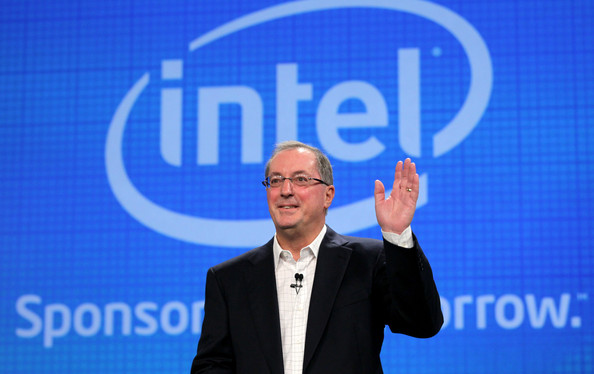

Intel’s CEO Paul Otellini is retiring in May 2013. His 40-year career at Intel now ending, it’s a timely opportunity to look at his impact on Intel.

Intel As Otellini Took Over

In September 2004 when it was announced that Paul Otellini would take over as CEO, Intel was #46 on the Fortune 100 list, and had ramped production to 1 million Pentium 4’s a week (today over a million processors a day). The year ended with revenues of $34.2 billion. Otellini, who joined Intel with a new MBA in 1974, had 30 years of experience at Intel.

The immediate challenges the company faced fell into four areas: technology, growth, competition, and finance:

Technology: Intel processor architecture had pushed more transistors clocking faster, generating more heat. The solution was to use the benefits of Moore’s Law to put more cores on each chip and run them at controllable — and eventually much reduced — voltages.

Growth: The PC market was 80% desktops and 20% notebooks in 2004 with the North America and Europe markets already mature. Intel had chip-making plants (aka fabs) coming online that were scaled to a continuing 20%-plus volume growth rate. Intel needed new markets.

Competition: AMD was ascendant, and a growing menace. As Otellini was taking over, a market research firm reported AMD had over 52% market share at U.S. retail, and Intel had fallen to #2. Clearly, Intel needed to win with better products.

Finance: Revenue in 2004 recovered to beat 2000, the Internet bubble peak. Margins were in the low 50% range — good but inadequate to fund both robust growth and high returns to shareholders.

Where Intel Evolved Under Paul Otellini

Addressing these challenges, Otellini changed the Intel culture, setting higher expectations, and moving in many new directions to take the company and the industry forward. Let’s look at major changes at Intel in the past eight years in the four areas: technology, growth, competition, and finance:

Technology

Design for Manufacturing: Intel’s process technology in 2004 was at 90nm. To reliably achieve a new process node and architecture every two years, Intel introduced the Tick-Tock model, where odd years deliver a new architecture and even years deliver a new, smaller process node. The engineering and manufacturing fab teams work together to design microprocessors that can be manufactured in high volume with few defects. Other key accomplishments include High-K Metal Gate transistors at 45nm, 32nm products, 3D tri-gate transistors at 22nm, and a 50% reduction in wafer production time.

Multi-core technology: The multi-core Intel PC was born in 2006 in the Core 2 Duo. Now, Intel uses Intel Architecture (IA) as a technology lever for computing across small and tiny (Atom), average (Core and Xeon), and massive (Phi) workloads. There is a deliberate continuum across computing needs, all supported by a common IA and an industry of IA-compatible software tools and applications.

Performance per Watt: Otellini led Intel’s transformational technology initiative to deliver 10X more power-efficient processors. Lower processor power requirements allow innovative form factors in tablets and notebooks and are a home run in the data center. The power-efficiency initiative comes to maturity with the launch of the fourth generation of Core processors, codename Haswell, later this quarter. Power efficiency is critical to growth in mobile, discussed below.

Growth

When Otellini took over, the company focused on the chips it made, leaving the rest of the PC business to its ecosystem partners. Recent unit growth in these mature markets comes from greater focus on a broader range of customer’s computing needs, and in bringing leading technology to market rapidly and consistently. In so doing, the company gained market share in all the PC and data center product categories.

The company shifted marketing emphasis from the mature North America and Europe to emerging geographies, notably the BRIC countries — Brazil, Russia, India, and China. That formula accounted for a significant fraction of revenue growth over the past five years.

Intel’s future growth requires developing new opportunities for microprocessors:

Mobile: The early Atom processors introduced in late 2008 were designed for low-cost netbooks and nettops, not phones and tablets. Mobile was a market where the company had to reorganize, dig in, and catch up. The energy-efficiency that benefits Haswell, the communications silicon from the 2010 Infineon acquisition, and the forthcoming 14nm process in 2014 will finally allow the company to stand toe-to-toe with competitors Qualcomm, nVidia, and Samsung using the Atom brand. Mobile is a huge growth opportunity.

Software: The company acquired Wind River Systems, a specialist in real-time software in 2009, and McAfee in 2010. These added to Intel’s own developer tools business. Software services business accelerates customer time to market with new, Intel-based products. The company stepped up efforts in consumer device software, optimizing the operating systems for Google (Android), Microsoft (Windows), and Samsung (Tizen). Why? Consumer devices sell best when an integrated hardware/software/ecosystem like Apple’s iPhone exists.

Intelligent Systems: Specialized Atom systems on a chip (SoCs) with Wind River software and Infineon mobile communications radios are increasingly being designed into medical devices, factory machines, automobiles, and new product categories such as digital signage. While the global “embedded systems” market lacks the pizzazz of mobile, it is well north of $20 billion in size.

Competition

AMD today is a considerably reduced competitive threat, and Intel has gained back #1 market share in PCs, notebooks, and data center.

Growth into the mobile markets is opening a new set of competitors which all use the ARM chip architecture. Intel’s first hero products for mobile arrive later this year, and the battle will be on.

Financial

Intel has delivered solid, improved financial results to stakeholders under Otellini. With ever more efficient fabs, the company has improved gross margins. Free cash flow supports a dividend above 4%, a $5B stock buyback program, and a multi-year capital expense program targeted at building industry-leading fabs.

The changes in financial results are summarized in the table below, showing the year before Otellini took over as CEO through the end of 2012.

| GAAP | 2004 | 2012 | Change |

| Revenue | 34.2B | 53.3B | 55.8% |

| Operating Income | 10.1B | 14.6B | 44.6% |

| Net Income | 7.5B | 11B | 46.7% |

| EPS | $1.16 | $2.13 | 83.6% |

The Paul Otellini Legacy

There will be books written about Paul Otellini and his eight years at the helm of Intel. A leader should be measured by the institution he or she leaves behind. I conclude those books will describe Intel in 2013 as excelling in managed innovation, systematic growth, and shrewd risk-taking:

Managed Innovation: Intel and other tech companies always are innovative. But Intel manages innovation among the best, on a repeatable schedule and with very high quality. That’s uncommon and exceedingly difficult to do with consistency. For example, the Tick-Tock model is a business school case study: churning out ground-breaking transistor technology, processors, and high-quality leading-edge manufacturing at a predictable, steady pace of engineering to volume manufacturing. This repeatable process is Intel’s crown jewel, and is a national asset.

Systematic Growth: Under Otellini, Intel made multi-billion dollar investments in each of the mobile, software, and intelligent systems markets. Most of the payback growth will come in the future, and will be worth tens of billions in ROI.

The company looks at the Total Addressable Market (TAM) for digital processors, decides what segments are most profitable now and in the near future, and develops capacity and go-to-market plans to capture top-three market share. TAM models are very common in the tech industry. But Intel is the only company constantly looking at the entire global TAM for processors and related silicon. With an IA computing continuum of products in place, plans to achieve more growth in all segments are realistic.

Shrewd Risk-Taking: The company is investing $35 billion in capital expenses for new chip-making plants and equipment, creating manufacturing flexibility, foundry opportunities, and demonstrating a commitment to keep at the forefront of chip-making technology. By winning the battle for cheaper and faster transistors, Intel ensures itself a large share of a growing pie while keeping competitors playing catch-up.

History and not analysts will grade the legacy of Paul Otellini as CEO at Intel. I am comfortable in predicting he will be well regarded.

Good read. Considering all the backlash that Paul has faced, this is a positive assessment on his tenure. This reinforces why Intel has gone with an internal candidate for the CEO position. Intel has demonstrated the best leadership model with a smooth transition over the last 35 years. I’m glad that the board did not succumb to analyst opinion.

Intel has done OK. They are like MS – squeezing the last monopoly profits out of a declining market. They are a mature and stagnating business with most of its strengths in the wrong places. Their real strength has come from being a vertically integrated chip maker (own their architecture and manufacturing) living off the back of the Windows monopoly. They are beginning to reap the whirlwind for pillaging the PC market for years. They have been an unmitigated failure in the mobile market. The Atom brand is a joke associated with Netbooks with a poor user experience. I’ll believe that resurrection when I see it.

They will now have to compete in a largely consumer-driven market where the leader doesn’t even release chip speeds or details. OEMs have no interest in being beholden to Intel unless they offer a game changing benefit at a low price. The first is possible though unlikely the way ARM/OEMs are innovating, the second is unlikely or will gut their margins.

Add in their dubious business tactics employed against AMD and they deserve everything they will get. The final section is pure unfounded supposition about Intel’s investments paying off by a Intel booster.

Even financials are nothing to shout about. Their margins even declined since 2004 (Operating and Net Income) and I can’t see mobile offering any respite in that trend. By putting an aggregate figure on the growth numbers you suggest some sort of major growth trend but revenue is up just 5.7% per year on average and profits less than that. Hardly stellar performance in the world where Apple and Samsung have quarters better than Intel has a FY. In 2004 Apple had FY revenue of $8.28Bn with profit of just $0.25Bn. FY2013 will be close to $190Bn/$40Bn. That is impressive growth.

Teen Girls Pussy Pics. Hot gallerieshttp://nimmonsbuffbitchesporn.adablog69.com/?stephanie free frida farell porn hd long tube free porn porn tube photo shoot faq of gay porn career gay gang bang mobile porn

If this is the case then results could possibly beskewed or even the writer may be not able to draw any sensibleconclusions. Understand the subject – While writing the essay, the first thing you need todo would be to define the topic. Reading and writing whenever possible should be the best way to develop a writing style.

code red delta 8 edibles

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Woah! I’m enjoying the template/theme of this website. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between superb usability and visual appeal. I must say you’ve done a very good job with this.

Definitely what a great blog and instructive posts I definitely will bookmark your site.All the Best!

You have noted very interesting details! ps decent web site.

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. It helped me a lot and I hope it will also help others.

Hi to every one, the contents existing at this web page are actually remarkable for people experience, well,

keep up the nice work fellows.

Thanks for sharing such a good idea, post is fastidious, thats why

i have read it completely

Hi to all, how is all, I think every one is getting more from this web page,

and your views are good in favor of new people.

What a stuff of un-ambiguity and preserveness of

valuable knowledge regarding unexpected feelings.

I for all time emailed this webpage post page to all my associates, as if like to read it next

my friends will too.

It’s a pity you don’t have a donate button! I’d certainly donate to this brilliant blog!

I suppose for now i’ll settle for bookmarking and adding

your RSS feed to my Google account. I look forward to new updates and will talk about this website

with my Facebook group. Talk soon!

Right now it sounds like Movable Type is the best blogging platform

available right now. (from what I’ve read) Is that what you are using on your blog?

You have made some decent points there. I checked

on the web for more information about the issue and found most individuals will go along with your views on this website.

Hi there! I know this is kinda off topic but I was wondering if

you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having difficulty finding one?

Thanks a lot!

It’s remarkable to pay a quick visit this web site and reading the views of all friends regarding

this article, while I am also keen of getting experience.

The other day, while I was at work, my cousin stole my iPad and tested to see if it

can survive a twenty five foot drop, just so she can be a youtube sensation. My

apple ipad is now destroyed and she has 83 views.

I know this is entirely off topic but I had to

share it with someone!

sex ロボット アマゾン対AliExpressでセックスドールを購入する:より良いオプション

Hi there this is kind of of off topic but I was wanting

to know if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding experience so I wanted to get guidance from someone with experience.

Any help would be greatly appreciated!

Thanks in support of sharing such a pleasant idea, piece of

writing is good, thats why i have read it fully

Hi there, I enjoy reading through your article post. I wanted

to write a little comment to support you.

Hey there! I could have sworn I’ve been to this website before

but after reading through some of the post I realized it’s new to

me. Anyhow, I’m definitely delighted I found it and I’ll be book-marking and checking

back frequently!

This is my first time go to see at here and i am actually impressed to read

all at single place.

What i do not understood is in reality how you’re now not

really a lot more well-preferred than you might be now.

You are very intelligent. You understand thus significantly in terms of this matter, made me in my opinion believe it from so many varied angles.

Its like women and men don’t seem to be

fascinated until it’s something to accomplish with Lady gaga!

Your personal stuffs excellent. Always deal with it up!

Hello! I could have sworn I’ve visited this website before but after

browsing through some of the articles I realized it’s new

to me. Anyways, I’m certainly happy I found it and I’ll be bookmarking it and checking back often!

I was able to find good information from your articles.

Somebody necessarily lend a hand to make significantly posts

I would state. That is the first time I frequented your website

page and to this point? I surprised with the research you made to create this actual submit extraordinary.

Magnificent job!

My family members always say that I am killing my time here at web, but

I know I am getting experience all the time by reading thes fastidious articles or reviews.

Oh my goodness! Amazing article dude! Thank you so much, However I am going through issues

with your RSS. I don’t understand the reason why I am

unable to subscribe to it. Is there anybody else getting the same RSS issues?

Anyone who knows the answer will you kindly respond?

Thanx!!

Heya i’m for the first time here. I came across this board and I find It

truly useful & it helped me out a lot. I hope to give something back and help

others like you aided me.

Can you tell us more about this? I’d want to find out some additional information.

Touche. Great arguments. Keep up the good spirit.

Definitely what a great blog and instructive posts I definitely will bookmark your site.All the Best! .Live TV

Hey very interesting blog!

Thankfulness to my father who shared with me regarding this website,

this web site is genuinely remarkable.

WOW just what I was searching for. Came here by searching for Best hair regrowth products

for women

I was more than happy to discover this page. I want to

to thank you for ones time due to this fantastic read!!

I definitely savored every part of it and i also have you bookmarked to look at new

stuff in your web site.

I very delighted to find this internet site on bing just what I was searching for as well saved to fav .-sendung vox heute

We have iptv and other all payment soluation

Gobuypro.com

** Paypal balance to buy bitcoin safely way we have.

0.European All Country Paypal account available Persona & Business✅

1.UK/USA verified Business & Personal PayPal Accounts✅

2.Binance Verified/Verified plus✅

3.Cashapp VCC activate/BTC enable✅

4.Wise Personal/Business account✅

5.Revolut business account✅

6.Buy Aged Facebook account 5 year old✅

8.Payoneer/Venmo/Pst.net account available✅

9.Any $ Dollar exchange service✅

10.Unlimited email sending software life time✅

12.Buy USA bank+ credit card account with all access✅

Contact

Whatsapp: +44 7308 244260

Telegram: @gobuypro

Skype: live:.cid.236f261e6814fdd8

Mail: gobuypro@protonmail.com

We always follow your beautiful content I look forward to the continuation.Garmin 010-02038-02 DriveSmart 65 Built-In Voice-Controlled GPS Navigator with 6.95” High-Res Display Black – Hot Deals

We have iptv and other all payment soluation

Gobuypro.com

** Paypal balance to buy bitcoin safely way we have.

0.European All Country Paypal account available Persona & Business✅

1.UK/USA verified Business & Personal PayPal Accounts✅

2.Binance Verified/Verified plus✅

3.Cashapp VCC activate/BTC enable✅

4.Wise Personal/Business account✅

5.Revolut business account✅

6.Buy Aged Facebook account 5 year old✅

8.Payoneer/Venmo/Pst.net account available✅

9.Any $ Dollar exchange service✅

10.Unlimited email sending software life time✅

12.Buy USA bank+ credit card account with all access✅

Contact

Whatsapp: +44 7308 244260

Telegram: @gobuypro

Skype: live:.cid.236f261e6814fdd8

Mail: gobuypro@protonmail.com

I’m amazed, I must say. Rarely do I encounter a blog that’s both

equally educative and interesting, and without

a doubt, you’ve hit the nail on the head. The issue is something which too few people are speaking intelligently about.

Now i’m very happy I found this in my search for something regarding this.

Hello, after reading this awesome post i am too cheerful to share my familiarity

here with colleagues.

Thanks for another informative site. Where else could I am getting that type of information written in such an ideal approach?

I’ve a challenge that I’m simply now running on, and I’ve been on the glance out for

such info.

Appreciating the commitment you put into your website and detailed information you offer.

It’s nice to come across a blog every once in a while that isn’t the same out of date rehashed material.

Great read! I’ve bookmarked your site and I’m adding your RSS feeds to

my Google account.

it’s awesome article. look forward to the continuation. – hey dudes kids

https://mhpereezd.ru/

https://gruzchikov19.ru/

Hi there just wanted to give you a quick heads up.

The words in your article seem to be running off the

screen in Chrome. I’m not sure if this is a formatting issue or something to do

with browser compatibility but I thought I’d post

to let you know. The style and design look great though! Hope you get the issue solved soon.

Cheers

Fantastic beat ! I would like to apprentice while you amend your

website, how can i subscribe for a blog web site?

The account aided me a applicable deal. I have been a little bit familiar of this your broadcast offered

shiny transparent idea

It’s an amazing paragraph in favor of all the online viewers; they will take benefit from it I am sure.

This blog was… how do you say it? Relevant!!

Finally I have found something that helped me. Many thanks!

But wanna say that this really is quite helpful Thanks for taking your time to write this.

Качественное написание рефератов https://referatnovy.ru/, курсовых и дипломных работ от лучших авторов. Уникальные работы под ключ. Заказать студенческую работу за 2 дня.