With Chinese New Year upon us, I thought I’d focus on some observations on China related to smartphones and particularly Apple.

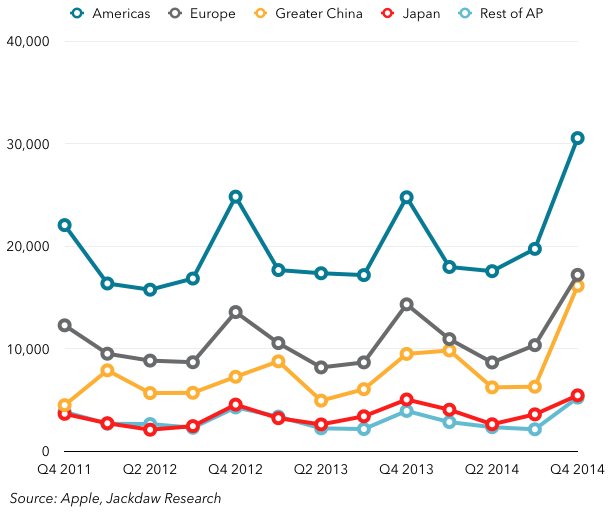

Apple’s growth in China has been modest but steady — until Q4 of 2014. Apple saw a more than significant increase in Chinese sales during the December quarter as evidenced by their revenue from the greater China area.

We may look back at Apple in China and view their presence there as “pre-iPhone 6 and 6 Plus” and “post iPhone 6 and 6 Plus”. Without question, the years prior to the 6 and 6 Plus were about laying the foundation for their strategy in the region. This included the opening of 17 stores to date (40 within the next few years), the localization of iOS for specific regional needs in China, the addition of all their major carriers including China Mobile, and the support of Union Pay for iTunes. All of these things were essential for Apple’s foundation of their ecosystem in China. Now that the groundwork is fully laid, we are seeing Apple’s presence in China take shape.

There has always been strong demand for Apple products in China but not for Apple’s ecosystem. Consumers there were getting iPhones largely on the grey market, jailbreaking them, and not investing in the Apple ecosystem. This was a risky proposition from a loyalty standpoint. Despite the allure of Apple’s brand, their longevity to succeed and grow in China is helped by the stickiness of their ecosystem. Ultimately, Apple does not want to just sell hardware to Chinese consumers. Yet that was what was happening prior to the things I outlined above and all based on the high appeal from an aspirational viewpoint of Apple’s brand in the region. However, things are changing and it appears the China ecosystem is gaining traction as well.

Now that Apple’s base in China has become large enough, local developers are realizing the same things many Silicon Valley developers already know — iOS is a better place for developers to monetize. The dynamics I have continually explained, that Apple has the most desirable customers who are willing to spend, drives this. Local app developers, and even local services companies, commerce companies, etc., are starting to cater to iOS customers in ways they previously haven’t before. While this is trend is still in the early phases, there is a shift on the horizon. Some of it has to do with China’s maturing consumers but it seems there are dynamics at play which are bringing iOS into its own as a desirable software platform and ecosystem. Meaning, Apple is appealing to Chinese consumers beyond just hardware and brand. This is key.

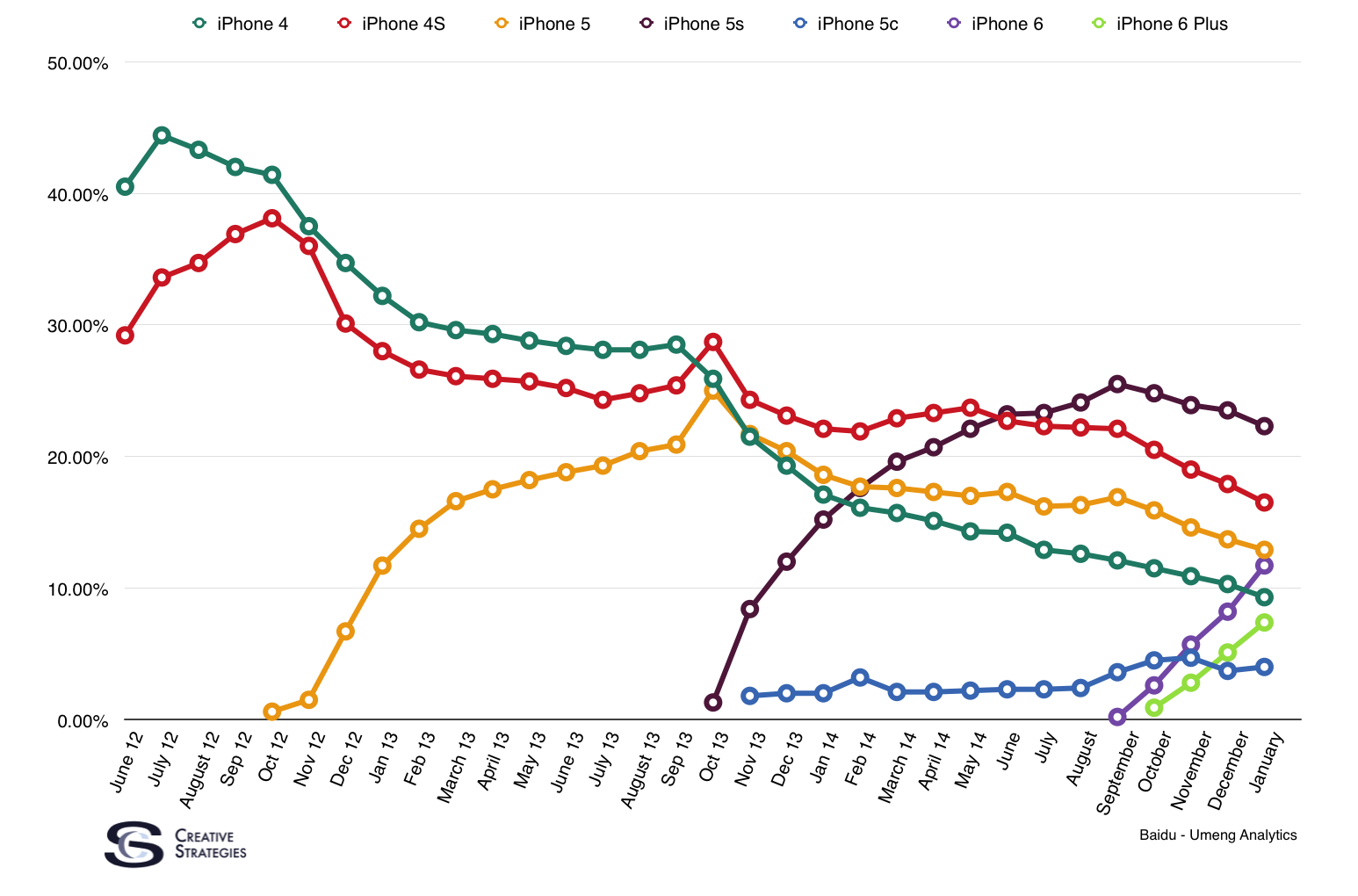

This chart shows the history of iPhones in China by usage. Prior to the ecosystem foundation, iPhone 4 and 4s (largely acquired by secondary and grey market sales) dominated usage. But now the entire shift is happening to new devices with deep ecosystem ties (jailbreaking is now less than 10%. It was over 50% at one point in time).

Competition

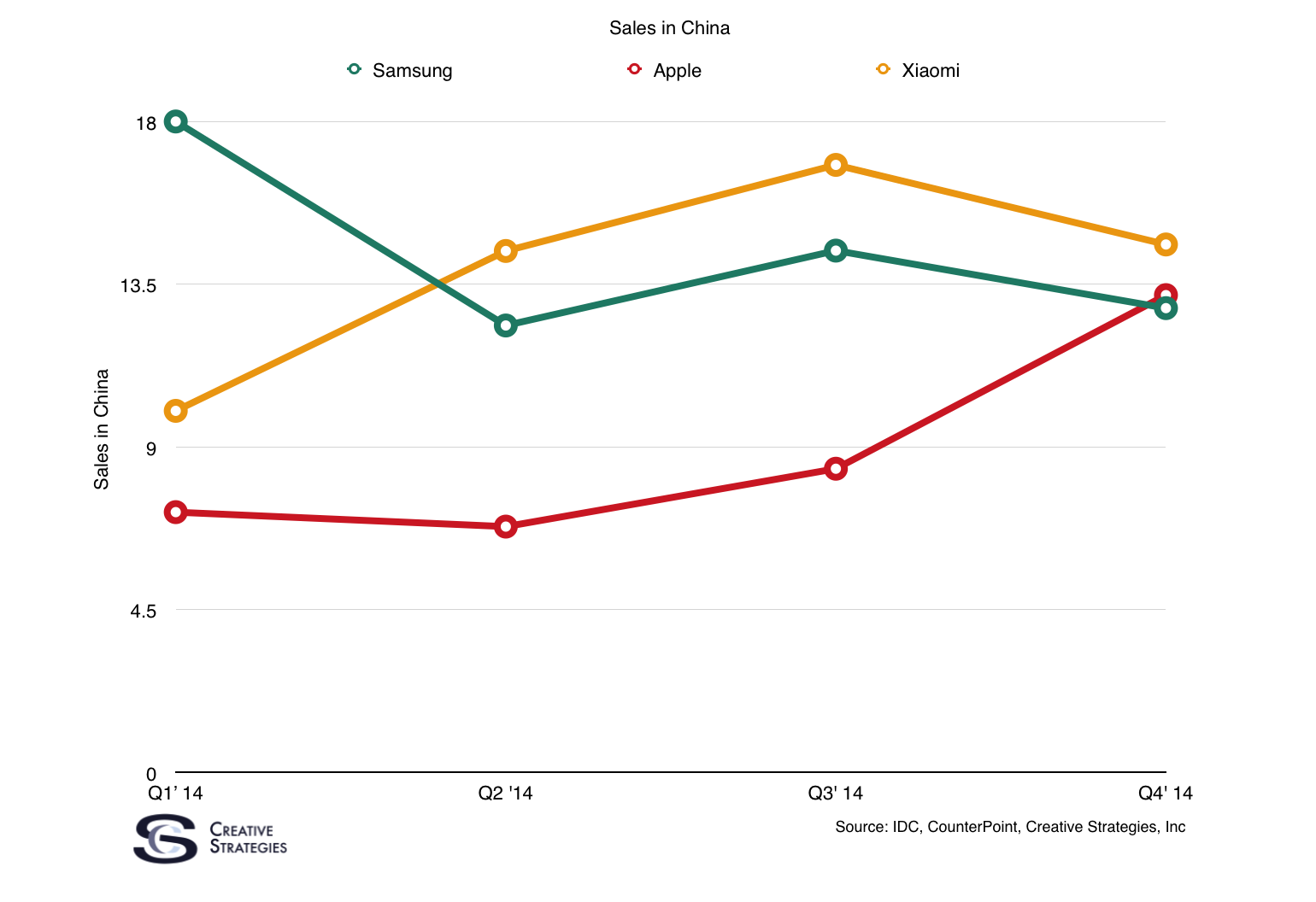

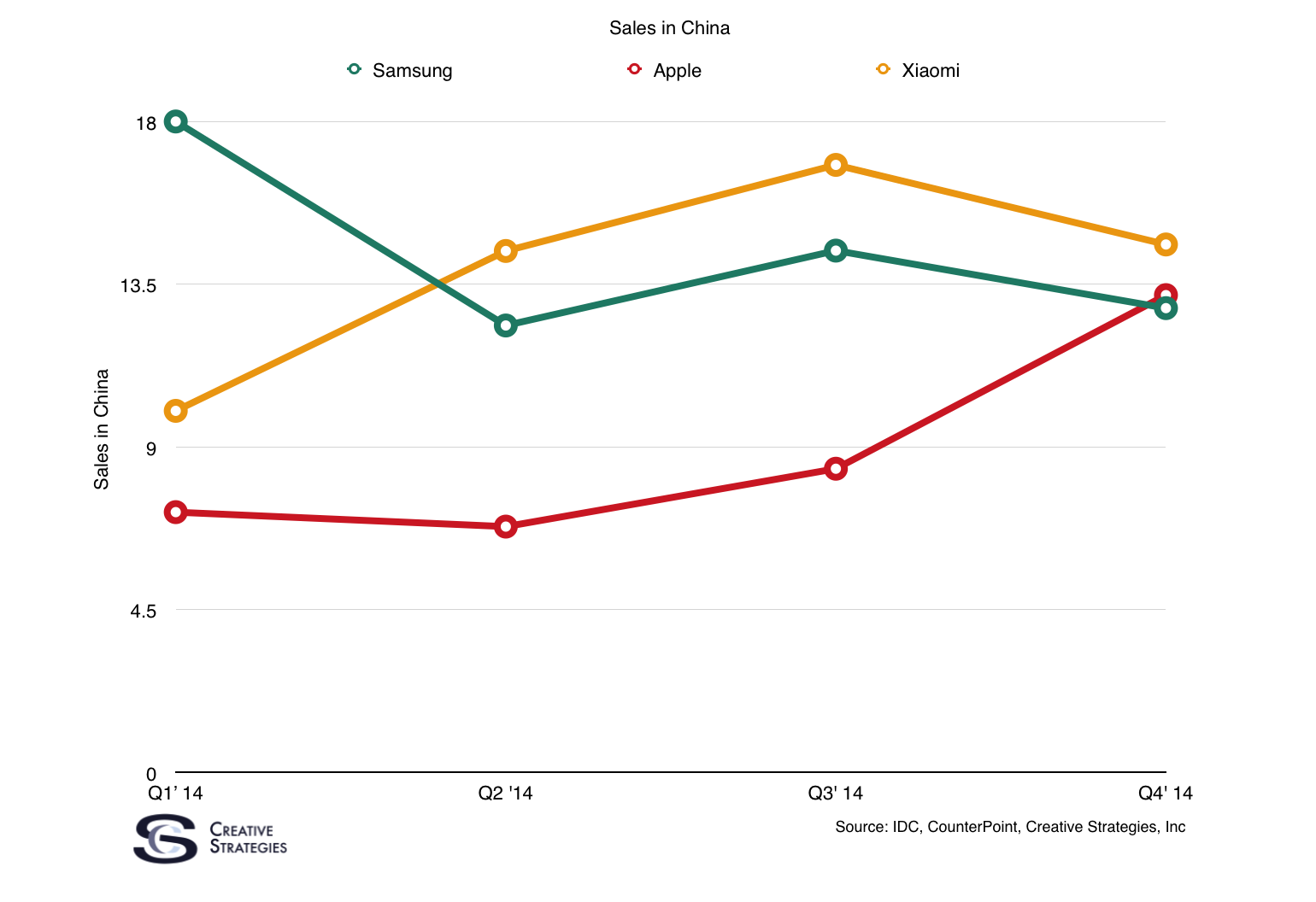

Highlighting three frequently talked about brands in China tells some key stories. Samsung once dominated China and their rise and fall is a useful case study specific to global strategy. Similarly, Xiaomi’s rapid rise to number one in China is another telling case study of regional success. As you can see, Apple’s trend line has remained steady in terms of sales in China for iPhones.

Samsung’s fall from number one in China to number five took just over four quarters. Similarly, Xiaomi’s rise from lower than the top five to number one took just over four quarters. Apple’s rise from the bottom of the pack to #2 took one quarter. Apple will very likely take the number one spot in the March quarter thanks to the Chinese New Year.

It was hard for many who did not study China to understand the massive upside Apple has in the country. Looking at every region we study, I’m not sure I can say this about any other area other than China at the moment. Apple will certainly increase their base in the US, possibly getting to 60% share, but the US has only a little over 300m people. The number of consumers in China Apple can likely appeal to is double that number and growing.

While the revenue chart above still shows US and Europe ahead of China, China will likely continue to grow and get closer to US. The US remains, in the short term, Apple’s largest market by revenue even though, and soon, China will be the largest market for iPhone sales.

China could be the Apple Watch’s largest market day one. I have quite a bit of luxury watch market data for the China region and while a huge number of very cheap watches get sold there, a large number of very expensive watches get sold there as well. The Apple Watch lines up with China’s gadget craze, particularly around mobile, and Apple’s aspirational brand appeal, all which lead me to believe the Apple Watch will not only sell well in China but will drive demand for iPhones even higher. I do believe the ASP of Apple Watch sales will be higher in China than any other country.

Some possibilities for Apple in China in 2015:

- Apple could sell more smartphones in China than Samsung

- Apple could be the number one or number two smartphone vendor in China for all of 2015

- While possible but somewhat doubtful, Apple could see China revenue be higher than the US towards the end of year (driven by Apple Watch revenue

- Apple could average more smartphones sales in China than any country (it will be a back and forth between China and the US in 2015)

The last point I want to make with regard to Apple in China in 2015 is a look ahead toward the end of the year. I have a feeling that, when the current iPhone 6 and 6 Plus get discounted in China to the $500-$600 range, whether through primary channels like carriers or secondary/grey market channels, Apple will see iPhones compete with smartphones in the $300-$400 range in China. This means those customers who may have spent $300-$400 may consider an iPhone 6 or 6 Plus in the $500 range within reach and continue saving. If this happens, Apple’s customer base could increase dramatically as the $300-$400 price range sees, on average, more than 40m shipments per quarter in China.

As our readers know, I update and share my data models for China regularly and Apple’s line in 2015 will be interesting to watch. Tim Cook mentioned on the last analysts call that many didn’t think they could do it in China. There is a similar narrative about Apple in India. While it is true the dynamics in India are completely different, I believe it is time to start focusing more on India and what Apple’s upside may look like there as well.

For many quarters Apple has been giving strong hints that China would be big for them. I guess people simply didn’t believe them.

Tim Cook said (for the first time?) that he thinks India has a strong future for Apple. I get the sense many people don’t believe him.

If I recall, what Tim Cook has said before was there was interest in India. That they were looking at it closely. India for Apple feels much like it did before the smartphone boom in China. While the dynamics are certainly different since their customers search more for value than prestige (like China does), it makes for an interesting market.

I study India deeply so this is and has been on my radar.

Yes, he has expressed interest in India, but my impression is they mostly talked about the challenges there. This time he sounded more optimistic, as if they were getting close to making a breakthrough.

Glad to hear you’re on top of it and look forward to future articles.

I thought there were also significant differences in the way you can go to market (as a foreign company) in India as compared to China. And, I think the telco market is more fragmented than in China. Both these things make India different. Though no one said this explicitly, just because they figure out China doesn’t mean they’ll have a solution for India.

That said, it looks to be another huge potential market that’s currently underserved by Apple.

India has endemic problems which may be insurmountable (bureaucracy, distribution, corruption)…Mind you some of these problems mirror those found in China, but the Chinese consumer seems more predisposed to spending on brands – Indians, like you correctly point out, seem more cost conscious (with the exception of their leader – did you see the suit he met Obama with – gold pine stripes).

If the Apple Watch is a big hit in China to the extent that you say, and if ultimately the wearable category sticks, then the next big question becomes, what will be the alternative wearable platform?

In smartphones, the alternative to the iPhone was Android. That was the platform that the vast majority of other OEMs supported. The same for tablets. However, given that Google is very weak in China, it is very possible that the alternative platform for wearables will not be Android Wear.

The following DigiTimes article suggests that Chinese-language support on Android Wear is weak, and that some major OEMs are considering launching devices running on their own platforms.

http://www.digitimes.com/news/a20150213PD203.html

The following VentureBeat article also suggests that Mandarin support on Google Now is exceptionally poor.

http://venturebeat.com/2015/02/07/siri-crushes-cortana-google-now-when-it-comes-to-foreign-languages/

I’m wondering whether Google’s lack of attention to the Chinese market will cause them to completely miss the next wave of computing (assuming of course that wearables will be the next wave).

Although China is certainly a huge market, Google could do very well (as they do with phones) in the rest of the world. My question is how quickly can they & their hardware partners catch up to Apple this time around. The security & privacy questions around payments, keyless entry, health data and other identity-related aspects of a smart watch present quite a challenge for Google.

If China becomes the world’s largest market for wearables, it is likely that the killer apps will be conceived there. And we all know that wearables do not yet have a killer app.

If Google is absent from that market, it will make it difficult to downright impossible for them to ride that trend.

An example is messaging. Messaging is huge in Asia (LINE, Kakao, WeChat) and other countries (WhatsApp), but not so much in the US. Google completely missed it.

It is very likely that Google will miss out again. If they had managed to establish a strong presence in China, at least they would have had a fighting chance. This however doesn’t look like it’s going to be the case.

To answer your question more directly, the fact of the matter is that nobody knows yet what wearables are good for. Even if somebody thought they knew, it would rapidly change within a few years. For example, nobody expected iPhones to become the most commonly used cameras or spontaneous taxi stations.

Hence whether or not they can catch up to where the Apple Watch is now, is kind of irrelevant. It is more important to be where the action is. It is more important to have entrepreneurs with the idea for the killer app, willing to create an app for your platform.

If those entrepreneurs are going to come from China, which I certainly expect they will, then Android Wear has to be strong in China.

I agree with you that China is very important. I’m simply saying that Google may not completely miss the wearable “wave”. Certainly Apple is in a much better position.

I also agree that we don’t know where the smartwatch category will take us in the next few years. But we do know what Apple has announced and planned in the short term. I think competitors are going to have a tough time even matching that, much less what’s in store down the line.

As Ben has pointed out in recent articles, Apple’s user base represents a majority of the most valuable customers. Entrepreneurs realize this and will continue to target these customers first. This will probably be more true with the Watch than with the iPhone.

I agree with what you say. I think our difference is the amount of emphasis we place on China.

I think it is possible to come up with scenarios where China would dominate the wearables scene, especially in use-cases outside of fitness (because I assume Californians are much more fitness aware than the Chinese). I think it could dominate in both consumption and creation of new killer apps.

Of course, we have to wait and see. But if my suspicion turns out to be even half true, then it could be very bad for companies that don’t have significant presence in China.

Excellent article! We will be linking to this particularly great article on our website. Keep up the good writing.