Tesla reported its financial results last week and the tech industry once again responded with quite a bit of enthusiasm for its results, especially for the promises of expansion. Three new Gigafactory battery factories are planned for later this year and massive growth in its number of charging stations are planned as well. Tesla’s market cap passed (at least briefly) Nissan’s, one of the largest auto manufacturers in the world. With so much excitement and coverage for Tesla in the tech industry, it’s worth putting Tesla in context with regard to where it fits in the broader automotive business.

2016 Figures are In

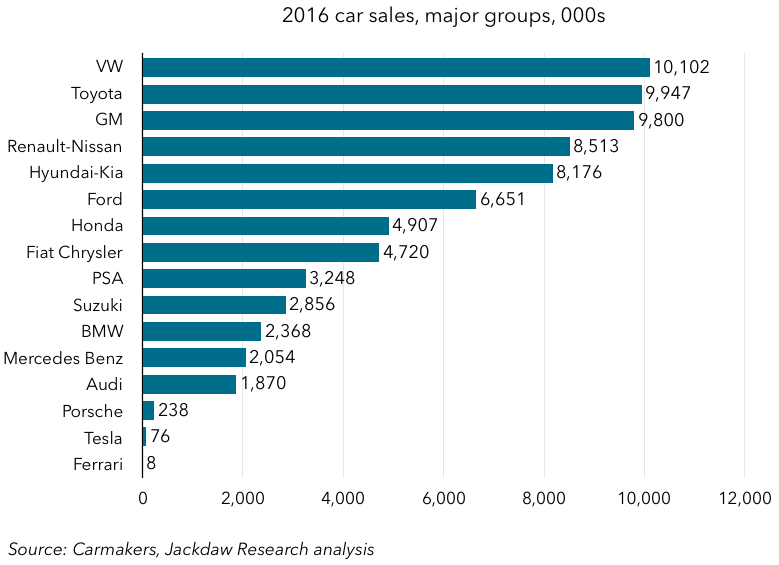

Over the last couple of months, all the major car manufacturers have reported their results for 2016, so we now know how each shaped up, who won overall, and where Tesla fits in. VW beat Toyota by a small margin to become the top carmaker in the world in 2016, with GM back in third place (apologies for the earlier glitch in this chart – GM is now where it belongs):

The world’s largest carmakers each sold millions of cars last year, with the largest selling 8-10 million in a single year. Depending on what you count as a car, there were as many as 88 million sold last year globally. In that context, Tesla’s 76 thousand cars sold are barely a blip on the radar – they were less than 1% of each of the top four carmakers’ sales in 2016. But perhaps the better peer group for Tesla isn’t the largest manufacturers but other high-end car brands. A comparison with these carmakers and sub-brands is shown in the chart below:

As you can see, Mercedes’s car sales (the vast majority of which were Mercedes rather than SMART cars) came out on top with a little over two million in 2016, although BMW was right behind it and Audi just behind BMW, with the three German luxury carmakers coming in the first three places. A variety of other brands fill out the top spots, although the numbers drop very quickly from there. Tesla’s 76k sales in 2016 are a little easier to see on this chart, but they’re still bringing up the rear. While they are head of niche car brands like Maserati, Ferrari, and Rolls Royce, they are behind the major Japanese luxury car brands, as well as Cadillac (and a slightly lower end but much more popular brand Buick, not shown), and Jaguar.

It’s clear Tesla isn’t justifying its valuation or the excitement about the company on the basis of sheer volume – it’s still a tiny player in the global market, behind even most of the rest of the major luxury and high-end brands.

Profits don’t Account for the Valuation Either

Perhaps it is outsized profits that help drive Tesla’s valuation? No – that’s not it either. Though carmakers aren’t the most profitable enterprises in the world – somewhat akin to consumer electronics companies as a rule – the larger ones are at least generating profits fairly predictably at the moment. But Tesla certainly isn’t – it did generate a net profit briefly last year but they mostly lose lots of money every quarter. It’s making some progress here but its massive investment in manufacturing and charging infrastructure certainly isn’t helping. Like Snap or Twitter, this is a large and rapidly growing company that hasn’t yet managed to turn a sustainable profit, so that’s not the explanation either.

Trajectory and Disruption might be the Answer

In the end, it’s neither sheer scale or finances which explain the excitement about Tesla or its outsized valuation. Instead, we have to look at other factors. Trajectory could certainly be one – it’s definitely grown rapidly in percentage terms, although in terms of unit sales it actually grew more slowly last year than almost all the other big premium brands. Its forecast is for even faster growth, though, with its Model 3 coming online in the second half of this year and projected to outsell its earlier models several times over in the next few years. But it’s always missed its production targets in the past and its production plans for the Model 3 look unreasonably ambitious given its past performance. So, if you’re betting on Tesla’s rapid growth, that’s a risky bet.

Lastly, I think it likely comes down to excitement over Tesla’s disruptive potential. Electrification feels like the future, and Tesla is all in on this vision, making nothing but electric cars (and recently, investing more in both solar power generation and storage). Given how small electric cars are as a percentage of global sales, that is a future bet, not a bet on the present (especially as hybrids and EVs seem to have been dealt a setback by recent gas prices) but it’s likely electric cars will make up an ever greater portion of total sales in the coming years. Then there’s Tesla’s bet on autonomy, another of the three big shifts under way in the automotive industry. Tesla has received a lot of positive attention, both for its cars’ current capabilities and the fact that cars rolling off the production line today apparently have all the hardware necessary to support full autonomy with a software update in future. But the reality is, it’s still working at the lower levels of autonomy according to the standard model and its higher-level autonomous technology seems to be at the very early stages.

Tesla hasn’t yet participated directly in the third big shift underway – sharing – but has stated it plans to get into that race eventually. As such, Tesla checks the boxes on all the big disruptive things happening in transportation and does it with very attractive, very fast cars. All that allows investors and others to overlook its small size, its poor financials, and its inability to hit its short-term targets (though Elon Musk has admirably executed on his more general and longer-term vision for the company over the last few years). Tesla, it seems, is a bet on the future and on the disruptive potential of the tech industry relative to old established industries. I’m not yet convinced tech companies are ultimately going to win out in these battles but they’re certainly interesting to watch.

The first chart looks wrong. You have GM down at the bottom with only about 1M units. Also, there are a number of sizable companies missing: SAIC (6.5M units), Mazda (1.5M) and Fuji/Subaru (1+M).

You’re right on GM – there was a glitch in the chart earlier, which is now fixed. And yes, the chart isn’t intended to be comprehensive, merely illustrative.

Thank you for great article. I look forward to the continuation.

I used to be suggested this web site by my cousin. I am not sure whether or not this

submit is written by means of him as nobody else recognize such distinct approximately my

difficulty. You are incredible! Thanks!

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You clearly know what youre talking about, why waste your intelligence on just

posting videos to your site when you could be giving us something informative to read?

My coder is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on a number of websites for

about a year and am worried about switching to another platform.

I have heard excellent things about blogengine.net.

Is there a way I can transfer all my wordpress content into it?

Any kind of help would be really appreciated!

Having read this I thought it was extremely informative.

I appreciate you finding the time and energy to put this article together.

I once again find myself spending a lot of time both reading

and leaving comments. But so what, it was still worthwhile!

Hi, I read your new stuff on a regular basis. Your

story-telling style is awesome, keep up the good work!

This article will help the internet viewers for creating new blog or even a blog from start to end.

Hi, Neat post. There’s a problem with your

site in internet explorer, might test this? IE still is the marketplace chief and a large component to folks will miss

your wonderful writing due to this problem.

Every weekend i used to go to see this web site, because i want

enjoyment, since this this site conations in fact pleasant funny data too.

Write more, thats all I have to say. Literally,

it seems as though you relied on the video to make your point.

You clearly know what youre talking about, why throw away your intelligence

on just posting videos to your site when you could

be giving us something enlightening to read?

I don’t know whether it’s just me or if everybody else encountering problems with your site.

It seems like some of the written text within your posts are running

off the screen. Can someone else please provide feedback

and let me know if this is happening to them as well? This could

be a problem with my browser because I’ve had this happen previously.

Cheers

Quality posts is the key to be a focus for the

visitors to visit the site, that’s what this site is providing.

Hey there! I just wanted to ask if you ever have any trouble with

hackers? My last blog (wordpress) was hacked and I ended up losing months

of hard work due to no backup. Do you have any solutions

to prevent hackers?