Acquisition strategy has been in the news this week. Apple CFO Luca Maestri was asked at a Goldman Sachs conference about how the company might use its cash in the wake of a repatriation tax holiday. He downplayed the potential for acquisitions while reiterating Tim Cook’s point that Apple doesn’t reject deals on the basis of being over a certain price point. There’s also been reporting this week about Apple’s negotiating strategy during acquisition talks hurting its ability to close big deals. In that context, it’s worth looking at the history of consumer tech acquisitions and how they’ve fared.

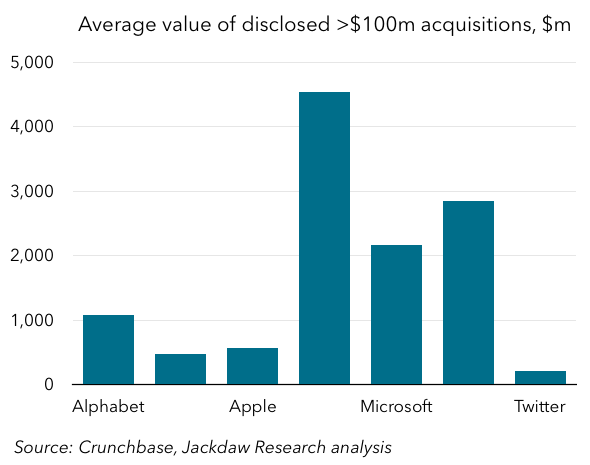

I’ve focused this analysis on a handful of the largest and most acquisitive companies in the consumer tech sphere and used data from Crunchbase to identify those deals worth over $100 million. The charts below show both the total value of these deals and the average deal size for each company:

As you can see, there’s a big range here with Microsoft coming out on top, in terms of total value of the deals, and Facebook coming out on top with highest average deal size (heavily affected by its $19 billion WhatsApp acquisition). Among the larger companies, Apple and Amazon have done the smallest total value of deals over $100 million, while Twitter’s total is quite a bit less.

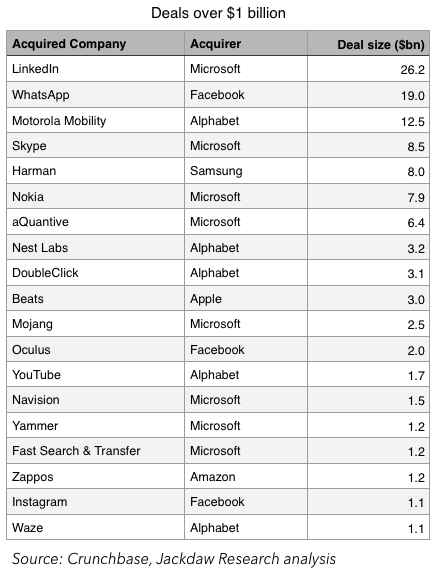

If you narrow the focus to deals over a billion dollars, which might reasonably be considered “big” deals, an interesting picture emerges – here’s the listing of deals I found which match that criterion:

Microsoft is most represented on this list, in part by virtue of being one of the longest-standing companies in the group, but also because it seems particularly willing to do these billion-plus deals relative to others. It has eight out of the 19 deals shown with Alphabet second at five. Apple only has one entry on the list (Beats at $3 billion) and Samsung also has just the one, with its recently announced Harman deal at $8 billion.

How, then, have these various big deals fared? It’s worth looking at them in several categories:

- Big successes: I’d put Instagram, DoubleClick, YouTube and Zappos into this camp – each of those companies has been a massive success for its new parent

- Big failures: Skype, Motorola Mobility, Nokia, and aQuantive all belong in this list – each was either resold at a much lower price, written down almost entirely by the acquirer, or has simply failed to perform

- Solid successes – I’d say this group includes Beats, on the basis of the solid success of Apple Music (but also part of the declining accessories business at Apple), Fast Search and Transfer at Microsoft (now Microsoft Development Center Norway), Waze, and Navision (although it could be argued it belongs in the big success bucket as a foundational piece of Dynamics).

Many of the rest of the deals are too early in their tenure at their new homes to be certain how these acquisitions will fare long term. The LinkedIn deal just barely closed, while the WhatsApp deal has been closed for some time but Facebook hasn’t really turned on monetization for it yet so it’s hard to tell whether that will ever pay off.

Some companies seem to fare particularly poorly. Microsoft has three of the four big failures, with Alphabet having the other. But it’s also done well with some deals and all the big failures happened during the Steve Ballmer era rather than under new CEO Satya Nadella. Alphabet’s deals have mostly done well, Facebook’s are a mixed bag, and Samsung’s only big acquisition looks smart on paper but hasn’t even closed yet. Apple has only the one pretty successful acquisition on the list.

The reality is M&A is a risky business, with one of the biggest challenges being cultural fit. That’s particularly challenging at Apple because it sees its culture as both unique and uniquely important. That means smaller deals for technology and tight-knit teams of people are a better fit than massive established businesses with large workforces. For other companies with more generic engineering and software cultures, such acquisitions may be easier.

But it’s also fair to say the biggest failures include several attempts to use big acquisitions as levers for massive strategic shifts, while the most successful acquisitions have often been logical extensions of existing businesses. Skype, Nokia, and aQuantive at Microsoft all fell into the former category, for example, whereas Zappos at Amazon, YouTube and DoubleClick at Google, and Instagram at Facebook were all fairly adjacent businesses. Big strategic shifts have rarely been enabled by taking on entirely new and different businesses – those are often best established through organic change or technology acquisitions which enable broader changes.

To me, it looks like the smartest companies in this group understand this and are very discerning about the acquisitions they make. In some cases, that probably means looking at a lot of deals they eventually pass on and, in other cases, it means losing out to companies willing to move faster on due diligence. But that’s the price you pay for a careful acquisition strategy intended to protect a corporate culture rather than bring change at any cost.

I’m not 100% sure Google’s Moto deal was a failure: https://dealbook.nytimes.com/2014/01/29/did-google-really-lose-on-its-original-motorola-deal/?_php=true&_type=blogs&smid=li-share&_r=1

In the end they paid $3.2b for patents. Did Google initially intend to hang on to the smartphone business ? But then changed their mind before the Google-designed pipeline had time to get to market ? That would be more than sloppy, and feels improbable.

Interesting update on that article you linked to:

“Update: There is one thing to keep in mind, however: whether the value of the patents holds up in court. Last year, Microsoft claimed victory in its dispute with Motorola over the value of standard essential patents, when a judge determined that a reasonable licensing rate for some patents was a shade under $1.8 million a year. That’s well below the $4 billion a year that Motorola had sought.”

So those patents might not be worth what Google had hoped.

Liars, damn liars, businessmen, lawyers and accountants?

Say it ain’t so…

“Business men, they drink my wine

Plowman dig my earth

None were level on the mind

Nobody up at his word” -Robert Allen Zimmerman

Cute, but it has little to do with my comment. The reality is Google likely did not do very well on the Motorola deal. I don’t care either way, but it’d be nice if we could all agree to simply tell the truth rather than spin everything to fit a personal bias.

It has to do with the heart of your comment. Which liar to believe more on how those patents are valued.

Show me a businessman that does not spin to satisfy their own goals. The official name is marketing.

Motorola sought four billion per year and got less than two million per year. That is what is true. There is no marketing or spin, just reality. You can argue about what is fair but you cannot argue about what actually happened.

They both spun the value, Moto apparently lost. I really don’t care, it’s the character of the participants that I’m judging, hence the Dylan quote.

Good article with great ideas! Thank you for this important article. Thank you very much for this wonderful information.

Some really excellent info Sword lily I detected this.

I appreciate you sharing this blog post. Thanks Again. Cool.

http://medicinefromindia.store/# top online pharmacy india

pharmacy website india

pharmacies in mexico that ship to usa mexican online pharmacies prescription drugs mexico pharmacy

reputable mexican pharmacies online pharmacies in mexico that ship to usa buying prescription drugs in mexico online

pharmacies in mexico that ship to usa buying from online mexican pharmacy mexico drug stores pharmacies

mexican rx online mexican pharmacy buying prescription drugs in mexico

http://mexicanph.shop/# mexico pharmacies prescription drugs

medication from mexico pharmacy

medication from mexico pharmacy buying from online mexican pharmacy mexico drug stores pharmacies

mexican pharmaceuticals online п»їbest mexican online pharmacies mexico pharmacies prescription drugs

п»їbest mexican online pharmacies mexico drug stores pharmacies mexican pharmaceuticals online

mexico drug stores pharmacies mexican drugstore online medication from mexico pharmacy

mexican pharmacy reputable mexican pharmacies online mexican border pharmacies shipping to usa

pharmacies in mexico that ship to usa mexico pharmacies prescription drugs mexican pharmacy

mexican online pharmacies prescription drugs best online pharmacies in mexico mexican mail order pharmacies

mexican online pharmacies prescription drugs mexico pharmacies prescription drugs pharmacies in mexico that ship to usa

reputable mexican pharmacies online medicine in mexico pharmacies best mexican online pharmacies

http://mexicanph.shop/# mexico pharmacies prescription drugs

mexican pharmaceuticals online

best online pharmacies in mexico mexico drug stores pharmacies mexican pharmaceuticals online

mexico drug stores pharmacies medication from mexico pharmacy reputable mexican pharmacies online

mexican pharmaceuticals online mexican pharmaceuticals online best mexican online pharmacies

mexican online pharmacies prescription drugs purple pharmacy mexico price list reputable mexican pharmacies online

mexican border pharmacies shipping to usa best online pharmacies in mexico mexican border pharmacies shipping to usa

medicine in mexico pharmacies mexican drugstore online pharmacies in mexico that ship to usa

best mexican online pharmacies mexican online pharmacies prescription drugs mexican pharmaceuticals online

mexican pharmacy reputable mexican pharmacies online purple pharmacy mexico price list

buying prescription drugs in mexico п»їbest mexican online pharmacies buying prescription drugs in mexico online

п»їbest mexican online pharmacies mexican pharmacy medicine in mexico pharmacies

mexican mail order pharmacies mexican rx online reputable mexican pharmacies online

best mexican online pharmacies mexico pharmacies prescription drugs mexico pharmacy

mexico drug stores pharmacies mexico pharmacy reputable mexican pharmacies online

https://mexicanph.shop/# medicine in mexico pharmacies

purple pharmacy mexico price list

mexico drug stores pharmacies п»їbest mexican online pharmacies п»їbest mexican online pharmacies

mexican online pharmacies prescription drugs mexican mail order pharmacies mexican drugstore online

mexican mail order pharmacies buying prescription drugs in mexico best online pharmacies in mexico

pharmacies in mexico that ship to usa mexican rx online reputable mexican pharmacies online

purple pharmacy mexico price list п»їbest mexican online pharmacies reputable mexican pharmacies online

mexico pharmacy purple pharmacy mexico price list medicine in mexico pharmacies

mexico drug stores pharmacies mexican online pharmacies prescription drugs mexico drug stores pharmacies

pharmacies in mexico that ship to usa buying prescription drugs in mexico best mexican online pharmacies

mexican online pharmacies prescription drugs purple pharmacy mexico price list mexico drug stores pharmacies

mexico pharmacies prescription drugs mexican border pharmacies shipping to usa mexico drug stores pharmacies

medication from mexico pharmacy mexican pharmaceuticals online buying prescription drugs in mexico online

buying from online mexican pharmacy mexican pharmacy reputable mexican pharmacies online

buying from online mexican pharmacy best online pharmacies in mexico mexico pharmacies prescription drugs

medication from mexico pharmacy mexico pharmacy mexican rx online

purple pharmacy mexico price list mexican pharmacy best online pharmacies in mexico

mexican border pharmacies shipping to usa mexican border pharmacies shipping to usa mexican online pharmacies prescription drugs

https://mexicanph.shop/# reputable mexican pharmacies online

best online pharmacies in mexico

buying from online mexican pharmacy mexican drugstore online mexican rx online

mexican mail order pharmacies best online pharmacies in mexico mexican border pharmacies shipping to usa

buying prescription drugs in mexico mexico pharmacies prescription drugs mexico drug stores pharmacies

buying from online mexican pharmacy best mexican online pharmacies mexico drug stores pharmacies

mexican pharmacy mexico pharmacies prescription drugs buying prescription drugs in mexico

mexican rx online mexico pharmacies prescription drugs buying prescription drugs in mexico online

prednisone 2 5 mg: prednisone canada prices – prednisone oral

http://amoxil.cheap/# amoxicillin discount coupon

https://lisinopril.top/# zestril brand name

prednisone 200 mg tablets: buy prednisone nz – can i order prednisone

lasix 40mg: Over The Counter Lasix – furosemide 100mg

http://buyprednisone.store/# purchase prednisone from india

prednisone where can i buy: buy prednisone online paypal – 50 mg prednisone canada pharmacy

http://stromectol.fun/# buy ivermectin

http://buyprednisone.store/# prednisone 50 mg coupon

lisinopril 25mg tablets: zestril 20 mg cost – lisinopril 10 mg online

https://lisinopril.top/# website

where to buy amoxicillin: amoxicillin 500 mg tablet – prescription for amoxicillin

http://amoxil.cheap/# amoxicillin generic

ivermectin oral: stromectol generic name – ivermectin tablet 1mg

https://buyprednisone.store/# canada buy prednisone online

buy lasix online: Over The Counter Lasix – buy furosemide online

lasix furosemide 40 mg: Buy Lasix No Prescription – lasix 100mg

http://amoxil.cheap/# buy amoxicillin 500mg usa

http://buyprednisone.store/# no prescription prednisone canadian pharmacy

prednisone 10 tablet: medicine prednisone 5mg – prednisone price canada

https://furosemide.guru/# furosemida 40 mg

can i buy prednisone online without prescription: buy prednisone no prescription – prednisone in canada

prednisone brand name: prednisone 1 mg daily – prednisone 10mg price in india

http://buyprednisone.store/# prednisone prices

https://amoxil.cheap/# amoxicillin 500mg capsules

lisinopril 10 best price: prinivil 20 mg – lisinopril oral

http://stromectol.fun/# stromectol 3 mg

https://stromectol.fun/# ivermectin medication

prinivil: price of lisinopril – prinivil 5 mg tablets

http://amoxil.cheap/# amoxicillin online purchase

ivermectin 0.08%: stromectol cvs – minocin 50 mg for scabies

http://stromectol.fun/# stromectol price usa

lasix: Buy Lasix – buy lasix online

lisinopril 2.5 cost: zestril coupon – lisinopril tabs

http://furosemide.guru/# lasix

https://lisinopril.top/# 40 mg lisinopril for sale

furosemida: Buy Lasix – lasix 20 mg

https://buyprednisone.store/# prednisone tablets 2.5 mg

lisinopril 5 mg price: rx drug lisinopril – lisinopril 3972

https://amoxil.cheap/# buy amoxicillin 500mg

1 mg prednisone daily: prednisone 54 – prednisone 54

http://buyprednisone.store/# prednisone pak

furosemida: Buy Lasix – furosemide 100 mg

lasix furosemide 40 mg: Buy Furosemide – lasix for sale

http://lisinopril.top/# zestril 10 mg tablet

http://amoxil.cheap/# amoxicillin 500 mg tablet price

prednisone 50 mg tablet canada: average cost of prednisone – purchase prednisone from india

https://amoxil.cheap/# can i buy amoxicillin over the counter

can i purchase amoxicillin online: generic for amoxicillin – generic amoxicillin cost

stromectol order: ivermectin tablet 1mg – ivermectin online

https://stromectol.fun/# stromectol ireland

can you buy stromectol over the counter: ivermectin 3 mg dose – stromectol medicine

https://buyprednisone.store/# prednisone nz

ivermectin cost uk: ivermectin online – where to buy ivermectin cream

http://furosemide.guru/# furosemide 40 mg

ivermectin online: ivermectin 250ml – ivermectin 3 mg tablet dosage

https://lisinopril.top/# how to order lisinopril online

https://stromectol.fun/# minocycline 50mg without doctor

prednisone without a prescription: steroids prednisone for sale – prednisone 10mg canada

http://lisinopril.top/# medicine lisinopril 10 mg

prinivil: lisinopril discount – lisinopril 2.5 mg coupon

http://lisinopril.top/# zestoretic cost

medicine amoxicillin 500: amoxicillin 500 mg cost – cost of amoxicillin 875 mg

http://amoxil.cheap/# amoxicillin 500mg price in canada

cost of ivermectin pill: buy ivermectin stromectol – ivermectin 5

https://buyprednisone.store/# prednisone tablets canada

https://lisinopril.top/# lisinopril 12.5 mg price

http://stromectol.fun/# ivermectin tablets uk

ivermectin buy online: buy stromectol online – ivermectin 50

medicine amoxicillin 500mg: where can i buy amoxicillin over the counter uk – order amoxicillin online no prescription

https://indianph.xyz/# top online pharmacy india

india online pharmacy

indianpharmacy com india pharmacy mail order top online pharmacy india

http://indianph.xyz/# indianpharmacy com

mail order pharmacy india

online pharmacy india Online medicine home delivery india pharmacy mail order

http://indianph.com/# mail order pharmacy india

Online medicine order

http://indianph.com/# Online medicine order

https://indianph.com/# online shopping pharmacy india

online pharmacy india

http://indianph.com/# online pharmacy india

indian pharmacy

best india pharmacy top online pharmacy india india pharmacy mail order

https://indianph.com/# best india pharmacy

india online pharmacy

http://indianph.com/# indian pharmacy

online pharmacy india

cipro for sale: purchase cipro – cipro ciprofloxacin

http://nolvadex.guru/# nolvadex for sale

http://diflucan.pro/# diflucan prices canada

ciprofloxacin 500mg buy online: ciprofloxacin order online – buy cipro cheap

https://nolvadex.guru/# tamoxifen for sale

tamoxifen and ovarian cancer: nolvadex side effects – tamoxifen and ovarian cancer

https://diflucan.pro/# buy diflucan medicarions

http://nolvadex.guru/# tamoxifen hot flashes

tamoxifen alternatives: nolvadex estrogen blocker – alternative to tamoxifen

http://diflucan.pro/# diflucan 150 cost

Misoprostol 200 mg buy online: buy cytotec over the counter – purchase cytotec

http://diflucan.pro/# diflucan over the counter

cipro: ciprofloxacin 500mg buy online – п»їcipro generic

https://cipro.guru/# ciprofloxacin generic price

http://doxycycline.auction/# doxycycline pills

http://cipro.guru/# buy cipro online

http://cipro.guru/# buy cipro cheap

http://cytotec24.shop/# Misoprostol 200 mg buy online

http://nolvadex.guru/# where can i buy nolvadex

https://nolvadex.guru/# tamoxifen vs raloxifene

eva elfie filmleri: eva elfie – eva elfie

http://abelladanger.online/# abella danger filmleri

https://abelladanger.online/# abella danger izle

eva elfie modeli: eva elfie – eva elfie filmleri

http://lanarhoades.fun/# lana rhoades

eva elfie: eva elfie video – eva elfie filmleri

http://angelawhite.pro/# Angela White izle

Angela White filmleri: abella danger izle – abella danger izle

http://lanarhoades.fun/# lana rhoades izle

https://lanarhoades.fun/# lana rhoades izle

Angela White: abella danger izle – abella danger filmleri

https://evaelfie.pro/# eva elfie video

https://abelladanger.online/# abella danger filmleri

Angela White video: ?????? ???? – Angela White izle

https://abelladanger.online/# abella danger video

http://sweetiefox.online/# sweety fox

Angela White video: abella danger filmleri – abella danger video

https://abelladanger.online/# abella danger izle

Angela White filmleri: abella danger izle – abella danger video

http://angelawhite.pro/# Angela White filmleri

http://abelladanger.online/# abella danger izle

eva elfie filmleri: eva elfie – eva elfie modeli

https://abelladanger.online/# abella danger filmleri

?????? ????: Angela White video – Angela White filmleri

https://abelladanger.online/# Abella Danger

https://lanarhoades.fun/# lana rhoades filmleri

https://angelawhite.pro/# Angela White video

Sweetie Fox video: sweeti fox – Sweetie Fox video

http://lanarhoades.fun/# lana rhoades

https://angelawhite.pro/# Angela Beyaz modeli

Angela Beyaz modeli: Abella Danger – abella danger video

Sweetie Fox video: sweeti fox – sweety fox

https://abelladanger.online/# abella danger video

http://evaelfie.pro/# eva elfie filmleri

lana rhoades unleashed: lana rhoades boyfriend – lana rhoades boyfriend

https://sweetiefox.pro/# sweetie fox full

eva elfie new videos: eva elfie new video – eva elfie full video

https://evaelfie.site/# eva elfie

eva elfie full videos: eva elfie new video – eva elfie

free datinsites chat: https://lanarhoades.pro/# lana rhoades boyfriend

http://lanarhoades.pro/# lana rhoades pics

sweetie fox new: sweetie fox full – ph sweetie fox

https://lanarhoades.pro/# lana rhoades boyfriend

lana rhoades hot: lana rhoades boyfriend – lana rhoades solo

date free site: https://sweetiefox.pro/# sweetie fox full

http://evaelfie.site/# eva elfie full videos

mia malkova full video: mia malkova videos – mia malkova videos

http://sweetiefox.pro/# sweetie fox new

sweetie fox full video: sweetie fox new – sweetie fox

sz dating seiten: http://evaelfie.site/# eva elfie hd

sweetie fox full video: sweetie fox full video – sweetie fox cosplay

http://lanarhoades.pro/# lana rhoades pics

eva elfie: eva elfie new video – eva elfie

date game online: http://lanarhoades.pro/# lana rhoades pics

http://evaelfie.site/# eva elfie hot

eva elfie full video: eva elfie photo – eva elfie full video

mia malkova latest: mia malkova photos – mia malkova hd

https://lanarhoades.pro/# lana rhoades solo

mia malkova photos: mia malkova videos – mia malkova

online dating best sites: https://miamalkova.life/# mia malkova photos

http://lanarhoades.pro/# lana rhoades

sweetie fox cosplay: sweetie fox video – ph sweetie fox

http://miamalkova.life/# mia malkova hd

lana rhoades: lana rhoades hot – lana rhoades

https://evaelfie.site/# eva elfie full video

eva elfie new video: eva elfie hd – eva elfie new video

https://aviatormocambique.site/# aviator bet

aviator: aviator mz – aviator online

http://pinupcassino.pro/# pin up aviator

pin up cassino online: pin-up casino – pin-up cassino

aviator game online: aviator bet – aviator game online

http://jogodeaposta.fun/# ganhar dinheiro jogando

aviator oficial pin up: pin-up cassino – aviator oficial pin up

https://aviatormalawi.online/# aviator bet malawi

aviator oyna: aviator bahis – aviator

http://aviatormocambique.site/# jogar aviator

aviator sinyal hilesi: aviator hilesi – aviator oyunu

http://aviatorjogar.online/# jogar aviator online

pin up bet: pin-up cassino – pin-up cassino

aviator betano: jogar aviator online – aviator betano

https://aviatormocambique.site/# aviator mz

https://aviatormocambique.site/# aviator

aviator game: play aviator – aviator game

aviator online: como jogar aviator em mocambique – como jogar aviator em mocambique

aviator game: aviator game – jogar aviator Brasil

aviator bet: como jogar aviator – jogar aviator

aviator bet malawi login: aviator bet malawi – aviator malawi

https://aviatormocambique.site/# aviator

aviator: aviator game – aviator game

play aviator: aviator bet – aviator game

aviator betting game: aviator game – aviator

aviator: aviator game bet – aviator ghana

melhor jogo de aposta para ganhar dinheiro: site de apostas – aviator jogo de aposta

can you buy zithromax over the counter – https://azithromycin.pro/how-much-does-zithromax-cost.html generic zithromax over the counter

aviator game online: aviator game online – aviator bet malawi

can i buy zithromax online: zithromax for sale online – buy generic zithromax no prescription

http://aviatormocambique.site/# aviator online

aviator pin up: aviator jogar – aviator jogo

where to get zithromax: is zithromax an antibiotic buy zithromax online australia

https://indianpharm24.com/# india pharmacy mail order indianpharm.store

india pharmacy mail order: Online medicine order – best online pharmacy india indianpharm.store

http://mexicanpharm24.shop/# mexico pharmacy mexicanpharm.shop

https://indianpharm24.shop/# best india pharmacy indianpharm.store

https://canadianpharmlk.shop/# canadianpharmacyworld com canadianpharm.store

http://canadianpharmlk.shop/# canadian drugs online canadianpharm.store

https://indianpharm24.shop/# indian pharmacy paypal indianpharm.store

top online pharmacy india: Pharmacies in India that ship to USA – mail order pharmacy india indianpharm.store

https://indianpharm24.shop/# indianpharmacy com indianpharm.store

https://canadianpharmlk.com/# my canadian pharmacy canadianpharm.store

https://canadianpharmlk.com/# canadian pharmacy meds review canadianpharm.store

http://mexicanpharm24.shop/# mexico drug stores pharmacies mexicanpharm.shop

https://canadianpharmlk.com/# best canadian online pharmacy reviews canadianpharm.store

http://indianpharm24.com/# Online medicine home delivery indianpharm.store

http://indianpharm24.shop/# indian pharmacies safe indianpharm.store

http://indianpharm24.com/# indian pharmacy indianpharm.store

http://canadianpharmlk.com/# my canadian pharmacy rx canadianpharm.store

http://indianpharm24.com/# online shopping pharmacy india indianpharm.store

http://mexicanpharm24.com/# mexico pharmacies prescription drugs mexicanpharm.shop

http://indianpharm24.com/# best india pharmacy indianpharm.store

http://indianpharm24.shop/# online shopping pharmacy india indianpharm.store

http://mexicanpharm24.shop/# mexican rx online mexicanpharm.shop

where to buy generic clomid no prescription: where buy clomid online – order generic clomid online

can i buy amoxicillin online: amoxicillin generic brand – amoxicillin 500mg for sale uk

buying prednisone mexico: where to buy prednisone 20mg no prescription – online order prednisone 10mg

https://prednisonest.pro/# can i buy prednisone online without a prescription

prednisone purchase canada: can you drink alcohol with prednisone – prednisone best price

buy amoxicillin online without prescription amoxicillin 500mg capsule cost buying amoxicillin in mexico

http://amoxilst.pro/# amoxicillin 875 mg tablet

prednisone 20mg buy online: prednisone generic brand name – prednisone 20 mg tablet

how to buy prednisone online: prednisone for gout – prednisone buy

can you buy clomid without insurance: nolvadex vs clomid – can i purchase generic clomid pills

https://clomidst.pro/# can i purchase generic clomid without prescription

buy amoxicillin without prescription: amoxicillin online without prescription – amoxicillin 500mg cost

amoxicillin 500 mg purchase without prescription: amoxicillin 500 capsule – buy amoxicillin online without prescription

prednisone for sale online: prednisone taper schedule – 50 mg prednisone canada pharmacy

http://prednisonest.pro/# prednisone over the counter cost

where to get clomid pills can i purchase cheap clomid without a prescription can you buy cheap clomid without dr prescription

where buy clomid no prescription: can i order cheap clomid tablets – where to buy generic clomid

can i buy cheap clomid for sale: clomid iui – where can i get clomid prices

purchase amoxicillin online: amoxicillin 500 mg without a prescription – amoxicillin 875 125 mg tab

price of amoxicillin without insurance: amoxicillin rash adults – amoxicillin over the counter in canada

https://prednisonest.pro/# prednisone 2.5 mg price

get ed prescription online: online erectile dysfunction prescription – best online ed medication

http://onlinepharmacy.cheap/# online pharmacy no prescription

online erectile dysfunction pills: boner pills online – generic ed meds online

http://edpills.guru/# buy erectile dysfunction treatment

cheap pharmacy no prescription: canada pharmacy online – rx pharmacy no prescription

online pharmacy prescription: canadian pharmacy online – no prescription needed pharmacy

https://pharmnoprescription.pro/# buy drugs without prescription

best ed meds online: buy erectile dysfunction treatment – online erectile dysfunction pills

mexican pharmacy no prescription buying online prescription drugs buy medications without prescriptions

affordable ed medication: online erectile dysfunction prescription – ed medications cost

https://pharmnoprescription.pro/# best online pharmacy that does not require a prescription in india

cheapest erectile dysfunction pills: where can i buy ed pills – ed treatments online

https://onlinepharmacy.cheap/# cheapest pharmacy for prescriptions

online pharmacy without prescription: buying online prescription drugs – canadian pharmacy without a prescription

http://edpills.guru/# best ed medication online

indian pharmacy no prescription: canadian pharmacy prescription – online pharmacies without prescription

buying erectile dysfunction pills online: cheapest online ed treatment – ed online treatment

canada pharmacy not requiring prescription canadian pharmacy online online pharmacy non prescription drugs

https://onlinepharmacy.cheap/# online pharmacy no prescription

https://pharmnoprescription.pro/# mexican prescription drugs online

online prescription for ed: top rated ed pills – ed treatment online

http://mexicanpharm.online/# mexico drug stores pharmacies

medications online without prescription: canada prescription online – prescription from canada

https://indianpharm.shop/# indianpharmacy com

indian pharmacy reputable indian pharmacies reputable indian pharmacies

best online pharmacy india: online pharmacy india – indianpharmacy com

http://indianpharm.shop/# online pharmacy india

canadian drug: canadian pharmacy service – legit canadian pharmacy

online shopping pharmacy india: Online medicine order – indian pharmacies safe

http://canadianpharm.guru/# canadian family pharmacy

п»їlegitimate online pharmacies india: reputable indian pharmacies – buy medicines online in india

canadian prescription drugstore review: canada drugs no prescription – online pharmacy no prescription

pharmacies in mexico that ship to usa buying from online mexican pharmacy pharmacies in mexico that ship to usa

http://canadianpharm.guru/# canadianpharmacymeds

buying from online mexican pharmacy: п»їbest mexican online pharmacies – mexican pharmaceuticals online

india pharmacy: buy prescription drugs from india – best india pharmacy

www canadianonlinepharmacy: best canadian online pharmacy reviews – canadian online pharmacy

http://mexicanpharm.online/# mexican drugstore online

canada pharmacy without prescription: cheap prescription medication online – prescription drugs online canada

mail order pharmacy india: indian pharmacies safe – top online pharmacy india

purple pharmacy mexico price list: buying from online mexican pharmacy – mexico pharmacy

https://pharmacynoprescription.pro/# best online pharmacy that does not require a prescription in india

safe reliable canadian pharmacy: onlinepharmaciescanada com – canadian pharmacy 365

canada pharmacies online prescriptions buying prescription drugs online from canada buying drugs without prescription

best canadian pharmacy online: canadian pharmacy prices – cheapest pharmacy canada

buying online prescription drugs: no prescription on line pharmacies – buy prescription online

http://indianpharm.shop/# reputable indian pharmacies

pharmacies in mexico that ship to usa: purple pharmacy mexico price list – mexican rx online

https://pharmacynoprescription.pro/# mexico online pharmacy prescription drugs

pharmacy canadian: prescription drugs canada buy online – canadian pharmacy checker

top 10 pharmacies in india: cheapest online pharmacy india – п»їlegitimate online pharmacies india

best india pharmacy: pharmacy website india – online shopping pharmacy india

canadian mail order pharmacy canadian pharmacies compare canada drugs online review

http://canadianpharm.guru/# canadianpharmacymeds

https://indianpharm.shop/# world pharmacy india

indian pharmacy online: buy prescription drugs from india – buy prescription drugs from india

reliable canadian pharmacy: trustworthy canadian pharmacy – cross border pharmacy canada

https://canadianpharm.guru/# canadian discount pharmacy

buying prescription drugs in india: best non prescription online pharmacy – canadian prescription

mail order pharmacy india: mail order pharmacy india – top online pharmacy india

http://canadianpharm.guru/# canadian pharmacy meds

buying prescription drugs in mexico: pharmacies in mexico that ship to usa – mexican mail order pharmacies

best india pharmacy indian pharmacy Online medicine order

canadian drugs online: canadian pharmacy online ship to usa – canadian drug pharmacy

https://pharmacynoprescription.pro/# buying online prescription drugs

indian pharmacy: online pharmacy india – indian pharmacy

http://mexicanpharm.online/# buying from online mexican pharmacy

prescription meds from canada: no prescription medication – no prescription online pharmacy

http://canadianpharm.guru/# reddit canadian pharmacy

buying prescription drugs in mexico: buying prescription drugs in mexico online – mexican drugstore online

mexico drug stores pharmacies: mexico pharmacy – best online pharmacies in mexico

buying from online mexican pharmacy: reputable mexican pharmacies online – buying from online mexican pharmacy

http://mexicanpharm.online/# mexican pharmaceuticals online

purple pharmacy mexico price list pharmacies in mexico that ship to usa buying prescription drugs in mexico

best canadian online pharmacy: canada drugs reviews – best rated canadian pharmacy

buying prescription drugs in mexico online: mexican mail order pharmacies – pharmacies in mexico that ship to usa

mexican rx online: mexico drug stores pharmacies – buying from online mexican pharmacy

http://indianpharm.shop/# indian pharmacy online

https://sweetbonanza.bid/# sweet bonanza bahis

aviator pin up: pin-up casino indir – pin-up online

http://sweetbonanza.bid/# sweet bonanza yorumlar

https://sweetbonanza.bid/# sweet bonanza hilesi

aviator hilesi: aviator giris – aviator oyunu 100 tl

http://pinupgiris.fun/# pin-up online

pin up indir: pin up guncel giris – pin-up online

http://aviatoroyna.bid/# aviator bahis

aviator: aviator sinyal hilesi ucretsiz – aviator sinyal hilesi

https://slotsiteleri.guru/# güvenilir slot siteleri

http://gatesofolympus.auction/# gates of olympus s?rlar?

http://aviatoroyna.bid/# aviator hilesi

2024 en iyi slot siteleri: slot siteleri bonus veren – yeni slot siteleri

guvenilir slot siteleri: en iyi slot siteleri – guvenilir slot siteleri 2024

https://sweetbonanza.bid/# sweet bonanza slot demo

sweet bonanza hilesi: guncel sweet bonanza – sweet bonanza kazanc

https://gatesofolympus.auction/# gates of olympus demo free spin

https://slotsiteleri.guru/# slot oyunlari siteleri

sweet bonanza bahis: sweet bonanza nas?l oynan?r – sweet bonanza giris

https://sweetbonanza.bid/# sweet bonanza kazanç

gates of olympus demo turkce: gates of olympus – gates of olympus 1000 demo

aviator bahis: aviator sinyal hilesi ucretsiz – ucak oyunu bahis aviator

http://slotsiteleri.guru/# bonus veren casino slot siteleri

http://slotsiteleri.guru/# yeni slot siteleri

casino slot siteleri: slot oyunlar? siteleri – deneme veren slot siteleri

https://gatesofolympus.auction/# pragmatic play gates of olympus

https://gatesofolympus.auction/# gates of olympus taktik

aviator pin up: pin up giris – pin up casino giris

guvenilir slot siteleri 2024: slot siteleri guvenilir – yeni slot siteleri

https://gatesofolympus.auction/# gates of olympus max win

http://pinupgiris.fun/# aviator pin up

gates of olympus demo oyna: gates of olympus demo oyna – gates of olympus oyna

http://pinupgiris.fun/# pin-up casino

best online pharmacy india: Generic Medicine India to USA – pharmacy website india

top online pharmacy india: pharmacy website india – top 10 online pharmacy in india

http://indianpharmacy.icu/# best india pharmacy

reputable mexican pharmacies online: Mexican Pharmacy Online – mexico pharmacies prescription drugs

mexican pharmacy mexican drugstore online mexican online pharmacies prescription drugs

mexico pharmacy: mexico pharmacy – buying from online mexican pharmacy

https://mexicanpharmacy.shop/# purple pharmacy mexico price list

canadian pharmacy world reviews: Certified Canadian Pharmacy – reliable canadian pharmacy

canadian 24 hour pharmacy: Licensed Canadian Pharmacy – canada drug pharmacy

canadian pharmacies comparison: Certified Canadian Pharmacy – reddit canadian pharmacy

canadian pharmacy 24h com: Certified Canadian Pharmacy – canadian pharmacy online

mexico drug stores pharmacies: mexican pharmacy – mexican pharmacy

https://canadianpharmacy24.store/# global pharmacy canada

india pharmacy mail order: indian pharmacy – reputable indian online pharmacy

mail order pharmacy india: Healthcare and medicines from India – reputable indian pharmacies

indian pharmacy Generic Medicine India to USA top 10 online pharmacy in india

reputable indian pharmacies: buy medicines online in india – india pharmacy mail order

canadian pharmacy: Certified Canadian Pharmacy – the canadian drugstore

http://mexicanpharmacy.shop/# mexican border pharmacies shipping to usa

best mexican online pharmacies: cheapest mexico drugs – mexican drugstore online

http://zithromaxall.shop/# zithromax 500 without prescription

buying amoxicillin online: 875 mg amoxicillin cost – amoxicillin 775 mg

http://prednisoneall.shop/# prednisone 10

generic zithromax over the counter: zithromax 500 price – buy zithromax online with mastercard

http://amoxilall.com/# amoxicillin online no prescription

https://prednisoneall.com/# prednisone buy online nz

http://prednisoneall.com/# prednisone 10 mg price

https://amoxilall.com/# price for amoxicillin 875 mg

http://prednisoneall.com/# buying prednisone mexico

http://clomidall.shop/# how to buy cheap clomid without prescription

where can i buy clomid no prescription: where to buy clomid online – generic clomid price

http://zithromaxall.com/# zithromax capsules australia

http://zithromaxall.com/# cost of generic zithromax

http://sildenafiliq.com/# Buy Viagra online cheap

Cialis over the counter: cheapest cialis – Cialis without a doctor prescription

cheapest cialis: Tadalafil price – Cialis without a doctor prescription

Sildenafil 100mg price: sildenafil iq – sildenafil over the counter

generic sildenafil: sildenafil iq – order viagra

https://kamagraiq.com/# Kamagra 100mg

cheapest viagra: buy viagra online – Viagra online price

https://kamagraiq.com/# Kamagra 100mg price

Cialis 20mg price: Generic Cialis price – Buy Tadalafil 20mg

cheapest cialis: cheapest cialis – cialis for sale

http://tadalafiliq.com/# Generic Cialis without a doctor prescription

Generic Tadalafil 20mg price: cialis best price – Cialis 20mg price in USA

Cheap generic Viagra cheapest viagra generic sildenafil

https://sildenafiliq.com/# cheapest viagra

Viagra online price: sildenafil iq – sildenafil over the counter

https://sildenafiliq.com/# Viagra online price

https://tadalafiliq.com/# Cheap Cialis

http://tadalafiliq.com/# Generic Cialis without a doctor prescription

Kamagra 100mg price: Kamagra 100mg price – kamagra

Cheap Cialis: tadalafil iq – Tadalafil price

https://sildenafiliq.xyz/# order viagra

Buy Tadalafil 20mg: Generic Tadalafil 20mg price – Generic Tadalafil 20mg price

sildenafil oral jelly 100mg kamagra: Kamagra Iq – Kamagra Oral Jelly

http://kamagraiq.shop/# п»їkamagra

buy viagra here: generic ed pills – Buy Viagra online cheap

https://sildenafiliq.com/# sildenafil over the counter

https://sildenafiliq.com/# buy Viagra over the counter

Buy Cialis online: cheapest cialis – Buy Tadalafil 20mg

http://kamagraiq.com/# Kamagra 100mg price

Tadalafil price cialis best price Buy Cialis online

buy Viagra online: cheapest viagra – Cheap generic Viagra online

https://sildenafiliq.xyz/# Cheap Viagra 100mg

sildenafil over the counter: sildenafil iq – Viagra online price

https://tadalafiliq.com/# Cialis 20mg price in USA

Buy Cialis online: cialis without a doctor prescription – cialis for sale

Viagra generic over the counter: sildenafil iq – cheap viagra

https://kamagraiq.shop/# Kamagra tablets

https://sildenafiliq.com/# Cheap generic Viagra online

http://kamagraiq.shop/# buy Kamagra

pharmacies in canada that ship to the us Certified Canadian pharmacies reddit canadian pharmacy

https://canadianpharmgrx.com/# buying drugs from canada

buy prescription drugs from india: indian pharmacy delivery – best online pharmacy india

http://canadianpharmgrx.xyz/# canadian drugstore online

canadian neighbor pharmacy Canada pharmacy canadian pharmacy no scripts

Online medicine home delivery: Generic Medicine India to USA – mail order pharmacy india

https://indianpharmgrx.com/# online shopping pharmacy india

canada rx pharmacy canadian pharmacy cross border pharmacy canada

https://mexicanpharmgrx.com/# mexico pharmacies prescription drugs

http://indianpharmgrx.shop/# Online medicine home delivery

pharmacy website india: Generic Medicine India to USA – cheapest online pharmacy india

http://mexicanpharmgrx.shop/# mexican rx online

mexican mail order pharmacies: Mexico drugstore – п»їbest mexican online pharmacies

https://mexicanpharmgrx.com/# mexican pharmaceuticals online

best online pharmacies in mexico: medication from mexico pharmacy – mexico drug stores pharmacies

reliable canadian pharmacy reviews Canadian pharmacy prices best canadian pharmacy to order from

mexican online pharmacies prescription drugs: Pills from Mexican Pharmacy – buying from online mexican pharmacy

https://indianpharmgrx.com/# india pharmacy mail order

canadadrugpharmacy com Best Canadian online pharmacy best canadian pharmacy online

http://mexicanpharmgrx.com/# mexican pharmacy

buying prescription drugs in mexico online: Mexico drugstore – mexican border pharmacies shipping to usa

https://canadianpharmgrx.com/# canadian drug stores

canadian pharmacy reviews: Best Canadian online pharmacy – canada rx pharmacy world

https://mexicanpharmgrx.com/# reputable mexican pharmacies online

https://mexicanpharmgrx.com/# mexican pharmaceuticals online

vipps approved canadian online pharmacy: canadian pharmacy – best canadian pharmacy to buy from

indian pharmacy paypal: Generic Medicine India to USA – best online pharmacy india

buy diflucan without a prescription best diflucan price diflucan 1140

antibiotics cipro: ciprofloxacin 500mg buy online – cipro generic

buy misoprostol over the counter: cytotec online – buy cytotec pills online cheap

doxycycline order online: generic for doxycycline – generic for doxycycline

п»їcytotec pills online: buy cytotec over the counter – buy cytotec

nolvadex only pct: tamoxifen chemo – lexapro and tamoxifen

http://doxycyclinest.pro/# buy doxycycline monohydrate

Cytotec 200mcg price: buy misoprostol over the counter – cytotec pills buy online

cost of diflucan in canada: diflucan cost canada – diflucan cream india

cytotec pills buy online: Abortion pills online – buy cytotec online

buy doxycycline for dogs: buy doxycycline 100mg – buy generic doxycycline

buy cipro online without prescription: ciprofloxacin 500 mg tablet price – cipro pharmacy

п»їcipro generic: cipro for sale – ciprofloxacin generic price

cytotec pills buy online: Cytotec 200mcg price – buy misoprostol over the counter

https://misoprostol.top/# buy cytotec online

buy cheap diflucan online: online diflucan – diflucan online purchase uk

purchase cipro: ciprofloxacin generic – cipro generic

diflucan online purchase uk: diflucan 150 mg – diflucan 250 mg

canadian order diflucan online: diflucan 300 mg – diflucan price canada

buy generic ciprofloxacin: buy ciprofloxacin over the counter – cipro generic

diflucan online: diflucan singapore pharmacy – medicine diflucan price

http://doxycyclinest.pro/# buy doxycycline online 270 tabs

tamoxifen effectiveness: tamoxifen hair loss – tamoxifen medication

cytotec abortion pill: order cytotec online – Cytotec 200mcg price

Cytotec 200mcg price: buy misoprostol over the counter – buy cytotec in usa

buy cytotec over the counter: cytotec abortion pill – Abortion pills online

buy cytotec in usa: cytotec pills buy online – Abortion pills online

purchase cipro cipro ciprofloxacin cipro ciprofloxacin

where to buy diflucan pills: diflucan prescription cost – buy cheap diflucan online

prednisone 10 mg tablets: prednisone purchase canada – prednisone cost in india

amoxicillin 500 mg capsule amoxicillin 500mg pill amoxicillin 500mg price

ivermectin india: buy ivermectin – ivermectin cream 1%

amoxicillin no prescipion: amoxicillin over counter – amoxicillin 500mg capsule buy online

how to buy cheap clomid prices: can i get clomid without prescription – can i purchase generic clomid

where to buy zithromax in canada zithromax online usa no prescription buy zithromax online fast shipping

https://amoxicillina.top/# amoxicillin without a doctors prescription

buy zithromax online fast shipping: buy zithromax without prescription online – buy zithromax no prescription

zithromax price south africa: buy generic zithromax online – zithromax 250 mg tablet price

http://stromectola.top/# stromectol australia

amoxicillin generic: amoxicillin buy online canada – amoxicillin medicine

http://clomida.pro/# can you buy generic clomid without insurance

amoxicillin generic brand: medicine amoxicillin 500mg – buy cheap amoxicillin

amoxicillin generic: amoxicillin 500mg price canada – amoxicillin online no prescription

can you get generic clomid without dr prescription: order generic clomid tablets – where can i buy cheap clomid without rx

prednisone ordering online: buy prednisone without prescription paypal – prednisone pharmacy prices

how to get ed pills order ed pills cheap ed meds

https://edpill.top/# where to buy ed pills

ed rx online: buy erectile dysfunction treatment – cheap ed pills online

http://medicationnoprescription.pro/# no prescription medication

https://medicationnoprescription.pro/# online drugs no prescription

best online ed treatment get ed prescription online how to get ed pills

online pharmacy without prescription: prescription drugs from canada – pharmacy no prescription required

http://onlinepharmacyworld.shop/# cheapest prescription pharmacy

best ed meds online: buy erectile dysfunction medication – erectile dysfunction online

https://edpill.top/# erectile dysfunction online prescription

https://medicationnoprescription.pro/# pharmacy online no prescription

https://onlinepharmacyworld.shop/# cheapest pharmacy for prescription drugs

legit non prescription pharmacies: online pharmacy no prescription – non prescription medicine pharmacy

https://medicationnoprescription.pro/# canadian pharmacy no prescription

cheapest ed medication: cheapest ed online – ed medications cost

http://medicationnoprescription.pro/# no prescription on line pharmacies

https://medicationnoprescription.pro/# buy pills without prescription

no prescription needed: buying prescription drugs online from canada – buying prescription drugs online canada

https://edpill.top/# get ed meds today

buy ed pills: ed online meds – online ed medication

casino tr?c tuy?n vi?t nam: casino tr?c tuy?n vi?t nam – casino tr?c tuy?n uy tín

http://casinvietnam.shop/# danh bai tr?c tuy?n

casino tr?c tuy?n: casino tr?c tuy?n uy tín – game c? b?c online uy tín

http://casinvietnam.shop/# casino online uy tin

web c? b?c online uy tin casino online uy tin casino tr?c tuy?n uy tin

best online pharmacies in mexico: Mexican Pharmacy Online – mexican border pharmacies shipping to usa

https://canadaph24.pro/# canada drugstore pharmacy rx

reputable indian online pharmacy https://indiaph24.store/# best online pharmacy india

Online medicine home delivery

mexican mail order pharmacies mexican pharmacy mexican border pharmacies shipping to usa

https://indiaph24.store/# reputable indian online pharmacy

pharmacy website india indian pharmacy fast delivery best india pharmacy

mail order pharmacy india Generic Medicine India to USA cheapest online pharmacy india