About a month ago, I went into detail on Apple’s presence in China. Since then I have been tracking and plotting the iPhone’s presence on Umeng’s app and device usage analytics network since 2012. If you recall Umeng’s latest report, it was clear the iPhone had a larger presence in China than many thought. More importantly, the iPhone completely dominates the premium tier in China, a segment larger than many realized at 27%. I dug around and concluded Umeng’s analytics data is fairly comprehensive – likely covering approximately 70-80% of the smartphone market.

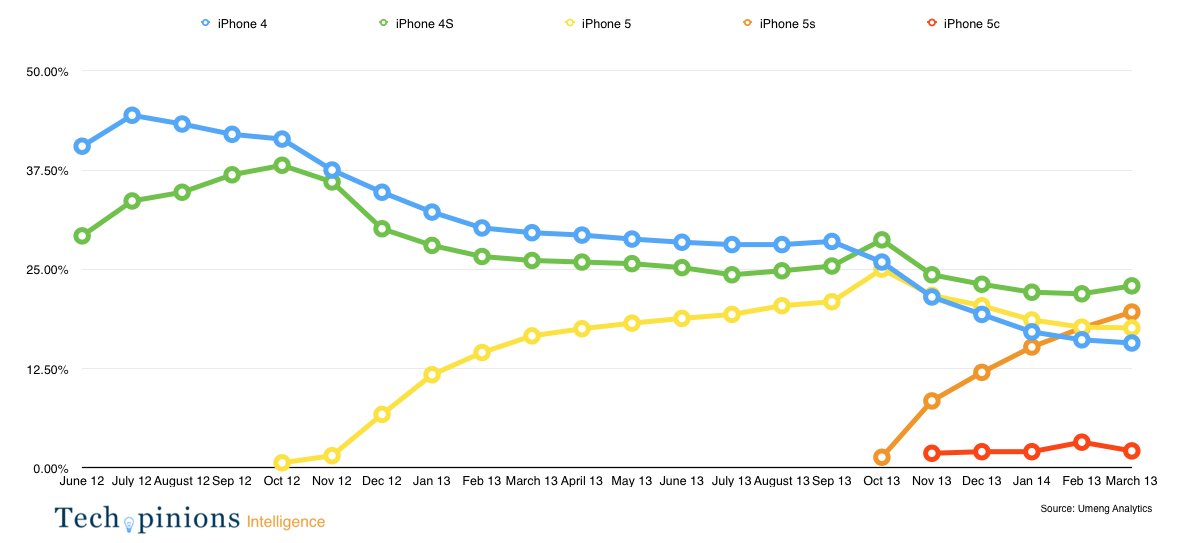

I’d like to share the chart I made plotting the breakdown of iPhone models in China over time.

The lack of popularity of the 5c is not surprising. The price differential is too minimal for the market in China who view premium devices as status symbols. For the group that can afford or aspire to afford an iPhone in China, only the best will do. This explains the rise of the 5 and 5s in the chart. The real observation needs to be made about the plotted lines of the 4 and 4S. The install base of these two devices is largely driven by the secondary market. The bulk of Apple’s install base in China and its continued rise is still driven through illegitimate or “gray market” channels more so than through legitimate channels. I believe this will change over time but a great many Chinese customers still buy iPhones from the secondary markets and having them activated to the network of their choice.

The 5s is on a steady ramp, like the 5 was. This looks to continue. From Umeng’s data, no version of the iPhone saw as high a monthly increase as the iPhone 5s. It is also worth noting there isn’t a single Android SKU in China that shows up as a percentage of monthly activity on Umeng’s network any higher than 4%. This shows how incredibly diverse China’s Android landscape is.

do you defined premium devices by its price or tech specs?

Price. Either retail to consumer, or wholesale to carrier/retailer.

do you consider xiaomi devices as premium?

also what about the Galaxy note 3 which is more expensive than any IPhone, and very popular in Asia

Of course on the Note 3. Let me clarify the chart. Umeng’s analytics dashboard separates iOS from Android. So I am only looking at iOS. The chart is not reflective of iOS and Android on the same chart. While several Note products have very high share on Umeng’s network none register above 3%. Which speaks to the diversity of Android in China.

Xiaomi is a little trickier since they have premium device experiences but lower cost. Issue with Xiaomi is they are unlikely to have latest generation specs in terms of screen, or other high end features the same time as their competitors. This could change but it seems they are hitting a sweet spot in China. No evidence premium iPhone or even premium Samsung owners are choosing a Xiaomi phone over an iPhone or other high end product like the Vivo from BBK. That could change but that is how its sits for now.

that’s why I think it is very difficult to associate premium with prices, mainly with Apple when they are not the one who sells successfully the most expensive Phone on the market,and the like of Xiaomi with their premium device experiences and High Specs but lower cost make this distinction even more trickier.

It holds up fine in our models. We track each device on every continent so we know the mix. The data is a means to interpret the trends in each market. To which you point out Xiaomi is which is why we don’t just analyze price points. That being said they are not the only trend in China.

To your point about the price, the Galaxy Note sells in no where near the volumes of the iPhone. Price points let us track ASPs. But there is much more to market analysis than that.