When it reported its earnings for the quarter ending December 2014, Apple stopped providing detailed information on its retail stores. Retail revenues, which had previously been separated out from the regional splits it provides, were now put back with the regions they came from and we lost visibility on one of the most interesting parts of Apple’s business. The reasons for this change is ostensibly that Apple manages its business this way internally but I suspect two other factors also played a role.

First, Apple is making more of its online retail store, especially in countries like China where its physical retail stores can’t yet reach much of the population. Second, with the launch of the Watch, non-Apple retail stores are playing a bigger role. With Angela Ahrendts now in charge of all forms of retail, it makes sense to stop splitting out Apple retail stores.

However, there’s still some really interesting data out there about the retail stores (not least, how many Apple has open at any given point in time), so I thought I’d dive into some of these numbers for Tech.pinions Insiders today.

Splits by global region

One of the interesting things to look at is how Apple’s revenue divides up by region versus how its store presence is split by region. The percentage of each of these represented by each region at the end of the first calendar quarter of 2015 is shown in the chart below:

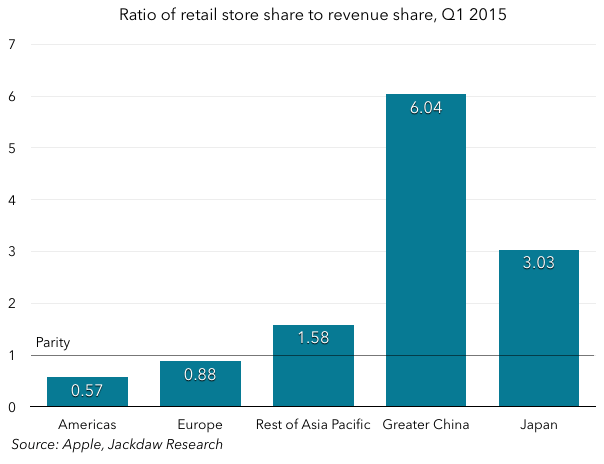

What you can see is the splits are pretty different in every region – in some, they’re misaligned in one direction and, in others, it’s the opposite. About the only region where the splits are fairly similar is Europe. Another way to look at the same data is below – this is the ratio of one split to the other, so you can see how misaligned some regions are:

Again, Europe is closest to parity, the Americas region has a far greater share of retail stores than of revenue, and the three other regions (all in Asia) skew in the opposite direction. No wonder then Apple is investing so heavily in building retail stores in China – it’s an enormous market, but it’s also under-penetrated with stores compared to its share of revenues. Even once Apple hits its target of 40 stores, it will still be nowhere near parity with China’s contribution to revenues. Interestingly, Japan is the next most misaligned region, but Apple isn’t making a similar effort there. Why not? I think part of the answer is – for whatever reason – retail has never been very effective for Apple in Japan. When it switched its reporting standards last quarter, it became clear Apple made hardly any profit on its Japanese retail operation, compared with good margins elsewhere. Something about Apple’s retail model doesn’t seem to work as well in Japan. I asked a Japanese Twitter contact for his take, and he pointed out the large number of very big and successful general electronics retailers in Japan, and the strong role of the carrier channel in selling phones in particular.

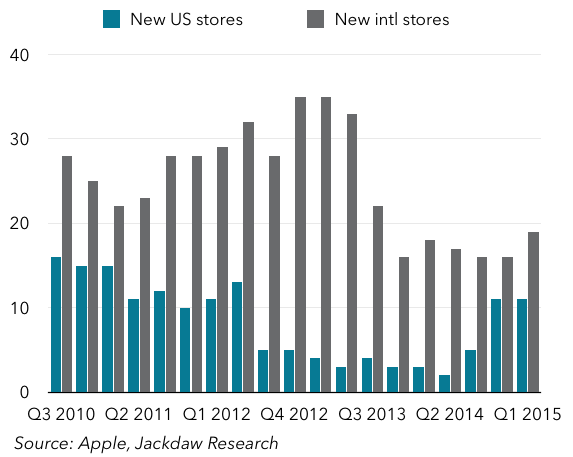

In general though, Apple is investing far more heavily in retail stores outside the US than inside the US – it’s added less than 20 new US stores in the last three years (11 of them in the second half of 2014), compared with 72 in the rest of the world. The rest of the world is clearly the major focus for its current investment in stores and perhaps the current level of US penetration is a good guide to where Apple might like to get to in other regions over time. Interestingly, the other countries with the highest penetration relative to population and the highest number of stores after the US are all English speaking countries: the UK, Australia, and Canada. As I’ve often observed, Apple tends to do particularly well in English speaking countries.

The US retail business

Another interesting exercise is drilling into the US store presence. The map below is color coded by the number of stores in each state in the US, with the darker colors representing states with more stores, and the lighter colors those with fewer. White states have no stores.

You can see the most populous states are those with the most stores – in order, California, Texas, Florida and New York (California by itself has more than any other country Apple operates in, with 52 versus 39 in the UK, the country with the most stores after the US). The six states which don’t have stores yet are Montana, North and South Dakota, Vermont, West Virginia and Wyoming. All six rank 38 or lower by population among the 50 US states, with West Virginia the highest ranked at 38 – four of them are clustered together in the sparsely populated area northeast of Utah, and four of the six also have populations of fewer than a million people. Aside from population, it’s likely Apple takes into account incomes in these markets and West Virginia is the second poorest state in the nation as measured by GDP per capita, ahead of Mississippi, which has two stores.

All this is to say Apple seems to be very well represented across the US at this point, with the exception of a handful of states with either small populations or a low propensity to spend money on Apple products. But a combination of carriers, other third party retailers, and online retail cover the gaps very well. As a result, I’d be surprised if there were a dramatic increase in stores in the US in the coming years and this pattern from the last few years is likely to continue to hold:

The role of Apple retail

Having gone through the numbers, I want to end by talking about the role of Apple’s retail stores. Of course, the stores are fairly new – for the first 20-plus years of its history, Apple didn’t have its own retail stores and it’s only in the last five years or so they’ve become a significant presence. Of course, Apple has always used third party retailers and, since the launch of the iPhone, carriers have become a very significant channel in certain markets like the US and Japan. In China too, the availability of the iPhone through China Mobile over the past year or so has been a major factor in the adoption of the iPhone there as well as the growth of Apple’s business. However, carriers don’t tend to do a good job selling Apple’s other devices – iPads with cellular modems are about the only other product most of them sell and those tend to sell poorly in comparison with the tablets Android OEMs increasingly bundle at heavy discounts with their phones. In China in particular, the Apple retail stores can serve a useful function in broadening the iPhone’s halo, a major factor in the resurgence of the Mac in recent years. As people buy into the Apple brand for the first time (once with the iPod, now with the iPhone in most cases), they are more likely to buy other Apple products, and the Apple retail stores are a great way to enable this. With the launch of the Apple Watch in particular, the retail stores will be very important channels since few other retailers will carry them. This, I think, explains as much as anything Apple’s heavy investment in China despite the fact the carrier channels are already doing very well there.

I remember the days when Apple was only in computer stores and it was such a roll of the dice if you got anyone from the store who cared. Even when Apple did (and still does) the store within a store concept. Can you speculate on what it is about the Apple brand that has them so much more successful than pretty much any other computer and maybe even single origin consumer electronics branded retail store?

Joe

I’ve set up reseller networks twice, and straight up totals are very misleading: you can have 10 resellers in one city, and .. that’s it for the whole country. What you want is a mesh across not quite the country, but your consumers’ (hunting grounds) buying area. Assuming your store is a “destination” in and of itself (which Apple Stores probably are, especially with the service part), the more relevant metric is : % of population/target market less than 1 hour away at some point during the week (ie, work or home). Depending on product draw, that one hour might be 2 hours or 1 minute instead, but that’s the gist of it.

Also, If your stores are capacity-constrained, it’s not so much number of stores as number of “seats”, or whatever the equivalent mesure of sales throughput is for retail (square footage is probably a good proxy, unless in some places sales take significantly longer for cultural reasons for example)

I think for example that in countries with an urban elite concentrated in few cities, and an impoverished rural population, few large stores in the relevant cities might provide good coverage, while in more homogeneous (revenue and population-wise) countries, you’ll need a smattering of smaller stores.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

As I website owner I believe the content material here is really good , appreciate it for your efforts.

Nice post. learn something new and challenging on blogs I stumbleupon on a daily basis.trt 1 c

A big thank you for your blog.Really looking forward to read more.<a href="https://www.maps.google.cd/url?sa=t

You’re so awesome! I don’t believe I have read a single thing like that before.VIMTAG Pet Camera 2.5K HD Pet Cam 360° Pan/Tilt View Angel with Two Way Audio Dog Camera with Phone APP Motion Tracking AlarmNight Vision24/7 Recording with Cloud/Local SD Smart Home Indoor Cam – Hot Deals

o great to find someone with some original thoughts on this topic. – hey dudes men

We always follow your beautiful content I look forward to the continuation.