What if I was to tell you that the global handset war of the future will be between Apple and Nokia? On a global scale this may very well be the case as I am convinced now that, from a global perspective, Apple and Nokia think very similarly.

What if I was to tell you that the global handset war of the future will be between Apple and Nokia? On a global scale this may very well be the case as I am convinced now that, from a global perspective, Apple and Nokia think very similarly.

This of course does not mean that other handset OEM’s will not be competitive in these areas. However, from a brand and global handset strategy perspective, Apple and Nokia seem poised to compete head to head.

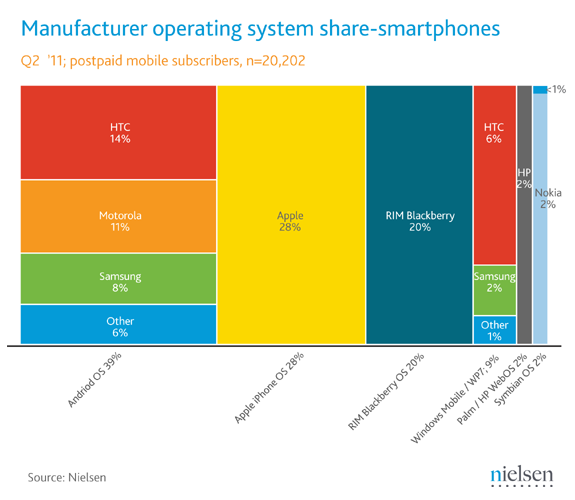

Nokia has never fully exited the realm of relevance. I follow the WW market for phones and am quite interested in what are the big picture global handset consumer trends. Because of that, Nokia and even RIM for that matter, still come up in conversations. However, I believe Nokia has a brighter future than RIM.

Nokia has maintained its relevance both in the terms of product offerings and brand very well on a global scale. Those of us who live, watch, and study the US market primarily, often forget that the world is bigger than the US. Nokia has a weak to non-existent brand in the US so it’s easy to count them out–although we shouldn’t.

There are a few key reasons why I think Nokia is interesting and I will be keeping a watchful eye on them as a global handset competitor. The first is their ability to manufacture handsets in massive quantities.

Nokia currently manufactures 1 million phones every day. Now, those are not all smart phones and mostly feature phones. However, what is key is Nokia’s ability to handle scale. This is one of the key things any global player will need to be able to manage and execute to meet the global handset demands of the future. Nokia can manufacture massive quantities of a single phone design and that is not easy to do.

Nokia has an extremely efficient process for designing and manufacturing handsets and this is one of the key reasons I think they are interesting and, other than Apple, can meet capacity of the future demands.

Again this is not to say other brands like HTC, Samsung, Moto and others will not be successful, only that they will ship more products in lower volume rather than massive volume of only a few designs.

The other element I think Nokia brings to the table is their roots in design innovation. Nokia has certainly had their share of design flops but generally speaking, they are at least creative and out-of-the-box when it comes to design.

The design of hardware is one of the central things factoring into the buying process of consumers. The ability to design an object of desire is very difficult and even companies who do it well don’t necessarily hit home runs each time. Nokia has a history of innovative design and because of that going forward I find them interesting.

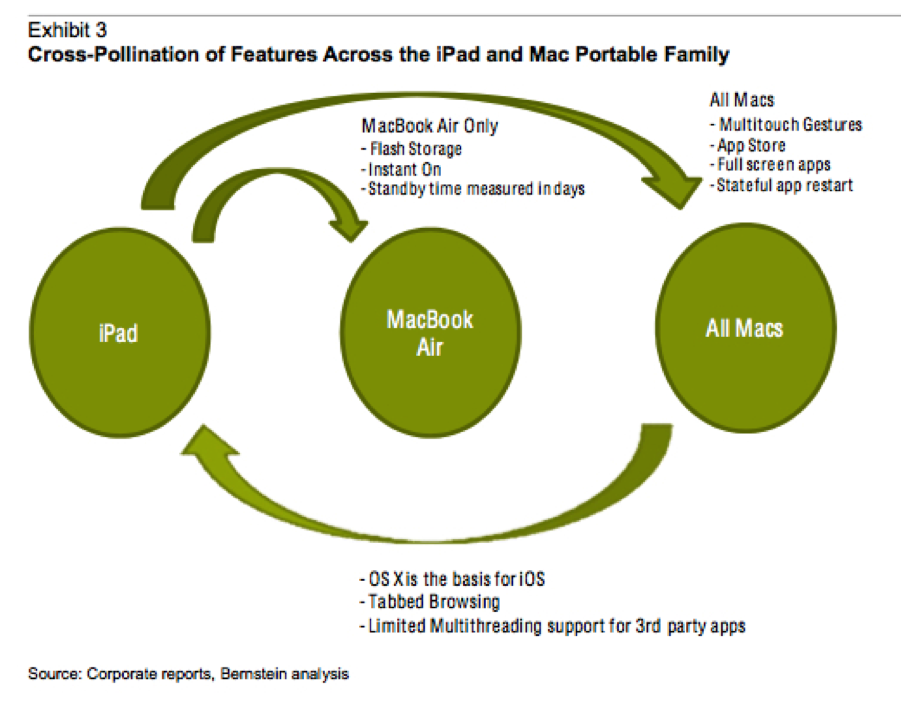

On a slightly lesser scale than the last two points, Nokia is also interesting because of their partnership with Microsoft. This, I feel, was a wise choice of an OS partner but it will still bring challenges.

I am very optimistic about Windows Phone and in particular Nokia as a partner in this area for Microsoft. Nokia has a strong brand in many parts of the region and with the release of two Windows phones, the Lumia 800 and the Lumia 710, they have taken their first step to become relevant in the smart phone segment.

Although I am optimistic and will follow Nokia with a keen eye from here on out, there are still many questions that need to be answered.

The first is how they will differentiate,beyond hardware design, on top of the Windows Phone platform. I’ve said this before and I’ll say it again- selling a standard OS only leads to the “sea of sameness” and overcoming that sea of sameness will be key for Nokia. I believe their penchant for design is a good start. They are also bringing core apps with maps, music and sports to Windows Phone and that is a good start.

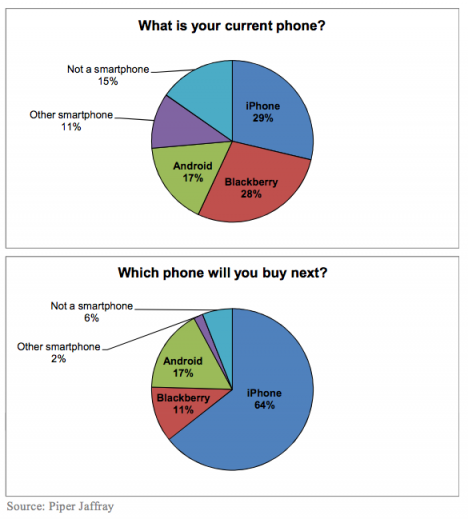

Second question is how successful will Nokia’s North America brand push be? Although here at Nokia World, Nokia did not release any specific data but they officially stated their commitment to the US market with a portfolio of products in the first half of 2012.

I believe there is still market share to be had with smart phones in the US and I feel RIM in particular is vulnerable there as well. In regard to Nokia in the US, if their efforts are successful,I believe it will affect Android devices more than the iPhone. So although Nokia is late to enter the US market, I hope they enter the US market strategically and relevantly and with a serious marketing budget as well. We will have to wait for further news before analyzing their North America efforts.

Overall, my take away from Nokia world is that Nokia is perhaps still highly relevant. In emerging markets they are designing devices with features consumers want, like dual SIMs, at price points they can afford. Their commitment to Windows Phone gives them a solid first step in smart phones and now executing in these areas above will be key.