In many discussions I’ve had about Apple and their future, the question of the iPhone is always at the heart. Although, as I listen to the tone and specifics of the questions that come my way, I realize this discussion is also about Apple itself.

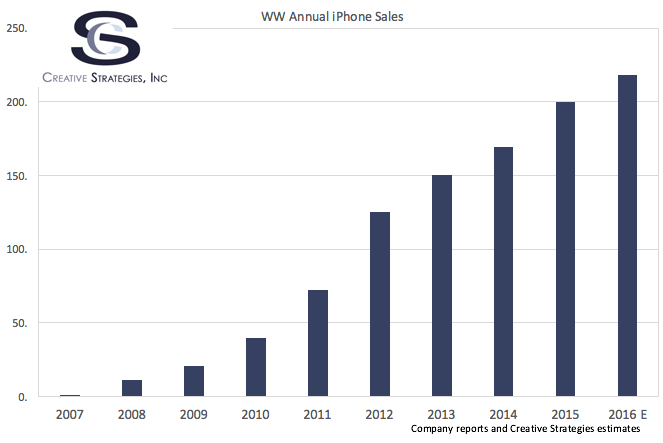

Can the iPhone grow again? The answer is undoubtedly yes. Will the iPhone see similar growth rates to the initial ramp? Obviously, it will not. I find this visualization helpful.

There is quite an increase from 2014 to 2015 thanks to the larger iPhones. As you can see, I have added consensus estimates for iPhone sales in 2016. What we have to realize is, in 2012-2014, Apple was seeing 12-20% annual growth rates. Then, with the large screen phones, it jumped to 37% in 2015. Just to illustrate the point, I calculated the average growth rates Apple had seen the two years prior and put them into the same chart to show you what 2015 and then 2016 growth estimates would look like if they followed the same averages.

Had Apple simply continued the normal growth rates, we would not be talking about a YoY iPhone decline. And honestly, the hypothetical chart I posted is closer to what I think Apple thought was going to happen. It seems Apple management was surprised at both how big the iPhone cycle was with the 6/6 Plus and the rate of slowdown with the 6s/6s Plus. Nothing wrong with either surprise as both were hard to see coming.

The growth rate of the 6/6Plus was a bit of an anomaly. It was hard to predict and was bigger than many thought. The 6s/6s Plus cycle is also showing to be weaker than original estimates. This is proving to be one of the weaker S cycle launches and the maturity of the market, saturation of the high-end smartphone segment, and global economic issues are all playing a role. Looking at the US installed base data we have by model, you can see the 6s is a bit lower in terms of base ownership than the 6 during the same period last year.

This weaker cycle has a lot to do with the diversity of Apple’s base. They have acquired many new customers but many of those customers don’t need or crave the shiny new gadget. They have grown into the part of the market that does not replace electronics until necessary. They aren’t swayed by a new camera or an OLED screen or wireless charging, etc. This is a new dynamic for Apple. For much of the iPhone’s growth run, they could count on early adopters and the early tech majority to help keep the train going. Couple their regularity of acquiring new devices with the brand new customers coming to the iPhone every year and you have the charts at the beginning of this post.

Yet, I remain convinced that not every person on the planet who wants, or will someday want an iPhone, has one yet. The issue is the growth won’t be at the same high double digits it was before. This was predictable and Apple has been preparing for this very thing. So where do they go from here?

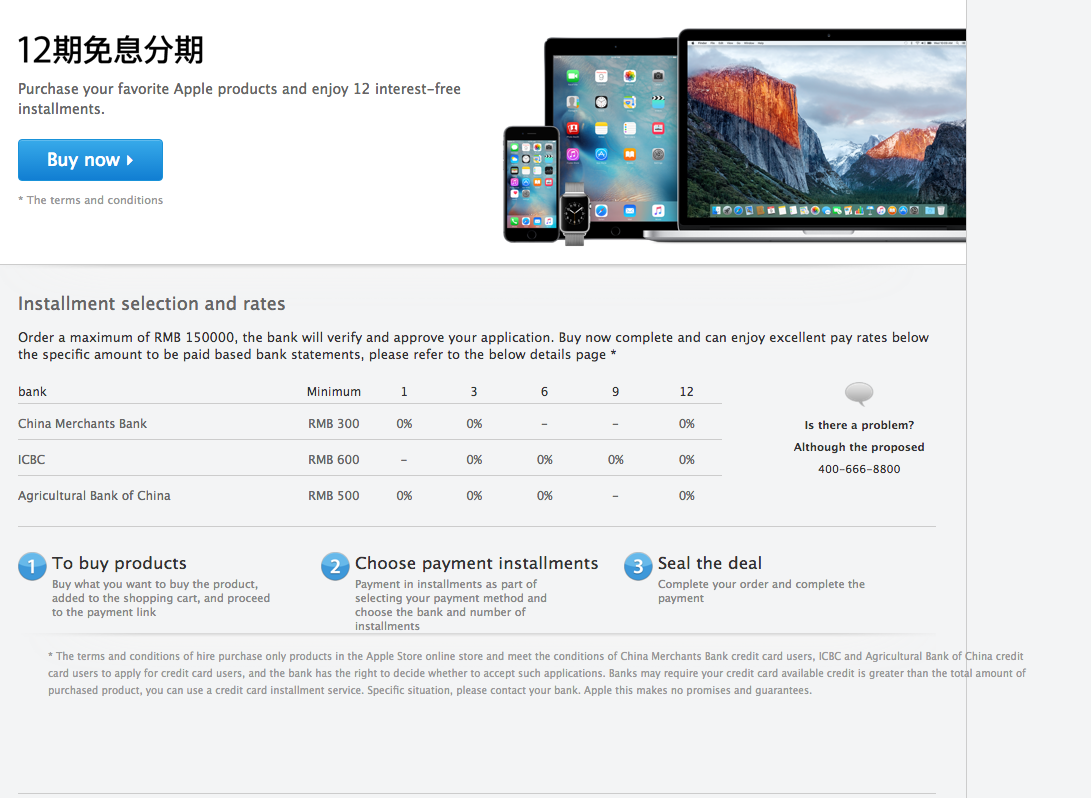

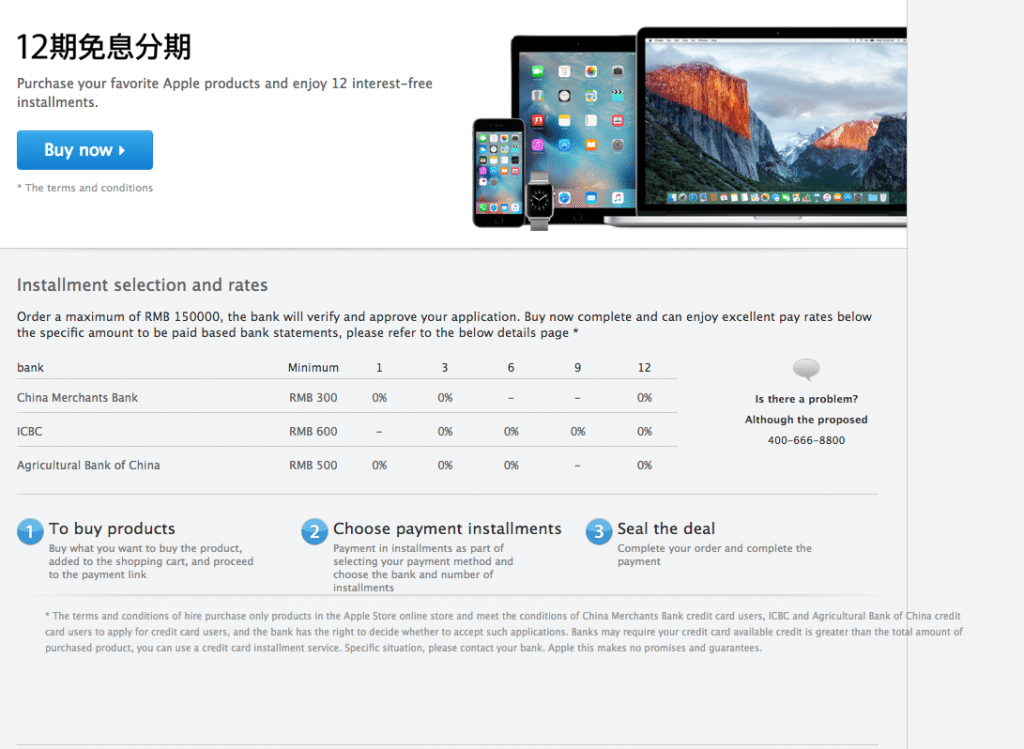

My first thought is the impact on payment/financing plans has not yet been fully observed. Take, for example, this promotion in China brought to my attention.

This page is translated from the Apple China site and it shows a financing plan for Apple products, not just iPhones, up to 150,000 RMB or $23,000 USD. Several banks are involved and handle the financing. Now, while it is only interest-free for 12 months, I’m intrigued by this move and, in some ways, I liken these banks willing to engage in financing plans for iPhones to carriers willing to subsidize iPhones to acquire high-value Apple customers. With China’s middle class rising and millions of new credit opportunities, it seems likely these banks want to find a way to acquire those Apple customers. This is the start of something interesting at a global level where financing Apple products does the job of acquiring high-value customers for financial institutions.

Another scenario talked about is to stagger the iPhone innovation cycle and move off of a S year lineup. By having one new flagship every other year, it gives consumers something new every year to choose from. This could help smooth the line but may already stress what is the highest scale manufacturing line in the world in Apple’s iPhone.

However, Apple is a consumer products company, not an iPhone company. As I pointed out here, Apple is in uncharted territory never having this many customers in the company’s history. Ultimately, any category where customer experience is terrible is ripe for Apple to enter. There are numerous growth upsides from healthcare services, enterprise services, VR/AR, autos, wearables, etc. As the world goes digital, Apple has a role to play in every area it decides it can better the customer experience.

Very nice thing going on about Chinese ‘partner’ banks. I hope this gets launched here and in EU.