I’ve struggled to articulate some of the sentiment I sense toward Apple in many public and private conversations, as well as the many we will see over the coming weeks and months. Apple has been an area of study for me for over 15 years. For my father, Apple has been a focus for over 30 years. The company, the cast of characters involved, their role in the tech industry, are all fascinating topics. Yet for Wall St., pundits, and so many commentators, there is a sensibility I could not put my finger on until recently. Apple does not seem to be granted what many companies like Amazon, Google, and more are–the benefit of the doubt.

Too often, it seems, discussion surrounding Apple tends to lean toward doubt and skepticism. “Apple is doomed!” is basically the underlying and all too common tone. Interestingly, this is nothing new. Steve Jobs was asked, during a Q&A at the 1997 Macworld Expo, why Apple is continually shorted by the media. He explained how this is common and it’s been going on forever. Whenever they shorted Apple, he said he recommends buying more stock. Steve believed. He had faith while many others did not.

The examples of Apple’s death are too numerous to count here but Bryan Chaffin of The Mac Observer has been keeping tabs with his Apple Death Knell Counter For many years. Check it out for some instances of Apple’s imminent demise being horribly wrong.

I’ve been having these discussions of doubt with many in the investor community, both on the private and the public side. How can Apple keep growing? How can they do better than last year? How do they keep the momentum going? It all has to end sometime, right? These are all questions and part of key debates in the industry. More often than not when I hear these remarks, they are statements, not questions. For smarter investors, these are questions. For the narrow-minded ones, they are remarks. The latter is generally deep with conviction from the all too dangerous viewpoint of a strong opinion strongly held. Regardless of whether these statements are questions or remarks, my favorite response is a simple why?

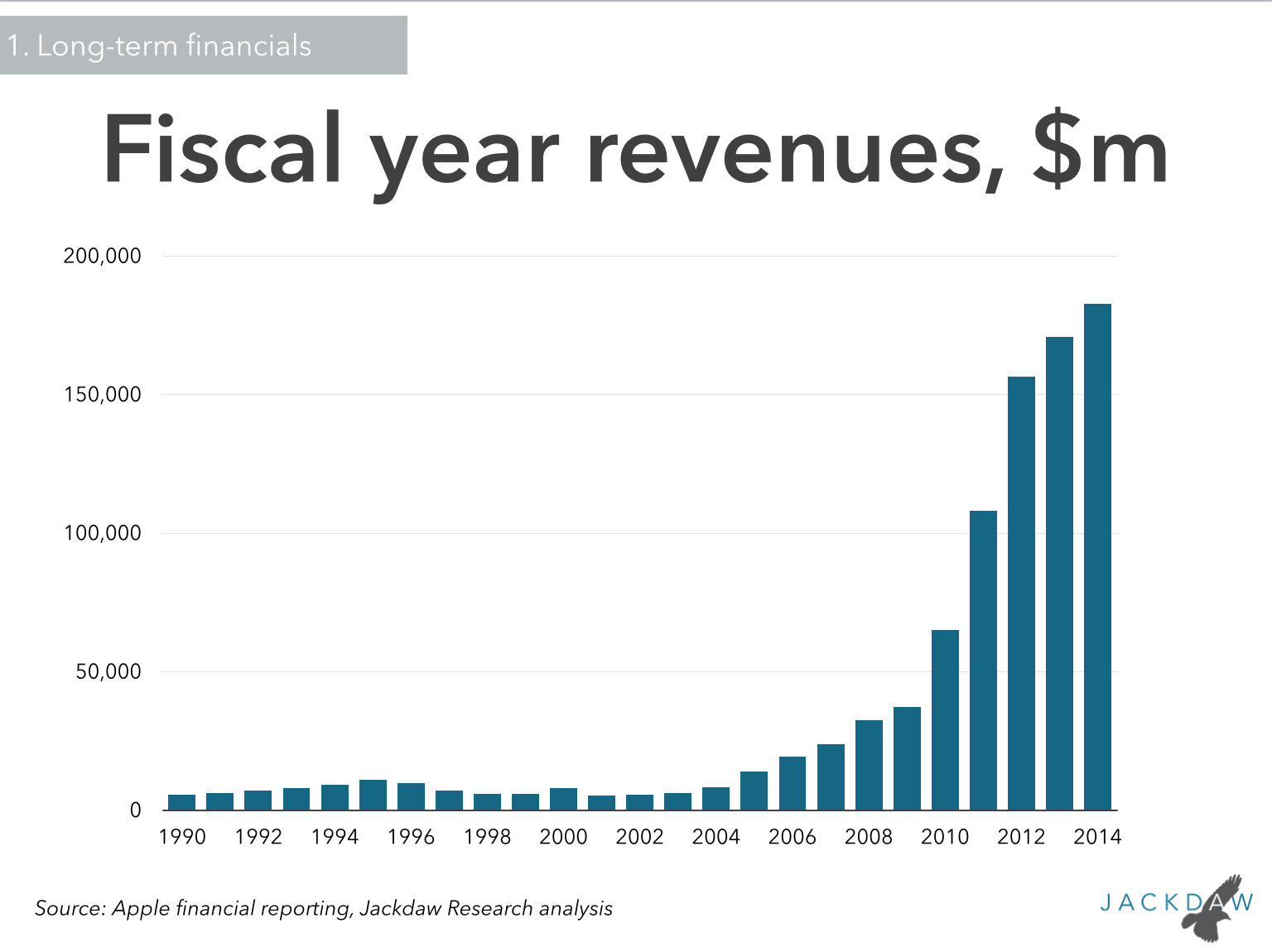

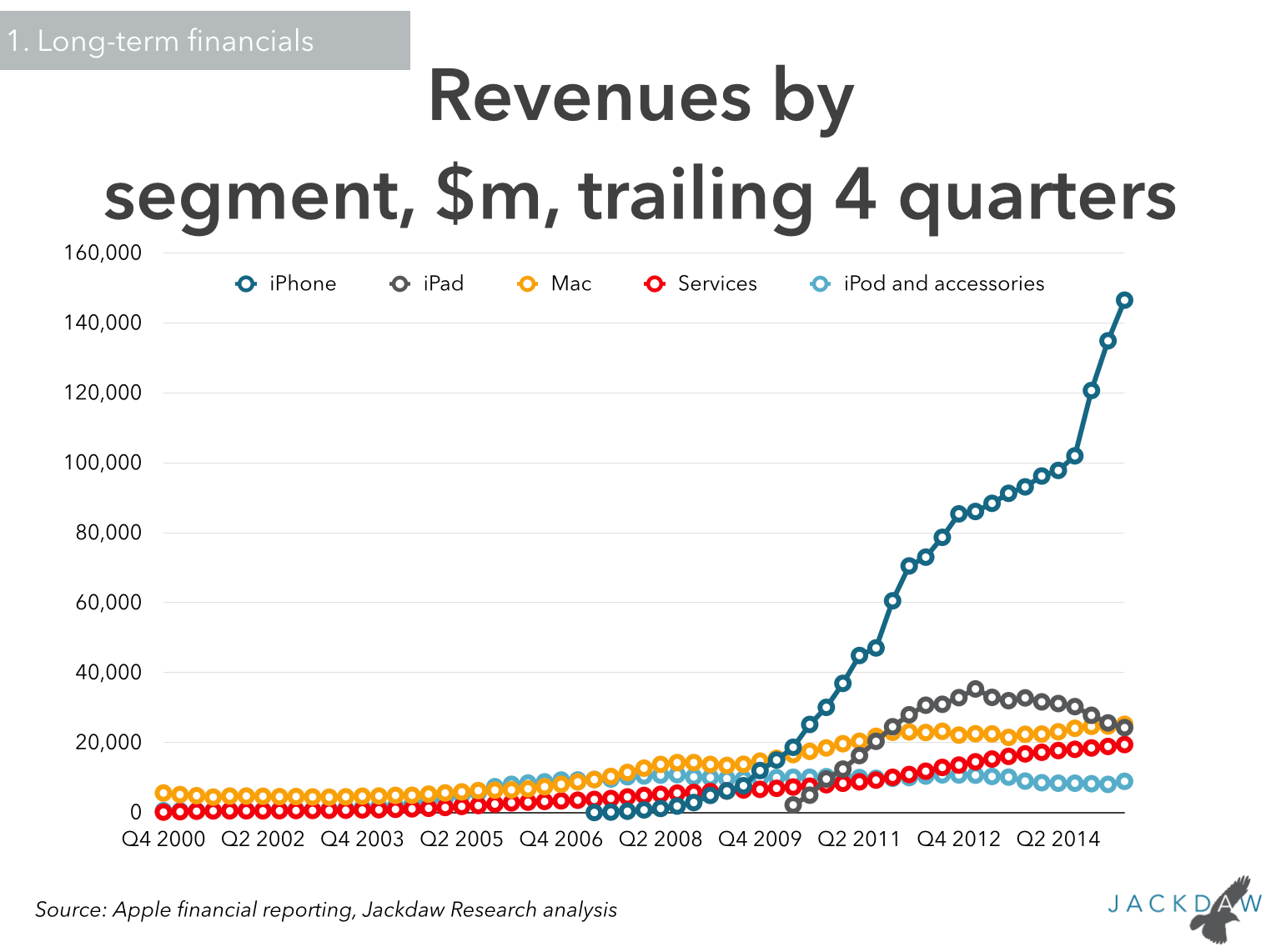

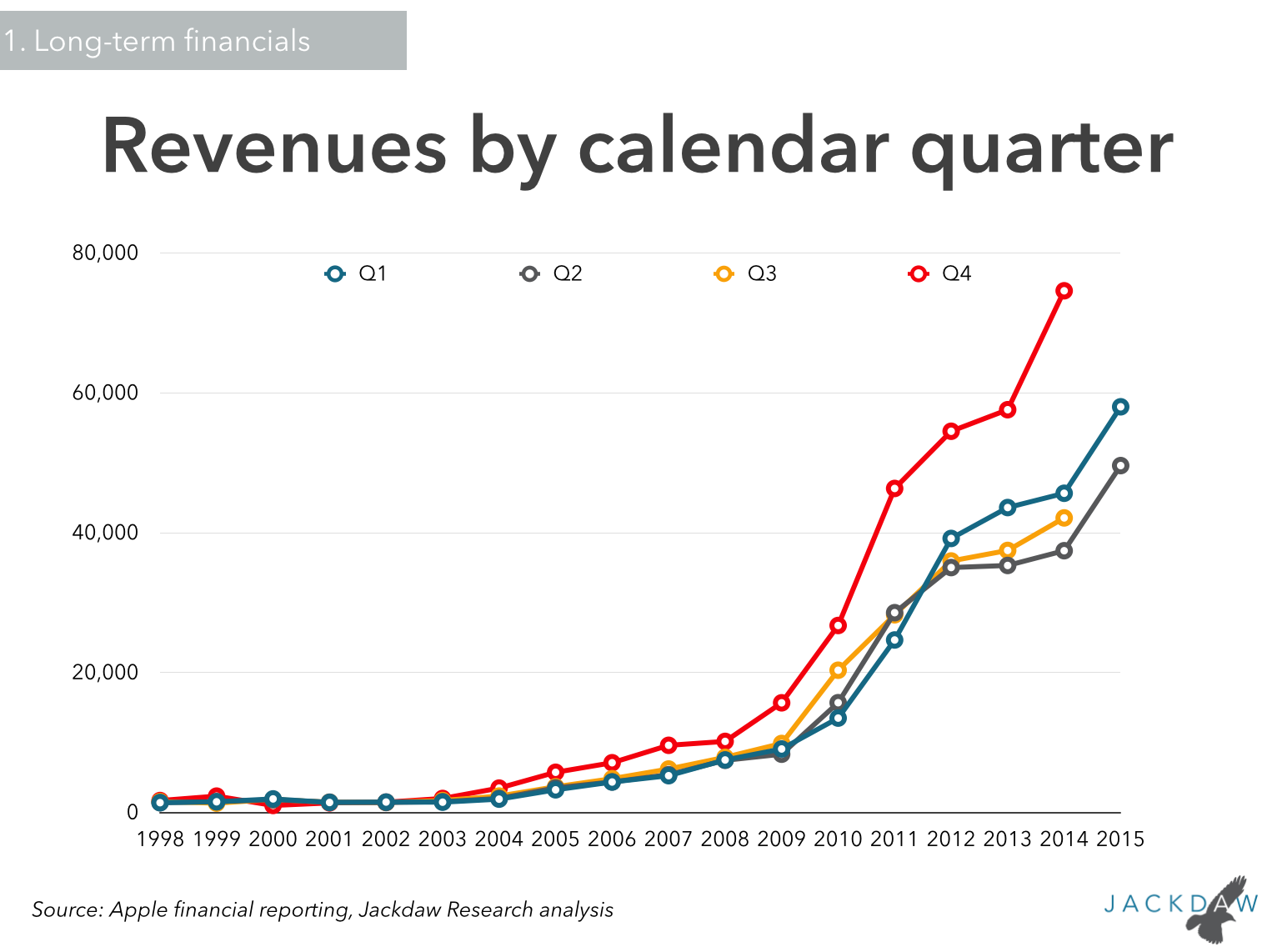

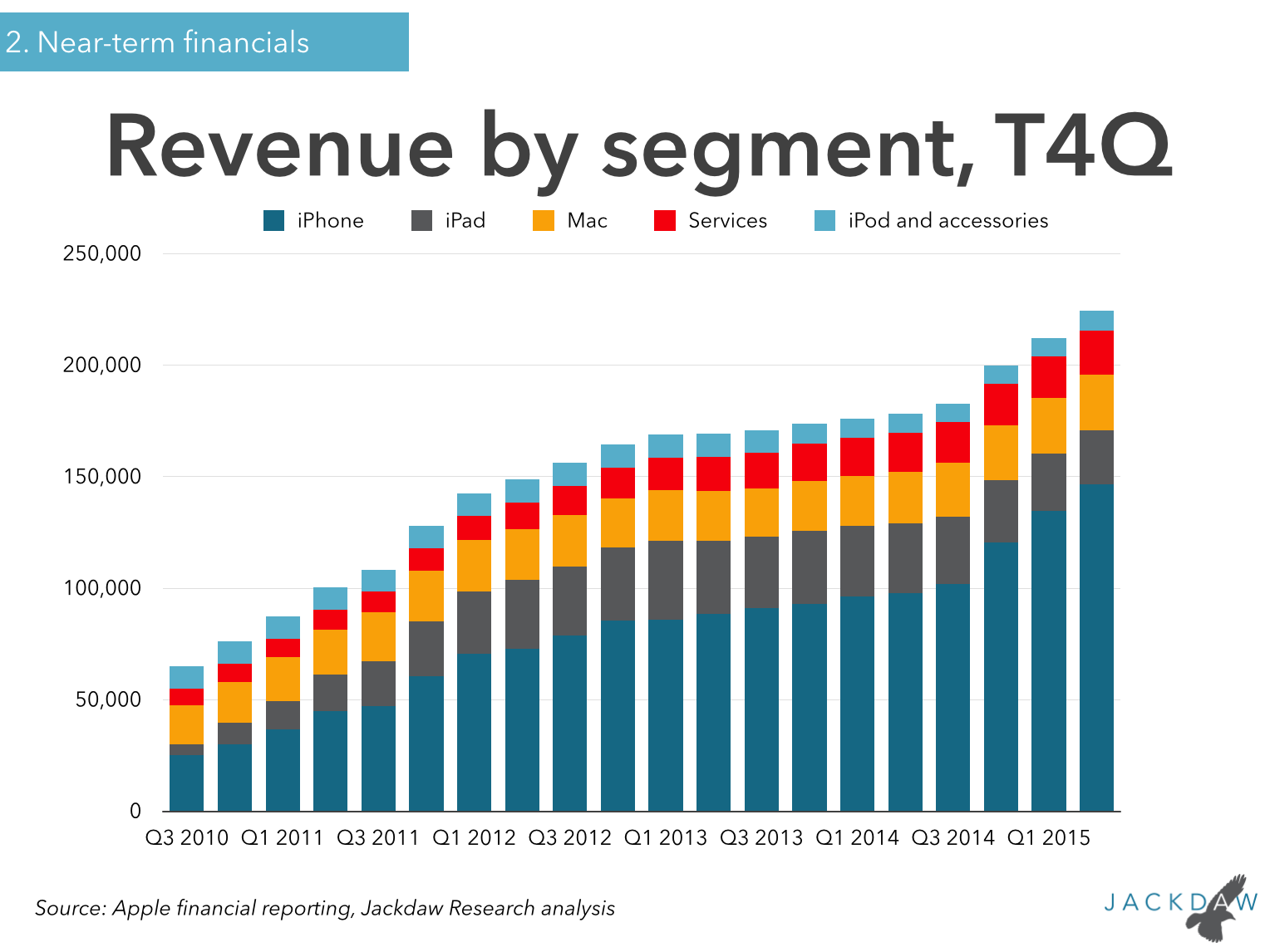

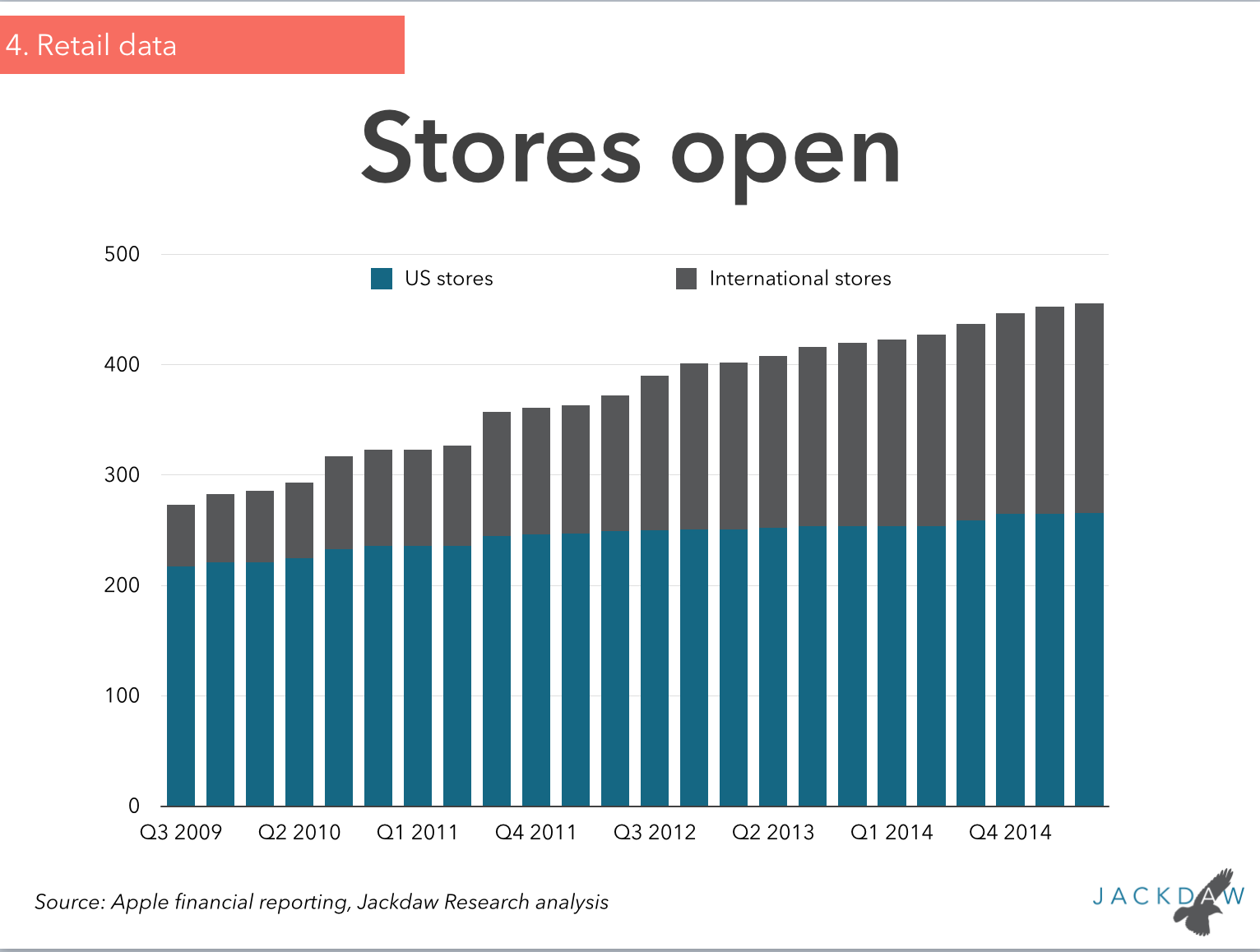

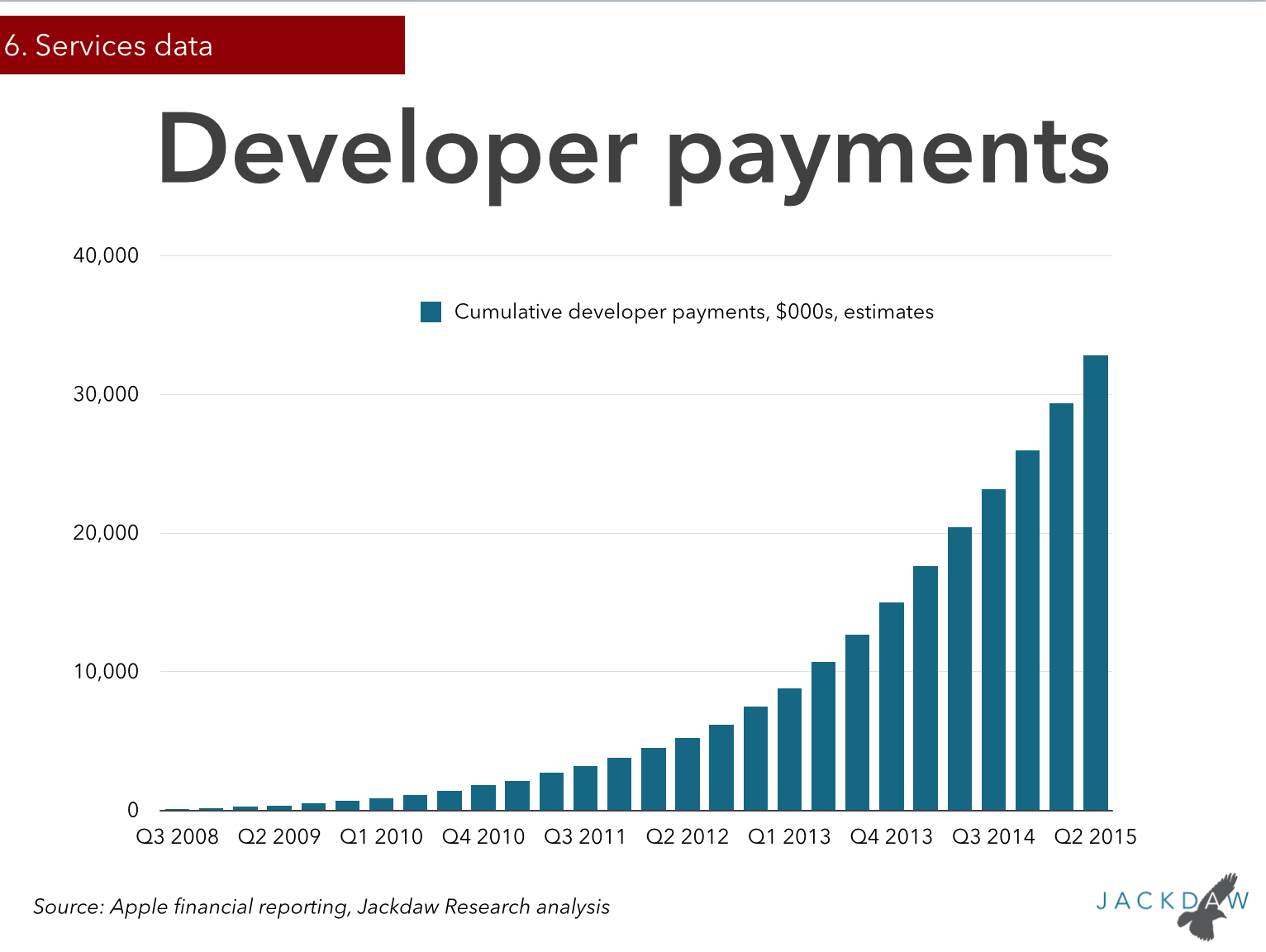

Are you absolutely certain they can’t keep the momentum going? Are you sure this was their best year? Does it really have to end? I submit the following charts from Jan Dawson. These charts are part of a service he offers for subscribers. I recommend checking it out if you are interested in the financial details of many public tech companies.

While not every line is an S-curve, and perhaps the line has slowed at times, the bottom line is Apple’s growth has continued. Of course, as the saying goes, we can’t ALWAYS use historical data to predict the future. What we can do is set up a belief system of the fundamentals — “if this holds true, then so does this”. Hence, the last slide from Jan’s deck. While I won’t go into every bit of fundamental analysis of Apple, the developer chart is an interesting one. Apple is an amazing company that makes amazing products. Those amazing products attract amazing developers. If those developers don’t just survive but thrive, then Apple succeeds. If Apple’s amazing products benefit more than just themselves, meaning, if they create things that create value for others, then their run will likely continue. It’s not entirely that simple, but it is a fundamental piece of the puzzle.

I’m not suggesting the benefit of the doubt be given lightly. On the contrary, I believe it should be earned. But so many other companies seem to have that benefit without earning it. While Apple’s stock trades at a P/E ratio much lower than many other companies, historical data doesn’t necessarily suggest they earned it in the way we can make a case Apple has.

No company is perfect. I think we have to make that clear. There are many things that make Apple unique and it is the culmination of people, process, culture, philosophy, and more that tend to help me extend Apple the benefit of the doubt. What they have is very rare. Maybe someday it won’t be but it is today.

As I pointed out in this article, seeing your death before it happens is tricky yet doable. Investing in the future and taking on new challenges with your company’s unique people, processes, and philosophies is the best way to keep momentum going. As we’ve seen, Apple is not afraid to enter new categories. Today it’s watches, then cars? TV? Apple doesn’t seem to be slowing down or believe their growth will end or that they are doomed.

The benefit of the doubt or “faith” in a company should not be given frivolously. It should be well earned. But, objectively speaking, Apple has indeed earned it.

Ben,

Security. I believe Security will have an enormous impact as things (Sony, Target, Gov’t Personnel Records) continue to surprise. Device security is only one piece of the security landscape, but the world will eventually notice and value Apple because of its peerless and uncrackable end-to-end encryption and its efficient and protective malware response system.

Apple’s response to malware delivers patches that are immediately and automatically installed on all iOS 7, 8, and 9 systems. That’s 500M iPhones protected within a month of patch release.

Android? 1B Androids updated within 3 YEARS of release.

Nexus devices are updated and safe. As are Motorola’s and Android ONEs.

People just choose other features than security. I’m not saying that’s the right choice, and personally I’m re-evaluating my own choices, but that’s a consequence of consumer choices, not an ecosystem intrinsic.

I don’t have problem with the 20-30M or so devices you mentioned. It’s the other 980M.

Exactly! The exception does not prove the rule. Even a stopped analog clock is correct twice a day. When we are taking about Android Security we are talking about what most user use and not the Nexus devices. The problem is that for Google, the cell phone carriers or the android OEM’s there is no incentive to make changes to the current system. So for those users who are looking for a better security model either they are going to get a Nexus device or more likely just get an iPhone and be done with it.

My point is, it’s a choice. Buyers can get safe Android devices, they choose not to. They prioritize price, features, performance… over safety.

Maybe this year’s first real Android security issues will move the needle. Maybe they won’t. I know I myself am ambivalent, I sure love big screens and big batteries, which Google and Moto aren’t offering, especially not combined, and Android ONE is very low-end.

“My point is, it’s a choice. Buyers can get safe Android devices, they choose not to.”

It’s not a ‘choice’. Samsung et al don’t advertise the lack of upgradability of their devices. Cigarettes have black box cancer warnings. People who smoke have been forewarned and they are /choosing/ to smoke.

If Android black boxed something like “This Android device may not be patchable due to telecom or OEM indifference.”, then a buyer would be /choosing/.

It’s just an Adored con with 1B owners being dupes. (Except for the geeks who /know/ what they’re buying. These geeks are, in fact, /choosing/.)

well said

It is disingenuous to say that people don’t value security in their purchases. Has Google explicitly made it clear that the only way to be secure on their Android platform is to buy only from the vendors you mentioned?

– It’s not the only way, Android is very secure to start with: 0.15% incidence of malware on non-rooted, PlayStore-only phones according to Google’s latest report. That was before stagefright though, which is a biggie (requires no root, no sideloading, and the only way to fix it is to either disable completely or at least disable preloading of MMSes) but is not yet being exploited.

– The whole Nexus line is about being the most updated phones. and that’s pretty much the only reason to buy them, they’re usually a downspecced derivative of their OEM’s flagship. Anyone who cares about security is aware that security = updates, and updates = Nexus.

I beg to differ. I had the first 3 Nexus devices. They received updates 2 or 3 times and then were EOL’ed. And it’s not like I bought them years after they were introduced. In 2 of the 3 cases I bought them within days of them being available. In one case I waited a couple of months because it was a Samsung device and I wanted to make sure it wasn’t horrible like the Samsung feature phones.

Maybe Nexus is better now. But not then. I finally just went to Cyanogen which was acceptable.

I beg to differ on your differing.

Nexus 4 (Nov 2012), 5, and 6 are still receiving updates. That’s 3 years at least, at par with realistic iOS updates (it seems upgrading iPhone 4S to iOS 8 isn’t recommended)

I did bail on the Nexus 4 before they EOL’ed it. The Nexus One stopped getting updates in the after barely a year. The excuse was the hardware was out-of-date. The Nexus S stopped after a couple of years.

Slightly off topic, do you have a recommendation for an Android tablet, somewhere in the 8 to 10 inch screen size, decent storage, around $200-ish? We’re looking for one, in Canada if that matters.

http://www.quora.com/Why-hasnt-my-Nexus-5-updated-to-Android-Lollipop-OTA

That is a link to a Google engineer explaining how Nexus are updated. See how cumbersome it is, compare that to how Apple simultaneously upgrades hundreds of millions of of devices. The nexus update system is no were comparable to Apples and would clearly collapse if Nexus devices sales increased in any meaningful way

You mean doing a staggered roll out starting slow and then accelerating once the update is proven safe in the field sounds complicated to you ?

It’s actually an industry Best Practice, recommend to avoid issues such as a missed bug crashing/bricking a lot of phones.. which Apple seem to have its fair share of ( https://www.google.fr/search?q=apple+pulls+iOS+update )

How would that rollout mechanism clearly collapse for more phones ? You think they couldn’t ramp up quicker ? Why ?

iPhone 4S and iPad 2 are both supported by iOS 8. We’ve got an iPhone 4S and a couple iPad 2s running iOS 8, works fine. We also had no trouble with iOS 7. So we’re at four years of updates with our iOS devices. I imagine iOS 9 will be the end of the line for updates though.

I’ll leave it to presumably nonpartisan experts:

– “iOS 8 on the iPhone 4S: Performance isn’t the (only) problem.

New OS wants screen space and processing power that the old phone doesn’t have.” ( http://arstechnica.com/apple/2014/09/ios-8-on-the-iphone-4s-performance-isnt-the-only-problem/ )

– “iOS 8.1.1, iPhone 4S, and iPad 2: A little faster, kind of, sometimes. Heavy users will see some improvement, but iOS 8’s worst regressions remain.” ( http://arstechnica.com/apple/2014/11/ios-8-1-1-iphone-4s-and-ipad-2-a-little-faster-kind-of-sometimes/ ).

I have no doubt that many technical aspects of our devices are affected. But in our daily use these degradations aren’t significant and don’t outweigh the benefits, so our experience is that our devices work fine and we get the latest version of iOS.

“Arrrrgh, but the Camera app opens 0.3 seconds slower in iOS 8, the horror, the horror!” cried the spec nerd 🙂

Weren’t RIM and Nokia on similar path for a time, before things went wrong ? I’m not saying Apple is in as vulnerable a position (they’ve got a lot more lock-in than the other two), but they’re still mostly a one-product company in a very fluid market.

That’s why I wrote the article on recognizing irrelevance a few weeks ago. The key is see it early and invest in new areas. The car stuff I’m hearing is pretty exciting and that is a huge market. And smartphones have so much life left in them.

Point is, are the fundamentals strong. Also few companies show true consumer market expertise.

But an interesting point to add is here look at what was happening during the iPhone 5/5s era. You could argue if they rested on their laurels that could have been it. But they didn’t and look what happened. They fought off irrelevance by going larger and nipped it in the bud.

No one, but no one, times and sequences product launches like Apple. This is a polite way of saying they really know how to milk it. That’s marketing, not tech. From a tech point of view, they fix their competitors existing features, and being the great design firm that they are, makes it seem as if they invented it. They launched the 6 series when there was momentum for it.

So which smartphone company’s multitouch feature did they fix to launch the iPhone? Or which OEM’s mobile operating system on a Tablet did they fix to launch the IPad ?

Until the iPad, the predominant (while few) tablets and tablet prototypes were Windows based. iOS “fixed” that, at a cost of functionality, and decimated what was the “netbook revolution”.

The iPhone 6 launched after market demand for a large size device was demonstated.

Launched yes, but larger screen iPhones were in development long before phablet sales were significant.

There’s not much difference between “nipping it in the bud” and playing catch-up. I’m curious to see whether IT can sustain a luxury brand that lags technically. Samsung must be praying it won’t ^^

Yet the OEM you see as being ahead are all having a hard time and racing themselves to the bottom? Maybe, just maybe the vast majority of people don’t care for the meaningless spec wars that impress spec nerds that add no value to their experience. Apple delivers the best GPU and single threaded performance which account for 98% of the use case on smartphones whilst Android OEMs fight over delivering the highest Geekbench multithreaded and off screen( because people obviously use devices sans the resolution of the screens) GPU benchmarks that have no impact inmost real world use and then wonder why people prefer iPhones.

Please name a single company on Earth that would have the iPhone as a product and not be said to be reliant on it because its revenue and profit dwarfs everything else? Bear in mind the iPhone makes more money than Microsoft and is on course to match the entirety of Samsung in revenue! The IPad and Mac business are multi billion dollar businesses. Even the hobby that is the Apple TV is a billion dollar business.

I have a cynical view of the stock market, and I try to view it purely for what it is, and not what it is theoretically supposed to be. That is, I view stock prices as a measure of not what a company is inherently worth, but as a measure of what the traders think it is worth.

Therefore, I expect that the investors seeking your advice are not really searching for the truth about future Apple revenues and profits. I sincerely think that they are more interested simply in what other investors are thinking. Therefore in their view, the value of an industry analyst is not whether they can accurately predict the future of a given company. Instead, the value of an industry analyst lies in the fact that they have had discussions with many investors, and know what they are thinking. Additionally, industry analysts may provide some rationales to back up the gut instincts that the investors already have. In the case of investors being bearish on Apple, that’s something that they probably have decided based on discussions with fellow traders and the consensus sentiment. The truth about Apple will not change their minds because that is not what trading is about. Instead what they want is something to put into their reports so they can look clever and rational.

The bottom line is that I believe stock market prices are not driven by future company revenues or profits. Instead, they are directly driven by whether fellow investors will buy or sell (are they bullish or bearish and how much money do they have to invest). If I were an investor, that would be the information that I would be seeking.

Some really excellent info, I look forward to the continuation.

ラブドール 投稿に関して、あなたが意図したものを手に入れました。グーグルでこのウェブサイトを見つけてうれしいです。jy人形との性交は、妻をだますこととは何の関係もありません。