If you have read much of what I have written here or at TIME, then you may be surprised at some of the conclusions my analysis of the Samsung Galaxy Note 2 have yielded. I have not been shy about my affection for the iPhone. The iPhone is by far the most elegant, the most simple, and the most sophisticated mobile phone I have ever used. However, to keep a keen eye on the mobile landscape, I try and use all the flagship Android phones for a period of time as my primary smart phone. Up until the Note 2, I have never felt that Android, or larger phones for that matter, every really presented any significant value to me over the iPhone. That is until the Note 2.

If you have read much of what I have written here or at TIME, then you may be surprised at some of the conclusions my analysis of the Samsung Galaxy Note 2 have yielded. I have not been shy about my affection for the iPhone. The iPhone is by far the most elegant, the most simple, and the most sophisticated mobile phone I have ever used. However, to keep a keen eye on the mobile landscape, I try and use all the flagship Android phones for a period of time as my primary smart phone. Up until the Note 2, I have never felt that Android, or larger phones for that matter, every really presented any significant value to me over the iPhone. That is until the Note 2.

I wrote a somewhat detailed analysis of Apple’s 4” iPhone vs. Android 4.7” phones last year. My conclusion from that analysis was that an Android phone in the 4.5-4.7” range did not present enough value for the tradeoff of one handed navigation. My conclusion is different since using the Note 2.

Related: Apple’s 4″ Plus iPhone 5 vs. Android 4″ Plus Devices

In that analysis I did with the 4” iPhone vs. a 4.7” Android phone I looked mostly at how information was presented. I looked at the web, email, twitter, FB, etc., and found that in most cases the amount of information displayed between the two OSes and screen sizes was roughly the same. The only major difference was that on the 4.7” screen the information was slightly larger. Again my takeaway was that although most information was larger, I didn’t see the value in the tradeoff of one handed navigation and or the robustness of iOS. It simply wasn’t a big enough difference in my opinion. That analysis led me to the conclusion that Android devices between the range of 4.5-4.7 inches were not worth the trade-off of one handed navigation.

Size Does Matter

This realization became clear to me in comparing the Samsung Galaxy GSIII to the iPhone. I used the GSIII for a few weeks but had the same feeling as I did when I compared the iPhone 5 to the Galaxy Nexus. Conclusion being the value of the larger 4.7″ screen was lost on me and it wasn’t worth the trade-offs. However, the Galaxy Note 2 is a different story.

After a few days of using the Note 2, I was struck by how good the experience of Android was on a phone over 5 inches. Oddly enough, it was a similar feeling to how I felt with the Nexus 7. Then these two experiences collided in my mind and I made a realization. I genuinely dislike Android on devices smaller than 5-inches and larger than 10-inches. Yet I like it a great deal on it on devices between 5-7 inches. It is an anomaly I know but that is exactly how I feel. It is almost if Android’s clearest differentiated value over the competition is in the 5-7 range. Both size ranges where iOS is not. Granted the iPad Mini comes close to the Nexus 7 in size, and the iPad Mini is significantly better than the Nexus 7 in my opinion, but I can see why people like and choose the Nexus 7. It is a good value and good experience for the price. Not the best, but for the price, good enough.

The Note 2 size range, however, feels to me like the area where Android really has a clear and distinct differentiated advantage. Again, part of this has to do with the fact that Apple does not offer an iOS device in this range so it is hard to compare. But its still a significant point from a competitive analysis standpoint.

The One Handed Mode Tradeoff

The strongest argument against these size phones is the one-handed operational trade-off and it is a very strong point. If one handed operation is important to you then stay away from devices 4.5-inches and above unless you have Lebron James size hands. But the key conclusion I made is that the trade-off of one-handed operation feels like less of a trade-off with the Note 2 than with any other 4.5-4.7” Android phone I have used. Any phone larger than 4.5” is going to require a trade-off of one-handed operation anyway so why not just go larger and get more value.

Interestingly, I had discussions with folks who owned the Note 2 and specifically many women. They told me that since they have smaller hands, most phones were already hard to use with one hand and therefore they simply wanted the biggest screen possible because they found that valuable. Many were overwhelmingly pleased with the Note 2. This makes my point that if one handed navigation is not that important to you then the value of the screen size experience of the Note 2 is significant.

Although much of my analysis of the 4.7” screen holds true with the Note 2 about information displayed, it is with the Note 2’s size range where bigger actually does feel better. Take Facebook for example. Comparing the Facebook app experience on the iPhone 5 vs. a 4.7” Android phone yields only slightly larger photos and media making the size difference moot in my opinion. However comparing the Facebook experience on the iPhone 5 vs. the Galaxy Note 2 yields much larger photos and media which resulted in quite a different experience. An experience that was definitely more tablet like than phone like.

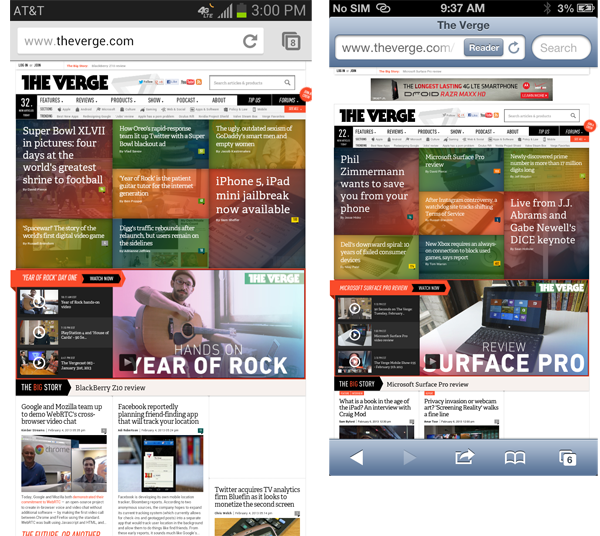

Web browsing is another good example. I pointed out in my screen size analysis the web experience was nearly moot with the iPhone 5 and other Android 4.5-4.7” devices. However, with the Note 2 the difference in web browsing was significant. Not only were mobile sites larger and easier to read but so were full desktop sites. In fact with the Note 2, I set it to always bring up the desktop site. Never before have I done this on any non-iOS devices. Here is a side-by-side screen shot to scale of the Note 2 and the iPhone 5.

It was examples like these where the bigger screen truly brought value. What really struck me is that the experience with the Galaxy Note 2 is more tablet like than phone like. This is probably a key point in why I think this form factor is so interesting. It is also one that makes it very hard, for the first time, to actually compare an Android phone with the iPhone.

Samsung has also done some interesting things in software to enable more ease of one hand use which led me to the conclusion that larger phones present the most opportunity for new hardware and software innovation.

Conclusion

In all the cases where I found the value of the Note 2 clearly differentiated was with regards to media. Photos, videos, games, social media apps, and other places were media was a key part of the experience. This is a key point because the use cases I identified where value is clear in a giant phone are exactly the ones that matter the most to the mass market.

My personal conviction is that the value of the 5” plus phones are worth some of the trade-offs of one handed navigation where 4.5-4.7″ devices are not. The primary point being that for devices where one-hand navigation is already difficult like ones above 4.5”, consumers are better off going larger in my opinion.

5″ smart phones are an are where a lot of innovation in hardware and software exists. Perhaps more so than any other smart phone form factor. Particularly around voice automation, smart sensors, gestures, and software.

So am I leaving the iPhone? No, for reasons I finally believe I can articulate and will share in a column soon. However, after using the Note 2, I can honestly say it is the best Android phone I have ever used and the only one I could identify tangible differentiated value.

Related: Apple’s 4″ Plus iPhone 5 vs. Android 4″ Plus Devices

For some deeper audio context to this column, click the play button below to listen to my interview on the Galaxy Note 2 and whether Apple should make a larger phone.