Marissa Mayer and Firefox: can the marriage last? Photo of Marissa Mayer by Fortune Global Forum on Flickr.

Who stands to lose if Yahoo is sold — besides of course Marissa Mayer, who will probably lose her job along with a fair number of Yahoo staff? The surprising, and unobvious, answer is Mozilla and the Firefox browser.

That’s because Mozilla is highly dependent on a five-year contract with Yahoo, signed in December 2014, where it receives about $375m per year to make Yahoo the default search provider in the Firefox browser on the desktop. From 2004 to 2014, that contract was exclusively with Google; now it’s Yahoo in the US, Google in Europe, Yandex in Russia and Baidu in China.

How much is $375m per year compared to Mozilla’s spending? Most of it. Mozilla’s audited financials offer some useful details. They’re not as timely as a public company’s numbers; the most recent date to the end of 2014.

Mozilla’s numbers

In 2013, the Mozilla foundation recorded “royalties” (mainly, search income) of $306.1m out of total revenues of $314.1m; in 2014, 323.3m of $329.6m. Search income is about 97% of Mozilla’s total income.

It’s also clear Yahoo is paying Mozilla more than it got from Google. Marissa Mayer was reportedly so keen to secure the business, she made a preemptive bid that turned out to be far too high for the reality of a world where Firefox’s share on the desktop was falling and its position on mobile is minimal.

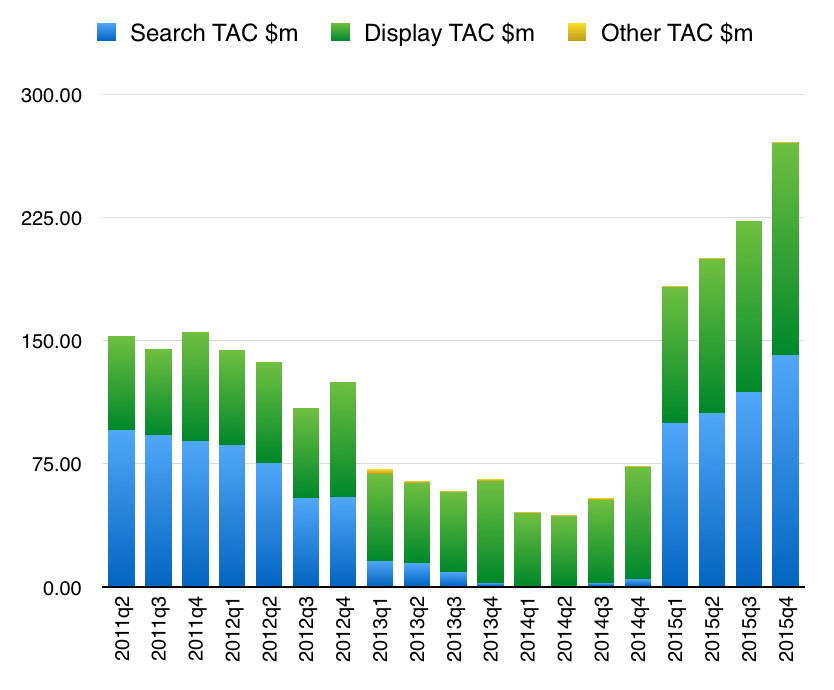

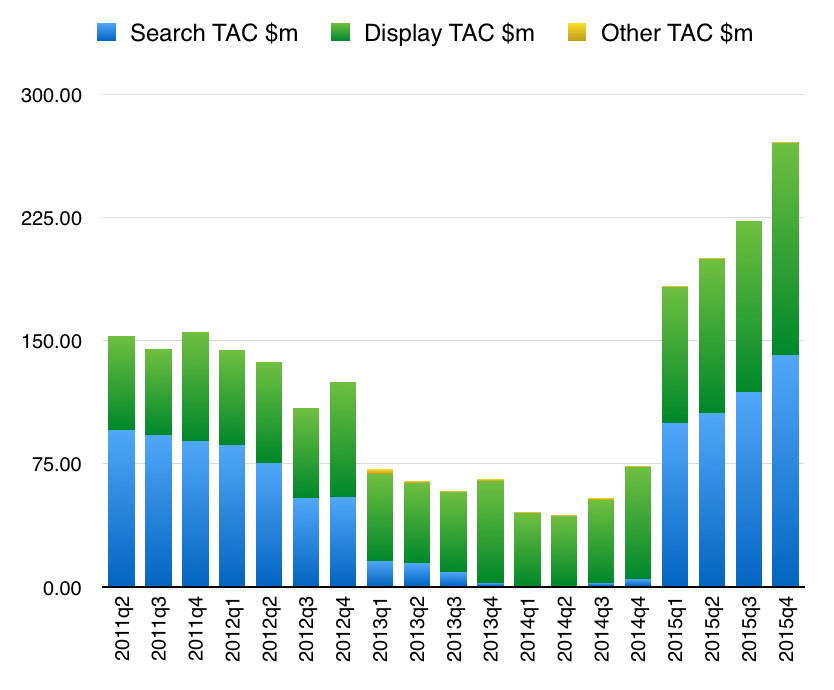

The question is, with Yahoo on the block, would a buyer of Yahoo want to continue with the Mozilla contract? It is a big drag on Yahoo’s spending. According to Yahoo’s financials, its Traffic Acquisition Costs (TAC) – the money it pays other companies to bring traffic to it – have rocketed.

Clearly, it’s spending a lot more both for display ads and for search. TAC can be a good thing: you pay a third-party site to bring people to you and then you make a profit by selling those people products or showing them ads.

Yahoo’s search TAC, in particular, has rocketed from a low of 0.7m in the first quarter of 2014 to $141m in the fourth quarter of 2015, just over a year after signing the deal with Mozilla.

That’s not all going to Mozilla. But digging into Yahoo’s financial statements, we can find out precisely how much it is paying.

In its annual report for 2015, Yahoo says: “Of the $350m increase in revenue and $660m increase in TAC for the year ended December 31, 2015, $394m and $375m were attributable to the agreement we entered into in November 2014 to compensate Mozilla for making us the default search provider on certain of Mozilla’s products in the United States (the “Mozilla Agreement”).”

(You might wonder: why is the increase in overall revenue smaller than the increase from Mozilla? It’s because Yahoo’s overall revenues fell.)

So Yahoo is paying $375m annually to Mozilla just to be the default search engine in Firefox on the desktop in the US. And it’s going to keep on paying. In the 3Q 15 report, it said: “The Company is obligated to make payments, which represent TAC, to its Affiliates. As of September 30, 2015, these commitments totaled $1,682 million, of which $100m will be payable in the [fourth quarter] of 2015, $401m will be payable in 2016, $400m will be payable in 2017, $375m will be payable in 2018, $375m will be payable in 2019, and $31 million will be payable thereafter.”

Given that $375m went to Mozilla in 2015, it seems likely the large part of those future sums are also bound for Mozilla.

But a future buyer might not want to stick with Mozilla because Yahoo’s TAC is beginning to get out of whack.

For comparison, Google’s TAC used to be between 23% and 25% of its ad and total revenues; more recently – since the end of the Mozilla contract – that has fallen below 20%.

As a proportion of search revenue, Yahoo’s search TAC has gone from a low of almost 1% of search revenue, to 27% in the fourth quarter of 2015. That’s bigger than Google’s TAC proportion. Yahoo’s problem is it doesn’t have the monopoly Google does and doesn’t monetise its advertising as well as Google. Google’s AdWords are a high-margin ad business. Yahoo offers display ads, which are a commodity.

The end of the search affair

So a Yahoo buyer would be very likely to look for a way to get out of the five-year Mozilla contract. How would that affect Mozilla?

Quite hard.

Mozilla’s expenses in 2013 were, mainly, $197.5m on “software development” (out of total costs of $295.4m); in 2014, that was $212.8m (of a total of $317.8m). “Software development” swallowed up about 65% of the royalty income in 2013; the same in 2014.

As Mozilla acknowledges, those “royalties” are payments from “various search engine and information providers”. What happens if one of those sources dries up?

Mozilla knows it’s at risk here. Under the “Concentrations of Risk” subheading, there’s this:

Mozilla entered into a contract with a search engine provider for royalties which expired in November 2014. In December 2014, Mozilla entered into a contract with another search engine provider for royalties which expires December 2019.

Approximately 90% of Mozilla’s royalty revenues were derived from these contracts for 2014 and 2013 with receivables from these contracts representing approximately 77% and 66% of the December 31, 2014 and 2013 outstanding receivables, respectively.

Yahoo, as we can see, is paying about $400m per year just for US search. How much did Google pay? In 2011, when it re-signed for three years, the estimate was that Google was paying just over $100m per year – for a worldwide deal. It seems likely the real figure was higher. But Mozilla relied on it. And the Yahoo money is even more needed as Mozilla tries to recover from the dead-end of Firefox OS on mobile.

Pulling the plug

Basically, if a new Yahoo owner pulls the plug on the search deal, Mozilla will have to seek a new contract in the US. But who’s going to be willing to step up? Microsoft, probably; but the price that Mozilla will be able to demand will be much lower than it got from Yahoo. Unless, of course, Google decides to step back in and push the bidding up. But its actions around the last auction suggest it wouldn’t be interested; Chrome is too dominant, and Firefox is dwindling.

So the next few weeks aren’t going to be tense just for Yahoo. There’s a whole team of software engineers working on Firefox and other products who will have to wonder about their future if Yahoo has a new owner.