I wrote previously about the slowing smartphone upgrade rate in the US. Today, I want to tackle the other side of the smartphone sales coin — slowing growth in the US smartphone base. Together, these two factors will make life more challenging for companies trying to sell smartphones in the US in the coming years.

Each quarter, growth slows

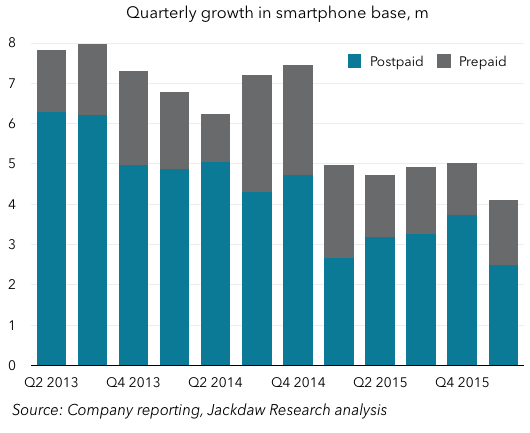

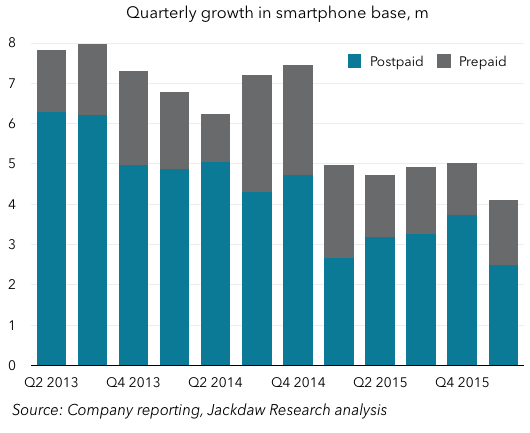

I track figures for the major US wireless operators and, according to those numbers, the smartphone base has been growing less each quarter. If you look at it on a quarterly growth basis, the numbers jump around quite a bit because the market is fairly cyclical, but you can still discern a downward trend:

If you look at the numbers on a year on year basis, the trend is even clearer:

Each quarter for at least the last six quarters shown, the five major operators I track have added fewer smartphone subscribers year on year than the previous quarter. From a total growth of almost 28 million back in Q4 2014, they added just 18.8 million in Q1 2016.

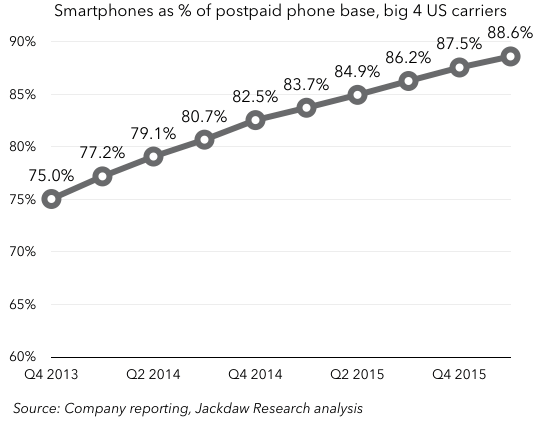

Increasing saturation in postpaid

The obvious reason for the slowdown in growth is the increasing saturation of the postpaid base with smartphones. Sprint and T-Mobile have both crossed the 90% mark, while AT&T and Verizon are both in the 80s already in terms of penetration of their postpaid phone base. The aggregate penetration for these four carriers is shown in the chart below:

As you can see, we’re approaching 90% across the market and the slope of the curve has flattened over the past three years as the market approaches a state of saturation. Note, however, this is just the postpaid base and penetration rates on the prepaid side (where devices aren’t subsidized) is quite a bit lower. Hence, the slowdown in growth on the prepaid side has been less dramatic and prepaid smartphone sales have held up better in recent quarters than on the postpaid side.

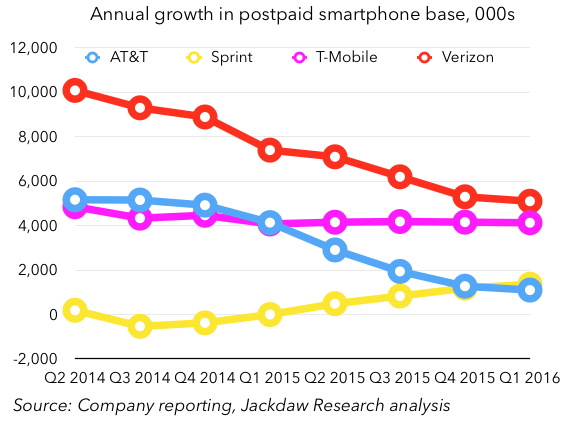

Trends vary by carrier

As well as the postpaid/prepaid differences, there are also fairly different trends by carrier, as the chart below shows:

At both Verizon and AT&T, the rate of growth has declined dramatically over the last two years, with a halving of growth at Verizon and an even more significant decline at AT&T, which added just 1.1 million postpaid smartphone customers over the past year, versus 5.2 million in a similar period in late 2013 and early 2014. Meanwhile, Sprint has returned to overall phone subscriber growth and, as a result, boosted its smartphone base growth to the extent it’s now adding more subscribers each year than AT&T, despite its much smaller base of overall customers. Then we have T-Mobile, which has been consistently growing its base by around 4 million a year for the past two years, almost matching Verizon’s total.

More headwinds for device vendors

Again though, the key point here is clear: as the upgrade cycle lengthens and as the growth in the smartphone base also slows, there will be two major headwinds for device vendors looking to sell smartphones in the US market. That market has already arguably peaked, with its biggest single quarter in Q4 2014 and declines over recent quarters, but we’re likely only two years or less away from an end to meaningful growth in the US smartphone base. That will bring big changes to the number of smartphones sold and this trend is likely to be repeated in many other mature markets with similar levels of smartphone adoption.

Jan, I don’t think there is any question that saturation of new users is pretty well here and with it we are also are now getting lengthening refresh cycles within the existing install base. Heck, for the first time ever I didn’t get the new iPhone, and generally I do it ‘just to have it and be knoweldgeable’ even when I know I don’t actually need it. Anecdote of one, but for me when that guy skips a generation it’s meaningful!

I think the interesting question is how long will the refresh cycle get? Is there any real incentive for carriers to get involved to slow this trend? Usually at this time in the cycle people start migrating to cheaper but ‘good enough’ devices as the value of ‘latest and greatest’ wears off . But, on the other hand, now that many cheap Android owners truly understand their need for a smartphone and want to buy one that pleases them for a longer period of time, will the ‘switchers’ market buck the trend to cheaper and favor iPhone as more people make ‘semi-permanent and brand-aware’ buying decisions?