About six months ago, I wrote a post here about how installment plans appeared to be accelerating smartphone upgrade rates, based on the data available at the time. Across the three carriers we had data from at the time, upgrade rates were higher in the first two quarters of 2015 than in the same periods in 2014. However over the last two quarters, things have begun to change. It’s now clear something of a dichotomy is emerging, where some carriers are seeing faster upgrades while others are seeing slower ones as they embrace installment plans.

The new data

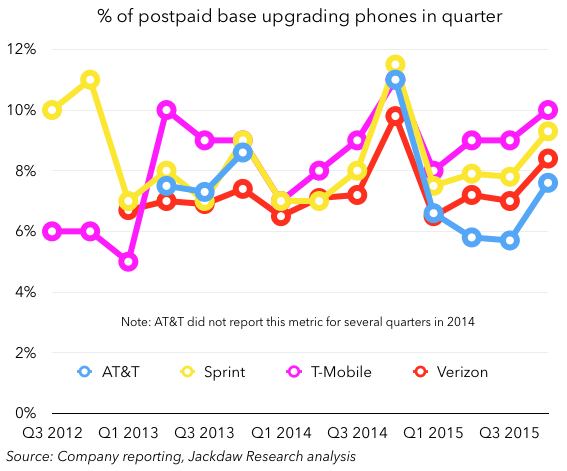

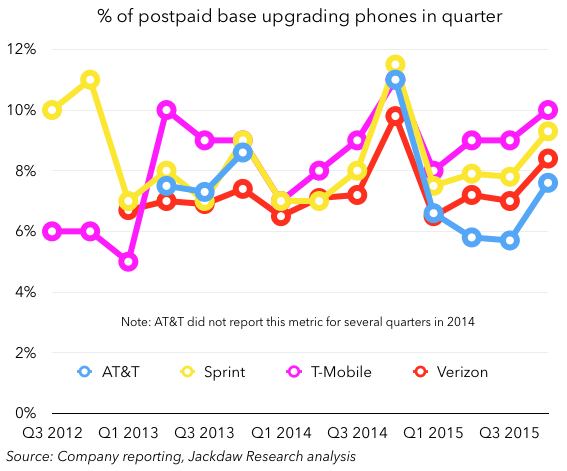

The charts below show the postpaid phone upgrade rate (i.e. the percentage of the postpaid phone base upgrading their handset in the quarter) for each of the four major US wireless carriers:

What you can see is, even though the first two quarters of 2015 did see higher upgrade rates for all three carriers who reported the figure for both years, in the last two quarters of 2015 the situation somewhat reversed. In Q3, both Sprint and Verizon saw lower upgrade rates in 2015, while in Q4 all four carriers saw lower upgrade rates. Now, part of that is because Q4 simply saw lower smartphone sales in general (after an exceptional Q4 2014) due to the launch of the iPhone 6 (something I wrote about previously). But part of what’s happening is a slowing of upgrades at two of the carriers in particular – Verizon and AT&T – while the picture is somewhat different at Sprint and T-Mobile.

At the same time, actual upgrade rates are now considerably lower at the larger two carriers than at the two smaller carriers:

As you can see, AT&T and Verizon’s upgrade rates are the lowest, while Sprint’s and T-Mobile’s are considerably higher. The outgrowth of this is that T-Mobile in particular now sells almost as many smartphones per quarter as AT&T, despite having a much smaller base of smartphone customers. The next question then becomes, why this discrepancy?

Attitude toward upgrades, and the prevalence of leasing

The two biggest drivers of the difference between these groups of carriers are their overall attitudes towards upgrades and their approach to leasing in particular. It’s worth remembering that T-Mobile introduced frequent-upgrade policies with its Jump program in 2013 and the other carriers followed with their own installment plan programs over the following year. However, even though the programs share superficial similarity, the details have been different, especially in the implementation. For one thing, though Jump offers very frequent upgrades by default, plans from the other carriers offer a range of payoff periods and, in practice, Verizon and AT&T’s plans are essentially intended to recreate the standard two year plus upgrade cycle rather than really incentivize more frequent upgrades. Of course, even T-Mobile doesn’t see all its customers upgrading as often as they’re entitled to, for a variety of reasons, but AT&T and Verizon have largely backed off encouraging customers to upgrade as soon as they’re eligible, while T-Mobile has done more to push customers in that direction.

The other issue is leasing, where both Sprint and T-Mobile now have programs, and where Sprint is essentially making leasing its default option for new handsets. T-Mobile has been a little more equivocal about its leasing plans (marketed as Jump on Demand) and in fact said on its recent earnings call it would be mostly prioritizing installment plans in Q1 after more heavily favoring leasing in Q4. However, given that T-Mobile’s installment plans closely mimic leasing in key respects, including the ability to upgrade frequently, that actually doesn’t matter much from an upgrade rate perspective.

Some carriers are punching above their weight

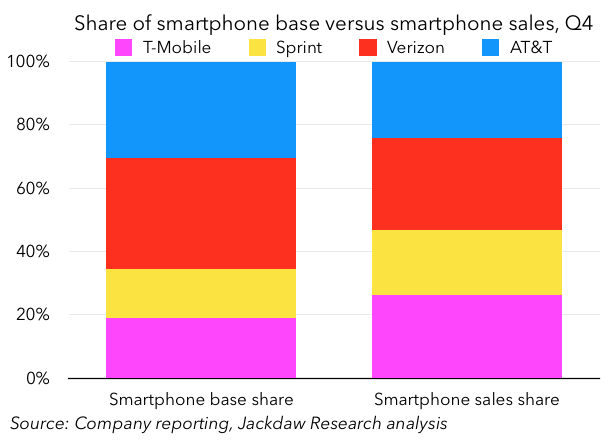

The long and short of all of this is AT&T and Verizon are taking their feet off the gas as far as driving smartphone upgrades, while Sprint and T-Mobile are doing all they can to accelerate them. The result is Sprint and T-Mobile are punching considerably above their weight in terms of smartphone sales, while AT&T and Verizon are selling fewer smartphones than their sizable bases would suggest:

Why does all this matter? For starters, if you’re a handset vendor, it means if you allocate your resources by who has the bigger smartphone base, you’re likely to put your money in the wrong place. But even if you’re only watching the dynamics of the US smartphone market, it’s worth noting how these trends shift and change over time, because the impact of installment plans is proving much less straightforward than it first appeared.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really..

This post post made me think. I will write something about this on my blog. Have a nice day!!

LeanFlux is a revolutionary dietary formula specially crafted for individuals dealing with obesity and those on a weight loss journey. https://leanfluxbuynow.us/