Unlike the PC computing era where the industry was made up of “market share” of only one company, the “Post PC Era” is poised to be made up of market shares. That means many platforms competing in different segments, each with a share of each market. As we dive into several of the charts I’ve created, this point will stand out. It will also highlight this isn’t simply a case of iOS vs Android vs Microsoft in every segment. More to the point, it is wrong to look at the industry as purely a platform battle. The right big picture view to have of the industry is to think about what each platform means to each segment and, more importantly, what opportunities exist within each platform independently. I will cover the platform market shares in a three part series. I’ll start with smartphones, then tablets, then PCs.

Smartphones

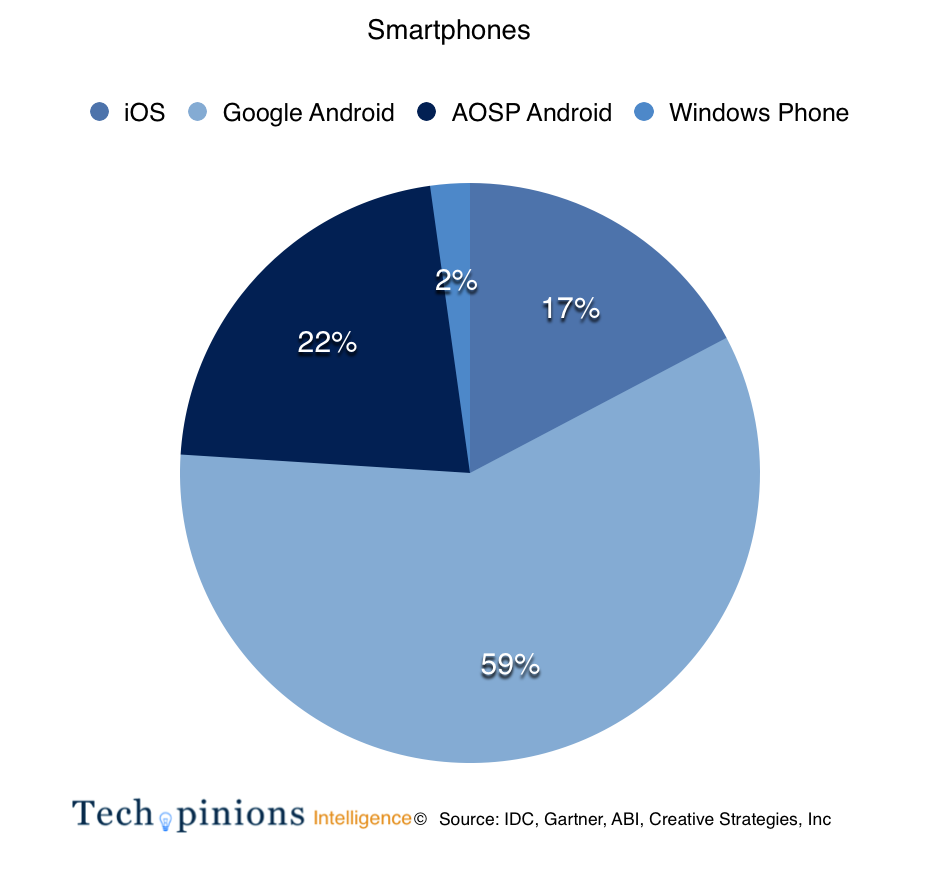

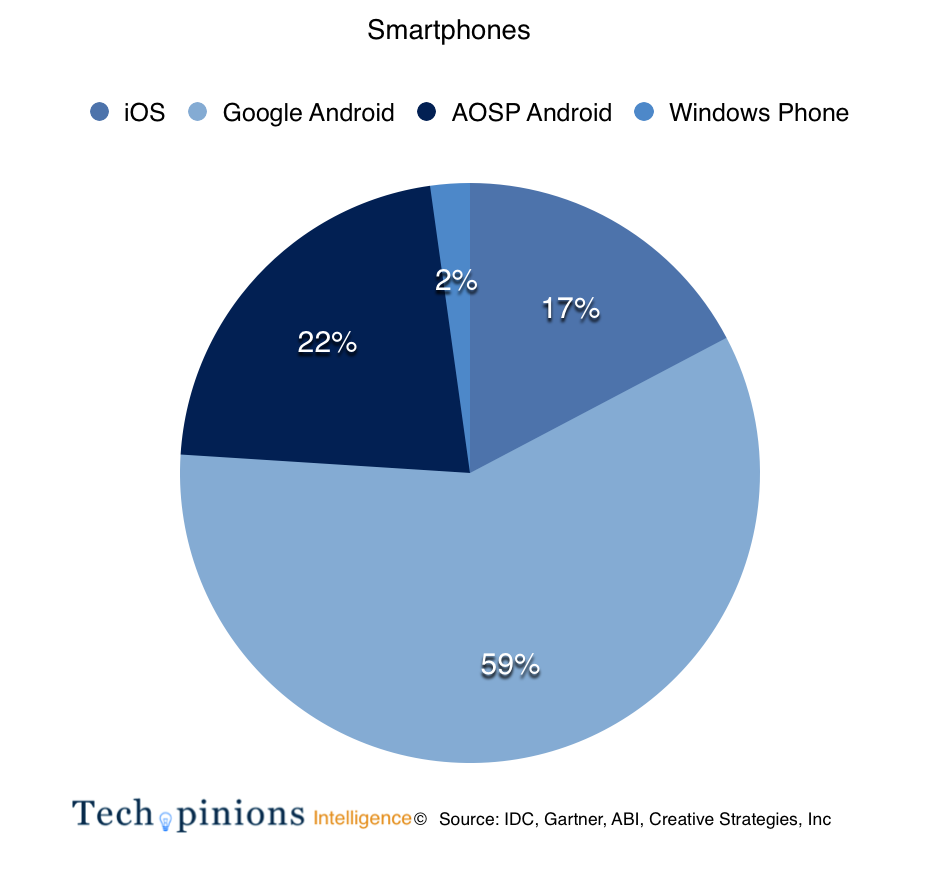

Yes, Android ships the majority of smartphones each quarter. But what most analysts estimates don’t do is break out the sales between AOSP (Android Open Source Project) and Google’s version of Android. We essentially have three viable mobile platforms. We have iOS, we have Google’s version of Android tied to Google services and Google’s app store, and we have the AOSP version which is what is on over 95% of smartphones sold in China. The best way to understand AOSP is as China’s proprietary smartphone platform. With that context, let’s look at the percentage each platform has of smartphones in active use.

In my smartphone model, I estimate the total active smartphone installed base to be 2.04 billion devices. As you can see from the chart, the smartphone market is not so black and white as to be just iOS vs. Android. What is absolutely essential in this model is to understand what the customer makeup is within each market share.

- iOS: We know iOS owns the majority of the most profitable customers. And while iOS currently has 17% of the smartphone installed base, it is likely Apple could raise that to 20% within in the next 12 months. iOS customers are higher value customers and therefore Apple’s share of the market presents certain opportunities. Things like subscription services, hardware add-ons, a-la-carte media purchasing, e-commerce, and more are viable opportunities for iPhone customers.

- AOSP: AOSP is not a forked version of Android (like Kindle Fire OS), it is simply a stock version of Android installed without Google’s core services like search, maps, app store, etc. China has all their own local services and they use vanilla AOSP and vendors pre-load local services and app stores on their devices for that region. AOSP must be understood within the China context. Companies like Xiaomi have uniquely benefited from using AOSP to their advantage in China. Other hardware opportunities may emerge as the door is wide open in China for many companies to leverage AOSP and use inexpensive hardware as a giveaway in order to capture monthly revenue from a service or subscription. It remains unclear how much of an opportunity there is for AOSP Android outside of China. If there is not, this piece of the pie will shrink over time.

- Google’s Android: Google’s version of Android will remain the dominant market share, especially as big regions like India, Brazil, and South East Asia start to ramp. Yet, Google is still faced with a problem. As Android begins to saturate in markets where hardware is very low cost, the overall value of an Android customer on average will decline. Google’s advertising business model works well now but how much will advertisers be willing to spend on customers who do not have much monthly disposable income? Android will have the largest market share but it will also consist of a large variety of consumers at different economic stages. Ultimately, I believe this will be a challenge for the platform and the ecosystem.

- Windows Phone: This is still a minority platform. Its fate seems yet to be sealed. Microsoft has been slow to gain partners other than Nokia and even those who have embraced Windows Phone in markets like India or SE Asia have experienced very slow sales. It is yet to be seen whether Microsoft can advance the platform by chasing the low end of the smartphone market. Given the extremely low installed base of Windows Phone, and the slow sales, it remains hard to be optimistic on the platform.

Apple has a monopoly on iOS. Market share is up for grabs should they be creative with pricing and services offered. Android OEMs will battle it out quarter after quarter and we will see if loyalty to a brand can be established in Android the way it is with iOS. What is clear is different strategies and opportunities are emerging in different regions. What is working in the US is not working in China but rather something different entirely is a success in China. The same is true of India, and early evidence suggest regionally focused strategies are going to also work in Brazil and Indonesia.

It is fascinating to watch a market in real time where there is so much at stake, yet so little is actually settled.

Usually a humble person my elitist side rears its head when I see comments from Android fans who beat the marketshare-dominance drum as though that equates to undisputed success over the market. I just keep in mind that there’s only one Apple against several dozen Android hardware manufacturers.

No doubt Ford and Honda move more units per quarter than Maybach or Lamborghini but I doubt that deters those companies from making high-end automobiles or feel forced to make a lesser vehicle to compete with the likes of the Fiesta or the Civic.

Why any investor would want Apple to play in the Wal-Mart space of the smartphone industry is beyond me. Apple continues to post record profits and has revenue streams that will keep it afloat for the foreseeable future. No other company can make that claim regardless of how much of the market they can lay claim to.

I always say that just because McDonald’s have more restaurants in no way implies that they make better burgers than In-N-Out or Habit or craft a better smoothie than Jamba Juice.

Yes, profit share is a much better metric. But it is useful to know as a percentage of installed base what platforms have what share. It gives us a picture of what is being actively used and in what volume.

True, it is useful information, as the capabilities and success of phones depends much more heavily on an ecosystem than it would for cars. But a rich ecosystem is enabled by having their active user base reach some unit/spending threshold, not a smartphone market share threshold.

One possibility that I am playing around with, is that in the near future, Chinese Internet service companies like Baidu might make a strong push for the emerging countries. In this scenario, Baidu would have to promote an ASOP platform, otherwise they stand no chance because Google demands prominent placement of Google services on Google Android phones.

Since Google Android is effectively free to use, for ASOP to become popular, ASOP has to be cheaper than free. That is, OEMs must be paid for using ASOP. One way for this to happen is if Chinese service providers are willing to pay the OEMs to expand their user base. In some ways, this is similar to Google paying Mozilla to be the default search engine on Firefox.

This is why I am interested in how good the Chinese Internet services are. Are they closing the gap with Google in terms of features? Do they have a business model that better suits emerging markets? Do they have features that are popular in Asia, which for example, border on IP issues in a way that Google cannot copy? If this is starting to be the case, then China again might be a driving force that changes the mobile landscape.

“This is why I am interested in how good the Chinese Internet services are. Are they closing the gap with Google in terms of features?”

That’s an interesting question. I think a lot of people overestimate the difficulty in meeting or beating Google services. Google’s various services are not invulnerable.

Yes. Services can be commoditized like everything else.

Search is probably the hardest to copy, but in many ways, organic Google search is over serving the market. Google itself recognizes that users most often just want to find a company’s web site, flight info or an entry in Wikipedia, and has redesigned accordingly.

Why could Chinese companies use IP-challenged stuff outside of their home IP-free turf ?

Most of the cloud stuff, as I understand it, is not IP-challenged.

I’m wondering how AOSP is more or less of a fork than Amazon’s Android. Both do the exact same things:

1- take the basic OS

2- replace Google ‘net services with their own

3- replace Google’s store with their own

4- replace Google’s launcher with their own.

How are they different ?