Microsoft’s newest ad campaign is breath taking but not, I think, in the way that Microsoft imagines.

“Just a toy“, my ass. ~ Steven Aquino (@steven_aquino)

This is why Microsoft will lose. This shows they don’t get it…“ ~ Ben Bajarin (@BenBajarin)

Is there some sort of Redmond Triangle — a mysterious zone where ad executives of talent disappear without a trace? The Microsoft ad is ignorant, insulting, and shockingly naive. How could a company as successful as Microsoft get it so very, very wrong?

History Repeats

[pullquote]The only new thing is history we don’t know. ~ Harry S. Truman[/pullquote]

Of course, Microsoft is not the first — nor will they be the last — to dismiss their competitor’s products as mere “toys.” There is a long and storied history of such foolish behavior.

Most recently, Blackberry, a.k.a, RIM, proudly boasted that their phones were “not a toy“.

Bad omen for Microsoft: It’s using BlackBerry’s ‘tools not toys’ line. ~ BGR (@BGR)

I remember the last company to push the “tools not toys” line: BlackBerry. Worked out awesome for them. ~ Brad Reed (@bwreedbgr)

[pullquote]History is a very good teacher, but he has very few students. ~ Wael El-Manzalawy[/pullquote]

But the story of dismissing the new as mere toys, goes back over a hundred years and surely extends throughout all of history.

While theoretically and technically television may be feasible, commercially and financially, I consider it an impossibility, a development of which we need waste little time dreaming. ~ Lee De Forest, inventor, 1926

I have determined that there is no market for talking pictures. ~ Thomas A. Edison, 1926

Airplanes are interesting toys but of no military value. ~ Marechal Ferdinand Foch, Professor of Strategy, Ecole Superieure de Guerre , France

X-rays will prove to be a hoax. ~ Lord Kelvin, British mathematician and physicist, 1896

When the Paris Exhibition closes, the electric light will close with it, and very little more will be heard about it. ~ Professor Erasmus Wilson, 1878

It’s only a toy. ~ Gardiner Greene Hubbard, future father-in-law of Alexander Graham Bell, on seeing Bell’s telephone, 1876

Although it is…an interesting novelty, the telephone has no commercial application. ~ J. P. Morgan, to Alexander Graham Bell

Well-informed people know it is impossible to transmit the voice over wires as may be done with dots and dashes and signals of the Morse code, and that were it possible to do so, the thing would be of no practical value. ~ Editorial in the Boston Post, 1865

Disruption Repeats

Disruption seems to follow a fairly steady pattern:

Stage 1: The incumbent over-serves the vast majority of their customers.

Stage 2: A challenger appears with a cheaper and/or simpler product or service that only performs a subset of the incumbent’s services. However, that subset served is the set of tasks that the vast majority of users wish to enjoy or perform.

Stage 3: The incumbent dismisses the challenger’s product or services as “beneath contempt”. Calling a new and inferior product a “toy” is a subset of such disdain ((Inspired by Horace Dediu)).

Who says you can’t do “real work” on a non-Microsoft tablet?

Just because Microsoft SAYS non-Microsoft tablet don’t do real work, doesn’t make it so.

In sales environments, a tablet is a better and more useful tool [than a PC]… ~ Nicholas Paredes

James Kendrick, of ZDnet, certainly seems to think that he gets “real work” done on his tablet.

And the way that Enterprises are snapping up non-Microsoft tablets suggests that SOMEBODY — and a whole lot of somebody’s — thinks that tablets are eminently capable of doing “real work.”

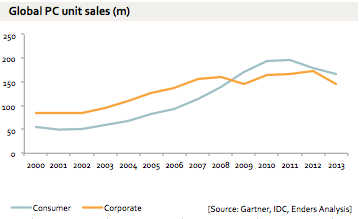

How many people use PC’s for “real work” anyway?

Benedict Evans poses — and then answers — the question: “How many people use PCs for ‘real work’?

Benedict Evans poses — and then answers — the question: “How many people use PCs for ‘real work’?

One problem with saying that you need a PC to do ‘real work’ is that a large % of people don’t actually use their PC for ‘real work’ ~ Benedict Evans (@BenedictEvans)

[pullquote]The easiest software incumbent to disrupt is the one prioritizing the needs of its strategy over the needs of its customer. ~ Aaron Levie (@levie)[/pullquote]

Microsoft has the question backwards. They’re asking: “How many tablets can run programs like Excel, Word and Powerpoint?” What they should be asking is: “How many people who use tablets need to use programs like Excel, Word and Powerpoint?”

Efficiency is doing things right. Effectiveness is doing the right things. Microsoft’s tablets may or may not be efficient, but they’re not effective because they’re not doing the right things.

What’s So Wrong With Being A Toy?

Quite often, when incumbents think a new entrant product is a toy, they’re right. ~ Benedict Evans (@BenedictEvans)

[pullquote]The supreme accomplishment is to blur the line between work and play. ~ Arnold J. Toynbee[/pullquote]

Being called a “toy” is not the insult Microsoft thinks it is. It may, in fact, be the ultimate compliment.

In the war between platforms you can use for real work and platforms that are just toys, the toys always win. ~ Benedict Evans (@BenedictEvans)

Creating a computer that does real work is the act of an engineer. Creating a computer that makes work feel like play is an act of genius.

I LIKE the tools that help me get work done. I LOVE the tools that make my work fun to do.

When the craftsman made the first wheel, industry veterans pointed out you couldn’t use it for real work. ~ Benedict Evans (@BenedictEvans)

It made for a fun toy though. ~ John Gruber (@gruber)

Microsoft Just Doesn’t Get It

[pullquote]Wisdom doesn’t necessarily come with age. Sometimes age just shows up all by itself. ~ Tom Wilson[/pullquote]

Microsoft seems to make the same mistake over and over and over again. The phrase “less is more” is literally untrue; it’s a logical impossibility. But when people use this expression, they’re not speaking logically, they’re using self-contradictory phrasing to describe an important principle — that keeping things simple; that avoiding unnecessary detail; often improves things.

Microsoft just can’t seem to learn this lesson. And, ironically, the longer they think of their competitor’s products as toys, the less likely it will be that their prospective customers take them seriously.