As a part of some new content styles I’m looking into for subscribers, I’m testing the idea of a weekly post where I hit a number of hot topics in one post. Most subscribers know that each daily analysis has been focused on one subject. With posts like these, I’ll cover a bit of ground on a range of subjects rather than just one. So each week, subscribers will get a mix of subject-specific analysis, posts that cover several different topics, and an analysis of a weekly data point of mine or one I’ve gathered that is significant. Any feedback is appreciated.

Twitter 10k

Yesterday, a rumor said Twitter may be looking into expanding the potential tweet word count beyond 140 characters to 10,000 characters. My instant reaction was a tweet: “Please, Twitter powers that be — don’t do this.” In this instance, my fear is Twitter will let walls of text proliferate. Although, the way I and others take screenshots of text and add commentary to them is a clear use case of why, sometimes, more than 140 characters are necessary.

Shortly after the news broke, Twitter’s CEO and one of the original founders, Jack Dorsey, sent out a lengthy note explaining how the folks at Twitter think about new features. His note was actually 1300 characters or so (no where near 10,000) but he made the point about how sometimes more words are useful and perhaps necessary within a Twitter conversation or timeline. I admit to doing this at times where I type a response and then take a screen shot to tweet it in response to something. There is certainly a use case here but I have two questions and then a point on execution.

Who would the 10k word count be for? We likely assume it is for publishers. After all, and from my own experience trying to do screen shot commentary, constructing these types of tweets is actually quite a bit of work. Not likely something the casual Twitter user will do. So production values will come to Twitter if this happens and I think Twitter will make this move. Is this also for advertisers? Is there a money angle here which is really the underlying reason Twitter makes this move? After all, they are under significant pressure from Wall St. to grow revenue and users, the latter being much harder for them than the former. I’ve been pounding the drum about how so many companies’ user growth need to focus on monetizing their current base of users more effectively. This is likely a step in that direction for Twitter. Lastly, they seem to position this as a move to acquire new users. That part I’m not convinced of which brings up the question of execution.

I hope I am not too naive to assume Twitter is smart enough to not force every single tweet north of 140 characters on us. If our timelines are filled with walls of text articles from every publisher or random rants of Donald Trump being retweeted by the masses, I can say with absolute conviction it will kill the Twitter experience. If however, like the screen shot execution, I find myself interested in the text beyond 140 characters and can click to expand the tweet, then I can see that working as a much more elegant solution.

I understand most people don’t click links. I’d argue Twitter users in general are better at this than those reading a blog, as evidenced that Twitter is the single largest referrer to articles on Tech.pinions than any other medium. However, Twitter wants–needs–to own more of the engagement with their service. This seems an effort in that direction. Good or bad, I sense this is coming.

FitBit Blaze

Yesterday, FitBit did what many investors hoped they would not. They launched a product, seemingly attempting to go upstream against the Apple Watch and other smart watches. I speak with many Fitbit investors and knew when they saw this the stock would take a hit and it did just that.

Realistically, though, Fitbit launched a better product (minus the GPS which I’ll come back to), than their Surge in terms of look and feel as well as price.

Here is the Surge at a $250 price point in case you haven’t seen it:

Here is the Fitbit Blaze at $200:

Blaze has a color screen, band changing options, and a (claimed) five day battery life but does not have integrated GPS like the Surge and, therefore, needs to be in proximity to your smartphone to use the GPS. Competitively, one would think these feature at a lower price point than the Surge (which did not sell in massive volumes) is a competitive option in the Fitbit ecosystem. The rub, however, is how its design aesthetic will have it positioned against smart watches and the Apple Watch. It will lose that battle.

It is true within the Fitbit ecosystem it is competitive but the street had hoped they would launch a product more in their sweet spot, like new versions and features around the Charge HR line which is FitBit’s volume seller by far. I’m sure Fitbit has more products up their sleeve for this year, but the short-term outlook for their stock is not positive despite a monster holiday sales season.

Huawei’s Growing Global Presence

If you have followed much of my writing the past few years, I’ve been sounding the bell to watch Huawei as a more interesting global player than Xiaomi–at least for now.

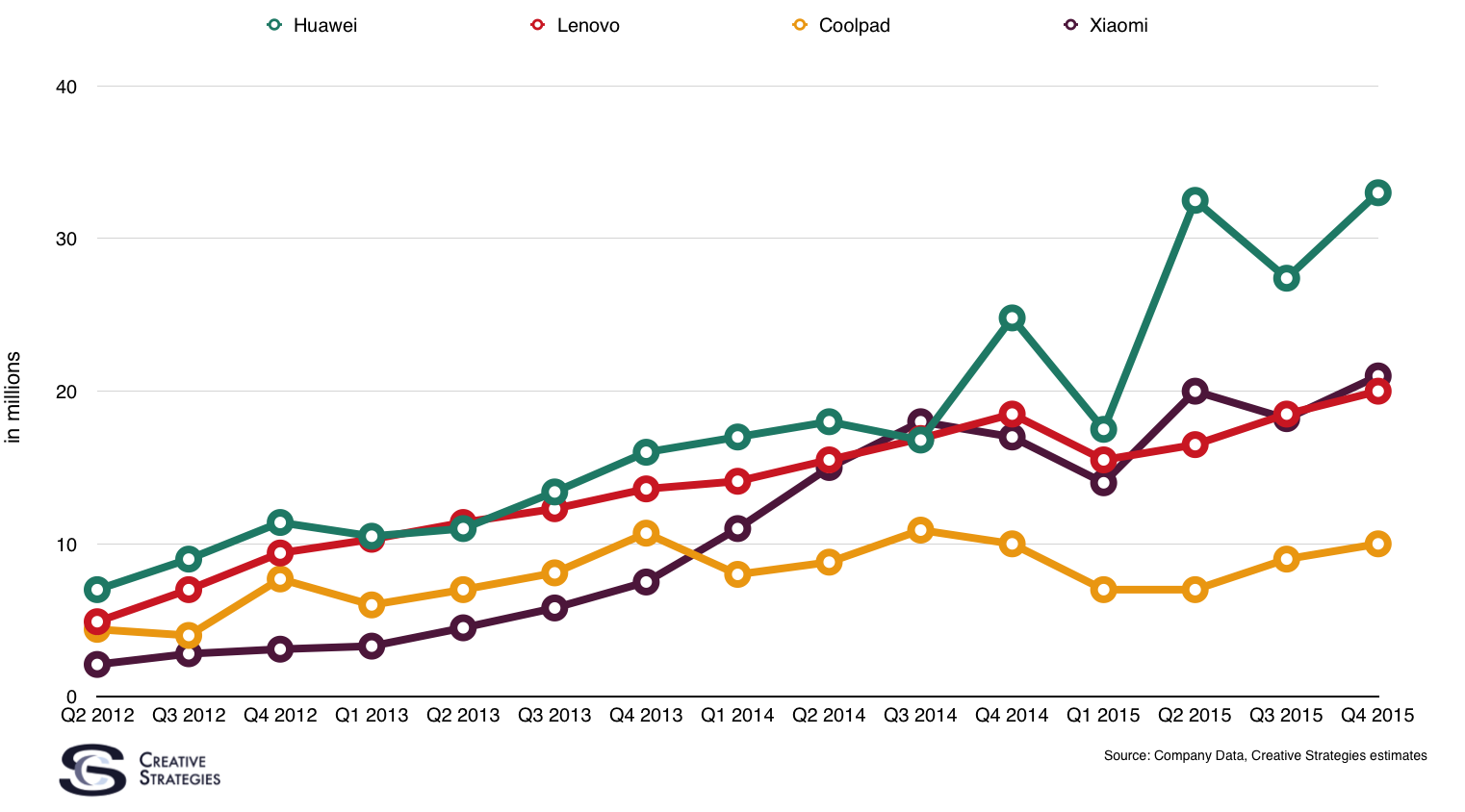

Here is my model of a few of the Chinese players’ quarterly smartphone shipments the past few years. As you can see, Huawei is pulling away from the pack and, as I predicted, has become the first Chinese OEM to surpass 100m smartphone shipments in a year. Only Apple and Samsung have done this and is quite a feat. Who the next Chinese OEM to do this (maybe Xiaomi?) will be something to watch.

The battle between Xiaomi and Huawei was close for a while, but a fascinating dynamic in this was, for most of 2014, Huawei underestimated Xiaomi and did not take them seriously. Once that mindset changed we saw what happened. It is little appreciated or known that Huawei owns their own semiconductor company called HiSense. Semiconductors are a primary area of study of mine and I’ve been watching HiSense for some time. This asset will prove extremely valuable as they increase their global presence. And, contrary to what many believe, there are doors opening in the US market for mobile semiconductor and modem companies beyond Qualcomm.

iPhone Concern

This seems to be a narrative we can’t get away from. Is Apple’s iPhone growing or not? I get this question more than I care to admit from many pockets of the industry.

I’m sure you all would like me to do a more in-depth post on this and I will at some point. However, the supply chain is very tricky to read. It is much more nuanced than many realize. Most analysts have one or two vendors they track and they seem to think those isolated examples are indicative of a larger supply chain trend. That is rarely true. Very few people read supply chain well and there are only a few that have gained my trust as sources as I try to do this myself as well.

Apple’s supply chain is much trickier. They spread supply much larger than many appreciate and are always coy on which vendors they use. It is masked intentionally for competitive reasons and masked well. So what is happening?

Apple likely slowed production (this is common) so the question is, why? Is it because iPhone sale are stalling or slowing? This will be a narrative which will not go away.

I believe iPhones sales will be up YoY from last Q4. Data I see from China suggest China is slightly up YoY with the new models, but also that the 6 and 6 Plus are still selling extremely well, something myself and a few other analysts I know predicted. This is a dynamic to include as it will impact ASP in these analyses as well as mix estimates of newer and old devices as analysts work up their revenue models. This may the first quarter in a long time, and signal a larger trend, of a different percentage mix of new and old iPhone sales versus past quarters.

One other thing those analyzing the cuts could be missing is these cuts may have nothing to do with the March quarter as so many assume. I’ve heard rumblings in supply chain that Apple is producing more phones up front in line with their expectations. Meaning, the cuts we are seeing could be related to the June quarter and beyond, not the March quarter.

As I said, a longer post on this topic is necessary at some point.

Any feedback on this style is appreciated. A few others doing subscriptions do this style daily but I’d do it more once a week on hot topics and have the others subject-specific analysis. Please share any thoughts on the style.

Thanks

Hi Ben, I really like this additional format. I think it is a keeper.

I like it in addition to your other styles. The single topic posts sometimes seem a bit stretched so adding a second or third topic allows a shorter note about a topic while making the overall post longer.

Great post Thank you. I look forward to the continuation.