My article on Netflix from Monday fits into a much larger theme I have been looking into about who is best positioned in the paradigm shifts of media/online media we are witnessing. If you have ever dove into the advertising business of late, you know the slow shift from traditional advertising to more online/digital advertising is happening. Estimates are online advertising could take over the majority share from TV advertising around the 2019 time frame. Obviously, this could accelerate as forecasts are far from perfect, but traditional advertising is still king for the time being. Facebook and Google remain the talk of the town as this shift happens largely due to the nature of the value of the western markets from an ad standpoint. Knowing there is still huge advertising dollars moving from traditional to online is the main reason it is hard not to be bullish on Facebook (and Facebook family of apps like Instagram) and Google and to some degree Twitter and Snapchat. Many analyst notes on the matter refer to this coming dynamic as a winner take most (not all) market, and this may certainly be the case.

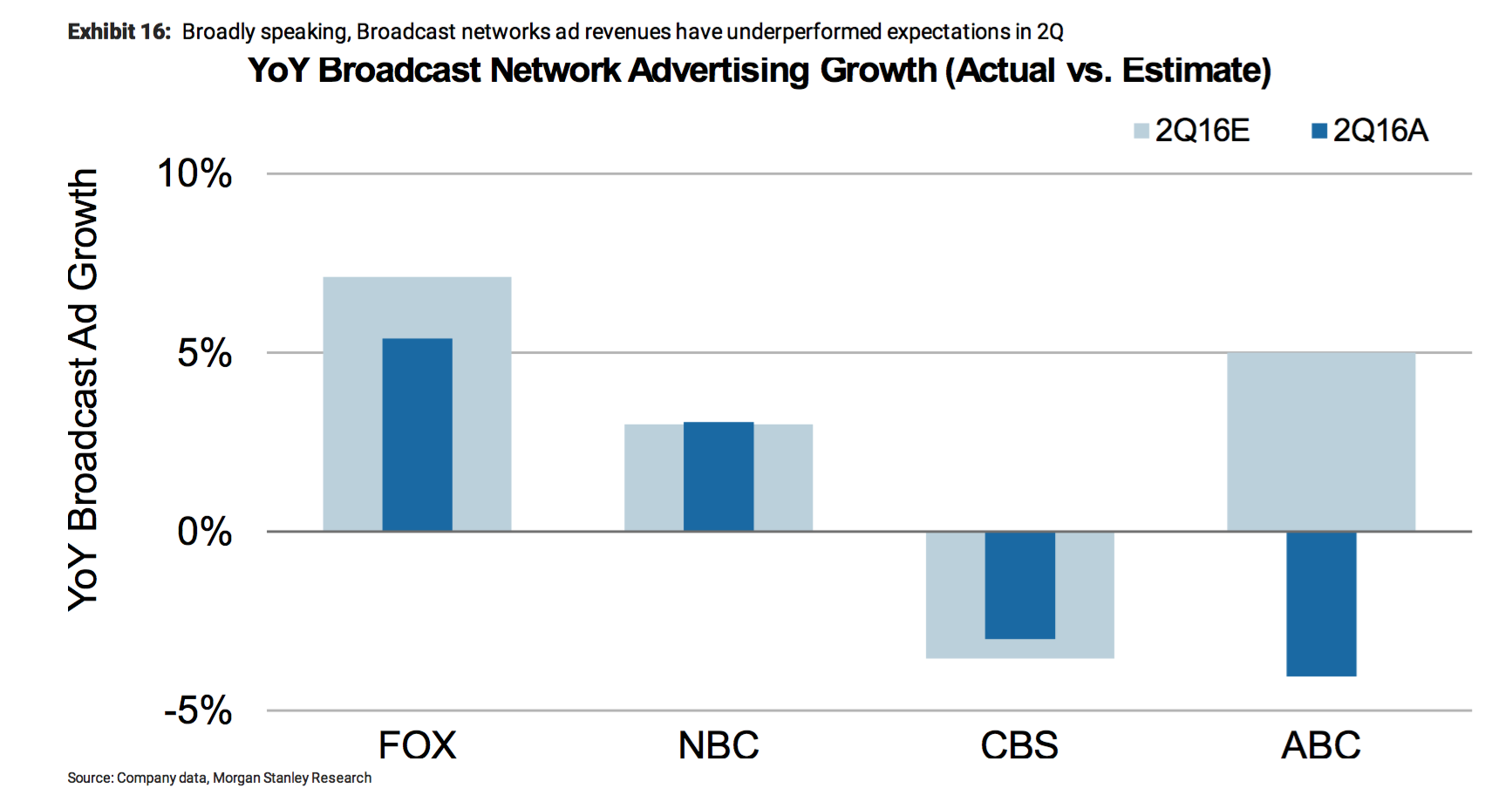

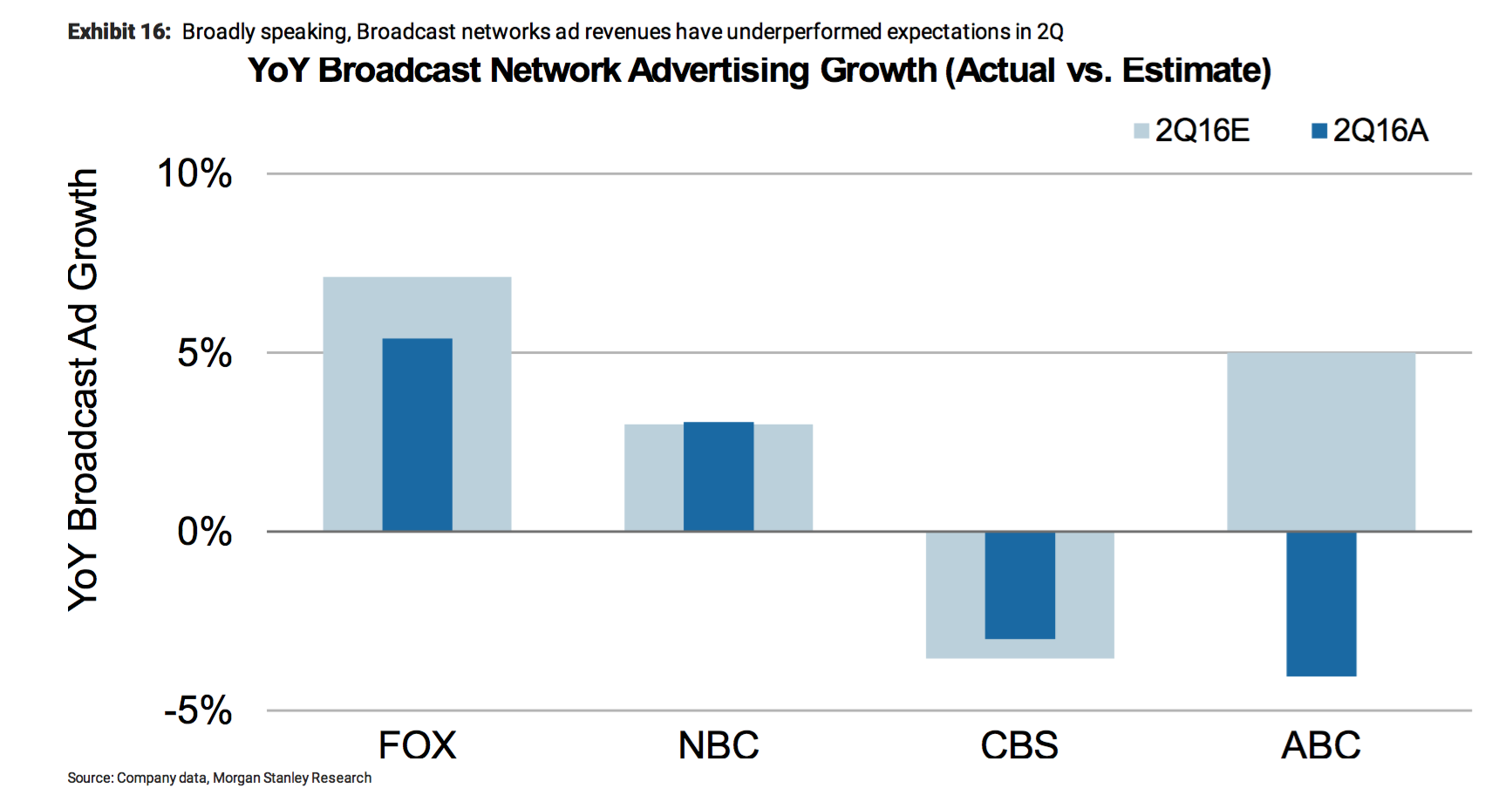

Recently, I’ve had some discussions with execs in the advertising space, and what I found interesting from these discussions was how advertisers were taking what is considered more “off peak” seasonal time frames to start to dabble more aggressively in online advertising strategies. We know all forms of advertising see a big spike around the holiday time frame and that time frame is also when advertisers stick to their tried and true methods. Once I understood this, it made sense to see this chart from Morgan Stanley’s online advertising analysis note on estimate vs. actual YoY advertising growth of the major US networks.

Looking back at similar data from years past, we had not seen such an impact of online in off peak times as we are today. Which, to me, suggests this shift could happen sooner than 2019 if these off-peak ad spends with the online incumbents like Facebook and Google pay off or lead to new learnings which influence the shift in spend in the coming years. To my point about Netflix, and even some of the recent data suggesting the big increase in online streaming of the Olympics vs. watching it through cable, perhaps consumers are making the shift to streaming video much faster than anticipated. Should this shift happen sooner, as I suspect it could, then advertisers are currently planning to spend in the wrong places when it comes to video. 2016 online video advertising spends look to be in the $6-9 billion dollar range in the US depending on whose estimates you look at. Compared to $70 billion spent in the US on traditional TV advertising. The spending trends simply seem out of whack with consumer behavior and the question is when advertisers will catch on.

Timing is the central discussion taking place with investors looking to gauge when a hyper growth cycle to the advertising business to the likes of Facebook and Google could happen. Obviously, as online video plays a much more central role in taking advertising dollars, Netflix, Amazon, Snapchat and others could stand to benefit by taking large chunks of these ad dollars which will be up for grabs during this shift.

Offline advertising spends signal the shift which will likely come to TV if consumer behaviour continues over the long haul. Both Newspaper and Magazine YoY spends continue their downward decline, with estimates of 11% combined spending declines in both those categories in 2016. Only TV and Online ad spending are on track to see a YoY increase in 2016. But all eyes will be watching this big ad shift, and when it happens, it is likely to inject more growth to the Googles and Facebook of the world.

Totally agree that there is still room for Google to grow, and that is because TV advertising is still the majority. However, taking over the largest segment in advertising means that growth will be harder from here.

Just like smartphones have come close to saturating the market (at least the market for reasonably priced ones), online advertising cannot grow larger than the total market for advertising, and the total ad market in turn is largely determined by the pockets of the markets which use ads extensively. If online advertising were to show phenomenal ROI, then maybe online advertising could substantially grow the market size of advertising as a whole. However, I don’t think that has been the case to date.

The question for me is how long Google can maintain double digit growth? What will determine the ceiling for online ad spending? How small will cable TV ad spending become? What are the demographic trends? Will markets targeting older demographics still rely on TV ads (like automobiles)?

Also, TV ads are probably better suited for display ads (as opposed to search ads). What is the relative strength between Google and Facebook in this segment? Although Netflix is an obvious winner if dollars run away from TV ads, among Google and Facebook, who will benefit more?

Lot’s of questions here.

Very nice blog post. I definitely love this site. Stick with it!