On Monday, Google holding company Alphabet will announce its first earnings under its new reporting structure. This past week, the company provided some information about exactly how it will break down its reporting between the core Google business and its “Other Bets” and, in anticipation of the earnings announcement, it’s worth thinking about what we’ll learn that we haven’t known before.

The Core Google Business

Let’s start with the core Google business. The biggest thing we’ll learn from the new reporting structure is the true profitability of the core Google business. We already know the revenues from this business, because they’ve been reported under the “Google websites” and “Google Network Members’ websites” segments but, because operating income has only been reported at a company level, we’ve never known how profitable this business was. Now, we will (though operating profit will still include the “Other” segment – more on this below). It’s almost certain this core business will look more attractive following the new breakout, because all the loss-making Other Bets that have been dragging down overall margins will be stripped out. I think this is actually one of the biggest reasons the company is adopting this new reporting structure – it wants investors to see the true performance of the Google business.

A (slightly) smaller “Other” segment

Google has always reported an “Other” business in addition to its two advertising ones. Interestingly, in the description of this business in its SEC filings, the only “Other Bets” business that has ever been mentioned is Nest:

Other revenues consist primarily of:

•Sales of apps and media content in the Google Play store;

•Sales of all hardware in our Google online store;

•Sales of certain Google and Nest branded hardware;

•Subscription fees paid for Google for Work, including Cloud Platform and our Maps API; and

•Licensing-related revenue.

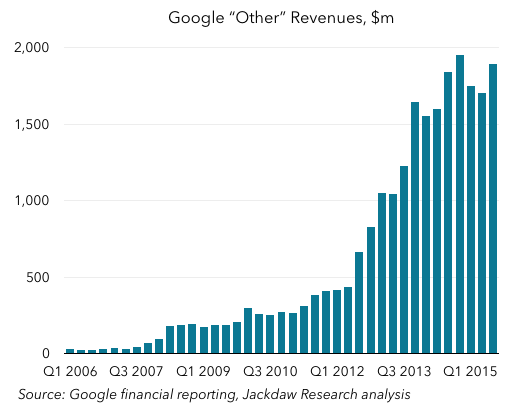

All the elements of “Other” listed there, apart from Nest, are sticking with the core Google business. What I’m really curious about is how much is left in this “Other” line once the Other Bets are taken out because that will give us a better sense of the combined Google Play, Google hardware (excluding Nest), and Google Enterprise businesses. We still won’t get any direct visibility over the individual components, but it will allow us to see the combined size of these non-ad-supported businesses within Google proper. Revenues in this segment have been through an interesting period over the last several years, with hyper-growth followed by stagnation more recently:

Other Bets

The other really big news, of course, will be the performance of the Other Bets under the Alphabet umbrella. Sadly, we won’t get a breakout of the individual Bets, but we will have a sense of how they’re performing overall. To my mind, the biggest insights we’ll get are:

- The size in revenues of this combined business. It’s a subset of that Other segment above, so the ceiling is roughly $7 billion on an annualized basis, but it’s likely a tiny fraction of that. Is it $1 billion? Less? Given that Google has only mentioned Nest in this category and since many of the Other Bets don’t generate any revenue yet, the total may be significantly under $1 billion annually

- The profitability (or rather the scale of losses) of this business. Is it massively loss-making?

- The trajectory of both these items. In other words, are revenues growing rapidly? Slowly? Is profitability increasing or worsening over time? How does management characterize the trajectory of this business, in terms of how long it will be before it can make a meaningful positive contribution to Alphabet?

The overarching question with the Other Bets as a whole is whether the bets Alphabet is making on these initiatives are worthwhile, and whether they’re going to pay off over time in such a way as to justify the investment.

R&D Spend

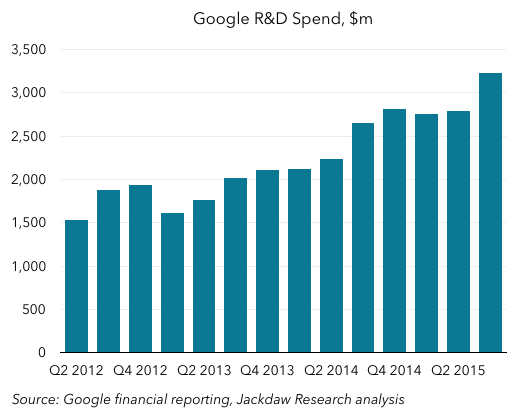

Sadly, although we’ll get capital expenditures for the Other Bets, we won’t get R&D spending broken out. That has been very significant over recent years – annualized spending has been over $11 billion (see chart below), so I’m curious to see how this is split between Google and the Other Bets. Clearly, Google has some big R&D projects with Deep Mind and AI in general, but certain other projects, like self-driving cars, robotics, and so on, are in the Other Bets category. How much of Alphabet’s R&D is in that business?

No Visibility in Other Areas

Sadly, even with this new transparency over the non-core areas, we won’t get any new visibility over the mobile business, Android, YouTube, or any other individual aspects, from a revenue or profitability perspective. Although the core Google business as a whole will look healthier in the new breakout, we won’t know whether YouTube is making money, how fast mobile advertising is growing, or how much it’s spending on Android. And, unless there’s evidence the mobile business in particular is growing and highly profitable, the continued unfavorable comparisons to Facebook are likely to increase the pressure further to provide that transparency too.

What was the result of the game last night?

This post post made me think. I will write something about this on my blog. Have a nice day!!