Internal data I have access to from Baidu in China allows me to see a picture of what is happening at ground level in terms of daily active users by device on Baidu’s network/app distribution platform. Baidu is the largest search engine in China both by use and revenue and their app distribution platform represents over 50% of the app distribution share and is growing. This data comes from analytics of devices that are accessing Baidu’s app platforms, not their search engine. They point out this data covers over 600m users.

There are a number of key takeaways from the most recent October data that relate to the iPhone 6, the 6 Plus, and the iPhone 5c.

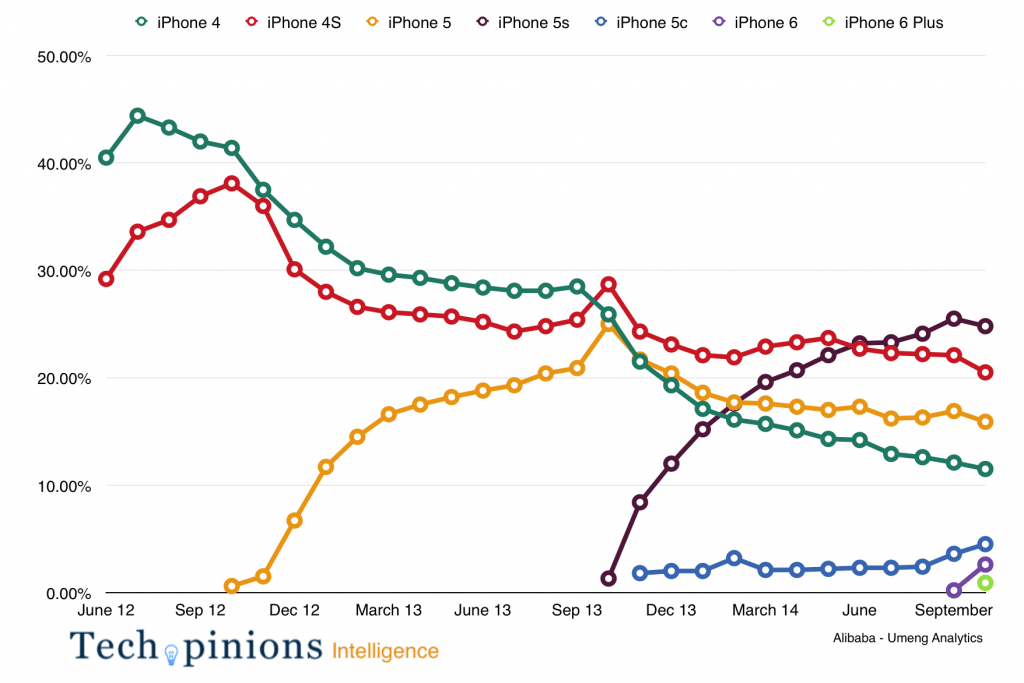

First let’s look at the chart:

When the iPhone went on sale in China at the end of September, it showed up on Baidu’s network at 0.9% of active use of all iOS devices. The 6 Plus didn’t show up at all. At the end of October, the iPhone 6 registered 2.6% of all active iOS devices and the 6 Plus 1%. Obviously, this suggests there are more iPhone 6s being sold in China than the 6 Plus–for now. Speaking with friends and colleagues in the region, it appears the shortage of availability of the iPhone 6 Plus is one of the major factors for this. I had several of them tell me customers were waiting more than a month, sometimes two, just to get their hands on the 6 Plus they ordered.

Knowing what I know about the region, I assume this will balance itself out and the anticipated 50/50 to 60/40 6 Plus to 6 split in China mix will play out. While I can’t quite use this data to interpret sales volume for these iPhones in October, I can use other means to estimate it in the coming months.

While these data points are interesting and I will continue updating this chart every few months, the uptick of the iPhone 5c may be the most interesting story line. As you can see from the chart, the iPhone 5c maintained a relatively steady flat line. But over the past few months the iPhone 5c has been gaining share in China. This seems to be counter to many of the assumptions of China as only a super premium market for Apple. Many were quick to point out the 5c was not targeted at China and thus expectations for it were tempered. However, things may be starting to change for the 5c and I believe there are a few reasons why.

One thing you realize when you study Chinese urban, and in particular, youth culture, is sometimes certain things/trends take a little while to make an impact in China. Many trends which start out global do not hit China and go big overnight. When I talked to some fellow researchers in China about this, a point was made that for the youth culture (who we believe is the source of the uptick in 5c sales) certain trends need to be established as culturally cool before they buy into it. It seems this is the common wisdom on the ground in China with regards to the 5c. It was not viewed as cool initially, since it was the “cheaper” iPhone but influences from metropolitan areas like Hong Kong have helped change the initial perception and it has become acceptible as an “entry level” iPhone. More succinctly, the 5c took a little while to be viewed as culturally acceptable since it is/was not the premiere iPhone.

If you read what I wrote about Xiaomi and Apple, you will recall I said Xiaomi’s phones are viewed as a cultural symbol for a young person who is upwardly mobile or moving up in society. From some dynamics I can see around the 5c, it seems it is also perceived now in a similar light as Xiaomi’s phones as a cultural status symbol. It helps the iPhone 5c is now also much closer in price to Xiaomi’s phones, especially the Mi4, with the heavy discounts coming to the later generation device. Given the iPhone 5c has a limited shelf life and no similar product was released last year, this dynamic may not last forever. However, I have a feeling once the iPhone 7 line come out and the iPhone 6 and 6 Plus are discounted in the region, we will likely see even greater penetration of iPhones in the exact same markets Xiaomi is looking to capitalize on. But, for the time being, it is interesting to see the dynamic of the 5c starting to play into the middle smartphone price tier of the Chinese market where Xiaomi has and continues to be quite strong.

There is one more important data point for the iPhone in China this report tells us. It relates to jailbroken iPhones. The number of jailbroken iPhones has been steadily decreasing. This is part of the reason why UnionPay being supported is a big deal. As I studied behavior of jailbroken iPhone users in China, the heaviest of whom were on the iPhone 4 and 4s, it became clear those who jailbroke their devices were not investing in Apple’s ecosystem. Which would have been a concern to Apple’s overall China strategy.

The Baidu data shows us since the 5s and 5c, the number of jailbroken devices is less than 10% of those devices, and less than 1% on the current iPhone 6 and 6 Plus models. Meaning, more and more iPhone consumers are not jailbreaking their devices and thus investing, to some degree, in Apple’s ecosystem. UnionPay helps this and both are very positive signs for Apple’s ecosystem story.

Um..Do you guys see the newest news of iphone 6 plus?Incredible!!!!!Iphone 6 plus’s lensgate are coming again, http://www.casecoco.com/?023 , see here.

Thanks for sharing this data. I had assumed that Apple would set aside a large amount of iPhone 6 pluses for the Chinese market, but that doesn’t seem to have been the case.

I would also like to know what the iPhone 6 plus ratio is like in the US market. From what I hear, it’s something like 3:1 in favor of the iPhone 6, but even then, the iPhone 6 plus ratio is much higher than I expected for the US market.

Given how phablets were unpopular in the US prior to the iPhone 6 plus launch, I’m guessing that a lot of consumers might even think that Apple invented the phablet category. Which makes me feel quite sorry for Samsung.

I was also a bit surprised about the shortage of availability in China. I also thought they would reserve more of the initial run for China. But it will get worked out and in a few months it will be good to see this data again to see how it plays out.

Checkout IPhone 6 / IPhone 6 plus mods/accessories at:

https://myaccessorieschoice.com/product-category/phone-accessories/iphone-aaccessories/

Not directly related, but I was thinking about your old article comparing how Apple utilized screen real estate on the 5/5s vs larger phones and phablets. I think it might be interesting to briefly revisit that with how the 6/6+ compares to the 5/5s or even Android similar sized phones and phablets.

Just a thought,

Joe

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really..