Are tablets really taking hold in the enterprise? Are they replacements for a PC or supplemental? While tablet sales have been shrinking of late, does this mean companies are no longer enamored with deploying them? Finally, for those looking at tablets, has Apple already won or do Microsoft (Windows) and Google (Android) still have hope?

Let’s take a closer look at the tablet market. There seems to be a belief that, because Apple’s iPad has a large early start in enterprise adoptions, it will continue to dominate the market for the foreseeable future. While I don’t buy into that vision, it’s important to look at facts rather than just speculate. Android has a lot of momentum due to the sheer number of suppliers and devices available and it’s likely to do well despite early issues with security and non-compatible versions. But Windows is more problematic. Early Windows-based tablets from HP, Dell etc., were less than stellar performers and Windows 7 wasn’t exactly tablet friendly. But with the launch of Windows 10, has this perception (and future reality) changed? Can tablets that aren’t iPads make inroads in the enterprise market?

To find out, we recently completed an online survey of 231 medium to large enterprises in the US. While we asked a number of questions on various topics related to mobile devices and software, one of the key areas of inquiry we included was to acquire quantitative data about the various options organizations have in tablets and what their future plans were. What we found was interesting.

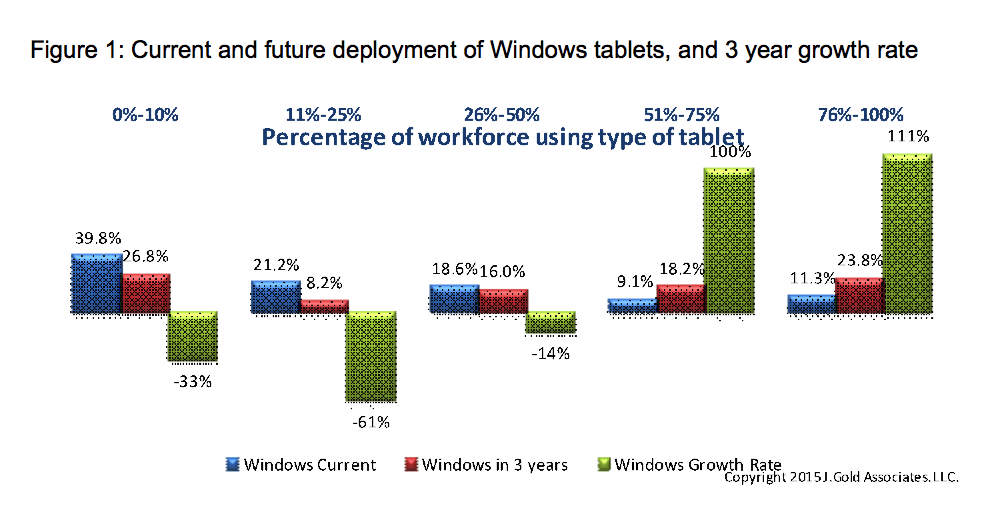

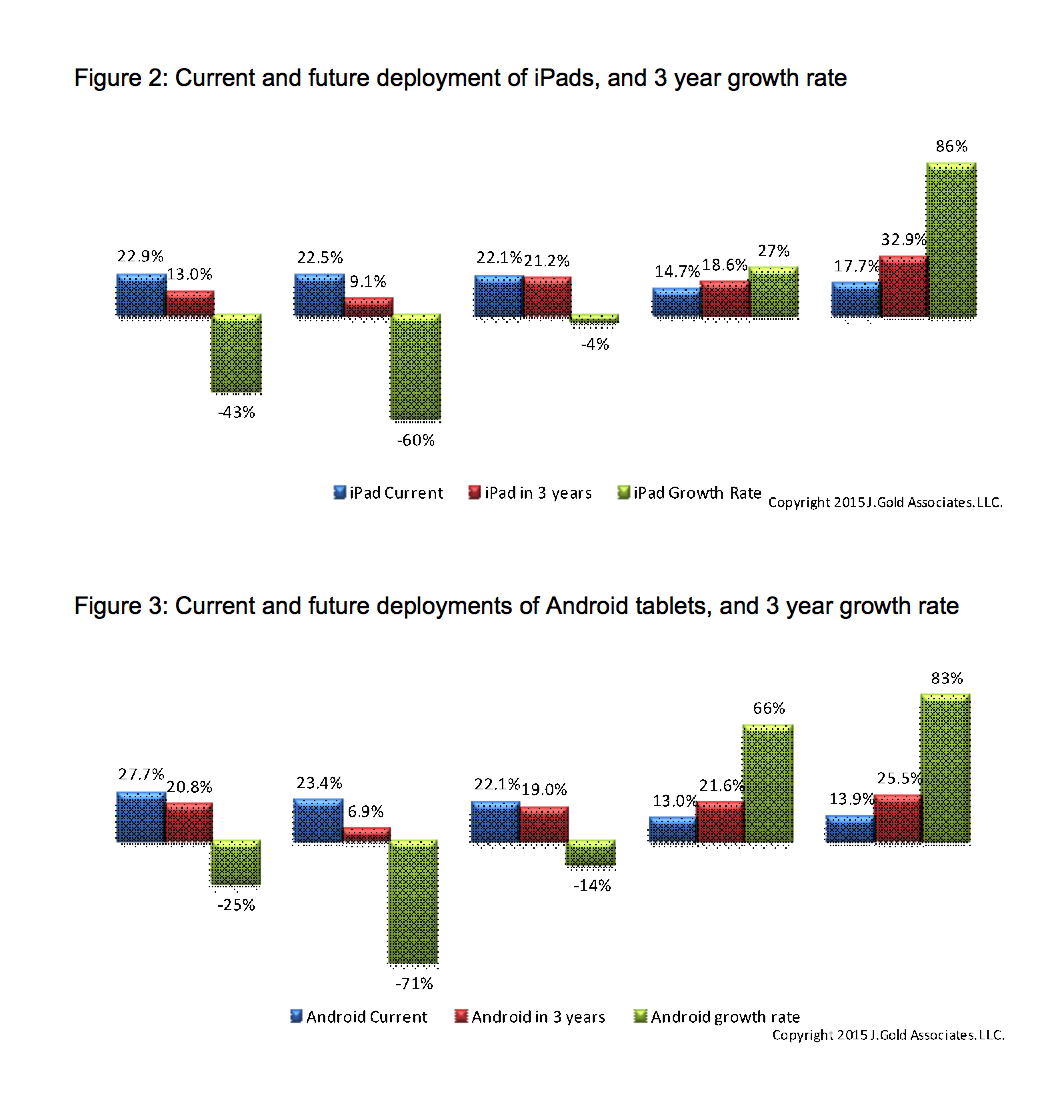

We asked the respondents to indicate what percentage of their workforce currently had a tablet and what that percentage would be in three years. To simplify (and allow easy multiple choice survey responses), we provided a fixed selection of deployment ranges: 0%-10%, 11%-25%, 26%-50%, 51%-75%, or 76%-100%. From this data, we were able to calculate not only the deployment rates but also a growth rate for the next three years. We obtained this data for iPads, Android, and Windows-powered tablets.

For our purposes, we assumed those choosing the 0%-10% range have minimal to no installation of tablets in the workforce (that doesn’t mean there are no tablets being used – just not sanctioned workplace production units). Those selecting the 76%-100% range indicated a nearly full deployment of workplace tablets. We also assumed the higher ranges were selected in those companies that see tablets as a general deployment option, while the lower ranges represented those organizations who see tablets as a work-specific (or application-specific) requirement.

Figure 1 indicates the results for Windows-based tablet adoption currently, in three years, and the overall growth rate. Figure 2 indicates the same results for iPads and figure 3 indicates the results for Android-based tablets. (As an aside, we have similar data for smartphone adoption, but we’ll leave that for another time).

What does the data show? While starting from a smaller base, the highest growth rate for tablet deployments in fully deployed or nearly fully deployed workplaces was Windows, followed by iPad and then by Android. It’s important to note this is growth rate, not number of devices, but it still indicates a significant growth in units, especially in those organizations who are leaning towards full tablet deployment across the user population.

The three year deployment rates show Windows and Android gaining on the iPads in the higher deployment rate organizations (76%-100%) — 23.8% for Windows, 32.9% for iPad, and 25.5% for Android. While the gains are impressive for Windows and Android given their current smaller base, this indicates to us that those companies engaged in deploying tablets to the full workforce still favor iPads.

In the 51%-75% deployment range, iPad (18.6%) loses to Android (21.6%) in devices selected and Windows (18.2%) is nearly equal to the iPad share. This indicates to us that a mid-level deployment of tablets in companies not fully engaged in “tablets for all” are much more likely to obtain alternatives to iPads and are open to implementation of Windows and Android tablets for their needs. This is most likely a result of a “solution sell” where a specific problem is addressed either as an extension of existing infrastructure compatibility or through a complete solution offered by a vendor.

So what’s the bottom line? These results confirm our expectations that the large market advantage of iPads in the workplace will fade over the next three years. The market will become a closer competitive race, with Android and Windows-powered devices picking up a significant share of organizational deployments. The data also suggests that not all organizations view the various tablet options the same and indeed, we found there are significant differences among various verticals (which we will save for a future discussion). Finally, size of deployments matter when devices are selected, indicating those organizations that have less than complete deployments of tablets (deployment to the general population) are much more likely to choose a solution based on HW and SW availability from vendors (task specific deployments).

The data also suggests that the notion tablets are general replacements for notebook and desktop PCs is false. Neither do they appear to be general replacements for smartphones. This is borne out by the data above suggesting many tablets used within enterprises are solution specific deployments and not general purpose computing platforms, such as traditional PCs are (this is also borne out by many conversations I’ve had with staff at companies in the midst of using tablets).

What isn’t yet clear is how 2 in 1 devices (notebooks that allow the screen to be separated and act as a tablet) will affect the market. Nearly all of these will be Windows-powered (with perhaps a few Chromebooks included and unless the iPad Pro gets categorized as a 2-in-1). So I’d expect some overlap with pure tablets in enterprises. But this form factor will also have an effect on the sale of notebooks (they are, after all, a notebook when docked).

Nevertheless, we expect to see many of the gains in Windows in the mid-tier deployment ranges be re-focused on 2 in 1s as they look both for solution specific tablet functions and general purpose computing (PC) platforms. So the PC form factor is not dead and being replaced by the tablet form factor, nor do we expect to see a huge uptick in general tablet sales to enterprise users over the next three years, instead seeing them used mostly for solution specific needs.

Interesting, thank you.

I’d think there’d be a huge difference depending on actual usage within the same company: for example (oversimplifying greatly) iPads for customer-facing positions (needs to look nice), Windows for back-office work (needs to run legacy apps), and Android for other cases (cheap, rugged, interoperable…). Or are all corps standardizing on a single mobile platform for simplicity’s sake ?

There are over 100k firms in the US with 100+ employees, which is a common definition of medium and large firms. The split between medium (100-499 employees) and large (500+) is about 80/20. So, my initial reaction is that you survey is not statistically representative and your results are potentially biased, especially if you are not giving weight to larger firms. That is not to say your conclusions are wrong, but I do not believe the data you present “confirms” anything.

+1. The data here has no useful bearing on the overall market except as to the perceived intentions of these particular firms

Who in the company did you ask?

Does the long term anti-Apple bias contribute to this? Based on his history and this web sites primary customer, I’d bet IT was asked.

I’m retired so I’ve a small observational basis for this but I’ll bet the following:

– IT department personnel has a higher percentage of Android phones than the rest of the company.

– Sales / marketing has a higher percentage of Apple phones than the rest of the company.

– Rest of the company – toss up.

Throw in the strong anti-Apple (not really pro-Windows bias cause they really weren’t all that fond of it either) inclinations, is Windows first if at all possible drive.

IT was forced to support Apple phones and to a growing extent that is true of Macs.

Who is going to be making the tablet decision?

You sound fruity.

who else would they ask if not IT?

You’re detecting a long-term Apple bias on this site ?

In the Entreprise, an anti-Apple bias can be rational: single supplier, closed ecosystem, expensive hardware, wholly different dev+admin environment…

I’m guessing the ones making decisions for Mobile will be the same ones making decisions for PCs ? That might be Apple’s biggest hurdle ?

1. “Do Windows or Android Stand a Chance?”

No. They do not.

Do you want your airline pilot looking at his Jeppesen Charts on an iPad Pro or some crappy low-res Android device?

Do you want your doctor looking at your medical charts on an iPad Pro or some crappy low-res Android device?

The problem with Android devices is that price is of paramount concern. This means less functionality and lower quality. The manufacturers can’t help themselves.

2. “What does the data show?”

I am sure you meant to write: “What do these data show?”

And, the answer is: nothing of significance as N is small and no one really know what they are going to do in the future.

For example–The City of Denver Forestry Dept is doing a city-wide inventory of all trees in preparation for the arrival of the Emerald Ash Borer. Using iPads. If you had asked 3 years if they would be doing this, the answer would have been: unlikely/not sure/no/too expensive…

3. “The [sic] data also suggests that the notion tablets are general replacements for notebook and desktop PCs is false. Neither do they appear to be general replacements for smartphones.”

Didn’t the pundits predict that the crappy iPhone (circa 2007) was a useless toy that could never replace a “real computer (aka, PC)?

1. Usual amalgam: just because there are cheap low-spec Android tablets, it doesn’t mean all of them are. The Nexus 10 and Samsung Galaxy Tab S for example have higher resolution than the iPad Air 2. And resoltuion isn’t the only relevant criteria I think. In some cases, I’d rather someone have a rugged tablet, or the nurses have (maybe cheaper) tablets too…

2. “some people consider the singular data incorrect. This view is based on a misunderstanding of how English develops” from http://grammarist.com/usage/data/ . But feel free to be a… wrong.. pedant.

As for your example… how does the job specifically require an iPad ?

3. Data != pundits ?

Datum/data are Latin, not English.

I will bet you write: stadiums and aquariums.

Both stadiums and stadia are fine. The rule for most foreign words (not spaghetti, presumably) that have been assimilated is that you can use either the foreign plural, or build the regular English plural by adding an s.

But feel free to disagree with… the Oxford Dictionnary….

http://www.oxforddictionaries.com/definition/english/stadium

http://www.oxforddictionaries.com/definition/english/aquarium

N = 231 is small? Have you seen a t distribution table recently? I have no idea how reliable or unbiased the sample is but N = 231 isn’t a sample size that can be dismissed offhand as ‘small’.

It is when the total population size is over 100,000 and there is no indication that the sample is random.

Have you taken a stats course, or maybe you’ve just forgotten? It is counterintuitive, but population size hardly factors into this discussion at all. There is no indication that the sample is random but no clear indication either in what way it is biased and how that bias skews the results. All I am saying is that N=231 cannot be dismissed offhand based on the claim that 231 is a “small” sample size. And “small” really is about the absolute size of the sample (10 is small) not its size relative to the population.

Android doesn’t have security. That turns off businesses. Windows stands a chance because it is a full desktop version so can replace laptops. And it has security. Office 365 is HIPAA security compliant. No cloud based platform competitor is compliant.

Thanks so much for the blog article.Really looking forward to read more. Keep writing.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Thank you for great article. I look forward to the continuation.

Superb post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.

I really like reading through a post that can make men and women think. Also thank you for allowing me to comment!

Thank you ever so for you blog. Really looking forward to read more.

My website: порно видео русское

I am incessantly thought about this, thanks for posting.

My website: секс студентки

Thank you ever so for you blog. Really looking forward to read more.

My website: русское порно с пьяной

Respect to post author, some fantastic information

My website: насилуют баб

I got what you intend,bookmarked, very decent website.

My website: смотреть порно на русском

A round of applause for your article. Much thanks again.

My website: порно ебут дома

As a Newbie, I am continuously exploring online for articles that can be of assistance to me.

My website: семейное порно смотреть бесплатно

This site definitely has all of the information I needed about this subject

My website: смотреть порно трансы

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: порно видео онлайн анал

Respect to post author, some fantastic information

My website: русское порно первый анал

Respect to post author, some fantastic information

My website: порно кастинг женщин

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: молодой ебет старуху

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: трахнул жену раком

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: европейский секс видео

I reckon something truly special in this website.

My website: порно латекс бдсм

I gotta favorite this site it seems very beneficial handy

My website: домашние потрахушки

Respect to post author, some fantastic information

My website: глубоко засадил

I reckon something truly special in this website.

My website: страпон парня

My website: негр трахает жену

I reckon something truly special in this website.

My website: госпожа фемдом

Major thanks for the article post. Much thanks again.

My website: красивые натуральные сиськи

I reckon something truly special in this website.

My website: секс бабуля