I have been speaking with various vendors of tablets lately and more than once, the topic of Apple “iPodding” them has come up. iPodding basically refers to the fact that although Apple has had the iPod on the market for over 10 years now, they still have over 70% of the MP3 portable digital music player market. This fact is giving many of the tablet vendors nightmares. Although they see this tablet market as a very large one and believe there is room for multiple tablet vendors given the potential market size and potential world wide demand, they know very well that Apple has done a great job in cornering the MP3 player market with iPods and are afraid that Apple could do the same with tablets.

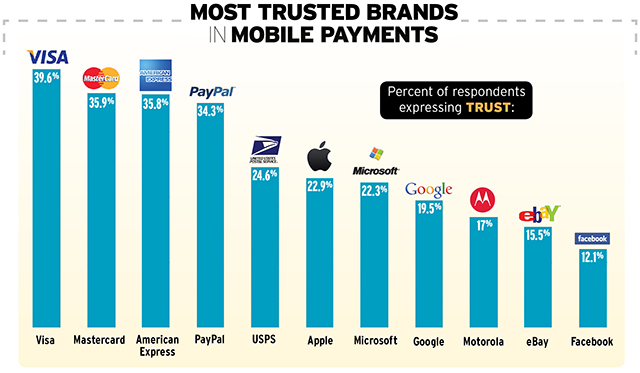

And even though Apple has not cornered the market in smartphones, all are amazed that Apple had record iPhone sales last quarter and realize that Apple has just started selling iPhones in the Chinese market and could be expanding to other BRIC (Brazil, Russia, India, China) countries too. And many of the smartphone vendors are certain that Apple will bring out a lower cost iPhone at some point and get very aggressive in emerging markets within the next two years. An even harder fact for them to swallow is that when it comes to smartphone profits, Apple takes about 75% of all profits made in cell phones.

And even though Apple has not cornered the market in smartphones, all are amazed that Apple had record iPhone sales last quarter and realize that Apple has just started selling iPhones in the Chinese market and could be expanding to other BRIC (Brazil, Russia, India, China) countries too. And many of the smartphone vendors are certain that Apple will bring out a lower cost iPhone at some point and get very aggressive in emerging markets within the next two years. An even harder fact for them to swallow is that when it comes to smartphone profits, Apple takes about 75% of all profits made in cell phones.

While all of them think that they can compete with Apple when it comes to hardware, and maybe even software, what they all pretty much know is that the secret to Apple success is that they have built their hardware and software around an integrated ecosystem based on a very powerful platform. And it is here where their confidence level lags and the “iPodding” fears raise its head. And to be honest, this should really concern them.

Apple is in a most unique position in which they own the hardware, software and services and have built all of these around their eco-system platform. That means that when Apple engineers start designing a product, the center of its design is the platform. For most of Apple competitors, it is the reverse; the center of their design is the device itself, and then they look for apps and services that work with their device in hopes that this combination will attract new customers. In the end, this is Apple major advantage over their competitors and they can ride this platform in all kinds of directions.

For example, when they were working on the iPad, they already had in place the iTunes content store and since all were based on the iOS platform, it was pretty straight forward for them to now build the iOS iPad Apps environment that easily sat on top of this already existing software platform. Of course, the iOS app platform already existed for the iPhone so all they had to do is to create an apps toolkit to take advantage of the new screen size they now had with the iPad.

We will see this same concept repeated when they eventually release anything for the TV. The current Apple TV product is a good first step and is also based on this iOS platform and eco system. But let’s say they design an actual TV; the platform is already in place for them to tap into it and indeed, the center of design for any future TV is the platform itself.

For a lot of vendors, they had hoped that Google’s Android would deliver to them a similar platform to build on, but to date that has not been the case. The various versions of Android only complicate things for the vendors and the software community and in essence they really don’t have a solid unified platform to build anything as powerful as Apple’s iOS architecture. As a result there is a lot of fragmentation in the Android marketplace. This is more than problematic and has been at the heart of Android failures in tablets thus far.

And I am not sure Microsoft’s new Windows 8 platform will deliver what they need either. The key reason is that Windows 8 is still based on a PC Centric OS and this is being extended downward to tablets. At the same time, they have a Windows OS for their smartphones that share no code and no app base. In the end, it delivers at best splintered apps and a non-unified ecosystem even if all the devices have the same Metro UI. I believe this OS has more of a chance to challenge Apple then Google’s Android will, especially in tablets. But the lack of a powerful unified platform that the vendors can really design around and support, along with vendors own quests to differentiate, could cause this approach to have a hard time competing with Apple too.

The bottom line is that when it comes to competing with Apple, it really is all about the platform. And at the moment, I don’t see anybody creating a unified and powerful enough platform that comes close to or is equal to what Apple already has in the market. That is why Apple is cornering the market in mobile devices today and why it could continue to grow its user base WW at the expense of their competitors. Based on marketing material on Apple’s own website, I would say they understand this as well.

standard iOS email app, but nothing that is really exciting the wide swath of users if “number of stars” is any indicator. To boot, many have argued that the Gmail app actually removes features from standard iOS email platform. So the question is why did Google really launch Gmail application for iOS? There’s a lot here beneath the surface.

standard iOS email app, but nothing that is really exciting the wide swath of users if “number of stars” is any indicator. To boot, many have argued that the Gmail app actually removes features from standard iOS email platform. So the question is why did Google really launch Gmail application for iOS? There’s a lot here beneath the surface.