The hundred meter dash, archery, weightlifting and the long jump are four very different Olympic sports with four very different methods of keeping score. The hundred meter dash is scored on speed. Archery is scored on accuracy. Weightlifting is scored on strength. The long jump is scored on distance. You don’t judge the participants in the hundred yard dash by how much weight they can lift. That would be the wrong way to measure them.

“…looking at ‘smartphone share’ or ‘profit share’ or ‘platform share’ all tell you something about the industry, but all three metrics mislead you if you try to treat them as a way to see who’s ‘winning’, because ‘winning’ means different things for Apple, Samsung or Google. After all, Google may well still make more money from searches on iOS than it does from searches on Android.” ~ Ben Evans, On market share

Hardware manufacturing, advertising, “razors-and-blades” content sales, and platforms are four very different business models and they have four very different methods of keeping score too.

You don’t take the metrics used to measure one business model and apply them to another business model. That would be the wrong way to measure them.

Each business model demands its own specific forms of scoring. The goal should be to devise, discover, or discern a form of measurement that properly and accurately reflects how a business is performing in the business model in which it is participating.

Biathlons, Triathlons and Decathlons are all unusual Olympic events in that they group together several disparate sports and then determine an overall winner. Think of Apple, Google, Samsung, and Amazon as Olympic teams that compete with one another in the four interrelated mobile business models – hardware manufacturing, advertising, “razors-and-blades” content sales, and platforms – a sort of Quadrathlon. Each team has its strengths and its weaknesses, each team wants to win the events that they’re best at and maximize their score in the other events in order to win the overall Quadrathlon.

Let the games begin!

Hardware Manufacturing

Last week I tried to explain how using only market share to analyze mobile hardware manufacturing was not only the wrong way to keep score of that business model but that it was actually obscuring the real score.

“The truth is that focusing on market share as the primary metric is the only way to paint the iPhone as anything other than a roaring success.” ~ John Gruber

I suggested an alternative measurement known as the “Fair share profit analysis,” in order to generate some perspective but, truth be told, the only real way to accurately “score” who’s winning in hardware manufacturing is with net hardware profits. When it comes to selling mobile hardware, do Apple, Samsung, HTC, Motorola, etc. really care what their market share is? No they do not. That’s the top line, a means to an end. The only thing that matters when they are selling mobile hardware is profit. That’s the bottom line, the end for which the means were made. Market share is all well and good but only if it brings home the profits. Keep your eyes on the prize – and profits are the prize.

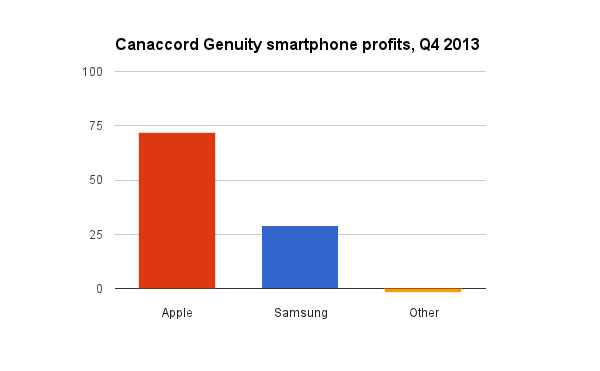

So who’s winning the medals in the olympic sport of mobile hardware manufacturing?

Source: “Who’s Winning, iOS or Android? All the Numbers, All in One Place”

Awards Ceremony: Apple walks away with the Gold (both figuratively and almost literally), Samsung takes the Silver and no one else even medals. The Bronze podium stands empty.

Advertising

The only proper way to score advertising is net advertising profits retained. Market share and platform may be used to garner advertising revenue but they are only the means and they should never be confused with profit, which is the end.

Today, there are three great truths in mobile advertising:

1) Google is killing it in mobile advertising.

2) Google is killing it in mobile advertising…but mobile advertising is still relatively small; and

3) The vast majority of Google’s mobile advertising revenue is generated on the iOS platform, not the Android platform.

1) Google is killing it in mobile advertising.

Google dominates the mobile search market with 93% of US mobile search advertising dollars, according to eMarketer. Facebook is at No. 2.

2) Mobile advertising is still relatively small.

The mobile ad market alone stood at roughly $4.1 billion at the end of last year, up from $1.5 billion at the end of 2011. Google, currently has more than half the mobile ads market with annual revenues of around $2.2 billion.

Just to keep things in perspective, mobile ad revenue only accounted for 9% of all online ad revenue last year, although the percentage of mobile ads vis-a-vis other online ads is rapidly growing. And mobile ad revenues paled in comparison with mobile hardware sales. While it took an entire year for ALL mobile ad revenue to reach $4.1 billion, Apple alone, and in 90 days, and in what many considered a down quarter, brought in revenues of approximately $31.4 billion just from iPhone and iPad sales.

3) Google is making its advertising money on iOS, not Android

“(I)t’s Android’s large market share that is the winner for Google. The more Android devices being used, the more Google services with Google ads are being used.” – Virtual Pants

Actually, not so very much. Most of Google’s advertising dollars are generated by iOS’s relatively smaller market share, not by Android’s massive market share.

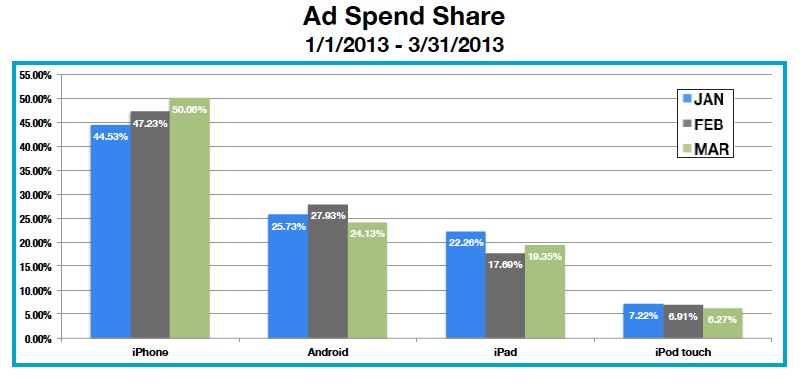

Source: MoPub

Take a good hard look at the chart, above. The iPhone ad spend doubles the ad spend share of ALL of Android. The iPad almost matches ALL of Android BY ITSELF. And even the lowly iPod has one-quarter of the ad spend that ALL of Android does. Market share is all that matters? I don’t think so. That’s like arguing that acreage is all that matters in real estate. The size of the lot does matter in real estate but location, location, location matters more, more, more. And market share does matter in mobile advertising but it is the location of the market share that matters even more.

— Apple’s iOS Mobile Ad Metrics Dominates Android

— Why 75 cents of every dollar spent on mobile advertising is spent on iPhone and iPad

— iOS leads Android in mobile ad revenue

— Apple’s iPad dominates online shopping traffic & revenue generation

— iPad Still Dominates Tablet Ads With iPad Mini Gaining, Velti Finds

“My belief, though, is that what Google is winning with Android is a booby prize — overwhelming majority share of the unprofitable segment of the market.” – John Gruber

When it comes to ad revenues and profits, we shouldn’t be counting Android as a single entity anyway. Ad revenues don’t help Android, the platform. They help specific digital stores. Ads going to Amazon, Google, and the various stores in China and elsewhere need to be broken out separately, not lumped together.

Awards Ceremony: Google wins the Gold and they win it going away. But they receive their Gold medal standing on the Apple iOS platform, not the Android platform.

Silver and Bronze? I’ll let you decide if it’s Facebook, Yahoo, Microsoft’s Bing or someone else. They’re all so far back that it doesn’t much matter now anyway. That may change over time but we’ll have to wait and see how this market develops.

“Razors-And-Blades” Content Sales

“(T)he razor and blades business model, is a business model wherein one item is sold at a low price (or given away for free) in order to increase sales of a complementary good, such as supplies…” ~ Wikipedia

The “razors-and-blades” business model is tricky to score.

— Hardware revenues and profits mean NOTHING in the “razors-and-blades” model. In fact, it’s not unusual to LOSE money from hardware (razor) sales.

— Market share means both nothing and everything in the “razors-and-blades” model. It means nothing because it doesn’t actually generate any profits but it means everything because it is a prerequisite to generating profits. In fact, the only reason you’re giving away your hardware in the first place is to acquire massive market share which, in turn, will hopefully lead to massive profits.

— Ultimately, the only way to measure the success of the “razors-and-blades” model is on the net profits generated by the sale of the complementary goods (razors). In mobile, the complementary goods are content such as music, video, books, etc. and apps. Amazon also has the added advantage of being able to sell everything from their sprawling retail catalog.

As I tried to explain in my tersely titled article: “Selling The Amazon Kindle Fire and Google Nexus 7 Is As Silly As Selling Razor Blades To Men Who Love Beards“, the “razors-and-blades” model makes no sense in this market space. At least it makes no sense to me. In the “razors-and-blades” model, the complementary sales – whether it be blades for razors, or ink for inkjet printers or games for gaming consoles – must be proprietary and must command a premium price. That’s the whole point. Give away the razor, make it back – and more – by selling the blades at a premium.

If you’re selling content, you want to be platform agnostic so that you can sell as much content as possible. This, in my opinion, should be Amazon’s strategy.

If you’re giving away hardware in order to sell content, then you want that content to be tied to your hardware product so that you can monopolize the sale of the complementary product and command a premium price.

In the mobile space, the complementary sales ARE NOT proprietary, they ARE subject to competition and they DO NOT command a premium price. Amazon and Google don’t sell content that is any different or superior to that being sold by Apple and other content providers and their content isn’t being sold at a premium. In fact, Amazon often sells their merchandise at a DISCOUNT which – in the “razors-and-blades” business model – is completely bat-manure crazy. ((Then again, we all know that Jeff Bezos is crazy like a fox.))

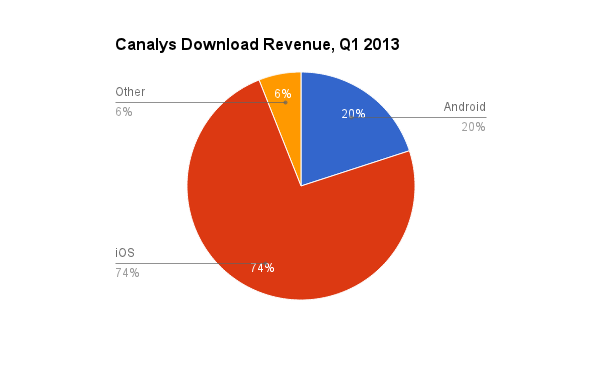

So who’s winning in the “razors-and-blades” business model? Why, surprisingly, it’s Apple and it’s Apple in a runaway.

— Google Play now at 90% of iOS app store downloads; iOS still holds a 2.6X revenue lead

Despite growing competition from other tablets, Apple’s iPad still accounts for a whopping 89.28 percent of e-commerce website traffic, and also rakes in more money on a per-user basis than any other platform. ~ Monetate

Distimo reports that iOS App Store revenues were 430% larger than Android during 2012. ~ Apple F2Q13 Earnings Call

“…iTunes inclusive of Apple’s own Software generates as much as 15% operating margin on gross revenues. That’s over $2 billion a year.” ~ Asymco, So long, break-even

Source: Canalys

Apple sells their content, not in order to make money but, in order to make their hardware more attractive so that they can sell ever more hardware and make ever more profits. With regard to tablets, Apple is playing the OPPOSITE game that the Amazon Fire and the Google Nexus are playing. While Amazon and Google subsidize their tablets (razors) in order to make money on the sale of their content (blades), Apple should be subsidizing the sale of their content (blades) in order to make money on the sale of their hardware (razors). But that’s not how Apple rolls. Instead, Apple sells their hardware at a premium AND they sell their content at a premium. That’s not supposed to happen but that’s just how good the Apple ecosystem is.

It’s like a walk-on winning the Olympic marathon while everyone else is stuck in the starting blocks.

You can say that it’s elitist or arrogant to argue that iOS users are better customers than Android users. But you can also say that it’s the truth. ~ John Gruber, Church of market share

One last thing. If Amazon and Google have an incentive to sell discounted hardware and premium content and Apple has an incentive to sell premium hardware and discounted content, one of those business models is going to fail and it’s going to fail hard. Since Apple is, so far, successfully selling premium hardware AND premium content, I’ll let you be the judge of how this is going to play out.

Awards Ceremony: I’m tempted to award all three medals to Apple just for having the sheer audacity to win a game that they didn’t even enter. But I guess Apple will have to console themselves with just winning the Gold.

And the Amazon Fire and the Google Nexus tablets? Disqualified for not understanding the rules of the game that they were playing.

Remember, Amazon and Google sell their hardware at cost. They don’t make a penny off those sales and they might even be taking a loss.

Market share? Yes, they have taken some minor market share…in a market where they are GIVING AWAY THEIR MERCHANDISE. And market share is not how you score in the “razors-and-blades” game. While the press and the pundits fawn over the market share of the Amazon Fire and the Google Nexus, what they’re entirely missing is that in the “razors-and-blades” business model, market share should be a GIVEN. I mean, honestly, if you can’t obtain overwhelming market share when you’re giving away your product at cost, then you should be ashamed, embarrassed, abashed, chagrined, humiliated and mortified ’cause you’re doing something terribly, terribly wrong.

You win the “razors-and-blades” game by scoring the most content profits. All those Amazon Fire and Google Nexus market share numbers that the analysts are always going gaga over? Meaningless. They should be removed from the count. They’re probably not hurting the sales of the other available tablets and they’re not helping the bottom lines of their makers either. There is zero proof that Amazon and Google’s hardware giveaways have led to increased retail sales which, after all, in the “razors-and-blades” model, IS the point.

And if you’re going to prophesy that market share alone gives Google data that will someday, somehow, be worth something to someone, then you need to go back and re-read how the “razor-and-blades” business model is scored.

What we desperately need in analyzing mobile computing is far more attention paid to profits and far less attention paid to prophets.

Next Time

Next time I will finish with the “mother” of all business models – platforms – and do the medal count.

Google’s Android Activations Are A Lot Less Cash Cow And A Lot More Bull. And That’s OK.

Read Part One of John’s column entitled: Android’s Market Share Is Literally A Joke

Read Part Three of John’s column entitled: Google’s Android Activations Are A Lot Less Cash Cow And A Lot More Bull. And That’s OK.

The author would like to gratefully acknowledge the contributions of Ben Bajarin and Steve Wildstrom. All the great ideas, that you agree with, were theirs. All the bad ideas, that you disagree with, were mine.

*applause* (standing up) As usual.

Jeff Bezos is beyond crazy like a fox. Amazon is so successful it’s frightening to me – and I’m not even in business.

Define “successful.”

The US Postal Service has pretty impressive volume and pricing that cannot be beat. They still suck as a business.

“Define ‘successful.'”

Well, they’re pretty good at destroying the profits of anyone who dares to try to compete with them, doing huge amounts of business and keeping their customers happy. And they’re pretty good at making a salary for Bezos and everyone who works for him. And after running in the red for quite a while in the early 00’s, now they’ve finally become pretty good at not losing money (breaking even or clearing a small profit). If they were a private company, that would be enough, wouldn’t it?

The only thing Amazon is bad at is making significant profits. But that’s neither here nor there — the only group who is harmed by Amazon’s lack of profits are all the investors who have been massively suckered into buying Amazon stock despite the fact that they might not live long enough to see the stock make back its purchase price (I figure Bezos must have some really amazing futuristic mind-control ray that he aims at Wall street every quarter).

I wouldn’t say investors have been suckered into buying Amazon stock. Investors are responsible for researching stocks before they buy them, and Amazon’s small profit margins have been well-known for quite awhile.

“…If they were a private company, that would be enough, wouldn’t it?”

This is probably the best point I’ve read on Amazon. We always trash large public companies and Wall St. analysts for their myopic focus on the present and immediate future, the need to goose each quarter’s results. Amazon management are rightly praised for their willingness to always maintain a big-picture, long-term perspective. Costco is probably the best analog in the physical retail world, as the company is content to maintain perpetually small margins; they “win” with merchandising and proprietary customer data.

I guess I’m just a little jaded (as it appears you are) that AMZN owners are willing to assign such a high valuation to the company. I don’t even mind that the company isn’t making any net profit today. More troubling is that there is no rough timeline given (even a vague one) for when the company expects to begin revving its profit engine. Or that FCF is also pretty darn low. My pet theory is that the stock price falls apart if Amazon ever does start to generate real profits. At this point, traditional earnings-based valuation metrics suddenly become relevant, and the company will have a nearly impossible hill to climb. But since I don’t own the stock, it’s more just a curiosity.

Here’s one person’s view of how successful Amazon is: https://medium(dot)com/what-i-learned-building/d233f02d52a5

I read that article last week. Interesting stuff, and he cites so many specific examples that his points are hard to refute. My main takeaway is that Amazon’s real objective is to constantly raise the table stakes for competitors. Free shipping, broad selection, generous return policies, etc. are all hygiene factors today; customers won’t shop at a site lacking these services, but ascribe very little value relative to the huge cost retailers bear. The company is making it impossible for other general purpose etailers to compete. My question is, so what? Is this how Amazon defines its own success, or is there something more?

For the purposes of the broader discussion here, what does this fortress of retail do for Amazon vis-à-vis Apple, Facebook, Google, Microsoft, content owners, and OEMs? If retail is merely a means to an end, what is the end? Or is it the other way around, where all other services and products are just a giant catcher’s mitt to bring more users into the retail fold? If the ultimate objective is just to dominate low-margin, third-party retail, then why do the other tech companies need to worry about Amazon (except of course Google, who needs other retailers to buy ads)?

If you’ve read my comments scattered across Techpinions, PED, ben-evans, and asymco articles, you’ll know that I think many of these companies are headed to retail (Amazon, Google, Facebook). Why else would they want to identify and know everything about each one of us, if it’s not to gladly take the cash we want to spend. Retail is huge, so even low-margin still brings huge profits.

But where are the boundaries to retail? For example, an e-wallet that takes a small cut of each transaction. Who will take that cut? A device company like Apple? Or a services company like VISA? Or the techno-sophisticated retailer like Amazon or Google? Another example, advertising. Would not advertising dollars eventually go to the techno-sophisticated retailer? Or can a services company like Facebook still matter? After all, Amazon already has a heavily influential social network hidden in its popular ratings system. It’s not necessarily your friends, but it is the people who’ve bought and used the product, and so are likely to be very knowledgeable. Imagine if that is scaled even further.

If the retailer becomes dominant, let’s say, it’s the only retailer that has the sacle to have profitable same day delivery. When that happens, can a device company still get good prices for its devices? Would people still go to a brick-and-mortar store, even an Apple Store? Or will the relationship and revenue be like Amazon and the ebook publishers? Or like Apple and the music labels? Or like cellular operators and the non-Apple phone manufacturers? Who takes almost all of the revenue and profits?

Transaction processing is a no brainer; each of the tech titans has some user information or trust that they can exploit to earn a slice of each sale. I don’t know what e-wallet services will look like in a couple of years, but I’m confident that explosive growth is coming in the near future. I think of Apple, Google, and Amazon all as service companies (among other things), so it doesn’t seem a huge leap to me.

That said, I don’t see all the other tech giants getting into direct product merchandising. Google and Facebook would have to walk away from lucrative advertising and referral revenue to enter the fray directly. This would be the equivalent of Microsoft getting into the hardware business, except that Google and Facebook are weaker monopolies than Microsoft. The ad buyers can turn to Microsoft, Yahoo, Twitter and others if they feel threatened by Google and Facebook. Apple doesn’t even want to vertically integrate its own product supply lines due to the risk/reward of manufacturing, so it’s hard for me to imagine the company spending tens of billions to get into a 2% margin business.

I may be naive, but I just don’t see a future where brick and mortar retail evaporates completely. Zappos has proven that free returns are enough to entice many people to make “risky” soft goods purchases online, but the vast majority of shoppers would still rather peruse a selection of shoes in person, physically handling several different choices and trying on a few for fit. Even if Amazon had same HOUR delivery, the process would still be less convenient than conventional shopping for a large portion of the population. The same is true with several product categories.

Also, same day delivery is obscenely expensive from an inventory standpoint. Much of what Amazon sells cannot be allowed to sit on shelves at hundreds of micro distribution centers, for fear of obsolescence. Amazon’s price algorithms prevent the problem today, but inventory turn is an order of magnitude more difficult to manage with localized sales. I’m not saying it’ll never happen, but I don’t see it as a panacea the way that many do.

Google already offers Google Shopping and is “piloting” same-day delivery (Shopping Express) in San Francisco area. Google can still sell ads; Amazon sells ads today.

I don’t think Apple will get into retail, but how will these changes (if they occur), impact them.

Brick and mortar will never disappear entirely, just like PCs may never disappear. But so much of it could move online that retail, and the names of the largest retailers, will be fundamentally changed.

There’s still much to figure out to make same-day delivery successful even in dense populations, and Amazon is busy trying to do so.

In Amazon’s case, I’m defining successful as an ever-increasing number of retail sales are leaving physical stores and going to Amazon, and the shift is happening quite rapidly. If it’s suggested that Amazon’s profit margins are small, ask the managers of the physical stores whether that’s any comfort to them.

The remarkable thing about Amazon is that its income statement looks like a mass-market retailer–razor-tin net margins–but the stock is treated like a tech company. Of course, AMZN is a little of both. Its business model is definitely retail. But it is also a deep tech company, as demonstrated by its AWS business.

I just think it’s amazing that some people keep beating the drums about Amazon’s margins. So they’re small – who is it hurting? Not investors; they’re responsible for checking out the stock before they buy it. If they buy it anyway, that’s their choice.

The CEOs of the big retail chains don’t see Amazon’s profits as a flaw. To them it looks more like a lethal weapon.

No less of a super-smart person than Marc Andreessen said recently that Amazon is going to destroy physical stores. I hope he’s wrong, but he said it.

Amazon is successful because it a Internet business and the world is it market hence the uge revenue but not the profits.

You can’t say that about the brick and mortal retail outlets.

Let see what happen when buyers have to pay sale tax on the goods purchased.

I find it amusing that in the attempt to enter the market that Apple succeeds in quite well, certain companies are actually giving away or slightly losing money on the products that they produce.

Further, they appear to only have established a tenuous toehold in limited facets of that market.

All quite fascinating to my mind.

As with the market share/profit share article last week, it’s not clear (to me at least) how profit is being calculated, which I believe is important. (The Canaccord paper doesn’t disclose methodology either.) It matters because Samsung has made substantial fixed investment in recent years to revamp and boost manufacturing related to mobile, which may be a drag on profitability depending on how it is calculated. Being the first-mover, in a sense, Apple got a jump on fixed investment, which may mean it’s more of a variable game for them since much of their early fixed investment has depreciated. A rough analogy is that new businesses tend to drain cash, due to investment, while mature ones tend to be cash cows. Perhaps profitability needs to be normalized between Samsung and Apple, perhaps not. The point of my comment is that the details appear to be missing.

Apple is spending about $10B a year now in fixed costs. It’s going up, not down.

Missing details are because the companies want them to be missing.

“Apple is spending about $10B a year now in fixed costs”

Something I am digging hard to understand as to the what and why. I have some good clues but more investigating is required.

Definitely. Horace Diedu is teasing it out, but I don’t think anyone has full insight into where they’re putting all that money.

I agree. Horace and I have talked about this recently and I think we have a pretty good handle on it. Still some things worth getting more clarity on with regards to several components and infrastructure.

Well, I guess they, or a subcontractor, is building out a large factory in Texas somewhere. I guess that’s some of it.

I think that is too general of a statement considering the context of this article. Apple manufacturers a number of products and they also have retail and land – it’s hard to tease the $10 billion apart without details. I can’t find anything which details how much capex is going to mobile manufacturing. There is some evidence, however, that $2+ billion of that $10 billion is related to rescuing Sharp late in 2012. A second point here is not how much Apple is investing, but how much Apple is investing relative to Samsung, specifically in mobile hardware. Profitability of mobile hardware manufacturing is, after all, one of the points of this article.

The bulk of Apple’s costs are now mobile. See their COGS. It only makes sense that most of their CapEx goes there too. Take 50%,75%,100%. It doesn’t significantly change the point.

You’ll never get investment info out of Samsung, so a comparison is actually just a wild guess.

COGS is not investment. It’s an income statement item. This is my whole point: the article relies on data that does not specify how profitability is calculated, nor does the article’s source. When capex is measured in billions, it could, in fact, change the point. Samsung is not traded on a U.S. exchange, so it doesn’t have the same reporting requirements as, say, Apple. However, they still make a lot of information available in English and, better yet, it is audited and reviewed. Like Apple, they are not super transparent, but they do a lot more than they have to.

The challenge with Samsung, which is also becoming and will become challenge with Apple, is that because of areas of verticalization they are transferring component costs across BUs to generate margins. Samsung uses other Samsung parts and uses that to cut costs and transfer for margins. That is very hard to pinpoint. Same with Apple, iOS is a differentiator and and investment by way of RND and talent, etc., but we can’t pinpoint a percentage that Apple software contributes to profits, but I’d argue its there, we just can’t directly but our finger on it. Just a few examples of the complexities of more vertical companies and calculating profit.

There’s a little more insight from Peter Oppenheimer, Apple CFO on the quarterly call, when he said “We expect to spend about $10 billion in CapEx this fiscal year; that will be up little under $2 billion year-over-year. We expect to spend a little bit under $1 billion in the retail stores. And the other $9 billion is spent in a variety of areas. We are buying equipment that we will own that we will put in partners’ facilities. Our primary motivation there is for supply, but we get other benefits as well. We are also adding to our datacenter capabilities to support all the services that Tim spoke about in answering Ben’s question and in facilities and in infrastructure. So, that’s where the capital is going.”

At this point, that “equipment” is likely mostly for mobile, not for Mac. Datacenters are costly but we know Apple only has four (CA, NC, OR, NV), and can calculate that it could only be a small slice of the $9B.

Also, I’m not sure anyone ever confirmed an Apple investment in or prepayment to Sharp. There’s more evidence Samsung invested in Sharp. Also, Samsung spends far more on capex than Apple, but most believe a good chunk of that is for semiconductor fabs.

Those are helpful comments from Oppenheimer, but please keep in mind the following: 1) they are forward looking and don’t explain actual profitability, 2) they don’t shed light on how profitability is calculated by Canaccord, which is a source used by the author of this article, and 3) speculation that ” ‘equipment’ is likely for mobile” is just that – speculation. Apple manufactures laptops, desktops, runs cloud services like iCloud, and presumably is scaling up for future products we don’t even know about. As a finance guy myself, I can tell you that fixed costs have to be allocated and there likely isn’t even consensus *within* Apple as to how profitable certain product lines are. It’s a notoriously difficult thing to know for most companies, certainly all of the ones I’ve worked at. It’s not necessarily a percent or two either. The swings can be large depending on allocation of fixed costs, method (cash or income), and other factors.

From our standpoint in tracking the industry in our analysis reports, we run up against the same rubs. In some cases we know exactly how revenue and profit is disclosed and in others we are left to make an educated guess. Even though us analysts are not investigative journalists, we still have to do a lot of digging to be as accurate as we can in these matters.

I read the previous article in this series last week but found it to be lacking some important details. This is a significantly more concrete and compelling picture of the mobile ecosystem, good work.

“This is a significantly more concrete and compelling picture of the mobile ecosystem, good work.” – Michael Hofer

Thanks. Next week, platform.

Kirk, so many links to read to prepare for discussion. the rest of the week is been planned. Thanks, I am sure.

I’m not sure if you will cover this in your platform article, but I think both Amazon and Google are still in the “investment” or startup phase of their strategy. I think both are headed toward ultra-high-volume e-commerce, which when scaled, creates a wide moat. (Think of the scale needed to get to profitable same-day delivery of non-digital goods.) They both someday want to be able to suggest and sell you any good or service at the moment you need it (which they’ll know by tracking you all over the physical and virtual worlds). Google has the luxury of being able to fund their investment from their ample advertising profits.

For Amazon, I think selling hardware at cost is a defensive strategy (i.e., just in case you get locked out of the other platforms) that also has the benefits of creating “virtual storefronts” in people’s houses (which is a different take on a retail store), and of potentially commoditizing the hardware business model (of Apple). Same for Google, except its ecommerce play is in its infancy.

You seem to miss the fact that both Amazon and Google are diversified. They make money from many different markets. For them it isn’t a matter of having to the most profitable kid on the block when it comes to competing in the same space as Apple. For them, it’s purely strategic..

The Kindle and the Kindle Fire were strategic moves for Amazon. They helped to lock in book customers at a time that the industry experienced a shift from paper based books to ebooks. It had nothing to do with having devices in the tablet space.

It’s my opinion that Amazon doesn’t see themselves competing against Apple. Their strategy is ensure that customers do not have to leave their online store to find goods, whether they are physical or digital content (i.e. ebooks, MP3, streaming, electronic downloads, etc.).

Saying that Apple’s business model is better than Amazon’s business model is missing the fact that they have entirely different business models. It’s like comparing a 7/11 to a grocery story. They sell some of the same stuff, but that’s as far as it goes…

“You seem to miss the fact that both Amazon and Google are diversified” – Dave_Hart

My focus is on mobile computing.

“My focus is on mobile computing.”

But you can’t simply carve out a business unit from a diversified company and compare it to a company that is much more focused on the same sector. They will have completely different goals and business strategies.

If Apple lost their revenues from the mobile computing sector it would have a huge impact on their earnings and their stock evaluation. However, if Amazon lost their revenues from the mobile computing section, it would be a drop in the bucket.

The point is that you are evaluating the business strategy of Amazon in the wrong light. Their business strategy is to have a one stop shop for just about anything physical or digital and they are succeeding in this strategy. Evaluating it by any other light simply results in a poor and, perhaps, misleading analysis.

Thanks for the comments.

I understand your perspective, but I respectfully disagree. It is, as you say, important to understand the overall business strategy of each company. But sector comparisons can still be made so long as the overall strategies are fairly represented.

“I understand your perspective, but I respectfully disagree. It is, as you

say, important to understand the overall business strategy of each

company. But sector comparisons can still be made so long as the overall

strategies are fairly represented.”

I agree with your statement. I also would agree with your analysis if I thought that it fairly represented Amazon’s strategy in the mobile space. The problem is, in my opinion, that it doesn’t. As a result, you concluded that Apple is beating Amazon at their own game, but this is a poor conclusion because Amazon is playing an entirely different game than the one your analysis describes.

Amazon’s strategy isn’t to sell content (blades), it’s to get people into the store and keep them there. Selling content is Icing on the cake.

We’ll just have to respectfully disagree on this one. : – )

“Amazon’s strategy isn’t to sell content (blades), it’s to get people into the store and keep them there.” – Dave_Hart

Actually, you’re in the right. I have no idea what Jeff Bezos and Amazon are doing. Their business model is a miracle to behold and the devil to understand. 🙂

I think Amazon is still an internet-boom company, and their strategy is to give everything away and make it up in the stock price.

Congratulations…you managed to put all my random thoughts and opinions into one(now two) article(s).

Looking forward to the next one.

Thanks.

Hi John, super excellent analysis.. as always.. keep up the superb work !

Great piece, John. One small point though: the figures on mobile ad spend for iOS vs Android come from MoPub, which I believe doesn’t carry Google ad inventory. While it’s likely that their metrics in terms of proportion of platform mirror Google’s, it’s not definite.

I do not even understand how I ended up here, but I assumed this publish used to be great

I think the admin of this site is really working hard for his website, since here every stuff is quality based data.

http://withoutprescription.guru/# non prescription erection pills

canadian drug prices: Legitimate Canada Drugs – canadian pharmacy meds

https://indiapharm.guru/# india pharmacy

buy prescription drugs online legally: sildenafil without a doctor’s prescription – buy prescription drugs without doctor

https://withoutprescription.guru/# buy prescription drugs without doctor

ed meds online without doctor prescription: real viagra without a doctor prescription – ed meds online without prescription or membership

non prescription ed pills: prescription drugs without prior prescription – prescription drugs without doctor approval

can i order cheap clomid: can you buy generic clomid price – cost of generic clomid pill

Levitra online USA fast: Buy Vardenafil 20mg – Levitra generic best price

tadalafil prescription medicine tadalafil tablets tadalafil 100mg online

http://sildenafil.win/# sildenafil citrate over the counter

п»їkamagra: п»їkamagra – п»їkamagra

https://tadalafil.trade/# tadalafil 20mg no prescription

buy tadalafil from india: tadalafil brand name in india – buy tadalafil online usa

pills for ed ed meds online without doctor prescription new ed drugs

https://kamagra.team/# Kamagra Oral Jelly

sildenafil 20 mg online india: sildenafil 80 mg – sildenafil 50mg united states

cheap erectile dysfunction pill generic ed drugs treatment for ed

https://levitra.icu/# Buy Vardenafil 20mg online

medication for ed dysfunction: buy erection pills – erectile dysfunction drugs

http://sildenafil.win/# buy sildenafil uk

tadalafil tablets 20 mg online tadalafil over the counter uk 60 mg tadalafil

https://kamagra.team/# sildenafil oral jelly 100mg kamagra

tadalafil 30: buy tadalafil uk – tadalafil 2.5 mg generic

cheap kamagra Kamagra 100mg Kamagra 100mg price

https://lisinopril.auction/# cost of lisinopril 2.5 mg

ciprofloxacin generic price: ciprofloxacin without insurance – ciprofloxacin over the counter

buy zithromax without presc order zithromax over the counter where can you buy zithromax

http://doxycycline.forum/# doxycycline 75 mg cost

can you buy amoxicillin over the counter canada: purchase amoxicillin online – where can i buy amoxocillin

lisinopril 15 mg: Lisinopril 10 mg Tablet buy online – lisinopril in mexico

doxycycline 500mg tablets Buy doxycycline hyclate buying doxycycline online

http://lisinopril.auction/# online pharmacy lisinopril

generic amoxicillin online: buy amoxil – amoxicillin 500 mg brand name

doxycycline 100 mg india: Buy doxycycline for chlamydia – doxycycline 200mg tablet

doxycycline online with no prescription Buy doxycycline 100mg purchase doxycycline online

http://doxycycline.forum/# doxycycline order online canada

buy cheap doxycycline: Buy Doxycycline for acne – doxycycline online canada without prescription

where can you buy amoxicillin over the counter buy amoxicillin 500mg usa amoxicillin in india

60 lisinopril cost: Buy Lisinopril 20 mg online – lisinopril 5 mg daily

prinivil 20 mg tablet buy lisinopril buy prinivil

http://ciprofloxacin.men/# cipro ciprofloxacin

buy cipro: buy ciprofloxacin over the counter – ciprofloxacin generic

https://buydrugsonline.top/# certified canadian pharmacies

indian pharmacy online: best india pharmacy – buy prescription drugs from india

mexico drug stores pharmacies: top mail order pharmacy from Mexico – mexico drug stores pharmacies

http://canadiandrugs.store/# canadianpharmacyworld com

order prescriptions Top mail order pharmacies reliable online pharmacies

canada online pharmacy reviews: Online pharmacy USA – most reputable canadian pharmacy

buying prescription drugs in mexico: mexican pharmacy online – mexico drug stores pharmacies

http://ordermedicationonline.pro/# canadian online pharmacy reviews

drugs from canada: certified canadian pharmacy – canadian pharmacy online

https://gabapentin.life/# buy generic neurontin online

wellbutrin sr 150: Buy Wellbutrin online – average cost for wellbutrin

https://wellbutrin.rest/# wellbutrin brand price

ventolin nebules: buy Ventolin inhaler – ventolin pharmacy

https://paxlovid.club/# п»їpaxlovid

price of wellbutrin: buy wellbutrin – wellbutrin 75 mg cost

https://clomid.club/# cost of clomid now

https://wellbutrin.rest/# wellbutrin sr generic

neurontin 30 mg: buy gabapentin online – medicine neurontin 300 mg

http://clomid.club/# where can i buy cheap clomid without a prescription

https://paxlovid.club/# paxlovid generic

neurontin 150mg: gabapentin best price – neurontin 150 mg

viagra originale in 24 ore contrassegno viagra online spedizione gratuita viagra generico in farmacia costo

https://farmaciait.pro/# farmacie online autorizzate elenco

migliori farmacie online 2023: farmacia online migliore – comprare farmaci online con ricetta

viagra subito viagra online spedizione gratuita viagra generico in farmacia costo

http://kamagrait.club/# migliori farmacie online 2023

comprare farmaci online all’estero: п»їfarmacia online migliore – farmaci senza ricetta elenco

comprare farmaci online all’estero cialis generico consegna 48 ore farmaci senza ricetta elenco

migliori farmacie online 2023: Avanafil farmaco – top farmacia online

farmacia online: kamagra oral jelly – farmacie online affidabili

https://avanafilit.icu/# п»їfarmacia online migliore

pillole per erezione immediata cerco viagra a buon prezzo viagra cosa serve

farmacie online affidabili: comprare avanafil senza ricetta – farmacia online senza ricetta

farmacia online piГ№ conveniente avanafil generico farmacie online sicure

https://farmaciait.pro/# comprare farmaci online all’estero

viagra subito: viagra prezzo – pillole per erezione immediata

comprare farmaci online con ricetta: Farmacie a milano che vendono cialis senza ricetta – farmacia online

alternativa al viagra senza ricetta in farmacia: viagra online spedizione gratuita – viagra cosa serve

comprare farmaci online all’estero kamagra oral jelly consegna 24 ore farmaci senza ricetta elenco

http://tadalafilit.store/# farmacia online

farmacia online: cialis generico – acquistare farmaci senza ricetta

farmacie on line spedizione gratuita: kamagra gold – farmacia online migliore

viagra 100 mg prezzo in farmacia viagra prezzo le migliori pillole per l’erezione

farmacia online barata: farmacia online 24 horas – farmacias baratas online envГo gratis

http://vardenafilo.icu/# farmacias online baratas

sildenafilo sandoz 100 mg precio comprar viagra comprar viagra en espaГ±a envio urgente

farmacia envГos internacionales: kamagra oral jelly – farmacias baratas online envГo gratis

https://vardenafilo.icu/# farmacias online seguras en españa

https://vardenafilo.icu/# farmacia online barata

п»їfarmacia online: kamagra jelly – farmacia online 24 horas

farmacia envГos internacionales Comprar Levitra Sin Receta En Espana farmacia 24h

http://vardenafilo.icu/# farmacia online madrid

farmacia online madrid: kamagra 100mg – farmacia online envГo gratis

farmacia online 24 horas kamagra 100mg farmacias online seguras

https://vardenafilo.icu/# farmacia barata

farmacia online barata: Cialis generico – farmacia online barata

farmacia online 24 horas comprar kamagra farmacia envГos internacionales

https://sildenafilo.store/# viagra online cerca de la coruГ±a

farmacia gibraltar online viagra: comprar viagra en espana – sildenafilo precio farmacia

farmacia envГos internacionales kamagra oral jelly farmacia online internacional

https://vardenafilo.icu/# farmacia online 24 horas

farmacias online seguras en espaГ±a: kamagra gel – farmacia envГos internacionales

https://tadalafilo.pro/# farmacia online madrid

http://vardenafilo.icu/# farmacia barata

farmacias online seguras en espaГ±a vardenafilo sin receta п»їfarmacia online

farmacia online 24 horas: comprar kamagra en espana – farmacia online internacional

https://tadalafilo.pro/# farmacias online baratas

farmacias baratas online envГo gratis: Levitra 20 mg precio – farmacia online barata

https://tadalafilo.pro/# farmacias online seguras en españa

farmacia online 24 horas gran farmacia online farmacia online 24 horas

http://kamagraes.site/# farmacias online seguras en espaГ±a

farmacias online seguras: Levitra Bayer – farmacias baratas online envГo gratis

Viagra 100mg prix: Viagra sans ordonnance 24h – Sildenafil teva 100 mg sans ordonnance

Viagra homme sans prescription Viagra 100mg prix Viagra Pfizer sans ordonnance

farmacia online 24 horas: se puede comprar kamagra en farmacias – farmacias online seguras en espaГ±a

Viagra gГ©nГ©rique sans ordonnance en pharmacie: Viagra generique en pharmacie – Viagra pas cher livraison rapide france

farmacia online madrid: se puede comprar kamagra en farmacias – farmacia 24h

https://pharmacieenligne.guru/# Pharmacies en ligne certifiées

pharmacie ouverte 24/24: Acheter mГ©dicaments sans ordonnance sur internet – Pharmacies en ligne certifiГ©es

farmacias online baratas: se puede comprar kamagra en farmacias – farmacia online madrid

Pharmacie en ligne livraison 24h cialis generique Pharmacie en ligne pas cher

Pharmacie en ligne livraison rapide: acheter mГ©dicaments Г l’Г©tranger – acheter medicament a l etranger sans ordonnance

Pharmacie en ligne livraison rapide Levitra acheter Acheter mГ©dicaments sans ordonnance sur internet

versandapotheke deutschland Online Apotheke Deutschland online-apotheken

http://apotheke.company/# online apotheke gГјnstig

http://cialiskaufen.pro/# online-apotheken

versandapotheke deutschland potenzmittel kaufen versandapotheke

https://apotheke.company/# versandapotheke

https://apotheke.company/# gГјnstige online apotheke

versandapotheke versandkostenfrei kamagra online bestellen online apotheke gГјnstig

http://viagrakaufen.store/# Viagra Tabletten

online apotheke versandkostenfrei online apotheke rezeptfrei online apotheke versandkostenfrei

https://viagrakaufen.store/# Viagra Generika kaufen Deutschland

п»їonline apotheke: potenzmittel cialis – п»їonline apotheke

http://cialiskaufen.pro/# online apotheke deutschland

https://cialiskaufen.pro/# internet apotheke

online apotheke gГјnstig: online apotheke gunstig – online-apotheken

medication from mexico pharmacy reputable mexican pharmacies online buying prescription drugs in mexico online

mexican mail order pharmacies mexican pharmacy medication from mexico pharmacy

http://mexicanpharmacy.cheap/# mexican border pharmacies shipping to usa

https://mexicanpharmacy.cheap/# purple pharmacy mexico price list

reputable mexican pharmacies online mexican border pharmacies shipping to usa medication from mexico pharmacy

reputable mexican pharmacies online best online pharmacies in mexico mexican pharmacy

http://mexicanpharmacy.cheap/# purple pharmacy mexico price list

best online pharmacies in mexico mexican online pharmacies prescription drugs mexican rx online

https://mexicanpharmacy.cheap/# п»їbest mexican online pharmacies

https://mexicanpharmacy.cheap/# best online pharmacies in mexico

mexican border pharmacies shipping to usa reputable mexican pharmacies online pharmacies in mexico that ship to usa

pharmacies in mexico that ship to usa buying prescription drugs in mexico online mexico pharmacies prescription drugs

http://mexicanpharmacy.cheap/# mexican pharmaceuticals online

https://mexicanpharmacy.cheap/# mexican online pharmacies prescription drugs

mexican pharmaceuticals online mexican rx online mexican border pharmacies shipping to usa

best mexican online pharmacies buying prescription drugs in mexico online purple pharmacy mexico price list

my canadian pharmacy review canadian pharmacy king reviews – reputable canadian pharmacy canadiandrugs.tech

pharmacy website india india online pharmacy – indian pharmacy indiapharmacy.guru

http://canadapharmacy.guru/# canada pharmacy online canadapharmacy.guru

indian pharmacies safe india online pharmacy online shopping pharmacy india indiapharmacy.guru

http://edpills.tech/# erectile dysfunction medication edpills.tech

top online pharmacy india pharmacy website india – best online pharmacy india indiapharmacy.guru

best erectile dysfunction pills cheap erectile dysfunction pill natural ed medications edpills.tech

http://mexicanpharmacy.company/# mexico pharmacies prescription drugs mexicanpharmacy.company

erection pills viagra online best pill for ed ed treatment review edpills.tech

reputable indian online pharmacy reputable indian pharmacies – reputable indian online pharmacy indiapharmacy.guru

best ed pill buy erection pills – ed meds edpills.tech

ed drugs generic ed drugs best ed pills edpills.tech

certified canadian pharmacy online canadian pharmacy review – canadian mail order pharmacy canadiandrugs.tech

cheap erectile dysfunction pills online what are ed drugs – ed drug prices edpills.tech

http://edpills.tech/# best over the counter ed pills edpills.tech

https://mexicanpharmacy.company/# buying prescription drugs in mexico mexicanpharmacy.company

best male ed pills otc ed pills drugs for ed edpills.tech

cheap ed pills what are ed drugs – men’s ed pills edpills.tech

india pharmacy mail order reputable indian pharmacies – Online medicine home delivery indiapharmacy.guru

ed drugs list best ed medications ed meds edpills.tech

http://indiapharmacy.pro/# top 10 online pharmacy in india indiapharmacy.pro

best online pharmacy india best india pharmacy – online shopping pharmacy india indiapharmacy.guru

ed pills ed pills cheap – best non prescription ed pills edpills.tech

where can i buy cipro online buy ciprofloxacin over the counter buy cipro without rx

buying amoxicillin online: buy amoxicillin 500mg capsules uk – how to get amoxicillin

amoxicillin no prescription: amoxicillin 250 mg price in india – amoxicillin 500mg capsules

https://prednisone.bid/# can you buy prednisone over the counter

https://ciprofloxacin.life/# buy ciprofloxacin

where buy clomid without insurance can i purchase cheap clomid no prescription how to buy cheap clomid price

buy cipro cipro 500mg best prices where to buy cipro online

http://ciprofloxacin.life/# buy ciprofloxacin

amoxicillin 500 capsule: can you buy amoxicillin over the counter canada – amoxicillin 500 coupon

buy amoxicillin online without prescription: cost of amoxicillin 875 mg – how to get amoxicillin over the counter

https://ciprofloxacin.life/# buy cipro online canada

generic amoxicillin over the counter: buy amoxicillin online without prescription – where can i get amoxicillin

paxlovid buy: buy paxlovid online – Paxlovid buy online

buy ciprofloxacin over the counter buy ciprofloxacin cipro ciprofloxacin

https://prednisone.bid/# 50 mg prednisone tablet

http://clomid.site/# generic clomid without insurance

can i purchase generic clomid without rx can i purchase clomid tablets rx clomid

amoxicillin 500 mg for sale: amoxicillin 500 mg online – buy amoxicillin online without prescription

Paxlovid over the counter paxlovid india paxlovid pill

https://clomid.site/# where to get clomid without insurance

generic amoxicillin buy amoxicillin 500mg capsules uk prescription for amoxicillin

amoxicillin generic: buy amoxicillin – amoxicillin medicine over the counter

cipro: ciprofloxacin order online – cipro for sale

https://clomid.site/# where to buy cheap clomid without rx

http://nolvadex.fun/# where to get nolvadex

tamoxifen blood clots: tamoxifen men – tamoxifen and ovarian cancer

lisinopril 5: can i buy lisinopril over the counter in canada – lisinopril 2.5 mg

http://nolvadex.fun/# nolvadex pills

http://lisinoprilbestprice.store/# buy lisinopril 20 mg online

https://zithromaxbestprice.icu/# zithromax prescription in canada

nolvadex for sale: tamoxifen depression – aromatase inhibitors tamoxifen

zithromax online pharmacy canada: zithromax 500mg price in india – zithromax without prescription

https://cytotec.icu/# Misoprostol 200 mg buy online

http://zithromaxbestprice.icu/# where to get zithromax

http://doxycyclinebestprice.pro/# how to buy doxycycline online

nolvadex gynecomastia tamoxifen generic does tamoxifen make you tired

doxy 200: price of doxycycline – purchase doxycycline online

https://zithromaxbestprice.icu/# zithromax canadian pharmacy

buy generic zithromax online: how to get zithromax – zithromax 500 mg lowest price pharmacy online

https://nolvadex.fun/# does tamoxifen cause bone loss

tamoxifen medication: tamoxifen brand name – tamoxifen breast cancer prevention

http://lisinoprilbestprice.store/# online pharmacy lisinopril

http://indiapharm.llc/# mail order pharmacy india indiapharm.llc

indianpharmacy com india online pharmacy п»їlegitimate online pharmacies india indiapharm.llc

mexican mail order pharmacies: Medicines Mexico – buying prescription drugs in mexico mexicopharm.com

https://mexicopharm.com/# best online pharmacies in mexico mexicopharm.com

legit canadian pharmacy: Canada Drugs Direct – best online canadian pharmacy canadapharm.life

https://mexicopharm.com/# buying prescription drugs in mexico mexicopharm.com

https://canadapharm.life/# canada drugs online reviews canadapharm.life

mexico pharmacies prescription drugs mexico drug stores pharmacies reputable mexican pharmacies online mexicopharm.com

canadian pharmacy victoza: Pharmacies in Canada that ship to the US – reputable canadian pharmacy canadapharm.life

http://canadapharm.life/# reputable canadian online pharmacies canadapharm.life

http://canadapharm.life/# canada pharmacy online legit canadapharm.life

mexican border pharmacies shipping to usa: Medicines Mexico – mexico drug stores pharmacies mexicopharm.com

http://canadapharm.life/# canadian pharmacy price checker canadapharm.life

top 10 online pharmacy in india Online India pharmacy india pharmacy indiapharm.llc

https://indiapharm.llc/# online pharmacy india indiapharm.llc

canada pharmacy reviews: Canada Drugs Direct – drugs from canada canadapharm.life

http://canadapharm.life/# canadian pharmacy meds reviews canadapharm.life

https://kamagradelivery.pro/# Kamagra tablets

tadalafil online india cheap tadalafil canada buy tadalafil cialis

http://sildenafildelivery.pro/# sildenafil 100mg price usa

http://sildenafildelivery.pro/# 100mg sildenafil online

medicine tadalafil tablets: Buy tadalafil online – tadalafil for sale in canada

https://sildenafildelivery.pro/# buy sildenafil from india

https://tadalafildelivery.pro/# tadalafil 10mg coupon

cheap generic sildenafil citrate cheap sildenafil 120 mg sildenafil online

https://sildenafildelivery.pro/# sildenafil india buy

https://levitradelivery.pro/# Buy Vardenafil online

https://tadalafildelivery.pro/# tadalafil 2

https://edpillsdelivery.pro/# best treatment for ed

sildenafil oral jelly 100mg kamagra buy Kamagra Kamagra Oral Jelly

http://sildenafildelivery.pro/# sildenafil canada paypal

ivermectin 2ml: cheapest stromectol – ivermectin cream 1%

http://amoxil.guru/# where can i buy amoxicillin online

https://paxlovid.guru/# paxlovid cost without insurance

paxlovid for sale paxlovid best price buy paxlovid online

http://paxlovid.guru/# paxlovid generic

order generic clomid tablets: clomid generic – how to get clomid price

https://prednisone.auction/# prednisone purchase online

http://prednisone.auction/# iv prednisone

http://paxlovid.guru/# paxlovid for sale

http://amoxil.guru/# amoxicillin online without prescription

minocycline brand name: stromectol guru – ivermectin 0.08 oral solution

http://paxlovid.guru/# paxlovid price

paxlovid pill Paxlovid buy online Paxlovid buy online

http://clomid.auction/# can you buy generic clomid for sale

http://stromectol.guru/# buy stromectol online uk

п»їpaxlovid: paxlovid price without insurance – п»їpaxlovid

http://furosemide.pro/# lasix 100mg

http://azithromycin.store/# zithromax 500 mg for sale

http://lisinopril.fun/# lisinopril prescription cost

http://finasteride.men/# buy propecia prices

cytotec online buy cytotec online buy cytotec

http://misoprostol.shop/# cytotec pills online

https://azithromycin.store/# buy generic zithromax no prescription

buy cytotec buy cytotec online Misoprostol 200 mg buy online

http://furosemide.pro/# furosemide 40 mg

http://furosemide.pro/# furosemide 100 mg

https://azithromycin.store/# zithromax buy

lasix 100 mg tablet: Buy Furosemide – generic lasix

https://azithromycin.store/# zithromax over the counter

lasix medication Buy Lasix No Prescription buy lasix online

http://misoprostol.shop/# cytotec online

http://furosemide.pro/# furosemide 100mg

zestoretic online: over the counter lisinopril – lisinopril generic 10 mg

https://lisinopril.fun/# lisinopril 10 12.55mg

https://misoprostol.shop/# purchase cytotec

buy misoprostol over the counter buy misoprostol Cytotec 200mcg price

http://furosemide.pro/# lasix

order generic propecia: Best place to buy propecia – propecia without dr prescription

http://furosemide.pro/# lasix pills

https://misoprostol.shop/# cytotec online

zithromax coupon cheapest azithromycin zithromax 250 mg tablet price

https://misoprostol.shop/# buy cytotec over the counter

http://furosemide.pro/# buy furosemide online

farmacia online senza ricetta: kamagra gel – п»їfarmacia online migliore

https://kamagraitalia.shop/# comprare farmaci online con ricetta

farmacia online miglior prezzo farmacia online spedizione gratuita farmacia online senza ricetta

http://kamagraitalia.shop/# farmacia online miglior prezzo

https://farmaciaitalia.store/# farmacia online migliore

http://kamagraitalia.shop/# farmacie online autorizzate elenco

https://sildenafilitalia.men/# gel per erezione in farmacia

farmacie online sicure: Cialis senza ricetta – acquisto farmaci con ricetta

farmacia online piГ№ conveniente kamagra gold comprare farmaci online all’estero

http://avanafilitalia.online/# farmacia online piГ№ conveniente

https://farmaciaitalia.store/# farmacia online migliore

http://farmaciaitalia.store/# farmacie online autorizzate elenco

https://tadalafilitalia.pro/# farmacie online sicure

comprare farmaci online all’estero: farmacia online piu conveniente – acquisto farmaci con ricetta

viagra 100 mg prezzo in farmacia alternativa al viagra senza ricetta in farmacia miglior sito dove acquistare viagra

https://avanafilitalia.online/# acquistare farmaci senza ricetta

top farmacia online: kamagra oral jelly consegna 24 ore – acquisto farmaci con ricetta

viagra generico sandoz: viagra consegna in 24 ore pagamento alla consegna – viagra subito

http://tadalafilitalia.pro/# farmacie on line spedizione gratuita

https://avanafilitalia.online/# farmacia online

farmacie online autorizzate elenco dove acquistare cialis online sicuro comprare farmaci online con ricetta

http://sildenafilitalia.men/# viagra generico prezzo più basso

https://tadalafilitalia.pro/# farmaci senza ricetta elenco

https://mexicanpharm.store/# mexico pharmacies prescription drugs

https://indiapharm.life/# reputable indian online pharmacy

pharmacy website india best india pharmacy cheapest online pharmacy india

canadian pharmacy online: the canadian drugstore – canadian pharmacy drugs online

http://canadapharm.shop/# canadian discount pharmacy

mexican online pharmacies prescription drugs: reputable mexican pharmacies online – mexican online pharmacies prescription drugs

https://indiapharm.life/# indian pharmacy

https://mexicanpharm.store/# mexican drugstore online

pharmacies in mexico that ship to usa mexican pharmaceuticals online п»їbest mexican online pharmacies

mexican pharmaceuticals online: medication from mexico pharmacy – reputable mexican pharmacies online

http://mexicanpharm.store/# mexico drug stores pharmacies

https://mexicanpharm.store/# medicine in mexico pharmacies

top 10 pharmacies in india: india pharmacy – online pharmacy india

mexico pharmacies prescription drugs: п»їbest mexican online pharmacies – mexican rx online

https://indiapharm.life/# buy prescription drugs from india

canadian online drugstore canadian family pharmacy reputable canadian pharmacy

https://mexicanpharm.store/# mexico pharmacies prescription drugs

http://canadapharm.shop/# canada drugstore pharmacy rx

canada pharmacy reviews: canada rx pharmacy – best canadian online pharmacy

http://indiapharm.life/# legitimate online pharmacies india

online pharmacy india: indian pharmacy online – buy medicines online in india

http://indiapharm.life/# reputable indian pharmacies

world pharmacy india Online medicine order buy medicines online in india

http://mexicanpharm.store/# mexico pharmacy

prednisone 10 mg price: can you buy prednisone – prednisone cream rx

They offer the best prices on international brands https://prednisonepharm.store/# prednisone where can i buy

where to buy zithromax in canada: zithromax purchase online – zithromax for sale 500 mg

Their worldwide reputation is well-deserved http://clomidpharm.shop/# can you buy cheap clomid without prescription

https://nolvadex.pro/# nolvadex for sale amazon

The drive-thru option is a lifesaver http://prednisonepharm.store/# purchase prednisone canada

liquid tamoxifen: tamoxifen hormone therapy – liquid tamoxifen

A harmonious blend of local care and global expertise http://nolvadex.pro/# where to get nolvadex

zithromax for sale us: zithromax online usa no prescription – zithromax 500 without prescription

They ensure global standards in every pill http://clomidpharm.shop/# how to buy cheap clomid prices

zithromax 250: how to buy zithromax online – zithromax online australia

Some are medicines that help people when doctors prescribe http://clomidpharm.shop/# buying clomid without rx

https://cytotec.directory/# order cytotec online

cytotec online buy cytotec in usa Cytotec 200mcg price

can i buy generic clomid without insurance: cost clomid tablets – can you get cheap clomid online

World-class service at every touchpoint https://prednisonepharm.store/# prednisone 20 mg tablet

Prescription Drug Information, Interactions & Side http://prednisonepharm.store/# prednisone uk

how to get prednisone tablets: prednisone 20 – prednisone 15 mg daily

http://reputablepharmacies.online/# canadian pharmacy no prescription required

canadian pharmacy certified canadian mail order pharmacy reviews canadian drugs

canadian mail order meds http://edpills.bid/# generic ed drugs

online canadian pharmacy no prescription needed

http://reputablepharmacies.online/# on line pharmacy with no perscriptions

medicine erectile dysfunction generic ed drugs male ed pills

https://edpills.bid/# best ed treatment pills

https://reputablepharmacies.online/# canadian pharmacies reviews

п»їerectile dysfunction medication best ed medication best pills for ed

buy prescription drugs without doctor 100mg viagra without a doctor prescription best non prescription ed pills

buy canadian drugs online https://reputablepharmacies.online/# canada pharmacy

your discount pharmacy

https://edpills.bid/# herbal ed treatment

mexican pharmacy list my canadian pharmacy rx canada online pharmacy

http://reputablepharmacies.online/# online canadian pharmacy no prescription

online prescriptions no prescription canadian pharmacies no 1 canadian pharmacy

http://edpills.bid/# best ed drugs

http://edpills.bid/# men’s ed pills

pills for ed over the counter erectile dysfunction pills medications for ed

erectile dysfunction medications best pills for ed medications for ed

safe reliable canadian pharmacy: canada drugs online reviews – best online international pharmacies

https://edwithoutdoctorprescription.store/# viagra without doctor prescription amazon

buy prescription drugs from canada viagra without a doctor prescription walmart viagra without a doctor prescription

http://canadianpharmacy.pro/# canadianpharmacyworld com canadianpharmacy.pro

http://mexicanpharmacy.win/# mexican drugstore online mexicanpharmacy.win

online pharmacies of canada

canadian pharmacy no scripts canadian pharmacy tampa canadian pharmacy meds canadianpharmacy.pro

https://mexicanpharmacy.win/# pharmacies in mexico that ship to usa mexicanpharmacy.win

mexico drug stores pharmacies Medicines Mexico mexican drugstore online mexicanpharmacy.win

http://indianpharmacy.shop/# top 10 online pharmacy in india indianpharmacy.shop

https://indianpharmacy.shop/# pharmacy website india indianpharmacy.shop

canadian pharmacy 24h com Cheapest drug prices Canada canadian pharmacy ed medications canadianpharmacy.pro

https://canadianpharmacy.pro/# canadian pharmacy online canadianpharmacy.pro

canadian drug store cialis

http://indianpharmacy.shop/# cheapest online pharmacy india indianpharmacy.shop

buying prescription drugs in mexico online online mexican pharmacy mexican mail order pharmacies mexicanpharmacy.win

http://canadianpharmacy.pro/# the canadian drugstore canadianpharmacy.pro

world pharmacy india indian pharmacy indianpharmacy com indianpharmacy.shop

canadian neighbor pharmacy Pharmacies in Canada that ship to the US canadian pharmacy ed medications canadianpharmacy.pro

https://mexicanpharmacy.win/# mexican rx online mexicanpharmacy.win

cheapest online pharmacy india

https://canadianpharmacy.pro/# online canadian drugstore canadianpharmacy.pro

https://mexicanpharmacy.win/# mexican mail order pharmacies mexicanpharmacy.win

meds without a doctor s prescription canada

http://mexicanpharmacy.win/# mexican mail order pharmacies mexicanpharmacy.win

world pharmacy india

https://mexicanpharmacy.win/# mexican drugstore online mexicanpharmacy.win

buy medicines online in india

https://canadianpharmacy.pro/# canadian pharmacy store canadianpharmacy.pro

mexico drug stores pharmacies mexico pharmacy buying prescription drugs in mexico online mexicanpharmacy.win

http://canadianpharmacy.pro/# canadian pharmacy uk delivery canadianpharmacy.pro

Online medicine home delivery

https://mexicanpharmacy.win/# mexico drug stores pharmacies mexicanpharmacy.win

http://canadianpharmacy.pro/# canadian pharmacies online canadianpharmacy.pro

indian pharmacy online

https://indianpharmacy.shop/# india pharmacy indianpharmacy.shop

http://canadianpharmacy.pro/# canada online pharmacy canadianpharmacy.pro

india pharmacy mail order

https://mexicanpharmacy.win/# mexican drugstore online mexicanpharmacy.win

Acheter mГ©dicaments sans ordonnance sur internet: cialis sans ordonnance – Pharmacie en ligne fiable

http://pharmadoc.pro/# pharmacie ouverte

http://viagrasansordonnance.pro/# Viagra prix pharmacie paris

Pharmacie en ligne livraison 24h

п»їpharmacie en ligne: pharmacie en ligne – п»їpharmacie en ligne

http://acheterkamagra.pro/# pharmacie ouverte 24/24

Pharmacie en ligne pas cher: Acheter Cialis 20 mg pas cher – Pharmacie en ligne pas cher

Pharmacies en ligne certifiГ©es Pharmacie en ligne livraison gratuite acheter medicament a l etranger sans ordonnance

Viagra pas cher livraison rapide france: Viagra sans ordonnance 24h – Viagra pas cher inde

https://cialissansordonnance.shop/# pharmacie ouverte

Acheter mГ©dicaments sans ordonnance sur internet

Pharmacie en ligne livraison 24h: cialis prix – Pharmacie en ligne livraison rapide

Pharmacie en ligne livraison rapide levitra generique prix en pharmacie pharmacie ouverte

Pharmacie en ligne fiable: Pharmacie en ligne pas cher – Pharmacie en ligne pas cher

Pharmacie en ligne sans ordonnance kamagra oral jelly Pharmacie en ligne pas cher

Pharmacie en ligne France: acheter mГ©dicaments Г l’Г©tranger – Pharmacie en ligne livraison 24h

http://levitrasansordonnance.pro/# Pharmacie en ligne livraison 24h

buy ivermectin for humans uk cost of ivermectin pill ivermectin lice

prednisone 20 mg tablet price: cheapest prednisone no prescription – where to buy prednisone 20mg

http://clomiphene.icu/# where buy generic clomid

https://amoxicillin.bid/# amoxicillin 500mg pill

buying amoxicillin online amoxicillin 750 mg price order amoxicillin online uk

can i order clomid pills: cost cheap clomid now – cost of clomid pills

no prescription online prednisone: prednisone 20 mg tablets coupon – generic prednisone pills

https://prednisonetablets.shop/# prednisone buy

ivermectin 3mg tablet: stromectol order online – stromectol tablets 3 mg

http://prednisonetablets.shop/# no prescription online prednisone

stromectol online pharmacy buy ivermectin pills buy ivermectin cream

amoxicillin price canada: amoxicillin 500mg price – amoxicillin for sale online

amoxicillin 500 mg tablet price: amoxicillin 500 coupon – amoxicillin over the counter in canada

https://ivermectin.store/# stromectol tablets

http://amoxicillin.bid/# where to buy amoxicillin pharmacy

zithromax 500 price: zithromax 250 price – zithromax

zithromax azithromycin buy zithromax online zithromax 500 mg lowest price pharmacy online

http://amoxicillin.bid/# where to buy amoxicillin 500mg

can you get generic clomid without rx: can i buy clomid without rx – where to get cheap clomid

http://clomiphene.icu/# how to get clomid

buying prednisone from canada prednisone cost in india prednisone for sale without a prescription

where can i get zithromax: zithromax over the counter uk – zithromax azithromycin

40 mg prednisone pill: buy prednisone 10mg online – where to buy prednisone in canada

https://clomiphene.icu/# order cheap clomid pills

http://prednisonetablets.shop/# buy prednisone canadian pharmacy

stromectol ivermectin tablets buy ivermectin pills stromectol 3 mg tablet price

prednisone drug costs: prednisone cream – prednisone 5093

http://clomiphene.icu/# buying generic clomid without dr prescription

legitimate canadian pharmacy online canadian pharmacy 1 internet online drugstore canadian drug stores canadianpharm.store

canadian medications: Licensed Online Pharmacy – canadadrugpharmacy com canadianpharm.store

http://indianpharm.store/# online shopping pharmacy india indianpharm.store

buy prescription drugs from india: Online medicine home delivery – mail order pharmacy india indianpharm.store

canada pharmacy Certified Online Pharmacy Canada safe reliable canadian pharmacy canadianpharm.store

https://mexicanpharm.shop/# buying prescription drugs in mexico online mexicanpharm.shop

top 10 online pharmacy in india: Indian pharmacy to USA – Online medicine home delivery indianpharm.store

Online medicine order: order medicine from india to usa – online shopping pharmacy india indianpharm.store

http://indianpharm.store/# india pharmacy mail order indianpharm.store

online shopping pharmacy india Indian pharmacy to USA cheapest online pharmacy india indianpharm.store

best online pharmacies in mexico: Online Pharmacies in Mexico – mexican rx online mexicanpharm.shop

https://mexicanpharm.shop/# mexican pharmaceuticals online mexicanpharm.shop

mexican pharmaceuticals online: mexican drugstore online – purple pharmacy mexico price list mexicanpharm.shop

canadian pharmacy price checker Canadian International Pharmacy 77 canadian pharmacy canadianpharm.store

canadian drugs: Canadian Pharmacy – precription drugs from canada canadianpharm.store

https://mexicanpharm.shop/# mexico drug stores pharmacies mexicanpharm.shop

top online pharmacy india: order medicine from india to usa – top 10 online pharmacy in india indianpharm.store

п»їbest mexican online pharmacies: Online Pharmacies in Mexico – mexican drugstore online mexicanpharm.shop

http://indianpharm.store/# cheapest online pharmacy india indianpharm.store

п»їlegitimate online pharmacies india mail order pharmacy india india pharmacy indianpharm.store

http://mexicanpharm.shop/# pharmacies in mexico that ship to usa mexicanpharm.shop

canadian pharmacy victoza: Certified Online Pharmacy Canada – canadian pharmacy meds reviews canadianpharm.store

https://mexicanpharm.shop/# mexican border pharmacies shipping to usa mexicanpharm.shop

п»їbest mexican online pharmacies Online Mexican pharmacy mexico pharmacies prescription drugs mexicanpharm.shop

п»їlegitimate online pharmacies india: indian pharmacy online – indian pharmacy paypal indianpharm.store

best online pharmacies in mexico: Certified Pharmacy from Mexico – mexico pharmacies prescription drugs mexicanpharm.shop

http://mexicanpharm.shop/# mexico pharmacy mexicanpharm.shop

canadian pharmacy antibiotics: Canada Pharmacy online – the canadian pharmacy canadianpharm.store

reputable indian pharmacies international medicine delivery from india indian pharmacy indianpharm.store

canadian drugs pharmacy: Canada Pharmacy online – drugs from canada canadianpharm.store

https://indianpharm.store/# best online pharmacy india indianpharm.store

adderall canadian pharmacy: Certified Online Pharmacy Canada – canadian pharmacy king canadianpharm.store

http://mexicanpharm.shop/# mexican pharmaceuticals online mexicanpharm.shop

canadian pharmacy meds: Canadian International Pharmacy – is canadian pharmacy legit canadianpharm.store

п»їbest mexican online pharmacies: Certified Pharmacy from Mexico – purple pharmacy mexico price list mexicanpharm.shop

https://indianpharm.store/# india pharmacy indianpharm.store

buy medicines online in india: international medicine delivery from india – best india pharmacy indianpharm.store

https://indianpharm.store/# indianpharmacy com indianpharm.store

northwest canadian pharmacy: Canadian International Pharmacy – canada drugs online canadianpharm.store

canadian pharmacy Pharmacies in Canada that ship to the US best online canadian pharmacy canadianpharm.store

https://mexicanpharm.shop/# mexican pharmacy mexicanpharm.shop

https://canadianpharm.store/# best rated canadian pharmacy canadianpharm.store

pharmacies in mexico that ship to usa: medicine in mexico pharmacies – best online pharmacies in mexico mexicanpharm.shop

pharmacy canadian: Pharmacies in Canada that ship to the US – canadian pharmacy online canadianpharm.store

canadadrugpharmacy canadian prescription canadian rx pharmacy

https://canadadrugs.pro/# canadian pharmacy antibiotics

online drugs: legitimate online pharmacy – canadiandrugstore.com

online canadian pharcharmy: prescription cost comparison – pharmacies with no prescription

best pharmacy prices: canadian drugstore cialis – online drugs

canadian pharmacy tadalafil online drugstore coupon canada rx pharmacy

approved canadian online pharmacies: online canadian pharmacy no prescription – canadian pharmacy certified

http://canadadrugs.pro/# best 10 online pharmacies

medications without prescription: best mail order canadian pharmacy – drug store online

online meds: discount drugs – drugs from canada without prescription

medications without prescription canada pharmacies top best prescription without a doctor’s prescription

reliable online pharmacy: online pharmacies reviews – pharmacy price comparison

canadian pharmaceuticals for usa sales: non perscription on line pharmacies – the generics pharmacy online delivery

https://canadadrugs.pro/# top rated canadian pharmacies

canadian pharmacy cheap: canadian pharmacies – best 10 online pharmacies

canadian online pharmacy reputable mexican pharmacies online online pharmacy canada

http://canadadrugs.pro/# reliable mexican pharmacy

canadian prescription filled in the us: canadian pharmacies for cialis – mexican pharmacy online no prescription

reliable canadian pharmacy: canadian pharmacies recommended – online ed drugs no prescription

canadian drug mart pharmacy: reputable canadian pharmacy – drugs from canada with prescription

https://canadadrugs.pro/# buying prescription drugs canada

canada prescriptions online: canadian neighbor pharmacy legit – non prescription drugs

mexican pharmacies online cheap: legitimate online canadian pharmacies – best online pharmacy stores