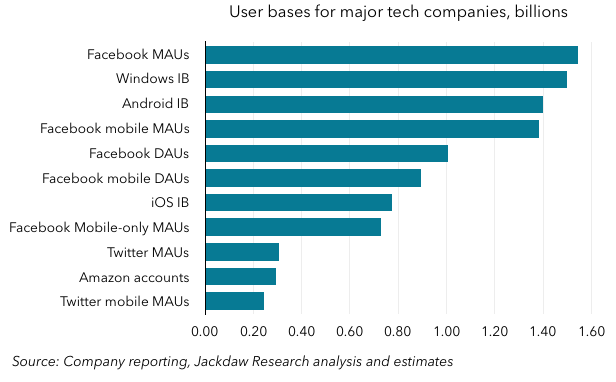

Yesterday, Facebook announced its results for Q3 2015 and with it, provided an update on all its standard user metrics. Facebook is one of the most transparent companies when it comes to these numbers and provides five different measures of the size of its user base (both monthly and daily active users) and splits by mobile and mobile-only. These numbers are not only growing rapidly, but growth is actually accelerating, driven by Facebook’s increasing traction outside North America and Europe. Interestingly, Facebook’s monthly active user number (which stands at 1.545 billion) now gives it arguably the largest cohesive base of regular customers of any technology company (and perhaps of any company in the world). The chart below shows user base numbers for several large technology companies, including some estimates of operating installed bases:

(In the chart above, IB = installed base, MAUs = monthly active users, DAUs = daily active users)

As you can see, Facebook has several of the top slots, but Microsoft (with Windows), Google (with Android), and Apple (with iOS) round out the top four companies. There is then a huge drop from Apple (with a little under 800 million active iOS devices) to Twitter and Amazon, with around 300 million each. The kind of global scale Facebook, Microsoft, Google, and Apple have achieved is unmatched by almost any other company on a global basis. The only exceptions are some of the largest Chinese companies, which are able to achieve similar scale, but within China itself rather than globally.

Size doesn’t matter – it’s how you use it

However, a large installed base does little good if you can’t monetize it effectively. Interestingly, Microsoft generated just under $15 billion from Windows in its last fiscal year, while Facebook’s total revenue in the past four quarters was just over $15 billion. However, these two numbers are going in very different directions, which is an indication both of the trajectory of the user numbers and the companies’ ability to grow their revenue per user. Facebook generated almost $40 per US user in the past four quarters, a number that continues to rise rapidly.

Google, the only other company at similar scale on a global basis, doesn’t really monetize Android directly at all, so that user base of 1.4 billion generates very little revenue itself. It does monetize a variety of other services which have user bases on a similar scale, including Google search, Gmail, and others, of course. But Google’s challenge is Android itself captures very little user attention – almost all that attention is absorbed by apps, over which Google has very little control. With Google Now On Tap, Google is clearly trying to insert itself back into users’ in-app lives, but it’s likely a poor substitute for providing the apps users actually want to spend time in, especially from a monetization perspective.

And then we have Apple which, despite having a user base a little over half the size of the big three, generates about $300 per iOS user per year. It’s interesting to me that Apple has been steadily getting back into the business of providing the content applications where its customers spend their time, with the launches of Apple Music and Apple News being the biggest examples to date. While these aren’t huge money-spinners in their own right, these services both help make the Apple experience stickier and associate more of the value with Apple itself rather than third parties.

Amazon also generates around $300 from e-commerce sales per year from each of its “active customer accounts,” demonstrating there’s no single business model for significant revenue per customer. Like Apple though, Amazon has created an ecosystem where people are happy to spend money, because they’re convinced of the value they will get. This highlights an interesting contrast between several of these companies – Apple and Amazon get people to spend money directly in their ecosystems, while Facebook and Google get people to spend their time and advertisers to spend money trying to capture some of their attention. Microsoft needs to decide which strategy it will pursue going forward, as its traditional software business model becomes ever less relevant in the consumer market. I and several other Tech.pinions contributors have written in the past about the challenges of ad-based business models, and it’s not clear Microsoft has what it takes to succeed there regardless.

Twitter’s challenge – small user base, poor monetization

One of the biggest challenges for Twitter on the other hand is it neither has a very large customer base like Google, Microsoft, or Facebook, nor does it monetize that base at anything like the rate of Apple or Amazon. Though its ARPU is rising, it’s generating just half of what Facebook does in the US and at one fifth the scale. To achieve the kind of growth Twitter needs going forward, it will have to either return to growing its user base or dramatically increase its potential to monetize the base it has, preferably both. It’s clear Jack Dorsey understands this challenge, but it’s not yet clear he has the right strategy or execution in place to meet it. Moments seems like a decent move in Twitter’s bid to attract a different kind of user, but the switch this week from Favorites to Likes seems like just the kind of move Twitter needs to avoid if it’s to resolve the tension between attracting new users while retaining existing ones.

Twitter’s challenge also seems to be the timeline form. I would think they are in a position to know things about their users in the same way as Facebook and as Google more often lacks. Twitter is in a better position to target advertisers.

But the Twitter form does not lend it to advertising opportunities beyond the twitter stream. If Twitter’s monetization is only open to primarily an advertising model, then they have not done a good job setting themselves up for that structure, IMO.

Joe

Amazon may have the same $300 per user per year, but it absolutely does NOT have a comparable profit per user as Apple.

Also of interest is that figure of almost 800 million active iOS users. This highlights that the iOS *platform* is about 55% the size of Android, far larger than the often cited 12% smartphone market share figure that everyone always quotes.

It indicates that as many have often suspected, iOS devices are handed-down, on-sold or kept in use far longer than the vast majority of cheap and nasty plastic Android devices. No doubt part of the reason is also that a large number of Android devices are simply glorified featurephones, contributing nothing to the Android platform as a whole.

Great website. Lots of useful information here. I look forward to the continuation.

Excellent article! We will be linking to this particularly great article on our website. Keep up the good writing.

It’s hard to find educated people on this topic, however, you sound like you know what you’re talking about! Thanks

Way cool! Some very valid points! I appreciate you penning this post and also

the rest of the website is really good.

It’s very trouble-free to find out any topic on web as compared to textbooks, as I found this piece of writing at

this site.

I was more than happy to discover this web site.

I wanted to thank you for ones time just for this fantastic read!!

I definitely liked every little bit of it and i also have you

saved as a favorite to check out new stuff on your website.