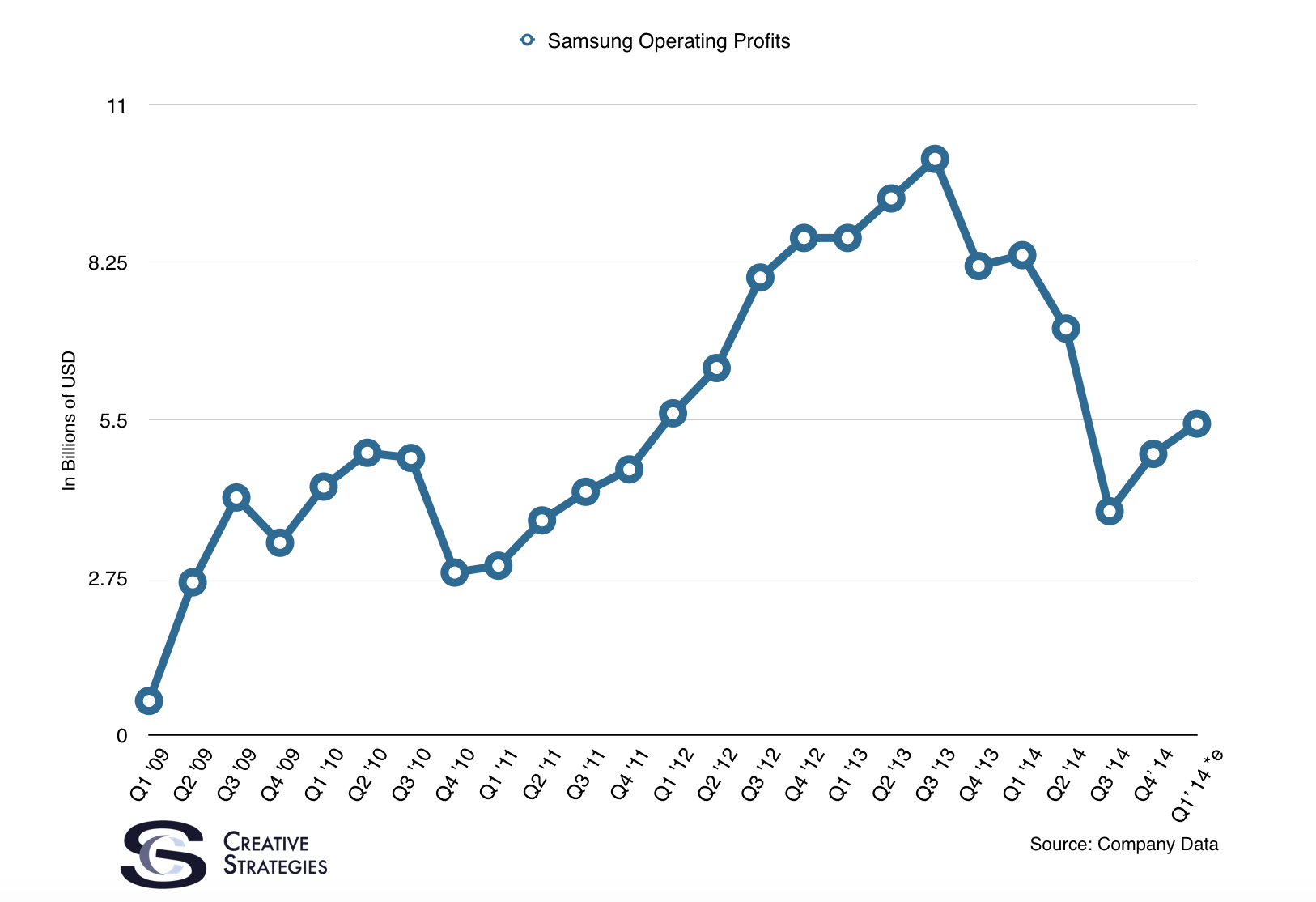

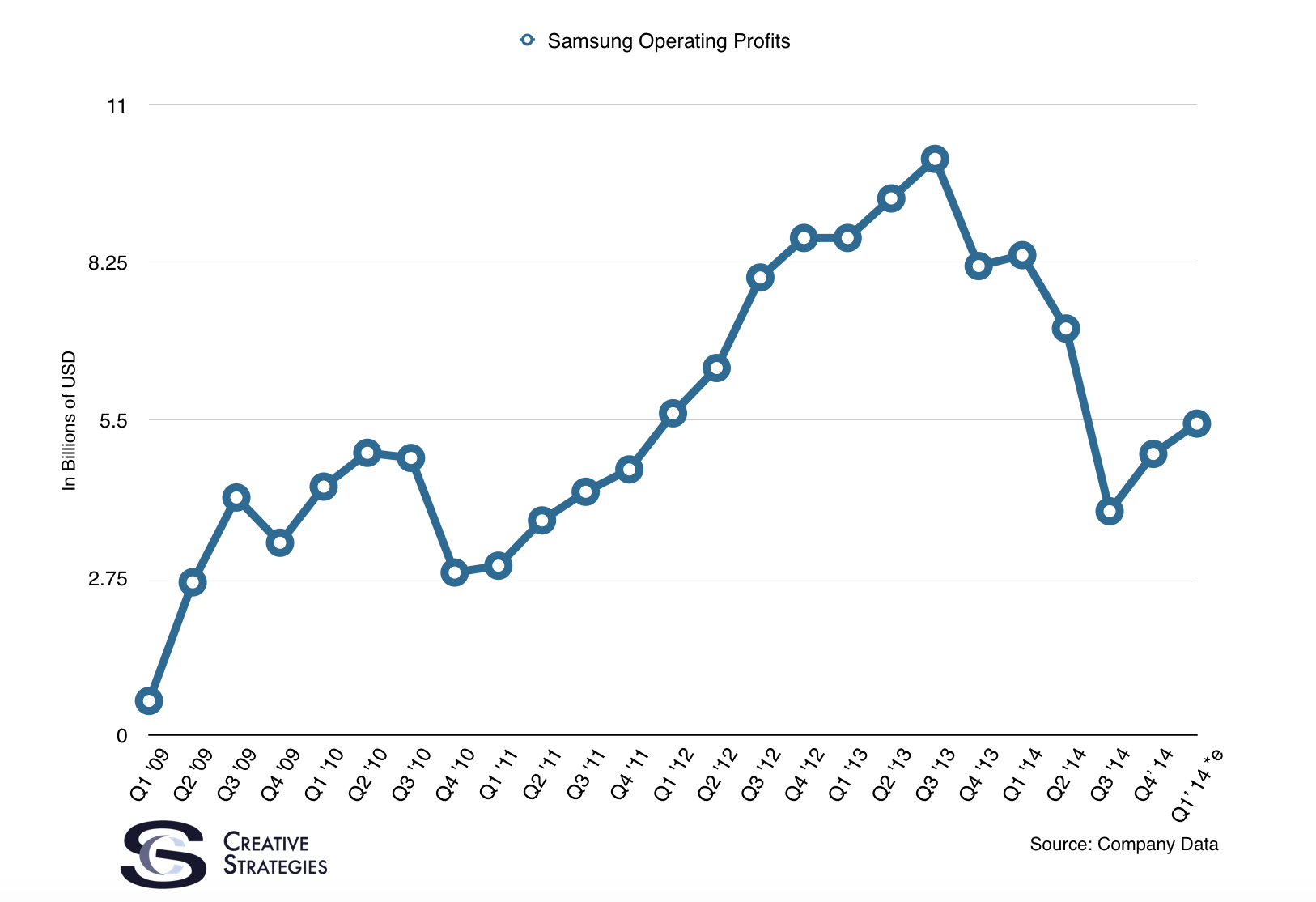

As you know, Samsung has many different business units. However, the semiconductor and mobile group are the largest contributors to the company’s operating profit. Samsung’s tale has been quite the roller coaster and, while I feel things may be stabilizing for them, I don’t see their mobile division (the one that makes Samsung-branded smartphones) getting the company back to its peak revenue days, which happened some time ago. Here is what they pre-announced with regard to earnings.

Interestingly, the report highlights that operating profits were up even though sales were not. There are a few dynamics playing into this.

First, the Korean Won has depreciated one percent vs. the US dollar during 1Q15, which was estimated by financial analysts to have a positive impact on component profits. I saw analyst forecasts upping their component estimates as high as 5% based on this point. Component revenues contribute a great deal to Samsung’s operating profits, sometimes more than 50%, and this clearly helped this quarter, perhaps more than many realize.

In my view, the component side of Samsung’s business is the most important and has been for a long while. I’m fond of saying Samsung is a component company and that the brand has historically been used to move those components in volume. But as Samsung is finding out, it is beginning to require more than their brand to move key components in volume. This is ultimately why I feel Samsung is getting aggressive on the semiconductor side of things. Their flash memory and semiconductors business has long been a key contributor thanks to their partnership with Apple. However, it seems they are looking to broaden their semiconductor efforts.

Some time ago, Samsung acquired an ARM architecture license which gave them the ability to fully customize, in ways Qualcomm, AMD, Apple, Nvidia, Broadcom and others have, ARM cores. The benefit to being an ARM architecture licensee is differentiation. The companies above, with the exception of Apple, sell their cores to customers and add their own proprietary value to separate their offering from the traditionally lower priced generic ARM core ones. Making this move can only mean one of two things. One, Samsung intends to focus more heavily on the premium parts of the smartphone market or two, they intend to compete with Qualcomm, Mediatek, and even Intel, in selling their cores more broadly to other OEMs. Of course, a mix of both could be true, but development costs surrounding being an architecture licensee and customizing an ARM core to create a proprietary ARM architecture are not cheap. Therefore, one has to monetize this investment. I’m not sure Samsung can do this by just focusing on premium, let alone their own premium offerings.

Regardless, this side of the business may have more upside than their branded mobile division and it will be interesting to see how they navigate through it.

On to Samsung branded smartphones. Most analyst estimates have Samsung smartphone shipments in the 80-82m range. Interestingly however, the release stated earnings were a beat on estimates but sales were not. The sales figures of smartphones are not disclosed, so those of us who estimate will have to do the hard work.

Samsung is tough to estimate because they promote shipments not sell-through. While these numbers generally correlate at some point in time, we know Samsung likes to stuff the channel to make their shipment numbers look good. Sometimes in excess of 5m units or more could be pushed to channel and not sold through. So I generally take any estimates with a grain of salt until we get a clearer sell through picture. Personally from my own channel discussions, I’m not sure Samsung got to the 80m range but rather mid 70s perhaps — flat for the quarter. This will still put them back as the number one smartphone seller by volume but most of those sales came from the low end.

Samsung is at a crossroads in my view. They are losing low end smartphone sales faster than they are losing sales in premium. They don’t actually sell a lot of premium smartphones, less than 100m per year, but they make 70-80% of their profit from these devices. One could argue Samsung should just focus on the premium market and make a go at growing this business and the premium middle, devices in the $400-500 range, which is likely to become the new Android premium price point. This is the price where many vendors will focus their “premium” efforts and it makes sense for Samsung to focus in this area and the super high end against Apple rather than chase the sub-$200 market for growth. If they are doing what it seems like they are doing with their semiconductor strategy then this path seems plausible.

Lastly, Samsung may, and likely should, perhaps buy some of the less dominant brands in other markets. Oppo in China, for example, is one that is rising quickly, or Micromax in India, or even a smaller vendor in the region who is trying to separate with a brand identity. These companies don’t want just to chase the bottom but are looking to build a regional brand appealing to regional players. Samsung could buy these companies and use them to ship their own components like memory, chipsets, displays, etc., and thus have more brands helping their component business grow. This seems like the best way to address their brand struggles to move components in volume and help them avoid channel conflict with their own brand while trying to sell low end and high end smartphones.

2015 is going to be a defining year for Samsung as they navigate these waters. The choices they make this year will dictate their chances to be a global player in some capacity going forward.

“Their flash memory and semiconductors business has long been a key contributor thanks to their partnership with Apple.”. The relationship seems extremely litigious for a “partnership”. Maybe I’m missing something, but it feels like Apple use Samsung as a supplier because no other can match their volume/price/specs… criteria. And Samsung’s components business was big even before Apple chose it as a supplier, indeed even before Apple started making phones, though Apple is indeed making it bigger.

“Making this move can only mean one of two things. One, Samsung intends to focus more heavily on the premium parts of the smartphone market or two, they intend to compete with Qualcomm, Mediatek, and even Intel, in selling their cores more broadly to other OEMs. “. It can actually mean both things, some 3rd-party phones started using Exynos when fab capacity was freed by Apple switching to TSMC. Also custom cores don’t *have* to be for high performance. Huawei’s SoCs for example (not sure if they use custom cores, or just a custom arrangement of standard cores) are fairly middling, but power-efficient.

Also, apart from memory and chips, Samsung has been investing heavily in camera sensors and screens. They have top-range offerings in both, which wasn’t the case a few years back, especially for cameras. In screens, AMOLED used to be a trade off (contrast vs color accuracy). It no longer is.

As for the parts vs whole… Since Samsung pretty much have all the parts, making the whole isn’t much of an effort. Designing and marketing that whole does require a different skillset, but I don’t think Samsung are at a disadvantage on those fronts, at least at the high end.

The high-end vs low/mid range issue does seem to be harder. Huawei are deploying a 2-brands strategy: Huawei at the top, Honor at the low+middle. That’s proving successful I think, freeing them to compete on price on good-enough phones, while building a strong brand on fancy phones (they actually got a sapphire one ^^) at the high end. The other OEMs aren’t though, but they probably don’t have the money (LG, Sony, HTC) or market presence (Lenovo.. yet) to support two brands. I think other Chinese OEMs are going 2-brands too, Oppo/OnePlus are rumored to be the same, and another pair.

The last paragraph is sort of what I’m getting at holistically. I see them moving more aggressively toward a general supplier vs. one driven primarily by their brand.

I think the mutlibrand makes sense, and was the wrong term they took calling everything Galaxy. I think they need to address the low-end but do so with a fighter brand strategy.

And the point you made about all their components getting better is the arc of my narrative. I see them needing to outgrow their brand.

I’m wondering why the reasoning should be different for Samsung and Apple. We keep being told that Apple is superior because they’re more vertically integrated, design their own SocS… why shouldn’t it also apply for screens, cameras, RAM… ? Shouldn’t there be a whole narrative developing around how each and every component of a GS6 -instead of just one in the case of the iP6- is “designed by Samsung, manufactured by Samsung, this is the essence of Tech” ? (just don’t hire Grace Jones for the commercial ).

Granted, Apple vertical integration also happens downstream from the hardware. But their upstream part does get a lot of press, and Samsung did try and mostly fail at the downstream part… they should probably stick to their strengths.

In the end, the same reasoning applied to Apple would mean Apple should license the iOS ecosystem.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.