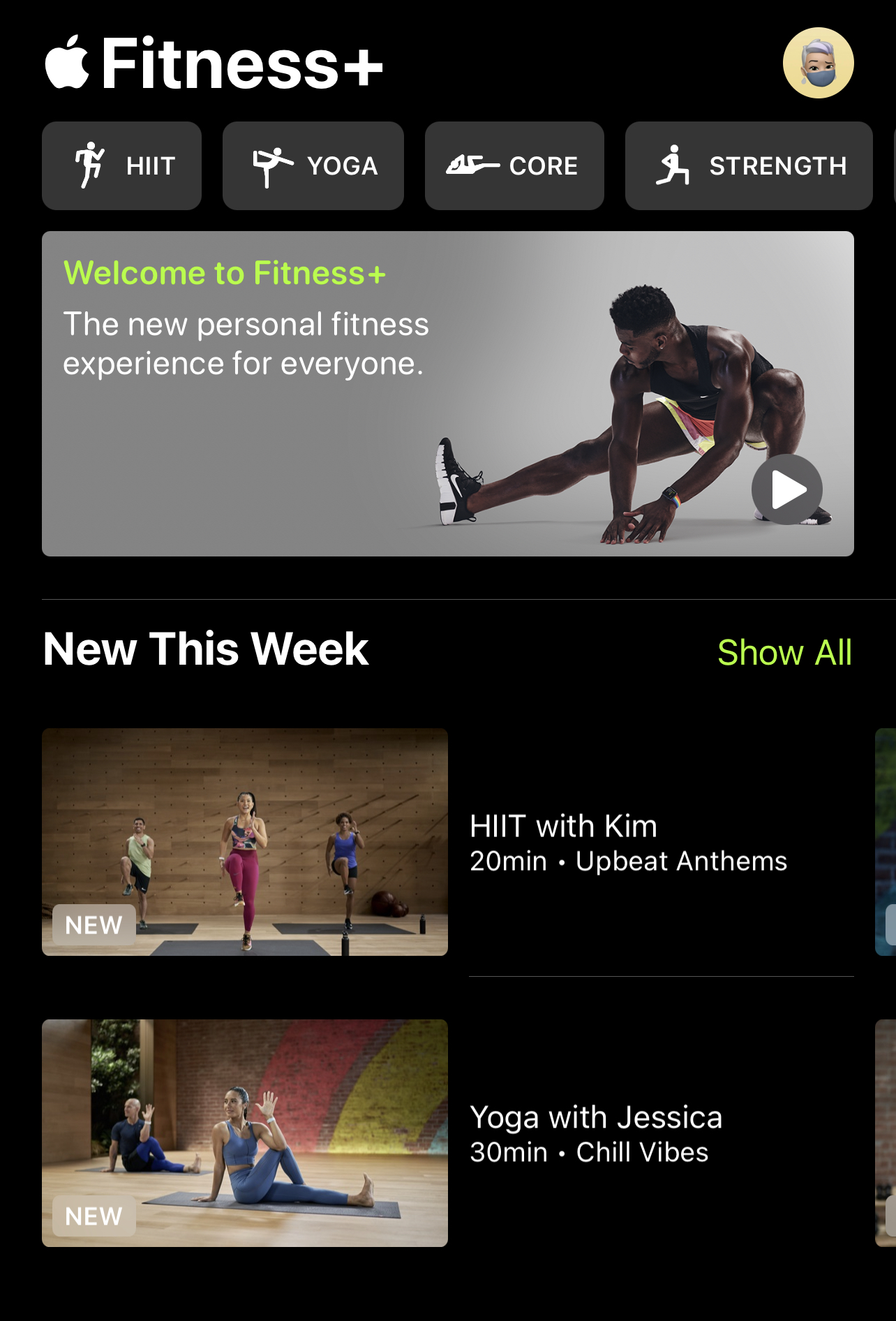

This week marked the launch of Apple Fitness+, the workout service that Apple announced back in September, together with the new Apple One subscription bundle. I spent some time checking out the trainers and some of the videos across a range of workouts. While jumping around to check everything out and have a sense of the service, I was glad to see that diversity and inclusion were clearly top of mind for Apple. There’s a good mix of female and male trainers. There are different body types, skin colors, ethnicities, and even accents all represented. The trainers are making an effort to be as inclusive as possible by suggesting modifications to the workout for beginners and using sign language to welcome and encourage users who might be hearing impaired. I also noticed different-limb people are working out in the studio with the trainers.

As expected, the overall number of trainers is still limited, but I do not doubt that it will grow over time as the user base grows. It will certainly be interesting to see if the talent acquisition battle in tech will expand to include trainers, given how much of the experience is directly linked to them.

Apple Fitness+ vs. Peloton

The first class I took was a cycling class as I was curious to compare it to my Peloton experience.

First, let me say that I’m not a hardcore Peloton user. I just started at the end of September, and I am on ride 61! I got to Peloton with a good dose of skepticism. I really wasn’t interested in the whole Peloton Tribe, class and instructor fandom thing that I saw so many users talk about all the time. And yet, in such a short while, I came to change my mind about those instructors and how much they drive the actual engagement. Peloton also offers quite a range of instructors in a similar way to what I explained about Apple Fitness+. I made an effort to try out different instructors gravitating towards US-based and UK-based instructors and ultimately favoring women over men. I then landed on two particular trainers, Tunde Oyeneyin and Ally Love, who I find to offer the right balance of carrot and stick, but most of all, some inspiration and mind release at a time when we all can do with some. I also appreciate the effort by Peloton in creating theme-based classes rooted in celebrations like Black History Month, International Women Month, or LGBTQ or different music, which is used as a way to open people up to something new.

With this as my experience backdrop, the other day, I got on my Peloton, I set it on “just ride” where you see your stats, but there is no instructor, and I started a workout with Apple Fitness+ and Sherica.

You start the workout, and your Apple Watch is in total sync with the device you are using, being the iPad, Apple TV, or the iPhone. You can control your workout from the device or right from your wrist. I used my iPhone set on the side of the bike for this specific workout but I would turn to Apple TV and the larger screen experience it would offer if it were not so early in the morning. I could see my heart rate data, where I ranked on the Burn Bar, and the workout’s elapsed time. The data displayed made up for some of the data I usually see displayed on the Peloton screen. Sherica was an excellent instructor, maybe a bit less polished than those I rely on the most with Peloton but effective nonetheless. One thing that struck me was how much she was panting, which made me feel better about my own panting, of course. This is not something I ever notice with Peloton instructors even when they say they are finding the workout hard. What I missed the most in my workout experience, which shows Apple’s limitations of not being able to tap into the equipment you might be using, was the resistance set up. The instructor could only suggest increasing or decreasing resistance, but there was no base of reference for any adjustment I was making. This made me feel a disconnect between the call out on the RPM and how hard the instructor wanted me to work. In the end, I burned more calories and reached a higher output goal than I usually do when not taking a class, proof that I worked harder than I do on my own even if I did not benefit from an “informed” instructor.

The more I thought about my experience, the more I came to conclude that the narrative around Apple not wanting people to go back to the gym when they reopen is a false one. On the contrary, Apple is clearly thinking about the opportunity that the gym will offer to drive value through the Apple Watch’s connection to the equipment. Remember that Apple already started to drive integration between Apple Watch and gym equipment such as treadmills, ellipticals, indoor bikes, and rowers. Think about going back to the gym and using any equipment, your Apple Watch, and AirPods and do a class without having to pay a personal trainer or pay extra for a class. It seems like a compelling proposition to me.

One Service Can Fit All

The ultimate hook Apple Fitness+ offers that will create real stickiness to the service is flexibility. It ranges from providing a quick workout with no equipment needed while you’re at home or on a business trip, to coming with you to the gym and be that loyal fitness coach who supports you through your effort to stay fit and healthy.

One interesting thing I noticed with Apple Fitness+ is that the workouts seem to end quite abruptly at the end of the allotted time, but this is because the different workouts are intended to be added to one another to create a longer workout session. So while Peloton has a warmup and a cooldown period with the ability to add more if you want to, Apple offers a warmup but no cooldown. Apple also provides specific videos that walk you through equipment setup, posture, and so on, while Peloton reminds you of how the bike works at the start of every workout. As a user, you can skip this part, but I am guessing given that Peloton is responsible for the bike, they are addressing any possible liability by providing the reminder.

I will continue to explore workouts and take more bike classes, but I will not cancel my Peloton subscription just yet. I am curious to see how Apple will grow Apple Fitness+ because it seems to me that this might be the first product that they aimed at the broadest set of users by appealing to first-time users and fitness enthusiasts. One aspect I am particularly interested to see is how Apple intends to facilitate discovery. This is not something you can walk into an Apple Store and try, which makes me think that the tie into gyms makes even more sense if Apple can link the subscription to the gym and users log into equipment through their Apple ID. Time will tell, but considering Apple made Apple Watch the center of the Fitness+ experience, I expect Apple to make a significant and prolonged investment in the service.