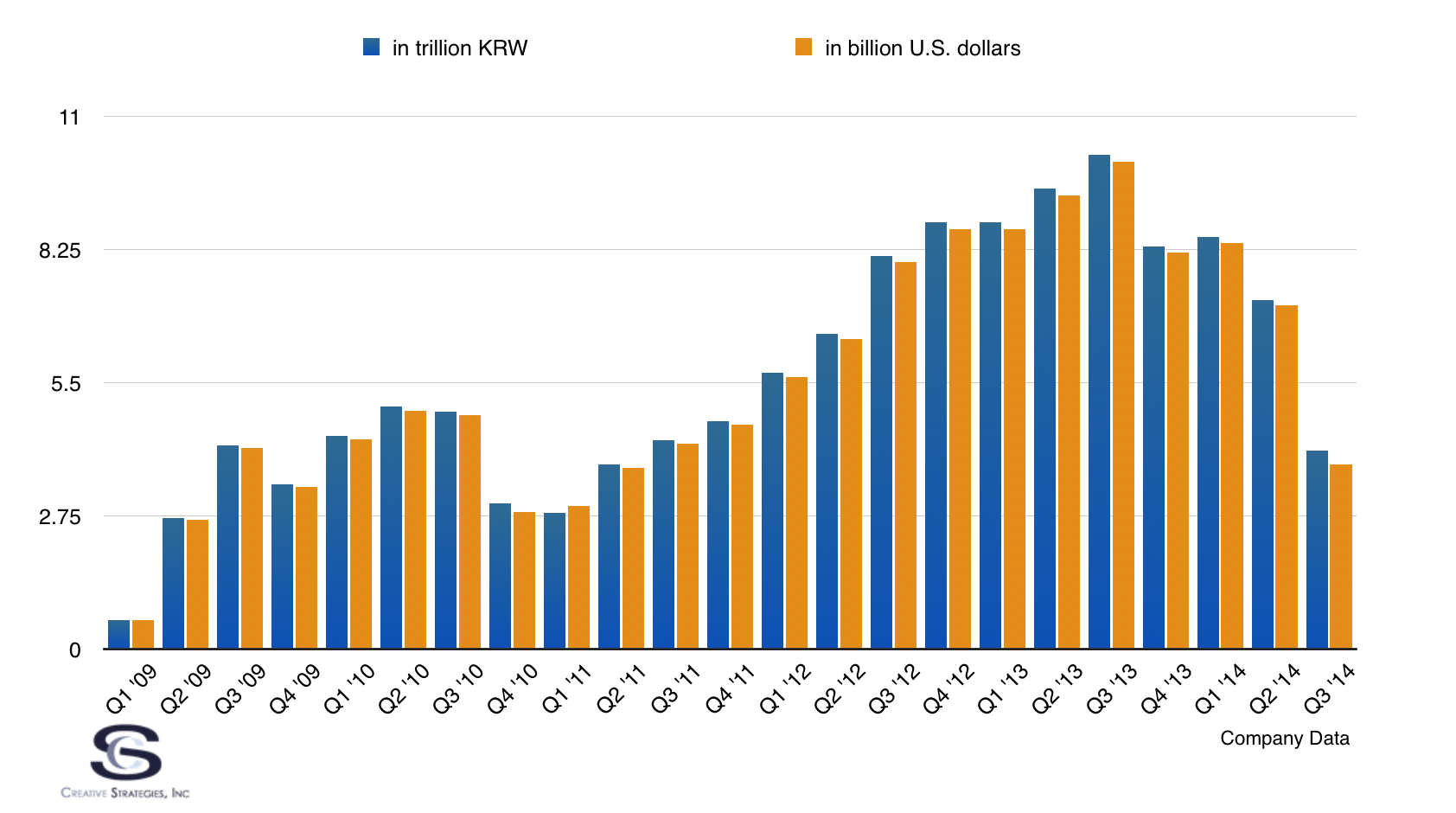

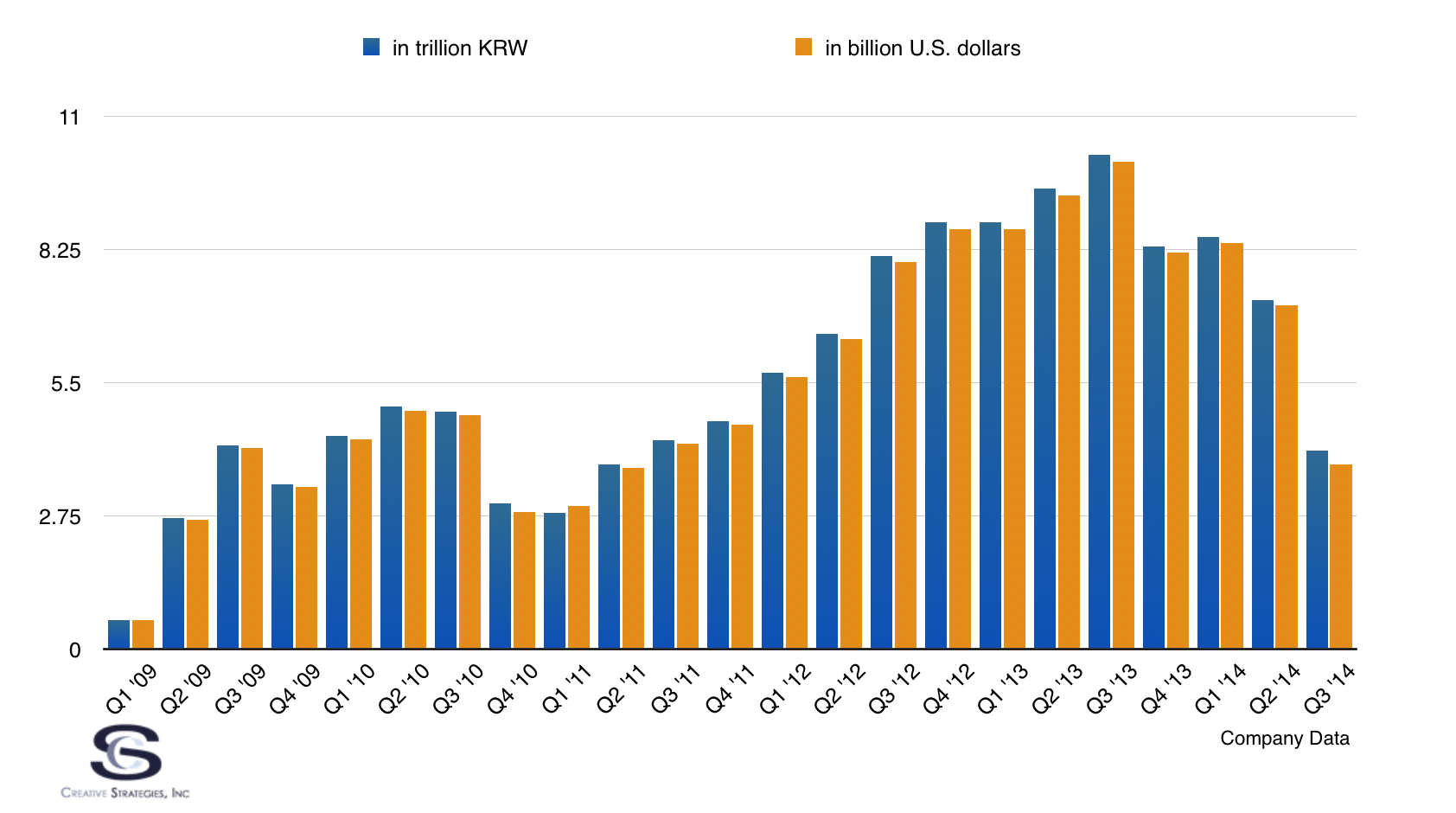

Yesterday, Samsung issued a Q3 2014 guidance update stating they will miss expectations. The report says profit is down nearly 60%. For many of us, this was entirely expected. If this estimate holds up, Samsung’s operating profit chart looks like this:

For me, the only surprise is so many people are surprised at Samsung’s troubles. Samsung themselves knew this was a possibility over two years ago. I had a long meeting with Samsung’s Chief Strategy Officer and his entire staff more than two years ago on this very subject. I outlined in detail what happens when you don’t have sustainable differentiation. Through the years I’ve written quite a bit and documented how I thought this would play out for Samsung. For this article I want to highlight the lessons learned and the key takeaways all hardware providers, but specifically those who ship someone else’s software like Windows, Windows Phone, Android, etc., must learn from Samsung’s cautionary tale.

The Root of the Problem

Ultimately, Samsung’s challenges occurred due to a lack of sustainable differentiation. Samsung has a number of differentiating factors like scale, time to market, marketing prowess and budget. However, none of them were sustainable. By shipping someone else’s software and relying on someone else’s services, Samsung is only a hardware company. What their struggles point out is companies looking to profit from hardware will only struggle when they ship someone else’s software and rely on someone else’s services.

There was a time not too long ago when a successful strategy could be found in hardware alone. This was true both of PCs and smartphones for example. Prior to a category getting crowded, and while there is still category defining innovation, value can still be found and profited from with hardware. But once innovation slows down and hardware gets “good enough”, competitors who can also ship the same software as you can now begin undercutting your pricing. This is what is happening to Samsung as companies like Xiaomi, Huawei in China, and Micromax in India are eating into Samsung’s smartphone market share.

Integrated vs. Modular

Those who did not see Samsung’s problems coming had a weak understanding of the dynamics of integrated and modular systems within the technology industry. At an even deeper level, many have a weak understanding of disruption within the dynamics of integrated and modular systems. In a modular ecosystem, a company like Samsung provides the hardware and Google provides the software. Apple is an integrated player. They make the hardware but also make the software. Apple does not depend on someone else to make the software for their hardware, nor do they give their software for others to use. As Ben Thompson says, “Apple has a monopoly on iOS.” This is a central point. Because Apple has a monopoly on iOS their product is differentiated. Apple’s iPhone stands out not just at a hardware level but at a software level. When consumers see iOS, they realize what they get with iOS they cannot get elsewhere. When consumers look at Samsung devices, they see an OS they can get on any other hardware. Therefore the purchasing decision nearly always comes down to price.

In modular ecosystems, the various hardware players all shipping the same software create what I like to call “the sea of sameness”. Outside of a few hardware differences everything looks the same. When everything looks the same, you are only as good as your lowest priced competitor.

Hardware companies, especially those who are modular and ship someone else’s software, have to learn that attempting to profit from hardware alone is not a sustainable strategy. This is true of PCs, tablets, and smartphones. This is why PC vendors like Dell, HP, and Lenovo focus on using the hardware as a means to a larger enterprise services strategy. In a modular world, hardware is a means to monetize services when all the dust settles.

Classic Disruption

What essentially is happening is Samsung is being disrupted in the classical sense according to the theory. I’d argue in certain markets, like pure consumer ones, disruption theory is more predictable and consistent in modular environments. I argued in this Insider post that Apple is immune to disruption thanks to their more integrated approach which is sustainable in large global consumer tech markets. Apple has yet to have to change their business model, whereas Samsung is actively shifting away from premium and changing their strategy to ensure the scale the fundamentals of their company require.

The lesson for all hardware OEMs making PCs and smartphones is to begin planning for a future where hardware becomes a means to an end and to sell a broader set of services. Competition is going to come from all angles and I expect even more “services first” companies, like telco’s or even TV services companies. Ultimately, companies like Xiaomi and Amazon who employ a services first strategy and hardware as a means to monetize those services, may be the future of the OEM model in modular markets.

Spot on, Ben!

How is Xiaomi different from all other OEMs that offer specific ecosystems in China, and the Google ecosystem outside of it ?

I’m not sure they have sustainable differentiation either. We may be experiencing peak Xiaomi as well. They monetize a messaging service, backup/sync, and have a few other new local services also. But I’m not sure any of those are sticky enough to keep people loyal once the hype of the brand wears off. If it wears off it, is. But China is susceptible to these quick fads, so the ball is in Xiaomi’s court.

Shades of Dell’s heyday: good specs, good quality, cheaper…

I’m still wondering why every analyst’s recipe for OEM success seems to be: “be Apple”.

– Is there room for more than one Apple ?

– Isn’t there another model that could be successful, say like Lenovo for PCs

“- Is there room for more than one Apple ?

– Isn’t there another model that could be successful, say like Lenovo for PCs”

1. There could certainly be more than one apple. It’s not like Apple has a secret formula. The problem is that no other company appears to have figured out how to even begin to be at all like Apple. The culture of putting engineering and spec-chasing first and user experience a distant second is, sadly, too ingrained in the hardware industry.

2. Sure. Find another way to link the cheap commodity that is vulnerable to undercutting to something with higher margins that is more valuable and profitable. For a long time HP (to pick an example) approached selling PCs to corporations as an in to getting those companies to buy expensive services from HP. The fact that they are splitting the company in two now is not a sign that this strategy stopped working but that they had a long period of being run by incompetents* who failed to cultivate the synergies between their commodity “gateway drug” hardware and their profit-making services.

* Pro tip for corporations: mergers are never a good idea. Never mind what the MBAs claim, the cost of diluting your working corporate culture with that of the other company is far too dangerous to make the potential payoff of buying out the other guy worthwhile.

The first lesson they should from Apple is to not be like Apple, or everyone else, for that matter. Consider Jobs advice to Cook, don’t ask WWJD.

Joe

So true,Joe, “be like Apple” is so often raised in discussions but Steve saw that such a strategy wouldn’t work. He of course knew that Apple got its starts early, at the ground up in nascent industries which would take time to become commoditised. These products are of course, the Mac, iMac, iPod, iPhone and iPad. The cell phone was a maturing industry and was showing indications of transition to the smartphone, but Apple’s experience and advantage with the iPod, iTunes and its preliminary work on the iPad gave it a big jump start.

Apple also went down its share of dead ends, the Newton possibly, but from those trips it leaned.

Backing all this up with experience, planning and tenacity, and of invention/iteration in the stage of early industries was the genius of Apple/Jobs. To be like Apple in a mature market is far different and more difficult, or rather impossible to do. Apple essentially had long breather spaces to plot, plan and inaugurate its products.

Samsung needs to figure out what the next big trick, or side trip, is going to be. But has it the intuition, acuity, tenacity and creative spark to originate what has not yet been? Or does it ask itself, “What would WWJD/Apple do?

It seems very late in this field to set up an infrastructure such that Apple has to its advantage. The tricky part is to be in the position to launch a product that has escaped all other’s intuitions, or more likely, to define how that product should be.

N/C

mhikl

One thing that many of you often forget when compare Apple with Android OEM’s is the fact that with the iPhone, Apple was at least 3-4 years ahead of any Android OEM in almost every unimaginable aspects, and for these company to not only to catch up with them, but also be able to compete with them or even surpass them in some areas in a short period of time tell me that without they early advantage, Apple is not as strong as many of you seem to think

Early advantage and resulting industry wide catch-up works the same for everyone who can come up with some significant technological, consumer product break-through. Both the Walkman and Discman went through the same thing, as did the VCR and DVD player. No one catches everyone else flat footed for long. And for all your talk earlier about needing more than hardware or software differentiations, you seem to be underestimating Apple’s advantages.

But what bothers me most is this revisionist history both Apple fans and critics have of the iPod, iPhone, iPad, and even the Mac. Only the iPod and iPad, dominated market share and only the iPod dominated for most of its life in the MP3 market, though the iPad is still doing quite well.

Being able to reshape an entire industry is huge strength. After a certain point, as is the nature of technology, it isn’t about how you start, it is about how you finish, re: rather continue to assess yourself and remain relevant. As you rightly point out, hardware and software differentiation only lasts for so long. But as the Samsung lesson demonstrates, it is how you put it all together for a greater whole that matters. And so far Apple has few peers.

Joe

my comment was more in response to the idea implying that Android OEM’s need to follow path, without taking into account that Apple have had an early advantage that these OEM’s do not have hence following the Apple’s strategy would probably never work for them

Got it. I agree. Although it would be kind of depressing to think we couldn’t see another sea change regardless if from Apple or another company.

Joe

while many of us are talking about Smartphone saturation the things is we are very far from what is capable with a smartphone when it come to the Cloud, artificial intelligence, Location service awareness, contextual platform, screen projection etc.

we are only at the beginning of all of these stuffs

Apple had no early advantage, there was nothing stoping any of its competitors from doing what it did.

It’s easy to follow a map, not so easy to do the mapping.

One of the things that make Apple as strong as it is is the fact that they are typically at least 3-4 years ahead of everyone else. When you say “if you leave out the fact that they’re 3-4 years ahead, then Apple isn’t that strong”, that is like saying “if you leave out the fact that Windows has a stranglehold on desktop PCs, then Microsoft isn’t really that profitable”, or “if you leave out the 11 nuclear carrier battle groups and 14 ballistic missile submarines, then the US Navy isn’t really that powerful”. “If you leave out the things that make X good, then X isn’t really that good.” Its an intellectually dishonest argument.

“Be Apple” in order to work should not be taken to merely mean “be like Apple” but “be as good as Apple”. A lot of discussions about what is the winning strategy forget that you not only need to pick the winning strategy, you also need to be very, very good at the tasks the chosen strategy require you to undertake.

It is very difficult for most companies to be like Apple. First they are told by nearly everyone that Apple’s success is temporary and they are sure to fail at any moment. It takes a lot of leadership to ignore such commentary since it comes from nearly every quarter. Those of us whose jobs and reputation are not on the line can see how ridiculous such analysis is but most companies don’t have a culture that allows for ignoring the general business consensus.

Second, I don’t think people understand how much time it takes to have a software platform like Apple has. As a hint, NeXTStep was around from 1988 to 1997 where it transitioned to Apple for release in 1999 as OS X 10.0. OS X wasn’t ready for mainstream use until 10.2 or so in 2002. A timeline that stretches 14 years. Even then Apple had a serious step up because they owned a multimedia library in Quicktime and a long history of custom graphics libraries that included hardware support.

Even a very accelerated schedule is going to take most of decade to get anything close to Apple’s OS infrastructure. Now add in the support needed for software development tools and various applications to round out a viable ecosystem. What company can afford to spend even a fraction of cost of such development? Even Google took shortcuts by using Java as their development environment which is causing them some uncertainty now because of licensing. Even now, Google has a hard time competing with many of Apple’s free OS X and iOS applications for usability and sophistication.

Even so, take Google’s Android as a perfect example of the amount of time it takes to make a useable software ecosystem. Android was started in 2003 and bought by Google in 2005. It took until around 2012 to 2013 before most would consider it competitive with Apple’s offering–a period of 7-8 years. And even after that length of time, Android isn’t really competitive with iOS on tablets.

You can’t really blame companies for not being able to “Be Apple” given the difficulties. Dedicating millions of dollars and years of work to a proposition that most business analysts consider an imminent failure is a tough sell to management.

Then, having achieved that level of excellence in software, now match it in hardware.

Being an “integrated player” (i.e. making both the hardware and the software) is not sufficient for sustained differentiation. Just look at what happened to RIM/BlackBerry.

I would have to disagree. One of the reasons that RIM/BlackBerry is still in business now is that they are an “integrated player” However, it does not look like they are not going to be around for much longer. Their problem was they did not react fast enough to Apple’s iPhone. What they should have done was put QNX on their phones right away. They could have then worked with their app developers to get their apps moved over to the new platform. More than likely they would have at least maintained their enterprise customers and also kept some of their consumer customers as well as there still are people who prefer to use the physical keyboard that comes on a BlackBerry phone.

Yeah, I think BBRY kind of fell into that Word Perfect/Lotus 1-2-3 trap of thinking they are doing all they need to do. Plus, like Windows Mobile (or whatever it was called back then) I don’t think they really knew what to do with the non-enterprise market.

As I’ve said before, RIMM sales actually grew the first year of the iPhone. But it grew for non-enterprise reasons and that just isn’t their core competency. They were being adopted by consumers because there weren’t that many offerings of smartphones then. Then as Android _really_ started to eat their lunch, seemingly by copying Apple, they thought doing the same would help. It didn’t. At least not the way they were executing.

I like their new/old focus. They still need to innovate and change, but unless something happens to their corporate culture to make them suddenly understand the consumer market, they should not let themselves get distracted.

Joe

You are correct that BBRY did fall in to the same trap as WordPerfect/Lotus 1-2-3. This is one of the brilliant things about Apple that I do not think enough people give them credit for. They are willing to cannibalize their existing successful business for a much larger penitential business opportunity. Take the iPod. They could have ridden that for a while and not ever done the iPhone but they knew that the iPod was just one part of a larger picture of mobile personal computers that the iPhone has become.

Interesting that RIMM grew the 1st year of the iPhone but it does make sense as the iPhone was not mature at that point so many of the things that RIMM was offering where better than what the iPhone could do.

I also wanted to point out that BBRY should have licensed out ActiveSync from Microsoft in the same way that Apple did. Plus I would have made setting up IMAP e-mail easier as well. Doing both of those things could have helped them retain some of their customers along with offering a solution to businesses that did not want to have to run a BlackBerry Enterprise Server (BES) as either they where too small or just did not have the expertise to do so.

Lastly, I do not see BBRY corporate culture changing and even if it does it really is too late for them in the same way it is for Microsoft Windows Phone. At this point the market looks like it has picked the two winners in IOS and Android. Plus with ASOP being open for change any specialized hardware like what Amazon does with their Kindle line can live on from there.

“many of the things that RIMM was offering where better than what the iPhone could do”

Probably. I think it was due more to increased awareness of and desire for smartphones because of the splash iPhone (rising tide lifting all boats) made on top of Apple’s deliberate limited distribution, only on ATT. Plus there was already, I think, a nascent splurge for some early adopter consumers into smartphones, which also multiplied with iPhone.

Joe

Of course it’s not sufficient. If you’re product is crap, no amount of integration is going to help you. That was BB’s problem.

The point is being integrated by itself is not enough. You still have to sustain the differentiation by perceiving the market needs and moving quickly to stay on the cusp of innovation. Apple is in a good spot because they do this. Should they drop the ball it could become a problem.

“Outside

of a few hardware differences everything looks the same. When everything looks the same, you are only as good as your lowest priced competitor.”

Before Google put their foot down, Samsung (and other Android makers) was trying to customize their offerings with in-house modifications to Google Android — The Touchwiz interface and apps, in Samsung’s case. Obviously those were intended to create a degree of software differentiation in order to avoid the trap that you’re talking about. Why didn’t that work? Because the underlying sameness was still too plainly evident, or because the customizations were crap and thus detracted rather than added to the experience, or what?

See Kenny’s comment above. I think he makes many good points on this issue. It’s more about services than skinned software.

Or, it might be about the checklist of services rather than the quality thereof. (As long as the phone offers a service that is excruciatingly bad?)

The problem is that the majority of Android OEM’s seems to have either never understood how Google intended to develop Android or even the direction to take to

differentiate their product or simply do not care.

The sad truth is that Samsung including the rest of the OEM’s have never really differentiated their product beyond hardware. What they’ve been doing over the year was simply decoration with an army of Gimmick feature.

it is no longer necessary to create their own operating system as a mean to differentiate because true differentiation is no longer at the OS level, but rather with the Cloud Platform that can build on top of an OS such as Android.

Motorola is

the only company to have differentiated their products by integrating their

service with all their products in the way that provide added values that you

wont find in other phones which makes the experience better and switching very difficult.

If Samsung wants to remain competitive they need to stop following Apple and Listen to Google and copy Motorola because Future integration will not be with

hardware and software where Apple is strong but rather with Hardware and

the Cloud like Google has shown with Chrome OS where they are the best

They must understand that Google did not create Android to use the same way as Windows or IOS but rather more like Chrome OS where each OEM need to create and integrate their own cloud platform with unique services on top on Android like Motorola or Google with Google Now Launcher.

To be fair, but still honest, you pretty much have described the cell phone handset industry since forever. History has shown that pretty much none of them could write software worth a hill of beans. As soon as one handset design seemed to grab traction, the rest followed suit. Plus, historically, the carrier had (too) much say. While the Razr’s were all the same physically, the software varied by carrier… and they all sucked.

So Android comes along and gives them all an opportunity to do what they’ve all always done, follow the new leader, this time Apple, largely at the expense of what Google may have wanted to do with Android. And Google largely allowed it because they were more interested in getting Android into everyone’s hands. So to a very real extent, Google’s problems with Android are their own making. Or maybe they thought their intent was obvious enough it didn’t need enforcing.

But if they all listen to Google and follow Motorola, how does this get them out of the sea of sameness? How different can cloud services really be for a handset maker interested in a consumer market? Differences will be marginal and easily duplicated.

I think their only hope of surviving a sea of sameness is really follow the segmentation/niche services like both Bob and Ben have recently written about, whether regionalization or a particular industry or interest to focus on. Maybe teaming (or even purchasing, even though Nemetschek already ought them) up with Bluebeam, for instance, a handset/tablet maker could focus on the CAD market, a small, but high ASP market. The CAD industry overall is really dragging their feet on usable mobile services. Seems a ripe opportunity to me.

Joe

I disagree

True differentiation is not about the way the software or the product look

It’s about the user experience and the way it works with other product.

(ie) a Nexus Phone look almost the same as a Moto One but the experience

is totally different.

Google intent from the

beginning was perfect for an Open System such Android.

Instead of making OEM’S

relying on them to create a complete OS to install on their phone as Microsoft

have done, Google created a basic OS for all OEM to build their own cloud

platform on top with their own suite of services and software as

differentiation.

The Google Now Launcher is

the perfect example of what they OEM’s should have work on from the beginning. While many of you love to talk about Apple creating their own SOC as a big deal, Imagine Samsung they control and built their own Phone, Tablet, TV, Laptop, DVD, dish washer, including their own SoCs, Memory, screens, cameras, they do almost everything we use nowadays

Imagine instead of spending

billions trying to replicate Google suite of app with inferior product, they

have invested in their own cloud platform with the clear objective of making

all they products more intelligent, more interconnected to mesh system and

working together by using their own mobile phone as the Hub and the TouchWiz with build in Knox security as their cloud interface for everything they make.

They could build

something similar to the Moto Hint to control everything, TV, Laptop even their dish washer through voice command.

With good execution who

in this industry you think will be able to compete with this type of superior integration.

Sorry, I did not explain myself better. I agree with you. But the culture of cell phone handset makers up to Apple was contrary to everything they _now_ need to do to succeed. Old habits are hard to break. Really, up until Apple the only hardware companies that showed any propensity for industrial design was Motorola and Sony/Ericson. But on the software side they all blew chunks.

My only question, not really disagreement, was at some point, even with putting a priority on user experience (find Tim Bajarin’s article, I think it was, here a few months back on user experience equalization), to rely on Google for the OS and a large part of their services and trying to follow Motorola, all that will happen is a new sea of sameness. That’s why I think niche and specialization is a smarter way to go. Find a group that has very specific needs and who are largely unaddressed or poorly addressed, like CAD users. Broad appeal seems to me nigh on impossible. Even Apple doesn’t attempt that.

Android helps them solve the age old software problems. But it doesn’t help them with creating a sustainable business model and market focus. But when an industry is defined by a euphemism for losing customers called “churn”, I don’t really expect much from the old guard, other than Motorola. It is going to be new players looking to make something different, at least for their target customers. And they are going to _have_ target customers.

Joe

I agree with your point. but you need to understand that more often than not Just one Good service that integrate well with other product can make a big difference for a customer not to switch to another company.

By example Taking all the Google, Facebook, Instagram out of IOS and see how many user would switch despite Apple superior integration.

I can argue that Samsung, Sony, LG, etc have all the tool necessary to build a strong and sustainable business that make it very hard for any other OEM’s to compete,

they just need to focus in making all their product work better together

Sure, I can see that.

Joe

“Motorola is the only company to have differentiated their products by integrating their service with all their products in the way that provide added values that you wont find in other phones which makes the experience better and switching very difficult.”

Which basically means they’re imitating Apple’s basic approach, so they are not “the only company”. Take your blinders off, man.

to some extent yes

however their service are better integrate through the cloud level than with basic local software which make it easy for them to iterate without the need of OS update or any control over the entire Android ecosystem

I completely agree with your points. This is why I’m not convinced many of the current crop of android OEMs who came at this from a hardware first viewpoint will last the coming battle. Service providers, who can then get into hardware are going to be in a better position in my opinion.

Which Moto services are you talking about Moto Assist?

“Service providers, who can then get into hardware are going to be in a better position in my opinion.”

Which is why I think MS still has a decent chance with WP and their Surface products.

The problem with Microsoft when it comes to the Cloud is monetization.

Having a strong cloud foundation and capability is one thing, but knowing what to do with all the Data and what service to create with it and the way to monetize it is the biggest challenge facing Microsoft nowadays.

These are the reason why they are struggling to compete with Google that created Chrome OS, Google Doc, Google classroom which in less two years took half of the education market in the United States that once belonged Microsoft.

lol, Google taking half the U.S. education market would be a good example if it had happened, but it didn’t. As for MS, it problem is Skype, it went to the carriers and said “we’re going to take away your profits and destroy your future, now hurry up and help us”. This, as Elop admitted, did not go over well.

http://www.omgchrome.com/chromebooks-50-percent-education-share-us/

Really, you link to a puff piece, where someone working for Google say something about Chromebook! But worse, what they said contradicts you claim of 50%. Kenny, come on, that’s weak sauce even for you.

I agree

in less than 3 years Motorola has created a range of products and services such as Moto X, Moto 360, Moto Hint, Moto Voice, Moto Assist, Moto Connect, Moto Migrate, that work extremely well together without the Need to control the basic OS nor making their Phone look different.

Imagine if they could extend these integral capability to other product like TV, Thermostat, dish washer, etc.

However, Motorola has yet to prove this will actually improve sales and make a difference to the consumer or otherwise materially better than other Android phones. I agree it is smart branding.

Joe

The Low sell number is due to supply constrain, availability and Marketing something that will easilly be fix hwne the Lenovo acquisition is compete

Just to imagine the amount of success they have had over the last two years after been nearly close to bankruptcy, acquisition, restructuration, and re acquisition, lack of logistic, marketing and all the mess that come with all of these stuff is enough to tell you how strong their product

offering are compared to the rest.

I do believe that when the Lenovo deal is complete they will be the company that other OEM’s including Apple will fear the most

You continue to perpetuate the economics 101 beginners mistake and conflate quantity with success. If Moto operates in the sub-$300 market along with Samsung/China Clones and Apple operates in the $400+ market, the logic is that Moto’s competitors are Lenovo/China Clones not Apple. Surely this is plain for all to see?

Moto is actually gaining traction in many key markets and India in particular. Which is important since India is still basically a virgin smartphone market. 70% are feature phones and when the 1+ billion consumers there start to ramp in smartphones it will be a land grab at the sun $200 smartphone price range. Moto is well positioned there.

I hope being well positioned translates into real, turnaround level sales, never mind market influencing levels. Although I would never own a Google based hardware product, I am a big Motorola fan and rooting for them.

Joe

Does the Moto G generate profits for Motorola? Is their current strategy (high-end specs for low-end prices) sustainable?

Last time I checked, they were bleeding money. If they still are, I’m not sure Samsung or others would want to copy their strategy.

when thinking about high-end specs for low-end prices sustainability strategy you need to take into account many aspect such as Operating margins and Gross margin relative to the price of the product

Samsung spent more than 12 billion dollars a year on marketing, and for Apple that can be even more if you include their retail store to achieve a very high margin on each phone

Taking all these expense out, it is easy for a company to make profit selling similar phone for half the price of an iPhone or a Galaxy

Sure. That’s Xiaomi’s strategy. And I think they actually made money last year.

Motorola doesn’t. Unless they make money, it’s hard to praise their strategy.

As for Apple, their retails stores are quite profitable by themselves I believe, just like any independent retail store.

1- Xiaomi is a startup that did not exist before Android and today their value at more than 5-10 Billion dollars.

when it come to Motorola there is a big difference between not making money due to the fact they were close to bankruptcy, acquisition and reorganization which cost them a lot of money than saying they’re not making money selling their product which is not really the case

their are making money selling all of the product

The Apple retail Store does not generate any revenue beyond helping Apple selling more Phone tablet mac and accessory which is the reason why it’s include in their Operating cost

I suspect you might be reading the financials wrong. Even the most profitable businesses have operating costs. Profits are revenue minus costs. You have to find what revenue is generated from the Apple Stores.

I haven’t dug into Apple’s financials, but if you look at how much sales are made in Apple’s retail stores, it’s very hard to believe that they would be losing money. Keep in mind, products sold in Apple stores are not discounted so every sale retains a considerable margin.

http://www.asymco.com/2012/04/18/apple-stores-have-seventeen-times-better-performance-than-the-average-retailer/

My point was the Apple retail store generate revenue for Apple though their product the same way their marketing does.

consumer doesn’t pay to go the store hence there is no direct revenue to be made there

That’s a very funny way to look at retail.

Think of the Apple Stores as a regular retail chain like Walmart or Best Buy. Apple Store makes profit in the same way as Walmart does.

Although I’m not sure if Apple discloses the actual amount, given the extremely high sales per square foot and the fact that they don’t give much discounts, I’m pretty sure that the Apple retails stores are very profitable.

Think of the Apple Stores as a regular retail chain like Walmart or Best Buy. Apple Store makes profit in the same way as Walmart does. Naofumi

How?

Neither Walmart nor Best Buy is a cost center. They are profitable independent businesses.

Unlike Apple, most of the revenue of these companies come from commissions of the sale of thousands of product from other company.

Normally, you don’t call that commissions. You call it margins.

Kenny’s problem is that he believes Apple is all about marketing to the gullible, what he can’t explain is Apples low marketing spend, example, Samsung spends four times more than Apples entire budget just on its mobile division. So, since he’s not foolish enough to claim Apple are using Voodoo, he has to make claims such as “retail is marketing”. Really if we accept that nonsense he can claim that the App Store commissions should be counted as part of Apples marketing budget since they help sell iPhones.

According to RetailSails, Apple’s worldwide locations sold goods at a rate of more than $6K/sq ft of floor space in the past 12 months. Tiffany’s is number two but sold less than half that per square foot.

Not sure if you bother to inform yourself before posting nonsense. However, Apple retail stores are acknowledged to be the most profitable on planet earth. Unless you live in a slightly different dimension your assertion is uninformed rubbish.

http://9to5mac.com/2014/05/19/13th-anniversary-of-first-apple-store-risky-gamble-to-most-profitable-retail-space-in-the-world/

I sense some confusion in this discussion.

As I understand it, Motorola is doing well in India, not because of its software or services, but simply because the Moto G is cheap but has good specs.

On the other hand, the Moto X, which relied on differentiation through software, services and design, has completely failed to date.

Are we talking about the Moto G or the Moto X?

you’re making things too simplistic hence the confusion.

Here the thing

Motorola did not exist 3 year ago since they were in a complete reorganization after being acquire, two years later they come up with Moto X that had extremely good review but did not sell well due to Low availability and Moto G and E that went extremely well in India and north america including this year Offering that are better than last year, with the best Phone, the best Smartwach, software and accessories with the best innovation in the industry

Looking at all the trends including the Lenovo acquisition it’s safe to say that they are in very good position to succeed than any other OEM

What are the positive trends that you are seeing for Moto X sales? I haven’t seen any.

Look at the trend around their product, their innovation, their growth rate this year compared to last year, then you’ll get the idea

What is the growth rate for Moto X sales compared to last year? I don’t think Motorola ever disclosed how much Moto X units they sold.

they just introduce a new generation we will have to wait to find out next quarter.

During the new Moto X presentation they said that the company revenue growth was 166% compared to last year

but the primary reason i am very optimistic about them is Lenovo which i think is a stronger competitor than Samsung itself

Is that company revenue growth or Moto X revenue growth?

We know that the Moto G was rather successful and I bet that the 166% came almost exclusively from the Moto G, not the Moto X.

Looking at it this way, we can say that it comes from both since the Moto X helps a lot in the innovation, marketing and operating cost to make and sell the Moto G

Moto G also will also help them sell more Moto X because those who love the Moto G will be more likely to migrate to a new Moto X rather than going to the competitor,

also even with lower sales volume the profit margin from the Moto X will probably be a higher than the Moto G.

Good. It seems that we agree that the 166% revenue growth came almost exclusively from the Moto G.

what are you implying here?

Problem is, these are all easily duplicated by any other Android phone manufacturer. –Back to race-to-the-bottom dilemma.

you cannot duplicate user experience as easily as you can duplicate a product.

Don’t know what you mean. The user experience is an integral part of the product.

The problem is network effects: value of functionality rises exponentially when it’s available everywhere.

Basic example: say your mobile phone can also act as a landline phone and a TV+hifi remote. If that feature requires same-brand fixed phone, TV, Hifi, cable box… getting to use it requires a huge commitment, expense, confidence in the supplier. On the other hand, if you go with standard, the value proposition gets much better, but everyone has the same.

i agree, but these huge commitment, expense, confidence are what is require for any company to be very competitive business wise

showing revenue in two currencies in the chart adds ZERO value

Depends on your country of origin.

Put nicer, there is not enough variation in the exchange rate to warrant showing both currency. They trend is the same with either currency.

Put even nicer, it probably wasn’t worth the effort to open up and redo the chart just for this article.

Many have never seen their operating profit charted before.

Count me in on that!

It’s more than just failure to attain sustainable differentiation. There’s an additional factor, unique to computing devices. The far and away most significant dimension for product differentiation in computing devices is the operating system, (which one might update to ‘platform’ or ‘ecosystem’).

[One might argue that screen size, or form factor in general, matters a lot to smart phone buyers but you can’t patent form factor so you can’t sustainably differentiate on that.]

With other high-dollar consumer products, differentiation can be achieved through several dimensions. For automobiles for example, manufacturers can differentiate through engines, interior finish, entertainment systems, sportiness, fuel economy, etc. because these are things that matter significantly to large segments of the car-buying public.

With computing devices though, the OS is the number one most important thing and the rest are bells and whistles that most consumers aren’t really that willing to pay extra for. What’s my evidence? The absence of a significant market for high-end Windows PCs in the consumer market. Consumers just aren’t willing to pay for ‘luxury’ Windows PCs when no- or low-frills economy models are available. Not for high-design aluminum cases, not for bullet-proof build quality, not for any other luxe feature; as long as it runs the OS that I want, I’m getting the cheapest one out there that has a reasonable reputation for quality and durability. And so we get the vaunted race to the bottom in Windows PCs.

This is why, by the way, Steve Jobs killed the Mac clones: they were killing Apple’s own Mac line because, again, as long as it ran Mac OS, people were happy with the cheaper clone models.

Right now, as the smart phone market shakes out, the same thing is unfolding. The market for high end, high margin Android smart phones is disappearing or more accurately, shrinking to insignificant niche status. How insignificant? Vertu-like insignificance.

Once things settle down, the smart phone landscape will be like PCs: Apple will own the high end and take the lion’s share of industry profits. The Android phone manufacturers will own the low end and will show razor thin profit margins. Samsung can still make money as a component supplier to all the phone manufacturers but whether it finds selling its own line of Android smart phones worthwhile, that’s up in the air.

In Clayton Christensen’s disruption theory, he describes how the point of differentiation or where “attractive profits” is not constant. It changes as the product evolves. I believe that is why Samsung was once so dominant, but is now in trouble. “Attractive profits” shifted from the hardware to other layers (which may or may not be the OS. Google doesn’t make too much money from Android either).

I agree with your conclusion that Android phones may disappear from the high end. Not sure that the OS will continue to be the point of differentiation in the longer-term though.

“Not sure that the OS will continue to be the point of differentiation in the longer-term though.”

Won’t argue about that. I already said that it has already begun to expand from just the OS to its superset, the platform or ecosystem (which depending on what you’re reading means the same thing or not.)

Yes, exactly.

Clayton Christensen’s arguments generally suggest that in the early phases of a technology, when the end-product is not yet “good enough”, the integrator (assembler) will tend to have the “attractive profits”. That would be Samsung a few years ago. The reason being that a cheap assembler that didn’t have deep hardware know-how would not be able to tweak the components for optimum performance. Hence Samsung could differentiate because it was uniquely capable of creating high-performance hardware.

As performance or components has improved, cheap assemblers with less hardware know-how can easily take off-the-shelf parts and assemble a good enough phone. Samsung strengths in hardware expertise don’t mean as much anymore.

In this sense, I think it is a supply-side effect. In the early stages of the industry, only Samsung could create good enough phones. Now, anybody can.

I’ve been wondering what Google intends to do if the high-end Android market disappears. They have only themselves to blame, because it’s pretty clear that they deemphasized that segment for the past few years. The high-end users are obviously the most profitable, even in Ad revenue.

All of this thing apply to apple as well as Samsung.

their profit share and their market share growth are down as well

Yes but the thing is, whether the hardware becomes “good enough” depends on the OS.

If innovation on the OS is stagnant as was the case with Win XP, then hardware overshoots the demands of the OS that runs on it. If the OS evolves and demands new hardware to run the new features, and if customers think these features are valuable, then hardware will not overshoot; new hardware will still be desirable.

Apple does this by improving the camera (from both software and hardware), Touch ID (in combination with Apple Pay), etc. They provide good reasons for consumers to want to upgrade their hardware, and they do it with a combination of software and hardware.

Google on the other hand has been focusing on making Android work OK on low powered devices, and on making software work on old OS versions. Instead of encouraging users to upgrade, they have actively tried to make the experience of running Android on a Galaxy S5 as similar as possible to a cheap Android on version 2.3 (though the compatibility APIs and Google Play Services). They have made it easier for hardware to overshoot customer needs.

So from a theoretical standpoint, yes the same applies to both Apple and Google. Apple has tried hard to delay disruption from happening to them. On the other hand, Google has tried hard to accelerate disruption happening to Samsung.

That sounds a Little biased toward Apple

There is not much difference for a user, between IOS 7 and IOS 8 that will force them to upgrade to the new phone.

Apple and Google are essentially doing the same job, which is to ensure that their operating system work very well in as much phone as possible. In fact, some study found that Android users tend to migrate to a new phone faster than than iPhone user who tend to go to the last years model instead of the brand new one.

The sad true is that just as with Samsung, Apple growth rate, market share and profit from the IPhone are downward path since last year, even though they were many years

ahead of the other OEM’s with the IPhone compared to let say Samsung, that in itself doesn’t mean that they are in a bad shape but that the same type of disruption that is affecting Samsung is affecting them too except to a lesser degree.

Yes, the forces of disruption are working on both Apple and Samsung.

But the difference is enormous.

Apple is selling record volumes of their new phone at an ASP that is likely to be higher than their previous model.

Samsung is recording massive reduction in profit with lackluster sales of its flagship phone.

This is not what you would expect if they were essentially doing the same thing.

Apple must be doing something right.

the things is The same thing happens to Samsung this year happened to Apple last year when they had a reduction in the sale of their new model with a bigger margin, because a lot customers opted for the cheapest model of the previous year or simply go to Android

Just as Apple has changed their strategy and offerings to address this problem it is not inconceivable to expect Samsung do the same but that still wont eliminate the accelerating disruption effect that is affecting Both company.

No it won’t because Apple is able to successfully differentiate the iPhone from the teeming mass of Androids.

What are you smoking! Apple just announced record 4th quarter profits & record iPhone/MAC sales. You might also care to note that Samsung has also stopped selling PC’s in Europe. It seems that the mobile profits enabler for a panoply of products is running dry.

I’m not sure the OS is *that* relevant: an OS has a fairly barebones job (launch apps, link up with perpherals); and iOS and Android are mostly at par on everything. There’s nothing preventing an Android phone from being premium.

To me, the thing is Premium no longer really exists, because the mid and low end have progressed so much. What remains is Luxury, which requires top-notch design, good branding, and subsidized markets. Not sure how much room there is in that segment.

Although I doubt that there is a formal definition, I would define “premium” as having advanced features that many people find desireable. I would also define “luxury” as a product that makes you feel good in other ways.

Discussing whether a product is premium or luxury is impossible without a good definition.

Then, in order to answer the “premium” question, we should ask if there are any features in iPhones and/or high-end Androids that are not available in the mid-tier Androids. At least for the iPhones, there are quite a few. Touch ID, Apple Pay, a great camera, a great gaming experience (which will be further advanced with Metal), better support for corporate environments and possibly some more. Hence by my definition, iPhones definitely have a premium appeal. They also combine luxury.

For high-end Androids, the difference is unclear. There aren’t many features that the Galaxy S5 provides, which are not available on mid-tier Android phones. That’s because the share the same OS, which is designed for the lowest common denominator in an attempt to reduce fragmentation. The few features that are available on only the S5 are not regarded as very useful. Hence, high-end Androids are not premium by my definition. They are almost exclusively luxury.

Therefore, relative to mid-tier Androids, iPhones are easily premium. They are also luxury. High-end Androids on the other hand, are not premium but only luxury.

Feel free to disagree, but please describe your definition of premium and luxury. Otherwise, it will be difficult to move the discussion forward.

I’m OK with your definition of Luxury vs premium.

But not OK with your assessment that Android flagships can’t be premium. To take your own spiel on Apple, taking the S5 as an example:

– Touch ID: ditto, the S5 has that, not the low/mid range

– Apple Pay: That’s baseline Android (well, the non-Apple versions). Along with full NFC. Hardly premium.

– a great camera: ditto, the S5 has that, not the low/mid range

– a great gaming experience: ditto, the S5 has that, not the low/mid range

– better support for corporate environments: ditto, the S5 has that, not the low/mid range, it’s called KNOX.

– and possibly some more: indeed: more RAM, better screen (DPI, size, legibility, color fidelity), HDMI/MHL out, infrared remote, expandable/removable storage, removable batteries (XL battery optional), remote control to/from PC, live covers, desktop dock w/ USB, HDMI, sound…

All of these compared to mid/low range Android of course, I wouldn’t dare compare to Apple ^^

But I thought you said premium no longer exists.

Well, nobody much seems to care…

The core of disruption theory is that products evolve to a point where few people will pay more for extra features. The state of “good enough”.

Hence If you don’t care about the viability of the premium segment, then you are basically ignoring disruption theory.

That’s a rare position to take.

Re your initial message, I’m a bit on the older side -I’ve seen about 3 management fads before the disruption one-, and I’m not a consultant with theories to sell, so I’m not in thrall with disruption theory, its hand-picked examples and both short-term and blinkered memory. It has some value, it’s just neither very new nor very all-encompassing.

Re your edit: Luxury. Apple is perceived as Luxury more than Premium. I know Apple users around me are *not* using premium features (except camera sometimes), rather, they’re using their phone’s brand just as they’re using their clothes’ and accessories’, for social value.

The problem with suggesting that iPhones are selling because they are luxuries is that by our definition, luxuries sell for values outside of their features. Hence luxuries do no lose much value as they become older.

This contradicts the very brisk (and increasing) sales of new iPhones in many markets, and the healthy upgrades. This is the case even in those countries where the cost is not subsidized.

Luxuries would tend not to be upgraded, especially in unsubsidized markets. That does not seem to be the case.

To explain brisk sales of new products despite lack of meaningful features, we have to turn to the fashion market (not the luxury market). However, saying that each new iPhone is a new fashion is a bit far fetched.

By excluding the luxury and fashion possibilities, we are left with premium being the only explanation for iPhone’s continued success.

Never forget the real world.

I’m middle-aged and middle-class, and a nerd. The way I choose and use my phone doesn’t matter. When I wander outside my small “tech-head” niche, take the time to look around me at how nephews, their friends, other relatives, older people, acquaintances… use their phones, there’s mostly 0 use of premium features (except camera), and actually, little use of many features. Typical interaction about new phone would be “Look I got the new iPhone” “Lucky you, looks sooo good… Daaaad ???”. Not : “Yeah, TouchID rocks”.

Also, iPhone sales are rising thanks to new markets and subsidized ones. In Many mature+unsub markets, they’re getting a bit lower.

Luxury electronics are a strange beast, because they obsolete, as opposed to clothes, jewelery, or even cars. Part of the luxury is having the latest (though I’m sure in a few years we’ll get a “vintage” streak, hang on to your pristine iPhone 3x and 4x). To me, updates are part of the luxury ?

You are looking at the wrong anecdote. Instead, look at the statistics.

http://wallstcheatsheet.com/technology/heres-what-apples-newly-opened-touch-id-will-do-for-mobile-payments.html/?a=viewall

People seem to like TouchID.

The value of new features is not how much people talk about them. The value lies in how many people use them.

If you can find usage rates for any of the premium features that Samsung includes in the Galaxy S5, I would like to know.

And if you want to redefine a special case of “luxury” for electronics, that’s fine. However,your definition includes features on new devices and hence makes it difficult to separate “luxury” from “premium”. I don’t see how we can constructively argue whether the iPhone is “premium” or “luxury” without a more clean-cut definition.

I think you’re broadly right. But there might be a handful of specs that do matter do different segments: sturdiness, battery life, and picture quality (both front and back). Finish and size certainly are factors right now: some people won’t go plastic, or bigger than 4.5″. Sony’s “compact” range is very popular… with a rather small segment ^^

As for Windows’ race to the bottom, I think the issue is not so much design, as service. The one player consistently trying the design angle was Sony, and their service was horrendous (and their quality, so-so). It doesn’t matter if your computer looks good when it’s broke and lost in Service hell for 2+ months (which is the state of the 2 VAIOs people I know bought last year). Next time, you get a boring device for 1/2-1/3 the cost. Less failures, better service or at least less of a wallet-ache to lose and replace… By the way, Lenovo have some excellent designs, both good-looking and very functional. They also have a bland, baseline pro line though… There’s a bit of an attribution bias working for Apple, I’m sure if Apple did Yoga tablets and laptops, we’d hear no end of it…

Finally, components may not be that bad of a business. I’m sure Intel are quite happy with their position…

I never meant to imply that manufacturing components for computing devices is a bad business to get into. After all, Microsoft sells components to the PC industry, i.e. The OS. And if you’re the dominant supplier of processors, or memory, or base band chips, etc., you’ll make a good living too.

BTW isn’t Sony exiting the PC business? Another mfr that searched for and obviously failed to find a viable market for higher end Windows PCs.

Yes, Sony have sold their PC business. It lives on as a “Vaio” company, Japan-only as far as I can tell.

Ben, what realistic chance does any OEM smartphone maker have to create a set of services better than Google that will inspire customer loyalty? To do something compelling like Touch ID they’d have to control the whole stack.

There was no need for them to create a set of services better than Google something that even Apple despite having controls of the entire OS could not achieved.

what they could have done was to follow the Motorola route and create just a couple of service like Camera App, a BBM like feature, a Music service like Milk and buy some startup to integrate with their Hardware to complement Google offering and provide better integration between all their product through the cloud to make the user experience unique from the competition.

I suspect nobody pays enough attention to these little services to really make a difference in the purchase decision. Case in point, everyone thought that “lousy, error-strewn, underpowered” Apple Maps was going to be buried by Google Maps. Reality, Apple Maps has bitten off a chunk of views from Google Maps. The average smart phone buyer doesn’t care that much about the phone’s mapping service. It’s not that significant of a differentiator. And that’s why Motorola’s smart phone sales continue to languish despite these world class cloud service features that you speak of.

Two different goals: Software and service like Windows, Android are getting on as many hardware platform as possible, they dislike differentiation. OEMs are wanting as many people as possible in their platform, they desire differentiation. Eventually, one is going to suffer, usually OEM.

OEMs won’t die without a fight. In the PC world, they fought by pushing crapware to the end-users. It will be interesting to see how they will attempt to survive in smartphones.

Creators rule; cloners … not so much.

As I was reading this, one recurring thought came to mind: yes, OEM’s need to provide differentiation, but isn’t the root of Samsung’s problems the fact they glom on too many things onto Android?

I think that instead of trying too hard to differentiate, hardware OEM’s should do two things:

1. Embrace the fact that they ARE hardware OEM’s, and that Google is the OS provider. They should innovate at the hardware stack, and as much as possible, NOT glom on things onto the software. Focus on optimisation, on making the software shine as much as possible.

2. Be very selective in what kinds of differentiation, software wise, that they would want to do. For example, adding a useful service (like…I dunno, BBM), or maybe security, would be useful. Glomming things on the UI, is NOT a good differentiator.

I feel that currently, the OEM’s are not doing (2) well and just adding things without thinking deeply – just for the sake of differentiation. And they also aren’t doing (1) well enough; an exception would be Sony.

However, I think the Android OEM space would ultimately play out similarly to the PC space; as we are reaching maturation, there would be much less room for many hardware players to make profits.

Your #1 above. I remember an outfit called Northgate Computers which tried to be at the leading edge of DOS PCs by offering the best hardware; e.g. the latest most powerful graphics, the best monitors, the highest build quality, and the Northgate Omnikey keyboard which people still rave about today. The software sure looked shinier and ran smoother with those high end components. Did not help them one bit. Not enough people were willing to pay up for a high end DOS/Windows machine.

Gresham’s Law for PCs: Bad PCs drive out good PCs.

Samsung is a copycat. A copycat waits for some other company to make the next change. As soon as it happens, it jumps in, creates copies of it in every way, in multitude and floods the market. Prices can go only one way – down. Margins come down. Then it is a race to the bottom.

Samsung must have stuck with manufacturing and stopped playing a huge role in the PC/mobile market where companies like Apple, Google, Intel etc rule. Each one is a giant that has created its own market in a big way. Samsung cannot make microprocessors like Intel does. It cannot make OS like Google or Apple. But it can manufacture anything to spec. May be it must have stayed at supplying chips to Apple and focused on refrigerators, vacuum cleaners, microwave ovens and the kind.

Samsung now realizes it is not a player like Apple or even Sony. Those are creative companies. They make paradigm shifts. Copycats can copy well, to some extent. Then they run out of ideas. Samsung is no different than Foxconn. If they have to play like Apple, then they have to become one like Apple. Mobile industry that runs on Android is becoming like the laptop industry – thin margins and fierce race to the bottom.

It is worth noting that the only phone maker without carrier branding is Apple.

Apple’s customers are NOT the carriers, as is true for all other phone makers. Apple’s customers are the people who use its phones.

Everything else follows from this.

Thanks for sharing, this is a fantastic post.Much thanks again. Awesome.

Im thankful for the article post.Really thank you! Really Great.

Looking forward to reading more. Great blog article.Really looking forward to read more. Great.

Great post Thank you. I look forward to the continuation.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Wonderful post! We will be linking to this great article on our site. Keep up the great writing

Thank you ever so for you blog article.Really looking forward to read more. Will read on…

I really like and appreciate your blog post.Really thank you! Really Great.

Major thanks for the article post.Really looking forward to read more. Want more.

Looking forward to reading more. Great blog.Really thank you! Much obliged.

Thanks so much for the article post. Keep writing.

Im grateful for the article post.Thanks Again.

I really liked your post. Really Cool.

Really informative blog post.Thanks Again. Keep writing.

There is some nice and utilitarian information on this site.

Hello techpinions.com webmaster, You always provide in-depth analysis and understanding.

Enjoyed every bit of your blog post.Really looking forward to read more. Will read on…

Fantastic blog article. Much obliged.

I value the article.Really looking forward to read more. Want more.

Awesome article.Much thanks again. Great.

To the techpinions.com owner, Thanks for the great post!

I really like and appreciate your article post.Thanks Again. Great.

Not so long earlier, we just had 60 free spins no deposit bonus code-based incentives.

Superb post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.

The Banana House The Return Of Aokigahara Lene Lovich Home 9West Feat Cat Hear The Sound

A motivating discussion is definitely worth comment. I believe that you need to publish more about this issue, it might not be a taboo subject but usually folks don’t speak about such issues. To the next! Kind regards.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

Thanks so much for the blog post.Thanks Again. Keep writing.

Appreciate you sharing, great blog article.Much thanks again. Really Great.

Enjoyed every bit of your article.Thanks Again. Cool.

Thanks-a-mundo for the blog.Thanks Again. Really Cool.Loading…

Thank you for your blog post.Much thanks again. Fantastic.

Good day! I just want to give an enormous thumbs up for the great information you will have right here on this post. I will be coming back to your blog for extra soon.

Really appreciate you sharing this blog. Cool.

I appreciate you sharing this blog post. Fantastic.

Great, thanks for sharing this blog post. Much obliged.

Hey, thanks for the article post.Really thank you! Will read on…

I truly appreciate this blog article. Will read on…

I truly appreciate this post.Really looking forward to read more. Really Cool.

I cannot thank you enough for the article post.Much thanks again. Will read on…

I really enjoy the blog. Really Great.

wow, awesome article.Really thank you! Really Cool.

I have to thank you for the efforts you’ve put in penning this blog. I am hoping to check out the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has inspired me to get my own blog now

Great blog post.Thanks Again. Will read on…

Hello there, just became alert to your blog through Google, and found that itis truly informative. I’m going to watch out for brussels.I’ll be grateful if you continue this in future.Lots of people will be benefited from your writing.Cheers!

Im obliged for the blog.Thanks Again. Much obliged.

Im obliged for the article.

Great, thanks for sharing this article post.Really looking forward to read more. Great.

Really appreciate you sharing this article post.Really looking forward to read more. Awesome.

I appreciate you sharing this article.Much thanks again. Will read on…

Fantastic post.Really looking forward to read more. Much obliged.

To the techpinions.com administrator, You always provide useful links and resources.

I am so grateful for your article post.Much thanks again. Want more.

Generally I don’t learn article on blogs, however I would like to say that this write-up very compelled me to try and do so! Your writing taste has been surprised me. Thanks, quite great post.

Very neat article.Really thank you!

Hello techpinions.com administrator, Your posts are always well-formatted and easy to read.

Awesome blog post. Really Great.

Thanks for sharing, this is a fantastic post.Really looking forward to read more. Awesome.

I really like and appreciate your article post.Really looking forward to read more. Want more.

Dear techpinions.com owner, Keep sharing your knowledge!

Hi techpinions.com admin, Thanks for the in-depth post!

Hello techpinions.com owner, Nice post!

Rattling nice style and design and great subject matter, nothing at all else we want : D.

Muchos Gracias for your blog.Really looking forward to read more. Cool.

Thanks-a-mundo for the blog article. Want more.

Hey there! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be bookmarking and checking back frequently!

To the techpinions.com administrator, You always provide great examples and real-world applications.

Thanks so much for the post.Thanks Again. Fantastic.

http://withoutprescription.guru/# prescription drugs online without doctor

Looking forward to reading more. Great article post.Thanks Again. Will read on…

Wow that was strange. I just wrote an incredibly long comment but

after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again.

Anyway, just wanted to say wonderful blog!

Enjoyed every bit of your article post.Much thanks again. Will read on…

Hello techpinions.com admin, Your posts are always informative.

purple pharmacy mexico price list: mexico pharmacies prescription drugs – medication from mexico pharmacy

I really like it when people get together and share ideas.

Great blog, stick with it!

non prescription ed drugs: levitra without a doctor prescription – sildenafil without a doctor’s prescription

propecia order: buy cheap propecia without insurance – get generic propecia without a prescription

https://edpills.icu/# erectile dysfunction medications

viagra without doctor prescription: 100mg viagra without a doctor prescription – buy prescription drugs without doctor

Nice weblog here! Additionally your website loads

up very fast! What host are you the use of? Can I get your affiliate hyperlink to your host?

I desire my site loaded up as fast as yours lol

Very nice article, exactly what I was looking for.

http://canadapharm.top/# pharmacy com canada

cost of generic propecia without a prescription: cost of generic propecia without a prescription – generic propecia without prescription

With havin so much content do you ever run into any problems of plagorism or copyright violation? My blog has a

lot of completely unique content I’ve either authored myself or outsourced but it

looks like a lot of it is popping it up all

over the internet without my authorization. Do you

know any ways to help prevent content from being ripped off?

I’d genuinely appreciate it.

legal to buy prescription drugs from canada: prescription drugs without doctor approval – viagra without doctor prescription

Generic Levitra 20mg: Buy Vardenafil 20mg – Cheap Levitra online

https://sildenafil.win/# sildenafil cost canada

https://kamagra.team/# super kamagra

Levitra 20 mg for sale Buy Levitra 20mg online Levitra online pharmacy

WOW just what I was looking for. Came here by searching for

Best hair loss treatments for women

Levitra online pharmacy п»їLevitra price Buy Vardenafil 20mg online

https://sildenafil.win/# price for sildenafil 100 mg

I get pleasure from, cause I found exactly what I used to be looking for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

cheap sildenafil 50mg: sildenafil tablets 150mg – canadian pharmacy generic sildenafil

tadalafil brand name in india: tadalafil mexico price – tadalafil 5mg tablets price

I was suggested this web site by my cousin. I’m not sure whether

this post is written by him as nobody else know such detailed about

my trouble. You are amazing! Thanks!

male ed drugs natural remedies for ed erection pills

http://levitra.icu/# Levitra generic best price

sildenafil otc usa: sildenafil 100 mg uk – buy sildenafil canada

tadalafil without prescription tadalafil 5 mg coupon buy generic tadalafil online

http://tadalafil.trade/# tadalafil

Levitra 10 mg buy online: Levitra 20 mg for sale – Buy Levitra 20mg online

medications for ed compare ed drugs gnc ed pills

http://lisinopril.auction/# cost of lisinopril 10 mg

buy generic ciprofloxacin: buy ciprofloxacin over the counter – cipro for sale

lisinopril 10 mg canada Buy Lisinopril 20 mg online lisinopril generic 10 mg

buy doxycycline online cheap: Doxycycline 100mg buy online – doxycycline brand name canada

buy amoxicillin over the counter uk: amoxicillin 500mg – how to buy amoxycillin

cipro for sale buy ciprofloxacin online ciprofloxacin 500mg buy online

http://lisinopril.auction/# lisinopril cheap price

п»їcipro generic: buy ciprofloxacin over the counter – ciprofloxacin 500 mg tablet price

order amoxicillin uk: amoxicillin 500mg capsule – amoxicillin 500 capsule

doxycycline prescription australia Doxycycline 100mg buy online doxycycline hyclate 100 mg cap

http://lisinopril.auction/# lisinopril 40mg

can you buy zithromax over the counter in mexico: buy zithromax – zithromax 500mg price

can you buy zithromax over the counter in australia zithromax z-pak zithromax coupon

prinivil 10 mg: Over the counter lisinopril – lisinopril 10 mg without prescription

http://azithromycin.bar/# can you buy zithromax over the counter in canada

cipro for sale: Buy ciprofloxacin 500 mg online – ciprofloxacin 500mg buy online

zithromax online pharmacy canada buy zithromax canada how to get zithromax over the counter

http://amoxicillin.best/# buy amoxicillin without prescription

where can i buy doxycycline in singapore: Buy doxycycline 100mg – where can you buy doxycycline

mexican pharmaceuticals online top mail order pharmacy from Mexico purple pharmacy mexico price list

canadian pharmacy no scripts: canada pharmacy online – canadian online drugs

trusted canadian pharmacies: cheapest online pharmacy – canadian prescription filled in the us

https://canadiandrugs.store/# pharmacy in canada

Muchos Gracias for your blog post. Really Cool.

northern pharmacy canada: trust canadian pharmacy – my canadian pharmacy rx

india online pharmacy: world pharmacy india – pharmacy website india

https://mexicopharmacy.store/# buying prescription drugs in mexico online

cross border pharmacy canada www canadianonlinepharmacy canadian pharmacy no rx needed

onlinepharmaciescanada com: trust canadian pharmacy – canadian pharmacy world reviews

Simply desire to say your article is as astonishing.

The clearness to your post is simply cool and that i can think you’re

knowledgeable on this subject. Well along with your permission allow me to take hold

of your RSS feed to stay updated with impending post.

Thank you one million and please continue the enjoyable work.

buy ventolin online australia: Ventolin HFA Inhaler – ventolin inhaler

paxlovid india: Paxlovid without a doctor – paxlovid cost without insurance

https://paxlovid.club/# paxlovid for sale

paxlovid cost without insurance https://paxlovid.club/# paxlovid india

http://paxlovid.club/# paxlovid pharmacy

buying ventolin online: Ventolin HFA Inhaler – ventolin salbutamol

ventolin price us: Ventolin HFA Inhaler – buy ventolin online cheap

ventolin hfa 108: Ventolin inhaler online – purchase ventolin inhaler online

Way cool! Some very valid points! I appreciate you writing this write-up and also the rest

of the site is extremely good.

farmacie online affidabili: avanafil generico prezzo – acquistare farmaci senza ricetta

migliori farmacie online 2023: kamagra gel prezzo – farmacie online autorizzate elenco

https://kamagrait.club/# farmacia online

farmacia online miglior prezzo farmacia online migliore farmacie online affidabili

siti sicuri per comprare viagra online: viagra online siti sicuri – viagra 50 mg prezzo in farmacia

farmacie online sicure: kamagra gel prezzo – farmacie online autorizzate elenco

http://farmaciait.pro/# comprare farmaci online all’estero

viagra online in 2 giorni sildenafil 100mg prezzo viagra subito

acquistare farmaci senza ricetta: farmacia online spedizione gratuita – farmacia online

farmacia online: avanafil – migliori farmacie online 2023

farmaci senza ricetta elenco farmacia online spedizione gratuita farmacia online

https://kamagrait.club/# acquistare farmaci senza ricetta

acquisto farmaci con ricetta kamagra oral jelly consegna 24 ore acquistare farmaci senza ricetta

farmacie on line spedizione gratuita: avanafil generico prezzo – comprare farmaci online all’estero

http://avanafilit.icu/# acquisto farmaci con ricetta

comprare farmaci online all’estero: farmacia online più conveniente – farmacia online migliore

comprare farmaci online all’estero farmacia online farmacia online miglior prezzo

acquisto farmaci con ricetta: farmacia online migliore – migliori farmacie online 2023

п»їfarmacia online migliore: avanafil generico – farmacia online migliore

https://tadalafilit.store/# acquisto farmaci con ricetta

comprare farmaci online all’estero: cialis generico – farmacia online miglior prezzo

migliori farmacie online 2023: farmacia online miglior prezzo – farmacie on line spedizione gratuita

No matter if some one searches for his essential thing, therefore

he/she wishes to be available that in detail, so that thing is maintained over here.

farmacias online seguras farmacia online barata y fiable farmacia barata

https://sildenafilo.store/# viagra entrega inmediata

http://kamagraes.site/# farmacias online baratas

http://kamagraes.site/# farmacia barata

farmacia online envГo gratis Levitra precio farmacia online 24 horas

http://farmacia.best/# farmacia 24h

viagra 100 mg precio en farmacias comprar viagra contrareembolso 48 horas sildenafilo cinfa 25 mg precio

http://vardenafilo.icu/# п»їfarmacia online

farmacia online internacional: Levitra 20 mg precio – farmacias online baratas

farmacias baratas online envГo gratis gran farmacia online farmacia online madrid

https://farmacia.best/# farmacia online 24 horas

http://sildenafilo.store/# comprar viagra en españa

http://kamagraes.site/# farmacias baratas online envГo gratis

farmacia online internacional farmacia 24 horas farmacia online envГo gratis

sildenafilo cinfa precio: comprar viagra contrareembolso 48 horas – sildenafilo 100mg precio farmacia

https://tadalafilo.pro/# farmacia envГos internacionales

http://vardenafilo.icu/# farmacia online internacional

farmacias baratas online envГo gratis tadalafilo farmacia envГos internacionales

http://vardenafilo.icu/# farmacias online seguras en espaГ±a

https://vardenafilo.icu/# farmacias online seguras

Acheter Sildenafil 100mg sans ordonnance Meilleur Viagra sans ordonnance 24h Viagra sans ordonnance 24h suisse

Pharmacie en ligne livraison 24h: Pharmacie en ligne livraison rapide – Pharmacie en ligne fiable

Acheter mГ©dicaments sans ordonnance sur internet Acheter Cialis 20 mg pas cher Pharmacie en ligne livraison gratuite

acheter mГ©dicaments Г l’Г©tranger: Levitra sans ordonnance 24h – acheter medicament a l etranger sans ordonnance

farmacia online envГo gratis: Cialis precio – farmacia online barata

Pharmacie en ligne fiable: Pharmacie en ligne sans ordonnance – п»їpharmacie en ligne

farmacia barata: kamagra jelly – farmacia online barata

Pharmacie en ligne sans ordonnance: Levitra pharmacie en ligne – Pharmacie en ligne pas cher

Pharmacies en ligne certifiГ©es kamagra 100mg prix acheter mГ©dicaments Г l’Г©tranger

http://potenzmittel.men/# online apotheke preisvergleich

https://cialiskaufen.pro/# online apotheke versandkostenfrei