This week, highly respected web and technolgy analyst, Mary Meeker, released her end of the year 2012 report on internet trends. The slide deck is 88 slides long and is highly recommended. You can view it here.

As I reviewed Ms. Meeker’s slides, some thoughts on Microsoft’s current prediciment and future prospects jumped out at me. I thought I would use the slides to help illustrate and examine those thoughts.

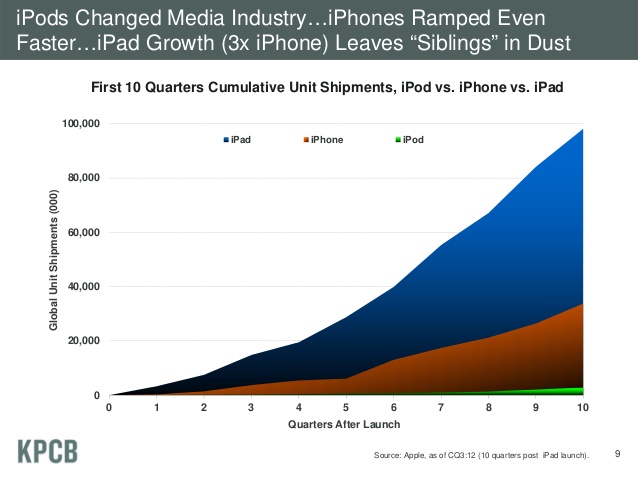

1. iPods, iPhones, iPads

Take a long hard look at the graph, above. That little green sliver you see represents the growth of the iPod. The very same iPod that powered Apple from near-bankruptcy to a genuine tech contender in less than five years.

Now take a good hard look at the much larger red portion of the graph. That represents the iPhone. The iPhone was the device that rocketed Apple from just one of many to the largest tech company, then the largest company, by market cap, in the free world. For context, that red portion of the graph, alone, is now worth more than all of Microsoft put together.

Now look at the much, much larger blue portion of the graph. Take a long, hard look. Now look at it again. That blue ramp represents the growth of the iPad. It’s growing at three times the rate of the iPhone. Three Times. If you are not awe-struck by the iPad’s rate of adoption, well, you should be.

If you want to know why Appe is rapidly expanding its influence in computing – and why Microsoft is scrambling to catch up – look no further. The above graph says it all.

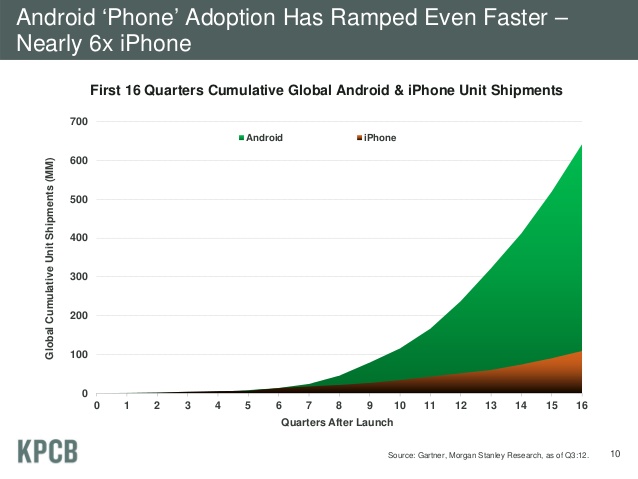

2. Android And iPhone Adoption

Most people look at the above graph and conclude that the iPhone is in trouble. But you’ll notice that the iPhone is still growing in real terms.

Do you know who’s really in trouble? Anyone not named Samsung and Apple, that’s who. Apple is doing just fine, taking in most of the industry’s profits. Samsung is doing just fine. Google? Not so much. All that market share and little to no profit to show for it has to be worrisome. But this article isn’t about Google. This article is about Microsoft. And no matter how closely you scour the above graph you won’t find a Microsoft product on it anywhere.

(Chart via AllThingsD)

3. Microsoft’s Minuscule Phone Market Share

According to some reports, Microsoft’s phone market share may actually be falling. In the past six years, Microsoft has managed to take its 12% share of the mobile phone market, combine it with Nokia’s 30% share, and convertert it into Windows Phone’s current 2% market share. That’s reverse alchemy – like turning gold into lead.

Steve Ballmer recently claimed that Windows Phone was selling four times faster than it was a year ago. But four times very little is still very little. Microsoft sold 2.8 million Windows phones a year ago. In the same quarter, Apple sold 35 million phones and there were roughly 123 million Android phones sold. So yeah, Microsoft is selling more phones. But so is everyone else that matters.

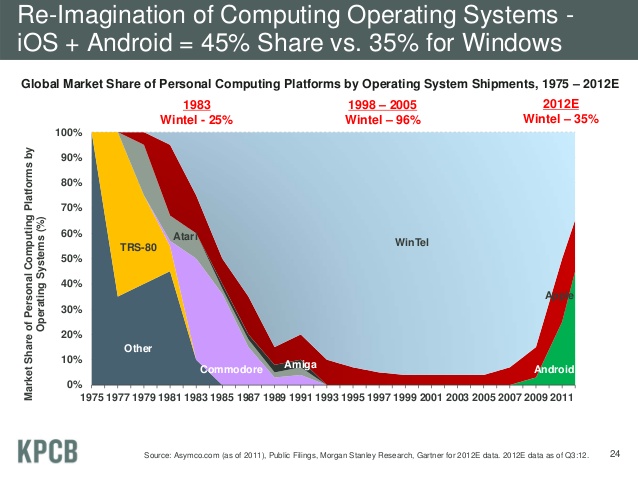

4. Operating Systems

People think that Microsoft’s Windows is still a powerhouse because it runs 90% of the world’s personal computers. That’s nonsense. Take a look at the chart, above. When you combine phones and tablets and notebooks and desktops, Windows’s only runs on 35% of the world’s personal computers. Android already runs on more personal computers than Windows does and iOS is expected to pass Windows by the end of 2012.

Just as importantly, look at the direction in which Windows is trending. Windows runs almost exclusively on notebooks and desktops, which are a rapidly declining portion of the market. If Windows doesn’t escape its notebook and desktop base and spread to phones and tablets, it is rapidly headed for niche status.

5. Smartphones + Tablets > Notebooks + Desktops

I know that the above graph has a legend, but let me spell this out so that there’s no mistaking the significance of what you’re seeing. The orange portion of the graph represents desktop PCs. The blue portion of the graph represents notebook PCs. Look at how those two portions, combined, are shrinking while the green – representing smartphones – and the yellow – representing tablets – are rapidly growing.

If you look at the above chart, you can clearly see Microsoft’s dilemma. Even if Windows were to power each and every notebook (blue) and desktop (orange) computer made going forward – which they won’t – their share of the market would soon dwindle to near nothingness. Microsoft NEEDS to get their operating system onto phones and tablets and they NEED to do it now.

6. Microsoft Isn’t Even Trying

Here’s the thing. Microsoft isn’t even trying to break into the pure tablet (yellow) portion of the market. Instead, they’re trying to create a hybid device, a new category, a new color, if you will, on the chart above.

In July, I wrote an article entitled: “The PC is the Titanic and the Tablet is the Iceberg. Any Questions?” The purpose of that article was to demonstrate the multitude of tasks that could be done well by a tablet but poorly or not at all by a traditional notebook computer. Windows 8 tablets – with their 16:9 aspect ratio, their desktop mode and their reliance upon keyboards – fall far closer to the notebook than they do to the tablet. One can’t help but feel that, even now, Microsoft still doesn’t totally believe in the stand-alone tablet form factor. Windows 8 tablets are notebooks first – and tablets only in emergencies.

After failing to field a competitor to the iPad for two and a half years, Microsoft is now ceding the tablet market (yellow) to Apple and the rest of the industry – yet again.

7. Conclusion

Microsoft faces a host of problems in the the years to come. Their competitors are far ahead of them in phones and tablets. Their bastion of strength – the notebook and the desktop – is an ever shrinking island. And their strategy to compete in the tablet market is, in my opinion, fatally flawed because it doesn’t even attempt to create a true tablet competitor.

Take a look at that last graph again. The green and the yellow portions are the future of computing. And in that future, Microsoft is nowhere to be found.