Once or twice in the past, I’ve provided little nuggets of information from the data I collect on the US wireless market each quarter on behalf of a number of my clients. Today, I wanted to share some numbers specifically on the question of where the growth is in the US wireless market now that we have at least subscriber numbers from all the major operators that I track for Q4.

Phone Subscribers Aren’t Really Growing

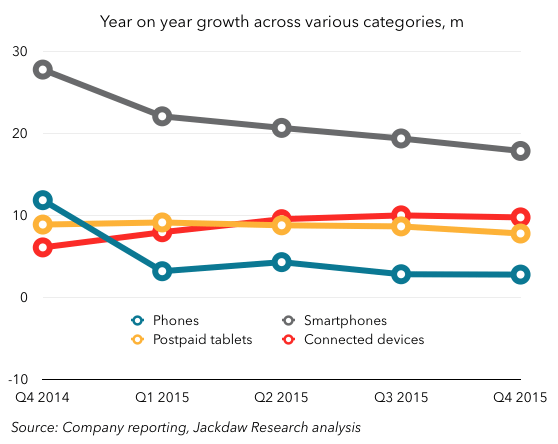

As I’ve said before, even though we tend to think of the wireless market primarily as the cellphone market, that really isn’t where the growth is today. As the chart below shows, the total number of phones in use among the five largest operators is barely growing year on year, at just 2-3 million versus a base of over 280 million:

Phones, shown in dark blue, are the slowest growing of the three major categories for the last four quarters. Both tablets and “connected devices” are growing considerably faster. (As a reminder, connected devices are non-traditional devices like utility meters, connected cars, and so on, where the connectivity isn’t sold directly to the end customer but rather to an intermediary.) The growth of tablets with cellular connectivity has also been slowing lately, but it’s still at around 7-10 million per year, largely driven by AT&T and Verizon, with Sprint and T-Mobile selling relatively few tablets in comparison. But it’s connected devices that are really driving industry growth, with AT&T leading the pack and Sprint and T-Mobile reporting respectable but not stellar numbers (Verizon doesn’t report this number officially, so the actual growth is likely even higher). Connected cars in particular have been a major driver for AT&T, which has been adding roughly a million per quarter. Both tablets and connected devices have significantly lower revenue per connection than phones, but far greater potential for growth in the coming years.

By contrast, almost everyone who’s going to get a phone has one and the only growth in the market comes from a combination of population growth and the cohort effect of teenagers replacing seniors in the addressable population, with a substantially higher likelihood of device ownership. But this is good for just 2-3 million new phone customers year on year, meaning that if wireless carriers in the US want to grow their phone bases, they have to drive switching from other carriers. This helps to explain why both T-Mobile and Sprint, the smaller two carriers, are pursuing switchers so aggressively with various price discounts and other promotions. In order to close the scale gap with Verizon and AT&T, they have to grow significantly. AT&T and Verizon meanwhile, do what they can to protect their phone bases while pursuing growth in tablets and connected devices.

Smartphones Aren’t the Boon They Once Were

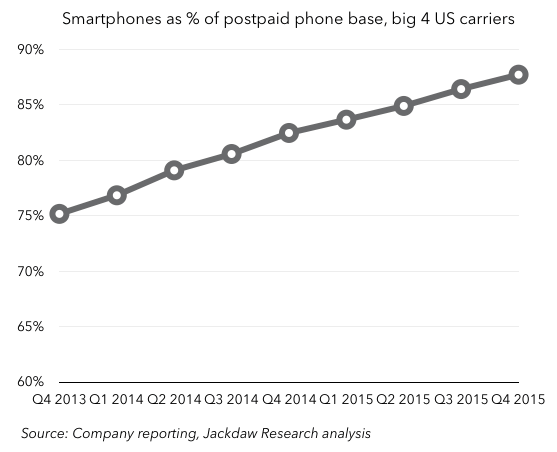

In part, carriers have avoided the unpleasant consequences of this phone saturation by aggressively driving their phone subscribers to upgrade from basic feature phones to smartphones over the last ten years or so. As customers move from feature phones to smartphones, they’re forced to pay for data plans, significantly increasing revenue per user. This has driven significant revenue growth for the US wireless carriers even as growth in the base of phone subscribers has slowed. The challenge now though, is smartphone penetration among the phone base is nearing saturation rates. The chart below shows penetration of smartphones in the postpaid phone base specifically (this is the segment which pays a monthly bill rather than topping up a balance of minutes and data periodically):

As you can see, penetration has risen rapidly over the last couple of years, from 75% to nearly 90%. But, of course, the closer the number approaches 100% the more it will slow down, as laggards stubbornly hold on to their feature phones. Smartphone sales have been 95% or more of postpaid phone sales in the US for some time now, but that 5% of buyers who prefer dumb phones refuses to budge. In the next year or two, this smartphone-driven boon for US wireless carriers will largely come to an end and they’ll be left trying to convince subscribers to move to higher-tier data plans. Going back to the first chart, you can see the smartphone base has been growing strongly, but the rate of growth is slowing significantly over time and this trend will continue. That’s bad news, not just for the carriers but the phone makers as well. They, like the carriers, will soon find themselves forced to compete for switchers rather than capturing entirely new smartphone customers. This helps to explain Apple CEO Tim Cook’s recent emphasis on Android switchers in his remarks on earnings calls, because that’s going to be almost the only source of growth for the US iPhone base within a year or two.

Of course, none of this is unique to the US market. Many other markets in Europe and parts of Asia will be seeing very similar trends over the next few years. This, in turn, means carriers there will also have to aggressively pursue new opportunities in connected devices and their bedfellow, the Internet of Things. It also means device vendors around the world will have to do a better job tapping into the remaining growth in the world market for smartphones, largely in emerging markets, while also diversifying their portfolios to include additional devices – tablets, wearables, and so on – that can be sold to their smartphone customer base.

We always follow your beautiful content, I look forward to the continuation.

A big thank you for your blog.Really looking forward to read more. Want more.

cost of cheap clomid pills get cheap clomid without a prescription – get generic clomid pills

https://ciprofloxacin.life/# cipro for sale

generic prednisone cost: fast shipping prednisone – buy prednisone 10mg

https://lisinoprilbestprice.store/# lisinopril 20 25 mg tab

200 mg doxycycline: buy doxycycline without prescription – where can i get doxycycline

https://doxycyclinebestprice.pro/# 200 mg doxycycline

doxycycline medication: buy doxycycline online uk – doxy

http://lisinoprilbestprice.store/# on line order lisinopril 20mg

buy generic doxycycline [url=https://doxycyclinebestprice.pro/#]doxycycline 100mg[/url] buy doxycycline online without prescription

http://nolvadex.fun/# how to lose weight on tamoxifen

https://nolvadex.fun/# tamoxifen endometriosis

https://zithromaxbestprice.icu/# where to get zithromax over the counter

200 mg doxycycline: doxycycline 100mg price – 200 mg doxycycline

can i buy zithromax online [url=https://zithromaxbestprice.icu/#]generic zithromax india[/url] zithromax for sale online

https://lisinoprilbestprice.store/# zestril 10 mg price in india

https://zithromaxbestprice.icu/# buy cheap zithromax online

tamoxifen lawsuit [url=https://nolvadex.fun/#]nolvadex gynecomastia[/url] tamoxifen and ovarian cancer

http://cytotec.icu/# cytotec pills buy online

buy cytotec pills online cheap: cytotec pills buy online – п»їcytotec pills online

doxycycline generic: doxycycline hyc – purchase doxycycline online

http://canadapharm.life/# real canadian pharmacy canadapharm.life

http://mexicopharm.com/# pharmacies in mexico that ship to usa mexicopharm.com

https://canadapharm.life/# canadian pharmacy prices canadapharm.life

cheap canadian pharmacy: Canada pharmacy online – canadian mail order pharmacy canadapharm.life

canadian drug prices: Canadian online pharmacy – canadian pharmacy ed medications canadapharm.life

canadian pharmacy meds: Canadian pharmacy best prices – ed meds online canada canadapharm.life

http://indiapharm.llc/# legitimate online pharmacies india indiapharm.llc

https://indiapharm.llc/# india online pharmacy indiapharm.llc

reputable indian online pharmacy: Medicines from India to USA online – indianpharmacy com indiapharm.llc

https://mexicopharm.com/# mexico drug stores pharmacies mexicopharm.com

reputable indian online pharmacy: indian pharmacy to usa – top online pharmacy india indiapharm.llc

http://indiapharm.llc/# indian pharmacy online indiapharm.llc

http://indiapharm.llc/# online shopping pharmacy india indiapharm.llc

canadian drugs pharmacy [url=http://canadapharm.life/#]Canada Drugs Direct[/url] canadian family pharmacy canadapharm.life

http://canadapharm.life/# safe canadian pharmacy canadapharm.life

http://sildenafildelivery.pro/# sildenafil 25 mg price

https://levitradelivery.pro/# Vardenafil price

best pill for ed [url=https://edpillsdelivery.pro/#]buy ed drugs online[/url] cheap erectile dysfunction pills

https://levitradelivery.pro/# buy Levitra over the counter

https://sildenafildelivery.pro/# sildenafil generic drug cost

https://kamagradelivery.pro/# buy Kamagra

Levitra generic best price: Buy generic Levitra online – Buy Vardenafil online

https://tadalafildelivery.pro/# cheap 10 mg tadalafil

super kamagra [url=https://kamagradelivery.pro/#]cheap kamagra[/url] sildenafil oral jelly 100mg kamagra

http://kamagradelivery.pro/# Kamagra 100mg price

http://levitradelivery.pro/# Cheap Levitra online

http://levitradelivery.pro/# Cheap Levitra online

http://kamagradelivery.pro/# sildenafil oral jelly 100mg kamagra

tadalafil soft [url=http://tadalafildelivery.pro/#]tadalafil cialis[/url] tadalafil soft gel capsule 20mg

medication for ed dysfunction: erection pills over the counter – erection pills viagra online

price of tadalafil 20mg: cheap tadalafil canada – buy tadalafil cialis

https://kamagradelivery.pro/# buy kamagra online usa

https://kamagradelivery.pro/# super kamagra

ed drugs [url=https://edpillsdelivery.pro/#]erection pills over the counter[/url] ed remedies

https://tadalafildelivery.pro/# cheap tadalafil 5mg

http://kamagradelivery.pro/# Kamagra 100mg price

http://paxlovid.guru/# paxlovid buy

https://stromectol.guru/# stromectol ebay

clomid generics: where can i get clomid – can i buy clomid without rx

http://paxlovid.guru/# paxlovid covid

http://clomid.auction/# can i buy clomid without insurance

https://paxlovid.guru/# paxlovid cost without insurance

п»їpaxlovid: Buy Paxlovid privately – п»їpaxlovid

https://paxlovid.guru/# paxlovid generic

http://prednisone.auction/# prednisone no rx

https://stromectol.guru/# ivermectin oral

http://stromectol.guru/# ivermectin brand name

https://clomid.auction/# cost cheap clomid now

how to get generic clomid without a prescription: clomid generic – where to buy cheap clomid without rx

https://stromectol.guru/# ivermectin 5

http://prednisone.auction/# prednisone 10mg cost

https://finasteride.men/# propecia cheap

cytotec pills buy online [url=http://misoprostol.shop/#]Buy Abortion Pills Online[/url] buy cytotec

http://misoprostol.shop/# order cytotec online

lisinopril 12.5 mg: cheapest lisinopril – buy lisinopril mexico

https://furosemide.pro/# lasix medication

https://furosemide.pro/# furosemide 40mg

https://azithromycin.store/# zithromax buy online

buy generic propecia pill [url=https://finasteride.men/#]Buy Finasteride 5mg[/url] cheap propecia

https://azithromycin.store/# buy generic zithromax no prescription

cost of propecia tablets: buy propecia – cheap propecia online

zithromax for sale us [url=https://azithromycin.store/#]cheapest azithromycin[/url] zithromax online australia

https://finasteride.men/# buying generic propecia for sale

http://furosemide.pro/# lasix uses

can you buy zithromax over the counter in mexico: Azithromycin 250 buy online – purchase zithromax online

https://misoprostol.shop/# buy cytotec online fast delivery

generic propecia pill [url=https://finasteride.men/#]cost of cheap propecia without a prescription[/url] order propecia no prescription

http://lisinopril.fun/# lisinopril 240

https://furosemide.pro/# lasix medication

https://finasteride.men/# buy generic propecia pill

furosemide 100 mg [url=http://furosemide.pro/#]Buy Lasix No Prescription[/url] furosemide

https://misoprostol.shop/# buy cytotec

http://finasteride.men/# cost of cheap propecia without a prescription

Abortion pills online [url=https://misoprostol.shop/#]buy cytotec online[/url] purchase cytotec

http://kamagraitalia.shop/# farmacie on line spedizione gratuita

http://sildenafilitalia.men/# esiste il viagra generico in farmacia

https://tadalafilitalia.pro/# farmacie online affidabili

acquistare farmaci senza ricetta: farmacia online miglior prezzo – acquisto farmaci con ricetta

farmacia online senza ricetta [url=https://farmaciaitalia.store/#]farmacia online[/url] acquistare farmaci senza ricetta

https://sildenafilitalia.men/# viagra online spedizione gratuita

https://tadalafilitalia.pro/# farmacie on line spedizione gratuita

farmacie on line spedizione gratuita: kamagra oral jelly consegna 24 ore – farmacie on line spedizione gratuita

https://sildenafilitalia.men/# viagra generico in farmacia costo

comprare farmaci online con ricetta [url=http://avanafilitalia.online/#]avanafil[/url] acquisto farmaci con ricetta

farmacia online: farmacia online miglior prezzo – farmacia online migliore

http://tadalafilitalia.pro/# farmaci senza ricetta elenco

http://sildenafilitalia.men/# le migliori pillole per l’erezione

http://avanafilitalia.online/# farmacia online

http://kamagraitalia.shop/# farmacia online miglior prezzo

п»їfarmacia online migliore [url=http://farmaciaitalia.store/#]farmacia online migliore[/url] п»їfarmacia online migliore

http://farmaciaitalia.store/# farmacia online più conveniente

http://tadalafilitalia.pro/# farmacie online autorizzate elenco

farmacia online piГ№ conveniente: Farmacie che vendono Cialis senza ricetta – farmacie online sicure

https://mexicanpharm.store/# mexican pharmacy

the canadian pharmacy: canadian world pharmacy – my canadian pharmacy reviews

http://canadapharm.shop/# certified canadian pharmacy

pharmacy rx world canada: thecanadianpharmacy – canadian discount pharmacy

http://canadapharm.shop/# canadian neighbor pharmacy

http://mexicanpharm.store/# medicine in mexico pharmacies

mexican border pharmacies shipping to usa: medicine in mexico pharmacies – mexican rx online

https://mexicanpharm.store/# buying prescription drugs in mexico online

https://mexicanpharm.store/# mexican online pharmacies prescription drugs

https://canadapharm.shop/# canadian pharmacy meds

medication from mexico pharmacy: buying prescription drugs in mexico online – mexican border pharmacies shipping to usa

https://indiapharm.life/# indian pharmacy

indian pharmacy: top 10 online pharmacy in india – india pharmacy mail order

best india pharmacy [url=http://indiapharm.life/#]world pharmacy india[/url] best india pharmacy

http://mexicanpharm.store/# mexican pharmaceuticals online

http://mexicanpharm.store/# mexican drugstore online

https://indiapharm.life/# legitimate online pharmacies india

http://canadapharm.shop/# canada drug pharmacy

medication from mexico pharmacy: mexican online pharmacies prescription drugs – mexican mail order pharmacies

cheapest pharmacy canada: canadian online pharmacy – canadian online pharmacy

https://mexicanpharm.store/# mexican rx online

https://mexicanpharm.store/# mexican mail order pharmacies

https://indiapharm.life/# buy medicines online in india

https://indiapharm.life/# Online medicine home delivery

canadian discount pharmacy: canadian pharmacy – the canadian drugstore

http://canadapharm.shop/# canadian pharmacy

hysterectomy after breast cancer tamoxifen [url=http://nolvadex.pro/#]tamoxifen benefits[/url] tamoxifen and uterine thickening

zithromax price canada: cheap zithromax pills – generic zithromax 500mg india

Their online refill system is straightforward http://zithromaxpharm.online/# buy zithromax without prescription online

https://nolvadex.pro/# tamoxifen breast cancer prevention

http://cytotec.directory/# Abortion pills online

Their 24/7 support line is super helpful http://nolvadex.pro/# hysterectomy after breast cancer tamoxifen

generic zithromax azithromycin: generic zithromax over the counter – buy zithromax online with mastercard

https://clomidpharm.shop/# order clomid without rx

They consistently go above and beyond for their customers http://prednisonepharm.store/# order prednisone online canada

buy cytotec over the counter [url=https://cytotec.directory/#]buy cytotec online[/url] buy cytotec over the counter

buy cytotec online fast delivery: buy misoprostol over the counter – buy cytotec over the counter

Always on the pulse of international healthcare developments https://cytotec.directory/# cytotec pills buy online

https://zithromaxpharm.online/# zithromax z-pak

http://nolvadex.pro/# tamoxifen and osteoporosis

Always leaving this place satisfied https://clomidpharm.shop/# can i buy generic clomid no prescription

buy cytotec in usa: Abortion pills online – cytotec buy online usa

They have a fantastic range of supplements https://zithromaxpharm.online/# can you buy zithromax over the counter in canada

buy cytotec over the counter: buy cytotec – cytotec abortion pill

The team embodies patience and expertise http://nolvadex.pro/# nolvadex online

Misoprostol 200 mg buy online: Cytotec 200mcg price – buy cytotec online fast delivery

They provide global solutions to local health challenges http://cytotec.directory/# purchase cytotec

can i get clomid without insurance: how to buy generic clomid no prescription – where buy cheap clomid

They provide access to global brands that are hard to find locally http://zithromaxpharm.online/# where to get zithromax over the counter

https://edwithoutdoctorprescription.store/# prescription drugs without doctor approval

ed pills that work [url=http://edpills.bid/#]new treatments for ed[/url] ed remedies

no prescription pharmacies: canadian pharmaceuticals online safe – canadian pharmacies that sell viagra

http://edpills.bid/# best ed treatment

http://edpills.bid/# ed pills

viagra without a doctor prescription [url=http://edwithoutdoctorprescription.store/#]viagra without a doctor prescription[/url] viagra without a doctor prescription walmart

online pharmacy medications: canada prescriptions online – overseas pharmacies

buy prescription drugs without doctor [url=https://reputablepharmacies.online/#]drugs from canada without prescription[/url] levitra from canadian pharmacy

best rated canadian pharmacy https://edwithoutdoctorprescription.store/# best ed pills non prescription

family discount pharmacy

http://edwithoutdoctorprescription.store/# best ed pills non prescription

discount prescription drugs: reliable canadian pharmacy – canadian pharmacy store

sildenafil without a doctor’s prescription [url=https://edwithoutdoctorprescription.store/#]buy prescription drugs from canada[/url] viagra without a prescription

prednisone mexican pharmacy: prescription drug prices – canada drug online

http://edpills.bid/# best treatment for ed

cures for ed [url=http://edpills.bid/#]buying ed pills online[/url] non prescription ed drugs

cheapest ed pills: ed dysfunction treatment – ed pills cheap

treatments for ed [url=http://edpills.bid/#]ed medications[/url] medications for ed

http://edwithoutdoctorprescription.store/# ed meds online without doctor prescription

trusted canadian pharmacies http://reputablepharmacies.online/# canadian generic pharmacy

online pharmacies

certified mexican pharmacy: discount drugs online pharmacy – cheap drugs online

drugs for ed [url=http://edpills.bid/#]ed meds online without doctor prescription[/url] best male ed pills

https://edwithoutdoctorprescription.store/# cialis without doctor prescription

п»їerectile dysfunction medication: pills for erection – male erection pills

no rx online pharmacy [url=http://reputablepharmacies.online/#]best canadian online pharmacies[/url] pharmacy canadian

http://edpills.bid/# ed medication

erectile dysfunction medicines [url=http://edpills.bid/#]natural ed medications[/url] best pills for ed

http://edwithoutdoctorprescription.store/# non prescription ed pills

http://canadianpharmacy.pro/# trusted canadian pharmacy canadianpharmacy.pro

canadian online pharmacy reviews [url=https://canadianpharmacy.pro/#]Canadian pharmacy online[/url] canadian pharmacies comparison canadianpharmacy.pro

mexican border pharmacies shipping to usa: online mexican pharmacy – buying prescription drugs in mexico online mexicanpharmacy.win

canadianpharmacyworld [url=https://canadianpharmacy.pro/#]cheapest pharmacy canada[/url] reputable canadian pharmacy canadianpharmacy.pro

http://indianpharmacy.shop/# indianpharmacy com indianpharmacy.shop

https://mexicanpharmacy.win/# buying from online mexican pharmacy mexicanpharmacy.win

mexico drug stores pharmacies [url=https://mexicanpharmacy.win/#]Medicines Mexico[/url] mexican drugstore online mexicanpharmacy.win

http://mexicanpharmacy.win/# mexican border pharmacies shipping to usa mexicanpharmacy.win

best online pharmacies in mexico: mexican border pharmacies shipping to usa – mexican pharmaceuticals online mexicanpharmacy.win

indian pharmacy paypal [url=http://indianpharmacy.shop/#]Order medicine from India to USA[/url] best india pharmacy indianpharmacy.shop

https://mexicanpharmacy.win/# buying prescription drugs in mexico mexicanpharmacy.win

canadian pharmacy service [url=https://canadianpharmacy.pro/#]Canadian pharmacy online[/url] medication canadian pharmacy canadianpharmacy.pro

http://indianpharmacy.shop/# indianpharmacy com

top 10 pharmacies in india

http://canadianpharmacy.pro/# canadian family pharmacy canadianpharmacy.pro

legitimate canadian pharmacies online

https://indianpharmacy.shop/# india online pharmacy indianpharmacy.shop

mexican online pharmacies prescription drugs [url=http://mexicanpharmacy.win/#]mexican pharmacy online[/url] pharmacies in mexico that ship to usa mexicanpharmacy.win

http://mexicanpharmacy.win/# mexico pharmacies prescription drugs mexicanpharmacy.win

indian pharmacies safe [url=https://indianpharmacy.shop/#]reputable indian pharmacies[/url] world pharmacy india indianpharmacy.shop

http://mexicanpharmacy.win/# mexico drug stores pharmacies mexicanpharmacy.win

best india pharmacy

the canadian pharmacy [url=https://canadianpharmacy.pro/#]Canadian pharmacy online[/url] canada pharmacy reviews canadianpharmacy.pro

https://mexicanpharmacy.win/# mexican pharmacy mexicanpharmacy.win

buy medicines online in india

https://mexicanpharmacy.win/# mexican pharmaceuticals online mexicanpharmacy.win

https://mexicanpharmacy.win/# best online pharmacies in mexico mexicanpharmacy.win

http://canadianpharmacy.pro/# canadian pharmacy no scripts canadianpharmacy.pro

indianpharmacy com

http://indianpharmacy.shop/# india pharmacy indianpharmacy.shop

order drugs online

https://indianpharmacy.shop/# buy medicines online in india indianpharmacy.shop

indian pharmacy

https://canadianpharmacy.pro/# pet meds without vet prescription canada canadianpharmacy.pro

http://indianpharmacy.shop/# п»їlegitimate online pharmacies india indianpharmacy.shop

non prescription canadian pharmacy

https://canadianpharmacy.pro/# legitimate canadian online pharmacies canadianpharmacy.pro

http://mexicanpharmacy.win/# pharmacies in mexico that ship to usa mexicanpharmacy.win

india online pharmacy

https://indianpharmacy.shop/# india pharmacy mail order indianpharmacy.shop

online pharmacy india

https://levitrasansordonnance.pro/# Pharmacie en ligne livraison rapide

Pharmacie en ligne livraison gratuite: kamagra livraison 24h – Pharmacie en ligne livraison 24h

pharmacie ouverte: Cialis sans ordonnance 24h – Pharmacie en ligne sans ordonnance

https://levitrasansordonnance.pro/# Pharmacie en ligne sans ordonnance

Viagra sans ordonnance pharmacie France: Viagra sans ordonnance 24h suisse – Le gГ©nГ©rique de Viagra

https://cialissansordonnance.shop/# Pharmacies en ligne certifiГ©es

Acheter mГ©dicaments sans ordonnance sur internet

Pharmacie en ligne sans ordonnance: Acheter Cialis – Pharmacies en ligne certifiГ©es

https://levitrasansordonnance.pro/# Pharmacie en ligne livraison 24h

http://levitrasansordonnance.pro/# Pharmacie en ligne livraison rapide

acheter medicament a l etranger sans ordonnance: cialissansordonnance.shop – acheter medicament a l etranger sans ordonnance

http://viagrasansordonnance.pro/# Viagra prix pharmacie paris

Pharmacie en ligne France

Pharmacie en ligne pas cher [url=https://pharmadoc.pro/#]Pharmacies en ligne certifiees[/url] Pharmacie en ligne livraison gratuite

https://pharmadoc.pro/# Pharmacie en ligne livraison gratuite

Sildenafil teva 100 mg sans ordonnance: Viagra homme sans ordonnance belgique – Meilleur Viagra sans ordonnance 24h

pharmacie ouverte 24/24: achat kamagra – Pharmacie en ligne France

https://clomiphene.icu/# buy clomid without rx

stromectol uk: minocycline 50 mg tabs – ivermectin 1%

where to buy zithromax in canada [url=http://azithromycin.bid/#]how to get zithromax online[/url] zithromax 500

prednisone 200 mg tablets: 20mg prednisone – prednisone uk price

http://clomiphene.icu/# can i get clomid prices

https://amoxicillin.bid/# where to buy amoxicillin

how to buy generic clomid for sale: can i buy generic clomid no prescription – where to get clomid without insurance

https://prednisonetablets.shop/# canine prednisone 5mg no prescription

2.5 mg prednisone daily: prednisone purchase canada – online prednisone

over the counter prednisone cream: prednisone online paypal – prednisone 40 mg price

amoxicillin 500mg buy online canada [url=https://amoxicillin.bid/#]medicine amoxicillin 500[/url] amoxicillin pills 500 mg

http://azithromycin.bid/# zithromax capsules australia

zithromax 500mg over the counter: buy zithromax 500mg online – generic zithromax 500mg

http://azithromycin.bid/# buy azithromycin zithromax

https://prednisonetablets.shop/# prednisone nz

where to get clomid no prescription: get clomid without rx – where to buy generic clomid without dr prescription

where buy generic clomid for sale: where to buy cheap clomid without prescription – cost of clomid without dr prescription

ivermectin 1% [url=http://ivermectin.store/#]buy stromectol online uk[/url] ivermectin 0.5%

zithromax cost uk: purchase zithromax online – zithromax 250mg

http://amoxicillin.bid/# amoxicillin 500mg cost

80 mg prednisone daily: buy prednisone online from canada – non prescription prednisone 20mg

http://clomiphene.icu/# cheap clomid online

amoxicillin 500mg pill: can you buy amoxicillin over the counter in canada – cost of amoxicillin prescription

how to buy amoxycillin: buying amoxicillin online – amoxicillin capsule 500mg price

http://ivermectin.store/# ivermectin price uk

https://canadianpharm.store/# safe online pharmacies in canada canadianpharm.store

mexican drugstore online [url=https://mexicanpharm.shop/#]Certified Pharmacy from Mexico[/url] buying prescription drugs in mexico online mexicanpharm.shop

canadian pharmacy prices: Licensed Online Pharmacy – canadian pharmacy 24 com canadianpharm.store

mexico drug stores pharmacies: pharmacies in mexico that ship to usa – п»їbest mexican online pharmacies mexicanpharm.shop

http://canadianpharm.store/# canada rx pharmacy world canadianpharm.store

top online pharmacy india: Indian pharmacy to USA – india pharmacy indianpharm.store

best online pharmacies in mexico: mexican pharmaceuticals online – purple pharmacy mexico price list mexicanpharm.shop

mexican pharmaceuticals online [url=https://mexicanpharm.shop/#]п»їbest mexican online pharmacies[/url] mexican pharmacy mexicanpharm.shop

ed drugs online from canada: Canadian International Pharmacy – canadian pharmacy 24h com safe canadianpharm.store

mexican rx online: Online Mexican pharmacy – best online pharmacies in mexico mexicanpharm.shop

canadian pharmacy meds: Certified Online Pharmacy Canada – canadian valley pharmacy canadianpharm.store

medicine in mexico pharmacies: Certified Pharmacy from Mexico – mexico drug stores pharmacies mexicanpharm.shop

http://canadianpharm.store/# buy prescription drugs from canada cheap canadianpharm.store

pharmacies in mexico that ship to usa: Certified Pharmacy from Mexico – buying prescription drugs in mexico mexicanpharm.shop

http://indianpharm.store/# indian pharmacies safe indianpharm.store

buying from online mexican pharmacy [url=https://mexicanpharm.shop/#]Certified Pharmacy from Mexico[/url] reputable mexican pharmacies online mexicanpharm.shop

mexican rx online: Online Mexican pharmacy – mexican online pharmacies prescription drugs mexicanpharm.shop

medicine in mexico pharmacies: best online pharmacies in mexico – mexican drugstore online mexicanpharm.shop

medicine in mexico pharmacies: Online Mexican pharmacy – mexican pharmaceuticals online mexicanpharm.shop

online shopping pharmacy india: international medicine delivery from india – cheapest online pharmacy india indianpharm.store

http://canadianpharm.store/# canadian pharmacies that deliver to the us canadianpharm.store

canadian pharmacy ed medications: Pharmacies in Canada that ship to the US – canadian pharmacy 365 canadianpharm.store

buying prescription drugs in mexico [url=http://mexicanpharm.shop/#]Online Mexican pharmacy[/url] mexican border pharmacies shipping to usa mexicanpharm.shop

reputable mexican pharmacies online: mexico drug stores pharmacies – mexico pharmacies prescription drugs mexicanpharm.shop

http://indianpharm.store/# india pharmacy mail order indianpharm.store

mexican online pharmacies prescription drugs: Online Mexican pharmacy – mexico drug stores pharmacies mexicanpharm.shop

canada drugstore pharmacy rx: best rated canadian pharmacy – canadian drugs canadianpharm.store

https://canadianpharm.store/# vipps canadian pharmacy canadianpharm.store

world pharmacy india: international medicine delivery from india – world pharmacy india indianpharm.store

https://canadianpharm.store/# best online canadian pharmacy canadianpharm.store

canadian family pharmacy: Licensed Online Pharmacy – northern pharmacy canada canadianpharm.store

https://canadianpharm.store/# cheapest pharmacy canada canadianpharm.store

canadian pharmacy 1 internet online drugstore: Canadian International Pharmacy – canadian pharmacies compare canadianpharm.store

https://canadianpharm.store/# canadian drug pharmacy canadianpharm.store

mexico pharmacies prescription drugs: Certified Pharmacy from Mexico – medicine in mexico pharmacies mexicanpharm.shop

https://canadadrugs.pro/# mail order prescription drugs

viagra no prescription canadian pharmacy [url=https://canadadrugs.pro/#]canadapharmacy com[/url] canadian drugs online viagra

canadian drug store viagra [url=http://canadadrugs.pro/#]verified canadian pharmacies[/url] canadian drugs online pharmacy

prescription cost comparison: discount drugs online pharmacy – top mail order pharmacies

order from canadian pharmacy: canadian pharmacies online reviews – canada drugs online pharmacy

canadian pharmacies selling viagra: canadian generic pharmacy – discount canadian pharmacy

canadian pharmacy canada: thecanadianpharmacy com – no 1 canadian pharmacy

https://canadadrugs.pro/# discount prescription drug

canada medications [url=http://canadadrugs.pro/#]canadian pharmacy order[/url] canadian pharcharmy reviews

online pharmacy mail order: prescription drugs without doctor – best canadian drug prices

https://canadadrugs.pro/# top canadian pharmacies

my canadian pharmacy viagra: most reliable online pharmacy – most reliable canadian pharmacies

prescription online: canada pharmacies online – reputable canadian pharmacy

mexican drugstore online: online ed medication no prescription – mexican pharmacies online cheap

reliable canadian pharmacy: aarp recommended canadian pharmacies – order canadian drugs

http://canadadrugs.pro/# prescription drug pricing

canada online pharmacy reviews [url=http://canadadrugs.pro/#]canadian pharmacy review[/url] the canadian pharmacy

http://canadadrugs.pro/# online pharmacies no prescription required pain medication

mexican pharmacy list: canadian pharmacies online legitimate – online pharmacy no prescription necessary

canadain pharmacy no prescription: on line pharmacy with no perscriptions – online drugstore reviews

http://canadadrugs.pro/# viagra online canadian pharmacy

https://canadadrugs.pro/# canada prescriptions online

meds canada [url=https://canadadrugs.pro/#]top online canadian pharmacies[/url] mail order pharmacies

reputable online canadian pharmacy: giant discount pharmacy – non prescription on line pharmacies

canadian mail order meds: no prior prescription needed – bestpharmacyonline.com

reputable online pharmacy: medications with no prescription – bestpharmacyonline.com

pharmacy online: discount pharmacies – prescription drugs without the prescription

cheap canadian cialis: prescription drugs online – trusted canadian pharmacy

https://canadadrugs.pro/# trusted online pharmacy

canadian online pharmacies prescription drugs [url=http://canadadrugs.pro/#]best internet pharmacies[/url] canada pharmaceutical online ordering

https://canadadrugs.pro/# most reliable online pharmacy

legal online pharmacies: best canadian pharmacy for viagra – pharmacy canada

canadian pharmacies selling cialis: canada drug prices – most reliable online pharmacy

canadian pharmacy reviews: pharmacy in canada – discount pharmacies online

real cialis without a doctor’s prescription: generic cialis without a doctor prescription – prescription drugs online without doctor

top 10 online pharmacy in india: Online medicine home delivery – top 10 pharmacies in india

http://edpill.cheap/# cure ed

buy prescription drugs without doctor [url=http://edwithoutdoctorprescription.pro/#]discount prescription drugs[/url] ed meds online without prescription or membership

cialis without doctor prescription: cheap cialis – ed prescription drugs

canadian pharmacy meds reviews: canadian pharmacy checker – best mail order pharmacy canada

indian pharmacy: top 10 pharmacies in india – best online pharmacy india

india online pharmacy: cheapest online pharmacy india – best online pharmacy india

real viagra without a doctor prescription usa [url=https://edwithoutdoctorprescription.pro/#]generic cialis without a doctor prescription[/url] п»їprescription drugs

buying prescription drugs in mexico [url=http://certifiedpharmacymexico.pro/#]medication from mexico pharmacy[/url] mexican border pharmacies shipping to usa

mexican pharmacy without prescription: prescription drugs online without doctor – how to get prescription drugs without doctor

canadian pharmacy meds [url=https://canadianinternationalpharmacy.pro/#]www canadianonlinepharmacy[/url] canadian pharmacy 24h com safe

legal to buy prescription drugs without prescription: cialis without a doctor prescription – ed meds online without prescription or membership

http://medicinefromindia.store/# india pharmacy

indian pharmacy

buy medicines online in india: top online pharmacy india – indian pharmacies safe

https://canadianinternationalpharmacy.pro/# certified canadian international pharmacy

http://medicinefromindia.store/# top 10 online pharmacy in india

world pharmacy india [url=https://medicinefromindia.store/#]mail order pharmacy india[/url] Online medicine order

https://mexicanph.shop/# pharmacies in mexico that ship to usa

pharmacies in mexico that ship to usa [url=https://mexicanph.com/#]mexican drugstore online[/url] mexico drug stores pharmacies

mexican online pharmacies prescription drugs mexican rx online mexico pharmacies prescription drugs

http://mexicanph.shop/# mexican pharmaceuticals online

buying prescription drugs in mexico

medication from mexico pharmacy mexico drug stores pharmacies mexico drug stores pharmacies

mexico pharmacy [url=https://mexicanph.com/#]medication from mexico pharmacy[/url] pharmacies in mexico that ship to usa

mexican pharmaceuticals online mexican rx online mexican rx online

buying prescription drugs in mexico online pharmacies in mexico that ship to usa mexican border pharmacies shipping to usa

http://mexicanph.shop/# mexican mail order pharmacies

buying prescription drugs in mexico online

best online pharmacies in mexico [url=http://mexicanph.shop/#]mexican rx online[/url] mexico pharmacy

п»їbest mexican online pharmacies [url=https://mexicanph.shop/#]reputable mexican pharmacies online[/url] mexican rx online

mexico pharmacies prescription drugs [url=http://mexicanph.shop/#]п»їbest mexican online pharmacies[/url] medication from mexico pharmacy

buying prescription drugs in mexico online reputable mexican pharmacies online mexican drugstore online

mexican pharmaceuticals online [url=http://mexicanph.shop/#]mexican border pharmacies shipping to usa[/url] best online pharmacies in mexico

mexican pharmacy best online pharmacies in mexico mexican rx online

http://mexicanph.com/# mexico drug stores pharmacies

pharmacies in mexico that ship to usa [url=https://mexicanph.shop/#]п»їbest mexican online pharmacies[/url] п»їbest mexican online pharmacies

purple pharmacy mexico price list [url=http://mexicanph.shop/#]п»їbest mexican online pharmacies[/url] mexico drug stores pharmacies

http://mexicanph.com/# buying from online mexican pharmacy

reputable mexican pharmacies online

п»їbest mexican online pharmacies [url=https://mexicanph.com/#]mexico pharmacy[/url] mexican online pharmacies prescription drugs

best online pharmacies in mexico mexican pharmaceuticals online buying prescription drugs in mexico online

mexico pharmacies prescription drugs [url=https://mexicanph.com/#]mexican mail order pharmacies[/url] mexican border pharmacies shipping to usa

pharmacies in mexico that ship to usa п»їbest mexican online pharmacies mexico drug stores pharmacies

mexico pharmacies prescription drugs [url=http://mexicanph.com/#]mexican online pharmacies prescription drugs[/url] medicine in mexico pharmacies

buying prescription drugs in mexico medication from mexico pharmacy mexican border pharmacies shipping to usa

medicine in mexico pharmacies mexico drug stores pharmacies п»їbest mexican online pharmacies

https://mexicanph.com/# medication from mexico pharmacy

reputable mexican pharmacies online

п»їbest mexican online pharmacies [url=http://mexicanph.com/#]п»їbest mexican online pharmacies[/url] best online pharmacies in mexico

buying from online mexican pharmacy mexico pharmacies prescription drugs best mexican online pharmacies

purple pharmacy mexico price list buying prescription drugs in mexico online mexican pharmacy

buying from online mexican pharmacy mexican border pharmacies shipping to usa mexico pharmacy

buying from online mexican pharmacy mexican pharmacy medication from mexico pharmacy

mexican mail order pharmacies medication from mexico pharmacy reputable mexican pharmacies online

https://mexicanph.shop/# reputable mexican pharmacies online

reputable mexican pharmacies online [url=https://mexicanph.com/#]mexican online pharmacies prescription drugs[/url] best online pharmacies in mexico

medicine in mexico pharmacies mexican mail order pharmacies pharmacies in mexico that ship to usa

purple pharmacy mexico price list [url=http://mexicanph.shop/#]mexico pharmacies prescription drugs[/url] best online pharmacies in mexico

buying prescription drugs in mexico mexican drugstore online п»їbest mexican online pharmacies

mexican pharmacy buying prescription drugs in mexico online п»їbest mexican online pharmacies

https://mexicanph.com/# reputable mexican pharmacies online

medication from mexico pharmacy

mexican pharmacy [url=https://mexicanph.com/#]pharmacies in mexico that ship to usa[/url] mexican mail order pharmacies

mexico drug stores pharmacies buying prescription drugs in mexico online mexican mail order pharmacies

mexican mail order pharmacies [url=https://mexicanph.shop/#]mexican pharmacy[/url] mexico drug stores pharmacies

mexico drug stores pharmacies mexican border pharmacies shipping to usa mexico pharmacy

buying prescription drugs in mexico online mexican border pharmacies shipping to usa mexico pharmacy

https://mexicanph.com/# medicine in mexico pharmacies

purple pharmacy mexico price list [url=http://mexicanph.com/#]pharmacies in mexico that ship to usa[/url] mexican rx online

mexican mail order pharmacies [url=http://mexicanph.com/#]medicine in mexico pharmacies[/url] mexico drug stores pharmacies

buying prescription drugs in mexico medication from mexico pharmacy mexican drugstore online

medicine in mexico pharmacies purple pharmacy mexico price list п»їbest mexican online pharmacies

mexican drugstore online mexican border pharmacies shipping to usa mexican rx online

mexico drug stores pharmacies medication from mexico pharmacy mexico drug stores pharmacies

mexican pharmacy [url=http://mexicanph.com/#]mexican mail order pharmacies[/url] medicine in mexico pharmacies

best online pharmacies in mexico mexican pharmacy buying from online mexican pharmacy

buying prescription drugs in mexico online mexican pharmaceuticals online mexican drugstore online

https://mexicanph.shop/# pharmacies in mexico that ship to usa

mexican mail order pharmacies [url=https://mexicanph.shop/#]mexican rx online[/url] mexico pharmacies prescription drugs

purple pharmacy mexico price list mexican pharmacy mexican border pharmacies shipping to usa

buying from online mexican pharmacy [url=https://mexicanph.com/#]mexico drug stores pharmacies[/url] buying from online mexican pharmacy

п»їbest mexican online pharmacies mexico drug stores pharmacies mexican rx online

https://mexicanph.com/# п»їbest mexican online pharmacies

reputable mexican pharmacies online

medication from mexico pharmacy mexican border pharmacies shipping to usa buying from online mexican pharmacy

mexican pharmacy reputable mexican pharmacies online buying prescription drugs in mexico online

mexico pharmacies prescription drugs mexican pharmacy mexican border pharmacies shipping to usa

mexican pharmacy [url=https://mexicanph.com/#]buying from online mexican pharmacy[/url] mexico drug stores pharmacies

mexican online pharmacies prescription drugs mexican pharmacy medicine in mexico pharmacies

buying prescription drugs in mexico mexican rx online mexico drug stores pharmacies

mexico pharmacy mexican drugstore online mexico drug stores pharmacies

reputable mexican pharmacies online mexico drug stores pharmacies mexican border pharmacies shipping to usa

https://buyprednisone.store/# prednisone otc uk

prednisone purchase canada [url=https://buyprednisone.store/#]prednisone 50 mg tablet canada[/url] prednisone cream rx

lisinopril tablets: lisinopril 10mg price in india – lisinopril 10 mg price

http://buyprednisone.store/# prednisone 54

http://furosemide.guru/# lasix furosemide 40 mg

where to buy amoxicillin over the counter: where can i buy amoxicillin over the counter – amoxicillin 825 mg

https://amoxil.cheap/# buy amoxicillin without prescription

furosemide 100mg [url=http://furosemide.guru/#]Buy Lasix No Prescription[/url] lasix furosemide

amoxicillin without a prescription: amoxicillin over the counter in canada – where can i buy amoxocillin

http://furosemide.guru/# furosemide 100mg

buy lasix online [url=http://furosemide.guru/#]Buy Furosemide[/url] lasix generic

https://stromectol.fun/# cheap stromectol

ivermectin cream 1%: ivermectin 15 mg – generic ivermectin for humans

lasix 40mg: Buy Lasix – lasix for sale

http://amoxil.cheap/# buy amoxicillin 500mg capsules uk

amoxicillin over the counter in canada [url=http://amoxil.cheap/#]amoxicillin medicine[/url] where to buy amoxicillin pharmacy

https://amoxil.cheap/# can you buy amoxicillin over the counter canada

40 mg lisinopril for sale: order lisinopril online us – generic zestril

http://amoxil.cheap/# amoxicillin generic

prednisone purchase online [url=https://buyprednisone.store/#]prednisone brand name us[/url] 1 mg prednisone cost

https://furosemide.guru/# lasix

https://furosemide.guru/# lasix dosage

can i buy amoxicillin over the counter in australia [url=http://amoxil.cheap/#]amoxicillin generic[/url] over the counter amoxicillin

ivermectin brand name: stromectol tablets for humans – ivermectin cream uk

http://stromectol.fun/# ivermectin lice

lasix 100 mg: Buy Furosemide – furosemide 100 mg

ivermectin 4 [url=http://stromectol.fun/#]stromectol otc[/url] ivermectin 0.1

https://buyprednisone.store/# prednisone tablets india

prednisone 5 mg tablet price: prednisone pharmacy prices – prednisone 20 mg purchase

http://stromectol.fun/# ivermectin nz

lasix for sale: Buy Lasix – lasix generic

https://lisinopril.top/# lisinopril 2.5 mg for sale

lasix medication [url=https://furosemide.guru/#]Buy Furosemide[/url] lasix 40 mg

prednisone 10mg tablet cost: 54 prednisone – prednisone 40mg

https://stromectol.fun/# stromectol online

lisinopril online prescription: lisinopril price in india – lisinopril pill

http://buyprednisone.store/# prednisone brand name in usa

furosemida 40 mg: lasix for sale – generic lasix

amoxicillin 500 capsule [url=http://amoxil.cheap/#]generic amoxicillin[/url] amoxicillin 825 mg

http://stromectol.fun/# stromectol 3mg tablets

ivermectin oral: stromectol price uk – ivermectin 5 mg

lisinopril 10mg tabs: lisinopril 40 mg tablet – lisinopril 40 mg for sale

http://lisinopril.top/# lisinopril 40 mg coupon

https://lisinopril.top/# lisinopril 10mg daily

lisinopril 1.25 mg: lisinopril 40 mg canada – prinivil 10 mg tablet

https://amoxil.cheap/# price for amoxicillin 875 mg

http://lisinopril.top/# lisinopril 12.5 20 g

furosemide 40 mg [url=https://furosemide.guru/#]Over The Counter Lasix[/url] lasix 100 mg tablet

furosemida 40 mg: Buy Lasix – furosemida

ivermectin 3 mg [url=https://stromectol.fun/#]ivermectin lotion price[/url] stromectol 12mg

lisinopril average cost: lisinopril 10 mg without prescription – lisinopril 10 mg price in india

https://amoxil.cheap/# how to get amoxicillin over the counter

ivermectin lotion 0.5: ivermectin where to buy – ivermectin malaria

http://furosemide.guru/# lasix tablet

iv prednisone [url=http://buyprednisone.store/#]prednisone prescription for sale[/url] prednisone 10mg buy online

lisinopril 5 mg tablet price in india: lisinopril 5mg prices – lisinopril 120 mg

http://lisinopril.top/# lisinopril 420 1g

prednisone without a prescription: prednisone 15 mg tablet – prednisone canada prices

http://amoxil.cheap/# buying amoxicillin in mexico

lasix pills: Buy Lasix – furosemide 40mg

http://stromectol.fun/# ivermectin 200

buy generic prednisone online: order prednisone on line – prednisone online pharmacy

https://stromectol.fun/# buy ivermectin for humans australia

generic for amoxicillin [url=https://amoxil.cheap/#]medicine amoxicillin 500[/url] price for amoxicillin 875 mg

prednisone 10 mg canada: 1 mg prednisone daily – where to buy prednisone without prescription

http://furosemide.guru/# lasix side effects

https://amoxil.cheap/# where to buy amoxicillin

amoxicillin 1000 mg capsule: amoxicillin order online – amoxil generic

lasix pills: Buy Furosemide – lasix tablet

http://stromectol.fun/# ivermectin 4

lisinopril price 10 mg [url=https://lisinopril.top/#]lisinopril 30[/url] 100 mg lisinopril

https://furosemide.guru/# generic lasix

amoxicillin online purchase [url=http://amoxil.cheap/#]can you buy amoxicillin uk[/url] amoxicillin 875 125 mg tab

amoxicillin 500mg buy online uk: amoxicillin discount – antibiotic amoxicillin

http://buyprednisone.store/# cost of prednisone 5mg tablets

amoxicillin script [url=http://amoxil.cheap/#]where can i buy amoxicillin over the counter uk[/url] amoxicillin order online

ivermectin india: stromectol lotion – stromectol tablet 3 mg

https://stromectol.fun/# stromectol tab

http://stromectol.fun/# stromectol nz

http://furosemide.guru/# lasix for sale

lasix 100 mg tablet: Buy Lasix No Prescription – lasix 100 mg

buy ivermectin stromectol: stromectol brand – ivermectin tablet price

prednisone uk [url=https://buyprednisone.store/#]generic prednisone for sale[/url] prednisone 50 mg price

http://amoxil.cheap/# buy amoxicillin online without prescription

price of stromectol [url=https://stromectol.fun/#]can you buy stromectol over the counter[/url] minocycline generic name

ivermectin 15 mg: ivermectin 5 mg – stromectol order online

ivermectin 1mg: stromectol price usa – ivermectin pills

lisinopril online without a prescription: lisinopril 10 mg for sale without prescription – lisinopril tablet 40 mg

lisinopril 40 mg no prescription [url=http://lisinopril.top/#]lisinopril 40 mg best price[/url] lisinopril 10 mg tablets price

indian pharmacies safe top online pharmacy india top 10 pharmacies in india

п»їlegitimate online pharmacies india [url=http://indianph.xyz/#]top 10 pharmacies in india[/url] cheapest online pharmacy india

top online pharmacy india indian pharmacies safe Online medicine order

https://indianph.xyz/# india online pharmacy

cheapest online pharmacy india [url=https://indianph.com/#]top 10 pharmacies in india[/url] mail order pharmacy india

https://indianph.com/# legitimate online pharmacies india

india pharmacy mail order

http://indianph.com/# Online medicine order

indian pharmacies safe

indian pharmacy online indian pharmacy best india pharmacy

http://indianph.com/# indianpharmacy com

cheapest online pharmacy india

buy prescription drugs from india [url=http://indianph.xyz/#]Online medicine home delivery[/url] buy medicines online in india

http://indianph.xyz/# indianpharmacy com

reputable indian online pharmacy

https://indianph.com/# india online pharmacy

indian pharmacies safe [url=https://indianph.com/#]indianpharmacy com[/url] cheapest online pharmacy india

diflucan tabs: diflucan buy – diflucan 150 mg

cipro [url=http://cipro.guru/#]cipro online no prescription in the usa[/url] buy cipro online

http://diflucan.pro/# buy diflucan 150mg

buy cheap doxycycline online: doxycycline mono – doxycycline generic

tamoxifen dose [url=http://nolvadex.guru/#]nolvadex gynecomastia[/url] where to get nolvadex

http://cytotec24.shop/# cytotec online

doxycycline 50mg: doxycycline hyclate – 200 mg doxycycline

tamoxifen hair loss [url=https://nolvadex.guru/#]tamoxifen moa[/url] who should take tamoxifen

buy cipro online: ciprofloxacin generic – ciprofloxacin over the counter

ciprofloxacin 500 mg tablet price [url=https://cipro.guru/#]ciprofloxacin mail online[/url] cipro online no prescription in the usa

https://nolvadex.guru/# tamoxifen vs raloxifene

doxycycline hyclate 100 mg cap: doxycycline generic – buy doxycycline without prescription uk

http://cytotec24.com/# Abortion pills online

where to purchase doxycycline [url=https://doxycycline.auction/#]doxycycline online[/url] buy doxycycline without prescription uk

https://cytotec24.shop/# buy cytotec over the counter

http://cipro.guru/# buy cipro cheap

where to buy diflucan pills [url=http://diflucan.pro/#]diflucan 200 mg cost[/url] where to buy diflucan

http://cipro.guru/# ciprofloxacin mail online

tamoxifen effectiveness [url=http://nolvadex.guru/#]tamoxifen[/url] nolvadex during cycle

buy doxycycline online [url=http://doxycycline.auction/#]buy doxycycline[/url] doxycycline vibramycin

eva elfie filmleri: eva elfie – eva elfie izle

http://lanarhoades.fun/# lana rhoades filmleri

https://angelawhite.pro/# Angela White video

Angela White filmleri [url=http://angelawhite.pro/#]Angela White video[/url] Angela White

http://sweetiefox.online/# sweety fox

https://abelladanger.online/# Abella Danger

Angela White filmleri: Angela White filmleri – ?????? ????

https://abelladanger.online/# abella danger video

eva elfie video: eva elfie izle – eva elfie filmleri

https://angelawhite.pro/# Angela White

lana rhoades izle [url=https://lanarhoades.fun/#]lana rhodes[/url] lana rhoades modeli

https://abelladanger.online/# abella danger filmleri

https://lanarhoades.fun/# lana rhodes

Angela White izle: abella danger video – abella danger izle

https://lanarhoades.fun/# lana rhoades filmleri

http://evaelfie.pro/# eva elfie filmleri

sweeti fox [url=https://sweetiefox.online/#]Sweetie Fox modeli[/url] Sweetie Fox

https://sweetiefox.online/# Sweetie Fox filmleri

Sweetie Fox video: Sweetie Fox filmleri – sweeti fox

https://abelladanger.online/# abella danger filmleri

Angela White [url=https://angelawhite.pro/#]Angela White video[/url] Angela White

https://lanarhoades.fun/# lana rhoades izle

https://evaelfie.pro/# eva elfie izle

Angela White izle: Abella Danger – abella danger video

http://angelawhite.pro/# Angela White

http://sweetiefox.online/# Sweetie Fox modeli

https://evaelfie.pro/# eva elfie

sweeti fox [url=https://sweetiefox.online/#]Sweetie Fox filmleri[/url] sweety fox

https://abelladanger.online/# Abella Danger

?????? ????: Abella Danger – abella danger filmleri

http://lanarhoades.fun/# lana rhoades izle

http://angelawhite.pro/# Angela White

Sweetie Fox: swetie fox – Sweetie Fox filmleri

https://abelladanger.online/# abella danger filmleri

https://evaelfie.pro/# eva elfie izle

Angela White izle [url=http://angelawhite.pro/#]?????? ????[/url] Angela White video

http://sweetiefox.online/# Sweetie Fox filmleri

Sweetie Fox: Sweetie Fox modeli – swetie fox

https://abelladanger.online/# abella danger filmleri

http://sweetiefox.online/# Sweetie Fox video

eva elfie modeli: eva elfie filmleri – eva elfie izle

https://abelladanger.online/# abella danger video

Angela White izle [url=https://angelawhite.pro/#]Angela White[/url] Angela Beyaz modeli

http://abelladanger.online/# abella danger video

https://sweetiefox.online/# Sweetie Fox video

lana rhoades filmleri: lana rhoades izle – lana rhoades

http://abelladanger.online/# abella danger filmleri

https://sweetiefox.online/# Sweetie Fox filmleri

http://evaelfie.pro/# eva elfie modeli

http://sweetiefox.online/# Sweetie Fox

Abella Danger [url=http://abelladanger.online/#]abella danger izle[/url] abella danger filmleri

http://abelladanger.online/# abella danger izle

http://angelawhite.pro/# Angela White

https://evaelfie.pro/# eva elfie izle

http://lanarhoades.fun/# lana rhoades filmleri

abella danger filmleri [url=http://abelladanger.online/#]abella danger izle[/url] Abella Danger

Angela White video: abella danger filmleri – abella danger izle

http://abelladanger.online/# Abella Danger

https://abelladanger.online/# abella danger video

https://sweetiefox.online/# Sweetie Fox filmleri

https://lanarhoades.pro/# lana rhoades solo

fox sweetie: sweetie fox full video – sweetie fox cosplay

skip the games dating site free: http://lanarhoades.pro/# lana rhoades boyfriend

lana rhoades unleashed: lana rhoades – lana rhoades pics

eva elfie hot: eva elfie full video – eva elfie photo

https://miamalkova.life/# mia malkova

mia malkova movie: mia malkova – mia malkova

mia malkova full video: mia malkova new video – mia malkova girl

https://miamalkova.life/# mia malkova

mia malkova movie: mia malkova girl – mia malkova only fans

https://evaelfie.site/# eva elfie hd

sweetie fox new: sweetie fox cosplay – sweetie fox cosplay

eva elfie: eva elfie full videos – eva elfie hd

totally free dating service: http://sweetiefox.pro/# sweetie fox cosplay

https://lanarhoades.pro/# lana rhoades

mia malkova hd: mia malkova latest – mia malkova movie

sweetie fox new: ph sweetie fox – sweetie fox cosplay

http://miamalkova.life/# mia malkova girl

eva elfie hd: eva elfie – eva elfie new video

online dating plus 50: http://lanarhoades.pro/# lana rhoades full video

sweetie fox cosplay: sweetie fox – sweetie fox full video

http://sweetiefox.pro/# sweetie fox cosplay

eva elfie full videos: eva elfie videos – eva elfie new videos

our time dating service: http://miamalkova.life/# mia malkova movie

https://evaelfie.site/# eva elfie videos

mia malkova movie: mia malkova videos – mia malkova

http://evaelfie.site/# eva elfie

lana rhoades full video: lana rhoades videos – lana rhoades videos

sites online dating: http://lanarhoades.pro/# lana rhoades hot

http://lanarhoades.pro/# lana rhoades hot

lana rhoades pics: lana rhoades boyfriend – lana rhoades solo

lana rhoades full video: lana rhoades hot – lana rhoades solo

http://evaelfie.site/# eva elfie new video

http://aviatormalawi.online/# aviator

aviator oyunu: pin up aviator – aviator hilesi

http://aviatorghana.pro/# play aviator

aviator mz [url=http://aviatormocambique.site/#]jogar aviator[/url] como jogar aviator em mocambique

https://aviatorjogar.online/# aviator betano

http://pinupcassino.pro/# pin-up casino

jogo de aposta: jogo de aposta – site de apostas

https://jogodeaposta.fun/# melhor jogo de aposta

https://aviatorghana.pro/# aviator bet

pin up aviator [url=http://aviatoroyunu.pro/#]aviator sinyal hilesi[/url] aviator oyna

melhor jogo de aposta: jogo de aposta online – ganhar dinheiro jogando

https://aviatorjogar.online/# aviator bet

pin up bet: pin-up – pin-up cassino

aviator: aviator mocambique – aviator

https://aviatoroyunu.pro/# aviator

http://jogodeaposta.fun/# site de apostas

aviator: aviator oyna – aviator

http://aviatorjogar.online/# aviator game

aviator mz [url=https://aviatormocambique.site/#]aviator[/url] aviator mocambique

http://aviatoroyunu.pro/# aviator oyunu

aviator oyunu: aviator oyna slot – aviator sinyal hilesi

http://jogodeaposta.fun/# jogo de aposta

aviator bet malawi login: aviator game – aviator malawi

pin-up casino login: pin up aviator – pin-up casino entrar

aviator sportybet ghana: aviator login – aviator bet

jogar aviator Brasil: jogar aviator Brasil – aviator betano

aviator: aviator – aviator oyunu

jogo de aposta online: jogo de aposta – jogo de aposta

melhor jogo de aposta: jogo de aposta – site de apostas

aviator mz: aviator bet – aviator bet

aviator bet: aviator bet malawi login – aviator bet malawi login

zithromax tablets for sale – https://azithromycin.pro/zithromax-warnings.html zithromax cost canada

aviator oyna: aviator oyunu – aviator oyna slot

aviator oyunu: pin up aviator – aviator

zithromax 250 mg – https://azithromycin.pro/pfizer-zithromax.html zithromax for sale online

aviator sinyal hilesi: aviator oyna – aviator hilesi

pin-up: pin-up casino – pin-up casino entrar

http://aviatormocambique.site/# aviator online

como jogar aviator em moçambique: aviator online – como jogar aviator em moçambique

medication from mexico pharmacy [url=https://mexicanpharm24.com/#]mexican pharmacy[/url] mexico pharmacies prescription drugs mexicanpharm.shop

cheapest online pharmacy india: Online India pharmacy – top 10 online pharmacy in india indianpharm.store

top 10 online pharmacy in india: Top online pharmacy in India – Online medicine home delivery indianpharm.store

indian pharmacies safe: top online pharmacy india – Online medicine home delivery indianpharm.store

canadian pharmacy 24 com [url=https://canadianpharmlk.com/#]Cheapest drug prices Canada[/url] canada rx pharmacy canadianpharm.store

http://mexicanpharm24.shop/# buying prescription drugs in mexico online mexicanpharm.shop

https://mexicanpharm24.com/# mexican border pharmacies shipping to usa mexicanpharm.shop

https://indianpharm24.shop/# indian pharmacy indianpharm.store

Online medicine order [url=https://indianpharm24.com/#]Pharmacies in India that ship to USA[/url] indian pharmacy paypal indianpharm.store

top 10 online pharmacy in india: cheapest online pharmacy – india pharmacy indianpharm.store

http://canadianpharmlk.shop/# legit canadian online pharmacy canadianpharm.store

http://indianpharm24.com/# buy prescription drugs from india indianpharm.store

http://canadianpharmlk.shop/# best canadian pharmacy to buy from canadianpharm.store

mexico drug stores pharmacies: mexican mail order pharmacies – mexican border pharmacies shipping to usa mexicanpharm.shop

https://indianpharm24.com/# indian pharmacy indianpharm.store

top online pharmacy india: Online medicine home delivery – Online medicine home delivery indianpharm.store

certified canadian international pharmacy: Certified Canadian pharmacies – legit canadian pharmacy canadianpharm.store

mexico pharmacies prescription drugs [url=https://mexicanpharm24.com/#]buying prescription drugs in mexico[/url] mexican drugstore online mexicanpharm.shop

https://indianpharm24.com/# mail order pharmacy india indianpharm.store

https://indianpharm24.com/# Online medicine home delivery indianpharm.store

northwest canadian pharmacy: Pharmacies in Canada that ship to the US – my canadian pharmacy reviews canadianpharm.store

http://canadianpharmlk.shop/# reputable canadian pharmacy canadianpharm.store

http://indianpharm24.shop/# india pharmacy indianpharm.store

https://mexicanpharm24.shop/# buying from online mexican pharmacy mexicanpharm.shop

http://mexicanpharm24.com/# best mexican online pharmacies mexicanpharm.shop

http://indianpharm24.com/# indian pharmacy paypal indianpharm.store

canadian pharmacy ratings: canadian pharmacy – canadian medications canadianpharm.store

indianpharmacy com: online pharmacy usa – indianpharmacy com indianpharm.store

buy amoxicillin: amoxicillin capsules 250mg – amoxicillin 500 mg tablet

https://clomidst.pro/# cost cheap clomid pills

where buy clomid online: how to buy clomid online – where to buy generic clomid without a prescription

buy cheap clomid without dr prescription: cost of cheap clomid without a prescription – can you get cheap clomid online

prednisone for sale: prednisone used for inflammation – 10mg prednisone daily

http://clomidst.pro/# order cheap clomid without a prescription

where to get cheap clomid price: clomid for testosterone – order generic clomid pills

amoxicillin 500mg without prescription: can you buy amoxicillin over the counter canada – buy cheap amoxicillin online

https://clomidst.pro/# can i buy clomid without a prescription

order amoxicillin uk: amoxicillin-clavulanate – buying amoxicillin in mexico

get clomid without rx: clomid for women side effects – can i purchase generic clomid prices

prednisone 5mg capsules: buy prednisone 40 mg – 10 mg prednisone

amoxicillin brand name: amoxil suspension – amoxicillin 200 mg tablet

http://prednisonest.pro/# where to get prednisone

can i order prednisone [url=http://prednisonest.pro/#]prednisone for sale online[/url] 2.5 mg prednisone daily

online order prednisone: prednisone 2 mg daily – prednisone 60 mg tablet

online prednisone: price of prednisone 5mg – prednisone pills cost

https://prednisonest.pro/# prednisone price canada

can i get clomid without insurance: clomid 50 mg – cost of clomid without dr prescription

where buy clomid without a prescription: clomid success rate – get cheap clomid without dr prescription

how can i get cheap clomid without dr prescription: does clomid help erectile dysfunction – can you get generic clomid online

http://clomidst.pro/# how to buy clomid

amoxicillin 500 mg where to buy: amoxicillin 500mg price – amoxicillin 500mg price

buy amoxicillin: amoxicillin over the counter – amoxicillin 500 mg tablets

how to buy cheap clomid without prescription [url=http://clomidst.pro/#]where buy cheap clomid without prescription[/url] can i purchase clomid now

https://amoxilst.pro/# buy amoxicillin online mexico

canadian pharmacy coupon: online pharmacy delivery – cheapest pharmacy to fill prescriptions with insurance

http://onlinepharmacy.cheap/# canadian pharmacy without prescription

canadian pharmacy coupon code: canada pharmacy online – canadian pharmacy without prescription

online pharmacy discount code: Online pharmacy USA – cheap pharmacy no prescription

how to buy prescriptions from canada safely [url=https://pharmnoprescription.pro/#]canadian pharmacy online no prescription needed[/url] can you buy prescription drugs in canada

cheapest pharmacy for prescriptions: online pharmacy delivery – legal online pharmacy coupon code

https://edpills.guru/# where can i buy erectile dysfunction pills

no prescription needed pharmacy: best online pharmacy – canadian pharmacy no prescription needed

no prescription medicines: canadian pharmacy prescription – canadian prescription prices

ed med online: boner pills online – edmeds

https://onlinepharmacy.cheap/# canadian pharmacies not requiring prescription

overseas online pharmacy-no prescription: prescription drugs canada – canadian prescription prices

pharmacy no prescription required: pharmacy online – legal online pharmacy coupon code

erectile dysfunction medication online: cheap boner pills – cheapest ed pills

http://onlinepharmacy.cheap/# non prescription medicine pharmacy

erectile dysfunction meds online [url=http://edpills.guru/#]best online ed medication[/url] cheap ed drugs

erectile dysfunction medications online: cheap erection pills – ed medications cost

https://onlinepharmacy.cheap/# canadian pharmacy world coupon code

discount prescription drugs canada: canadian pharmacy without prescription – canadian and international prescription service

erection pills online: order ed pills – ed doctor online

https://onlinepharmacy.cheap/# reputable online pharmacy no prescription

mexican online pharmacies prescription drugs: purple pharmacy mexico price list – mexico drug stores pharmacies

http://canadianpharm.guru/# canadian pharmacy

http://indianpharm.shop/# online shopping pharmacy india

canadianpharmacyworld com: pet meds without vet prescription canada – 77 canadian pharmacy

canadian drugs no prescription [url=http://pharmacynoprescription.pro/#]canadian rx prescription drugstore[/url] no prescription needed online pharmacy

п»їlegitimate online pharmacies india: cheapest online pharmacy india – world pharmacy india

https://indianpharm.shop/# buy prescription drugs from india

indian pharmacy paypal: top 10 online pharmacy in india – world pharmacy india

http://mexicanpharm.online/# mexican pharmacy

legitimate online pharmacies india: world pharmacy india – cheapest online pharmacy india

buy medicines online in india: indian pharmacy paypal – indian pharmacy online

india pharmacy mail order [url=https://indianpharm.shop/#]world pharmacy india[/url] india pharmacy

http://mexicanpharm.online/# mexican drugstore online

world pharmacy india: online shopping pharmacy india – india online pharmacy

online medication no prescription: prescription drugs online canada – buy medications without a prescription

certified canadian pharmacy: canadian pharmacy sarasota – best online canadian pharmacy

http://canadianpharm.guru/# canadian pharmacy com

http://canadianpharm.guru/# best canadian pharmacy

Online medicine order: indianpharmacy com – reputable indian pharmacies

https://mexicanpharm.online/# mexican pharmacy

п»їbest mexican online pharmacies: mexican rx online – buying from online mexican pharmacy

online shopping pharmacy india [url=http://indianpharm.shop/#]mail order pharmacy india[/url] Online medicine home delivery

buy medicines online in india: online pharmacy india – india pharmacy

https://canadianpharm.guru/# canadian pharmacy review

mexico pharmacy: mexican mail order pharmacies – medicine in mexico pharmacies

best india pharmacy: indian pharmacies safe – Online medicine home delivery

mexican pharmaceuticals online: mexico pharmacy – mexico drug stores pharmacies

https://mexicanpharm.online/# mexico drug stores pharmacies

http://canadianpharm.guru/# buy prescription drugs from canada cheap

medications online without prescriptions: no prescription medicines – best non prescription online pharmacy

legitimate canadian pharmacy online: canada drugs online review – canada drugs reviews

https://indianpharm.shop/# pharmacy website india

mexican rx online [url=https://mexicanpharm.online/#]reputable mexican pharmacies online[/url] mexican mail order pharmacies

mexican mail order pharmacies: buying prescription drugs in mexico – reputable mexican pharmacies online

canadian drug stores: reliable canadian pharmacy – canadian pharmacy checker

http://canadianpharm.guru/# my canadian pharmacy reviews

maple leaf pharmacy in canada: canadian pharmacy online – safe reliable canadian pharmacy

http://mexicanpharm.online/# medicine in mexico pharmacies

http://mexicanpharm.online/# buying from online mexican pharmacy

canadian and international prescription service: no prescription needed online pharmacy – no prescription needed

online pharmacy reviews no prescription: canadian pharmacy no prescription – buying drugs without prescription

best online pharmacies in mexico [url=https://mexicanpharm.online/#]п»їbest mexican online pharmacies[/url] mexican drugstore online

http://mexicanpharm.online/# buying from online mexican pharmacy

best india pharmacy: Online medicine home delivery – best india pharmacy

online shopping pharmacy india: reputable indian online pharmacy – online shopping pharmacy india

http://pharmacynoprescription.pro/# prescription meds from canada

legitimate canadian pharmacies: canadian drug prices – legitimate canadian pharmacy online

http://indianpharm.shop/# mail order pharmacy india

indian pharmacy: buy medicines online in india – online pharmacy india

http://pharmacynoprescription.pro/# canada pharmacies online prescriptions

cheapest online pharmacy india: buy medicines online in india – Online medicine home delivery

best india pharmacy [url=https://indianpharm.shop/#]п»їlegitimate online pharmacies india[/url] indian pharmacy paypal

canadianpharmacy com: best canadian pharmacy online – northern pharmacy canada

buying prescription drugs in mexico: mexican rx online – medicine in mexico pharmacies

https://indianpharm.shop/# best online pharmacy india

is canadian pharmacy legit: canada pharmacy reviews – canadian mail order pharmacy

https://slotsiteleri.guru/# slot bahis siteleri

pragmatic play sweet bonanza [url=https://sweetbonanza.bid/#]sweet bonanza demo[/url] sweet bonanza yasal site

http://slotsiteleri.guru/# en guvenilir slot siteleri

canl? slot siteleri: canl? slot siteleri – en guvenilir slot siteleri

http://slotsiteleri.guru/# yasal slot siteleri

https://gatesofolympus.auction/# gates of olympus demo

https://aviatoroyna.bid/# aviator casino oyunu

gates of olympus demo oyna [url=https://gatesofolympus.auction/#]gates of olympus taktik[/url] gates of olympus nas?l para kazanilir

sweet bonanza 100 tl: slot oyunlari – sweet bonanza 100 tl

http://aviatoroyna.bid/# aviator oyunu 100 tl

https://sweetbonanza.bid/# sweet bonanza yorumlar

https://sweetbonanza.bid/# sweet bonanza giris

pin up casino guncel giris [url=https://pinupgiris.fun/#]pin up casino giris[/url] aviator pin up

slot siteleri: deneme veren slot siteleri – slot kumar siteleri

http://gatesofolympus.auction/# gates of olympus max win

https://aviatoroyna.bid/# aviator hile

pragmatic play sweet bonanza: pragmatic play sweet bonanza – slot oyunlari

http://slotsiteleri.guru/# slot oyun siteleri

yeni slot siteleri: en iyi slot siteleri – slot oyunlar? siteleri

http://gatesofolympus.auction/# gates of olympus taktik

pin up giris: pin-up bonanza – aviator pin up

https://aviatoroyna.bid/# aviator oyunu 100 tl

http://gatesofolympus.auction/# gates of olympus nasil para kazanilir

http://sweetbonanza.bid/# sweet bonanza demo turkce

aviator nas?l oynan?r [url=https://aviatoroyna.bid/#]aviator oyunu 10 tl[/url] aviator oyunu 50 tl

bonus veren casino slot siteleri: slot siteleri 2024 – bonus veren slot siteleri

https://pinupgiris.fun/# pin up indir

slot siteleri bonus veren [url=https://slotsiteleri.guru/#]slot oyunlar? siteleri[/url] en cok kazandiran slot siteleri

gates of olympus: gates of olympus oyna – gates of olympus s?rlar?

sweet bonanza bahis: sweet bonanza kazanc – sweet bonanza guncel

http://sweetbonanza.bid/# sweet bonanza oyna

pin up aviator: pin-up online – pin-up casino indir

https://sweetbonanza.bid/# sweet bonanza 100 tl

slot casino siteleri [url=https://slotsiteleri.guru/#]slot siteleri guvenilir[/url] guvenilir slot siteleri

https://sweetbonanza.bid/# sweet bonanza slot

http://aviatoroyna.bid/# aviator oyunu 20 tl

pin up [url=http://pinupgiris.fun/#]pin-up online[/url] pin up indir

gates of olympus giris: gates of olympus 1000 demo – pragmatic play gates of olympus

https://pinupgiris.fun/# pin up casino indir

http://aviatoroyna.bid/# aviator

slot siteleri [url=http://slotsiteleri.guru/#]guvenilir slot siteleri[/url] bonus veren slot siteleri

gates of olympus demo: gates of olympus oyna – gate of olympus hile

https://gatesofolympus.auction/# gates of olympus sirlari

aviator oyna slot: aviator nas?l oynan?r – aviator oyna

http://pinupgiris.fun/# pin up casino

pragmatic play gates of olympus [url=https://gatesofolympus.auction/#]gates of olympus hilesi[/url] gates of olympus demo oyna

http://sweetbonanza.bid/# sweet bonanza

http://slotsiteleri.guru/# oyun siteleri slot

pin up casino giris: pin-up giris – pin up aviator

http://pinupgiris.fun/# pin up bet

canada drugs online review: pills now even cheaper – certified canadian international pharmacy

reputable mexican pharmacies online [url=http://mexicanpharmacy.shop/#]mexican pharmacy[/url] pharmacies in mexico that ship to usa

top 10 pharmacies in india: indian pharmacy – Online medicine order

online canadian pharmacy reviews [url=https://canadianpharmacy24.store/#]Licensed Canadian Pharmacy[/url] onlinecanadianpharmacy 24

mexico drug stores pharmacies: mexican pharmaceuticals online – buying prescription drugs in mexico online

buy prescription drugs from india: Cheapest online pharmacy – mail order pharmacy india

Online medicine home delivery [url=https://indianpharmacy.icu/#]Cheapest online pharmacy[/url] online shopping pharmacy india

canadian pharmacy store [url=https://canadianpharmacy24.store/#]legit canadian pharmacy online[/url] canadian pharmacy 24h com safe

http://mexicanpharmacy.shop/# mexican online pharmacies prescription drugs

medication from mexico pharmacy [url=https://mexicanpharmacy.shop/#]Online Pharmacies in Mexico[/url] mexico drug stores pharmacies

indian pharmacy online: online pharmacy india – india online pharmacy

mexico drug stores pharmacies: mexico pharmacy – best mexican online pharmacies

mexican online pharmacies prescription drugs: cheapest mexico drugs – reputable mexican pharmacies online

п»їbest mexican online pharmacies [url=http://mexicanpharmacy.shop/#]Online Pharmacies in Mexico[/url] mexican border pharmacies shipping to usa

india pharmacy mail order [url=https://indianpharmacy.icu/#]Healthcare and medicines from India[/url] reputable indian pharmacies

reliable canadian pharmacy: Large Selection of Medications – canadian pharmacy tampa

https://indianpharmacy.icu/# online pharmacy india

canadian pharmacy prices [url=http://canadianpharmacy24.store/#]Licensed Canadian Pharmacy[/url] canadianpharmacy com

http://prednisoneall.shop/# buy prednisone 20mg without a prescription best price

buying clomid tablets [url=http://clomidall.shop/#]can you get clomid without a prescription[/url] how to buy cheap clomid no prescription

http://clomidall.com/# cost cheap clomid pills

prednisone pills for sale [url=https://prednisoneall.com/#]prednisone 20mg capsule[/url] pharmacy cost of prednisone

http://amoxilall.shop/# antibiotic amoxicillin

http://zithromaxall.com/# zithromax 250mg

https://prednisoneall.com/# prednisone 50 mg coupon

zithromax online [url=https://zithromaxall.shop/#]zithromax price canada[/url] zithromax for sale us

http://amoxilall.com/# amoxicillin tablet 500mg

amoxicillin buy canada: can i buy amoxicillin online – amoxicillin 500 mg price