Since Satya Nadella’s appointment as CEO at Microsoft, there’s been a lot of press coverage of the subtle and not-so-subtle cultural changes at the company, in contrast to Steve Ballmer’s tenure. The seeds of some of these changes were actually sown under Ballmer, however, and looking at Microsoft’s financial results provides some interesting insights into how the business is changing financially as a result of these cultural shifts. The composition of both its revenues and its workforce has changed fairly dramatically over the last few years as a result of changes instituted by both Ballmer and Nadella.

Revenue by segment

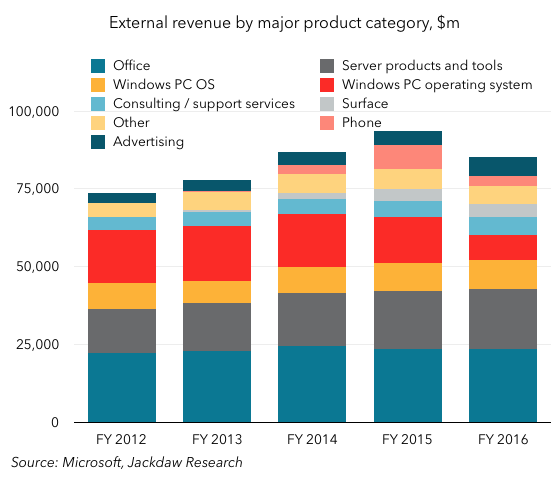

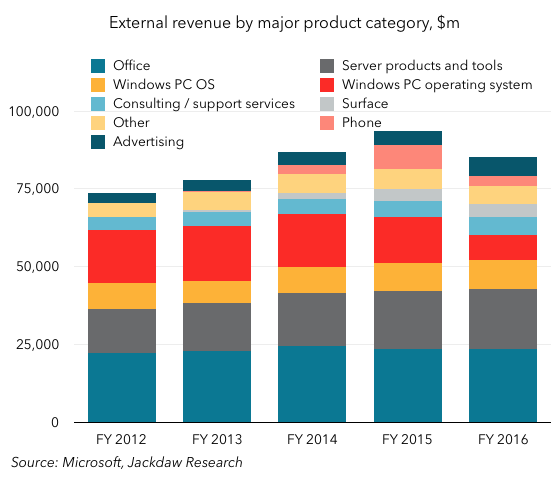

Microsoft has modified its standard segment reporting several times over the past few years as a reflection of the adjustments to its business during that time. However, one thing that’s remained fairly consistent is its annual reporting of external revenues by product line, which can be found in its 10-K filing. This snippet of data provides both a unique insight into what’s happening at the product level and a clearer picture of changes over time than Microsoft’s standard quarterly segment reporting. The chart below shows how the composition of revenue on this basis has changed over the last few financial years:

There are several things worth noting here:

- Office has been and remains the largest product by revenue, consistently in a two-billion-dollar range from $22 to $24 billion per year over the last five fiscal years and between 25% and 30% of revenues

- The Phone segment has varied significantly as Microsoft first added Nokia’s Devices and Services business and then cut that division significantly. It peaked at $7.7 billion or 8% of revenue in FY 2015 but was just $3.4 billion or 4% this past financial year

- The revenue line for the Windows PC operating system has shrunk enormously over the past two years from a financial reporting perspective but a big chunk of the most recent decline is down to revenue deferrals for Windows 10, amounting to $6.6 billion in FY 2016. Even so, revenues for Windows PC peaked at $18.2 billion in FY 2010 and have been declining since. Even adding those revenue deferrals back in for FY 2016 would yield just $14.7 billion

- Server Products and Tools is now the second-largest segment, with $19 billion of revenue or 22% of total revenue in FY 2016, up from $13 billion or 19% five years ago

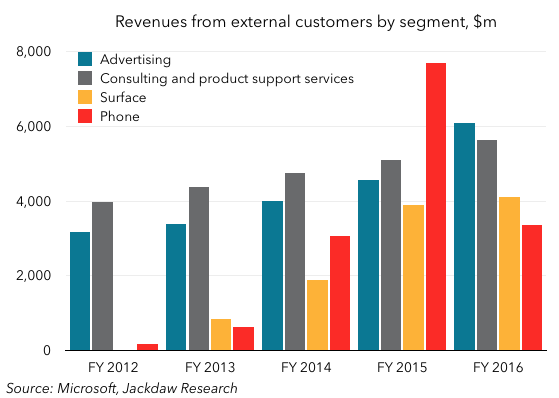

It’s interesting to drill down on some of the smaller segments which are harder to see in that overview chart:

Again, several things are worth noting here:

- The largest of these smaller segments in FY 2016 was Advertising, most of which is revenue from Bing. It’s striking that this is now larger than the Surface business and considerably larger in FY 2015 than Phone too. Advertising has been through a period of very rapid growth over the past couple of years, despite Microsoft’s recent abandonment of display advertising. Given how little attention this division gets, both in Microsoft’s discussion of its results and in public coverage, that’s surprising, especially given that Bing is now apparently profitable

- Second in FY 2016 among these smaller segments was Consulting and Product Support Services, which is a catchall for a variety of services Microsoft describes as follows in its filings: “[these services] assist customers in developing, deploying, and managing Microsoft server and desktop solutions and provide training and certification to developers and IT professionals on various Microsoft products.” We’ll return to this when we get to headcount below

- Third is Surface, which has grown from zero in FY 2012 to over $4 billion in revenue in FY 2016. That’s an impressive rate of growth for a company that has historically never made its own hardware. It’s still small relative to, say, Apple’s $21 billion in revenue from the iPad or $24 billion from the Mac over the past year but, from nothing, it’s a solid achievement

- Last is Phone, which as I’ve already mentioned has been through a rollercoaster from the small licensing business at pre-Nokia Microsoft through the acquisition and subsequent extensive cuts to that business and the dive in phone hardware sales

Revenue growth rates

Interestingly, of all these segments, the one growing fastest is Advertising, with Consulting and Product Support Services second. All the rest are under 5% year on year growth, while Windows PC and Phone are both well down year on year and Office was essentially flat.

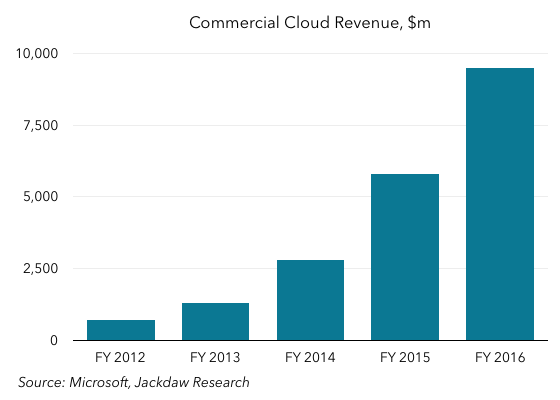

You’ll probably have noticed one word missing from all this — Cloud. This is because, although Microsoft talks up the cloud constantly, it isn’t anything like a single product line at Microsoft and is, in fact, spread among various segments, notably Server Products and Tools and Office. Microsoft does report a “Commercial Cloud” chunk alongside these annual numbers, and it looks like this:

As you can see, that’s a very healthy growth rate, and starting to be a fairly sizable business – it would be third if it were a standalone product line, behind Office and Server Products and Tools, though of course it’s actually part of both of those. But here’s where we get to the sticky part of Microsoft’s cloud reporting – this is a slice of a variety of different products and services at Microsoft and you always get the sense it’s crafted in such a way as to make it look as impressive as possible without really nailing down exactly what the components are. Certainly, given the overall slow growth rates in Microsoft’s business at this point, much of this growth is coming at the expense of other products and services which are being replaced by cloud versions – this isn’t necessarily additive revenue.

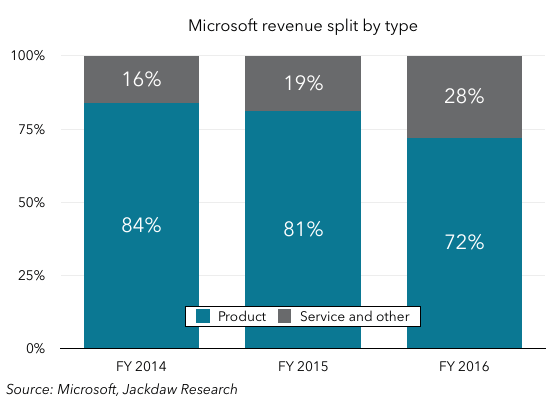

Products versus Services

One other interesting tidbit in this year’s 10-K was the revelation Services accounted for more than 10% of revenue for the first time in FY 2016 for Microsoft and therefore merited breaking out separately in segment reporting. However, Microsoft sadly decided to lump in a variety of non-service revenue with services in a broader Service and Other category, which has been well over 10% of total revenue for several years. But it’s still interesting to look at this breakdown. The definitions of these two broad categories are as follows, quoting from the 10-K:

- Product revenue includes sales from operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; hardware such as PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories; and training and certification of computer system integrators and developers

- Service and other revenue includes sales from cloud-based solutions that provide customers with software, services, platforms, and content such as Office 365, Azure, Dynamics CRM Online, and Xbox Live; solution support; and consulting services. Service and other revenue also includes sales from online advertising

Here’s the revenue breakdown and how it’s shifted over the last three years:

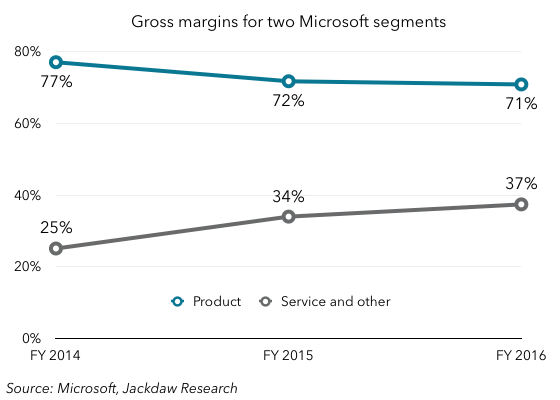

And here’s the gross margin for these broad segments over the same period:

I won’t dwell on these, but there is clearly a significant change happening here, too. As with Apple and Amazon, each of which I wrote about recently in this context, Services are becoming increasingly important to Microsoft as a business model. Part of the change here is about the revenue deferral in the Windows reporting, which impacts the Product side, but this is a broader shift. It’s also worth noting how much lower gross margins are in that Services and Other category than in Product. Some of that is down to the inclusion of both the Bing and Xbox Live businesses in here but part is also due to the nature of the new enterprise services Microsoft is pursuing. At their present scale, these are simply less profitable than Microsoft’s historical bread and butter of packaged software, which has enormous gross margins. That’s an indicator of where Microsoft’s future lies too.

Headcount

I’ve focused here mostly on the financial but it’s also interesting to look at Microsoft’s headcount figures, which it also provides only annually in its 10-K. Total headcount at Microsoft has fallen fairly significantly over the last two years, from a peak of 128,000 in June 2014 to 114,000 at the end of June 2016, largely as a result of the layoffs in the former Nokia business. Interestingly, Microsoft’s headcount outside the US briefly exceeded its domestic headcount following the acquisition, with 66k employees internationally and 62k in the US in June 2014, but that situation has quickly reversed itself again, with the vast majority of those layoffs happening outside the US. As of June 30, 2016, Microsoft again employed far more in the US than overseas, with 63,000 to 51,000 respectively.

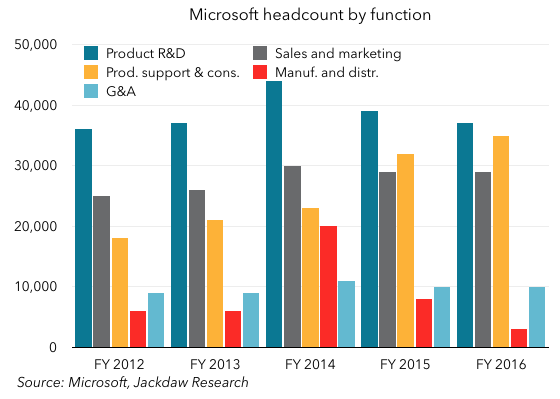

But, in some ways, the more interesting thing to look at is employment by job function. Sadly, Microsoft eliminated some detail from this reporting this year but, given past trajectories, it’s possible to arrive at a reasonable estimate. Here’s the breakdown for the last five fiscal years:

Again, several trends worth noting:

- Product Research and Development remains the largest base of employees, though it peaked in 2014 and has fallen since. A good chunk of the change from 2013 to 2015 was likely due to the addition and then the decimation of the Nokia team, as it ended up almost where it was back in 2012 and 2013 this past year

- Almost as large now, though, is Product Support and Consulting, which I estimate based on the trajectory through last year at around 35,000 in June this year. That’s interesting because, as we saw earlier, direct revenues from these employees were just 7% of the total but these employees are almost a third of Microsoft’s headcount. Clearly, the value these employees add is a meaningful chunk of the products and services they support, justifying this significant investment

- Third is Sales and Marketing, with a fairly consistent headcount of just under 30,000. This is par for the course in large enterprise software companies and it’s natural Microsoft would continue to have a very significant base of employees here

- The other two categories are fairly tiny. First is General and Administrative staff (which likely includes finance, HR, legal, administrative and other functions not tied to particular product lines or functions) at around 10,000, a number that again hasn’t changed much over the last two years. Last is Manufacturing and Distribution, which spiked significantly with the Nokia acquisition but has died down significantly since as that business has been scaled back. This simply isn’t a big part of Microsoft’s business anymore and that’s unlikely to change.

I do not even understand how I ended up here, but I assumed this publish used to be great

Hi there! I understand this is kind of off-topic

however I needed to ask. Does running a well-established blog such as yours require a lot of work?

I am completely new to running a blog but I do write in my diary everyday.

I’d like to start a blog so I can easily share my experience and views online.

Please let me know if you have any recommendations or tips for new

aspiring blog owners. Thankyou!

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to

come here and visit more often. Did you hire out a designer to create your theme?

Superb work!

An outstanding share! I have just forwarded this onto a co-worker who had been doing a little research on this.

And he actually ordered me breakfast due to the fact that I discovered

it for him… lol. So allow me to reword this….

Thanks for the meal!! But yeah, thanx for spending time to discuss this matter

here on your website.

I’m gone to inform my little brother, that he should also go to

see this blog on regular basis to take updated from latest gossip.

Hi there! I know this is kind of off topic but I was wondering which blog platform are you using

for this site? I’m getting sick and tired of WordPress because I’ve had issues with hackers

and I’m looking at alternatives for another platform.

I would be awesome if you could point me in the direction of a good platform.

Hi! Quick question that’s totally off topic. Do you

know how to make your site mobile friendly?

My website looks weird when viewing from my apple iphone.

I’m trying to find a template or plugin that might be able to fix this issue.

If you have any recommendations, please share. Thank you!

Hello! This is kind of off topic but I need some advice

from an established blog. Is it very difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to start.

Do you have any points or suggestions? Thanks

Admiring the dedication you put into your website and in depth information you

provide. It’s awesome to come across a blog every once in a while that isn’t the same out of date rehashed material.

Wonderful read! I’ve saved your site and I’m adding your

RSS feeds to my Google account.