Every so often for subscribers I do a deep dive on the China smartphone market. I’ll do another one on India in the upcoming weeks. We have some recent data on the China smartphone market I think paints a fascinating picture of what is happening as it relates to several players, and Apple in particular.

China is like no other market I study when it comes to not just mobile but the mobile internet. While we may be able to glean insights from the mobile internet trends in China and apply them to other areas, I’m not convinced we can apply the hardware trends — namely, the size of the market for customers willing to pay extreme premiums to own iPhones.

Overall View of the Market

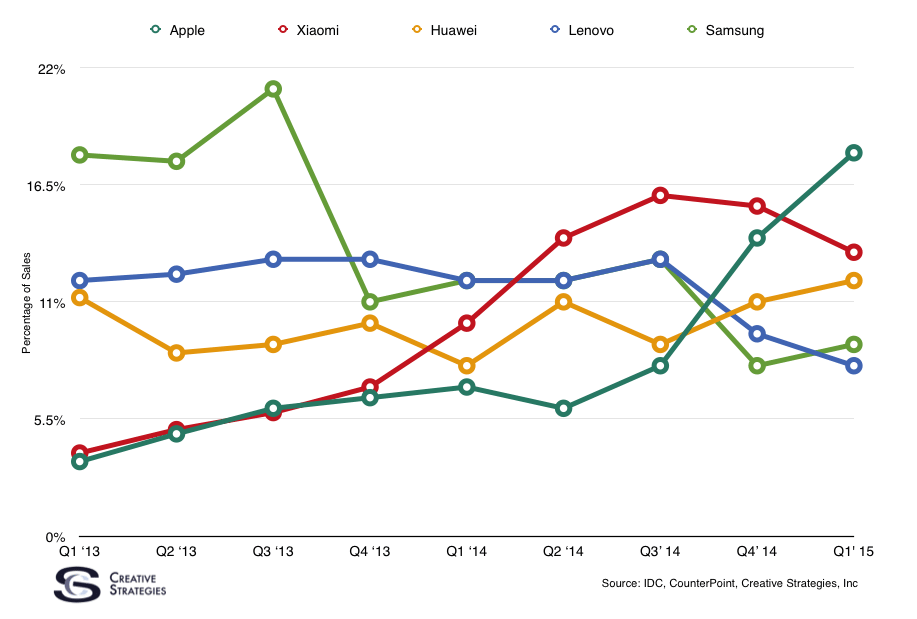

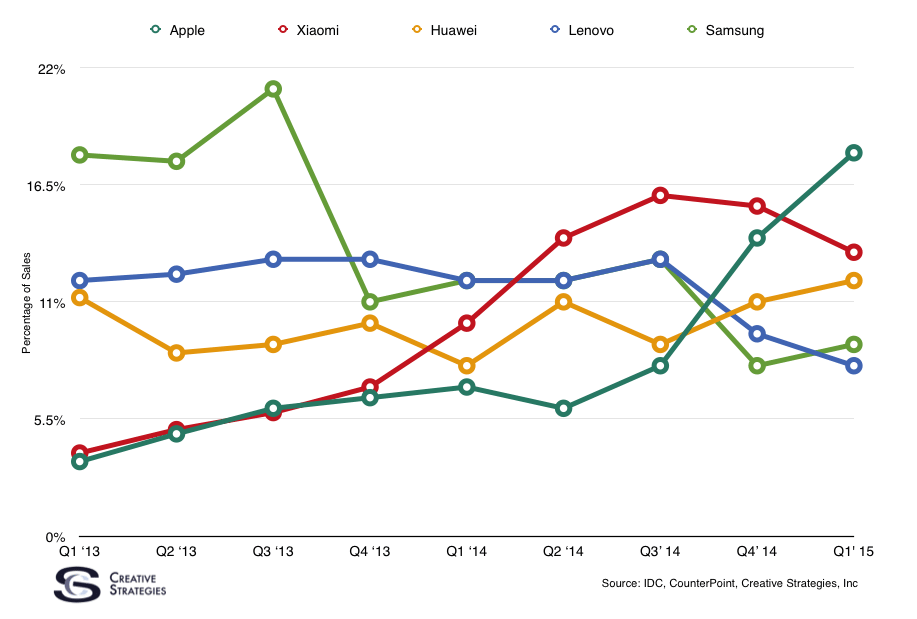

I track global sales of smartphones by vendor, but also break them out by region. Here is a view of the market share paths of the major vendors since early 2013.

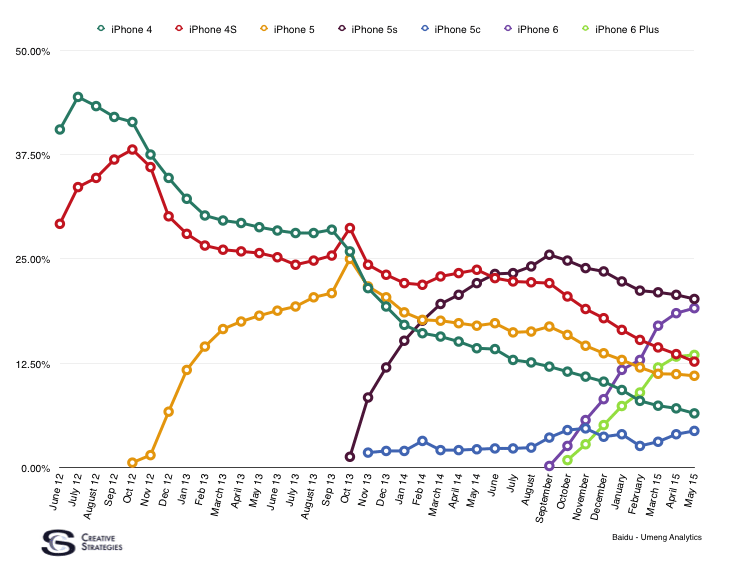

As you can see, the story of China’s smartphone growth was largely about Android, but also being driven by local manufacturers. In a market which grew from an average of 60 million units a quarter to over 100m units a quarter, there was plenty of share to go around. China was cutting their teeth on mobile and local vendors and low-cost handsets were driving the growth. All along, those of us who study the market knew Apple had a high aspirational brand but had yet to see the masses move. One thing these vendor share charts don’t show is the secondary market or the grey market. The market where iPhones are bought, not through official channels, but through unofficial ones. Remarkably, amidst the rapid smartphone growth of local vendors, Chinese consumers were buying iPhones in such significant numbers where, for a period of time in 2012, illegitimate iPhone sales made up 9-10% of all smartphones sold per quarter in China including through legitimate channels. Which, if legitimate plus grey market shipments were counted, would have put Apple in the top 5 of smartphone vendors by sales volume in China going back to 2012. Our research revealed that, during the time period, grey market iPhones sales were nearly double the number of iPhones sold through legitimate channels. This is why the device usage data from Baidu/Umeng had such high usage rates of iPhone 4 and 4s during that time frame. Such high penetration can only make sense when we add both grey market and legitimate market sales.

As you see from the chart over time, the huge base of iPhone 4 and 4s owners began to diversify and Apple began bringing new customers into their ecosystem as they cut more deals with local carriers with China Mobile being the driver of Apple’s growth push in China.

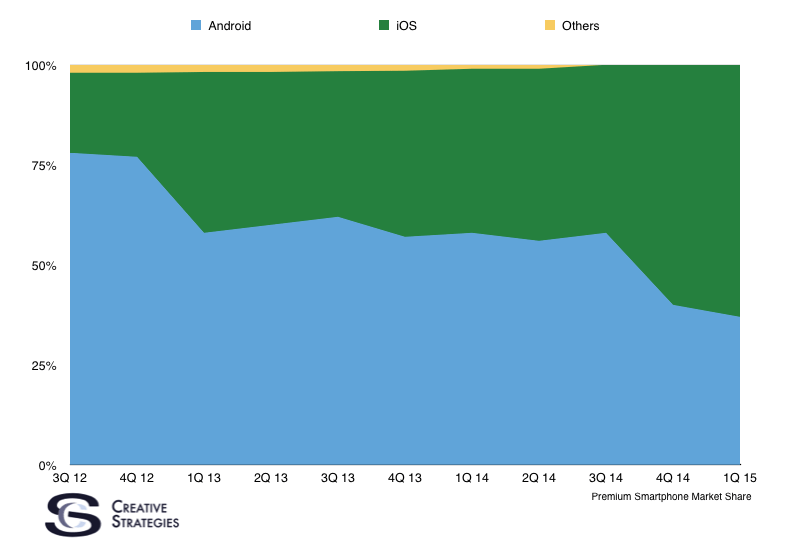

Android remains the dominant OS in China’s market of now over 600 million smartphone users. It wasn’t until the launch of the iPhone 6 and 6 Plus that Apple began to pull ahead as the majority leader in market share for the premium smartphone market in China. By vendor, Samsung and Apple were the two primary drivers of the premium smartphone market with Huawei and a few offerings from Xiaomi in the mix. Thanks to the iPhone 6 and 6 Plus, Apple’s share of the premium market is now over 60%. Furthermore, for the past two quarters, the iPhone has been the best selling smartphone brand in mainland China.

With the premium market sealed up by Apple, the real battle moves to the middle-income parts of the market. Tim Cook made an interesting statement last quarterly earnings call when he stated the iPhone was beginning to penetrate the mid-tier parts of the Chinese smartphone market. This correlates with some recent survey work we did in China where over 50% of those considered in the middle-income bracket expected to spend more money on their next smartphone. This is where the battle will lie for vendors in China. With the most developed parts of China already at 90% smartphone penetration, any meaningful growth by any vendor in mainland China will come from taking customers away from someone else. For the time being, this favors Apple but there are over 50 smartphone brands who sell into mainland China. However, only four brands rank among the most owned across all income classes–Apple, Samsung, Huawei, and Xiaomi.

Consolidation is likely coming in the China smartphone market as it will be difficult for all 50+ brands to continue to do well in the mid and premium price tiers. Any smartphone vendors looking for pure growth must look below the $100 device range and many are not positioned well to succeed there. While Apple is among those well positioned to grab new users from Android brands, Meizu and Oppo are brands to watch as well. Xiaomi was hot for a while but has now seen two quarters of back to back declines and we will see how 2015 pans out for Xiaomi in their home country.

Lastly, another data point that makes China interesting from a growth standpoint for well-positioned brands/vendors is that Chinese consumers replace their smartphones on faster cycles than any other market. The average US consumer refreshes their smartphone every 26 months while the average Chinese consumer refreshes every 22 months.

This is a picture of the market as it is today, but there are new dynamics coming to the Chinese smartphone market which may shake things up in an interesting way. In a similar vein as the US, the Chinese government is mandating all credit cards and retail store point of sale kiosks move to dual-purpose cards. These are cards not unlike the chip and pin cards coming to the US market but using different technology and including the secure element. These kiosks coming to point of sale will include both the RFID dual-purpose chip and an NFC chip which means there will be significant infrastructure for contactless mobile payments in many developed areas and the larger Chinese retailers by the end of 2015. I hear nearly every Android OEM is going full steam with NFC in China as well as OEMs and mobile payment companies starting to put the pieces together to compete for mobile wallets and mobile payments. Of course, if Apple can secure the right deals with UnionPay and others, they will also be right in the mix as the Chinese market ripens for mobile contactless payments via smartphones. Everyone I talk to at the component and hardware level who focuses on China believes another competitive cycle is coming from OEMs to capitalize on this new dynamic of mobile payments.

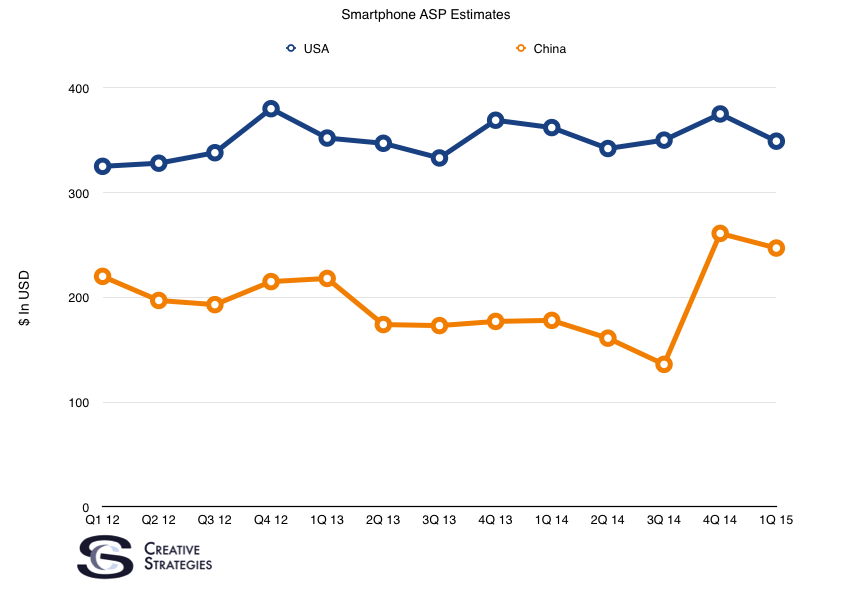

What’s perhaps most interesting about the smartphone hardware market in China is how it is moving more toward a premium market. Thanks to Apple, ASPs in China are actually growing not declining. Remember most believed the way to be successful in China was to make low-cost/cheaper handsets, but the market is actually moving up and this is true across income brackets. I’ve plotted estimates for ASP in China compared to that of the US to show this.

All these dynamics make China quite unique. It is becoming the largest premium smartphone market and I don’t see that changing anytime soon. It is the largest smartphone market with over 600m smartphones in active use, and the vast majority of those 600m smartphone users are looking to spend more on their next handset and simultaneously are investing more in the Chinese mobile internet and contributing to local economy. You can see why this market is so important to many competitors due to its size but for Apple it’s crucial to their growth. This is why we are seeing and will continue to see significant investments and customizations with Apple’s hardware, software, and services specific to the China market. To compete in China, hardware, software and services core competencies are becoming essential. Which is why my sense is there are only a handful you can tough it out.

Soon I’ll do a deep dive on the Indian smartphone market. India in terms of potential user size will rival China, but as you will see dramatically different market dynamics exist.

It’s amazing how fast this market moves. I thought there was up to another half decade left before those populating the mid tier market started trading up. Apple’s timing was impeccable, or, perhaps, the market was just waiting for a large sized iOS device. In China, larger screens are seen as a premium feature, and from my own anecdotes it seems Apple’s smaller screens were a serious knock against them for many shopping in higher product segments.

On a slightly separate matter, has any work been done on matching the faster product cycle and the rising ASP with increasing incomes? I have two pet theories for why the China market seems primed to move upstream. The first is related to the aforementioned income factor, but the second is postulated on an increasing usage, dependence, and value perception of the mobile internet. I imagine income has to be at least a contributing factor, but knowing just how much of a factor it is could tell us a lot about what’s shaping buying behavior in China, and how that buying behavior may change.

I am yet to see a decent chart plotting the rising income class in a way that I can plot ASP to. If you see anything feel free to let me know. There is another dynamic that adds to this however that I think is fascinating and would be curious on your take on it specific to what you know about the Chinese.

I came across a data point that iPhones are owned in the range of 15-20% across income classes of those making less than RMB 200k (household) income levels. It is this household point that I think is interesting and particular for gifting and younger Chinese. As you know the one-child policy helped create what many call the little emperor syndrome. Also referred to as little princes and little princesses. Cross that with the significant economic rise and these parents of little emperors growing up in a depressed environment and wanting to provide a better life for their kids. Which brings us to a place where a shared pool of financial resources, both sets of parents, grandparents, etc., is focused on just one child. Hence we see pooled resources of households buying iPhones for their kids, thus leading to the stat of high iPhone ownership even in lower income households thanks to financial pooling of the family.

This dynamic is interesting to me, because it reminds me of the generation in the US which grew up during the depressed times and going to great lengths to provide a better life for their kids which are the baby boomers of today. These things tend to shape quite a bit of the future mentality for generations and I think we need to take this mentality into consideration when thinking about where the little emperor generation will be in 20 years and the impact they will have not just on China but globally.

The princeling effect is a good point, but even with it expensive purchases like a new iPhone are probably priced out for some income tiers. Then there are many parents who may want to spoil their single child, but not excessively. Furthermore, as you get to lower income tiers, the replacement cycle is likely slower for those who were gifted phones through a pooled family income. Meanwhile those who are priced out or choose not to give their child the very best probably define a portion of that mid tier segment. In those cases, moving upmarket may be a slower phenomena. I think that’s the component of the market that will be more closely tied to income trends, but I do fundamentally think there’s an upward trajectory there.

However, I can also see a scenario where adoption with those kinds of consumers (and perhaps the middle segment more broadly) continues strong, or even strengthens. I’m curious to see whether the iPhone 6 will be treated like a mid tier product once the 6s replaces it as Apple’s top of the line, and then the 7 after it. An example would be if you wanted to buy an iPhone for your kid or yourself but were priced out, buying the previous year’s model over an Android alternative would be the default consolation. If the preference for the Apple brand in China penetrates middle segments that deeply (and in the paragraph after this I’ll explain why I think it does), the iPhone 6 may have a rather long and successful life cycle. If that’s what happens, it would, amongst other things, imply strongly that Apple’s own slow movement on screen size was big dampener on their own strong branding.

Beyond the princeling effect, I should note that the taste for premium products in China isn’t exclusive to parents wanting to spoil their single children. Abject poverty followed by explosive growth has has fueled a strong desire for conspicuous consumption and expensive tastes that spans across all demographic groups. Generally speaking, I would say the average Chinese (especially urban) consumer is far more aspirational than their counterparts in developed countries, and are willing to make one or two very expensive purchases as status symbols to sate some of those aspirations (this, more than anything else, is why we see a lot of Chinese knock off brands copying the aesthetics of foreign companies). Consumption of premium goods with great symbolic value generally seem to have higher downmarket penetration in China when compared to comparatively similar income segments in other developing countries (and maybe even developed countries).

I suspect (but can’t say with certainty) that this effect is even stronger if the good is seen has having important functional purpose, which is the space smartphones are starting to occupy in China. Furthermore, I think that that status symbol effect is further strengthened by the fact that a smartphone is both far more useful and accessible/affordable than other similar status symbols like cars or watches. I suspect for the sake of status there are more people willing to spend 1000 USD on a top of the line phone than 10,000 USD for an entry level car.

Great piece Ben! Thanks for writing.

Awesome stuff. Lots of empirical evidence Apple is just getting started in China.

very satisfying in terms of information thank you very much.