I have noticed an interesting thread of conversation both with some industry folks as well as in the media. That thread is around the assumption that the technology industry will repeat itself and a dominant platform will emerge and command the lion’s share of the market. I understand why many people would assume that this would be the case, but I would encourage more discussion around the topic. History might not repeat itself—at least not the way they think.

This assumption that history will repeat itself also lies at the core of why people keep making a big deal about market share statistics. Since market share does not equal profit share, the only reason we would make a big deal of it is if we are looking for the dominant platform to emerge. If we are to assume history will repeat itself and we are anxiously waiting for the dominant player to emerge, then I would fully understand why market share is such a big deal. However, I do not believe history will repeat itself and here is why:

First of all this industry (the computer industry), quite frankly, is not old enough to assume that history is cyclical. In fact, the majority of this industry’s computing history has been in the enterprise. Only in the past 5 years or so, I would argue, have we moved to a mature consumer market in personal computers.

We have a slide in one of our big picture industry trend presentations where we start out by saying that we are in the middle of a 50 year journey. The first 25 years was about bringing computing to business customers and the next 25+ years is about bringing computing to the masses. Given that perspective, it is difficult to say that the way the industry operated during the past 25 years or so by developing technologies largely for enterprises customers, is going to operate the same way going forward in bringing computing to the masses in every corner of the earth.

Using history as their guide, many who believe it is cyclical will point out a trend within product categories to start out vertical, then go horizontal, then back to vertical. Since this happened in the category of Mainframes, Mini Computers, and now personal computers it is easy to think that the vertical-horizontal-vertical trend is an industry truth. However, if we truly analyze the cycle it is clear it is more a product category truth rather than an actual industry truth. In the case of Mainframes and Minis toward the end of the product life-cycle they generally ended vertical and stayed that way.

The reason for this is because the vertical-horizontal-vertical product path is the same path a technology takes as it moves from creation-standardization-maturity. In the beginning when a new category or technology is created there is a flood to create similar yet different products. It begins vertical and fragmented. Soon after a standard emerges, which is when the life-cycle goes horizontal the single standard drives the market to maturity at which point it then begins to fragment again and trend vertical. As interesting as that factoid is the real evidence lies in understanding mature markets.

Understanding Mature Markets

In all case studies the dominant platform is only dominant until the market matures. This is perhaps one of the best ways to understand how it is possible that Microsoft’s Windows OS is actually losing market share and Apple’s OSX is gaining market share. When markets mature they fragment and open up the doors for differentiated vertical players to succeed and begin to forge their own market share. Below is a slide depicting how this happened in automobiles.

What you will see (or recall if you remember) is that the shape of the mid-sized car (embodied in this photo by a Toyota Corolla) was the dominant look and feel of a car. They mostly looked the same as the market was maturing and consumers were figuring out their needs, wants, and desires with this product. However as the market matured and consumers became familiar with these kinds of cars, they wanted ones that were more suited to their needs, wants, or desires. When this happened, design variation opened the door to fragmentation so the dominant shape and form of an auto began to break up into segments. Thus the luxury, economy, SUV, Mini-Vans, Trucks and more segments of the market were born.

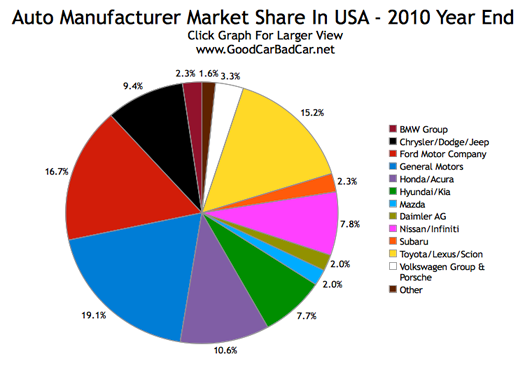

The fact of the matter is the consumer market is so large that it can sustain quite a bit of consumer choice rather easily. It is for this reason that multiple technology platforms, segments, and ecosystems can remain in the market and all retain healthy market shares. Take for example the chart below showing US automobile market share by brand in 2010.

I show this slide to show how a mature market that has segmented with a plethora of consumer choice all differentiated around form factors and preference can be sustained. Notice in this chart that there is not a clearly dominant brand or automobile platform. This is because the market for automobiles is mature and can sustain a healthy mix of variation.

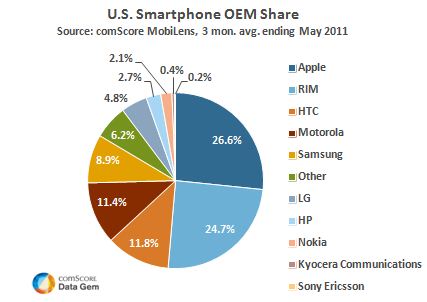

Now with those charts in mind take a look at the chart below with a breakdown of OEM Vendor market share from earlier this year. Keep in mind some of these numbers have changed but the changes up or down have not been drastic.

When you break down Smartphone market share by OEM it looks very similar to the US automobile OEM market share. Now some may be questioning the comparison between the automobile market and the personal technology market, however, I would argue they are very similar. Both are very personal choices based on personal preference. The automobile industry is 30+ years further along in its industry cycle therefore I believe provides many of the fundamental market elements to shed light on what the future of the personal computer industry may look like. Namely one by which there is not a dominant platform or hardware vendor but one that can sustain a healthy diversity of consumer choice.

In part two of this series we will dive deeper into a smarter discussion about how to think about vendor market share and platform market share going forward.

Part 2: Dear Industry, Focus on Profit Share not Market Share

Er.. auto industry pie sought.

sorry, it was there then disappeared when I updated. Slide is re-added. Thanks for pointing it out.

Too simple an analogy. Cars are like computers, but not like OS’s. So with PCs there are lots of hardware manufacturers but few OS’s.

Maybe mobiles will be different because of greater numbers though.

Agree, that is why next week in part two of this series, I will look at platform share and show why it won’t be like the 90’s when Windows had 98% of the market. I will show why all three and perhaps a fourth will have a healthy share. I’ll actually be surprised if in 5 years any one OS in mobile has more than 50% share. I could be wrong but I don’t think so.

The biggest fallacy of the Microsoft owned the PC market due to it’s licensing (and many vendors) vs Apple’s single brand strategy does not really acknowledge is that it was IBM that built the Intel based DOS > Widows PC in to a dominate position not Microsoft.

The market is very different and the issue is not that the market is mature, and there is not IBM in the market place that customers needed to validate the market.

again for the time being I am breaking up hardware from software or platform. You are correct though and honestly “for the time being” I think we can make the case that Apple is the new IBM. They are the trusted source helping not only mature the industry but the product life cycle.

Recalling the statement that IT wouldn’t buy anything other than IBM for fear that they would get in trouble simply because the brand and products were so trustworthy. I see the same consumer mentality in Apple customers. Only it may not stay that way forever due to market maturity and fragmentation.

Just thinking out loud of course.

How is the next 25+ years about bringing computing to the masses? Lots of people had computers in their homes in the 1980s.

That was a very small part of the market and mostly US during that time period. There are still many, many, billions of people who still don’t have computers of any kind. Smartphones, tablets, PC’s, connected TV’s etc will all start getting to billions of people for the first times and then some over the next 25+ years.

We still have a long long way to go.

Appreciated. Thanks.

“First of all this industry (the computer industry), quite frankly, is not old enough to assume that history is cyclical. In fact, the majority of this industry’s computing history has been in the enterprise. Only in the past 5 years or so, I would argue, have we moved to a mature consumer market in personal computers.”

That’s one of the smartest things I’ve seen written by any blogger, analyst, or commentator to date.

Joe

Thanks Joe!

Compelling piece – congratulations! One important difference between autos and PCs/phones is the time in market maturity at which China became the number one consuming geography of the “device” (now true in both PCs and smartphones). I expect we will see competitive forces swing to the experiential demands of a Chinese consumer more dramatically than in the automobile industry. Thoughts?

The past two years I have been studying China in depth. Although I point out parallels in autos and PC there are also differences. One of the things that I am noticing is that just as fragmented are US consumers and their mentality / personal preferences, so will be the Chinese. To be honest their interests may be very different.

What may end up happening is that vendors have regional strategies with their product portfolios. This would mean a slightly more complex supply chain but to cater to the unique needs of each region this may be necessary.

Basically what I am saying is that it is possible that the same product won’t work in every region. We will see how it plays out but Asia will be the largest market for consumer electronics by at least double. It will just take a little longer to mature.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

A big thank you for your blog.Really looking forward to read more. Want more.

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

As I website owner I believe the content material here is really good , appreciate it for your efforts.

Great website. Lots of useful information here. I look forward to the continuation.

1. “DO post footage that are flattering, but true to your actual look. 8. “Do understand you might be talking to other real people, no must insult, threaten, belittle! You’ll need robust pictures to get her swiping right. When sharing your private data online, you have to be very cautious. 12. “Don’t give out your personal information earlier than you meet in individual. 7. “Don’t continue to date somebody online if they refuse to get on camera and always provide you with excuses. ’ll get 1 again? More than two million data relationship again to the early 1500s have been positioned online by the University of York. In September, two males admitted their part in duping a lady out of £1.6m in the largest online dating rip-off the Met have investigated. The study confirmed that ladies tended to use extra constructive words when speaking with more desirable companions, whereas males tended to play it cool, displaying a slight decrease in positive phrases.

Men get 21 potential matches a day, while women receive a curated group of 5 or so guys who have already swiped proper. Shoot for round 70%. That leaves 30% about her, which studies have found to be essentially the most enticing ratio for an online dating profile. One study found that 80 percent of individuals misrepresent themselves or lie on their on-line profiles. 7. Profiles of people who aren’t local, especially if they solely need to meet at a hotel or other private space, needs to be approached with warning. When you’re feeling like it’s applicable, arrange a digital or in-individual meet-up to verify the particular person is who they say they are. It’s safe and simple to begin your search, signal as much as Clean Singles to search out like-minded members and meet your excellent match in the present day. Clean Singles moderates all profiles and photos, keep your personal particulars non-public and safe, and let you ship and receive messages with out having to reveal your true id. It has been round for awhile, and was redesigned just a few years back with millennial singles in thoughts.

Listen to Newsbeat dwell at 12:Forty five and 17:Forty five weekdays – or listen back right here. It could possibly develop into a full time job. Now that I consider it, has anybody tried a profile with the format of a job resume? Now I’m not saying this to scare you off. Mainly all a guy like you has to do is instantly grab her attention in a memorable way with each your profile and your messages, then spend the least amount of time doable convincing her to satisfy you in individual. This contains reading charmdate.com through your messages, responding to the ones you’d prefer to, looking at your daily matches and seeing who’s new on the site. Legislation enforcement and social media specialists say no reliable information is collected on how many violent crimes occur amongst individuals who meet in person after forming online relationships. In line with Lo, the web sites not solely encourage international citizenship, they also allow younger people in conservative international locations to decide on potential matches with greater freedom. The number of images you employ can have a huge effect in your number of matches on relationship apps. You’re representing your self in your profile, and that is the primary impression potential matches are going to see.

If you want to cease someone from contacting you, just click on on the “Block Him/Her” hyperlink at the bottom of their profile, and they will be out the best way. If they need to communicate with you, they’ll. If you wish to have a few extra virtual dates earlier than committing to an in-particular person date, that’s Okay too. Safety is crucial thing in all of this so you must do what you possibly can to ensure your safety. Whereas anyone can attain out to anyone on this app, it’s nonetheless completely different from conventional dating apps where you either swipe left or proper on a person. She’s going to finally find out what you want and dislike if you happen to make her swipe right with something more attention-grabbing. Cross-cultural (i., inter-ethnic, interracial, and inter-religious) romance can be extra probably with online dating (McDaniel, S., Tepperman, L., & Colavecchia, S. Pg. I see so many online dating/app courting profiles with out a profile textual content or have some text but no image.

That may not be excellent for the long life of consumers’ connections, but it needs to continue to profit investors’ love affair with openly traded firms like Suit Group as well as Bumble. So also if you manage to create a phony profile, there is long shot of finding individuals of your own age on one of these systems. Just how to contact a match in such a way that offers you with the ideal possibility of obtaining an action. To place it in a different way, applying the common person’s filters in concerns to discovering a suitable companion provides you much less than a 1 in 500 chance of ending up being effective. Yet with regards to making use of the proper actions to ask of someone away as well as lug on an informal initial day, points aren’t all that tough. Hundreds of individuals around the USA have actually located lasting as well as purposeful connections utilizing our on the internet dating services – don’t wait another day to set on your own up for success! Remember, nobody wants to date a Debbie or Donnie Bummer, so don’t write concerning your separation in your account, and make sure remnants of your ex do not join you on a date with a person new.

Finish the conversation by informing her one thing like, “Hey I need to go organize my sock cabinet now, nevertheless, you look like an actually enjoyable individual. Why do not we gather for a mug of coffee and also talk a lot more. Whenever are you presently readily available recently?” As quickly as you discover an event and also place to obtain together, claim one point including, “Okay, outstanding. I’ll see you on Thursday at eight thirty at Gas Coffee, after that.” By claiming the time and also area momentarily time, you solidify the location as well as time into both of one’s memories therefore it is harder for the 2 of you to neglect. Dating expert Bela Gandhi claimed something to bear in mind is that searching for love on a dating site requires dedication as well as persistence. Our professional online dating trainers will deal with you to create a distinct, personalized online dating account that will draw in the best suit for you. You can swipe right or left, depending upon whether you want the person or otherwise. Due to the fact that it is never ever an intimate setting, I think that lots of individuals would certainly think that dating a person in public is not the best solution. Kristie Jorfald, a 31-year-old celeb stylist as well as among the greater than 100 million solitary people in the U.S., informed ABC News she is relying on on-line dating this year in her look for an enchanting partner.

This research concentrates on particular niche dating sites for older grownups, among the fastest expanding specific niches in on-line dating. Through a qualitative content evaluation and also close reading of older-adult dating sites, I seek to figure out just how and also to what degree online dating websites that target older grownups actually customize their solutions to benefit this population. • We always assume for our participants prior to making any kind of changes into the solutions supplied to them. It unconditionally refuted the company sent communications in order to attract complimentary members to pay memberships. Position your order by filling in our short type. The majority of the time, a long checklist of achievements as well as prizes is likely to make you appear as an intimidating, or worse, overbearing person. The photos will certainly expose a lot about whether or not this individual can look after himself. A poorly lit car park or any out-of-the-way place is not risk-free. However, while the great memories are there a great deal of the time, we often fall short to shut out the negative memories. To make a great option, just ask on your own if you require simply a day for fun or a romantic partnership.

In this instance, the most preferred online dating services are those which do not need to be paid or provide a price cut for new customers. The market and also technology are relocating the instructions of location-based services. Three vital findings emerge: (1) using mass division, a strategy that combines elements of both mass advertising and marketing and market segmentation; (2) a strategic broadening of the limits of the older-adult niche; and (3) the use of deceitful advertising and marketing to bring in customers. These findings recommend that older-adult dating sites are, in fact, participating in pseudo-individualization. You’ll receive tips and also other handy resources that can aid you maximize your dating strategy for the results you’re looking for. With Todd’s twenty years of successful on-line dating experience, learn the secrets of “hacking” one of the most preferred dating apps while executing an approach of optimization that gets you more matches, dates and also high quality connections. There are so numerous Dating Applications available that it can be frustrating to choose one. When he saw I was worn down due to product distribution problems, he brought me a sandwich and coffee one day. Our premium online dating account production service will certainly provide you with the very best online dating profile for your selected web site, and also we’ll also supply you with in-depth mentoring that can assist you maximize your on the internet experience.

You can easily change from LatamDate complete website to mobile application. There are numerous filters on LatamDate that guys can make use of to examine out all the females on the website that fulfill their requirements. Millions of warm singles from Colombia, Brazil, El Salvador, Mexico-everywhere-raid the LatAm Day to fulfill a foreign person for a connection. It has countless members worldwide, and also about half a countless them originate from the USA. It’s finest to find to LatamDate only if you have some extreme intents. They have two functions: an icebreaker one as well as the job of making a female really feel special. Singles begin to really feel alone if they don’t have any individual to spend the cuddling period with. You’ll recognize why provider if you don’t such as for instance frills towards web site’s program. That’s right. The women on the system don’t need to wait for you. Latamdate, a global dating web site, enjoys to welcome a large group of individuals that are not happy to spend the vacations solitary to the platform. The representatives and client service will always interact to users using chat. To enter your account next time, fill in your participant ID (you will certainly receive it by means of email) or e-mail address as well as password in the LatamDate indication in food selection.

First, you need to fill out the registration kind. Latin ladies like guys who submit accounts appropriately, so you require to publish a couple of images as well as make a note of a couple of sentences concerning that you are and what you seek. They scan the accounts of you and also your prospective date as well as match individuals that have the most alike. Do you have any jokes you want to show me? An additional person has actually had a similar experience where he really felt that the person he spoke with appeared like a robot as well as the photo on the profile looked phony. If you are afraid of internet frauds as well as fake accounts, there is no demand to fret about that in instance of LatamDate. In instance you forget it, take down your password. Additionally, those customers need to provide info regarding themselves to the website, upload images, as well as share quality product that would certainly make females want to speak to them. Make certain it looks all-natural. What makes LatamDate so remarkable is that it has the simplest enrollment process on the planet! Hence, the enrollment rate on dating platforms boosts significantly during winter months. Dating systems normally concentrate on specific groups of customers; those that identify in those classifications have an opportunity to utilize those websites properly.

Why is November an Ideal Month to Register for Internet Dating Operatings Systems? New customers of dating sites need to locate a web site that matches their preferences as well as create accounts. The agents of the site welcome people from throughout the globe to join this high quality system, usage progressed interaction devices, acquire an extraordinary experience as well as discover their suitable ladies on the app. Checking out virtual scenic tours is interesting as well as enjoyable, especially for people that really did not get to travel to some top globe locations. I didn’t believe on the internet dating was for me, but as a guy living in the center of no place in the United States, I didn’t specifically meet a lot of Latin American ladies naturally. There are a great deal of solitary women registered on this system, and also a lot of them are searching for latamdate review significant relationships and also marital relationship with international males. Hereafter, he might perform his first research of the site, obtain accustomed with the methods it functions, and also inspect the girls that have their accounts there. Check out the different profiles on the website to find females that match your interests.

LatamDate com is a genuine working system where you can find great deals of wonderful accounts. Latamdate is a costs connection system that gives paid connection solutions to songs globe broad. They could go to any type of city in the globe practically while staying with each other. All those variables discuss someone’s personality; with some evaluation, this task will certainly be extremely valuable in learning more about each other while enjoying. Couples can either view films at the very same time while remaining offline or they might call as well as see movies while remaining on the phone call. Companions should recommend their preferred motion pictures as well as introduce them. Through movies, individuals can get to understand each various other much better by learning their preferences, favored categories, actors, and also their favored personalities from the films. Wish to get to understand her also better? For that factor, those that are not dating anybody already must authorize up for dating applications immediately, unless they desire to start a new year solitary. What dating choices are available to customers of this site? A stringent verification procedure is what protects against scammers from getting access to the site. For Valentine’s Day, there will certainly be special deals that will certainly facilitate the gifting treatment and also help them pick the ideal gifts for their partners.

Right away I am ready to do my breakfast, once having my

breakfast coming again to read further news.

You can definitely see your expertise within the work you write.

The sector hopes for more passionate writers such as

you who are not afraid to mention how they believe. All the time follow

your heart.

Hey there, You have done a fantastic job. I’ll definitely digg

it and personally recommend to my friends. I am sure they will be benefited from this web site.

Helpful info. Lucky me I discovered your web site unintentionally, and I’m stunned why this twist of

fate did not took place earlier! I bookmarked it.

Aw, this was an exceptionally good post. Taking the time and actual effort to generate a superb article… but what can I

say… I put things off a whole lot and never seem to get nearly anything done.

Oh my goodness! Amazing article dude! Many thanks, However

I am having problems with your RSS. I don’t understand the reason why I cannot join it.

Is there anybody having the same RSS issues? Anybody who knows the solution will you kindly respond?

Thanx!!

An impressive share! I’ve just forwarded this onto a coworker who was doing a little homework on this. And he actually ordered me lunch simply because I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanks for spending some time to talk about this topic here on your website.

Heya i am for the first time here. I came across this board and I find It truly useful & it helped me out a lot.

I hope to give something back and aid others like

you aided me.

BibisBeautyPalace,Xenia Adonts,Lena Mantler Nudes Leaks Only Fans ( https://UrbanCrocSpot.org/ )

You should be a part of a contest for one of the finest blogs on the

internet. I’m going to recommend this website!

Great web site you have here.. It’s hard to find high quality writing like yours

nowadays. I truly appreciate individuals like you! Take care!!

Hi there! I’m at work browsing your blog from my new iphone 4!

Just wanted to say I love reading through your blog and look forward to all

your posts! Keep up the fantastic work!

Undeniably believe that which you said. Your favorite reason seemed to be on the internet the simplest thing to be aware of.

I say to you, I certainly get irked while people think about worries that

they just do not know about. You managed to

hit the nail upon the top as well as defined out the

whole thing without having side-effects , people can take a signal.

Will probably be back to get more. Thanks

Thanks for sharing your thoughts about website. Regards

Hi, I think your site might be having browser compatibility issues.

When I look at your website in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that,

superb blog!

If some one wants to be updated with most up-to-date technologies then he must be pay a quick

visit this web site and be up to date every day.

Great delivery. Sound arguments. Keep up the great spirit.

I’d like to find out more? I’d want to find out more details.

What i don’t realize is actually how you are not really much more smartly-favored

than you may be right now. You are so intelligent. You already know thus considerably when it comes to this subject,

produced me for my part believe it from so many varied angles.

Its like women and men aren’t interested except it is something to do with Girl gaga!

Your individual stuffs excellent. At all times take care of it up!

Hi, i think that i saw you visited my website so i came to “return the favor”.I am attempting to find things to improve my web site!I suppose

its ok to use a few of your ideas!!

Howdy I am so thrilled I found your webpage, I really found you by mistake, while I was researching on Digg for something else, Anyways I am here now and would just

like to say many thanks for a remarkable post and a all round

enjoyable blog (I also love the theme/design), I don’t have time to read through it

all at the moment but I have saved it and also added your RSS

feeds, so when I have time I will be back to read more, Please do keep up the fantastic

job.

Hey there! I know this is kinda off topic but I was wondering

which blog platform are you using for this site?

I’m getting fed up of WordPress because I’ve had problems with hackers and I’m

looking at alternatives for another platform. I would be fantastic

if you could point me in the direction of a good platform.

I do consider all of the concepts you’ve offered for your post.

They’re really convincing and will definitely work.

Nonetheless, the posts are too quick for starters. Could you please prolong them a bit from subsequent time?

Thank you for the post.

It’s appropriate time to make some plans for

the future and it is time to be happy. I have read this post and if I

could I desire to suggest you some interesting things or

suggestions. Maybe you can write next articles referring to

this article. I desire to read more things about it!

It’s very easy to find out any matter on net as compared to textbooks, as I found this

article at this site.

Thanks for sharing your thoughts about forum lendir cirebon. Regards

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to

my blog that automatically tweet my newest twitter

updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would

have some experience with something like this. Please let me know if

you run into anything. I truly enjoy reading your blog and I look

forward to your new updates.

It’s a pity you don’t have a donate button! I’d without

a doubt donate to this outstanding blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to brand new updates and will

share this blog with my Facebook group. Talk soon!

I think this is among the so much important info for me.

And i am happy reading your article. But should remark on some common things, The site style is wonderful, the articles is truly great

: D. Good job, cheers

Definitely believe that which you said. Your favorite reason seemed to be on the

web the easiest thing to be aware of. I say to you, I definitely get annoyed while people consider worries that

they just don’t know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal.

Will probably be back to get more. Thanks

Hello There. I found your blog using msn. This is a really

well written article. I will make sure to bookmark it and come back

to read more of your useful information. Thanks for the post.

I’ll definitely return.

This excellent website truly has all of the info I needed concerning this subject and didn’t

know who to ask.

I am extremely inspired with your writing abilities as

neatly as with the structure on your weblog.

Is that this a paid subject matter or did

you modify it yourself? Either way stay up the excellent high quality writing, it

is uncommon to see a great blog like this one nowadays..

Very good article. I’m going through some of these issues as

well..

Hello! I’ve been reading your site for a long time now and finally got

the bravery to go ahead and give you a shout

out from Porter Texas! Just wanted to say keep up the great job!

I was recommended this blog by means of my cousin. I’m not positive whether this put up is written by means of him as nobody

else know such unique approximately my trouble.

You are incredible! Thanks!

Touche. Solid arguments. Keep up the great spirit.

Hello there! Would you mind if I share your blog with my facebook group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Many thanks

Hello there! This is my first comment here so I just wanted to give a quick shout out and tell you

I truly enjoy reading through your posts. Can you suggest any

other blogs/websites/forums that cover the same topics?

Thank you!

Have you ever thought about including a little bit

more than just your articles? I mean, what you say is important and

everything. Nevertheless think about if you added some great

images or video clips to give your posts more, “pop”!

Your content is excellent but with images

and video clips, this site could certainly be one of the very best in its niche.

Good blog!

What’s up, after reading this remarkable paragraph i am too glad

to share my know-how here with colleagues.

Appreciate this post. Will try it out.

I was pretty pleased to discover this great site. I wanted to thank you

for ones time just for this wonderful read!! I definitely appreciated every part of it and I have you saved as a favorite to

check out new information on your site.

I’m extremely inspired with your writing talents and also with the structure to your blog.

Is this a paid subject or did you customize it your self?

Either way keep up the excellent high quality writing, it is uncommon to look

a great weblog like this one nowadays..

Hello there! Would you mind if I share your blog with my zynga group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Thank you

Hey there, I think your website might be having browser compatibility issues.

When I look at your blog in Opera, it looks fine but

when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, awesome

blog!

Nice post. I used to be checking constantly this blog and I’m impressed!

Extremely useful information particularly the ultimate phase 🙂 I take care of such information much.

I was looking for this certain info for a very long time.

Thank you and best of luck.

Hi there! I’m at work browsing your blog from my new

iphone! Just wanted to say I love reading through your blog and look forward to

all your posts! Keep up the outstanding work!

I every time spent my half an hour to read this webpage’s posts every day along with a mug of coffee.

Someone necessarily help to make seriously articles I might

state. That is the very first time I frequented your website page and so far?

I amazed with the research you made to create this particular post

incredible. Excellent task!

An impressive share! I have just forwarded this onto a coworker who was conducting a little homework on this.

And he actually ordered me lunch simply because I found it for him…

lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanks for spending time to discuss this subject here on your internet site.

I do consider all the ideas you’ve presented in your post.

They are really convincing and will definitely work. Still, the posts are very short for

beginners. May just you please extend them a little from subsequent time?

Thanks for the post.

This post is actually a good one it assists new the web viewers, who are wishing in favor of blogging.

That is a very good tip particularly to those new to the blogosphere.

Brief but very precise information… Appreciate your sharing this one.

A must read post!

Have you ever considered writing an e-book or guest authoring on other sites?

I have a blog based upon on the same subjects you discuss and would love to have you share some stories/information. I know my subscribers would appreciate your work.

If you are even remotely interested, feel free to send me an email.

Wow, this article is pleasant, my sister is analyzing such things, so I am going to convey her.

Good day very nice web site!! Guy .. Excellent ..

Superb .. I’ll bookmark your blog and take the feeds also?

I’m satisfied to search out numerous helpful information right here within the

post, we want work out more techniques on this regard, thanks for sharing.

. . . . .

It’s going to be end of mine day, but before finish I

am reading this enormous paragraph to increase my know-how.

Wow, this paragraph is good, my younger sister is analyzing these things,

so I am going to inform her.

Hey I know this is off topic but I was wondering if you knew

of any widgets I could add to my blog that automatically tweet my newest

twitter updates. I’ve been looking for a plug-in like this for

quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy

reading your blog and I look forward to your new updates.

I visited many blogs but the audio quality for audio songs current at this website is really excellent.

I’m really loving the theme/design of your blog.

Do you ever run into any browser compatibility problems?

A couple of my blog audience have complained about my website not operating correctly in Explorer but looks great in Firefox.

Do you have any ideas to help fix this problem?

Hi, i think that i noticed you visited my web site thus i got here to return the choose?.I’m attempting to find issues to improve my web site!I suppose

its ok to use a few of your concepts!!

Hi! I know this is kinda off topic but I was wondering if

you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

Great article. I’m dealing with some of these issues as well..

Great post. I was checking constantly this blog and I’m

inspired! Extremely helpful information particularly the

closing part 🙂 I deal with such information a lot. I used to be seeking this certain info for a long time.

Thank you and good luck.

These are in fact wonderful ideas in about blogging. You have touched some good points here.

Any way keep up wrinting.

We are a bunch of volunteers and starting a brand new scheme in our community.

Your website provided us with helpful info to work on. You

have done an impressive job and our entire neighborhood will likely be thankful to you.

If some one wants to be updated with latest technologies afterward he

must be go to see this web page and be up to date all the time.

I just like the helpful info you provide for your articles.

I will bookmark your blog and take a look at

once more right here frequently. I am moderately sure I will learn lots of new

stuff right here! Good luck for the following!

I used to be able to find good info from your content.

I have read several excellent stuff here. Certainly value bookmarking for revisiting.

I wonder how a lot attempt you put to make the sort of wonderful informative website.

Hi just wanted to give you a brief heads up and let you know

a few of the pictures aren’t loading correctly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same results.

Everyone loves what you guys are usually up too.

Such clever work and exposure! Keep up the

awesome works guys I’ve included you guys to my blogroll.

It’s actually a nice and helpful piece of information. I am glad that

you shared this helpful info with us. Please keep us informed like this.

Thanks for sharing.

Hi there, yeah this article is in fact good and I have learned lot of things

from it regarding blogging. thanks.

Fastidious replies in return of this question with genuine arguments and explaining all about that.

I think this is among the most significant information for me.

And i am glad reading your article. But wanna remark on some general things, The site style is ideal, the

articles is really nice : D. Good job, cheers

Heya i am for the first time here. I found this board and I

in finding It really helpful & it helped me out much.

I’m hoping to provide one thing again and aid others like you helped

me.

Today, I went to the beach with my children. I found a sea shell and gave it to my

4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

It’s very effortless to find out any matter on web as compared to textbooks, as I found this post at this web page.

I every time emailed this website post page to all my

associates, for the reason that if like to read

it afterward my links will too.

I think that is one of the such a lot significant information for me.

And i’m glad studying your article. But wanna statement on few normal things, The web site taste is ideal, the articles is in reality great : D.

Excellent job, cheers

Today, while I was at work, my sister stole my iPad and tested

to see if it can survive a 30 foot drop, just so she can be a youtube sensation.

My iPad is now destroyed and she has 83 views. I know this is completely off topic but I

had to share it with someone!

This page really has all of the information and facts I needed about this subject and didn’t know who

to ask.

I truly love your site.. Very nice colors & theme.

Did you develop this site yourself? Please reply back as I’m

planning to create my very own blog and would love to learn where you

got this from or exactly what the theme is called.

Appreciate it!

This is very attention-grabbing, You are an overly skilled blogger.

I have joined your feed and look ahead to seeking more of your

fantastic post. Also, I have shared your site in my social networks

Hello, I check your blog like every week. Your writing style is awesome, keep doing what you’re doing!

Good post. I learn something new and challenging on websites I stumbleupon on a daily basis.

It will always be useful to read through content from other authors and use something from other sites.

hello there and thank you for your info – I’ve certainly picked up something new from right here.

I did however expertise some technical points using this website,

as I experienced to reload the site lots of times previous

to I could get it to load properly. I had been wondering if your web hosting is OK?

Not that I’m complaining, but slow loading

instances times will very frequently affect your placement in google and can damage your high-quality score if ads and

marketing with Adwords. Anyway I am adding this RSS to my email and could look out for a lot more of your

respective intriguing content. Make sure you update this again soon.

Attractive element of content. I simply stumbled upon your web site and

in accession capital to assert that I get in fact loved

account your weblog posts. Any way I’ll be subscribing on your feeds or even I fulfillment you get right of entry to consistently quickly.

Pretty! This was a really wonderful article. Many

thanks for providing these details.

Hi just wanted to give you a brief heads up and let you know a few of the images aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers

and both show the same outcome.

When someone writes an piece of writing he/she retains the thought of a

user in his/her brain that how a user can know it.

Thus that’s why this article is great. Thanks!

Greetings! Very helpful advice in this particular article!

It’s the little changes that will make the largest changes.

Thanks for sharing!

If you would like to obtain a great deal from this paragraph then you have to apply such

strategies to your won website.

I’m more than happy to find this web site. I wanted to thank you for your time

due to this wonderful read!! I definitely loved every part of it and i also have you saved as a favorite

to look at new information in your website.

My programmer is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the expenses. But he’s tryiong none the less.

I’ve been using Movable-type on several websites for about

a year and am concerned about switching to another platform.

I have heard great things about blogengine.net. Is there a way I can import

all my wordpress content into it? Any help would be really appreciated!

Hi! This is my first visit to your blog! We are a team of

volunteers and starting a new initiative in a community in the same niche.

Your blog provided us useful information to work on. You have done a wonderful job!

I quite like reading a post that can make people think.

Also, many thanks for allowing for me to comment!

First off I want to say terrific blog! I had a quick question that

I’d like to ask if you do not mind. I was curious to know how you center yourself and clear your head before writing.

I have had a tough time clearing my thoughts in getting my

ideas out. I do take pleasure in writing however it just

seems like the first 10 to 15 minutes are generally wasted

simply just trying to figure out how to begin. Any ideas or

tips? Appreciate it!

Have you ever thought about writing an ebook or guest

authoring on other websites? I have a blog based upon on the same subjects you discuss and would really like

to have you share some stories/information. I know my viewers would value

your work. If you are even remotely interested, feel free to shoot me an email.

Definitely consider that that you stated. Your favourite justification appeared to be on the net the simplest thing

to have in mind of. I say to you, I certainly get irked whilst folks think about worries

that they just don’t realize about. You controlled to hit

the nail upon the highest and also outlined out the whole thing

without having side effect , other people could take a signal.

Will probably be again to get more. Thank you

With havin so much content do you ever run into any issues of plagorism or copyright infringement?

My blog has a lot of unique content I’ve either written myself or outsourced but it looks like a lot of it is popping it

up all over the internet without my permission. Do you know any techniques to help prevent content from being ripped off?

I’d definitely appreciate it.

Fantastic goods from you, man. I’ve understand your stuff previous to and you’re just

extremely great. I really like what you have acquired here, certainly like what you are stating and the

way in which you say it. You make it entertaining and you

still take care of to keep it wise. I can not wait to read much more from you.

This is actually a great website.

I was wondering if you ever considered changing the layout of your website?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with

it better. Youve got an awful lot of text for only having 1

or two pictures. Maybe you could space it out

better?

Excellent post. I was checking constantly this blog and I am impressed!

Extremely helpful information specially the

last part 🙂 I care for such info a lot. I was seeking this certain information for a long time.

Thank you and good luck.

Hello I am so excited I found your weblog, I really found you by error, while I was

browsing on Digg for something else, Anyways I am here now and

would just like to say thanks for a remarkable post and a all round entertaining blog

(I also love the theme/design), I don’t have time to read it all at the minute but I have bookmarked it and also included your

RSS feeds, so when I have time I will be back to read a lot more,

Please do keep up the fantastic work.

Excellent pieces. Keep posting such kind of info on your page.

Im really impressed by your site.

Hello there, You have performed an excellent job. I’ll certainly

digg it and in my view recommend to my friends.

I am confident they will be benefited from this site.

Excellent items from you, man. I have be mindful your stuff previous to and you

are just extremely fantastic. I actually like what you’ve received right here, really like what you are stating and the

best way by which you say it. You’re making it entertaining and you continue to take care of to keep it

smart. I can not wait to learn much more from you. This

is actually a great website.

Pretty! This was a really wonderful article. Thank you for providing this info.

Oh my goodness! Amazing article dude! Many thanks, However I am experiencing difficulties with your RSS.

I don’t know the reason why I can’t subscribe to it.

Is there anyone else getting the same RSS issues?

Anybody who knows the solution will you

kindly respond? Thanx!!

This is very interesting, You are a very skilled blogger.

I’ve joined your feed and look forward to seeking

more of your great post. Also, I’ve shared your

site in my social networks!

Wow, marvelous blog layout! How long have

you been blogging for? you made blogging look easy.

The overall look of your site is magnificent, let alone the content!

My partner and I stumbled over here by a different page and thought I might check

things out. I like what I see so i am just following

you. Look forward to finding out about your web page yet

again.

Good post! We are linking to this particularly great content on our website.

Keep up the good writing.

This site was… how do I say it? Relevant!!

Finally I’ve found something that helped me.

Thank you!

Pretty nice post. I simply stumbled upon your weblog and wanted to say that I have

truly enjoyed surfing around your weblog posts.

In any case I will be subscribing for your feed and I hope you write once more

very soon!

I could not resist commenting. Well written!

Hello there, just became aware of your blog through Google,

and found that it is truly informative. I am going to watch out for

brussels. I’ll appreciate if you continue this in future.

Lots of people will be benefited from your writing.

Cheers!

Appreciating the persistence you put into your site and in depth information you provide.

It’s awesome to come across a blog every once in a while that isn’t the same

unwanted rehashed information. Great read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Can you tell us more about this? I’d care to find out some additional information.

Asking questions are truly nice thing if you are not understanding something totally, however this paragraph presents fastidious understanding even.

Just want to say your article is as astounding.

The clarity in your post is just nice and i could assume you are an expert on this subject.

Well with your permission let me to grab your RSS feed to keep updated with forthcoming post.

Thanks a million and please keep up the rewarding work.

Hello would you mind letting me know which web host you’re utilizing?

I’ve loaded your blog in 3 different internet browsers and I must say

this blog loads a lot quicker then most. Can you recommend a good internet hosting provider at a fair price?

Thanks a lot, I appreciate it!

Hello! Quick question that’s completely off topic. Do

you know how to make your site mobile friendly? My site looks weird when viewing from my iphone4.

I’m trying to find a theme or plugin that might be able to resolve

this problem. If you have any suggestions, please share.

Cheers!

Hey there! This is my 1st comment here so I just wanted to give

a quick shout out and say I genuinely enjoy reading

your blog posts. Can you suggest any other blogs/websites/forums that deal with the same subjects?

Thanks a ton!

I’ll right away snatch your rss feed as I can not in finding your e-mail subscription link or newsletter service.

Do you’ve any? Please permit me recognize in order that I may just

subscribe. Thanks.

fantastic publish, very informative. I’m wondering why the opposite experts of this sector don’t

realize this. You should continue your writing. I am sure,

you have a great readers’ base already!

I am actually happy to glance at this webpage posts which consists of lots of helpful data, thanks for providing

these statistics.

Just desire to say your article is as amazing. The clarity in your post is

simply excellent and i can assume you are an expert on this

subject. Well with your permission allow me to grab your RSS feed to

keep up to date with forthcoming post. Thanks a million and

please continue the rewarding work.

If you wish for to obtain a great deal from this paragraph then you have

to apply such techniques to your won blog.

Heya i am for the first time here. I came across this board and I find It really useful & it helped me

out a lot. I hope to give something back and help others like you helped me.

What’s up to every one, the contents existing at this web site

are truly remarkable for people experience, well, keep up the nice work fellows.

I visited many blogs however the audio quality for audio songs

existing at this web page is in fact wonderful.

Hi, just wanted to say, I enjoyed this article. It was

funny. Keep on posting!

Simply want to say your article is as surprising.

The clearness in your submit is simply nice and that i

can assume you’re a professional in this subject.

Fine with your permission let me to take hold of your RSS feed to keep updated with impending post.

Thank you a million and please keep up the rewarding work.

Thanks for sharing your thoughts about forum lendir tangerang.

Regards

I’ve been surfing on-line greater than three hours

as of late, yet I never discovered any attention-grabbing article like yours.

It is pretty worth enough for me. In my view, if

all web owners and bloggers made good content as you probably did, the net will be much more

useful than ever before.

Thanks for sharing your thoughts about forumsemprot.

Regards

Now I am going away to do my breakfast, when having

my breakfast coming yet again to read further news.

Touche. Sound arguments. Keep up the amazing effort.

It’s nearly impossible to find experienced people for this subject, however, you sound like

you know what you’re talking about! Thanks

Heya i am for the first time here. I came across this board

and I find It truly useful & it helped me out a lot.

I hope to give something back and aid others like you

aided me.

It’s actually a cool and useful piece of info. I’m satisfied that

you shared this helpful info with us. Please stay us up to date

like this. Thank you for sharing.

Today, while I was at work, my cousin stole my iphone and tested to see if it can survive a thirty foot drop, just so she can be a youtube

sensation. My iPad is now broken and she has 83 views. I know this is entirely off topic but

I had to share it with someone!

Right away I am going away to do my breakfast,

once having my breakfast coming over again to read more news.

Wonderful beat ! I wish to apprentice while you amend your website, how can i subscribe

for a blog web site? The account aided me a

applicable deal. I had been a little bit familiar of this your

broadcast provided vivid transparent concept

Hey just wanted to give you a quick heads up. The

text in your content seem to be running off the screen in Chrome.

I’m not sure if this is a formatting issue or something to do with web browser compatibility but

I figured I’d post to let you know. The style and design look great though!

Hope you get the issue fixed soon. Cheers

An outstanding share! I’ve just forwarded this onto a coworker who

was conducting a little research on this. And he in fact ordered

me lunch because I found it for him… lol. So

allow me to reword this…. Thank YOU for the meal!!

But yeah, thanks for spending the time to discuss this issue here on your site.

Great article. I’m dealing with many of these issues as well..

This is my first time pay a visit at here and i am truly pleassant to read everthing at single place.

excellent issues altogether, you just gained

a emblem new reader. What would you suggest about your publish that you simply made a few days ago?

Any sure?

Ahaa, its pleasant dialogue about this article here at this

website, I have read all that, so now me also commenting at this

place.

This article presents clear idea in favor of the new viewers of blogging,

that truly how to do blogging and site-building.

For most up-to-date news you have to pay a visit world-wide-web and

on web I found this website as a finest website for latest updates.

Thanks to my father who stated to me regarding this blog, this website is in fact amazing.

It is the best time to make some plans for the future and it is time to be happy.

I’ve read this post and if I could I desire to suggest you few

interesting things or advice. Maybe you can write

next articles referring to this article. I wish to read even more things about it!

Pretty nice post. I just stumbled upon your blog and wanted to say that

I’ve truly enjoyed surfing around your blog posts.

After all I will be subscribing to your rss feed and I hope you write again very

soon!

Usually I do not learn post on blogs, but I would like to say that

this write-up very compelled me to try and do it!

Your writing style has been surprised me. Thank you, quite great article.

Hi, i think that i saw you visited my web site so

i got here to go back the choose?.I’m trying to in finding things to

improve my web site!I guess its good enough to use some of your

ideas!!

I have read some just right stuff here. Certainly price bookmarking for revisiting.

I surprise how much effort you set to make this sort of wonderful informative website.

Excellent article. I definitely appreciate this site. Thanks!

Right here is the right site for anybody who would like to understand this

topic. You know so much its almost hard to argue with you (not that I actually would want to…HaHa).

You definitely put a fresh spin on a subject that’s been written about for ages.

Excellent stuff, just excellent!

I am genuinely grateful to the owner of this website who has shared this impressive piece of writing at

at this time.

Hi i am kavin, its my first occasion to commenting anyplace, when i read this paragraph i thought

i could also make comment due to this brilliant post.

I couldn’t resist commenting. Very well written!

Good day! I know this is kinda off topic but I was wondering if you

knew where I could locate a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

Cool blog! Is your theme custom made or did you download it from somewhere?

A theme like yours with a few simple tweeks would really make

my blog jump out. Please let me know where you got your theme.

Thanks a lot

Hi there colleagues, pleasant post and pleasant urging commented at this place, I am actually enjoying

by these.

I simply couldn’t depart your site prior to suggesting that I actually loved the

standard information a person supply for your guests?

Is going to be again continuously to inspect new posts

I’m curious to find out what blog system you are using?

I’m experiencing some minor security problems with my latest

blog and I’d like to find something more risk-free. Do you

have any solutions?

What’s up to every body, it’s my first go to see of this webpage; this weblog contains awesome and in fact

fine information in favor of readers.

What’s up to all, how is everything, I think every one is getting

more from this site, and your views are nice for

new visitors.

Hi, just wanted to say, I liked this blog post.

It was practical. Keep on posting!

Very good site you have here but I was wanting to know if you knew of any message boards that cover

the same topics talked about here? I’d really love to

be a part of online community where I can get opinions from other

knowledgeable individuals that share the same interest.

If you have any suggestions, please let me know.

Thanks!

This article presents clear idea in favor of the new viewers of blogging,

that truly how to do blogging and site-building.

Pretty component of content. I just stumbled upon your

web site and in accession capital to say that I acquire

in fact loved account your blog posts. Any way I’ll be subscribing on your augment or even I achievement

you get entry to persistently rapidly.

It’s amazing designed for me to have a web site, which is

valuable in favor of my knowledge. thanks admin

Amazing things here. I’m very satisfied to look your post.

Thanks so much and I’m having a look forward to contact you.

Will you kindly drop me a mail?

It’s not my first time to go to see this web site,

i am browsing this web page dailly and take fastidious data from here daily.

I really like reading a post that can make men and women think.

Also, thanks for permitting me to comment!

Wonderful blog! I found it while browsing on Yahoo News.

Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a

while but I never seem to get there! Cheers

Hurrah, that’s what I was seeking for, what a information!

existing here at this web site, thanks admin of this web page.

I’m amazed, I have to admit. Seldom do I come across a blog that’s both educative and

entertaining, and let me tell you, you have hit the nail on the head.

The issue is something that too few people are speaking intelligently about.

I’m very happy that I came across this during my search for something regarding this.

Hi there to every one, it’s really a nice for me to pay a quick visit this website,

it consists of important Information.

We are a bunch of volunteers and starting a new scheme

in our community. Your website provided us with helpful info to work on. You’ve performed a formidable activity and our whole group

will probably be grateful to you.

Hello every one, here every person is sharing such experience, so it’s pleasant to read this web site,

and I used to go to see this weblog everyday.

Very shortly this site will be famous amid all blogging and site-building

visitors, due to it’s good articles

I go to see each day some sites and blogs to read articles or reviews, except

this weblog presents feature based writing.

Hey there, You’ve done an excellent job. I’ll certainly digg it and personally suggest to my friends.

I’m confident they will be benefited from this site.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you!

By the way, how could we communicate?

Hey there! I could have sworn I’ve been to this blog before

but after reading through some of the post I realized it’s new to

me. Anyhow, I’m definitely delighted I found it and I’ll be bookmarking and checking back

frequently!

I am not sure where you’re getting your information, but great topic.

I needs to spend some time learning much more or understanding more.

Thanks for fantastic information I was looking for this information for my mission.

There is definately a lot to learn about this subject. I love all of the points you’ve made.

Awesome things here. I’m very happy to see your article.

Thank you so much and I am looking forward to contact you.

Will you please drop me a e-mail?

Thank you, I’ve just been searching for information approximately this subject for a long time

and yours is the best I’ve came upon so far. However,

what concerning the bottom line? Are you positive in regards to the supply?

This piece of writing is genuinely a nice one it assists new

net people, who are wishing for blogging.

Great delivery. Great arguments. Keep up the good work.

This page really has all the information I

needed about this subject and didn’t know who to ask.

I am in fact happy to glance at this blog posts which contains plenty of valuable

information, thanks for providing these kinds of

information.

With havin so much written content do you ever run into any problems of plagorism or copyright infringement?

My blog has a lot of unique content I’ve either written myself or

outsourced but it looks like a lot of it is popping it up all over the internet without my permission. Do you know any techniques to help prevent content from being ripped off?

I’d definitely appreciate it.

Hello very cool web site!! Guy .. Beautiful .. Wonderful

.. I’ll bookmark your web site and take the feeds also?

I am satisfied to find numerous helpful info here within the post, we’d like work out more strategies on this regard, thanks for sharing.

. . . . .

Hi, i read your blog from time to time and i own a similar one and i was just curious if you

get a lot of spam feedback? If so how do you prevent it, any plugin or anything you can suggest?

I get so much lately it’s driving me crazy so any help is very much appreciated.

I’d like to thank you for the efforts you’ve put in penning this blog.

I am hoping to view the same high-grade blog posts by you in the future as well.

In truth, your creative writing abilities has inspired

me to get my own, personal website now 😉

What’s Going down i am new to this, I stumbled upon this I’ve found

It positively useful and it has aided me out loads. I hope to contribute

& help other customers like its helped me. Good job.

Hmm it looks like your blog ate my first comment (it was super long)

so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new to

the whole thing. Do you have any recommendations for newbie blog writers?

I’d really appreciate it.

Incredible quest there. What happened after? Thanks!

Appreciate the recommendation. Will try it out.

Paragraph writing is also a fun, if you be acquainted with after that you can write if not

it is difficult to write.

Why people still make use of to read news papers when in this technological world all is existing on web?

Normally I do not learn article on blogs, however I wish to

say that this write-up very pressured me to take a look at and do so!

Your writing style has been amazed me. Thanks, very great

article.

Nice weblog here! Also your website lots up very

fast! What host are you the usage of? Can I am

getting your associate link to your host? I wish my

web site loaded up as quickly as yours lol

Greetings! Very useful advice within this post!

It is the little changes that produce the biggest changes.

Thanks a lot for sharing!

Fastidious response in return of this matter

with firm arguments and describing everything about that.

I’m gone to say to my little brother, that he should also visit this website on regular basis to obtain updated from newest reports.

Hello there, I found your web site by way of Google

whilst looking for a related matter, your web site got here up,

it appears good. I’ve bookmarked it in my google bookmarks.

Hello there, just changed into alert to your blog thru Google,

and found that it’s truly informative. I’m gonna watch out for brussels.

I will appreciate in case you continue this in future.

Many people will likely be benefited from your writing.

Cheers!

If you would like to increase your experience just keep visiting this web site and be updated with the hottest news posted

here.

I think the admin of this web page is really working hard in support of his web page, as here every stuff is quality based information.

Aw, this was a very good post. Spending some time and actual effort

to produce a superb article… but what can I say… I put things

off a whole lot and don’t manage to get anything done.

It’s truly very difficult in this active life

to listen news on Television, so I simply use the web for that purpose, and obtain the

most up-to-date news.

It is really a great and helpful piece of info.

I’m satisfied that you shared this helpful info with us.

Please stay us informed like this. Thank you for sharing.

Do you have a spam issue on this blog; I also am

a blogger, and I was wanting to know your situation; we have created some nice procedures and we are

looking to trade methods with other folks, please shoot me

an e-mail if interested.

Heya i am for the first time here. I came across this board and I find It truly useful & it helped me

out much. I hope to give something back and aid others like you helped me.

Howdy would you mind stating which blog platform you’re using?

I’m looking to start my own blog soon but I’m having

a difficult time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking

for something completely unique. P.S Apologies for getting off-topic but I had to ask!

Hello, of course this post is genuinely pleasant and I

have learned lot of things from it about blogging. thanks.

This design is wicked! You obviously know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my

own blog (well, almost…HaHa!) Excellent job. I

really loved what you had to say, and more than that,

how you presented it. Too cool!

Hello! I understand this is sort of off-topic but I needed to ask.

Does running a well-established website like yours require

a large amount of work? I am brand new to operating

a blog however I do write in my diary on a daily basis. I’d like to start a blog so I

can share my own experience and thoughts online.

Please let me know if you have any kind of suggestions or tips for new aspiring

bloggers. Thankyou!

Hi there! I could have sworn I’ve been to this

blog before but after checking through some of the post I

realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be book-marking and checking back often!

It’s a shame you don’t have a donate button! I’d without a doubt donate

to this fantastic blog! I suppose for now i’ll settle for

book-marking and adding your RSS feed to my Google account.

I look forward to brand new updates and will talk about this blog with my Facebook group.

Talk soon!

I think what you published was actually very logical.

However, consider this, suppose you added a little content?

I mean, I don’t wish to tell you how to run your website, but suppose you

added a title that makes people want more? I mean Dear Industry:

History Will Not Repeat Itself – Tech.pinions is kinda boring.

You could glance at Yahoo’s home page and watch how they create post titles to grab viewers interested.

You might try adding a video or a picture or two to grab

readers excited about everything’ve got to say.

In my opinion, it would bring your posts a little bit more interesting.

Very nice article, totally what I was looking for.

I used to be recommended this blog through my cousin. I am not

certain whether this post is written via him as no one else

recognize such unique about my problem. You are incredible!

Thanks!

you’re actually a excellent webmaster. The site loading velocity is incredible.

It kind of feels that you are doing any distinctive trick.

Also, The contents are masterpiece. you have performed a wonderful activity in this topic!

Heya i’m for the first time here. I came across this

board and I find It really useful & it helped me out a lot.

I hope to give something back and help others like you helped me.

You really make it appear so easy along with your presentation however I

to find this topic to be actually one thing that I believe I’d never understand.

It seems too complicated and very extensive for me.

I am looking ahead in your next submit, I’ll try to get the grasp of it!

Why people still make use of to read news papers

when in this technological globe everything is existing on net?

I’m not sure why but this website is loading very slow for me.

Is anyone else having this problem or is it a

problem on my end? I’ll check back later and see if the problem still exists.

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a

designer to create your theme? Great work!

Excellent post. I was checking continuously this blog and I am impressed!

Very helpful info specially the last part 🙂 I care for such info much.

I was looking for this certain info for a long time. Thank you and best of luck.

I would like to thank you for the efforts you’ve put in writing

this site. I’m hoping to view the same high-grade blog posts from

you later on as well. In fact, your creative writing abilities has motivated me to get my own, personal blog now 😉

I’m not sure exactly why but this site is loading incredibly

slow for me. Is anyone else having this issue or is it a issue

on my end? I’ll check back later and see if the problem still

exists.

It’s nearly impossible to find educated people in this particular subject, however,

you seem like you know what you’re talking about! Thanks

Thank you, I’ve just been looking for information about this subject for a while and yours is the

greatest I’ve came upon till now. But, what in regards

to the bottom line? Are you certain in regards to the supply?

Admiring the time and energy you put into your blog

and detailed information you offer. It’s great to come

across a blog every once in a while that isn’t the same out of date

rehashed information. Fantastic read! I’ve bookmarked your site and I’m adding

your RSS feeds to my Google account.

Admiring the commitment you put into your site and in depth information you provide.

It’s great to come across a blog every once in a while that

isn’t the same outdated rehashed material. Fantastic read!

I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

It’s hard to come by well-informed people about this subject, however, you seem like you know what you’re talking about!

Thanks

I’m not sure exactly why but this site is loading very slow for me.

Is anyone else having this problem or is it a issue on my end?

I’ll check back later on and see if the problem still exists.

Thanks for ones marvelous posting! I genuinely enjoyed reading it, you could be a great author.I will remember to bookmark

your blog and will come back very soon. I want to encourage you to definitely continue your

great posts, have a nice weekend!

I loved as much as you’ll receive carried out right here. The sketch is tasteful,

your authored subject matter stylish. nonetheless, you command get got an edginess over that