There were several interesting narratives out of Apple’s earnings report yesterday. The most glaring, and most confusing to many, was the struggles of the iPad. I’ll return to that in a moment. The Mac surprised many, but should not have surprised our readers. I wrote this in December of last year, and I explained the PCs upside in 2014. The PC will remain steady but we are still nowhere near the eventual bottom of annual cycles. We are seeing a refresh, mostly by corporations and education, and Apple, like many vendors, is positioned to capitalize on the upside. In an upcoming Insider post, I’ll layout why I think the Mac is actually a strong growth story for Apple.

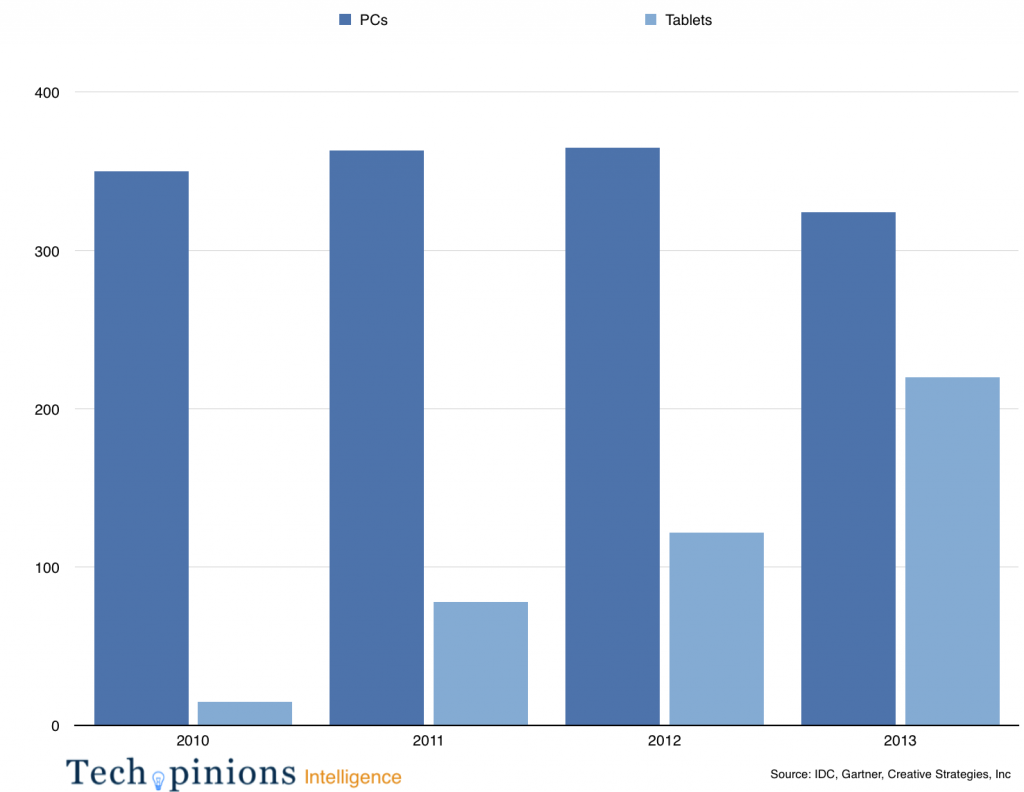

But the iPad remains an important narrative. The tablet market is functioning exactly like the typical PC market. Therefore, our deep knowledge of PC cycles helps us understand the tablet market. There is one difference though and it is a significant one which has led to many to misunderstand the tablet market.

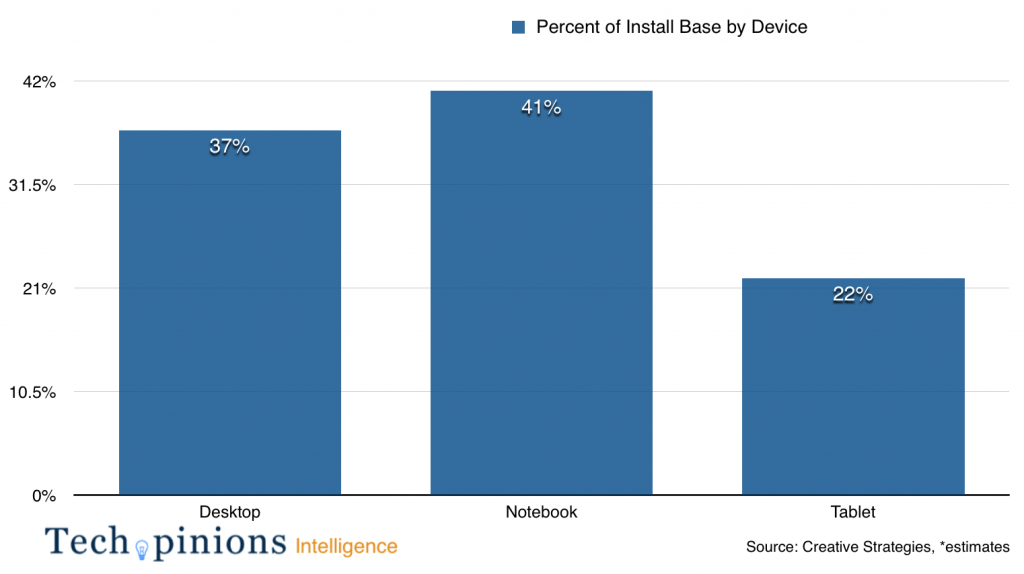

The tablet is still the fastest adopted technology in our industry history. Take a look at my install base estimates broken down by device.

Despite what you conclude about tablets, for a category which began in 2010, garnering 22% of the estimated current installed base is impressive. What gets lost is the speed in which this category grew.

It could be argued the iPad hit the perfect storm of lagging PC cycles, the mainstream’s desire for simplified computing paradigms vs complicated ones (the PC), and the Windows 8 debacle, all of which accelerated the adoption of the category. This burst led many to conclude the size of the tablet market was much larger than it actually is — potentially billions in annual unit shipments. Our forecasts were never that aggressive. While we believe the tablet market will remain a healthy segment, it will also be segmented. Segmentation will be what influences the total size of the tablet market.

With regard to iPad sales slowing, several things need to be mentioned. The first is the iPad had been experiencing solid growth in education and, to a degree, still is. However, new competition in the Chromebook has arisen for Apple in the education market. Every Chromebook manufacturer we speak with highlights to us they can not make enough to meet demand. Google announced they had sold one million Chromebooks to education in the second quarter, and the Chromebook segment is on pace to sell more than 5m units in 2014. While the iPad does more than double that number per quarter, the rising challenge of the Chromebook could be a factor in Apple’s education sector for iPads.

The enterprise is the other significant opportunity for iPad growth. I’ve spoken with a number of job market analysts and have heard numbers in the 300m-500m range for workers who don’t use a PC in their day job today but could benefit from a tablet computer. Things like construction, health, oil/gas/electic, factory workers, etc. Apple’s deal with IBM could help this, if for no other reason than it makes Apple in the enterprise more credible. Being viewed as credible to IT departments means they have more confidence to fully commit to iOS. This lack of credibility regarding Apple in the enterprise has been one of the things we hear from IT on why they hesitate to commit fully to iOS in their enterprise.

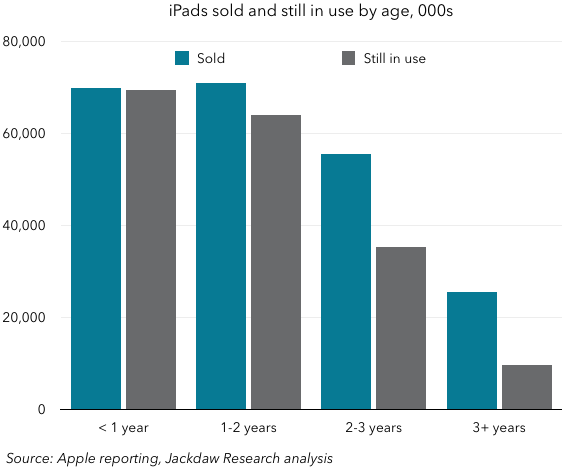

Lastly, replacement cycles are central to understand the tablet market. Fellow analyst colleague and Tech.pinions columnist Jan Dawson created a tremendous chart which we must dig into.

Jan has created a chart very similar in philosophy to ones used by all the PC vendors. It estimates the age of devices as a part of the active installed base. When I wrote earlier in the year about why I felt the PC would have a good 2014, it was based on a similar philosophy of estimates that there were around 300m PCs in active use five years or older. Knowing the replacement cycle for PCs to be in the 5-6 yr range, it was easy to conclude a large number would be upgraded soon. Using that same philosophy Jan has created this chart.

What we don’t know is the refresh cycles of tablets and, specifically, the iPad. Apple is somewhat cursed by the fact their products last so long without breaking. Consumers, on the other hand, are blessed by that reality. But if we simply look at the number of iPad’s still in use that are in the three yearr old range we can estimate the number to be around 50m units that should be eligible for upgrade in the near future.

Another key point to iPads we realized is the device is often handed down as new ones are purchased. Again, the value of the long life of the product allows this to happen. The impact of this will add to the overall installed base, but also could lead to a larger and difficult to predict refresh cycle at some point in time.

Adding new customers is the key metric to watch in this analysis. Apple reports frequently that 50% of iPad’s quarterly sales are to people who are first time iPad owners. Maintaining that statistic in our model is key as we track the installed base, growth cycle, and attempt to understand refresh patterns.

All of this brings us back to an important point about Apple’s business model. As I pointed out in my article on why Apple is immune to disruption, I specifically mention Apple has not and does not need to change their business model. What they do have to do, however, is capture more value per user. This is why watching iTunes services and revenue grow is a key statistic in the overall Apple narrative.

You have noted very interesting details! ps decent web site.