One of the markets I track closely is the US wireless industry, and especially the five largest providers: AT&T, Sprint, T-Mobile, TracFone, and Verizon Wireless. All of these companies recently reported their financial results for Q2 2017, and as a result we now have a good picture of what happened in the quarter. Here are three key insights from those results.

Smartphone Growth Continues to Slow

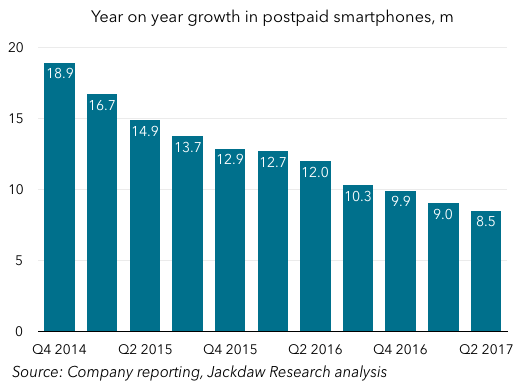

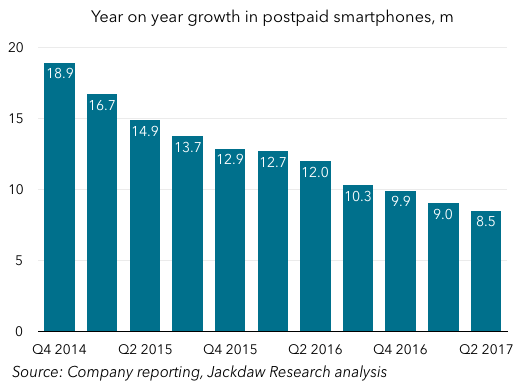

This trend has been in evidence for a while, but continued in Q2 2017: smartphone growth continues to slow significantly. The chart below shows year on year growth in the postpaid smartphone base as reported by the major carriers. Whereas in 2014 the industry added nearly 19 million new postpaid smartphone customers, in the past four quarters, the same carriers added just half that, at 8.5 million. That’s an inevitable result of the increased penetration of smartphones, which now averages around 92% across the four carriers’ postpaid bases.

Worse still, the postpaid device upgrade grade also continues to fall for most of the carriers, though all but AT&T saw a little upward blip in Q2 itself. Overall, though, the average in Q2 2017 was 5.9% of the base upgrading, compared to 7.5% two years ago. That means people are holding onto phones longer as devices last better and as installment plans incentive customers to keep devices after they’re paid off. All of this, in turn, means that smartphone sales are falling – postpaid smartphone sales this quarter were likely around 2 million fewer than a year ago.

Cellular Tablets are in Decline

What’s more, one of the big categories of retail connected devices outside of phones, tablets, is also in decline following years of growth. That decline was precipitated by moves two to three years ago to sell heavily discounted or even free tablets with 2-year service contracts, especially at Verizon and Sprint. As those customers have reached the two-year anniversary of their original purchase, many of them have been churning off the associated service plans, and in the last two quarters the four big carriers as a whole have lost subscribers, as shown in the chart below.

That’s a blow to the carriers at a time when they need more than ever to find new sources of postpaid growth as the phone market slows down and smartphone penetration reaches saturation levels. Smartwatches were thought by some carriers to be a promising new opportunity when they debuted, but in practice few connected devices have been sold so far. If Apple introduces an LTE-enabled Watch next month, as has been reported recently, that could change things, though it will still likely sell in the hundreds of thousands rather than the millions.

Customers are Sticking With Their Provider Longer

Other than the elevated churn levels being seen in tablets at present, the industry is actually doing a better job holding onto its subscribers. Three of the four carriers saw very low postpaid phone churn in Q2 2017, with Sprint the only exception, as shown in the chart below.

Verizon, which has always had the most loyal customers overall, generally hasn’t reported precise numbers for its postpaid phone churn, but did so in Q2 and was below even AT&T’s record low number. But T-Mobile has also seen significant improvements over time, and got a nice boost over the past few quarters from selling some of its low-end subscribers to Wal-Mart, improving the average churn of those that remained. Percentage rates may not mean much on the surface, but a 1% monthly churn rate (roughly between AT&T and T-Mobile’s rates in Q2) translates into a roughly eight year average customer lifecycle. So for all the fuss in the industry about competition and the way in which T-Mobile is gaining subscribers at the expense of the others, the vast majority of subscribers stay put with their carrier every month, and over 85% stay put every year. The reality is that the differences in network performance and other factors between the carriers have shrunk over time, and the plans they offer make it relatively difficult to compare prices directly, which makes most people reasonably content to stay where they are.

The one trigger for switching is often a device upgrade, which as we’ve already seen is happening less frequently recently. But that’s not to say that major events can’t shake things up – this fall’s iPhone launch is expected to be a big seller, and we’ll see lots of efforts by the carriers to lock in iPhone upgraders with discounts and promotions when the device is released. We’ll likely see strong smartphone sales (perhaps the strongest since 2014) and higher switching in Q4 as a result, with some of that bleeding over into Q1, traditionally a relatively quiet quarter for switching.

Thank you for great content. I look forward to the continuation.