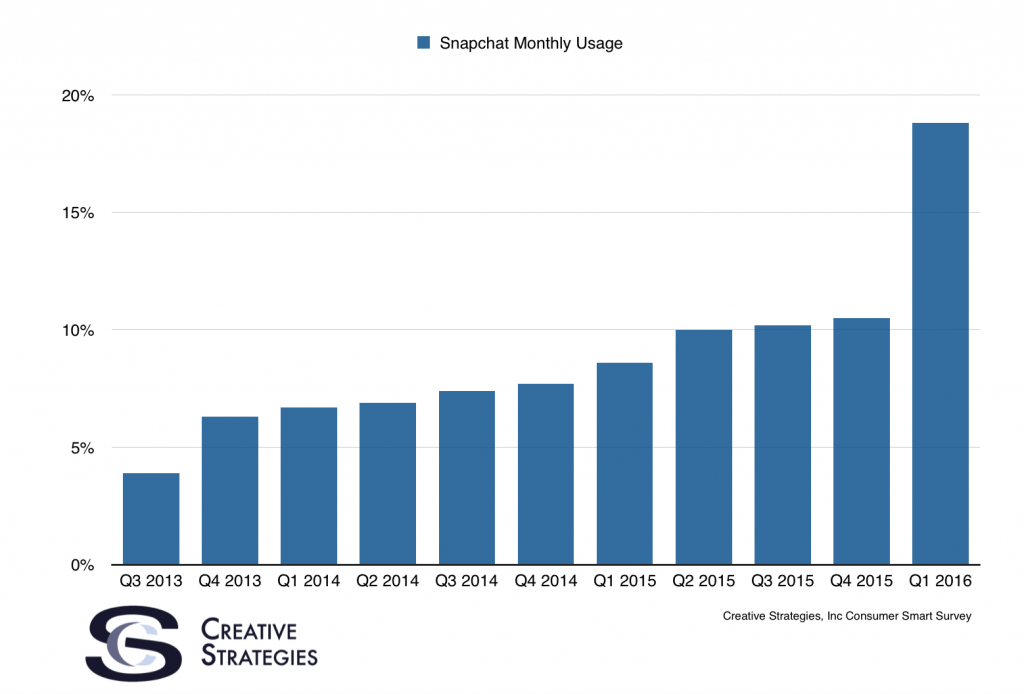

For whatever reason, over the past few months I’ve observed Snapchat gaining popularity. Between a blend of a noticeable number of people I follow on Twitter saying they are now on Snapchat and friends and family getting on the service, it seems there is a new level of heightened interest. That is why I was looking at our quarterly app usage study to see what percent of consumers now say they use Snapchat at least once a month and see whether it rose from last quarter or the quarters before. Sure enough, no single app on our list had as much of a quarterly increase in usage than Snapchat.

The above chart is for the US only but, when we look at the data globally, Snapchat usage went from 5% to 10.5% QoQ showing strong global growth as well. You can see Snapchat went from 10.5% of consumers in the US saying they use it to 18.5% in just one quarter. If you have read any of my commentary on Snapchat, you will know I’ve pointed out time and again how Snapchat is largely popular with the younger, under-24 demographic. However, for this type of growth to happen, my hunch was Snapchat is experiencing some growth outside of their core younger cohort. Looking at the above data by age of respondent and this is exactly what happened.

In the US, the Gen X demographic’s usage of Snapchat went from 5.6% in Q4 2015 to 14.6% in Q1 2016. Snapchat also added more millennials as well last quarter with that demographic going from 23% to 39% who say they use Snapchat at least once per month.

I’m beginning to wonder if we are at a tipping point for Snapchat. I’ve watched the data for the past year and growth was mild but consistent. To see usage jump as much as it did globally and in the high-value advertising market of the US may be signaling Snapchat is rising. The timing would be impeccable for them as the media advertising tides have shifted in the direction of mobile and Snapchat may be getting to a place where they have the right metrics to compete with Facebook and Google for media ad dollars. The key for them will be to make sure the advertising return on investment metrics is also there. This was something Facebook struggled with early on in their advertising push where many large advertisers did not get the return from spending with Facebook. Snapchat, by allowing users to touch any ad and quickly get rid of it, may need to make some tweaks to the service to get the right returns for advertisers.

While it is positive they are growing their user base outside of the Gen Y demographic, we need to see if the service is sticky enough to keep them engaged or if this quarter (and a few to follow) are one-off anomalies where people try Snapchat and quickly stop using it. Nonetheless, the QoQ spike is impressive and worth keeping an eye on.