to provide real-time data for caregivers.

But the Apple Watch, which can also be used for location tracking, has a dedicated focus on health monitoring and is increasingly becoming the kind of product that grown children are buying for their aging parents to not only track their health but to encourage them to move and be more active.

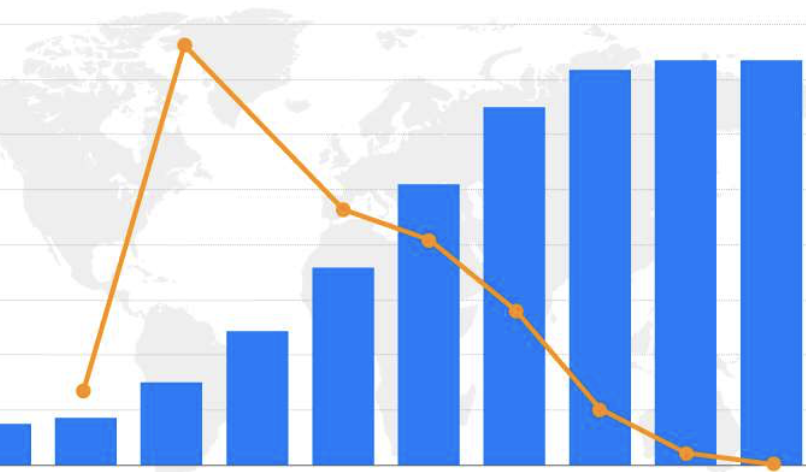

While it is difficult to get numbers on how many Apple Watches and Fitbit’s are bought buy grown children for their aging parents with an eye on helping their parents deal with health issues and stay closer in touch, you can see how this segment of the market for Apple and others is attractive. While none of these companies have created any ads for this market segment yet, it would be a good one for Apple and others to target as the aging population will be 47 million in 2020. https://www.urban.org/policy-centers/cross-center-initiatives/program-retirement-policy/projects/data-warehouse/what-future-holds/us-population-aging

My parents had health issues as they got older. I was traveling so much that I was highly negligent in keeping in touch with them and making sure they were doing well. If they were alive today, I would be the first to buy them an Apple Watch to help them monitor their health. Today’s technology has advanced so much that using Apple Watch and other fitness wearables as a tool to monitor aging parents health is more than possible and I believe that it will become a significant market segment for makers of health and location tracking wearables to target.