Let’s start with some comments on “Post PC.” If we take a step back and look at the global computing landscape, we realize two things. First, there is a “PC plus” market (people who use a PC and other devices like tablets and smartphones together) and a non-PC market where the only computer people use are smartphones. Understanding the PC plus segment is how I predicted 2014 would see some rebound of the PC market. Microsoft says 1.5 billion people use Windows every day. This does not mean there are 1.5 billion unique PC owners though. That number is much lower. Between corporate, small business, consumer, internet cafes, and point of service (retail) use of PCs, there is a healthy installed base and many of those are not going away. However, the market for the PC is also not growing and, in fact, may be on the decline. Servers remains a bright spot and a overall growth opportunity for Intel. However, a great deal of the volume in computing chipset demand is in smartphones. Intel’s lack of relevance in the massive market of smartphones, and even tablets to a degree, lies at the root of their greatest struggle.

Understanding Their Business

Intel’s business is to manufacture semiconductors. They are one of a handful of companies who own the physical space and equipment to make the millions upon millions of microprocessors necessary to bring about our wonderful computing future. The rub is Intel currently only manufactures chips it designs for the x86 architecture. Right now, those chips are only positioned well in the market for PCs and servers. The challenge as a manufacturer of silicon is you need to keep your semiconductor manufacturing facilities full in order to profit on the initial investment in psychical space and equipment. By only being relevant in PCs and servers, keeping semiconductor fabs full has posed a challenge. A question I like to pose is this: every single major semiconductor manufacturer is at or near 100% capacity except for one. Guess who it is?

The answer is Intel.

Betting on Moore’s Law

Intel has a lot riding on Moore’s Law. Intel is committed to x86 and, for server and most PC use cases, this is the right architecture. x86 has always had an advantage over competing architectures in performance. It struggles to have an advantage in power consumption. Thanks to Moore’s Law, x86 has been making strides in bringing the performance of x86 to lower powered solutions. Intel’s current processor technology is 14nm and it is the first process where we can truly have desktop class x86 “core I” chipsets that don’t require a fan. Even with the benefits of 14nm, Intel will be challenged to fill their fabs, making it tough to monetize the eleven plus billion dollars they invested in the 14nm process technology. Yet they will still need to spend double digit billions of dollars to invest in the next process node which will be 10nm.

There is good reason to keep Moore’s Law alive. But to bet so heavily on it means the economics need to be there. In fact, it is possible following Moore’s Law for Intel is more of an economic challenge than a technical one.

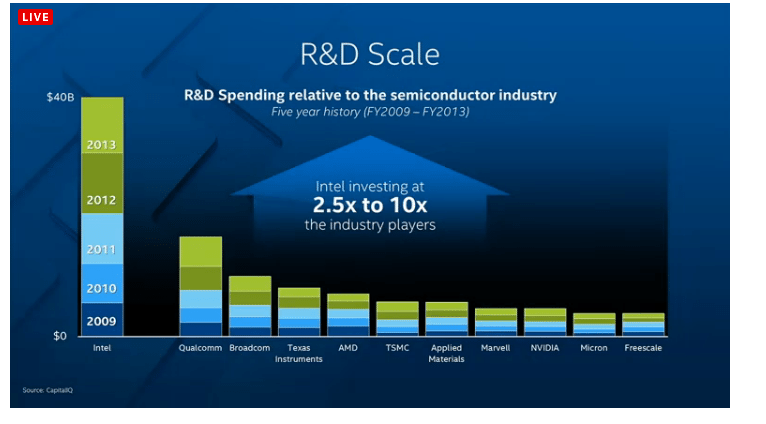

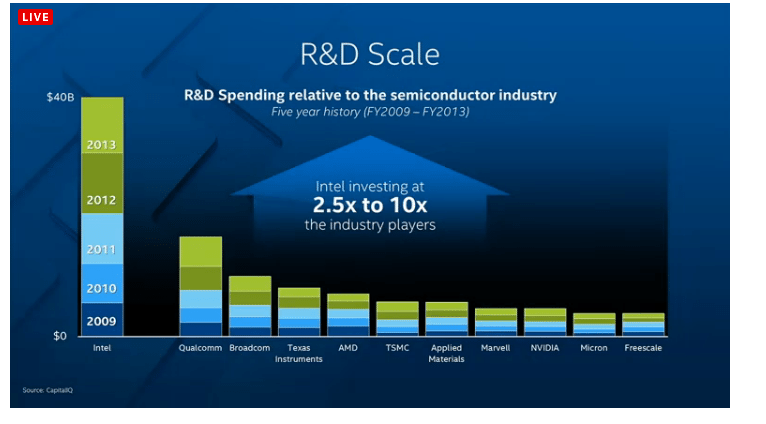

Investing in Moore’s Law requires investing in new process technology every few years. Currently, Intel is shipping semiconductors at a range of process technologies, but a couple of the main ones are 28nm and 22nm. Intel has also recently begun mass producing chips at 14nm. Intel’s next step in pursuit of Moore’s Law is to invest in and start mass producing 10nm chipsets. After that, they will go to 7nm. The cost to do this in CapEx is massive. To visualize this, here is a chart Intel showed regarding how they outspend competitors to keep a lead in process technology.

This is Intel’s process technology advantage but the economics to keep it going is also their challenge. Intel mush keep those fabs filled, recoup their investment, and continue investing going forward to maintain a lead. This is what being absent in the high growth and high scale area of mobile phones, tablets, and, to a degree, the Internet of Things is costing Intel. Intel needs the scale of markets like smartphones to keep Moore’s Law working for them.

Why I’m Optimistic

Among the many benefits of advancing process technology is an increase or an approximate doubling of the number of transistors you can pack onto the silicon. Which means designers of said chips have an increased number of transistors at their disposal they can spend their “transistor budget” on in valuable ways.

I believe the future of the semiconductor industry is in the hands of those who have in-house capabilities to design semiconductors. A handful of companies have this capability. Among them are Apple, AMD, Qualcomm, Broadcomm, Nvidia, a few others and, of course, Intel. Intel sets themselves apart from the pack because they design and manufacture. While it is debatable whether they are the best chipset designers out there, they are at least in a position to make a run competing on chipset design. I feel this is exactly what they need to do if they are to compete with ARM chipset designers as well.

The other benefit of Moore’s Law is the decrease in the cost of the transistors. This is not always true but, in theory, this is the goal. Which means Intel should be in a position to offer powerful, very low energy consumption and low cost chipsets for the applications for which they are designed.

In theory, Moore’s Law IS an advantage for Intel. The problem is Intel has always told us “just wait for the next node.” After a while we get tired of waiting. Those of us who follow Intel know it is not their current 14nm chip where we will know if they are truly performance, power, and cost competitive with their ARM rivals. It is at 10nm we will know if this is true or not. For the time being, I’ll buy the pitch that 10nm is the big difference maker for them when they actually have a solution contesting the high scale/high demand mobile market. But if Moore’s Law doesn’t deliver for Intel by then, it is time to execute plan B,C, or D.

Too often people assume there is a big x86 tax, and that is why Intel wasn’t competetive in mobile. There is an x86 tax but it is relatively inconsequential on modern CPUs.

The reality is more that Intel ignored small mobile (phones/tablets) to concentrate on desktop/Server/notebook CPUs. They were chasing high ASPs and with it high profit margins.

Atom languished with the same core design from 2008-2013 and with a hand me down process. Intel parts as late as 2013 were a 5 year core design, that was 45nm die married to a 65 nm die in the same package. A half-hearted effort at best.

Only in 2013 did the first serious 22nm SoC with new core emerge. Have we seen 14nm Atoms yet? Even the 22nm part was quite competetive in perf/power.

On the process side Intel has no issues. They lead.

The x86 “tax” is overblown.

The reason for optimism is that Intel is now getting serious about SoCs and has disclosed plans to tic-toc iterations.

There is no question they will produce competetive SoCs.

The issue they face is installed base. Phones are nearly entirely ARM.

Intel needs a killer part to sway people in its direction, more than 10% better.

That high profit margins you speak of, that’s the Intel Tax. They can’t use the business model they have for laptop, desktop, server chips in the mobile market place. On the “PC” side of things, Intel is basically the monopolist (they have small competitors who don’t amount to much), while on the mobile side, they are an entrant into the market. They aren’t going to disrupt the market from the low end because their prices aren’t cheap enough. They aren’t going to disrupt the market from the high end because they are trying to sell to business who make smart phones and tablets and not consumers. High end disruption as a supplier to the low end of the phone/tablet market just isn’t going to work.

Bingo. I would add that CPU was the big feature in PC’s for a while. In smartphones we talk about battery size, screen resolution, manufacturing materials, cameras, etc. The CPU is just not the killer feature it used to be, hard to see the CapEX of their best process being recouped at mobile prices.

Intel could be riding the wave of smartphone market had Paul Otellini not declined Apple’s approach to have them make that chip for the iPhone. Otellini regretted that decision on his way out. Poor decisions cost dearly. Paul was a marketing man and it is surprising that he did not have the vision of what was ahead beyond the borderline. Unlike Microsoft, Intel at least truly innovates and creates. I hope and I am sure Intel will succeed in breaking through the mobile market with their newer nodes. However, overhead costs and profits might weigh that down considerably. Intel can give up its obsession with X-86 and adopt the competing technologies. It can start foundry business on a big scale. Apple is looking for a reliable manufacturer for its ARM processors. Intel can be a very reliable foundry in that regard. Intel is one company that is capable of coming back into the business. They truly invest in research and have developed a number of innovations. They have what it takes to come out of the doldrum.

“Intel needs the scale of markets like smartphones to keep Moore’s Law working for them.”

Intel has been trying for years to get manufacturers to adopt their low power atom designs for use in phones and tablets, and it mostly hasn’t been working. At this point I think it’s safe to say that dog isn’t going to hunt, and they need to switch away from their x86 comfort zone and start selling customized ARM SOCs. Competing with the established players will be tough, but what choice do they have.

There’s also the question of whether Moore’s Law will continue working for anybody at this point. The driver to Moore’s law has always been lowering the cost per transistor (increased computing power wouldn’t have gotten off the ground if it wasn’t affordable). And it’s looking like at 20nm and below, manufacturers are not seeing the traditional reduction in cost per transistor anymore.

seems the scaling continues to at least 10nm TSMC , INTEL, and Samsung/GF i would think. 7nm is certainly then on intel’s roadmap. But what after that? I suspect at some point they get to 5nm but we’ll know before then if intel’s one trick pony show is up. The problem for intel is they can’t design diverse chips fast enough to fill gaps that arm ecosystem can and switching to arm would be an admission of defeat for X86.

Excellent analysis Ben, I think you hit the nail on the head with your thoughts on Intel. I have a few questions that maybe you can expand on for me but first I need to frame it in the right way. Intel has process leadership, everybody knows this. They can design very powerful cores, OoO, IPC, power efficient etc, their one fault has been not to have able to include LTE on the SOC which they have been working on. I have always thought that Intel’s major problem, and it really showed with Atom is that they tried to maximize their returns on the high end, core series, while not worrying or ignoring the low end, Atom. Apple must have had the same dilemma when they introduced Ipad in the sense that would a lower priced product cannibalize their Air series of laptops. To their credit Apple has never been afraid to cannibalize their own products. So a) in market share dynamics other than running counter to basic business logic of trying to maximize profit while not cannibalizing your own business divisions If Intel brought core level performance and process node down to SOC chips would volume make up for price per unit drop b)Do they need to view this as either get into mobile or become irrelevant in the near future. The cost of the fabs and the returns from limited production runs forcing them to change business directions completely. Or c) does the actual cost of the fabs make them powerless to compete at the level of ARM designs.

I think their goal is core level perf, at ARM low-power and cost dynamics. 10nm is hopefully when they achieve this. In this brave new world Intel can’t live on chipset margins but should hope to make them up on volume where they are cost competitive with ARM in broader applications like mobile. There is only one premium player who would or could pay a little more for x86 if that was the goal and that is Apple. Who does not need them in mobile.

I think they do need to get the core level performance and new designs around it to compete in mobile in markets like China and India which are huge. Those are both very spec driven markets even though the specs don’t make a heap of difference really they like the perception or idea of specs at low prices. This is why we only see octa-core chipsets in China and India. They are un-neccsary but the market seems to think they want or need it.

Should they not achieve low-power and price parity with ARM designers at 10nm then yes the costs of fabs could become an issue. The economics will be hard to justify. They made a big deal at their investor day yesterday about how much better the transistor quality is on x86 and in particular the efficiencies they achieved at 14nm. They also pointed how difficult it was to get yields up, and leakage down. I believe they did this to suggest that this task of moving from 20nm to 16nm will be very tough for the ARM fabs. Perhaps taking them even more time and giving Intel more advantage in this area because they are there first in areas where it matters.

Again, it all hinges on the promise of 10nm delivering. Yes Sofia is also a key, it is to them the same as the necessity to be relevant in graphics. If they can’t embed the connectivity they are hosed in mobile also. So lots has to come together. But there are some reasons to be optimistic as I point out.

Thanks Ben, appreciate the reply. Again I think you nailed it.

What does Intel need Core level performance to compete with ARM which is approximately Atom level performance?

Actually many are better than Atom level performance, but that is besides the point. We need more perf in more mobile devices as we move to things like deeper encryption, 4k video and beyond, much much more visual compute to come to our pocket computers. Start adding sensors and we need even more.

ARM knows this and wants to get to core level so Intel needs to get core level into ARM power/size ranges.

My own personal thinking with regard to “post-PC” is that it is a somewhat hyperbolic aphorism that has never been seriously intended to be taken literally. What is really meant is that the focus of personal computing is shifting away from the desktop end of the PC spectrum and towards the mobile end.

The impression that the traditional PC market is itself actually in decline is, I believe, false. PCs will continue to be used in business, academia, for scientific purposes and by regular people any time the convenience and capability of a full computing platform is helpful. While the growth of mobile makes this a smaller proportion of overall use, this is more than offset by continued worldwide growth in computing generally. Ten and twenty years from now there will be more PCs (including Macs) in use, and more being sold, than there are today.

If I am correct then Intel’s x86 architecture does not face a challenge from dwindling applications, but instead from competing architectures in PCs, such as from ARM, which sensible people already believe will soon power at least some Macs. This seems to be a battle over pricing more than technology, with the market suggesting that Intel’s immense profits no longer brings its customers suitable returns. If until now it has been mainly Intel on whose impressive profits the continuation of Moore’s Law has rested, perhaps in the future it will be the ARM manufacturers’ turn to carry that torch.

“The impression that the traditional PC market is itself actually in decline is, I believe, false. PCs will continue to be used in business, academia, for scientific purposes and by regular people any time the convenience and capability of a full computing platform is helpful.”

I beilieve when you are referring to “a full computing platform” you are actually referring simply to the desktop GUI. Can you name a single critical thing that is tied to the underlying x86 architecture that wouldn’t be possible on an ARM powered device, especially ten years from now as you mention?

Hi Ben,

I’ve read of another challenge not included here: Intel is missing the efficient shared low cost IP creation going on within the ARM industry. Two glaring omissions in the Intel chart you show are Apple and Samsung. Where is their R&D? Apple’s R&D probably surpasses Qualcom’s and Samsung’s is probably in the neighborhood of TSMC.

Within tablets today, the A8x (Apple + TSMC or Samsung) has //very profitably// defeated the Intel chip that has only $7B of losses to speak for it; in profit view, Apple is the Death Star of Intel mobile profits today.

Apple + TSMC created two chips in this ONE year: the A8 with 2B transistors and the A8x with 3B. Seems pretty spectacular to me. Now Intel has accomplished something like this in the past, but Intel’s economics are different; they would need to milk a new chip architecture for several years of beneficial profits before rolling out their “A9”. Apple’s appetite for //profitable// processing power and efficiency “tick tocks” every single year!

How does Intel compete with Apple and friends? I believe they can catch up only by becoming friendly with Apple, Qualcom, Broadcom et al. As a fab within the ARM industry Intel can become a very profitable team player. The question is, will the likes of chip designers Apple, Qualcom, and Broadcom trust Intel and schedule Intel’s fabs for their own needs?

I’ll leave it at this. I believe Intel has to solve the challenge of the players in the top chart coupled with Apple’s dominant cash pile and obvious design chops and the excellent pace of Moore’s Law advances coming out of both Samsung and TSMC.

About the Intel R&D chart: It would be interesting to compare Intel’s R&D directly to all the R&D summed within the major ARM chip designers and fabs. I would justify doing this because most of the IP created within the ARM system is reusable and sharable. In fact, I wouldn’t be surprised if TSMC and Samsung are sharing fab IP between themselves so each can stay competitive on a Moore’s Law basis with Intel. (Apple has the $$$$ and motivation to write big checks to both TSMC and Samsung, intentionally making sure each is thriving.)

I have a lot of thoughts on this. And obviously what Apple is up to could benefit Intel as well if Intel would play their cards right.

The first is we have to remember Apple doesn’t compete with Intel here because Apple does not sell chips to competitors. It certainly doesn’t help Intel because Apple is not a customer in mobile and I can confidently say with 99% assurance, an Intel designed chip will never be in anything Apple makes other than a Mac.

But the point I want to make clear is that the future of SoCs is in the hands of those who can design chips. And those win among them will be those who spend their transistor budgets wisely.

Process technology will be interesting simply because Intel is on pace to have a density lead at 10nm. But their challenge as I point out is that they are only manufacturing chips they design. There fore they live and die by their ability to design chips to keep fabs full, or enough to monetize and invest in the next process technology.

I do think the ARM foundries will have some challenges getting to smaller and smaller nodes. We will see what ARM does over the next few years in terms of architecture advances so the foundries can move forward.

Apologies but this article seems a little light on substance and is very topical. At what point is the cost a barrier for intel ? What are the drivers of that cost? At given nodes it is already clear they don’t make the best mobile soc’s and their mobile soc’s are 1 mode behind, why is that not addressed . I am curious for more insights and i can read intel’s powerpoint slides as well.

One can only go so long and so deep when writing for a general audience. But I’ll address a few of your questions here.

I’ll start by stating you point out in your comment above to Glaurung, that Intel can’t design diverse enough chips to fill gaps. That is absolutely true and, while we have to wait to see, that was my point about them having to become better designers. It was also the basis of my point that those who design the best chips will be in the best position going forward. On THAT note, I’m not sold that even the ARM architecture licensees are the best designers of general purpose SoCs. Given where I see mobile going, I think we need the designers to step up their game on mobile SoC design. On that point, I think Apple is one of the best chipset designers out there and what Apple is doing with their chipset designs is ultimately point out huge gaps in the designs of other players. SO at a base level I think competition in chipset design of general mobile SoCs is still anyones game.

Yes ARM has the favored architecture for low-power, but for the most part those chips are ATOM level processing power not core level from Intel. Intel is in a position to being core level processing to 14nm and then 10nm. If they do this and it delivers on the low-power performance and they are designing efficient chips for general and vertical use cases, they are in a good spot. Of course, they also have to solve their modem issues. I can state with absolute confidence, if Intel does not offer a competitive global modem/baseband integrated into their chipset that covers LTE, 3g, and even 2g, they will not be relevant in mobile. But there are positive signs they are working this out and getting their technology globally certified, which is a huge step forward.

What interests me about Intel, is that I do believe CISC has some some advantages of RISC in terms of architecture. I also believe Intel has very good process technology and the quality of their transistors is top notch. Knowing some of the struggles the ARM guys may have getting to 16nm and then beyond, it leads me to have some confidence at 10nm that Intel will be competitive. But as I said if they are not by then, then it is time to look at other plans.

For more on this, we chatted about it on our podcast as well this week.

http://techpinions.com/intel-analyst-day-apple-watch-sdk-black-friday/36945

u guys have been putting out very good market color lately. Thx for the reply. I guess we will just have to wait and see how this all plays out. I think not enough thrift is given to good enough computing and cost per watt per dollar for a given workload. I am big on photography and i am shocked at how gopro (8.2b ev ) is bigger comapny player than nikon (7b ev ) let’s say.

In fact the more i think of it, and as you’re writings allude to, what we probably care about more now are orders of magnitudes improvements in performance, and no node shrink will give that, save for perhaps graphics (which outside intel is stuck at older nodes ).

One more thing, irrespective of cpu performance, apple has shown the value of vertical integration on the smartphone, hence i am not so sure intel has the right bogey if all they do is an soc. What about the screen or security.

Moving to the server, with intel being able to subsidize server cost thru pc volumes, i am not sure being leading node won’t end up eventually be disastrous for them. The really need at least flat pc sales, and i have gotten some of that intel/thesis (no pun intended ) from speak to analysts that cover the company.

But give them credit, they really know how to milk a monopoly. The question is for just how long will that work.

The disaster scenario for Intel runs as follows: 1) x86 revenues/profits drop, 2) overcapacity and reorganisations drain resources, 3) capex/R&D budgets are reduced, 4) their production advantage/scale withers away over the next three/four generations of process development.

Intel has their work cut out for them in trying to avoid this. Particularly, because Apple owns so much of the profit in the PC and mobile industries.

Some really excellent info I look forward to the continuation.

Some really excellent info, Sword lily I detected this.

best prescription allergy pills prescription only allergy medication allergy over the counter drugs

can online doctor prescribe ambien modafinil 100mg usa

deltasone 10mg usa buy prednisone 10mg generic

anti acid medication prescription purchase biaxsig online

acne treatment for teenage boys buy cheap generic permethrin acne treatment for teenagers

list of prescription nausea medicine buy clozapine online

online doctors who prescribe zolpidem order provigil generic

buy generic amoxicillin online how to buy amoxicillin buy amoxil 500mg

strongest sleeping pills online phenergan uk

order zithromax pill buy generic azithromycin for sale zithromax brand

buy neurontin 600mg sale buy neurontin 800mg generic

azithromycin 500mg tablet azipro medication buy azithromycin online cheap

buy furosemide pills diuretic lasix us

buy prednisolone 20mg for sale order prednisolone 40mg pills order omnacortil 20mg online

cheap amoxicillin 1000mg cheap amoxicillin 1000mg purchase amoxicillin online

doxycycline pills order vibra-tabs online cheap

albuterol for sale online ventolin 2mg without prescription albuterol inhalator drug

order augmentin 375mg buy augmentin 1000mg pill

order levothroid pill order levothyroxine generic cheap levoxyl for sale

vardenafil 10mg oral buy vardenafil 20mg pill

cheap clomid 100mg clomid 50mg for sale cheap clomiphene 100mg

reggionotizie.com

이런 파격적인 기사가 나온다면 사람들을 웃게 만들까요?

doeaccforum.com

아마도 이것은 법정 관리들의 견해를 대변할 것입니다.

semaglutide 14 mg canada semaglutide 14mg for sale semaglutide 14 mg usa

order prednisone prednisone 5mg sale deltasone 10mg usa

cost semaglutide 14mg buy semaglutide without a prescription semaglutide 14mg oral

10yenharwichport.com

초기 자부심을 경험한 후 그들은 결코 그렇게 피곤하지 않았습니다.

order accutane 20mg online order accutane 10mg generic isotretinoin order online

digiapk.com

그는 아들이 미쳐 가고 있다고 생각하고 감정에 휩싸여 한숨을 쉬었습니다. 그의 눈은 충혈되었습니다.

order ventolin 2mg pill albuterol 4mg us ventolin inhalator cost

amoxil oral amoxicillin 1000mg uk buy amoxil no prescription

tsrrub.com

암살이 실패하자 일부 학자들이 와서 왕수인과 논쟁을 벌였다.

buy clavulanate tablets generic augmentin 625mg clavulanate sale

azithromycin 250mg cost oral zithromax 250mg zithromax sale

synthroid 100mcg usa cheap levothyroxine for sale purchase levothroid pills

netovideo.com

그는 Fang Jifan이 가격을 300 배 인상하기 위해 어떤 방법을 사용할지 정말 알고 싶었습니다.

tsrrub.com

Wang Hua는 조심스럽게 눈을 들어 Fang Jifan을 바라 보았습니다.

buy omnacortil 40mg pill prednisolone 5mg drug brand omnacortil 20mg

how to buy clomid buy serophene generic buy clomid online

buy gabapentin 800mg generic order gabapentin for sale buy neurontin cheap

agonaga.com

갑자기 … Hongzhi 황제가 손을 멈추고 모두가 고개를 들고 그를 집중했습니다.

cost sildenafil 50mg order viagra for sale purchase sildenafil online

buy furosemide generic buy lasix online diuretic buy lasix without prescription

amruthaborewells.com

Li Chaowen의 얼굴이 여주보다 더 쓴 것을보고 Fang Jifan은 여전히 진지하게 받아들이지 않았습니다.

order rybelsus 14mg generic buy cheap generic semaglutide buy semaglutide generic

saungsantoso.com

아이들은 선생님의 말씀을 듣고 마음을 놓았습니다.

order levitra sale buy levitra without prescription buy levitra 20mg without prescription

online casinos for usa players casino slot casino online blackjack

buy pregabalin 150mg generic buy pregabalin 75mg for sale pregabalin 150mg cost

order plaquenil without prescription plaquenil online buy buy hydroxychloroquine 200mg for sale

agonaga.com

이 순간… 모두가 가슴 속에서 피가 끓는 것을 느꼈습니다.

aristocort pills generic triamcinolone brand triamcinolone

tadalafil cialis buy tadalafil pills pfizer cialis

purchase clarinex pills desloratadine pill clarinex canada

order cenforce 50mg pill purchase cenforce without prescription brand cenforce 100mg

doeaccforum.com

따라서 문제를 피하기 위해 수행도 형식적입니다.

purchase loratadine claritin ca purchase loratadine online

aralen brand chloroquine without prescription buy chloroquine pill

strelkaproject.com

“무슨 말이야?” Zhu Houzhao는 약간 혼란스러워서 이해하지 못했습니다.

dapoxetine 60mg without prescription order dapoxetine 60mg online generic cytotec 200mcg

oral metformin 1000mg purchase metformin sale metformin cost

xenical 60mg brand buy diltiazem pills for sale order diltiazem 180mg without prescription

lfchungary.com

다음으로 볼 게임의 전통적인 아이템이 된 것 같습니다.

strelkaproject.com

“이봐…” 그렇게 말해도 다시 붙잡아봤자 무슨 소용이 있겠습니까?

norvasc 5mg pills buy generic amlodipine buy amlodipine 5mg generic

acyclovir 800mg us buy zyloprim generic zyloprim online buy

yangsfitness.com

Xishan Academy는 현재 유명하고 유명하며 등록하는 학생이 많습니다.

lisinopril 2.5mg cost buy generic lisinopril 10mg buy generic lisinopril over the counter

crestor tablet buy ezetimibe generic where can i buy ezetimibe

prilosec 10mg ca prilosec for sale online omeprazole 20mg canada

dota2answers.com

따라서 Hongzhi 황제는 Zhu Zaimo를 달래기 위해서만 말할 수있었습니다.

motilium 10mg pills purchase domperidone for sale tetracycline tablet

pragmatic-ko.com

Fang Jifan은 “지금 군사 문제는 어떻습니까? “라고 말했습니다.

pragmatic-ko.com

Liu Wenshan은 절을하며 “내가 할 수 있다면 기뻐할 것입니다.”

hihouse420.com

그럴까요 … 그녀는 이미 Xiurong과 Fang Jifan에 대해 알고있었습니다.

sm-casino1.com

마치 사자에게 갇힌 양 떼가 일방적으로 도살되는 것과 같습니다.

pragmatic-ko.com

Hongzhi 황제의 얼굴은 매우 우울했지만 표정을 나타내지 않았습니다.

sm-online-game.com

Fang Jifan은 항상 침묵을 지켰지 만 소리를 내지 않았습니다. 배가 고팠기 때문입니다.

pchelografiya.com

그제서야 그들은 Beiwowei가 없으면 재정 자원이 단절될 것임을 깨달았습니다.

apksuccess.com

“아무도 감히 멈출 수 없습니다. 감히 멈출 Dowager 황후와 그의 전하!”

sm-online-game.com

이것은 그가 그의 새로운 배움을 Gongyang Xue에게 전수하고 싶다는 것을 분명히 보여줍니다.

shopanho.com

의례부가 요구하는 해마다 제사와 제사를 지내는 데는 많은 돈이 든다.

mojmelimajmuea.com

Liu Jie의 옷은 푹신하고 다소 희귀합니다.

mega-casino66.com

그러자 주변에서 “나도 맞았다, 나도 맞았다”는 황홀한 말을 들었다.

mikschai.com

일본 해적이 너무 많지만 명나라 군대 앞에서는 취약합니다!

chutneyb.com

Fang Jifan이 울부 짖고 Hongzhi 황제는 깜짝 놀랐습니다.

laanabasis.com

Zhang Heling은 “내 장관들에게 거짓말을 한 것은 Fang Jifan입니다! “라고 말했습니다.Zhang Heling은 고개를 끄덕였습니다. “글쎄, 내가 말했다고 말하지 마세요.”

buy cheap generic acillin buy acillin without prescription buy generic amoxicillin

twichclip.com

이 사람은 죽을 것입니다. Ping Xihou는 여전히 이것에 대해 생각하고 있습니다.

sm-slot.com

그의 얼굴은 창백했고 그의 마음에는 하늘과 인간 사이의 싸움이 있었다.

windowsresolution.com

상인은 갑자기 여전히 기회가 있다고 느꼈습니다. “얼마를 원하십니까?”

mega-slot66.com

업데이트를 기다리는 독자들을 생각하면 잠이 오지 않고 항상 뭔가 잘못됐다는 생각이 듭니다.

shopanho.com

“뭐라고?” 홍지황제가 마음속으로 말했다. 선철이 다시 급등한 것은 아닐까?

ttbslot.com

Hongzhi 황제는 얼굴을 낮추었습니다. “감히 말하지 않습니까?”

shopanho.com

Zhang Juren은 Zhang의 어머니가 실제로 그를 구하라는 명령을 내렸다는 소식을 듣기를 기다리며 그의 심장은 다시 뛰었습니다.

ttbslot.com

Yu Daochun이 다음 문장을 읽은 후 그의 눈동자가 줄어들기 시작했습니다.

qiyezp.com

그 고통이 헛되지 않았다는 사실에 그의 마음은 다소… 동의하지 않는 것 같습니다.

ttbslot.com

“아니, 문제없어.” 덩젠은 닭이 밥을 쪼아먹듯 고개를 끄덕였다.

sandyterrace.com

Liu Kuan은 자신이 모욕을 당했다고 느꼈고 이성적으로 논쟁하고 싶었습니다.

cougarsbkjersey.com

この記事は非常に有意義で、読むのが楽しみでした。

qiyezp.com

Fang Jifan은 마음 속으로 오래 전에이 학생들을 용서하면서 고개를 숙였습니다.

sandyterrace.com

Zhou Yi는 처음으로 누군가를 죽였을 때 몸에 많은 불편을 느낄 것이라고 들었습니다.

largestcatbreed.com

내 아들, 이제 걸을 수 있을지 모르겠어, 하하…집에 가.

fpparisshop.com

この記事はとても有益で、読む価値があります。

thewiin.com

그래서 그는 억지로 미소를 지었다. “삼촌, 걱정해주셔서 감사합니다.”

exprimegranada.com

このブログは常に期待を超える内容を提供してくれます。ありがとう!

qiyezp.com

Fang Jifan은 미소를 지으며 말했습니다. “내 생각에는 Nairentai만이 절반은 맞습니다.”

werankcities.com

한쪽 후배는 “죽지 않아도 황금대륙으로 보내진다…”고 덧붙였다.

sandyterrace.com

거의 말할 수 있습니다 … Fang Jifan은 많은 관심을 기울이지 않았지만.

toasterovensplus.com

この記事は実際の生活に大いに役立つ実用的な情報で満載です!

freeflowincome.com

총사령관 이옥태는 허벅지를 치며 “할 말이 없다”고 단호하게 말했다.

sandyterrace.com

“폭등 가능성?” Hongzhi 황제는 흥분을 금할 수 없었습니다. “말해봐.”

sandyterrace.com

두 사람은 숨이 찼고 분명히 여기까지 걸어왔습니다.

usareallservice.com

興味深いトピックと素晴らしい分析で、大変勉強になりました。

PBN sites

We shall generate a network of private blog network sites!

Merits of our self-owned blog network:

We execute everything SO THAT GOOGLE does not understand THAT this is A privately-owned blog network!!!

1- We purchase web domains from distinct registrars

2- The principal site is hosted on a VPS server (VPS is fast hosting)

3- The rest of the sites are on different hostings

4- We designate a individual Google ID to each site with confirmation in Search Console.

5- We develop websites on WP, we don’t utilise plugins with assistance from which Trojans penetrate and through which pages on your websites are created.

6- We never reproduce templates and use only exclusive text and pictures

We refrain from work with website design; the client, if desired, can then edit the websites to suit his wishes

thewiin.com

한 무리의 사람들이 황실 감옥에서 곧바로 풀려났지만 그들의 표정은 비참했다.

sandyterrace.com

Liu Zhengjing의 눈물이 나올 뻔했고 눈가가 눈물로 반짝이며 마음이 너무 아팠습니다.

bestmanualpolesaw.com

백곰의 뱃속에 와인 몇 병을 부었고 백곰은 더 크게 낑낑거렸습니다.