Apple reported its results for the third calendar quarter of 2015 last week and, as is often the case, the performance of the iPhone was the biggest specific thing investors were looking at. The good news for Apple and its investors was iPhone growth was indeed strong year on year and this in turn drove strong growth in overall revenues. The big question is whether this strong connection between iPhone growth and overall revenue growth is a good thing or not.

Note: in the analysis below and in the charts, I’ll use calendar quarters rather than Apple’s fiscal quarters, which I find easier to grasp.

Apple without the iPhone isn’t growing

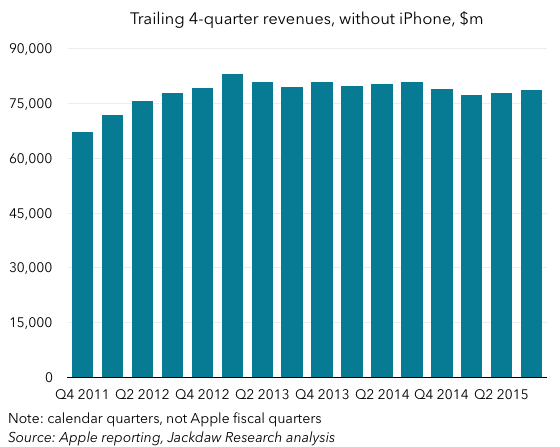

The key thing to understand here is the rest of Apple isn’t really growing:

As you can see, total revenues for the rest of Apple have been stagnant on a trailing 4-quarter basis for about the last two years, at right around $80 billion.

iPad is primarily to blame

What’s the reason for this? Well, it’s quite simple: it’s largely about the iPad, which has been shrinking faster than all the other product lines combined are growing. Until the June quarter this year, the Other Products category was also declining, but the launch of the Apple Watch has now begun to offset the decline of iPods and Beats accessories and grow that category over the last two quarters:

However, the annual shrinkage in the iPad revenue line is leaving Apple with anything from $4-7 billion in revenue it has to make up elsewhere just to stay flat year on year. Even with the Mac continuing to buck the downward trend in the overall PC market and App Store-driven growth in Services, Apple hasn’t been able to offset this decline entirely.

Two very different revenue growth rates

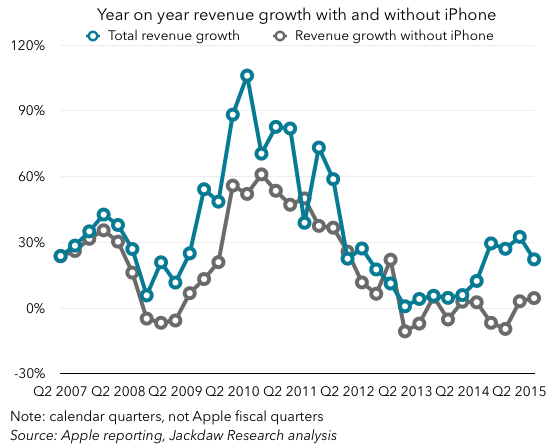

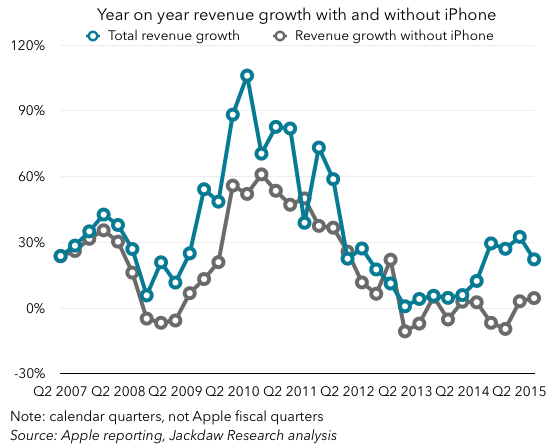

As a result, year on year growth for Apple with and without the iPhone looks very different:

Over the eight year history of the iPhone, Apple has had only three quarters when the growth rate of the rest of the company eclipsed the growth rate including the iPhone:

- Q3 2011

- Q2 2012

- Q1 2013

Interestingly, the iPad had just eight consecutive quarters posting year on year growth (with one additional isolated quarter of growth later), and all three of those quarters I just listed happened during this period, which lasted from Q2 2011 to Q1 2013.

Looking forward

So far, this analysis has been entirely backwards-looking. But let’s look forward to the next few quarters and ask what might happen to Apple’s overall growth. The company’s official guidance for the next quarter is for 1-4% growth in reported terms, which is significantly down on growth over the past four quarters (30%, 27%, 33%, and 22%). As we pass the one-year anniversary of the launch of the iPhone 6 line, the “comps” (year on year comparisons) become that much more challenging for Apple to beat. The outsized growth that came from outsized iPhones is going to slow again as the biggest one-time iPhone conversion cycle in several years comes to an end and Apple’s guidance reflects that. However, it also reflects the ongoing currency headwinds Apple faces – the underlying growth in constant currency will be more like 8-11%, still slower than the last four quarters, but not by as much.

However, I think there’s even upside beyond this number, especially in Q4 2015, for several reasons:

- Apple has been conservative in its guidance before, especially in quarters with huge upside and may turn out to be so again.

- With regard to the iPhone, it’s entirely possible year on year growth may turn out to be stronger than expected. The 30% Android switcher rate combined with the relatively low number of upgraders so far from within the iPhone base suggests a huge combined upgrade-and-switching cycle lies ahead. iPhone growth could therefore be well above what the company is suggesting it will be.

- In addition, iPad shrinkage (which as we saw above is by far the biggest driver of shrinkage in the rest of Apple’s business) could well slow considerably in Q4 as the iPad Pro launches. Even a couple of million sales of an iPad that starts at $800 would make a huge positive difference to the hole the iPad has been leaving in Apple’s year on year revenue growth. Anything more would be icing on the cake.

- As we saw above, the Apple Watch has already turned around the Other Products line, which had been shrinking by around 10% year on year but is now growing nicely. A big Q4 – especially with lots of Watch gifting – could grow that line significantly. Add in the impact of sales of the new Apple TV, now with a higher ASP, and Other Products could grow even faster.

- If Services and Mac continue to grow at the solid rates they’ve shown over the last few quarters, the combined impact of all of this could be decent growth in the rest of Apple’s business. Add that to the potential for stronger-than-expected iPhone growth, and suddenly overall growth could be significantly above the 1-4% suggested by guidance.

None of this is guaranteed, of course. That’s precisely why Apple’s guidance is fairly conservative. I’m not sure there have ever been as many unknowns in one quarter of Apple reporting as there are this time around:

- The year following an unprecedented iPhone upgrade cycle

- The first holiday quarter for the Apple Watch

- The launch of an entirely new iPad form factor

- The launch of an entirely new Apple TV and associated App Store

The important thing to note, though, is all these unknowns are on the upside, not the downside – if these things broadly perform relatively poorly, then Apple will still hit its guidance. But if any of them does well – and especially if several of them do – there could be a pretty significant beat to guidance for Apple next quarter.

There is some nice and utilitarian information on this site.

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!