Amazon surprised investors last week with a bigger, and better than expected, quarter, blowing through estimates and sparking a sharp rise in its share price. However, while much of the focus has been on the impact of the dramatic growth and increased margins of the AWS business, that doesn’t tell the whole story. For Tech.pinions Insiders today, I’m going to run through some of the key numbers from Amazon’s big quarter to illustrate why.

AWS was a major factor

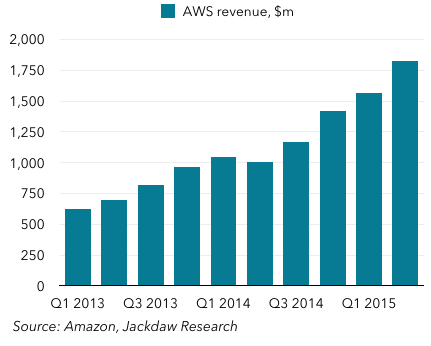

Whatever else contributed, it’s clear AWS did have a big impact on performance in Q2. The chart below shows revenues for AWS over the past two years or so (all the charts in this piece come from my Quarterly Decks subscription service):

As you can see, revenue growth has accelerated over the past year or so and this is now a $5 billion a year business and growing rapidly. But AWS also made an outsized contribution to margins – though it’s just 8% or so of Amazon’s revenues, it contributed $391 million to operating income, compared with $703 million for the North American segment, whose revenues are about seven times larger. It’s easy to see why many observers have credited AWS with both the strong revenue growth and the stronger margins this quarter, but it’s really not the whole story.

Seller units continue to have an impact

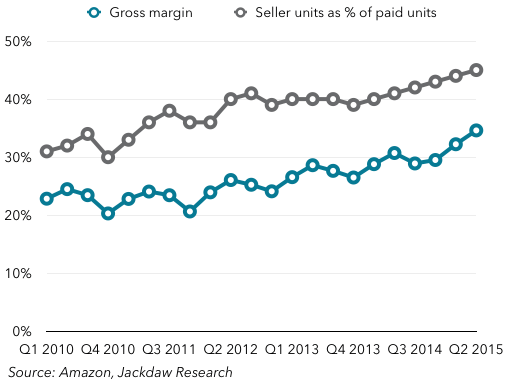

One of the things far less talked about but nonetheless also very significant to Amazon’s performance over the past several years is the growth of the third-party fulfillment business. The only real measure Amazon provides of the growth of this business is seller units as a percentage of total units sold (i.e. the proportion of all goods sold through Amazon which come from third parties rather than through Amazon itself). This number, as it turns out, tracks very closely to gross margins at Amazon:

As you can see, there’s a significant correlation between the growth in these two numbers over the past five years. Why? It’s quite simple: for its own sales, Amazon reports both the cost of the goods sold and the amount paid by customers for those goods. But for these third-party sales, it essentially only reports the fulfillment costs and revenue, which tend to have a far higher margin than Amazon’s own product sales. As a result, the increasing mix of third party units is driving gross margin up. Over the past few quarters, this correlation has become less clear, as AWS growth has begun to have a more significant impact on margins. However, the two combined are accelerating gross margin growth even further. As you can see during this period, Amazon’s gross margins have risen from the low 20s to the mid-30s and are, if anything, accelerating.

A bump in overall units

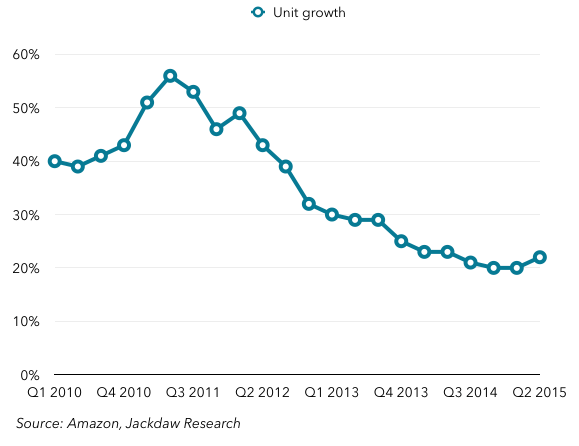

It’s also worth noting Q2 is typically a low quarter for Amazon – its lowest of the year, in fact. But this Q2 was actually up on Q1. Yes, AWS was again a contributor, but another contributor was the fact growth in total units actually sped up for the first time in a long time, as you can see in the chart below, which shows year-on-year unit growth:

It’s just a little blip for now – you can see it right at the end of the line that’s otherwise been trending downwards and then flat for a couple of quarters. But this unit growth, which was likely a mix of Amazon’s own and third-party unit growth, helped contribute to revenue growth too.

The margin question

Of course, with Amazon, the discussion always comes back to margins eventually. We’ve already seen AWS has outsized margins, but we’ve also seen seller units drive gross margins up and have done so fairly significantly over the last few years. Why then have operating margins and net margins not gone up by the same 10-15% over that period? The reason is simple: heavy investment, both in fulfillment centers to support the core e-commerce business, data centers, and related infrastructure for the AWS business. Depreciation and amortization has risen significantly at Amazon over that period, from under 2% of revenue five years ago to over 5% in the past few quarters. In essence, Amazon keeps reinvesting the gross margins into the infrastructure it needs to fund continued growth. In the AWS business, that investment is enormous, though the way Amazon accounts for it in its reported finances is a bit opaque and Amazon clearly believes it’s sustainable. But the end result of all this is, while gross margins have grown significantly, operating and net margins have remained largely unchanged until the last three quarters, when they’ve risen slightly:

But that margin picture is still the result of a mix of very different margins from Amazon’s three reported segments: AWS, where operating margins are now in the 20s; North America, with margins in the low-to-mid single digits; and International, where margins are fairly consistently a little in the red. I’ve written before about my skepticism about Amazon’s international business and my views haven’t really changed on this point. But overall, Amazon continues to be a fascinating experiment in mixing very different businesses, where the business that’s now performing the best is the one furthest removed from Amazon’s traditional core, and where the business Amazon started with – selling books and other media – is now the worst performing from a revenue growth perspective (declining by low single digits year on year).

I’m always a bit bemused at how assets sometimes of the intangible but mostly of the tangible kind are viewed as a Bad Thing.

Granted, making money out of nothing is better. But failing that, making money out of having big machines, the people to operate them, and the management to coordinate all that does not seem *that* bad: at the very least the time, investment, capital, know-how,… are barriers to entry ?

I can’t help but thing that, same as Amazon leveraged their Web know-how into AWS, they will leverage both the logistics and local presence webs they initially developed only for themselves in very profitable ways.

If I understand correctly, isn’t this exactly what their “third-party fulfillment business” (“seller units”) is? In fact, Jan shows “seller units” quickly approaching 50% of total units sold, which suggests that pretty soon, Amazon will be selling more from third-parties than from itself.

I don’t quite understand the details of Amazon’s third party business so I might be wrong, but it seems as if Amazon is no longer really interested in retail as a whole, but is instead trying to be a logistics and IT infrastructure provider.

Do you think this is an accurate understanding of where Amazon is heading? Why would Amazon de-emphasise retail and move into the services that would empower others to do retail easily? Is it simply a profit margin issue, or are there other financial merits to doing so?

I don’t think Amazon is de-emphasizing retail – it’s still a massive part of its business, and provides much needed scale that allows AWS to operate at such high margins. It’s conceivable that in time Amazon might decide to decouple the two and split the company, but for now one of the major reasons AWS is so profitable – at least on paper – is that Amazon runs all its own systems on AWS too. Take away that scale and it would suddenly become a lot less profitable. Amazon could potentially build enough scale from third party users to be able to break that link in time, but I don’t see that happening anytime soon.

Of course, 3rd party seller economics work the same way – many of those sales (40% or so) use fulfillment by Amazon too, which also benefits from all the investment Amazon has made to support its first party sales.

in short, these three businesses are all closely tied together, and at least for now it’d be very tough to separate them without massively impacting margins.

How much information do you have about AWS’s profits compared to Azure, etc. and are you sure that the way costs are allocated paint an accurate picture?

I have a bit of issue with the statement that Amazon’s retail business is what allows them to reduce costs on AWS. If this were the case, then Google would certainly be able to provide a very cheap AWS-clone, as would Microsoft, Facebook and maybe even Apple (with CloudKit). Do you know, for example, what percentage of AWS capacity is being used to run Amazon’s retail business as compared to 3rd-party sites? I do not expect it to be very big.

We have essentially no information about the other cloud providers’ profitability but Amazon does at least break out profits for AWS now.

If you look into the history of AWS, it started because Amazon was building its own cloud Infrastructure and realized that it could offer similar things to third parties. I have no idea what the split is at this point and it’s likely shifting all the time away from Amazon’s own use. I just don’t know at what point it could be totally independent without impacting margins.

Thanks. One additional question.

What do you make of Amazon’s decision to open up the Amazon Echo service? It seems to me that instead of using Amazon Echo as an entry point for e-commerce, Amazon is positioning the Echo cloud service as a platform for aspiring IoT vendors. This is very similar to how AWS enabled startups to scale easily.

Interestingly, early reviews suggest that the e-commerce interface for Amazon Echo is quite poor, which is further evidence that e-commerce was not the goal of Amazon Echo.

I take the news as an indication that Amazon intends to go full steam ahead on the AWS business model, which I interpret as providing infrastructure for other companies. The third-party fulfilment business also matches this business model. Among the businesses that Amazon is getting into, the odd-one-out may actually be Amazon’s own retail business.

http://phx.corporate-ir.net/phoenix.zhtml?c=176060&p=irol-newsArticle&ID=2062557

I think there are a couple of ways to read it. I think most likely it’s part of Amazon’s broader devices play, much as Apple’s HomeKit is. Both are designed to support third party home automation devices while ensuring their own devices are used as the controllers and in the process cementing the value of their ecosystem. In that sense, it’s worrying because Amazon’s devices business has become something of a millstone, with far fewer big hits than big flops recently.

I may be misreading the press release, but it seems that Amazon devices don’t need to be the controllers. Instead, it seems that Amazon is providing the voice interface as a separate cloud service.

Ah, interesting. Ok. I haven’t looked into it closely.

I think Amazon is trying to have its cake and eat it: once the infrastructure is in place, the marginal cost of having it store+move more things is marginal, so their own retail business could become only a small part of their activity. Using the infrastructure for Amazon Marketplace sellers certainly is a first step, there could be a lot more ways to utilize it though: fulfillment for non-Amazon Marketplace or even non-Web sellers, acting as a wholesaler or even as an importer,… I can see that happen on the logistics side, same as it is happening on the AWS side -even Amazon competitors use AWS.

I don’t think I said any of the assets Amazon is investing in are bad in the piece. I merely said that it’s having to invest incredibly heavily, and that’s something of a bet that these investments will (a) continue to pay off in the short term (b) eventually allow Amazon to reap the profits so many people seem to believe are coming eventually.

I don’t think your article is especially aggressive in that respect, mine was more of a general comment. I do think it is more of a long-term than a short-term investment, so certainly riskier and has the potential to irk Wall Street.

Another aspect is I think Amazon is building tremendous goodwill. All the Customer Service experiences with Amazon I’ve heard about / had myself have been tremendously positive, even in iffy cases. That goes into intangible assets, but I think trust/respect is one of the hardest things to build, and Amazon is “building” that too ?

Yes, I think Amazon has a tremendously valuable asset in its customer experience and the like. But it also has a liability in its growing reputation for treating its employees poorly. Treating customers well while treating employees poorly is not a great mix, and in Europe in particular the latter has been well covered by the press in key markets like the UK and Germany – perhaps France too?

Indeed in France too they sometimes take a bit of heat, but things are put in quite some perspective:

1- At least they do create local jobs, which is better than, say, OEMs with only factories in Asia, or, worse yet, OEMs with only subcontractors in Asia.

2- They don’t seem to be a significantly worse employer than anyone else relying on unqualified workers (supermarkets…). Whatever problems exist w/ Amazon exist with all other similar employers. And I’m sure the issues are more circumscribed in Europe/France due to more restrictive labour laws.

I don’t think the “think of the employees !” thing has a tenth of the “think of the children !” pull. Is there *any* big company with a labour/safety/corruption record not significantly worse than Amazon’s ?

I think Amazon’s is worse than almost any other company’s, when it comes to this stuff. Read some of the in-depth investigative reporting on their warehouses in the UK, for example. I’m sympathetic to the argument that a bad job is better than no job, but the working conditions are still often pretty horrendous. I know people who avoid shopping with Amazon because of this stuff.

Do those people buy anything at all, or have they also sworn off Apple and electronics in general, oil, chemicals, meat, … ?

Yes, these aren’t hermits or anything. 🙂

I’ve got a few selective activists around me, I’m always a bit puzzled. Why boycott, say, Amazon not Apple ?

– they think Amazon’s employees are treated worse than Apple ‘s ?

– they don’t, but it doesn’t count when it’s some else’s son not mine ? Especially, you know… in Asia…

– you can boycott Amazon and still get whatever from somewhere else, so let’s do that, instead of losing our iPhones ?

Apple’s employees are actually treated very well. If there’s a debate it’s about the employees of Apple’s contractors. But even there Apple has been making significant efforts since Jobs’ death to improve conditions.

But I can see how you could see them all as being on the same spectrum.

Yes, sorry, I meant the subcontractors making the devices.

Great website. Lots of useful information here. I look forward to the continuation.