As I woke up this morning to the news that Intel has acquired Mobileye, I changed my mind on publishing what I had written for today’s Insider post. For Intel, this is a key strategic move. Acquiring Mobileye allows them to better compete and solidify Intel’s position in not just autonomous and self-driving cars but the technology + automotive industry opportunity. In nearly all the discussions we’ve had with key brands and major players in the automotive space, Mobileye was a consistent name that came up. Emerging as a clear leader, Intel wasted no time making sure someone else didn’t sweep in and buy them first.

This signifies the continuation of the trend I’ve been talking about for the past few years as the semi-conductor industry consolidates into a few major players — Intel, Qualcomm, Broadcom/Avago, and Nvidia. This move also further validates my observation of the semiconductor industry’s renaissance and could even spur more startups to continue to make bold bets in new silicon startups. Lastly, this is another big win for the under-appreciated Israeli-based tech scene and Israeli-based semiconductor companies in particular. Israel has one of the most innovative semiconductor environments, with small/mid-size companies continually being acquired with key and exceptional IP around silicon-based chips and sensors. I hope this benefits the tech scene in Israel and that more great startups of all kinds continue to spring up from the country.

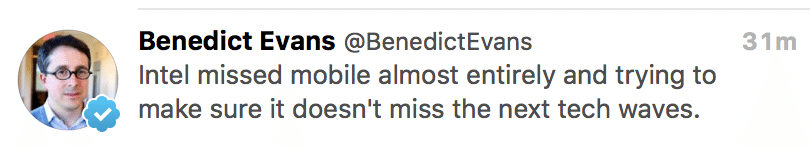

This latest move by Intel is also worthy of noting another observation. It is abundantly clear, as if it wasn’t before, that the big dominant tech incumbents are going to acquire their way into the next wave and to ensure they do not miss the next wave(s). As my friend Benedict Evans pointed out on Twitter this morning:

The above statement is not just apt but is also flexible as you can add any big companies name to the tweet and be correct. Apple, Microsoft, Google, Intel, Nvidia, Qualcomm, Oracle, SAP, SalesForce, IBM, etc., etc. They will all continue to acquire their way into not missing the next wave or waves of computing. It is understandably hard for big companies to disrupt themselves and risk hurting their cash cow. Too often that danger, known as the “Innovator’s Dilemma”, leads to not seeing what is around the corner that will inevitably disrupt your business. This is why these big companies’ M&A departments start to become a more important player in fighting disruption for those incumbents who have acquired a pile of cash from being the kings of the prior era of computing.

This single reality is also a big driver fuelling the continued momentum in venture capital. The knowledge that you don’t have to have a company you invest in go to an IPO for you to get a return. It may come as no surprise to many of our readers, including those of you in the VC industry, investments are often made with scenarios including which companies may be the target of acquisition by a larger firm.

Finally, all of this further convinces me the noted economics theory of “boom, bust, buildout” of new industries is completely at play. I articulate that theory in this post — this quote in particular:

The “boom” period is a period of euphoria where entrepreneurs, investors and early adopters rally around the product; followed by a relatively short “bust” where tough economic realities are faced; followed by an extraordinary “build-out.”

During the boom, an industry first gains traction and investment money floods the market. The result is that the supply outpaces the demand of the current market state. This is because the early interest is driven by early adopters, which is not a large market. The overflooding of capital, combined with an immature market, leads to the bust. The bust, however, causes a drop in price of essential market components, which leads to innovation.

In an example with the railroad industry, the “bust” led to such cost declines in essential components that it made it possible for enterprising entrepreneurs to create the frozen car, thus spurring the meat packing industry. The two-year railroad bust, however, was followed by a global build-out that lasted a century. That build-out occurred all around the world and forever changed transportation and commerce.

Through every cycle of the industrial revolution, this pattern has repeated. The initial boom of this current cycle was the startup bubble of the late 90s. Here we are, almost 20 years later and we still see the build-out portion of this cycle which will likely continue to last another several decades or longer.

Technology at large will sit in the center of all the major industry waves we see going forward. It is woven into our social fabric and is why the dominant companies of today will remain aggressive in acquiring their way into all new waves going forward. It is, simply, the natural order of things going forward. History will show, a company’s ability to remain relevant and avoid disruption will include, in part, the wisdom of their M&A departments.

There is some nice and utilitarian information on this site.

Very nice blog post. I definitely love this site. Stick with it!