One of the first articles/analyses I ever published on Tech.pinions was aptly titled Why Apple Has a Strong Competitive Advantage. I’m linking to this article, but I encourage you not to read it as my writing skills have greatly improved, and when I go back and read it..it is a little painful. Nevertheless, that article remains the most read article on Tech.pinions to this day and still generates significant monthly views because of people searching the term “Apple’s competitive advantage” via search engines. Meaning, this is clearly still a topic many are interested in.

I’m not going to go back through my points, but I will list the core pillars because I still believe they apply to Apple’s competitive advantage today. The core pillars of Apple’s advantage I outlined in my essay were:

- Apple’s Hardware + Software

- iTunes & Digital Asset Management (what turned into the services businesses)

- Apple’s Retail Strategy

This piece was written in 2011, and Apple as a company has matured greatly. What I outlined for iTunes/digital was the early seeds planted for Apple’s services business, which is absolutely a key part of their differentiation and advantage. Other things I would include today are things like Apple being a functional organization (one PNL instead of competing business units) and their hyper-focus on customer experience as a culture and philosophy. One could argue these are ingredients of their advantage more than pillars, like their integration of hardware and software is or retail, and I could agree with that. But if I were writing that article today, I would add two new areas that I feel are undoubtedly pillars of Apple’s competitive advantage.

Apple Silicon

My belief that Apple’s investment in custom silicon is a pillar of differentiation won’t shock many of you since I cover this subject extensively. However, in today’s computing economy, I would argue that Apple’s efforts in Silicon are the underlying foundation on which ALL of Apple’s differentiation is built. Meaning, every other pillar of differentiation and competitive advantage is made possible because of Apple Silicon.

I’m not saying Apple would not be as successful if they never started making their own silicon, although I am quite confident the lead they have over multiple competitors would not be nearly as significant if Apple shipped the same silicon components their competition does. In essence, their differentiation and advantage would likely still exist, and it would just not be as strong.

Apple’s investment in silicon brings them many advantages but first and foremost is the custom tuning of components to hardware, software, and services vision. Apple has the luxury of roadmap planning in lockstep with hardware, software, and silicon engineering, and this is a luxury they have that none of their competitors do.

It could be easy to say their efforts in silicon are just part of their integration strategy. And that is true, however, I contend it is the core of their integration strategy. I’ve long said the famous quote from Alan Kay that “people who are really serious about software should make their own hardware” should be revised to say “people who are really serious about software, and hardware, should make their own silicon.” I think if Steve Jobs were around today, he would be ok with that revision as an orientating way that Apple thinks about integration.

Privacy

In looking at structural competitive advantages, we look for things that the company we are analyzing is uniquely equipped to do that competitors are not, or at least not in the same way. This is why I would add Apple’s efforts in privacy as a pillar of their competitive advantage.

Apple’s business model is a key reason they aren’t able to harvest user data for economic gain. I know this has become a topic of debate lately since Apple has been clear they do collect some data to improve their products and services for their users. However, there is a difference between observing some of your habits for other people vs. observing some of your habits to make your experience better, and Apple falls more into the latter than the prior. I’m still on the fence on a few areas with Apple’s advertising pushes, but that’s for a different analysis.

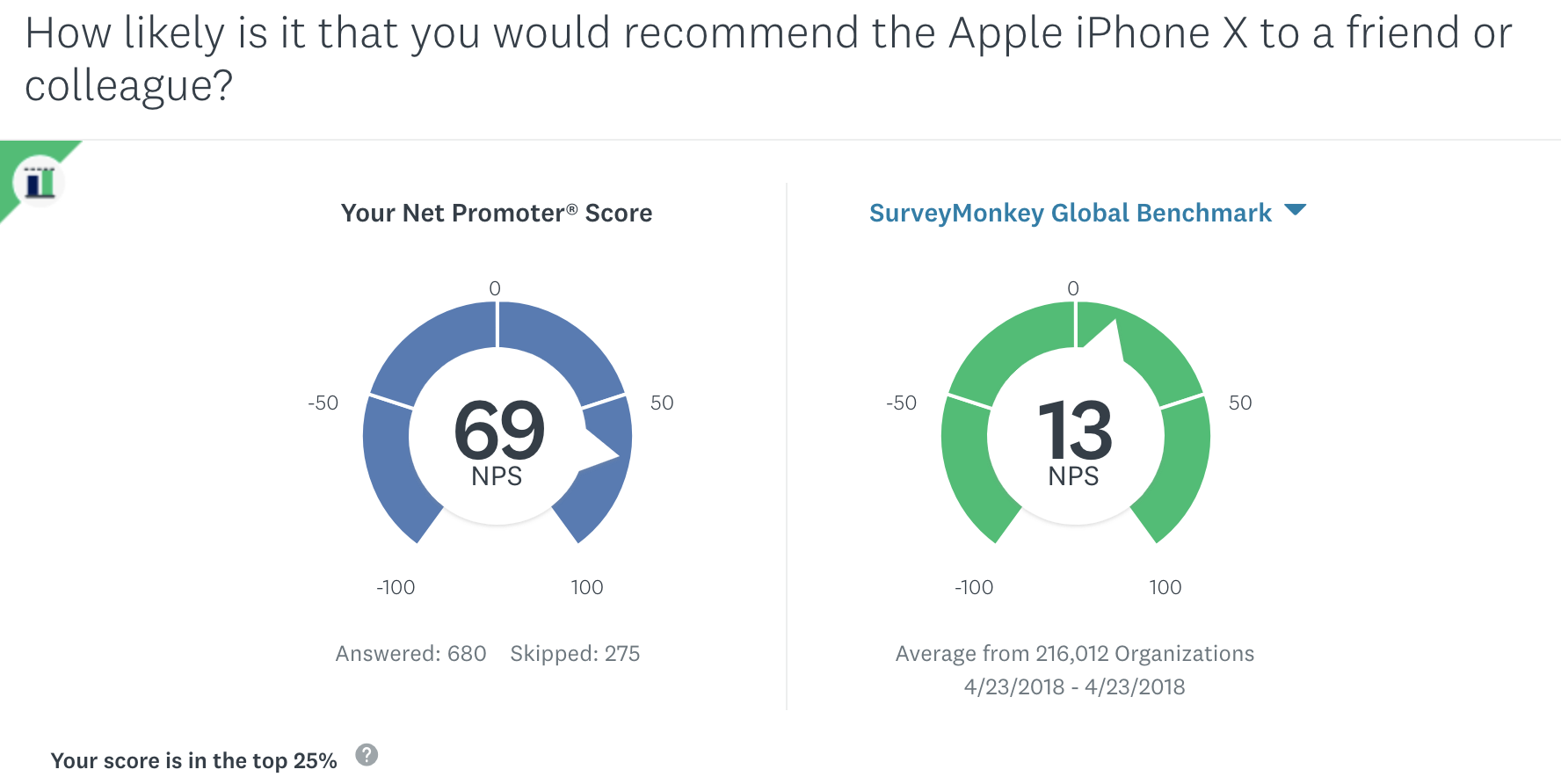

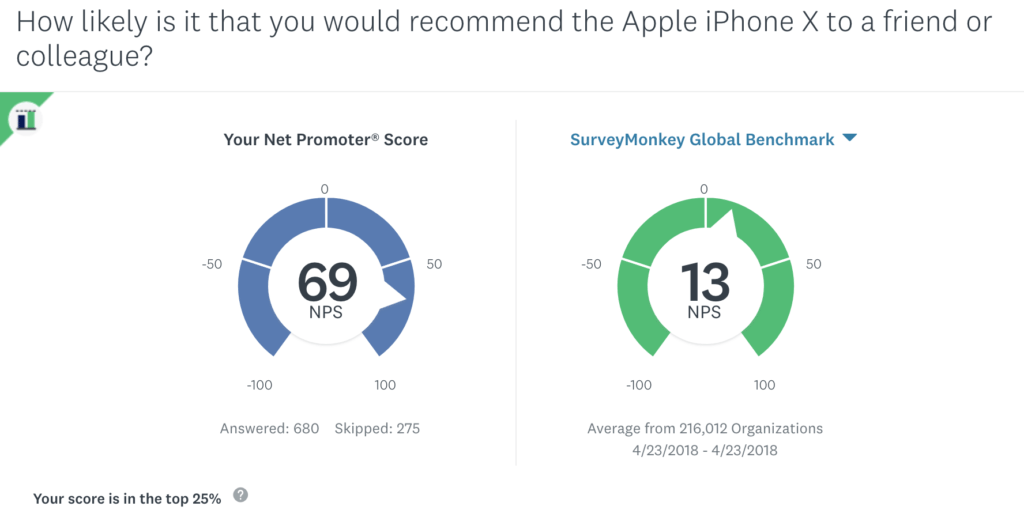

Ultimately, the point I want to make here is people trust Apple, and it is becoming clear their trust Apple with their data and their sensitive data. I’m not saying people don’t trust other companies, but I am saying that if you asked a random person on the street what technology companies they trust their most sensitive and private information to, it would be an extremely short list.

People have proven to trust Apple with their credit cards, location data, family location data and information, medical records, health information, and more. Of course, Apple didn’t get there overnight, and its efforts to protect consumer privacy have been around for a while. But making this a point of marketing and doubling down on privacy will award them some advantages that other companies will not have.

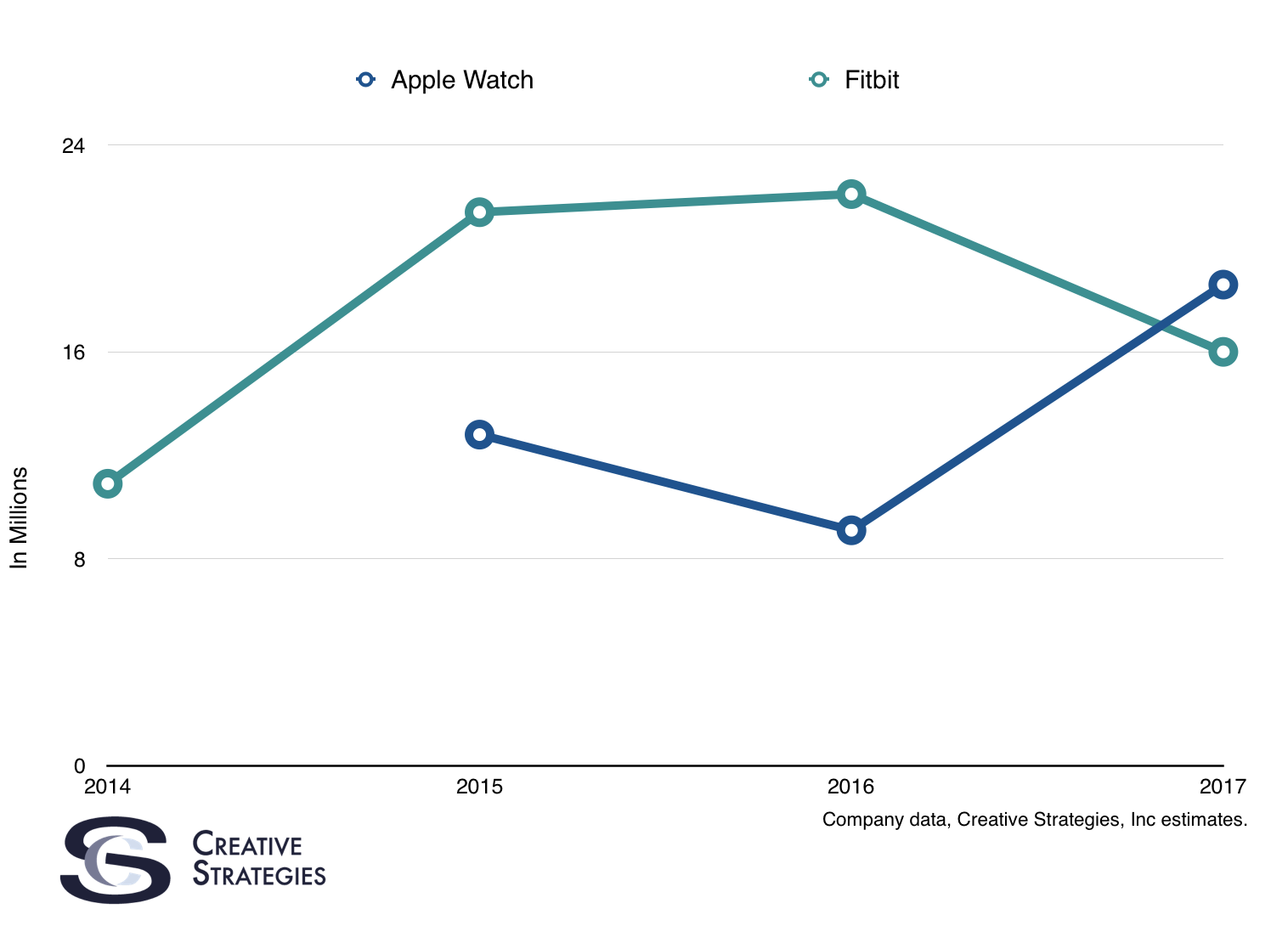

The main one that comes to my mind is around Apple Watch. Apple is by far the leader in wearable consumer devices, and the advancements made to Apple Watch every year only go deeper into a consumer’s health and well-being. However, they could not do this if they didn’t have a base of trust, and in some cases, are still working to earn the trust of their customer base.

Leveraging the Advantage

With those two additions to the pillars of Apple’s competitive advantage, I want to look forward to future products and industries Apple can move into. When we think about going deeper into health/healthcare, more personal and intimate wearables, computers like glasses and beyond, and even automotive where our lives are at stake, Apple Silicon and Apple’s privacy stance become fundamental advantages that will allow them to go into markets competitors can’t.

It is easy to see the whole picture now, but seeing how far back Apple has clearly been planning and deepening their advantage with the pillars of silicon and privacy as competitive advantages, shows us just how far down the road Apple thinks strategically.