Every quarter, one of the decks I put together as part of my Jackdaw Research Quarterly Decks Service is a comparison of financial and operating metrics for the “big six” consumer tech companies – Alphabet, Amazon, Apple, Facebook, Microsoft, and Samsung. As I’ve done for several previous quarters, I’m also doing a quick run-through here of some of the highlights from the deck for Q3 2017. You can learn more about the Jackdaw Research Quarterly Decks Service here, and I embedded the full deck for Q2 in last quarter’s post, which you can find here.

Apple Remains Ahead on Long-Term Revenue Despite Samsung’s Gains

Apple has returned to revenue growth over the past year, while Samsung has experienced some of its best growth (and profits) ever during this period. But although Samsung’s revenues have pipped Apple’s during individual quarters, the latter remains ahead on an annualized basis, and will almost certainly remain there given the monster December quarter Apple is predicting.

Meanwhile, Amazon is coming up very quickly behind Samsung, with some of the fastest growth of any of these companies (aided a little this past quarter by the acquisition of Whole Foods and to a lesser extent Middle-Eastern e-commerce property Souq. That’s particularly remarkable because, for much of the period from 2012 to 2014, Amazon and Microsoft were almost neck and neck, but the two took dramatically different paths from 2015 onwards. Microsoft’s own recovery, though, mirrors Apple’s: a strong return to growth in recent quarters, albeit helped a little by LinkedIn.

As the chart below shows, though, Facebook is still the king when it comes to percentage revenue growth, with very strong growth despite its repeated warnings of a coming slowdown driven by saturation of ad load. Meanwhile, the acceleration of both Apple and Microsoft’s growth rates is also easy to see in this second chart:

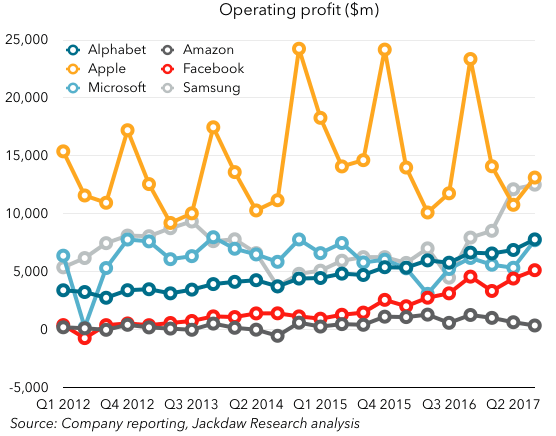

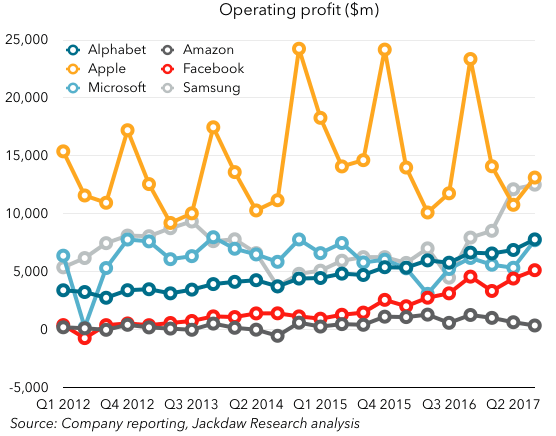

Apple Also Retakes Single-Quarter Operating Profit Crown from Samsung

In addition to its continued leadership on revenue, Apple this quarter also retook the quarterly operating profit crown from Samsung, after Samsung took a rare lead in Q2 thanks to the strength of its memory business:

On an annualized basis, of course, Apple is still miles ahead given the outsized contributions to its profits of December quarters, and that lead will be extended if it meets its outsized guidance for the current quarter. Further down the list, Amazon continues to be in one of its periodic investment phases, where it sacrifices a few points of margin in pursuit of faster growth, and its operating profits have dropped to almost nothing from already low levels. Meanwhile, Facebook continues to generate enormous profits, with its first $5 billion operating profit quarter ever, and a net margin of nearly 46%, almost 20 percentage points across the second most profitable company, Microsoft, at 27%. Despite its much smaller revenues, Facebook has several times approached Microsoft’s dollar profit number in the past year and a half.

Samsung Continues to Outspend the Rest on Capex

When it comes to investment in property, plant, and equipment (usually referred to as capital expenditures), Samsung continues to lead the pack by a wide margin in dollar terms:

That rapidly-steepening trajectory over the past year or so is down to the success of Samsung’s memory business, with nearly 70% of capex in Q3 going to its semiconductor unit, a number that’s risen from under half of its capex just over a year ago. It seems to be building capacity as fast as it possibly can to continue to take advantage of the supply constraints in the memory market and the resulting price hikes.

Apple continues to be in second place, with one of the more unpredictable investment trends over time, largely due to its strategy of securing capacity and equipment opportunistically and often ahead of big advancements in its product line. Alphabet’s capex spend, which moderated significantly from 2015 to 2016, has slowly begun got climb again, though mostly in line with revenue growth, maintaining a roughly constant spend level of 10-12% of revenue.

On R&D, Facebook Continues to be the Most Generous

Facebook continues to invest very heavily, just behind Samsung in terms of percentage of revenue spent on capital investment, while its R&D spend is by far the highest of the companies in this group which report it:

Its “R&D intensity” (percent of revenue spent on R&D) has come down quite a bit over the past couple of years, but it’s still well ahead of the other companies here, at over 20%. Alphabet and Microsoft spend at very similar levels of around 15% of revenue, while Samsung and Apple spend smaller percentages. Of course, the dollar spend picture looks very different, with Facebook actually in last place, and Alphabet in first, though four of the five companies – Alphabet, Apple, Microsoft, and Samsung, all spend within a roughly billion-dollar range each quarter (ranging from around $3-4 billion).

On Headcount, Amazon is Entirely in a Class of its Own

Lastly, when it comes to headcount, Amazon has been off in its own class for some time already, but with the Whole Foods acquisition has leapt into the ranks of the top few private employers globally, with over half a million employees.

Even without the Whole Foods acquisition, which added around 90k new employees, Amazon’s organic hiring rate was 47% over the past year, matching Facebook’s. Since the growth rate of the other companies is hard to see on that chart dominated by Amazon, here’s a version of it without Amazon:

On that chart, the underlying trends for the other companies are much easier to see – for three of them (Facebook, Alphabet, and Apple) the trend has been broadly upward, with some slight changes in trajectory over time. For Microsoft, on the other hand, the ride has been bumpier – a big spike driven by the Nokia acquisition in 2014, followed by a fairly rapid decline as it consolidated operations and then thinned them in the wake of the failure of the phone business. More recently, it’s begun hiring again, while the LinkedIn acquisition late last year provided another much smaller inorganic bump. Facebook has actually eclipsed Alphabet for the last two quarters in quarterly hiring as both companies ramp up spending in engineering and sales, and these two companies lead the rest of the pack on this basis, behind Amazon’s incredibly aggressive expansion of its workforce.