Author’s note: Many of the commentators aren’t even reading the article but, instead, are basing their comments on the article’s title alone. Let me throw one final analogy into the mix in the hopes of clarifying my position:

Apple is in the dairy business and Android is selling meat. Apple has the cream (pun intended) of the milk-producing cows but Android has far more cows that produce far less milk, but far more meat. Both are winning because they are selling different things, but pundits think that Android has won simply because they have more cows.

Apple has the profits. Android has the market share. And they’re both doing great.

Now back to the original article…

“My belief, though, is that what Google is winning with Android is a booby prize — overwhelming majority share of the unprofitable segment of the market.” – John Gruber

The Platform Business Model

“A computing platform includes a hardware architecture and a software framework…where the combination allows software to run. … A platform might be simply defined as a place to launch software. ~ Wikipedia

The advantage of a platform business model is that once the platform is established, others do much of the work to make the platform valuable. It’s like setting up a marketplace ((I never understood why Google changed their store’s name from Google Marketplace to Google Play. I thought that “Marketplace” was the ideal name. Oh well.)). Once it’s set up, the vendors do most of the work. The platform provider benefits either by taking rents or by taking a commission from each sale or by using their access to the customers gathered by the marketplace in order to sell some complementary product or service of their own.

The Mostly Misunderstood Network Effect

“In economics and business, a network effect…is the effect that one user of a good or service has on the value of that product to other people. When network effect is present, the value of a product or service is dependent on the number of others using it (emphasis added).

The classic example is the telephone. The more people own telephones, the more valuable the telephone is to each owner. This creates a positive externality because a user may purchase a telephone without intending to create value for other users, but does so in any case.” ~ Wikipedia

This is key, so please forgive me for repeating it:

“…a user may purchase a telephone without intending to create value for other users, but does so in any case.”

In other words, every user adds to the value of a phone network – even if they have no intention of doing so – JUST BY BEING ON THE NETWORK.

It is this understanding (or misunderstanding) of the network effect that makes so many mobile computer industry observers confident that:

— Market share alone creates the network effect;

— Android has market share; therefore

— Developers, profits and all the other benefits associated with the network effect MUST necessarily follow where Android’s market share leads.

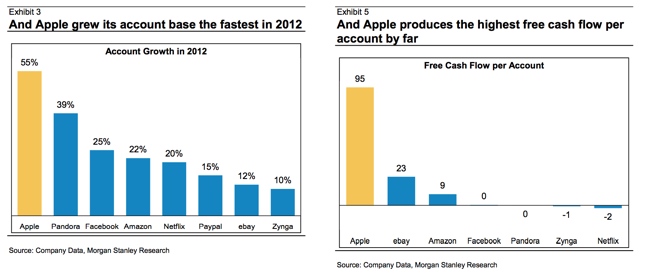

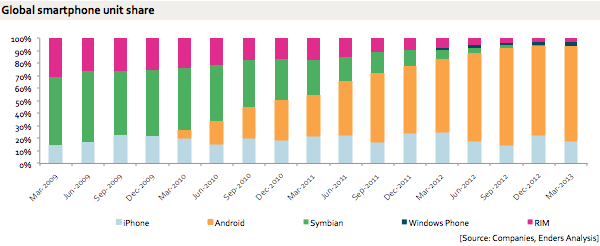

Source: Benedict Evans, On Market Share

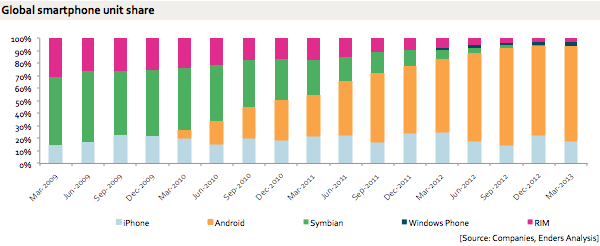

The high priests of market share contend that since Android HAS won the battle for market share, the network effect makes it inevitable that Android WILL win the war for mobile phones.

Derek Brown, ReadWrite:

In the world of technology platforms, ubiquity matters (a lot) when developers, manufacturers, etc., are considering future products/solutions.

Google Chairman, Eric Schmidt:

“Ultimately, application vendors are driven by volume, and volume is favored by the open approach Google is taking…. ((“(M)y prediction is that six months from now you’ll say (that Android apps are beating iOS versions to market…)” ~ December 7, 2011))

Matt Asay, ReadWrite

Over time, those developers are going to move to where the market share is. They have to.

John Gruber, The church of market share:

It’s an article of faith in the Church of Market Share that Android is nearing a tipping point where its market share lead will inevitably turn into a developer share lead, too.

So is it true? With Android holding such a commanding market share lead, do developers, and then users, and then profits, and then, ultimately, all smartphone users – including iPhone users – have to convert to Android?

No, of course not. Here’s why.

Phone Networks Are Not The Same As Computer Networks

— In a phone network, the value is in the phone owner.

— In a mobile computing network, the value is in the app, not the mobile phone owner.

— In a phone network, the more phone owners there are – the more people you could call and be called by – the more powerful the network effect and the more valuable the phone network becomes.

— In a mobile computing network, the more developers there are – the more apps available for consumption – the more powerful the network effect and the more valuable the computing network becomes.

— In a phone network, there is no difference between a phone owner and a phone user – they are one and the same.

— In a mobile computing network, there is a HUGE difference between the mobile phone owner and the mobile user.

— In a phone network, the phone owner begins contributing to the platform the moment they buy the phone.

— In a mobile computing network, the mobile phone owner doesn’t begin contributing to the platform until they voluntarily decide to participate, either by buying apps or content, consuming advertising or contributing data.

— In a phone network, the phone owner’s mere PRESENCE makes the phone network more valuable.

— In a mobile computing network, you don”t measure the value of a mobile phone owner by their mere presence, you measure their value by their PARTICIPATION.

Presence, without participation, adds no value to a mobile computing network.

It is fairly easy to simply add up all of the mobile phone sales and activations for a particular operating system. It is also fairly meaningless. The trick is to discern how much those mobile phone owners are participating and the value that their participation brings to the network.

Most mobile computing industry observers are measuring the wrong thing, the wrong way:

It’s not about counting the customers. It’s about having the customers that count.

Android can count more customers than iOS can, but they don’t count for much. The ranks of Apple’s iOS owners are filled with credit card carrying cash cows. As a result, Apple’s platform profits are udderly enormous. The ranks of Google’s Android activations are a lot less cash cow and a lot more Bull. ((Being a bad customer is not at all the same thing as being a bad person. I, myself, am a great Crispy Creme Donuts customer but a very poor customer for exercise equipment. That doesn’t make me a bad person, just a bad customer.))

It’s hard to milk a Bull. Dangerous too.

How Do You REALLY Measure The Success Of A Platform Business Model?

You measure the success of a platform in three ways:

1) The health of the platform – is it self-sustaining?

2) The wealth of a platform – the amount of net profits acquired from the platform.

3) The stealth of a platform – does it serve an ulterior purpose?

The Health Of A Platform

By any meaningful standard, Apple’s iOS platform is robust, healthy and rapidly growing.

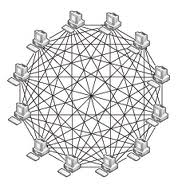

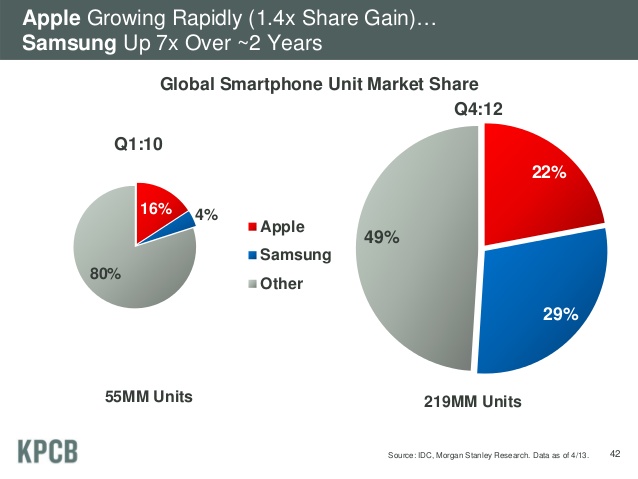

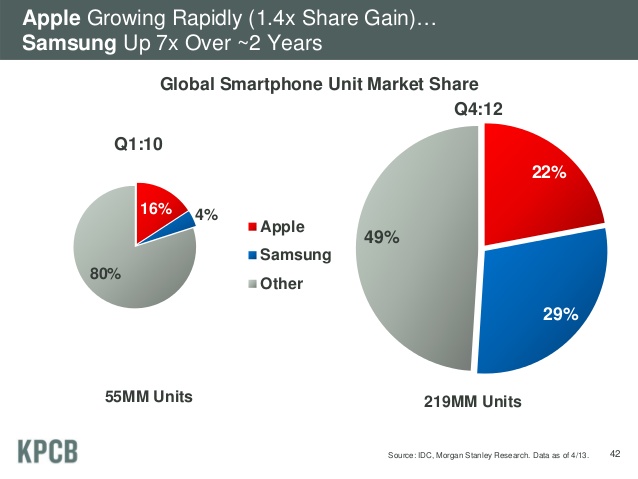

Take a look at the two pie charts, below. From Q1:10 to Q4:12, Apple’s share of the smartphone market grew from 16% to 22%. But during the same span of time, the pie itself QUADRUPLED from 55 million units to 219 million units!

Source: KPCB, Internet Trends

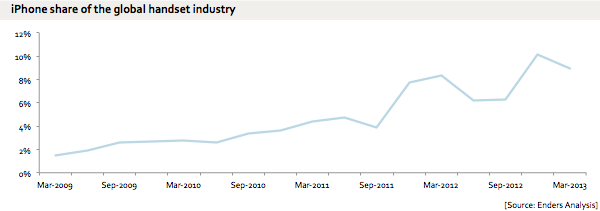

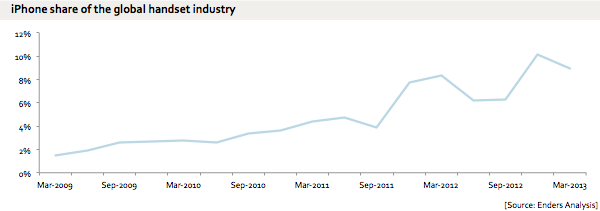

Further, “smartphone share” is not even the right way to measure the market that Apple is competing in. The more relevant market is the “mobile phone market”, not the “smartphone market”.

“… there is no such thing as a ‘smartphone market’. Or rather, talking about the ‘smartphone market’ is like talking about the ‘3G’ market or the ‘colour screen phone’ market: you’re picking out a sub-segment that is going to grow to take over the whole market. And ignoring the growth.

The whole mobile phone market is converting to smart. Apple is taking the high end and Android is taking the rest. Both are growing very fast, and Android is growing faster. But what matters is phone share, not smartphone share. ~ Benedict Evans

Source: Benedict Evans, On market share

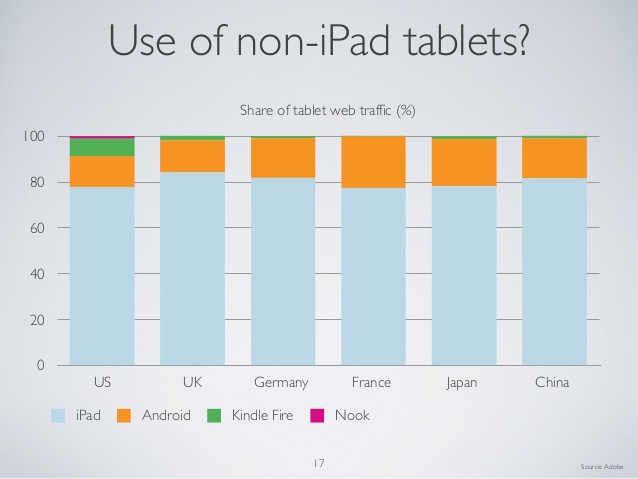

Finally, the “mobile phone market” is still not inclusive enough. When we’re comparing operating systems, we need to compare ALL of the devices in the operating system, whether they be MP3s, phones or tablets.

Source: “Apple Q2 2013 hardware sales: By the numbers”

“Cumulatively, Apple has sold almost 375 million iPods, over 356 million iPhones, and nearly 140.5 million iPads since the respective products were first released. In 23 quarters, Apple has sold almost as many iPhones as it has sold iPods over 46 quarters, and sales of the smartphone are likely to overtake the aging media player during this quarter if the respective sales trajectories hold true. Put that another way: the iPhone has sold twice as fast as the iPod did.” – Apple Q2 2013 hardware sales: By the numbers

I would only add that the iPad has been selling THREE times as fast as the iPhone did.

When one looks at the WHOLE market for iOS vs. the WHOLE market for competing operating systems, the metrics supporting the health of Apple’s iOS platform are so overwhelming and so voluminous that it was difficult for me to even find a suitable method for properly displaying them. Ultimately, I resorted to simply sorting them alphabetically, by category, in the extensive appendix, below. I dare you to read the associated links in the appendix and then tell me that the iOS platform is anything but healthy. No, wait…”I triple dog dare you.”

If the purpose of a platform is to be self-sustaining, then Apple’s iOS platform is as successful as it gets.

Open Trade-Offs

Android is no slouch ((By which I mean it is one of the greatest computer operating systems ever.)) as a platform either, but Android is based on an “open” philosophy. Open is not inherently good or bad, it is a tradeoff. It has many advantages but it has many disadvantages too. The same open policies that make it easier for Android to gain market share are also the same open policies that make it inherently harder for Android to maintain a strong platform.

— An open policy towards carriers encourages rapid dissemination of devices but it also permits the carriers to take unwanted liberties with Android’s core services and allows them to shirk their responsibilities with regard to operating system updates.

— An open policy towards manufacturers allows for rapid hardware iteration but it also creates rapid hardware fragmentation.

— An open policy towards the sales of applications leads to a wide variety of apps but it also leads to a wide variety of piracy, cloning and malware too.

— An open policy towards the operating system allows for rapid feature iteration but it also allows competitors to split off a confusing variety of competing operating systems and App Stores too.

The BBC Trust:

…a couple of … logical reasons why developers dealing with limited time and budget would opt for Apple’s mobile OS:

— Engagement is higher on Apple devices

— Android is fragmented

— Android development is complex and expensive

The Wealth Of A Platform

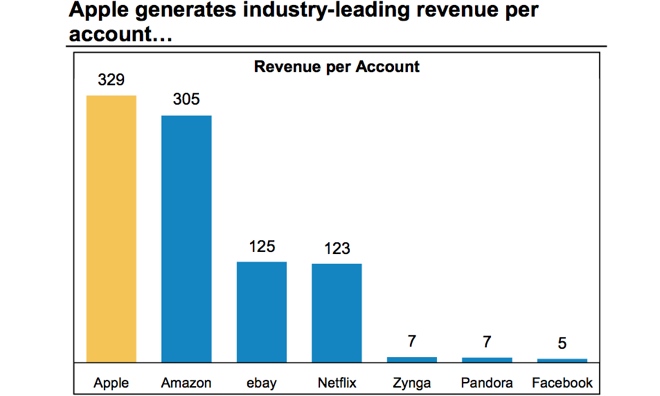

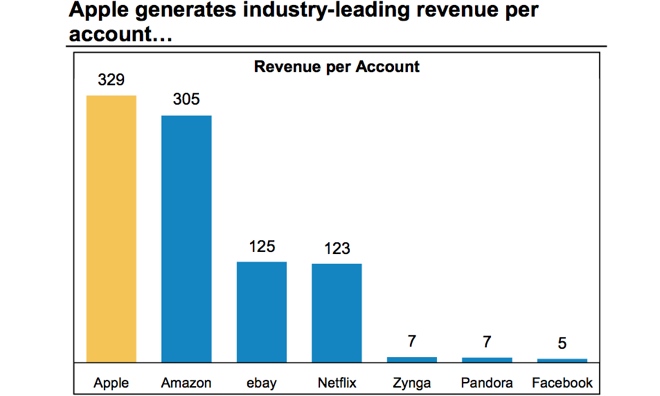

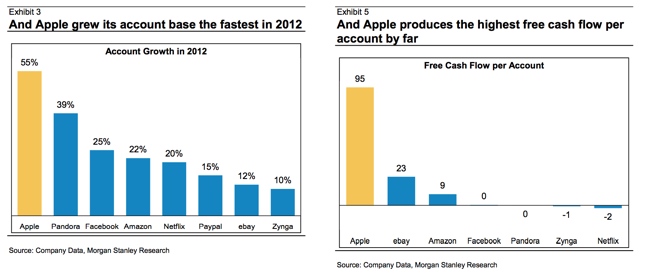

Google is profiting from their Android platform via advertising, app and content revenue. However, as I pointed out in “4 Mobile Business Models, 4 Ways To Keep Score“, none of these revenue streams add up to very much.

Google could also be benefitting from their Android platform via the gathering of mobile computing data. This is the big “get out of jail free card” that Android advocates play whenever it is pointed out that Google is not directly profiting from Android. “The data alone”, they protest “is invaluable.” Hmm. Unless you can draw a direct line from the data being gathered to the profits being made – and you can’t – data, in lieu of profits, seems like a very poor consolation prize, indeed.

Apple too is profiting from their iOS platform via advertising, app and content revenue. However, that revenue – a few billion dollars – barely registers on their books. The vast majority of Apple’s iOS revenue is generated from the platform’s related hardware sales. (See: “Android’s Market Share Is Literally A Joke“.)

The Stealth Of A Platform

I have stated that you measure the success of a platform by its health and its wealth. I am, however, keenly aware of a third way to measure the success of a platform – an exception to the rule that is so large that it might swallow the rule altogether.

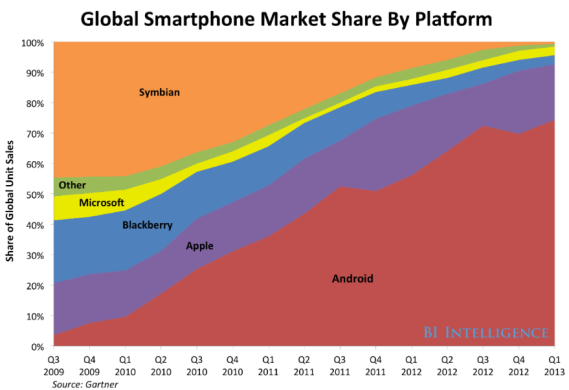

What if Google had an ulterior motive in Android? What if Android was actually a stealth weapon designed, not as a profit making engine but, as an engine of destruction aimed at Google’s mobile phone competitors?

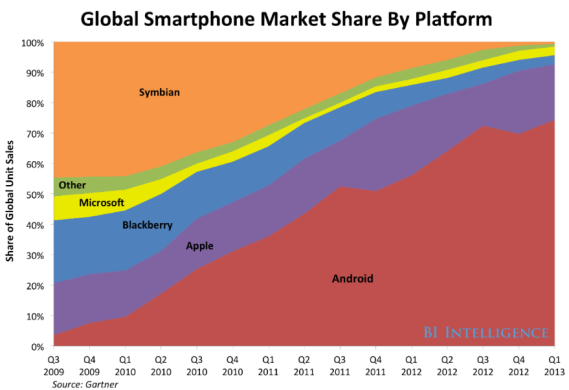

If the purpose of Google’s Android platform was a defensive action designed to destroy Google’s adversaries and ensure that Google’s advertising and services would run on every meaningful mobile platform, then I will grant you – based on the evisceration of Palm, webOS, Windows Mobile, Windows Phone 8, Nokia’s Symbian, MeeGo, Blackberry and Linux – that Android may well be one of the most successful computing platforms of our time or of all time. ((However, that is not the end of the story for Android but, perhaps, only the end of the beginning of the story. As Android splits into different self-serving streams – like the Amazon Fire and the various Chinese Android variants – will Google’s Android ultimately be seen as having successfully salted the lands of its enemies while simultaneously sowing the seeds of its own destruction?

“We often give our enemies the means for our own destruction.” ~ Aesop))

Source: “Apple 2.0, Which is more valuable to Apple, its market share or its brand?”

Apple Is Like DisneyWorld And Android Is Like A Chain Of Amusement Parks

Apple is playing the “give away the rides for free once you’re in the park, but charge for admission to the park” game. The purchase of Apple’s hardware is the golden ticket ((A Willie Wonka reference? Really? How many metaphors can this author mix together?)) that gives one entrée to their park. Google is playing the “give away the rides for free to attract customers to the park but make it up in revenues generated from the sale of ads and concessions” game.

Apple’s platform model is stronger – for now – because they get their money up front, at the point of admission to their walled garden. ((As an aside, DisneyWorld has much lower “market share” (total people in attendance) than do the tens of thousands of existing worldwide amusement parks, but does anyone ever claim that DisneyWorld is “niche” or “vulnerable”?)) Google’s platform model is weaker – for now – because it requires people to voluntarily buy the concessions and consume the advertising, and – for now – a lot of Android patrons are choosing not to buy and to just go along for the free ride.

Neither Android nor iOS is going away. Both platforms have different inherent strengths and weaknesses and instead of fruitlessly trying to decide which operating system is going to win EVERYWHERE, we should be focusing our efforts on determining WHERE, specifically, each OS is likely to win.

— Android will take the low end of the market.

— iOS will take the high end.

— Android will continue to grow like a weed.

— iOS will continue to grow like a well tended farm.

— Android will continue selling a mind-numbing array of diverse products.

— iOS will continue selling three year old iPhones as if they were new, because iOS’ value is found primarily in the platform, not in the device itself.

— Android will continue to rapidly iterate their hardware and their operating system.

— iOS will continue to relentlessly integrate their hardware with their software and their platform ecosystem.

— Android will appeal to third-world nations, emerging markets, tech aficionados who admire the virtues of “open”, those who require more options, those who require more diversity, and the cost conscious.

— iOS will appeal to more established nations, maturing markets, non-technical users who admire the virtues of easy and intuitive, those who require more security, those who require more consistency, those who require more integration, the quality conscious, and those who fear Google’s ad-supported business model.

— iOS will appeal to Enterprise, businesses, governments, institutions, organizations, and other entities that require more structure, security and control. ((As one who lived through the Windows v. Mac wars, the irony of Apple’s iOS becoming the favored operating system of the Enterprise is not lost on me.))

Where Do We Go From Here?

Am I criticizing Google or Android? No, I am NOT. Android has some fantastic hardware, a rapidly iterating operating system and a brilliant and innovative company backing it. It’s a clear success story.

What I’m criticizing is the nature of the debate. Market share is not only not the best way to measure success, absent context, it is one of the worst. [pullquote]Just because Android has a winning platform does not mean that Apple doesn’t have a winning platform too. And vice versa.[/pullquote]

It would be a monumental mistake to underestimate the strength of the Android Platform – but it would also be a colossal mistake to underestimate the power of Apple’s iOS too. The truth is that iOS and Android are the two great operating systems of our time and it looks like they’re both going to remain great for quite some time to come. One platform rules market share and one platform rules profit share and – in a rapidly growing market (see graphic, below) – there’s plenty of room for both business models to survive and thrive.

Source: KPCB, Internet Trends

And The Gold Goes To…

— In mobile hardware manufacturing, Apple is the clear cut winner with Samsung coming in a strong second.

— In mobile hardware manufacturing, Apple is the clear cut winner with Samsung coming in a strong second.

— In mobile advertising, Google is the big fish in a small, but growing, pond.

— In content sales, it’s difficult to judge, since the competitors are actually playing very different games. If you judge by revenue (and I don’t), the winner is Amazon. But if you judge by profit, you’ve got to give the nod to Apple…for now.

— In mobile platform? It’s much easier to say who has lost and that would be anyone not named “Apple” or “Google”. But so far as “winning” goes, Apple is already “winning” the only gold that matters to them (profit$) and Google’s Android has already “won” Google a seat at the mobile advertising table, which is the only gold that matters to them. They both sound like champions to me. But then, of course…

…the games are still far from over.

Read Part One of John’s column entitled: Android’s Market Share Is Literally A Joke

Read Part Two of John’s column entitled: 4 Mobile Business Models, 4 Ways to Keep Score.

APPENDIX

Adoption: iOS 6.1.2 is the Most Popular Version of iOS Less than One Week Following Launch

Adoption: Apple’s iOS 6 now accounts for 83% of all iOS-based traffic in North America

Adoption: The Orphans of Android

Adoption: “An OS that is 2 years and 2 months old controls over 45 percent of the Android ecosystem. An OS that is 1 year and 4 months old controls another 30 percent. 75 percent of the entire Android ecosystem is still on the non-current versions of the OS. It’s 2013.”

Advertising: Why 75 cents of every dollar spent on mobile advertising is spent on iPhone and iPad

Advertising: Apple’s iOS Mobile Ad Metrics Dominates Android

Advertising: iOS leads Android in mobile ad revenue

Advertising: iPad Still Dominates Tablet Ads

Advertising: iPhone Still Ranks Far Above Samsung Galaxy Line In Mobile Ads, Says Velti

Apps: Where’s Twitter Music For Android? Why Today’s Tech Companies Are Still Going iOS First

Apps: Walt Mossberg: How Apple Gets All the Good Apps

Apps: The Data Doesn’t Lie: iOS Apps Are Better Than Android

Apps: Why Android Takes Forever to Get Cool Apps

Apps: Games: Why Game Creators Prefer iPhone to Android

Apps: Games: Game developers still not sold on Android

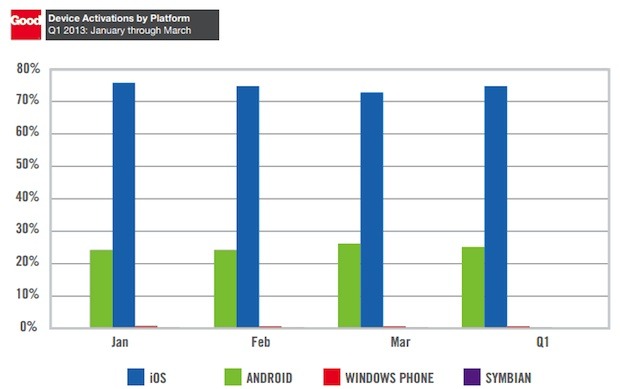

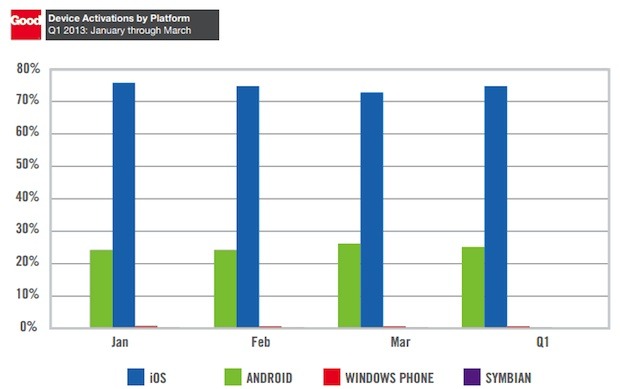

Business: “Apple’s iOS still dominated the enterprise mobile circuit with 75 percent of total device activations last quarter.”

Business: Google Android’s enterprise problem

Business: Study Says iOS Still Trumps Android at Work

Business: Fortune 500 Companies Moving to iPad Hits 94%

Business: Apple’s iOS continues to dominate the mobile enterprise

Business: Apple may have sold up to 4 million iPhones to businesses in Q4

Business: “Gartner: By 2014, Apple will be as accepted by enterprise IT as Microsoft is today”

Business: Forrester Report Says Apple Will Sell $39 Billion In Macs and iPads To Businesses Over Next 2 Years

Business: Bad news for Android: enterprise share dropped in Q4

Business: More Data Showing iOS, Especially The iPhone, Still Killing It In The Enterprise, At Android’s Expense

Business: Over 80% of organizations plan to support iPhones and iPads

Business: Apps: Why companies are still deploying iOS apps first

Source: “Who’s Winning, iOS or Android? All the Numbers, All in One Place”

Commerce: FAB.COM: More Than A Third Of Our Visits Are Now Mobile–And 95% Of Those Are iPhones And iPads

Consumption: Data: Study finds iPhone owners to be more data hungry than Android users

Consumption: Video: NPD Group: iTunes owns the internet video market

Consumption: Video: Apple Continues To Dominate Mobile Video Viewing, With 60% Occurring On iOS Vs. 32% On Android

Consumption: Video: Apple users watch 2X more video than Android users

Consumption: Video: Watching a Video on Your Phone? You’re Probably Using an iPhone, Not an Android.

Demographics: Android Owners Aren’t Real Smartphone Owners

Demographics: Age: Sorry, Samsung, iPhone Is Not Your Mother’s Smartphone

Demographics: Age: 48% of U.S. teens own an iPhone. 62% plan to buy one.

Demographics: Age: Nearly Half of Surveyed U.S. Teens Using iPhones, Over One-Third Using iPads

Demographics: Age: Greater percentage of Generation Y own iPhones than any other age group

Developers: Android fragmentation predicted to squeeze out independent developers

Developers: Apple And Google’s App Stores Now Neck And Neck – Except On The Metric That Matters Most To Developers

Engagement: Why Aren’t Android Users Actually Using Their Handsets?

Engagement: Validating the Android engagement paradox

Engagement: iPhone users found to spend more time on their handsets

Forks: Google’s penetration of Android

Forks: Google Shuts Down Its Shopping Service in China

Fragmentation: Fragmented Android drives big dev to Apple

Fragmentation: Google engineers: We’re trying to fix Android fragmentation

Loyalty: Survey Suggests, Loyalty, Upgrade Frequency, Says Raymond James

Loyalty: Survey shows iPhone loyalty still beating out Android

Loyalty: Apple Has The Most Devoted And Loyal Computer Users [Report]

Loyalty: Survey: Apple to Eclipse Android by 2016

Loyalty: Android’s Leaky Bucket: Loyalty Gives Apple the Edge Over Time

Malware: Mobile malware exploding, but only for Android

Malware: Malware On Mobile Grew 163% In 2012, Infecting Around 32.8M Android Devices

Malware: 99.9% Of New Mobile Malware Targets Android Phones

Malware: Spam: Nearly 60K Low-Quality Apps Booted From Google Play Store In February, Points To Increased Spam-Fighting

Reliability: Apple’s iPhone tops smartphone reliability ratings by wide margin

Retail: Apple retail revenues per visitor reach new record

Retention: The iPhone’s Greatest Weapon: Retention

Retention: Android’s Leaky Bucket

Source: Apple’s 500M user accounts second only to Facebook, viewed as key driver of future growth

Revenue: Canalys: Apple dominates with 74% of worldwide mobile app revenue

Revenue: Apple: App Store Now Makes Over $1 Billion In Profits Per Year

Revenue: iOS App Store accounts for nearly 75% of mobile app download revenue

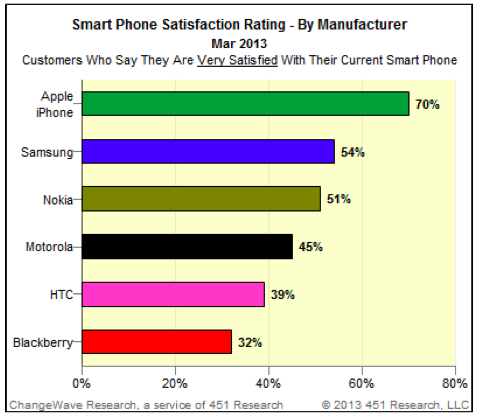

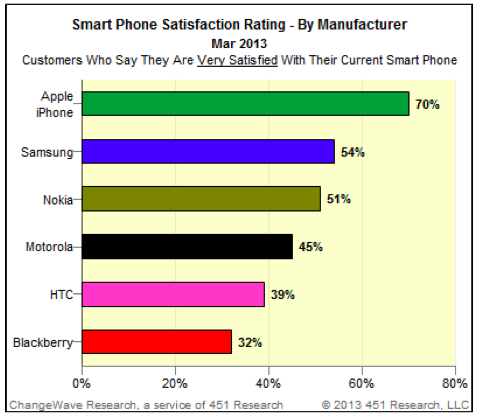

Satisfaction: iPhone dominates in customer satisfaction

Satisfaction: iPad tops in satisfaction among tablet owners

Satisfaction: J.D. Power: Apple iPad ranks highest in tablet customer satisfaction for second consecutive time

Satisfaction: J.D. Power: Apple ranks highest in smartphone customer satisfaction for 9th consecutive time

Source

Security: ACLU to FTC: Mobile carriers fail to provide good Android security

Shopping: Online: Apple’s iPad dominates online shopping traffic & revenue generation

Store: iTunes: NPD: Apple’s iTunes accounts for 67% of TV downloads, 65% of movies

Support: Apple tops Consumer Reports survey on PC tech support

Trade-In: Study finds Apple’s iPhone retains more value than top Galaxy models

Trade-In: Galaxy S4 announcement spurs trade-ins of other Samsung phones, not iPhones

Updates: Why Android Updates Are So Slow

Usage: You Spend a Lot of Time With Your Mobile Device at Home — Even More if It’s an iPad

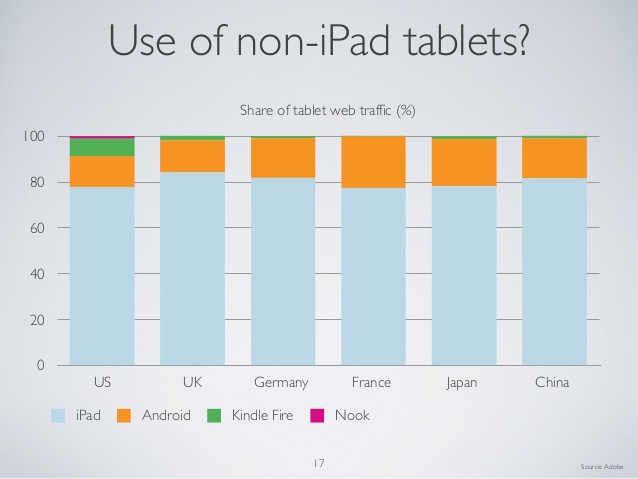

Usage: Apple’s iPad expands lead in tablet use at the expense of Amazon, Android, Microsoft Surface

Usage: Apple devices dominate in-flight Wi-Fi usage

Usage: Apple iPad continues domination with over 80% usage share in U.S. and Canada

Usage: Apple rules the skies with 84% in-flight share vs. Android’s 16%

Usage: Apple’s iOS continues to dominate with nearly 60% Web usage share vs. Android’s 26%

Usage: Apple’s iOS ups massive lead over Android in U.S. Web traffic with 69% share in April

Usage: Apple iPad dominates website traffic tablet share

Usage: Apple iPhone users use their devices 55% more than Android users

Usage: Safari jumps to 61 percent of mobile browser share

Usage: Android might own 75% of the smartphone market but all the action is still on the iPhone

Usage: Why The iPhone’s Usage Advantage Over Android Remains So Important

Usage: 5 Apples for every Android on Gogo Inflight Wi-Fi networks

Usage: Apple’s growing dominance of the mobile Web

Usage: Android’s Web share slipped in May, despite 10 million Galaxy S4s

Usage: iPhone owners are on their phones 53% more than Android users

Usage: The Android Conundrum: People Buy More Phones And Do Less With Them

Usage: Apple Is Destroying Android In Mobile Web Usage–Which Begs Key Question: Who Uses Android?

Usage: Apple Is Destroying Android In Mobile Web Usage–Which Begs Key Question: Who Uses Android?

Usage: Is It Time To Conclude That Android Gadgets Are Bought By People Who Don’t Actually Do Anything With Them?

Usage: Apple Continues Its Mobile-Browser Domination

Usage: Apple’s iPad Dominates Tablet Web Usage with 82% Share.

Usage: Android users: More of them than fanbois, but they don’t use the web

Vertical Markets: Doctors Are Choosing iPad Tablets Over Other Devices, Survey Says

Vertical Markets: Hospital Calculates The ROI Of An iPad At 9 Days

Vertical Markets: Why Android is losing in aviation

Vertical Markets: As medicine goes digital, Apple’s iPad is top choice among doctors

I think Apple’s business model is similar to the Disney World business model. There are boardwalks and amusement fairs aplenty, but there is only one Disney World. It it the crème de la crème of amusement parks. Similarly, there are smartphones and tablets aplenty but there is only one “Apple World.” It is the crème de la crème of mobile computing.

I think Apple’s business model is similar to the Disney World business model. There are boardwalks and amusement fairs aplenty, but there is only one Disney World. It it the crème de la crème of amusement parks. Similarly, there are smartphones and tablets aplenty but there is only one “Apple World.” It is the crème de la crème of mobile computing.

— In mobile hardware manufacturing, Apple is the clear cut winner with Samsung coming in a strong second.

— In mobile hardware manufacturing, Apple is the clear cut winner with Samsung coming in a strong second.