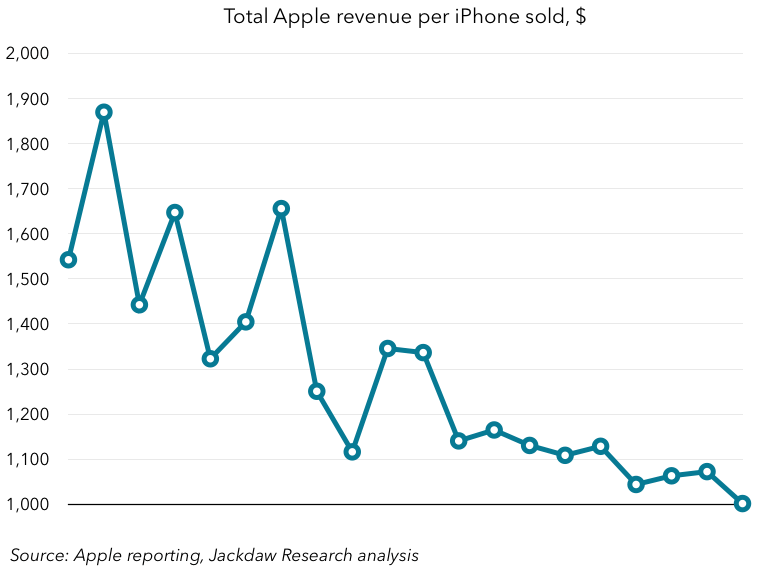

Apple’s earnings this week were such that it’s almost impossible not to be distracted by the sheer scale. However, since that’s been well covered every where the last couple of days, I wanted to focus on a particular way of looking at Apple, which I suspect fits well with where the company will go in the coming years. I’ll start with this chart, which is a datapoint you probably won’t have seen anywhere else – it’s the total revenue Apple generates as a company divided by the number of iPhones sold. Note: it’s not iPhone revenue per iPhone sold (i.e. average selling price), but the total revenue from all products and services per iPhone sold in each quarter:

What I want to look at today is the degree to which the iPhone has become central to the Apple ecosystem and the degree to which Apple can essentially be seen as the iPhone company. To some extent, we can also begin thinking about “the iPhone economy” as existing beyond the confines of Apple itself. What the chart shows is Apple is starting to stabilize at around $1,000-$1,100 per quarter per iPhone sold in total revenue. Now, iPhones themselves account for somewhere between $600 and $700 of that $1000, but the rest is made up of other devices and services and that’s where I want to focus our analysis.

What I want to look at today is the degree to which the iPhone has become central to the Apple ecosystem and the degree to which Apple can essentially be seen as the iPhone company. To some extent, we can also begin thinking about “the iPhone economy” as existing beyond the confines of Apple itself. What the chart shows is Apple is starting to stabilize at around $1,000-$1,100 per quarter per iPhone sold in total revenue. Now, iPhones themselves account for somewhere between $600 and $700 of that $1000, but the rest is made up of other devices and services and that’s where I want to focus our analysis.

Other devices – today

About 30% of Apple’s unit shipments in the quarter were something else – iPads, Macs and a few iPods. As the iPod goes away, the other devices are essentially becoming companions to – or extensions of – the iPhone. I’d bet a very high percentage of iPad and Mac owners are also iPhone owners and, with concepts such as Continuity and its implementation in features such as Handoff, the iPhone is becoming more and more interconnected with those other devices. These devices will largely be sold in future to iPhone owners and their interconnectedness with the iPhone will make them more and more attractive purchases, which will have a positive effect on sales over time (witness what’s happening with Mac sales, in contrast to the broader PC market). Today, these other devices make up about 25-30% of Apple’s revenue in an average quarter.

Other devices – tomorrow

But of course these aren’t the only devices Apple will be selling going forward. With the launch of the Apple Watch in April, Apple will have another companion device to the iPhone – the first to be explicitly tied to it (and of very little use without it). The revenue opportunity around the Apple Watch is significant – if it ships 20 million or more in 2015, as I think it might well do, then it could generate $10 billion or more in revenue, contributing about 5% of Apple’s overall revenue after it launches. Over time of course, it’s likely to generate significantly more than that and will make an increasing contribution to overall revenues. Then there are other devices that become part of the iPhone ecosystem: home automation devices connected to HomeKit, other wearables connected to HealthKit and the Health App, and so on. Apple will likely sell many of these in its stores and so capture revenue that way. But it’s also possible Apple will launch some of its own hardware in these categories, further stimulating sales. The Apple TV, of course, is another device tied in many ways to the iPhone, and which plays a role in HomeKit too. If it evolves and Apple manages to move it beyond the “hobby” phase, it too could play a significant role in boosting the iPhone economy.

Accessories

Then there are accessories – Apple sells lots of these today, though it’s just stopped reporting this number separately. Apple has also acquired Beats, which makes first party accessories for Apple and has the potential to grow and expand over time into other categories. And there are quite a few other segments Apple could expand into over time, within the broad scope of accessories, which could further boost revenues per iPhone sold.

Services and content

Lastly, there are services and content, including iTunes content, the App Stores across iOS and OS X, iCloud, and newer services such as Apple Pay. Assuming Apple is able to turn content performance around with whatever Beats evolves into, each of these has the potential to grow significantly over the coming years and make an increasing contribution to revenues and profits.

Perpetuating astonishing growth

All this is relevant because, even though the revenue per iPhone sold number has been falling, I expect at some point it’ll turn around and start rising again, as each iPhone sale generates not just $650-700 in revenue directly but an increasing amount of ancillary revenue through sales of iPads, Macs, Apple TVs, and Apple Watches, along with iTunes content, apps, Apple Pay, iCloud and a plethora of other products and services. Apple’s December 2014 quarter was astonishing in its scale and the growth it entailed and Apple will continue to feel the effects of the iPhone 6 and 6 Plus launch for several more quarters. But if it’s to generate that kind of astonishing growth going forward, these additional revenue opportunities, adding up to over $1,000 per iPhone sold, will be increasingly important as iPhone growth slows down a bit in a year’s time. But at the same time, these peripherals to the iPhone will help ensure its place as the most attractive ecosystem for both developers and consumers, which in turn should help keep iPhone sales ticking over nicely as well.

Just because you can make a chart does mean that you should.

I fail to see the point of this chart.

1 Mac Pro + 1 iPhone = high revenue per iPhone

2 Mac Pros + 10 iPhones = lower revenue per iPhone

So?

That’s been the main reason for the decline in that number until now. My point is that going forward the iPhone and things that act as peripherals to it will be things that drive that number back up again.

Sure, the more non-iPhone things that Apple sells, the more revenue it makes per iPhone.

As Dave implies, this “phenomenon” where revenue per iPhone is currently lower than it has been has lots to do with great iPhone sales.

Mac sales could double, from 5M to 10M, and that would also be phenomenal. At an ASP of 2000 that would add 10B in revenue. But Apple was expected to sell 66.5M phones 1st quarter, and actually sold 74.5M.

That hypothetical 5M extra Macs (a huge gain in anyone’s book) doubles an iPhone ASP of 650 for only those 8M extra phones. Across ALL 74.5M phones, it only adds $134 per phone, the low end of your scale.

So, Apple can beat the market trend for PC sales, but compared to the iPhone which holds onto a high ASP (and raises it with the 6+), it looks like Apple is missing a trick somewhere until it launches new, more personal products that are even more compelling companions to the iPhone.

Therefore, it is hard to disagree with the idea that if there are increasingly more personal products that are compelling companions to the iPhone, that more people will walk out of the store with both an iPhone and one of those. There will be many, many more people who will go into the store for an iPhone and walk out with both an iPhone and a $349 Watch, than an iPhone and a $2000 Mac.

Jan, in the year end/start podcast I recall you saying that Apple would face pricing pressures because of the extreme commodization of Android running devices. Are you still of this opinion given the apparanet success Apple had in China this last quarter?

I know comparisons are always risky, but Apple has been remarkably adept at maintaining supposedly higher price points in its personal computers over the years, a business which has exhibited extreme commoditization for many years now. So why can’t Apple sustain this pricing position in the iPhone as well?

Hi Mark. I don’t remember saying that, actually – doesn’t sound like something I believe, either. Is it possible I was referring to Samsung and not Apple? I very much believe what you said – i.e. that Apple can continue to maintain its premium pricing over time.

It has sustained its pricing position. The ASP of the iPhone actually went up. It’s just that Apple sold 8M iphones more than expected 1st quarter! (74.5 vs 66.5M).

Therefore, Apple could double Mac sales (5M to 10M) at an ASP of 2000 and still only bump revenue per iPhone a mere 134 dollars above an ASP of 650, and that wouldn’t even show on Jan’s chart — it would be too little to make a blip.

Apple’s success may be good for the company but not for its customers. For quite awhile now, when you call their Support line you’re always told “There’s currently an extended wait time to speak to an Advisor.” They used to say “15 minutes” but now they don’t even give a number, which means it could be more than 15 minutes! Their formerly wonderful customer service has deteriorated and that’s not a good trend.

First world problems, eh? A 15 minute wait, gasp! But I get your point, I think we’ll see some bumps in the road for a while as Apple continues to grow. I’m confident they’ll sort it out, Apple has a strong financial incentive to fix whatever goes wrong. That said, even Apple can’t do everything at once.

Excellent metric. Thanks!

New growth opportunities:

– Apple Watch (obviously)

– AppleTV, why do they wait for content providers when they could give TVs so many capabilities beyond TV: apps, games, room-wide FaceTime, etc. Once people start using their TVs for other things besides passive entertainment the content providers will see the need to get back in front of customers faces.

– Vertical for iPhone, by producing their own communications circuits

– Vertical for Mac, by producing their own desktop class ARM processors

– Marketshare for Mac, 20-30% of the PC market has relevance for Apple. (Servers and utility PCs don’t). Simpler, cheaper, lighter, longer battery MacBooks would be great for many consumers who still need a laptop, regardless of their tablet ownership.

But we have seen the peak growth rate for Apple. The smartphone market was a much bigger opportunity than any of the above, and coupled with one-time pent up demand for bigger screens.

Really informative blog.Really thank you! Awesome.

To the techpinions.com owner, You always provide great insights.

Hi techpinions.com admin, Thanks for the well-structured and well-presented post!

Dear techpinions.com owner, Thanks for the detailed post!

For the reason that the admin of this site is working no uncertainty very quickly it will be renowned due to its quality contents.

Very nice blog post. I definitely love this site. Stick with it!

To the techpinions.com admin, You always provide key takeaways and summaries.

Hi techpinions.com owner, Your posts are always well-formatted and easy to read.

Hello techpinions.com administrator, Thanks for the detailed post!

Hi techpinions.com administrator, Thanks for the well-organized and comprehensive post!

Dear techpinions.com owner, Your posts are always well-written and easy to understand.

Dear techpinions.com owner, Your posts are always well received by the community.

Whats up are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started and create my own. Do you need any html

coding knowledge to make your own blog? Any help would be greatly

appreciated!

I’ve been exploring for a little bit for any high quality articles or blog posts on this sort of space .

Exploring in Yahoo I at last stumbled upon this web site.

Reading this information So i’m satisfied to show that I’ve an incredibly good uncanny feeling I found out exactly what I needed.

I such a lot for sure will make sure to don?t overlook this website and give it a look

regularly.

Wow, fantastic blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your web site

is fantastic, as well as the content!

It’s very easy to find out any topic on net as compared to books,

as I found this article at this web site.

Piece of writing writing is also a excitement, if you be familiar with then you can write

or else it is complex to write.

Thanks for another magnificent post. Where else may just anybody get that type of information in such an ideal method of writing?

I have a presentation subsequent week, and I am at the look for such info.

Greetings, I do believe your web site could possibly be having browser compatibility issues.

Whenever I look at your web site in Safari, it looks fine however, if opening in Internet

Explorer, it has some overlapping issues.

I merely wanted to give you a quick heads up!

Apart from that, excellent site!

Hi there, i read your blog occasionally and i own a similar one and i

was just wondering if you get a lot of spam feedback? If so how do you prevent it, any plugin or anything you can suggest?

I get so much lately it’s driving me mad so any support is very much appreciated.

To the techpinions.com administrator, Your posts are always well-written and easy to understand.

Hi! I’m at work surfing around your blog from my new

iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts!

Carry on the great work!

My relatives always say that I am killing my time

here at web, except I know I am getting experience daily by reading such pleasant articles or

reviews.

You ought to take part in a contest for one of the greatest sites online.

I’m going to highly recommend this blog!

Hmm it appears like your website ate my first

comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying

your blog. I too am an aspiring blog blogger but I’m still new

to the whole thing. Do you have any suggestions for rookie blog writers?

I’d really appreciate it.

Dear techpinions.com administrator, Your posts are always well-balanced and objective.

I am really impressed with your writing skills as well as

with the layout on your blog. Is this a paid theme or

did you customize it yourself? Either way keep up the excellent quality writing,

it is rare to see a great blog like this one nowadays.

This paragraph is genuinely a nice one it helps new net viewers, who are wishing for blogging.

What a stuff of un-ambiguity and preserveness of valuable know-how about unexpected feelings.

I read this article fully concerning the difference of most recent and earlier technologies, it’s amazing article.

I just like the helpful information you provide for your

articles. I’ll bookmark your weblog and check once more here frequently.

I’m fairly certain I’ll learn many new stuff right right here!

Good luck for the following!

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: русские пьяные порно

I’m extremely pleased to discover this website. I wanted to thank you for ones time just for this fantastic read!

My website: порно студентки русское

Major thanks for the article post. Much thanks again.

My website: русское порно категории

Please let me know if you’re looking for a writer for your blog.

You have some really great articles and I feel I would be a good asset.

If you ever want to take some of the load off, I’d absolutely love to write some articles

for your blog in exchange for a link back to mine.

Please blast me an e-mail if interested. Many thanks!

I got what you intend,bookmarked, very decent website.

My website: смотреть бесплатно порно изнасилование

Muchos Gracias for your article.Really thank you! Cool.

My website: пьяное русское порно

Thank you ever so for you blog. Really looking forward to read more.

My website: порно русских студентов

My spouse and I stumbled over here from a different website and thought I should check things out. I like what I see so now i’m following you. Look forward to looking at your web page for a second time.

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: изнасиловали порно

Hmm is anyone else having problems with the pictures on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: новинки русского порно

This site definitely has all of the information I needed about this subject

My website: порно на русском категории

I’m extremely pleased to discover this website. I wanted to thank you for ones time just for this fantastic read!

My website: эротика пьяные

My website: порно русских студентов

At this time it looks like WordPress is the preferred blogging platform out there

right now. (from what I’ve read) Is that what you’re using on your

blog?

I reckon something truly special in this website.

My website: порно трахнул рыжую

I gotta favorite this site it seems very beneficial handy

My website: самые красивые сиськи

Respect to post author, some fantastic information

My website: бабы с волосатой пиздой

Thanks in favor of sharing such a pleasant

idea, piece of writing is fastidious, thats why i

have read it completely

Major thanks for the article post. Much thanks again.

My website: грубый секс

I got what you intend,bookmarked, very decent website.

My website: порно видео лижет жопу

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: ануслингус

I gotta favorite this site it seems very beneficial handy

My website: порно бдсм смотреть онлайн

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: жена изменила порно

It’s a pity you don’t have a donate button! I’d

certainly donate to this excellent blog! I guess for now i’ll

settle for bookmarking and adding your RSS feed to my Google

account. I look forward to fresh updates and will talk about this site with my Facebook group.

Talk soon!

Attractive section of content. I just stumbled upon your web site and in accession capital to assert that I acquire actually enjoyed

account your blog posts. Anyway I will be subscribing to your feeds and even I achievement you access consistently quickly.

Very good post.Really looking forward to read more. Great.

My website: смотреть порно хд

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: растянутое очко

I reckon something truly special in this website.

My website: смотреть лучшие жопы

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: порно с молодыми рыжими девушками

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: русское порно 18 лет

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: анал фистинг

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: домашний анальный секс

Muchos Gracias for your article.Really thank you! Cool.

My website: доктор и медсестра

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: русский трах

I am incessantly thought about this, thanks for posting.

My website: секс армения

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: трахнул врачиху

As a Newbie, I am continuously exploring online for articles that can be of assistance to me.

My website: реальный мжм

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: домашнее групповое порно с женой

I got what you intend,bookmarked, very decent website.

My website: порно глубоко в глотку

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: секс видео мжм

I reckon something truly special in this website.

My website: секс с толстыми зрелыми

Thank you ever so for you blog. Really looking forward to read more.

My website: русское порно брюнетки

Wohh precisely what I was searching for, regards for putting up.

My website: инцест с сестрой

Muchos Gracias for your article.Really thank you! Cool.

My website: мохнатые зрелки

Muchos Gracias for your article.Really thank you! Cool.

My website: папа трахнул дочку

Very good post.Really looking forward to read more. Great.

My website: секс видео от первого лица

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: порнуха скрытая камера

I gotta favorite this site it seems very beneficial handy

My website: порно anal

Hello my family member! I want to say that this post is amazing,

great written and include almost all important

infos. I’d like to look extra posts like this .

Heya just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show the same outcome.

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! However, how could we communicate?

I like the valuable information you supply for your

articles. I will bookmark your weblog and check again right here regularly.

I am reasonably sure I’ll be informed plenty of new stuff right right here!

Best of luck for the following!

whoah this weblog is wonderful i love studying your articles.

Stay up the great work! You understand, many persons are searching round for this info, you could aid them

greatly.

After looking over a handful of the articles on your web site, I honestly like

your technique of writing a blog. I book marked it to

my bookmark website list and will be checking back soon. Please visit my web site too and let me know how you

feel.

This blog was… how do you say it? Relevant!! Finally

I have found something that helped me. Thank you!

Hello techpinions.com owner, Excellent work!

PBN sites

We establish a network of PBN sites!

Benefits of our PBN network:

We perform everything SO THAT google DOES NOT grasp that this is A private blog network!!!

1- We purchase domains from different registrars

2- The main site is hosted on a VPS hosting (VPS is rapid hosting)

3- The rest of the sites are on different hostings

4- We assign a distinct Google account to each site with confirmation in Google Search Console.

5- We develop websites on WP, we don’t utilize plugins with assistance from which malware penetrate and through which pages on your websites are generated.

6- We never repeat templates and utilize only unique text and pictures

We do not work with website design; the client, if desired, can then edit the websites to suit his wishes