You can buy Bitcoin today, swap your next mortgage payment for this aggressively hyped “cryptocurrency,” lose it all to crime, fraud or incompetence, no questions asked. Yet you are still legally barred from even participating in crowdfunded investments of fully vetted Bitcoin start-ups.

Clearly, something is wrong.

Marc Andreessen and his A16Z venture capital group have regularly taken to Twitter to preach the Bitcoin gospel. Andreessen is such a believer in the expansive financial power of Bitcoin he intends to significantly increase his firm’s $50 million investment in the Bitcoin ecosystem — hinting he may invest upwards of hundreds of millions over the next few years:

Like the Internet, Bitcoin will emerge as an accepted technology, Mr. Andreessen argues, as it becomes more regulated and consumers and businesses become more comfortable with the idea of digital currencies.

Want to ride the Bitcoin start-up wave? Sorry, you can’t. The government considers you a lowly “non-accredited” person. Meaning, you cannot put any of your money into any venture capital fund or into any of its portfolio companies. You cannot even participate in a equity “crowdfunding” service, the kind that pools small fund amounts from dozens, potentially thousands of investors, eager to be part of the next big thing.

No matter how much you believe in Bitcoin, no matter how fully you believe in Andreessen et al, as a non-accredited person you won’t be able to legally invest in any of their well-promoted start-ups; at least, not during these heady land rush days. Your only hope is to buy a Bitcoin and pray for the best.

The early financing game continues to route around you.

Fair? Surprisingly, many think so, even those who have directly benefitted from the web’s otherwise open nature.

Tech news blogger site, GigaOm, which has received millions from venture capital, recently editorialized that preventing the “crowd” — that’s you and me — from investing just like venture capitalists is actually a good thing:

Full-blown crowdfunding — which allows anybody to buy shares in any company on the internet — has attracted hype, but it’s still not here. There are good reasons for that.

I disagree.

I believe the short history of the Internet reveals empowering individuals ultimately creates more new net value. Disruption works. There is nothing more disruptive than access to money — and the more you have, the greater the access. Being able to invest in start-ups from the start can do just that.

We can vote, own a gun, volunteer to serve in the military, run for public office, purchase Bitcoin, post intimate photos of our junk on social media. Yet we are still prevented by law from getting in on the ground floor.

This makes no sense.

Tens of millions have already been lost on Bitcoin, still more on day trading. Gambling is legal, much of it state-sponsored. There remains a plethora of “no money down” mortgage options that surround us. Given these high-risk, middling-reward options available, why then is the government still preventing us from investing in the high-risk high-reward field we know so well? Few understand the value of Snapchat, or Airbnb, or some amazing new smartphone beacon technology as keenly as we, yet still we are denied the opportunity to partake in the wealth-creating, sanctified pursuit that is venture capital.

In the valley of disruption, the biggest disruption of all eludes us.

The Crowd Is Kept Waiting

I would, right now, hand Marc Andreesson my spare $1,000 and have him place it in any A16Z fund, or directly into a Bitcoin-specific investment, such as their $25+ million investment in Bitcoin “wallet” Coinbase.

Even though I think Bitcoin itself is toxic.

I want in. I want in now. I know there is ample room.

According to the National Venture Capital Association (NVCA), there are approximately 450 venture capital firms in the US (based on available 2010 data). VC firms are managing $177 billion in committed capital. The average fund size (again, for 2010) was $149 million, with about 2,750 companies receiving funds — 1,000 received funding for the first time.

I believe I can do better than most of these sanctioned venture capitalists, at least in web tech — if given the chance.

You, like me, read up on this industry daily. We work in this industry, and have for many years. We know the CEOs, the investors, the products, the markets, the technologies, the dreamers. We understand the potential and respect the risks. But still we are kept on the outside, looking in. This is not merely denying our abilities, it is denying our potential to further empower this great country.

Again, from the NVCA:

Venture capital is a catalyst for job creation, innovation, technology advancement, international competitiveness and increased tax revenues.

If venture capital achieves all that now, imagine how much more good can be accomplished when you and I and everyone we know can directly add our monies and our smarts to the industry, right from the start. Question: Why haven’t the venture capital firms fought for empowering the crowd as eagerly as they have hyped the still suspect ‘currency’ they expect the crowd to use?

The Wisdom of the Government

I am an expert in technology, not investing. This has not prevented me, however, from leasing a car, mortgaging a house, buying stock in numerous companies, some with share prices hovering around $1. I am now ready to invest in start-ups. I know this industry and I know what can work. Regrettably, the government still won’t let me.

For the government, it’s still a rich man’s game. The only way you can contribute money to a venture capital fund (or even to a equity crowdfunding platform), is if the US government labels you an “accredited investor.” To earn this lofty designation, you must…

“…have a net worth of at least one million US dollars, not including the value of (your) primary residence or have income at least $200,000 each year for the last two years or $300,000 together with (your) spouse if married and have the expectation to make the same amount this year.”

Anything less, and you are callously labeled “non-accredited.” It breaks down like this: If you’re not riding the Google Bus, you probably don’t qualify. Doesn’t seem fair, I know.

This could all change, however, and perhaps quite soon.

The 2012 Jumpstart Our Business Startups (JOBS) Act altered many of the rules for funding start-ups. Title III of the JOBS Act could potentially allow those of us who are non-accredited to finally invest in start-ups, just like ‘real’ venture capitalists, should the SEC give the ok.

Be warned. There are several caveats to the rules changes the SEC is pondering:

Most notably, the government appears to still remain highly suspicious of the “equity model” of crowdfunding. (Kickstarter-like models, with no money on the line, are acceptable.)

The SEC appears set to require that any start-up seeking to raise money via equity crowdfunding will only be able to raise up to $1 million every 12 months. In addition, there will be rather arduous disclosure requirements that will cost start-ups dearly — money they obviously do not have. Worse, the very act of going through the crowdfunding disclosure process will likely brand any such start-up as unworthy to (ever) be invested in by Big Venture Capital, which can review the start-up’s unique assets behind closed doors. Thus, those with the most promising of ideas or technologies will remain incentivized to bypass the crowd. (Again, that’s you and me.)

In addition, we “non-accredited” investors will only be able to invest about 5% and no more than 10% of our income or assets.

Despite all this, the gate is rattling.

The SEC has apparently finished listening to comments on crowdfunding. Now, they are mulling exactly what to do. Perhaps it’s my techno-optimism, but unlike many financial analysts I fully expect the SEC to do the right thing. Once they do, once they allow the likes of you and me to invest in start-ups, expect a massive sea change.

It Don’t Take A Weatherman

I am no pollyanna. I’m quite certain clubby insiders will wish to remain clubby. The very best VCs will continue to grow their massive funds from institutional investors, not folks like you and me. Fraud will not magically disappear despite the vigilant buzz of the crowd picking through every document a crowdfunded start-up lays bare. The “magic the gathering” Bitcoin ‘bank’ painfully proved to far too many unfortunates that fraud and failure remain part of the human condition, even at the farthest reaches of the technology galaxy.

But we will finally have our shot.

Yes, we know venture capital is risky, even in small amounts. Is it any more risky than buying $10,000 in Mt Gox Bitcoins? Is it any more risky than flipping houses? We understand, as the Wall Street Journal states, that “over 60% of high-tech start-ups…failed to return any capital, and just 7 percent were essentially jackpots, generating returns of five times or more.” So be it. True equity crowdfunding will finally offer me a shot to invest at the start — just like blogging came along and enabled me to become a professional writer.

In fact, I have already registered with the “equity crowdfunding” site Startup Valley. No, they can’t legally allow me in, not yet. I am also registered at the crowd funding portal RockthePost. Still waiting there as well. That’s all right. My money is patient.

Who Will Be My Venture Capitalist While I Cannot?

It strikes me as both odd and extremely unfair that anyone in America can, with a bit of effort, buy Bitcoin. They can spend their life savings on it, in fact, and lose everything, and do so with almost no real recourse. Yet, for nearly all of us, including those of us who track this industry so closely, we cannot invest in any of the start-ups that are explicitly focused on growing the Bitcoin ecosystem!

Look, don’t touch. Buy, don’t own. So much for the belief in the wisdom of the crowd.

Sure, you can go on Kickstarter right now and “invest” in, say, that new Veronica Mars movie. If the producer generates enough, you might earn a free download of the final product. As for a financial stake? Forget about it.

We are being played. Worse — we are kept from playing. Still.

Billions in venture capital will be invested in the US this year alone. How much of it are you a part of? Zero, no doubt. You’re kept on the outside looking in, even in Silicon Valley — the land of the great disruptor.

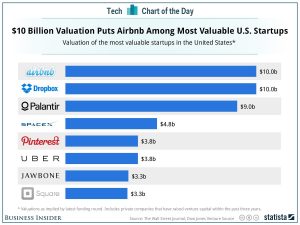

Check out some of the top VC-backed tech companies. You know these intimately. You use their products. You have followed them from the beginning, contributed to their success. Yet you are unable to garner any potential windfalls when they go public.

The first start-up to receive venture financing was Fairchild Semiconductor — in 1959. That was 55 years ago. It’s been a long, long wait to allow all adult Americans to be part of this extraordinarily cozy, massively wealthy, highly influential sector we glorify so dearly. I am confident it will happen very soon.

No more…Brian S Hall. Writer.

Soon…Brian S Hall. Writer. Venture Capitalist.

As it should be.